Table Of Content

Why Choosing the Right Exchange Matters

The crypto exchange you choose plays a crucial role in your overall trading experience and financial security.

A reliable platform helps protect your assets, ensures fast and fair trading, and supports compliance with regulations.

But choosing the wrong exchange can lead to losses, delays, or even hacks. Therefore, it’s essential to evaluate exchanges carefully before committing.

Key Features to Look for in a Trusted Crypto Exchange

Not all exchanges offer the same level of service, security, and usability. Here are six essential features to consider:

-

Strong Security Measures

Security should be your top concern when choosing an exchange. Hacks and theft are still common in the crypto world.

Two-Factor Authentication (2FA): Adds a second layer of login protection.

Cold Wallet Storage: Keeps most funds offline to reduce the risk of hacking.

Insurance Coverage: Some exchanges insure user funds in the event of a breach.

A good example is Coinbase, which stores 98% of customer funds offline and offers crime insurance. Therefore, an exchange with robust safeguards ensures that your crypto is well-protected.

-

Regulatory Compliance

An exchange that follows local regulations offers better legal protection and transparency.

KYC & AML Processes: Help prevent fraud and money laundering.

Registered with Authorities: Indicates government oversight and accountability.

Compliance with International Laws: Ensures broader access and security.

For instance, Kraken is licensed in multiple jurisdictions, boosting trust among global users source. As a result, compliant exchanges tend to offer safer trading environments.

-

Reasonable and Transparent Fees

Hidden fees can erode your returns, especially if you trade frequently.

Clear Fee Structure: Make sure trading, withdrawal, and deposit fees are visible.

Discounts for High Volume: Many exchanges reduce fees for larger trades.

No Hidden Charges: Transparent platforms build trust with users.

Binance, for example, offers competitive fees and volume-based discounts, which helps active traders save significantly. Therefore, always check the fee schedule to avoid surprises.

Platform | Coins | Spot Trading Fee | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | All-in-One Crypto Services |

|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Advanced Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Compliance & Regulation |

Robinhood | +20 | $0 | Fee-Free Trading |

MEXC | +2,300 | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | Low Fee |

-

Liquidity and Trading Volume

Higher liquidity means faster trades and better prices for buyers and sellers.

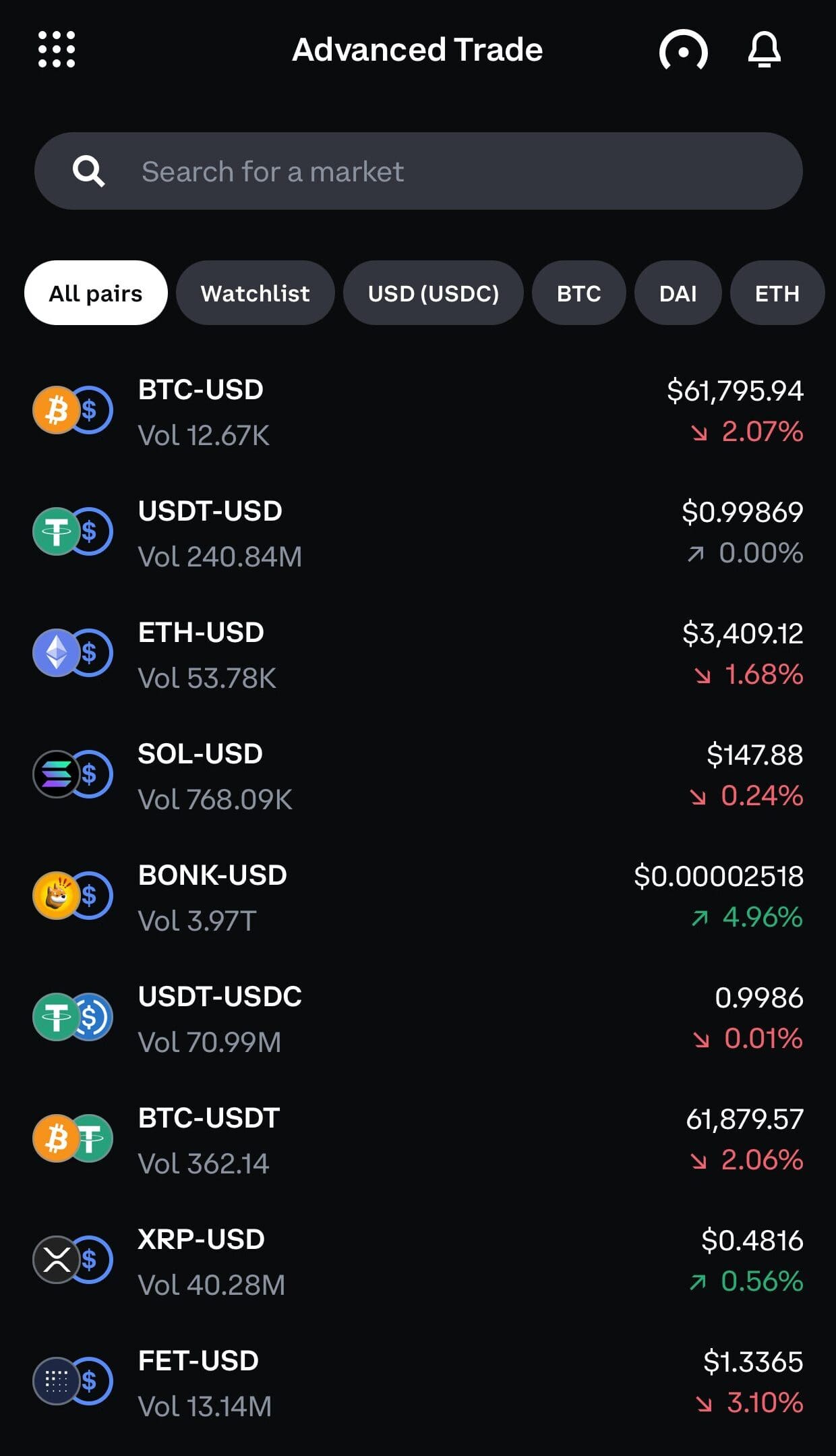

High Trading Volume: Ensures efficient order execution without big price swings.

Wide Market Access: More trading pairs mean more flexibility.

Depth of Market: Reduces slippage during larger trades.

Platforms like Binance and Coinbase consistently rank high in liquidity. As a result, choosing a high-volume exchange can improve your overall trading performance and can be great for day traders.

-

User Interface and Mobile App

A clean, functional interface reduces user errors and makes trading more efficient.

Simple Navigation: Even beginners can trade confidently.

Mobile Compatibility: A good app allows trading on the go.

Real-Time Data Access: Helps users make informed decisions.

For example, Crypto.com offers a sleek mobile app with charting, staking, and instant trade features. Therefore, user-friendly platforms benefit both new and experienced traders.

-

Responsive Customer Support

Support is often underrated—until you urgently need it.

Live Chat or Phone Support: Quick help during urgent issues.

Knowledge Base: Reduces reliance on support for simple questions.

Multi-language Options: Important for international users.

Exchanges like Gemini are praised for reliable customer service with live agents and educational resources. As a result, responsive support can make or break your experience during critical moments.

Red Flags to Avoid When Selecting a Platform

Before committing to a crypto exchange, it’s important to recognize warning signs that could lead to poor user experiences or financial loss.

Lack of Regulatory Oversight: If an exchange isn’t licensed or doesn’t follow Know Your Customer (KYC) rules, it could be operating illegally or be more vulnerable to shutdowns.

Poor Security Practices: No mention of cold wallet storage, two-factor authentication, or breach response plans can be a sign of weak protection.

Unclear or Excessive Fees: If the platform hides fees or charges much higher than average, you may end up overpaying.

Negative User Reviews: Repeated complaints about fund freezes, withdrawal issues, or customer service delays are clear red flags.

Aggressive Marketing with Guarantees: Exchanges that promise “guaranteed returns” or push aggressive referral bonuses often lack credibility and may be scams.

For example, multiple platforms flagged by regulators, like BitConnect, used such tactics.

Therefore, always verify a platform’s regulatory status and read independent user reviews, such as on Trustpilot, before depositing funds.

Popular Crypto Exchanges

Many exchanges stand out because they combine security, low fees, and ease of use. Below are some widely trusted options for various types of users.

Binance: Known for low trading fees and high liquidity, Binance supports a vast range of crypto assets and advanced trading tools.

Coinbase: Popular among U.S. users, Coinbase is fully regulated and offers an intuitive interface ideal for beginners.

Kraken: Offers strong security, margin trading, and futures contracts while maintaining regulatory compliance across several jurisdictions.

Gemini: U.S.-based and regulated, Gemini emphasizes security and transparency, making it a good option for conservative investors.

Crypto.com: Known for its mobile-first experience and integrated DeFi features, Crypto.com also offers Visa crypto cards and rewards.

FAQ

Yes, many investors diversify across multiple exchanges to access better trading pairs, reduce risk, or separate long-term and short-term holdings.

Decentralized exchanges offer more privacy and control but lack customer support and often have lower liquidity, making them less ideal for beginners.

The country where an exchange is headquartered affects regulations, KYC requirements, and the investor’s legal protections in case of disputes or hacks.

New platforms may offer attractive features, but always research their team, security, and reviews. A lack of track record adds risk.

Without FDIC-like insurance, funds may be lost. Some regulated exchanges hold insurance, but recovery can still take time and legal effort.

Most popular exchanges offer mobile apps, but their quality and features vary. Check for real-time data, security, and ease of trading on mobile.

Check the platform’s legal page or regulatory disclosures, and search financial authority websites to confirm its license in your region.

Yes, keeping large amounts on exchanges exposes you to hacking risk. Consider transferring to a hardware wallet for long-term storage.