Table Of Content

Can You Close a Vanguard Account Online?

Yes, most Vanguard accounts can be closed online by submitting a secure message through your account or calling their customer service.

However, some account types—such as IRAs or accounts with certain investment products—may require additional steps.

It’s best to ensure the account is cleared of all assets before initiating a closure request.

Steps to Close Your Vanguard Account

Closing your Vanguard account requires proper planning, especially if it holds investments or tax-advantaged assets.

Follow these steps to avoid delays or unexpected issues.

1. Review Your Account and Holdings

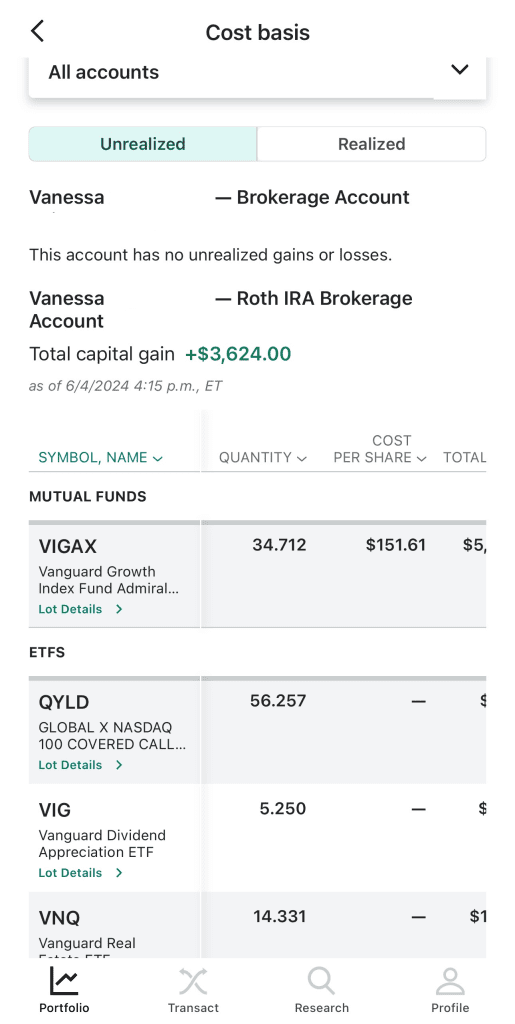

Before you close your Vanguard account, make sure it’s ready for closure by evaluating your balances and investment positions.

Withdraw Uninvested Cash: Any remaining cash should be moved to your linked bank account before initiating closure.

Sell or Transfer Investments: If you hold mutual funds, ETFs, or stocks, you can sell them or request a transfer to another brokerage.

Check for Pending Activity: Confirm that all trades, dividend payments, and contributions (in IRAs) are settled.

This step ensures a clean exit without holding up your closure due to unresolved activity.

2. Transfer Assets to Another Brokerage

If you wish to continue investing elsewhere, transfer your assets before closing the Vanguard account.

Initiate Transfer Through New Broker: Most brokers will guide you through an ACATS transfer by collecting Vanguard account info.

Use ACATS for Seamless Movement: Vanguard participates in the Automated Customer Account Transfer Service (ACATS) for supported asset types.

Account Must Be Eligible: Some proprietary Vanguard mutual funds may not transfer in-kind and might need to be liquidated.

Properly transferring your assets first can help avoid unexpected tax consequences or missed opportunities.

3. Request Account Closure

Once your assets are fully transferred or liquidated, you can request to close the account.

Send Secure Message Online: Log in to your Vanguard dashboard and use the secure messaging option to request closure.

Call Customer Support: Vanguard’s team can confirm if your account is ready to close and guide you through the process.

Obtain Confirmation: Request written or emailed proof that your account has been closed successfully.

Some accounts, such as traditional IRAs, may require additional forms or consent due to tax regulations.

4. Check for Tax and Reporting Requirements

After initiating the closure, monitor the account for any follow-up documents or obligations.

Ensure Year-End Tax Forms Are Issued: Vanguard typically provides 1099 or 5498 forms for taxable and retirement accounts.

Check Transaction History: Download your transaction reports and historical performance data before losing access.

Watch for Final Dividends or Reinvestments: Some reinvestments may process after your closure request—especially for mutual funds.

Keeping your records ensures a smooth tax season and prevents compliance headaches down the line.

5. Verify Final Account Status

Even after you've submitted your closure request, it’s important to confirm everything is finalized.

Log In to Double-Check: Ensure your account is no longer visible on your Vanguard dashboard.

Confirm Zero Balance: You should see no remaining positions, cash, or open trades.

Download and Save Documents: Retain all final statements and closure confirmations for your personal records.

This step provides peace of mind and allows you to fully move on to a new platform or financial strategy.

How to Withdraw Remaining Cash Before Closing?

To withdraw uninvested cash before closure:

Log Into Your Vanguard Account: From your dashboard, go to “My Accounts” and select the specific account.

Initiate Bank Transfer: Use the “Sell/Withdraw” option to move funds to a linked external bank account.

Monitor Processing Times: ACH withdrawals typically take 1–2 business days. Wire transfers may be faster but might incur fees.

Ensure your bank link is up to date and check for any unclaimed dividends before withdrawing.

How to Contact Vanguard for Account Closure

If you're unsure how to proceed or run into issues:

Call Vanguard Customer Service: Dial 877-662-7447 for support from 8 a.m. to 8 p.m. ET, Monday through Friday.

Use Secure Messaging: After logging into your account, use Vanguard’s secure message center to submit a closure request.

Vanguard representatives can help verify if your account is ready for closure or if any forms need to be submitted.