Table Of Content

How to Gift Stocks to Family and Friends

Gifting stocks to family or friends is a thoughtful way to share wealth and encourage investing. Here’s a simple five-step guide to help you transfer shares smoothly and meaningfully.

1. Decide What Type of Stock Gift You Want to Give

Before transferring shares, you need to decide whether you're gifting individual stocks, ETFs, or shares of a company you value.

For example, if your niece is into tech, you might gift her a few shares of Apple or a tech ETF. Gifting stocks with long-term potential can also encourage a habit of investing.

In some cases, people choose dividend-paying stocks as gifts because they can generate passive income.

This decision shapes the next steps, including which brokerage platform or method you'll use.

- The Smart Investor Tip

Consider gifting shares of a company the recipient already uses or loves—like Netflix for a movie buff or Starbucks for a coffee enthusiast—to create a personal connection to the investment.

2. Open or Confirm Brokerage Accounts

To transfer stocks, both you and the recipient typically need brokerage accounts.

Brokerage options include:

Fidelity Youth Account for teens age 13–17

Charles Schwab Custodial Account for minors

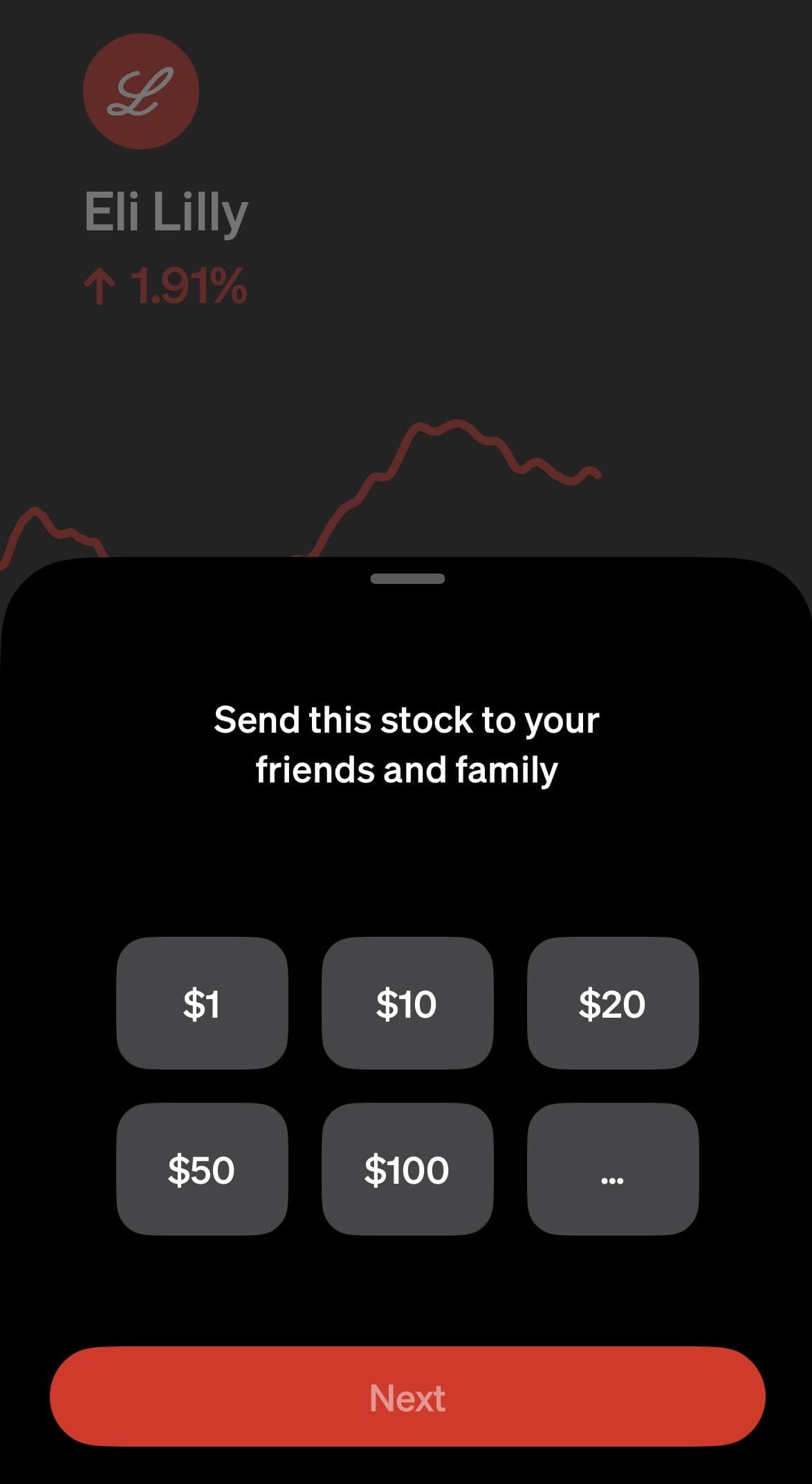

Robinhood or E*TRADE for adult recipients

Some platforms also support custodial accounts for minors, so if you're gifting to a child or teen, a parent or guardian can open the account on their behalf.

For instance, a father gifting stock to his 12-year-old son may use a custodial account under the Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA).

-

Custodial Accounts vs. Standard Brokerage Accounts: Comparison

Feature | Custodial Account (UGMA/UTMA) | Standard Brokerage Account |

|---|---|---|

Ideal For | Minors under 18 or 21 | Adults |

Account Holder | Custodian (usually a parent) | Individual owner |

Control Over Funds | Transfers to child at age of majority | Full control by account owner |

Tax Treatment | Minor’s tax rate (possible Kiddie Tax) | Adult’s capital gains tax |

Example Platform | Fidelity Youth Account | Robinhood, Schwab, E*TRADE |

3. Fill Out a Stock Transfer or Gifting Form

Once both parties have brokerage accounts, you’ll need to fill out a stock transfer or gifting form. Most brokerages offer these online (here's the Fidelity form, for example). You’ll need the recipient’s account number and personal info.

For example, if you're gifting 10 shares of Tesla, you'd specify that quantity and ticker symbol on the form. After submission, the transfer can take a few business days.

4. Consider the Tax Implications for You and the Recipient

Stock gifts are subject to IRS gifting rules. As of 2025, you can gift up to $18,000 per person per year without triggering the federal gift tax.

If your gift exceeds this amount, you’ll need to file IRS Form 709, though you likely won’t owe taxes due to the lifetime exemption.

For example, gifting $25,000 in stock to your sister would require filing paperwork, but not necessarily paying taxes. On the recipient's end, they may owe capital gains tax if they later sell the shares, based on your original cost basis.

- The Smart Investor Tip

Keep detailed records of the gift date, stock value, and your original cost basis. This helps the recipient calculate future capital gains and can simplify tax filing for both of you.

5. Add a Personal Touch and Educational Resources

Beyond the financial value, gifting stock can be a great way to teach investing.

Consider pairing the gift with a note explaining why you chose that company or asset. If you're giving stock to a teenager, you might also include a beginner investing book or video series.

For example, a grandmother gifting stock in Disney might explain how the company generates revenue, making the gift both personal and educational.

This helps make the stock more than just a number—it becomes a learning experience for the recipient.

How the IRS Gift Tax Rules Apply to Stock Transfer

When gifting stock, the IRS treats the shares' value as a taxable gift if it exceeds the annual exclusion limit—currently $18,000 per recipient in 2025.

For example, if you gift $25,000 worth of Amazon stock to your sibling, you’ll need to file IRS Form 709 to report the $7,000 overage.

However, because of the lifetime exemption (around $13.6 million in 2025), most individuals won’t owe gift tax unless they’ve exceeded this threshold.

To stay compliant, use brokerage-specific gift forms and consult a tax advisor if you're nearing the annual or lifetime limit.

How to Gift Stock as a Charitable Donation

Donating appreciated stock to a qualified charity can offer tax advantages while supporting causes you care about.

Instead of selling the stock and donating cash, gifting shares directly allows you to avoid capital gains tax and still deduct the full fair market value, if you’ve held the stock for over a year.

For instance, donating $10,000 of appreciated Google stock that you originally bought for $2,000 means you bypass tax on the $8,000 gain and can potentially deduct the full $10,000.

Organizations like Fidelity Charitable or Schwab DAFgiving360 offer donor-advised funds to streamline this process.

-

Gifting Stocks vs. Donating Stocks to Charity: Comparison

Feature | Gifting Stock to Individual | Donating Stock to Charity |

|---|---|---|

Tax Filing Requirement | May need IRS Form 709 | May need to file Schedule A (Itemized Deductions) |

Capital Gains Tax Avoided | No (transfers to recipient) | Yes (if donated directly) |

Deduction Eligibility | No | Yes, if donating to 501(c)(3) |

Ideal Use Case | Supporting family, teaching investing | Supporting causes, reducing tax liability |

Example Scenario | Gifting shares to a college-aged niece | Donating stock to a food bank fund |

What Happens If the Recipient Sells the Gifted Stock?

When the recipient sells gifted stock, they’ll be responsible for any capital gains taxes—calculated based on your original purchase price (cost basis) and holding period.

For example, if you bought Tesla stock at $150 and gift it when it's worth $300, your cousin who sells it at $350 will owe taxes on a $200 gain per share.

Because your basis transfers to them, the profit is treated as long-term or short-term depending on how long you held the stock. This can impact their tax rate significantly.

Also, if the stock loses value after the gift, the IRS may apply different rules depending on the sale price versus the basis and market value at the time of the gift.

FAQ

Yes, you can transfer stock directly to someone’s brokerage account without selling it. This avoids capital gains taxes for the giver.

Stock gifts can appreciate in value and teach investing, while cash gifts are simpler. It depends on your goals and the recipient’s needs.

You only need to notify the IRS if your gift exceeds the annual exclusion limit. In that case, you’ll file IRS Form 709.

Yes, but gifting to non-U.S. residents may involve additional tax rules and limitations. It's wise to consult a tax professional in these cases.

Most brokerage transfers take 3 to 7 business days. Timing depends on whether both parties use the same brokerage platform.

Some brokerages allow gifting fractional shares, especially with ETFs or high-priced stocks. Check with your provider before initiating the transfer.

No, the recipient inherits your original holding period. This can help them qualify for long-term capital gains tax rates when selling.

Yes, stock can be gifted to a trust for estate planning purposes. Make sure the trust is set up to receive and hold investments.

Most brokerages don’t charge a fee for stock transfers. However, some may have minor administrative charges depending on the platform.

No, once the stock is transferred, it's considered a completed gift and can’t be reversed. Be certain before initiating the process.