Table Of Content

Types of Ethereum ETFs: Spot vs. Futures-Based

Ethereum ETFs come in two main forms: spot-based and futures-based.

Spot Ethereum ETFs directly hold Ether (ETH), aiming to reflect its current market price. These ETFs offer exposure to actual Ethereum without the need for self-custody.

On the other hand, futures-based ETFs track Ethereum futures contracts, often traded on CME, which reflect speculation on ETH’s future price.

While both provide ETH exposure through traditional brokerages, they differ in pricing accuracy, regulatory treatment, and cost structure.

Feature | Spot Ethereum ETF | Futures-Based Ethereum ETF |

|---|---|---|

Underlying Asset | Direct ETH holdings | Ethereum futures contracts |

Pricing Accuracy | Closely tracks real-time ETH price | May deviate from spot price due to contango/backwardation |

Costs/Fees | Lower ongoing roll costs | May include additional futures management fees |

Availability | Subject to SEC approval in the U.S. | Already available in U.S. (e.g., ProShares, VanEck) |

Use Case | Long-term ETH exposure | Short-term trading, speculation, or hedging |

How to Buy an Ethereum ETF Through a Brokerage

Buying an Ethereum ETF is simple if you're familiar with online brokerages. Here's how to get started and make your first purchase:

Step 1: Open a Brokerage Account

Before investing in Ethereum ETFs, you need a brokerage account that supports crypto ETF trading. This can be done online in just a few steps.

Choose a Reputable Platform: Brokerages like Fidelity, Schwab, Robinhood, and E*TRADE offer commission-free trading for crypto-related ETFs.

Complete the Application: For regulatory purposes, you must provide personal information, employment status, and financial background.

Verify and Fund Your Account: Link a bank account and transfer funds via ACH or wire. Some brokers offer instant funding for small amounts.

Once your account is active and funded, you can explore Ethereum ETF options directly from your dashboard.

Broker | Annual Fees | Best For |

|---|---|---|

E-Trade | 0% – 0.35%

0% on stocks and ETFs in self directed brokrage, 0.35% for Core Portfolio Robo Advisor

| Options & Futures Trading |

Interactive Brokers | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% | Professional Trading Tools |

Fidelity | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| Retirement Account Investing |

Vanguard | Up to 0.30%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Vanguard Digital Advisor – 0.015%, Vanguard Personal Advisor: 0.03%, Vanguard Personal Advisor Select: up to 0.03%, Vanguard Wealth Management: up to 0.03% | Low-Cost ETF Investors |

J.P. Morgan Self Investing | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | Chase Bank Customers |

Charles Schwab | Up to 0.80%

$0 online commission on U.S. listed stocks, mutual funds and ETFs, options: $0.65 per-contract, Schwab Intelligent Portfolio – 0%, Schwab Intelligent Portfolios Premium – One-time planning fee: $300 + Monthly advisory fee: $30, Schwab Wealth Advisory: up to 0.80% | Advanced Trading Tools |

Merrill Edge | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | Bank of America Clients |

Step 2: Search for Ethereum ETFs

After setting up your brokerage account, the next step is to find Ethereum ETFs available on the platform.

Use the Ticker Symbol or Keyword: Search using tickers like ETHE (Grayscale Ethereum Trust) or EFUT (VanEck Ethereum Strategy ETF).

Review Fund Details: Check the ETF’s objective, holdings (spot vs. futures), expense ratio, and issuer reputation.

Compare Multiple Options: Use filters like performance history, volume, or cost to find the one that suits your goals.

Each Ethereum ETF has different structures and risks. Reviewing multiple listings helps ensure you're not just choosing based on name recognition.

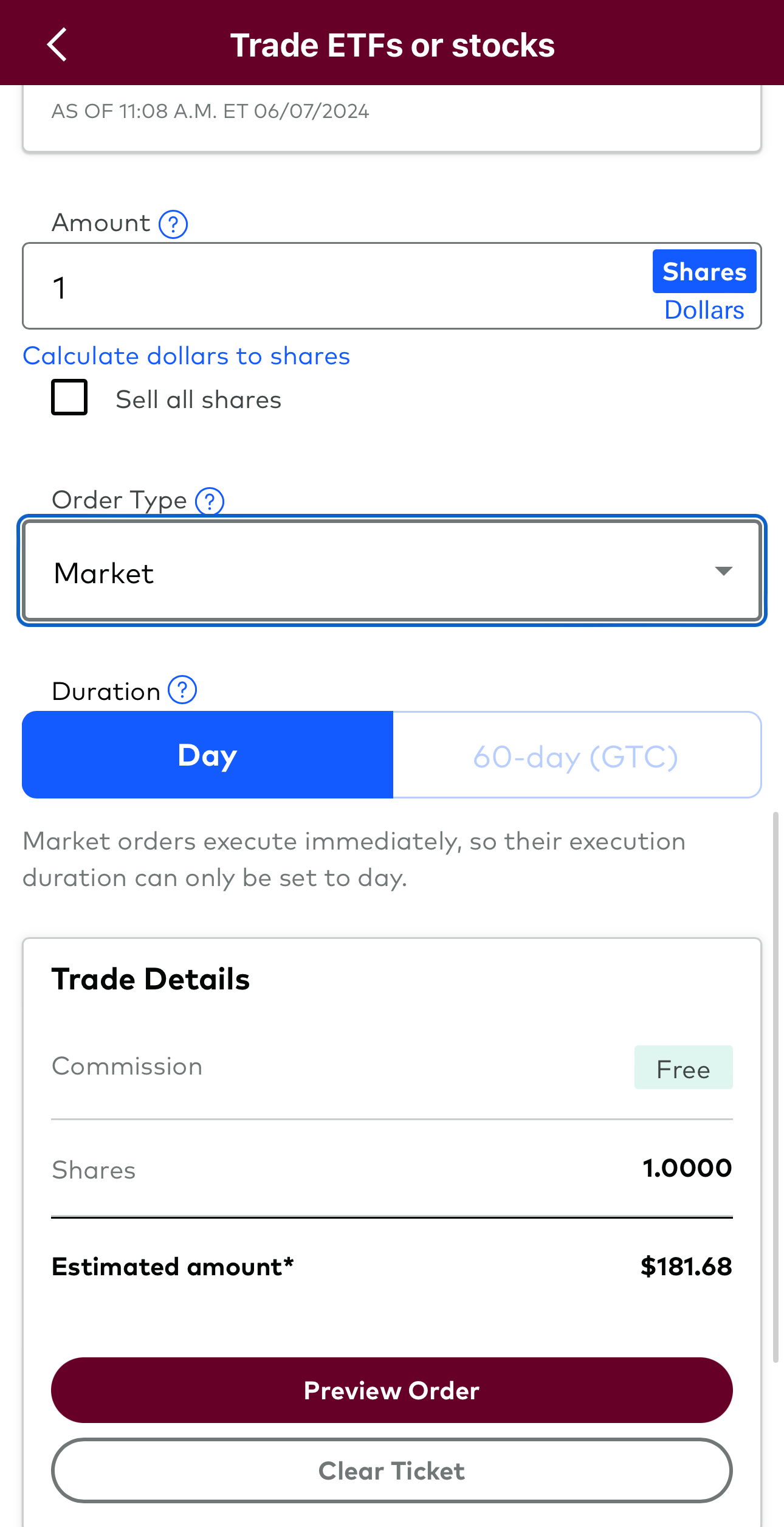

Step 3: Place a Buy Order

Now that you've chosen an ETF, you can place your order. Most brokers offer a simple interface to complete the transaction.

Select Order Type: You can choose between a market order (buy at the current price) and a limit order (buy at a set price).

Enter Quantity: Decide how many shares to buy based on your budget. Some brokers support fractional shares.

Preview and Confirm: Review the total cost and fees before placing your order. Confirm only when you're sure.

Once submitted, your order is processed almost instantly during market hours. You’ll see the ETF in your portfolio once filled.

Step 4: Monitor and Adjust Your Investment

Buying is only the beginning. Tracking your Ethereum ETF helps you stay aligned with your strategy.

Set Price Alerts: Use built-in tools to alert you if the ETF hits a certain price.

Review Performance Periodically: Compare your ETF’s performance against Ethereum itself and broader market benchmarks.

Rebalance When Needed: Adjust your allocation if it grows too large in your overall portfolio or underperforms.

Monitoring ensures your Ethereum exposure stays consistent with your financial goals. Rebalancing and staying updated with fund changes is key to long-term success.

How To Choose an Ethereum ETF

Selecting the right Ethereum ETF depends on your goals, risk appetite, and preference for futures or spot exposure.

Understand the ETF Structure: Some ETFs hold Ethereum futures (like VanEck’s EFUT), while others aim to hold physical ETH (pending SEC approval).

Compare Expense Ratios: Look at annual management fees. Higher costs can reduce net returns over time, especially in long-term holdings.

Evaluate Liquidity and Volume: ETFs with higher daily trading volume typically have tighter spreads, which helps reduce trading costs.

Research the Fund Provider: Choose ETFs from well-known issuers like ProShares or Grayscale for better transparency and reputation.

Choosing an Ethereum ETF is not just about performance—consider tax efficiency, asset tracking method, and your investment timeline.

Ethereum ETFs vs. Buying ETH Directly

Investing in Ethereum ETFs offers convenience and regulatory protection, especially for traditional brokerage users.

In contrast, buying ETH directly requires using crypto exchanges and wallets, which involves more control but also more responsibility.

ETFs can be better for retirement accounts or regulated portfolios, while holding ETH directly allows you to participate in staking or use DeFi platforms.

Feature | Ethereum ETF | Buying ETH Directly |

|---|---|---|

Ownership | No direct ETH ownership | Full control of Ethereum assets |

Storage Required | None – held in brokerage | Requires secure wallet (software/hardware) |

Use in DeFi/NFTs | Not possible | Fully enabled |

Regulation | SEC-regulated investment vehicle | Unregulated (depends on exchange) |

Ease of Access | Accessible via brokerage accounts | Requires crypto exchange account |

Best Ethereum ETFs Available for Investors

Here are some top Ethereum ETFs available today, each offering different structures and benefits based on investor needs.

ETF Name | Type | Expense Ratio | Launch Date | Fund Provider |

|---|---|---|---|---|

Grayscale Ethereum Trust | Trust (not ETF) | ~2.5% | 2019 | Grayscale |

VanEck Ethereum Strategy ETF | Futures-based ETF | 0.66% | 2023 | VanEck |

ProShares Ether Strategy ETF | Futures-based ETF | 0.95% | 2023 | ProShares |

Bitwise AETH | Hybrid (futures) | 0.85% | 2023 | Bitwise |

Each ETF has trade-offs in fees, structure, and tracking performance. Review prospectuses and use third-party sites for up-to-date metrics.

FAQ

Most brokerages allow you to buy a single share, and some even support fractional shares, making it accessible with small amounts.

Yes, Ethereum ETFs are eligible for IRAs or 401(k)s if your brokerage permits alternative asset exposure within those accounts.

No, ETFs do not support staking. If you want passive income through staking, you must hold ETH directly.

Yes. ETFs are taxed like traditional securities (capital gains), while direct ETH trades must be reported as crypto transactions.

Some ETFs can be shorted or used with margin, depending on your brokerage’s rules and the ETF’s liquidity and structure.

Availability depends on regional regulations. Futures-based ETFs are approved in the U.S., while spot ETFs may be available abroad.

No, Ethereum ETFs typically do not generate income or pay dividends since ETH itself doesn’t produce cash flows.

Only if the robo-advisor offers crypto ETFs as part of its allocation model. Not all platforms support this option.

Key risks include crypto market volatility, regulatory shifts, tracking errors, and ETF-specific fees or premiums.

Futures ETFs may suit short-term traders, while long-term investors should consider tracking accuracy and fee impact over time.