What Is Seeking Alpha?

Seeking Alpha is one of the leading platforms for fundamental research and portfolio management, providing stock market news, analysis, and investment insights.

It features content from both professional analysts and individual contributors, offering diverse perspectives on stocks, ETFs, and market trends.

Users can access earnings reports, financial data, and proprietary tools like Quant Ratings for stock evaluation.

While the platform offers free access to essential resources, its premium plans unlock more in-depth analysis and advanced tools for active investors and traders.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

How to Research Stocks with Seeking Alpha

Seeking Alpha offers a variety of tools that enable investors to conduct thorough stock research. Here are five effective ways to utilize the platform for research.

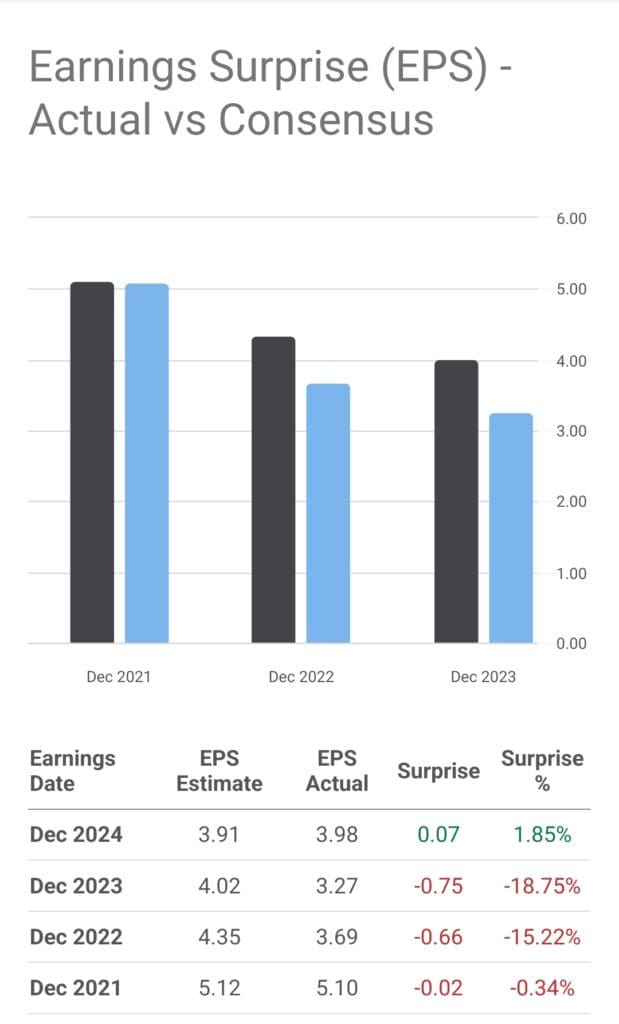

1. Leverage Earnings Reports for Company Insights

Earnings reports provide a snapshot of a company's financial performance, while earnings call transcripts provide management's insights on future growth.

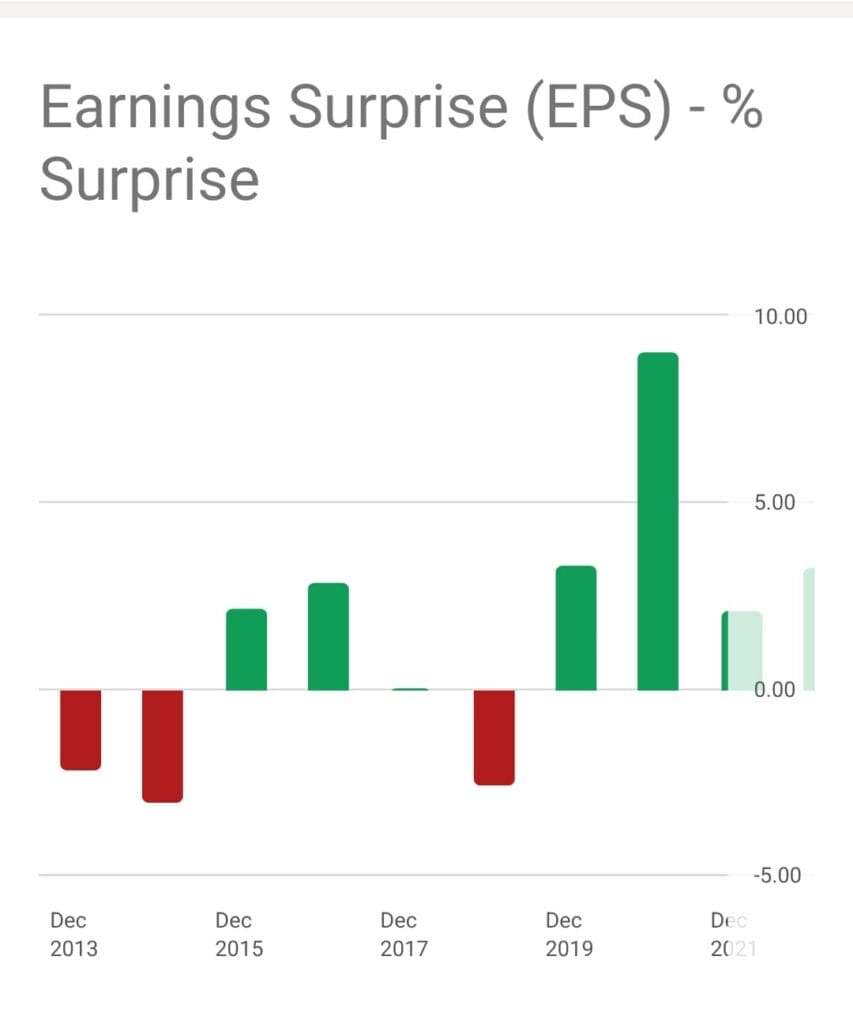

Earnings Surprise: Check if actual earnings exceeded or missed analyst expectations.

Guidance: Focus on forward guidance for expected revenue and profit growth.

Management Commentary: Assess how executives address risks and opportunities.

-

Example

An investor interested in companies with strong future growth might look for:

Earnings Surprise: 10% higher than expectations

Positive guidance for the next quarter

Management outlook focused on expansion

This approach helps identify companies with strong prospects and management confidence.

2. Use the Quant Ratings for Data-Driven Stock Insights

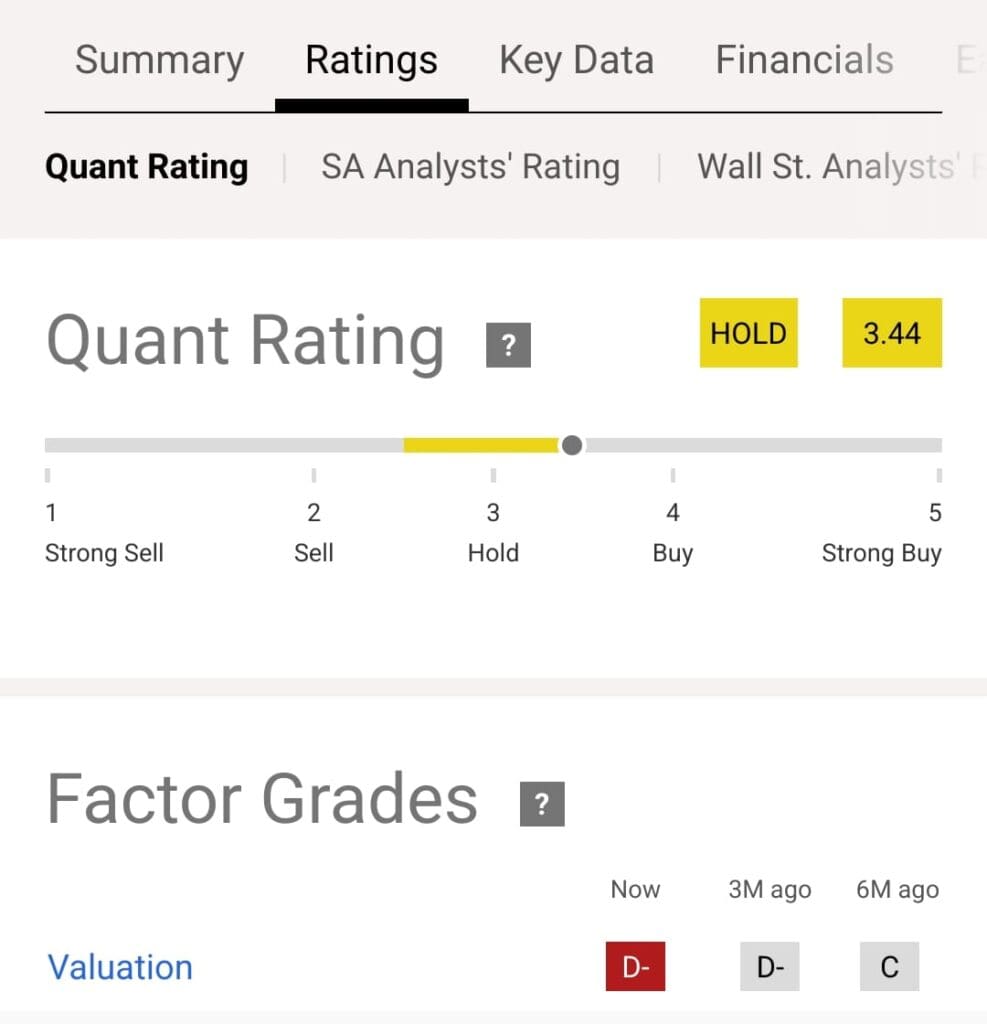

Quant Ratings offer a data-backed ranking system that assesses stocks based on key financial metrics like valuation, growth, and profitability.

Valuation: Assess if the stock is undervalued or overvalued based on metrics like P/E and P/B ratios.

Growth: Analyze projected earnings and revenue growth through revisions and estimates.

Profitability: Review metrics like return on equity (ROE) and net profit margins.

- The Smart Investor Tip

Regularly check the Quant Ratings to identify stocks with strong fundamentals that align with your investment goals.

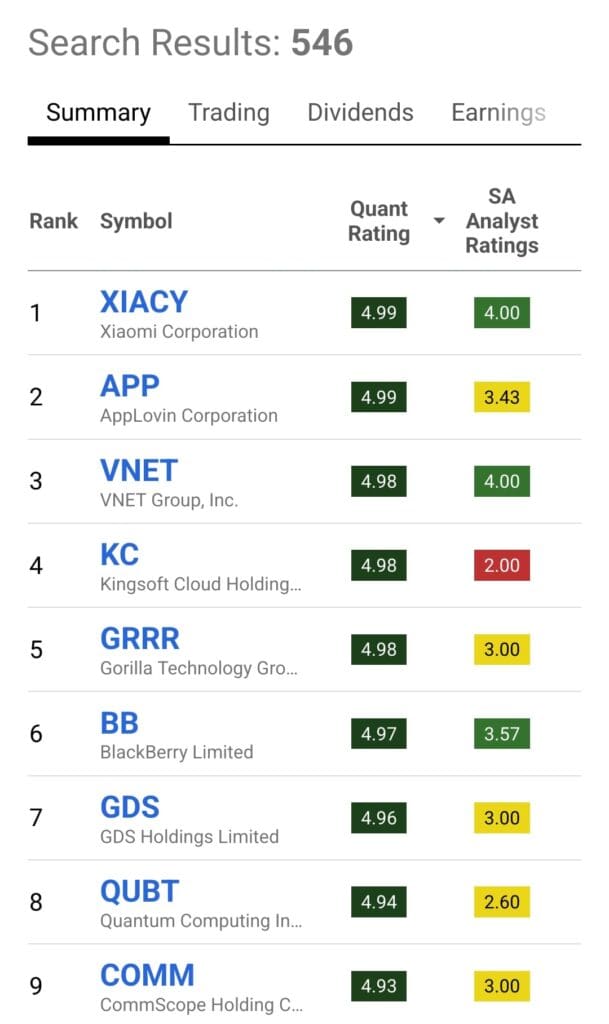

3. Utilize the Stock Screener for Custom Research

The stock screener on Seeking Alpha allows you to filter stocks based on a wide range of criteria to match your investment needs.

Sector & Industry: Filter stocks based on industry or sector, such as technology or healthcare.

Market Cap: Select stocks from different market caps, from small-cap to large-cap, depending on your risk tolerance.

Dividend Metrics: Screen for stocks that meet specific dividend yield and payout ratio criteria.

-

Example

An investor seeking growth stocks in technology might filter for:

Market Cap: Over $10B

Sector: Technology

P/E Ratio: Below 20

This helps identify growth opportunities in established sectors.

4. Follow and Learn from Top Authors and Contributors

Seeking Alpha allows you to follow top authors and contributors who share valuable stock analysis and insights based on their expertise. This strategy can help you gain insights from experienced investors and analysts.

Track Author Performance: Monitor which authors have a strong track record of accurate predictions.

Diverse Perspectives: Follow contributors with expertise in different sectors to gain various viewpoints.

Bullish/Bearish Analysis: Read both positive and negative articles to form a balanced view.

Sector-Specific Insights: Look for articles that focus on specific industries you’re interested in.

Community Contributions: Benefit from independent research and opinions from other investors.

- The Smart Investor Tip

If you're focused on tech stocks, following top contributors who specialize in the sector can help you stay updated with informed, niche analysis.

Also, follow multiple contributors to get a variety of perspectives on a stock's potential.

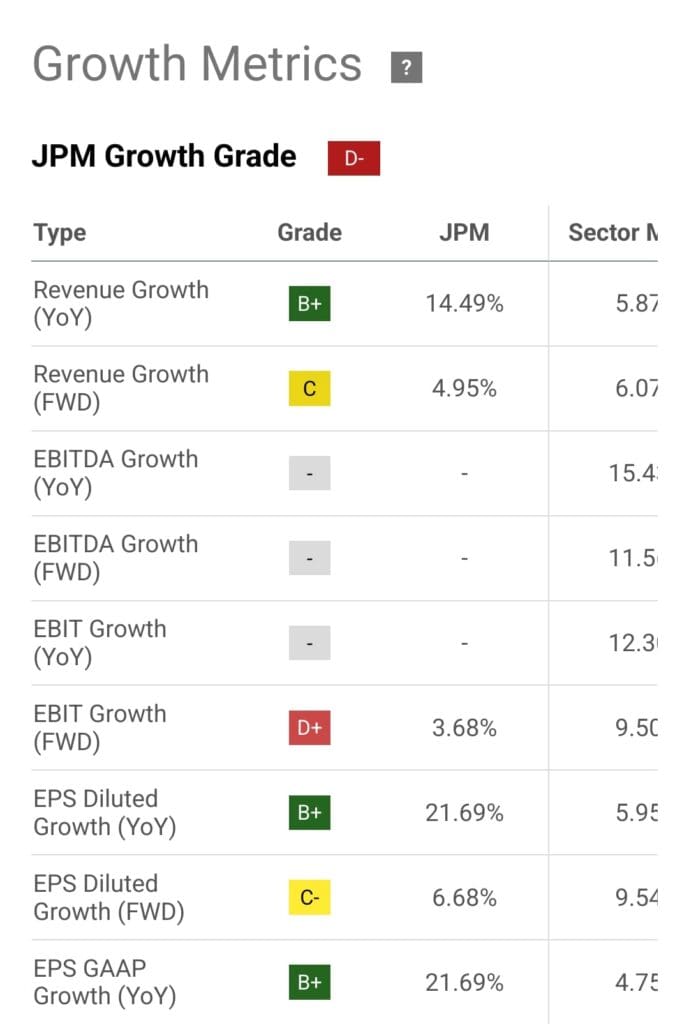

5. Analyze Company Financials for In-Depth Insights

Seeking Alpha provides access to comprehensive financial statements, including income statements, balance sheets, and cash flow reports.

Revenue Growth: Track how revenue is growing or shrinking over time.

Profit Margins: Check operating and net profit margins to gauge financial health.

Debt Levels: Analyze the debt-to-equity ratio to assess financial risk.

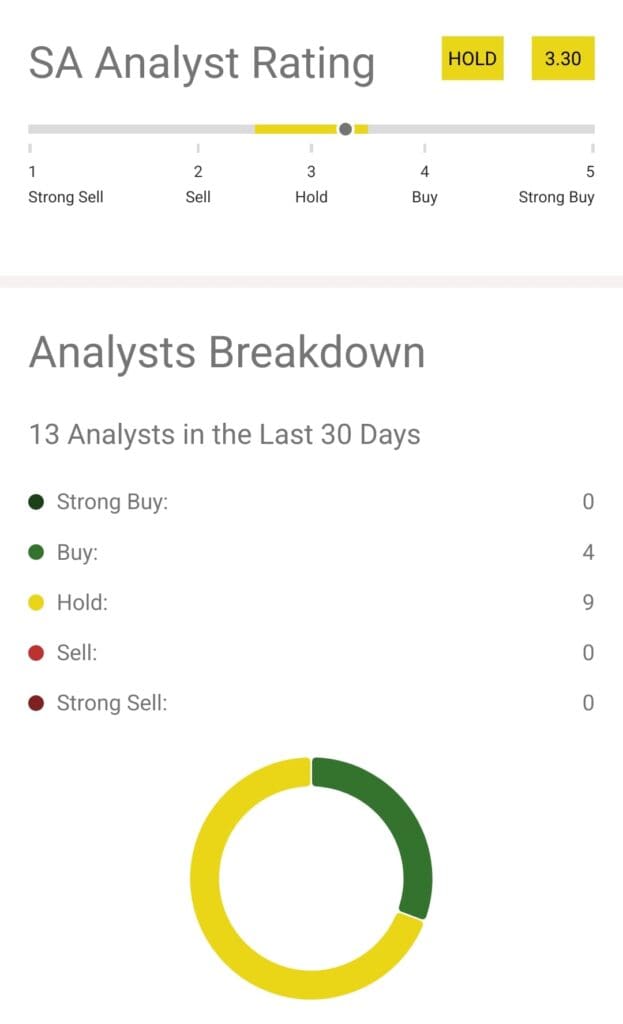

6. Explore Analyst Ratings for Expert Opinions

Seeking Alpha aggregates analyst ratings, providing a consensus view of a stock's potential from top industry experts.

Strong Buy/Hold/Sell: Understand the general sentiment of analysts toward a stock.

Price Targets: Look at the price targets set by analysts to gauge potential upside.

Analyst Upgrades/Downgrades: Track when stocks are upgraded or downgraded based on new information.

7. Monitor Insider Transactions for Market Sentiment

Insider transactions can provide valuable insights into how executives and key company insiders feel about the stock.

Buying Activity: Insider buying signals confidence in the company’s future.

Selling Activity: Frequent insider selling may indicate concern about future prospects.

Ownership Trends: Changes in insider ownership can signal strategic shifts.

8. Use the Dividend Safety Scores for Income Investments

Seeking Alpha’s Dividend Safety Scores provide a measure of a stock's ability to maintain its dividend payouts in challenging economic environments.

Dividend Safety: Evaluate the likelihood that a company will be able to continue paying dividends.

Payout Ratio: Check the sustainability of dividends based on earnings.

Free Cash Flow: Ensure the company generates enough cash flow to support its dividend policy.

-

Example

An investor looking for high-quality dividend stocks might filter for:

Dividend Safety Score: A or B

Payout Ratio: Below 60%

Free Cash Flow: Positive and increasing

This helps identify companies with reliable, sustainable dividends even during market downturns.

9. Monitor Analyst Earnings Estimates for Growth Predictions

Seeking Alpha’s earnings estimates feature provides insight into how analysts predict future company performance, based on revenue and EPS (Earnings Per Share) projections.

Revenue Estimates: Track analyst projections for a company’s future revenue.

Earnings Estimates: Look at earnings projections to gauge potential profitability.

Consensus Ratings: Compare different analysts’ expectations and the consensus outlook for a stock.

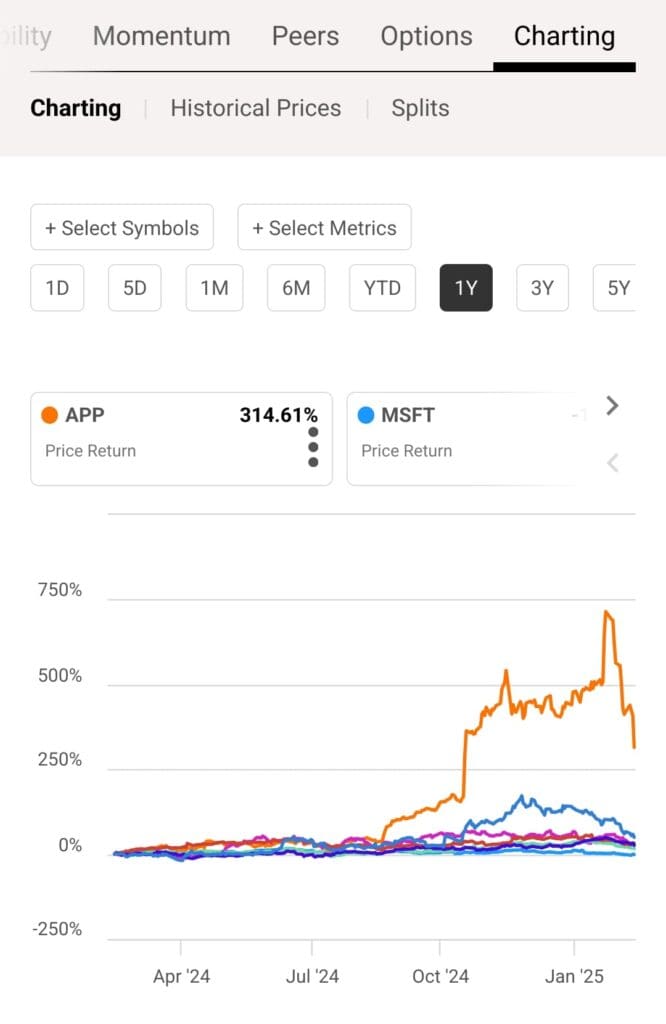

10. Use Peer Comparison Tool to Evaluate Stocks vs Competitors

The peer comparison tool on Seeking Alpha allows you to compare a stock’s performance and financials against its competitors within the same industry.

Performance Metrics: Compare key financial metrics like P/E ratio, revenue growth, and profit margins.

Valuation Comparison: See how the stock is valued compared to industry peers.

Risk Assessment: Assess which stocks are less volatile or more resilient compared to their competitors.

-

Example

For an investor focused on the retail sector, comparing stocks like Walmart vs Target can help identify which company is performing better and is more undervalued.

Use the peer comparison tool regularly to identify stocks that offer better risk-adjusted returns than competitors.

FAQ

Quant Ratings are data-driven stock rankings based on financial metrics like valuation, profitability, and growth. These ratings help investors quickly identify potential buy or sell opportunities based on objective data, rather than subjective opinions.

The stock screener allows you to filter stocks based on various criteria such as sector, market cap, P/E ratio, and dividend yield. It's a great tool for narrowing down stocks that meet your specific investment strategy, whether it's growth, value, or income-focused.

Seeking Alpha provides essential dividend data like yield, payout ratios, and dividend growth history. You can also use the Dividend Safety Score to assess the sustainability of a stock’s dividend payments, ensuring a reliable income stream.

Yes, Seeking Alpha offers access to earnings reports and earnings call transcripts. You can stay updated on a company's performance and management's outlook, which is crucial for understanding stock price movements and potential future growth.

Seeking Alpha offers a peer comparison tool, enabling you to compare a stock’s performance, valuation, and financial metrics against its competitors within the same industry. This is useful for assessing whether a stock is undervalued or overvalued relative to its peers.

Earnings call transcripts provide valuable insights into how company executives view their performance and future prospects. By reviewing these transcripts, you can get a better understanding of a company’s growth strategy and how it plans to tackle challenges.

Yes, Seeking Alpha allows you to follow top contributors and analysts. You can access their stock recommendations, insights, and performance reviews, which help in evaluating the stock’s potential based on expert opinions.

Seeking Alpha is great for long-term stock research due to its comprehensive coverage of earnings reports, financial statements, dividend history, and sector performance. These tools are ideal for investors focused on fundamental analysis and long-term growth.

Seeking Alpha’s data is updated regularly to ensure you have access to the latest market news, earnings reports, and analyst opinions. Stock prices and other key metrics are updated in real-time or with minimal delays.