Table Of Content

Selling Bitcoin means converting your BTC into fiat currency or another crypto asset based on your goals and market conditions.

It’s a straightforward process, but there are several decisions that can impact your profits, taxes, and transaction experience.

How to Sell Bitcoin: Step by Step

To sell Bitcoin smoothly and securely, follow these essential steps that help you choose the right platform, minimize costs, and stay protected throughout the process.

1. Choose a Platform That Supports Bitcoin Sales

Before selling, you’ll need a platform that allows easy BTC-to-cash or BTC-to-crypto transactions. Different platforms offer various options based on convenience, control, and fees.

- Centralized Exchanges: Sites like Coinbase, Binance, and Kraken allow you to sell Bitcoin directly to fiat or another coin with just a few clicks.

- Peer-to-Peer (P2P) Platforms: Services like Paxful or Binance P2P let you sell BTC directly to other users for cash or bank transfers.

- Bitcoin ATMs: Some allow BTC-to-cash transactions on the spot, though they often charge higher fees.

- The Smart Investor Tip

Compare withdrawal methods before picking a platform—if you want fiat in your bank fast, Coinbase might be better than Binance.

For example, Coinbase is ideal for U.S. users looking to cash out to a bank, while Binance P2P may appeal to sellers in countries with limited banking support.

Platform | Coins | Spot Trading Fee | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | All-in-One Crypto Services |

|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Advanced Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Compliance & Regulation |

Robinhood | +20 | $0 | Fee-Free Trading |

MEXC | +2,300 | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | Low Fee |

2. Transfer Bitcoin to the Selling Platform

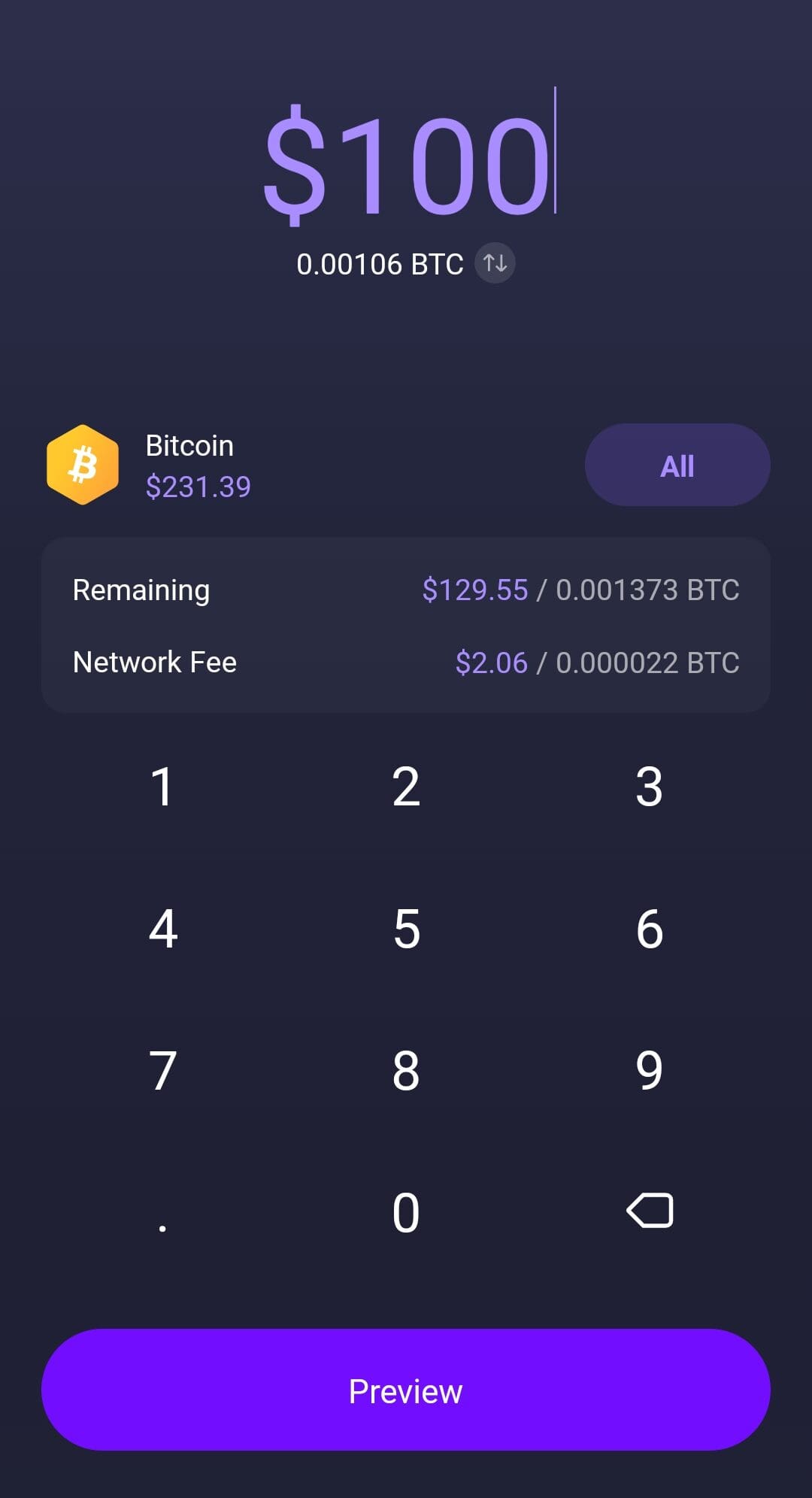

If your BTC is stored in a personal wallet, you’ll need to send it to the exchange or app where you plan to sell it.

- Use the Correct Wallet Address: Go to your chosen platform, generate a BTC deposit address, and send the amount you want to sell.

- Mind the Network Fee: Bitcoin transactions incur miner fees, so factor this into your total cost when transferring.

- Wait for Confirmations: Transactions usually require a few confirmations before funds are credited and sellable.

For example, if you use a Ledger or Trust Wallet, you can copy the receiving BTC address from Binance and transfer securely. Always double-check addresses and amounts before confirming.

- The Smart Investor Tip

Always double-check the BTC wallet address character-by-character before confirming the transfer—it’s irreversible if sent to the wrong one.

3. Select a Selling Method: Market or Limit Order

Once your BTC is on the platform, decide how you want to sell it—instantly or at a target price.

- Market Orders: Instantly sell at the current market rate. This is faster but may not fetch the best price.

- Limit Orders: Set the price at which you want to sell. Your order only executes when the market hits that level.

- Convert to Stablecoin: You can also convert BTC into USDT or USDC if you want to stay in crypto but avoid volatility.

For example, you could place a limit order to sell 0.01 BTC at $70,000. If the price hits your target, it executes automatically—this helps you avoid selling during sudden dips.

- The Smart Investor Tip

If the market is highly volatile, consider placing a limit order to avoid selling your Bitcoin for less than it’s worth in a price dip.

4. Withdraw Funds After Selling

After the sale is complete, you can choose to cash out or reinvest into another asset.

- Withdraw to Bank Account: Platforms like Kraken and Coinbase support direct withdrawals via ACH, SEPA, or wire transfer.

- Transfer to a Wallet: If you converted to another coin, you may prefer to store it in a personal wallet for future use.

- Be Aware of Withdrawal Fees: Each method has its own fee and processing time, so check before confirming.

For example, a USD withdrawal from Coinbase via ACH might be free, but a wire transfer from Bitstamp could cost $20+. Therefore, choose the method that aligns with your cost and speed preferences.

Consider Tax Implications of Your Sale

Selling Bitcoin can trigger capital gains tax, depending on your location, profit, and holding period.

- Track Purchase and Sale Prices: The difference between your buy and sell price determines your gain or loss.

- Short-Term vs Long-Term Gains: Holding BTC for over a year may result in lower tax rates in some regions.

- Use Tax Reporting Tools: Platforms like Koinly or CoinTracker can help organize your transaction history for easier filing.

For example, if you bought BTC at $20,000 and sold it at $65,000, you’ll owe taxes on the $45,000 gain—unless you sold within a retirement or tax-advantaged account, which may change the rules.

How to Sell Bitcoin Peer-to-Peer (P2P) Without an Exchange

Selling Bitcoin directly to another person allows you to skip centralized platforms and potentially get better rates.

To do this, use P2P marketplaces like Binance P2P, Paxful, or LocalBitcoins, which connect buyers and sellers directly and often offer escrow services to reduce risk.

You agree on the price, payment method, and terms with the buyer, then release BTC only after receiving funds. Some sellers also arrange local meetups, but these carry more security risks.

Always verify identity, use trusted platforms, and avoid dealing with strangers without a reputation score.

Sell Bitcoin: How To Lower Fees?

When selling Bitcoin, minimizing transaction and withdrawal fees can help you retain more of your profits.

Use Bank Transfers Over Cards: Bank withdrawals (like ACH or SEPA) often carry lower fees than credit or debit card withdrawals.

Sell During Low Network Activity: Bitcoin network fees drop when congestion is low—typically at night or on weekends.

Choose Fee-Friendly Platforms: Exchanges like Kraken or Binance generally have lower trading and withdrawal fees than platforms like PayPal or Coinmama.

Avoid Middleman Services: Selling directly on P2P platforms or to trusted buyers may help bypass certain platform fees.

Bundle Transactions When Possible: If withdrawing to a wallet, combine BTC into fewer transactions to save on miner fees.

How to Sell Bitcoin for Cash Safely & Avoid Scams

Selling Bitcoin for physical cash involves higher risk, so it's critical to prioritize safety and verification.

If using a Bitcoin ATM, ensure it’s from a reputable operator and check fees in advance. For in-person deals, meet in public locations with surveillance—like inside a bank branch—and never go alone.

Use platforms like Paxful’s cash option or LocalBitcoins with verified users and escrow protection. Also, count cash on the spot and wait for BTC confirmations before finalizing.

Because scams and fake payments are common in cash transactions, always double-check buyer credentials and payment legitimacy.

Selling Method | Pros | Cons |

|---|---|---|

Centralized Exchange | Fast, liquid, easy to use | May require KYC and charge withdrawal fees |

P2P Marketplace | Greater control over price, multiple payment methods | Requires trust, risk of scams if not careful |

Bitcoin ATM | Immediate cash access, no account needed | High fees, limited availability |

Broker Services | Simple process, some offer fixed quotes | Usually high spreads and fewer features |

FAQ

In most cases, selling Bitcoin anonymously is difficult due to regulations. However, using non-KYC platforms or meeting in person for small amounts may allow partial privacy, but it's riskier.

Bitcoin regulations vary. In many countries like the U.S., it’s legal but requires tax reporting. Always check your local laws or consult a financial advisor.

Yes, in many jurisdictions selling Bitcoin is a taxable event. You may owe capital gains tax depending on your profit and how long you held the asset.

Yes, you can sell BTC for cash through P2P platforms, Bitcoin ATMs, or gift card exchanges. However, your options are more limited without a bank.

Using a trusted exchange or P2P platform with escrow and good user reviews is generally the safest way. Avoid meeting strangers for cash unless absolutely necessary.

Yes, Bitcoin is divisible into smaller units called satoshis. You can sell as little as $10 worth of BTC or even less depending on the platform.

It depends on the method. Bank withdrawals may take a few days, while P2P or ATM sales can be nearly instant if both parties are ready.

Yes, but always ensure the transaction is recorded and verified. Use a wallet QR code and confirm the payment has cleared before releasing the BTC.