Table Of Content

Is It Safe to Sell Bitcoin on Gemini?

Yes, Gemini is considered one of the safest exchanges for buying and selling Bitcoin.

It is a New York trust company regulated by the NYDFS. It offers strong security measures, such as two-factor authentication (2FA), cold storage, and insurance coverage for digital assets.

Therefore, users can sell with confidence knowing their assets are protected.

How to Sell Bitcoin on Gemini in 4 Simple Steps

Selling Bitcoin on Gemini is straightforward once you understand the key steps. Here's how to do it efficiently:

Step 1: How Selling Fits Your Overall Investment Strategy?

Before rushing to sell, it’s essential to think about the bigger picture and how selling aligns with your financial goals.

Review your investment plan: Make sure selling fits your long-term or short-term objectives.

Consider market conditions: Analyze Bitcoin’s price trends and volatility before proceeding.

Understand tax consequences: Selling Bitcoin could trigger capital gains taxes depending on your location.

Taking a moment to reflect ensures that you're not making a hasty decision based on short-term price movements, therefore protecting your portfolio's long-term value.

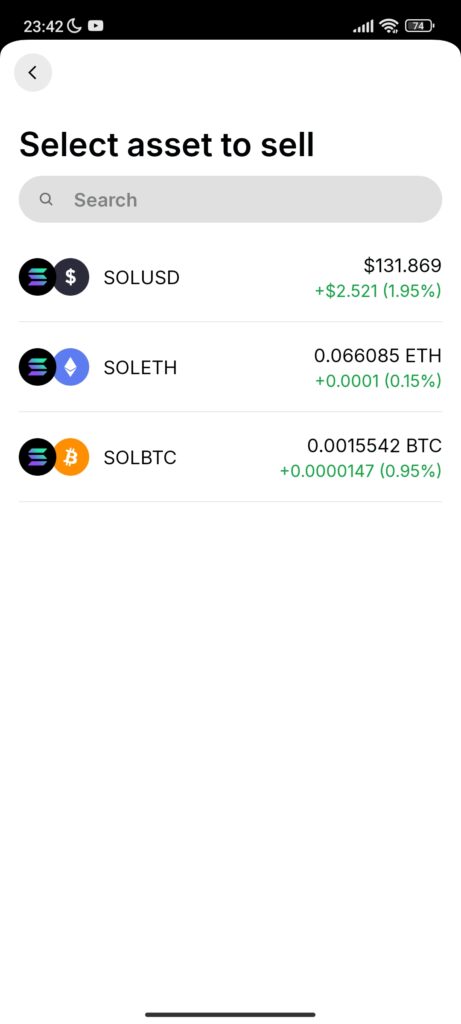

Step 2: Log In and Navigate to the 'Sell' Section

Once your decision is clear, accessing the selling feature on Gemini is quick and intuitive.

Use Gemini’s app or desktop: Both platforms provide a clean and secure interface.

Locate Bitcoin in your portfolio: You’ll find your holdings under the “My Portfolio” tab.

Select ‘Sell’ next to Bitcoin: This action leads you directly to the sale setup page.

Using the official app or website also ensures you benefit from the latest security updates and real-time price feeds, which helps you make a more informed decision.

Step 3: Choose Sale Amount and Confirm the Transaction

Selling Bitcoin on Gemini allows flexible choices depending on your needs and goals.

Sell a specific amount or full balance: Gemini lets you sell partial or entire Bitcoin holdings.

Select your preferred settlement method: You can sell for USD or stablecoins like GUSD.

Double-check the final price: Prices can change quickly because of crypto’s volatility.

Taking a moment to review all sale details before confirming is vital because crypto markets move fast, and any error could be costly.

Step 4: Withdraw Your Proceeds Securely

After selling, the final step is ensuring your funds are safely transferred to where you want them.

Withdraw to your linked bank account: Bank transfers usually take 1–3 business days.

Alternatively, move to another crypto wallet: If you’re staying within crypto, transfers are also quick.

Monitor withdrawal confirmations: Gemini provides real-time notifications and status updates.

Because crypto transactions are irreversible, it’s crucial to verify the withdrawal address or banking details before approving a transfer.

Mistakes To Avoid When Selling Bitcoin on Gemini

Selling Bitcoin on Gemini is simple, but mistakes can still happen if you’re not careful. Here’s what to avoid when cashing out:

Selling without checking real-time price: Bitcoin’s price can fluctuate significantly; therefore, waiting even a few minutes could change your final payout.

Overlooking withdrawal fees: Bank transfer fees or crypto network fees may apply, so factor these costs into your selling decision.

Ignoring tax implications: Selling Bitcoin could trigger capital gains taxes, but forgetting this can cause problems at tax filing time.

Rushing large sales: Selling a large amount all at once can create slippage, so consider using limit orders for better execution.

Not securing proceeds immediately: After selling, it's crucial to withdraw or reinvest quickly because leaving fiat balances on exchanges exposes you to platform risk.

Taking a few extra minutes to plan ahead and double-check each step helps you avoid costly errors when selling your Bitcoin on Gemini.

Alternative Places To Sell Bitcoin

While Gemini is trusted, there are other great crypto apps for beginners where you can also sell Bitcoin, depending on your goals and needs:

Coinbase: Known for a simple interface and strong liquidity, although convenience fees can be slightly higher than those of competitors.

Kraken: Offers excellent security and low fees, but beginners might find the trading interface a bit overwhelming at first.

Cash App: Allows you to quickly sell Bitcoin directly from your phone, though selling limits may be lower for new users.

Binance.US: Provides fast trade execution and low costs, but therefore may not suit those who prefer a highly regulated environment.

Crypto.com: Crypto.com enables quick selling and offers a range of payout options, but cashing out to a bank account can sometimes take longer.

Choosing the right platform depends on factors such as fees, speed, user experience, and how quickly you need access to your funds.

Platform | Coins | Spot Trading Fee | Best For | Crypto.com | +350 | 0.075%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0% – 0.050%. Holding and staking CRO tokens, Crypto.com native token, unlocks additional fee discounts. | All-in-One Crypto Services |

|---|---|---|---|

Kraken | +300 | 0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | Advanced Traders |

Coinbase | +250 | $0.99 – 2.00% (Standard), 0.05% – 0.60% (Advanced Trade)

For transactions above $200 (standard account): 1.49% fee for using a bank account or USD wallet, 3.99% fee for using a debit or credit card. For Coinbase Advanced Trade: 0.60% for taker trades and 0.40% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.05%. | Beginners |

Gemini | +150 | $0.99 – 1.49% (Web & Mobile), 0.20% – 0.40% (Active Trader)

For Gemini’s website or mobile app users are charged 0.50% convenience fee For Active Trader, 0.40% for taker trades and 0.20% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.03%. | Compliance & Regulation |

Robinhood | +20 | $0 | Fee-Free Trading |

MEXC | +2,300 | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | Low Fee |

FAQ

Yes, Gemini offers instant sell options, allowing you to sell your Bitcoin at the current market price without delay.

There is no strict minimum, but tiny transactions may be subject to minimum trade size limits depending on market conditions and fee structures.

Bank withdrawals typically take 1–3 business days after the sale is completed and approved by Gemini.

Yes, Gemini allows limit sell orders where you can set a target price and automatically sell when Bitcoin reaches that level.

Yes, Gemini charges a combination of spread and convenience fees which can vary depending on the transaction size and method.

Not directly. You must first transfer Bitcoin from your hardware wallet into your Gemini account before initiating a sale.

When using a market sell, your Bitcoin will be sold at the best available price at that moment, which may differ slightly from the quoted price.

Yes, Gemini supports crypto-to-crypto trading, allowing you to swap Bitcoin for other digital assets like Ethereum or stablecoins.

The process is almost identical, but the mobile app is optimized for faster transactions and on-the-go management.