With gold prices hitting record highs in recent years, many Americans are wondering if now’s the time to sell their gold coins.

Whether you bought them as an investment, inherited them, or just need the extra cash, selling gold doesn’t have to be complicated.

But to get the most money, you need to know where to go, what your coins are worth, and how to avoid common mistakes. Let's get into it.

How to Sell Gold Coins for the Best Price

If you’re thinking about selling your gold coins, it pays to be prepared. Here’s a simple five-step process to help you get the best price and avoid common mistakes.

-

Step 1: Know What You’re Selling

Before you even think about selling, take time to identify your coins. Are they bullion coins like American Gold Eagles, or older numismatic coins with collector value?

Look for markings like weight, purity (e.g., 1 oz .999), and mint year. A quick online search or checking with a coin guide can give you a general idea.

This step matters because some coins are worth more than just their gold content.

-

Step 2: Find Out the Current Gold Price

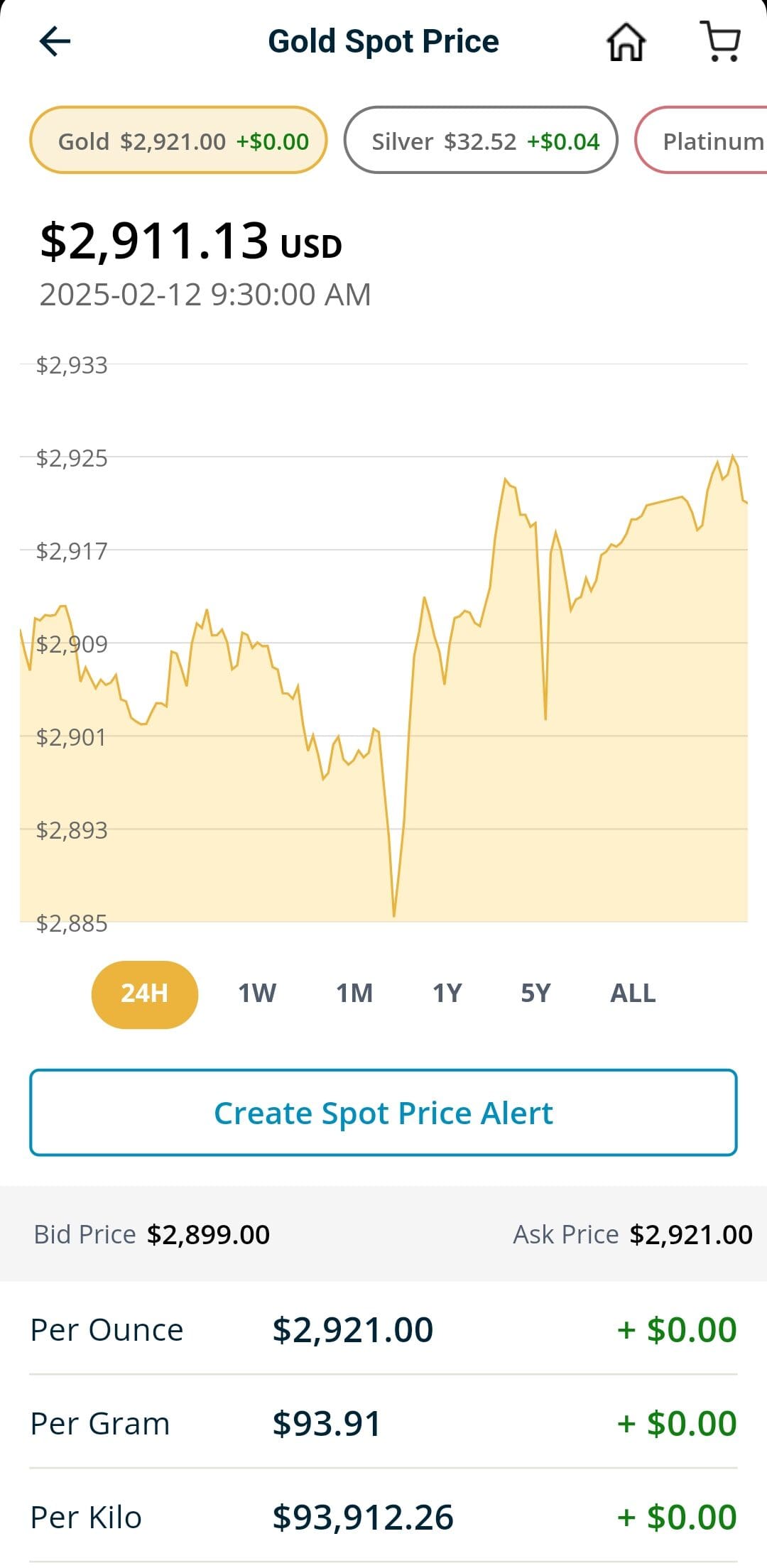

The value of your coin is tied closely to the current spot price of gold, which changes daily.

You can check live gold prices on financial websites or apps like Kitco, CNBC, or even Google. Knowing the current rate per ounce gives you a baseline.

Just remember: dealers won’t pay full spot price, but you’ll be in a stronger position to negotiate if you’re up to date.

-

Step 3: Get Your Coins Appraised or Evaluated

Once you know what you have, it’s worth getting a professional opinion.

Local coin shops, pawn shops, and online gold buyers may offer free evaluations. If you have rare coins, consider getting them graded by a service like PCGS or NGC.

This helps confirm authenticity and value. Don’t sell to the first place you visit—use the appraisal to compare offers.

-

Step 4: Shop Around for the Best Offer

Prices can vary widely between buyers. Some local dealers pay better for certain coins, while online gold buyers may offer convenience and competitive rates.

Check reviews, ask about fees, and see if shipping is insured when selling online.

You can also visit multiple coin shops and request written offers to compare side by side. The more quotes you get, the better your chances of finding the best deal.

-

Step 5: Close the Deal (Securely)

Once you find the best offer, make sure you sell in a secure and transparent way.

In person, choose a reputable dealer and request payment on the spot—preferably in check or bank transfer form. For online buyers, use companies with insured shipping and clear payout terms.

Always get a receipt. Selling gold coins can be quick and easy when you’ve done your homework and found a trustworthy buyer.

Should You Sell Gold Coins to a Local Dealer, Pawn Shop, or Online?

Choosing where to sell your gold coins can make a big difference in how much you walk away with. Each option has pros and cons depending on your priorities—speed, convenience, or price.

Let’s break down the differences so you can make the best decision based on your needs.

Option | Best For | Pros | Cons |

|---|---|---|---|

Local Dealer | Fair price + in-person service | Fast payment, expert appraisal | May offer less for non-bullion coins |

Pawn Shop | Quick cash | Immediate money, no shipping | Often lowest offers, less expertise |

Online Buyer | Convenience + higher value | Free shipping, competitive pricing | Payment delay, requires trust |

-

Local Coin Dealer

A reputable local coin shop can offer fair prices, especially for bullion or collectible coins. You get personal service, immediate payment, and a chance to negotiate face-to-face.

Make sure the dealer has good reviews and experience with your specific type of coin. This is often the best choice if you want both value and peace of mind.

-

Pawn Shop

Pawn shops offer fast cash, but they typically pay less than coin dealers or online buyers. They may not have expertise in gold coins and will likely base offers on melt value alone.

While convenient, they’re best used as a last resort or if you're in urgent need of money and are willing to trade off price for speed.

-

Online Buyers

Online gold buyers and marketplaces can offer competitive prices and often provide free, insured shipping. Platforms like APMEX, Kitco, and JM Bullion are trusted by many sellers.

The process can take a few days, but you get a quote before sending anything in. Make sure you’re dealing with a reputable company with a clear return and payment policy.

How to Determine the Value of Your Gold Coins Before Selling

To figure out what your gold coins are worth, you need to consider two main things: the current gold price and the specific details of your coin.

The spot price tells you how much an ounce of gold is trading for today, but your coin’s value also depends on its weight, purity (like 90% or .999 fine), and condition. Some coins, like rare or collectible issues, may be worth more than their gold content.

Tools like coin price guides, melt value calculators, and professional appraisals can help you get a realistic estimate before you sell.

Gold Coin Buyback Programs: Are They Worth It?

Some gold coin dealers and mints offer buyback programs, where they agree to repurchase coins previously sold through them.

These programs can be convenient since you’re dealing with a known entity, and they may offer better-than-market rates—especially for coins in good condition.

However, it’s important to read the fine print: some buybacks come with fees or restrictions, and not all guarantee top-dollar payouts.

Best Online Platforms for Selling Gold Coins

Selling gold coins online has become easier and more transparent, with several well-known platforms offering fast, secure, and competitive services.

Here are some top online options for 2025:

APMEX – Offers a strong buyback program with real-time pricing, fast payments, and insured shipping. Great for American Eagles and other bullion coins.

JM Bullion – Known for its straightforward buyback process and fair pricing. Provides prepaid shipping labels and quick turnaround.

Money Metals Exchange – Transparent pricing with daily quotes and free shipping on qualifying orders. Popular for both gold and silver coins.

SD Bullion – Competitive offers with a price-lock system once you submit your sell order. Works well for larger transactions.

Always check reviews, compare payout rates, and make sure your coins are fully insured during shipping.

FAQ

Some online platforms require a minimum sale amount or coin weight. Check the site’s policy before initiating a sale.

Most reputable buyers provide insured shipping labels. Always confirm insurance coverage and get tracking details before mailing anything.

Yes, many local dealers and even some online platforms allow negotiation, especially for larger transactions or collectible pieces.

Most reputable buyers will ask for a government-issued ID. This helps prevent fraud and ensures compliance with local laws.

Yes, you can still sell damaged coins, but they may only be valued for their gold content rather than any numismatic value. Buyers often deduct for wear or damage.

Profits from selling gold coins may be subject to capital gains tax. It’s best to keep records and consult a tax professional if you’re unsure.

No—cleaning can actually reduce their value, especially if they are collectible or graded. Leave them as-is unless a professional advises otherwise.