Table Of Content

What Are Premarket Movers?

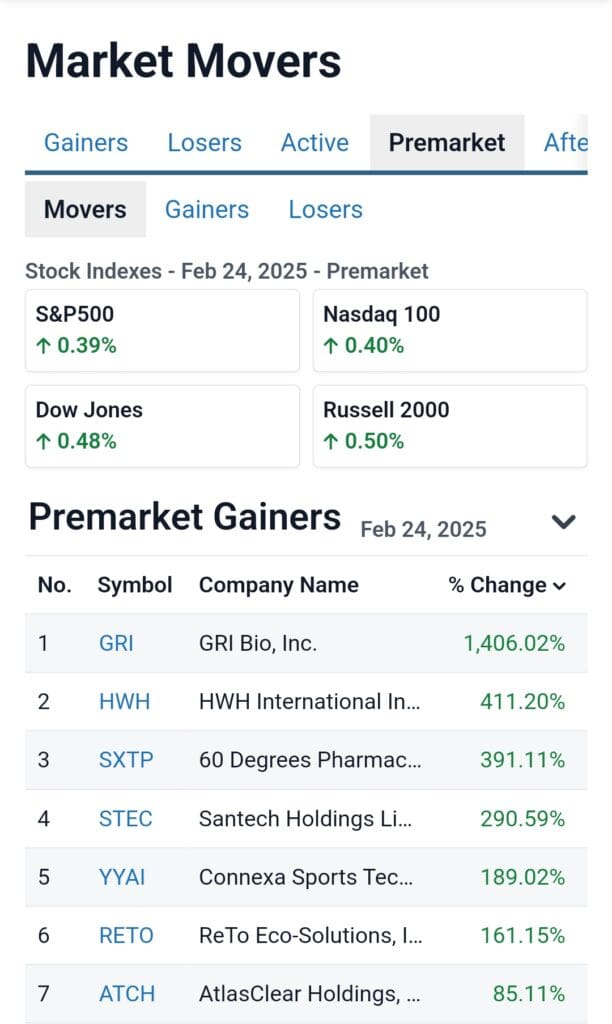

Premarket movers are stocks that experience significant price changes before the regular market opens — typically between 4:00 a.m. and 9:30 a.m. ET.

These price moves often result from earnings announcements, press releases, analyst upgrades, or overnight global events. Because premarket trading volumes are lower, even modest news can trigger exaggerated moves.

Premarket movers are closely watched by day traders and institutions looking for volatility and quick opportunities.

Can I Buy Any Stock In Pre Market?

No, not all stocks are traded in the premarket. Only a small portion of stocks—usually those with fresh news, earnings reports, or strong investor interest—have active premarket volume. Many stocks show no trades or extremely low volume during extended hours.

Larger-cap stocks, high-profile names (like Tesla or Apple), and low-float penny stocks reacting to news are more likely to trade actively. In contrast, less liquid or smaller companies may have no price movement at all until the regular session opens.

Best Strategies for Trading Premarket Movers

To succeed with premarket movers, you need more than fast reflexes — you need a structured plan, good tools, and strong risk control.

1. Focus on Stocks With Clear News Catalysts

Premarket price movement without a clear news driver can be misleading, as these moves often fade after the open.

Therefore, prioritize stocks with legitimate catalysts—such as earnings beats, FDA approvals, or major analyst upgrades.

For example, a biotech stock announcing positive Phase 3 trial results at 7:00 a.m. often gains strong momentum at the open.

Also, use platforms like Benzinga Pro or Seeking Alpha to verify the news before trading. Stocks that combine real news with strong volume tend to offer more reliable continuation plays.

2. Stick to Liquid, Low-Spread Names

Trading in illiquid stocks during premarket hours can result in poor fills and high slippage.

To avoid this, focus on stocks with tighter bid-ask spreads and at least 100K shares traded before the bell.Also, check Level 2 data and time-and-sales for signs of real buying—not just price spikes.

For instance, a $5 stock with a 50-cent spread and only 5K in volume is much riskier than a $30 stock with 200K shares traded and a 5-cent spread.

Liquidity ensures your entries and exits are smoother, especially in fast-moving premarket sessions.

3. Time Your Scans for Key Activity Windows

Timing your scans to match periods of high activity increases your chance of finding actionable setups.

When and how to scan:

Pre-market (8:00–9:30 AM ET): Scan for gap-ups of 5% or more, especially in stocks with fresh earnings, biotech approvals, or low-float setups.

Opening bell (9:30–10:30 AM ET): Use filters that show top percentage gainers with volume above average in the first 15–30 minutes of trading.

Use scanners with real-time feeds like Webull, Benzinga Pro, or Trade Ideas to catch moves as they develop—not after they peak.

Scanning at the right time puts you in front of moves—so you can prepare, not just react.

4. Map Out Key Support and Resistance Levels Before the Open

Premarket charts provide insight into intraday psychology. Identify price zones where volume spikes or pullbacks occur before the open—these areas often become support or resistance once regular trading begins.

Also, use premarket highs and VWAP (volume-weighted average price) as key breakout or breakdown levels.

For example, if a stock is holding above its premarket high with rising volume, it may break out once the opening bell rings.

Mapping these zones in advance improves your ability to plan risk-reward and set stop-losses appropriately.

Common Mistakes Traders Make With Premarket Movers

Premarket trading can be appealing, but it's easy to fall into costly traps without a solid plan.

Chasing the Spike Without a Plan: Traders often jump in after spotting a large premarket gainer, hoping for more upside. But without analyzing volume trends or catalysts, they may enter near the top and face sharp reversals.

Skipping News Validation: Some traders see a price move and assume it’s meaningful. But if the spike is based on a rumor or outdated information, the trade may reverse once real volume enters at the open.

Overtrading Volatile Names: Because premarket gainers are often volatile, traders may get whipsawed multiple times if they overtrade without clear levels or stop-loss discipline.

To avoid these issues, always analyze the news catalyst, confirm volume strength, and trade with predefined risk limits.

Free and Paid Tools for Finding Premarket Movers

To identify high-potential premarket movers, traders often rely on a mix of free and paid platforms—each offering different levels of speed, data, and filtering capabilities.

Plan | Subscription | Best For |

|---|---|---|

TradingView Premium | $59.95

$432 ($23.98 / month) if paid annually | Technical Analysts |

Benzinga Pro | $37

$367 ($30.58 / month) if paid annually | News-Driven Traders |

MarketBeat All Access | $39.99

$399 ($33.25 / month) if paid annually | Portfolio Trackers |

GuruFocus Premium | $499 ($41.58/ month)

No monthly plan, price for US citizens, price change by region | Guru Investors Portfolios |

StockTwits Edge | $22.95

$229.50 ($19.10 / month) if paid annually

| Social Sentiment Traders |

Finviz Elite | $39.50

$299.5 ($24.96 / month) if paid annually | Chart Pattern & Backtesting |

Benzinga Pro (Paid): Known for lightning-fast news alerts and a dedicated “Movers” tab that tracks top premarket gainers and losers with real-time headlines.

Yahoo Finance (Free) Lists trending premarket stocks with headlines and percentage changes, though updates may lag behind premium tools.

Finviz Elite (Paid): This tool allows scanning for premarket gaps and technical setups with customizable filters. It is also useful for swing traders.

Seeking Alpha (Free & Paid): Great for identifying news-driven movers. Premium plans offer early access to earnings and analyst commentary.

Investing.com (Free): Features a premarket movers tab, economic calendar, and access to global markets, helpful for tracking macro-driven moves.

Each tool has its strengths—combine a fast news feed with a real-time screener to stay ahead.