Table Of Content

What Is a Bond Screener and How Does It Work?

A bond screener is a research tool that lets investors filter and compare bonds based on key investment criteria, such as yield, rating, maturity, and sector.

Because the bond market includes thousands of corporate, municipal, and government bonds with varying risk-return profiles, a screener helps simplify the selection process and uncover fixed-income opportunities tailored to your goals.

Most screeners let you filter by credit rating, yield to maturity, sector, and duration. For example:

Filter by Yield and Maturity: Investors can search for bonds offering over 6% yield with a maturity range of 3–7 years for a balance of income and risk.

Screen by Credit Quality: You might select BB to B-rated bonds to focus on high-yield (junk) bonds with enhanced return potential.

Sector Focus: If you believe energy or healthcare will outperform, narrow the screener to those industries’ bonds.

Strategies to Screen for High-Yield Bond Opportunities

A bond screener can help you identify bonds with attractive income potential—especially if you're targeting high-yield (non-investment grade) instruments.

Here are some practical screening strategies:

-

Find High-Yield Corporate Bonds with Stable Outlooks

Focus on bonds offering elevated yields but issued by companies with manageable default risk.

Credit Rating Filter: Set ratings from BB+ to B- to capture high-yield territory without entering distressed debt.

Yield Filter: Look for corporate bonds above 7% to capture potential excess returns.

Issuer Outlook: Use screeners that integrate Moody’s or S&P outlooks; avoid negative or “watch” labels.

For example, a BB-rated bond from a telecom firm with a stable rating outlook might offer a 7.5% yield, appealing to income-focused investors willing to accept moderate risk.

-

Search for Short-Duration Bonds in a High Rate Environment

Short-term bonds reduce exposure to interest rate swings while still generating yield.

Maturity Filter: Set between 1 and 3 years to avoid long-duration volatility.

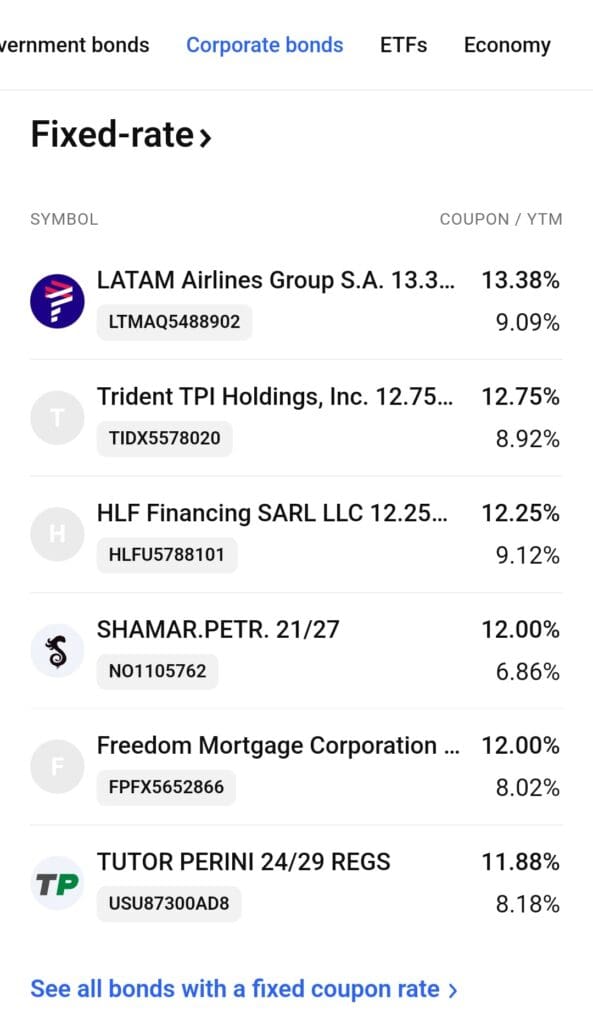

Coupon Type: Choose fixed-rate bonds to lock in high yields.

Price Filter: Screen for bonds trading near par to reduce premium risk.

This approach works well when you expect rates to stay high or rise further, as shorter bonds mature before rate cycles shift significantly.

-

Identify Bonds with Tax-Advantaged Income

For investors in high-tax brackets, municipal bonds can offer federally (and sometimes state) tax-exempt interest.

Bond Type: Select municipal or revenue bonds from the issuer filter.

Tax Status: Look for “tax-exempt” or “triple tax-free” listings.

State Filter: If you live in a high-tax state, screen for in-state issuers for added exemption benefits.

For instance, California residents may benefit from tax-free income on California municipal bonds yielding 4%—equivalent to a higher taxable rate after adjustments.

-

Find Bonds With Positive Momentum in Secondary Markets

Bonds trading above par with rising demand may reflect improving creditworthiness or investor confidence.

Price Change Filter: Filter for bonds that gained value in the past month.

Yield to Worst: Ensure yields remain attractive even with early call risk.

Credit Rating Outlook: Focus on companies recently upgraded or under positive review.

This method helps spot institutional interest and can signal safer high-yield plays, especially in sectors like energy or infrastructure.

-

Target Callable Bonds with Attractive Yield-to-Call

Callable bonds may offer higher yields, but they come with reinvestment risk if called early.

Call Date Filter: Look for bonds callable within 1–3 years to match short-term income goals.

Yield-to-Call vs. Yield-to-Maturity: Prioritize bonds with favorable yield-to-call spreads—this can indicate underpricing or strong coupon value.

Issuer History: Check if the issuer frequently calls early during falling rate periods, which could reduce actual income.

Example: A B-rated energy bond callable in 18 months with a 9% yield-to-call might be attractive—if rates hold steady or rise, it likely won’t be called, allowing you to keep the higher coupon.

-

Screen for Bonds in Improving Sectors Post-Downgrade

Some sectors may rebound after economic shocks, offering value in discounted high-yield debt.

Sector Filter: Focus on cyclicals like consumer discretionary or travel if economic conditions are stabilizing.

Recent Downgrades: Screen for bonds that were downgraded in the past 12–18 months but still maintain interest coverage ratios above 2.0x.

Price Discount: Look for bonds trading at 90–95 cents on the dollar with strong recovery prospects.

This is a contrarian strategy—ideal for investors who want to buy high-yield bonds at a discount before a sector recovery boosts both price and credit rating.

-

Filter for Fallen Angels with Potential Rating Upgrades

Fallen angels are former investment-grade bonds that were downgraded, often offering an attractive risk/reward setup.

Issuer History Filter: Look for bonds downgraded from BBB to BB in the past 12 months.

Credit Metrics: Focus on improving debt-to-EBITDA and interest coverage trends.

Price Action: Many of these bonds trade below par but with potential for both price recovery and yield compression if upgraded.

Example: A fallen angel telecom bond downgraded in 2023 may be trading at 93 with a 6.5% yield and could return to investment-grade status as margins recover.

How to Choose the Right Bond Screener

Choosing the right bond screener depends on your investing goals—whether you're focused on income, risk, or diversification.

Check for Credit Rating Filters: Ensure the screener allows filtering by Moody’s, S&P, or Fitch ratings to target investment-grade or high-yield bonds.

Look for Yield-to-Maturity and Yield-to-Call: These metrics are essential when comparing bonds with different coupon structures or callable features.

Include Tax Status Options: If you're in a high tax bracket, choose a screener that distinguishes between taxable and tax-exempt bonds.

Platform Access and Data Depth: Use screeners like Fidelity or FINRA that provide robust real-time data and issuer details, even for retail investors.

The ideal screener should balance ease of use with powerful filters that match your strategy, whether for safety or yield enhancement.

Common Mistakes to Avoid When Using a Bond Screener

While bond screeners are powerful tools, investors often misinterpret results or apply filters that distort real opportunities.

Ignoring Credit Risk: Don’t chase yield blindly—BB or B-rated bonds come with higher default risk and should be evaluated carefully.

Overlooking Call Features: Bonds with high yields may be callable, which means you might not receive the full expected return.

Setting Filters Too Narrow: Filtering by multiple strict criteria can eliminate good candidates; keep your ranges broad enough for discovery.

Forgetting Tax Considerations: Municipal bonds may appear to have lower yields, but their tax advantages can result in higher effective returns.

Avoiding these mistakes ensures your screener delivers bonds that align with your actual income, risk, and tax objectives.

FAQ

Yes, many screeners allow you to search for Treasury Inflation-Protected Securities (TIPS) or inflation-linked corporate bonds. These are useful when inflation risk is high, but yields tend to be lower than standard bonds.

Yield to maturity assumes the bond is held until it matures, while yield to worst accounts for early calls. This is important for callable bonds where the issuer might repay early, impacting your total return.

Some advanced platforms like Morningstar, Bloomberg, or Fidelity let you screen for foreign corporate or sovereign bonds. Be aware of added currency and geopolitical risks when investing abroad.

Yes, you can filter by maturity ranges to build a bond ladder. This involves buying bonds with staggered maturity dates to manage reinvestment risk and cash flow.

While some basic screeners only show current ratings, advanced tools may integrate outlooks such as “stable,” “positive,” or “negative” from Moody’s or S&P to assess future risk trends.

Yes, many screeners allow filtering by coupon type. Zero-coupon bonds can be useful for long-term investors who want to lock in a lump-sum payout at maturity.

Liquidity isn’t always directly shown, but price spreads and trade volume (if available) can offer clues. Bonds with wide bid-ask spreads may be harder to trade efficiently.

Municipal screeners often include filters for state, tax status, and project type. Corporate screeners focus more on industry, balance sheet strength, and ratings.