What Is a Crypto Screener and How Does It Work?

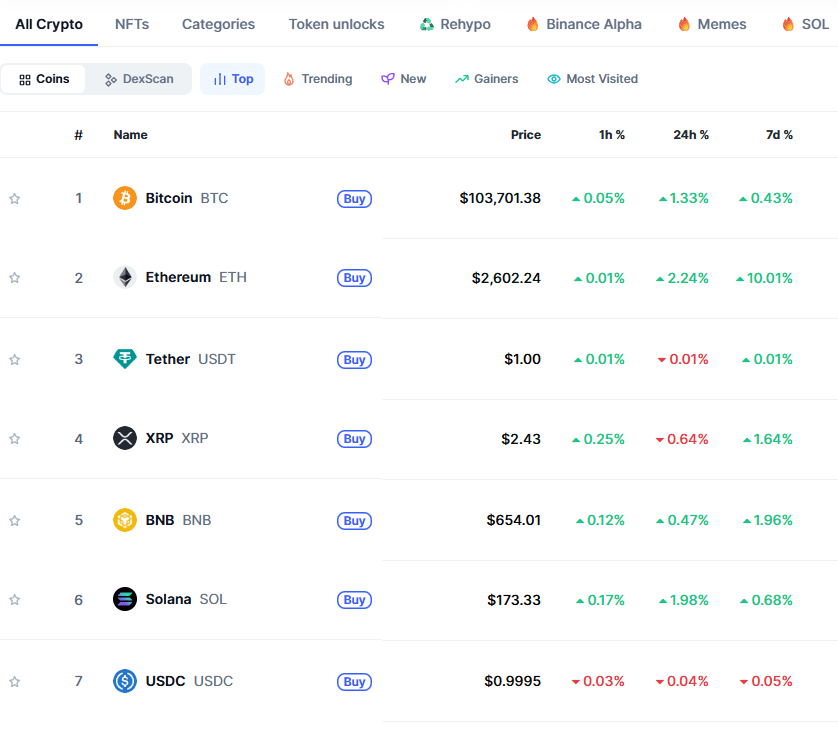

A crypto screener is a real-time tool that helps investors filter digital assets—like coins and tokens—based on criteria such as price, market cap, trading volume, blockchain network, and on-chain data.

Since the crypto market runs 24/7 and includes thousands of assets, a screener is essential to spot trends early, avoid scams, and filter out noise. The best crypto screeners also support technical and fundamental filters tailored for crypto.

For example:

Filter by Market Cap and Volume: To reduce risk, screen for tokens with over $50M market cap and $10M+ daily trading volume.

Use Blockchain Network Filters: Choose tokens built on Ethereum, BNB Chain, or Solana to avoid low-liquidity chains.

Check Token Age and Circulating Supply: Filter out recently launched projects with large supply unlock risks.

Best Strategies to Screen for Winning Cryptocurrencies

Crypto screeners allow traders to uncover early-stage opportunities, identify trends, and manage risks across a highly volatile market.

Here are our main targeted strategies you can use to spot promising crypto coins and tokens.

-

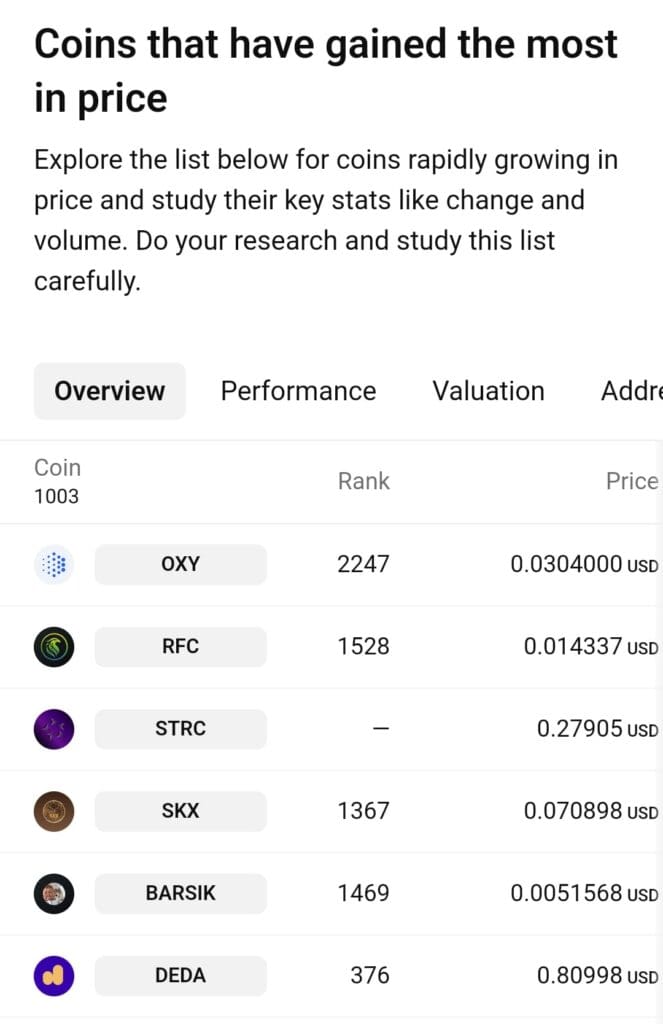

Find High-Volume Gainers for Momentum Trading

Coins with unusual volume spikes and price surges often signal short-term trading opportunities, especially for momentum-focused traders.

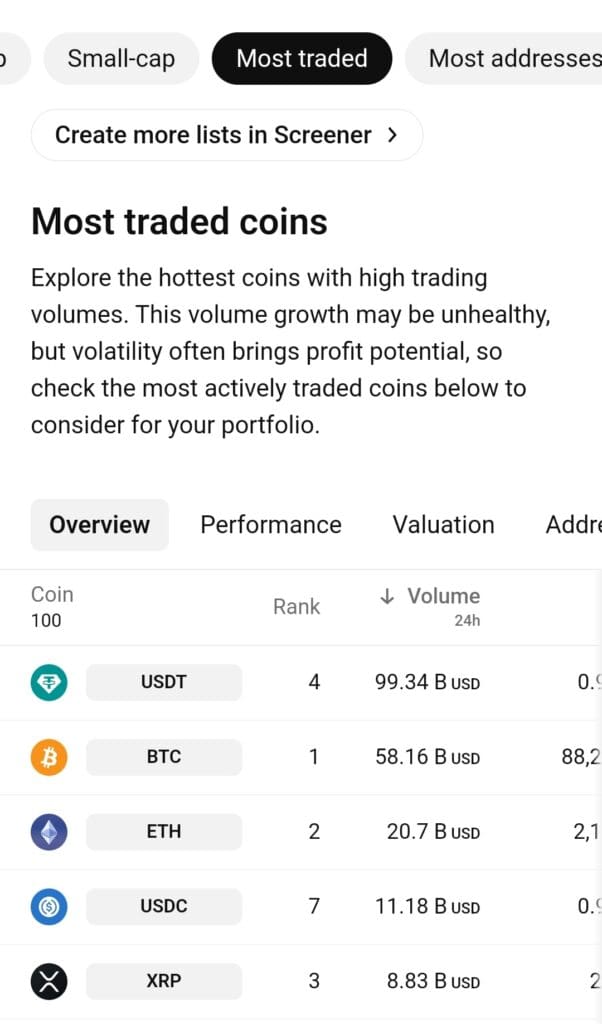

Volume Filter: Look for 24h volume above $50M with a recent spike of 2x or more over the 7-day average.

Price Change Filter: Screen for assets up more than 10% over 24h or 7d.

Time-Based View: Use 1h or 4h filters to catch intraday breakouts.

For example, a token might show a 25% surge alongside rising volume, signaling interest from whales or social media buzz.

-

Spot Upcoming Catalyst Coins

News-driven pumps are common in crypto. Use screeners to find coins with upcoming listings, mainnet launches, or major partnerships.

Event Filter: Platforms like CoinMarketCal or Crypto.com’s calendar show scheduled updates, token unlocks, or airdrops.

Category Filter: Focus on DeFi, AI, or gaming tokens that are actively building and have roadmap events.

Social Mentions: Use tools like LunarCrush or Santiment-integrated screeners to find spikes in chatter.

For instance, if a layer-2 network launches staking or enters a new DEX, that’s a catalyst that could drive demand ahead of the event.

-

Find Breakout Coins with Technical Strength

Some screeners incorporate price and technical chart filters—ideal for traders looking for breakout setups.

Relative Strength Index (RSI): Look for RSI rising from below 30 to indicate early reversal.

Price Pattern Filter: Spot assets forming bull flags, cup-and-handle, or triangle patterns.

Breakout Alert: Use screeners that track breakouts above recent resistance or multi-week highs.

Say you find a coin crossing above a long-term resistance with volume—this setup often attracts traders who follow technical analysis.

-

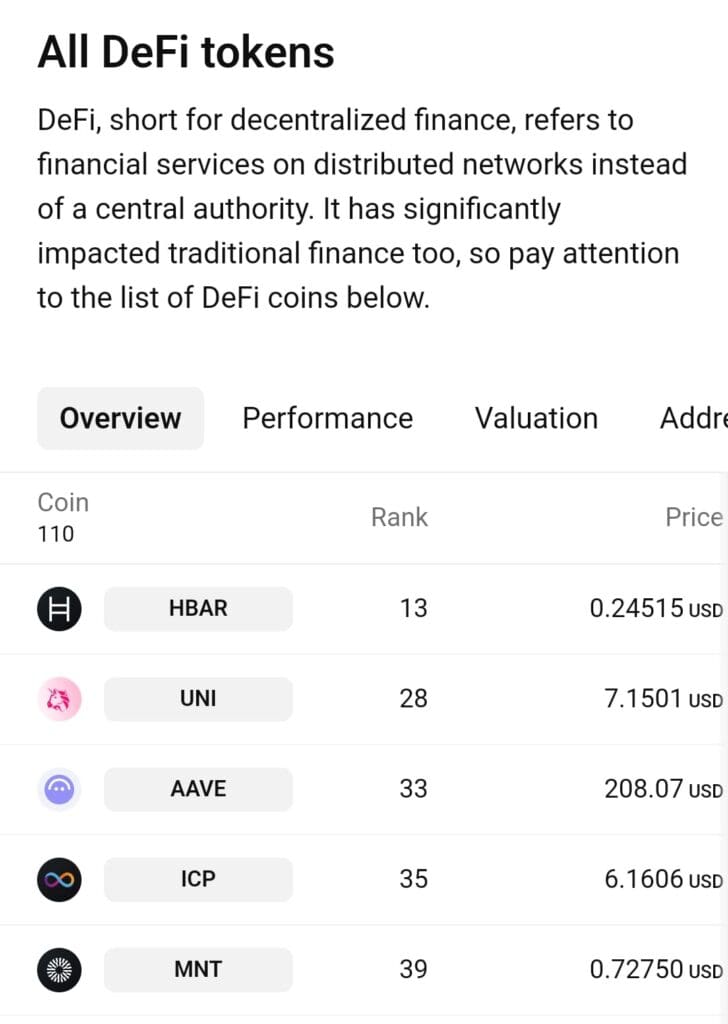

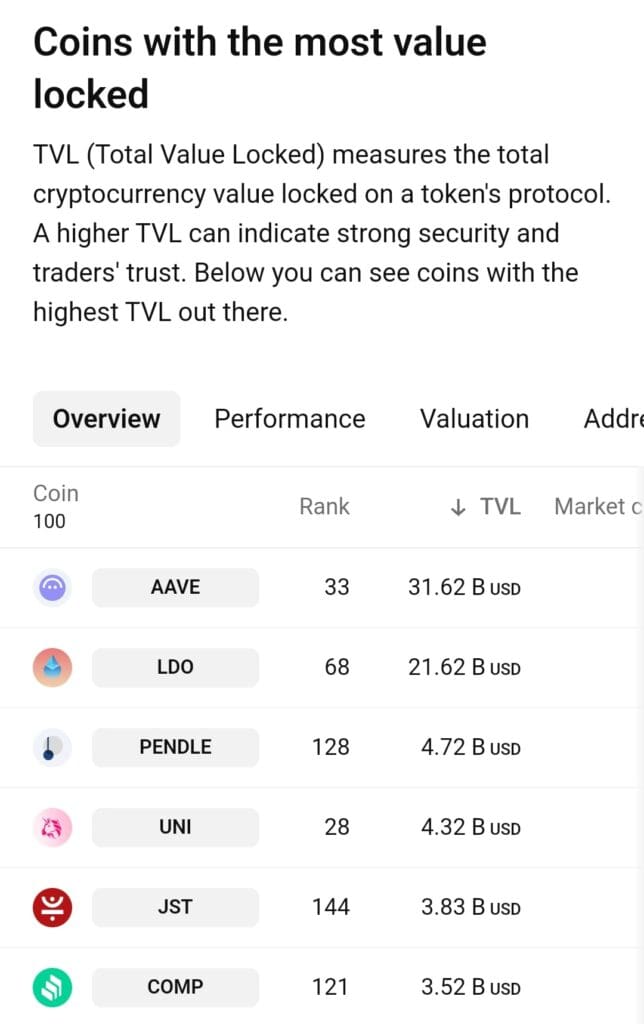

Target Undervalued Layer-1 or DeFi Projects

Instead of chasing hype, filter for fundamentally strong but overlooked projects with strong TVL, low FDV, and active development.

TVL/Market Cap Ratio: Use tools like DeFiLlama to find high utility vs. valuation.

Dev Activity Metrics: Some screeners show GitHub commits or team activity (e.g., on Santiment or Token Terminal).

Staking and Yield: Look for platforms offering sustainable on-chain staking or revenue-sharing.

This is useful when hunting for projects like Osmosis or Injective, which may not be trending yet but have solid fundamentals and user growth.

-

Screen for Recently Listed Tokens on Major Exchanges

New exchange listings often trigger price spikes due to exposure and liquidity.

Exchange Listing Filter: CoinMarketCap lets you filter tokens newly added to Binance, Coinbase, or Kraken.

Liquidity and Volume Check: Confirm the new listing has meaningful volume (e.g., over $10M in the first 24h).

Price Change After Listing: Check for tokens that initially dipped and are now reversing—these can offer second-entry points.

A recent Coinbase listing for a token like Axelar (AXL) might appear on this filter, giving traders a chance to ride post-listing demand.

-

Filter for Low Market Cap with High Growth Potential

Smaller market cap coins can offer higher upside, but come with more risk.

Market Cap Filter: Set under $100M to find micro-cap coins.

Volume Threshold: Make sure daily volume is over $1M to avoid illiquid tokens.

Growth Momentum: Look for 7-day price gains or strong monthly returns.

This strategy helps surface early-stage projects before they become widely known, especially in bullish markets.

-

Find Top-Performing Sectors

Crypto rotates between hot narratives—like AI, RWA (real-world assets), and DePIN.

Category Filter: Use CoinGecko or CoinMarketCap to sort by sectors (e.g., AI, Layer 2, Gaming).

7D Performance View: Sort tokens by sector and % change over 7 days.

Market Cap Check: Focus on projects with mid-sized caps ($100M–$500M) for a balance of safety and upside.

For example, during an AI narrative surge, coins like FET or AGIX may appear near the top.

-

Look for High Staking Yields or On-Chain Rewards

Tokens with staking and real yield can provide passive income while holding.

Filter by Staking or Yield Tags: Platforms like Crypto.com or StakingRewards list APYs.

Check Tokenomics: Make sure the yield isn’t based on inflationary emissions.

Lock Periods and Flexibility: Screen for coins with flexible staking or liquid staking options.

This approach suits long-term holders looking to earn while they wait for price appreciation.

How to Choose the Right Crypto Screener

With so many options available, choosing the right crypto screener depends on your trading style, research needs, and data preferences.

Check Supported Metrics: Choose a screener that includes market cap, volume, price change, and tokenomics data for deeper filtering.

Look for Real-Time Data: For active traders, screeners with live updates and minute-by-minute pricing are essential.

Evaluate Interface and Usability: A clean layout with customizable filters makes scanning easier and less time-consuming.

Consider Extra Features: Tools like watchlists, alerts, or DeFi-specific metrics (e.g., TVL) add long-term value.

Cross-Platform Access: Some screeners offer mobile apps or browser plugins for on-the-go tracking.

Ultimately, your choice should match your goals—whether it's finding new altcoins, swing trades, or long-term DeFi opportunities.

Common Mistakes To Avoid When Using Crypto Screener

Using a crypto screener without the right filters or mindset can lead to missed opportunities—or worse, bad trades.

Relying Only on Price: Don’t chase coins just because they’ve gone up 50%—look at volume, fundamentals, and context.

Ignoring Liquidity: Low-volume coins may look promising but can be hard to enter or exit without slippage.

Skipping Tokenomics: Failing to check circulating supply or unlock schedules can lead to buying into heavy inflation risk.

Overcomplicating Filters: Using too many filters can eliminate good opportunities—keep your criteria focused and strategic.

Forgetting Project Fundamentals: A screener can’t tell you everything; always research the team, use case, and roadmap separately.

Avoiding these pitfalls helps you use screeners as a smart discovery tool—not just a hype detector

FAQ

Yes, many screeners allow filters for stocks with upcoming earnings dates. You can combine this with elevated implied volatility to identify possible earnings trades.

They can be—especially for strategies like covered calls or cash-secured puts. You can screen for stable, dividend-paying stocks with attractive premium yields.

Start with volume, open interest, and implied volatility. These help ensure liquidity and give insight into how the market is pricing risk.

Some advanced screeners like those on thinkorswim or Barchart allow users to pre-filter for strategies like vertical spreads or iron condors.

Not all do. Free screeners often have delayed data, while premium platforms offer real-time options chain updates and IV charts.

Look for covered calls with high delta (above 0.7), low implied volatility, and stable stock price history. These setups favor consistency over speculation.

Yes, by filtering for high or low implied volatility relative to historical levels, you can identify mean-reversion or breakout volatility plays.

Some screeners offer alerts or filters for unusual volume or open interest spikes. This may signal institutional activity or speculative moves.

It depends on your trading frequency, but revisiting your filters weekly or monthly ensures they stay aligned with market conditions and volatility trends.