Table Of Content

What Is a Crypto Wallet?

A crypto wallet is a digital tool that allows users to store, send, and receive cryptocurrencies securely. It doesn’t physically hold your coins but stores the private keys that grant access to your digital assets on the blockchain.

Wallets can be either “hot” (internet-connected) or “cold” (offline), and choosing the right type depends on your trading habits and security needs.

Wallets also support token management, transaction tracking, and integration with DeFi platforms or exchanges.

How to Use a Hot Crypto Wallet

A hot wallet connects to the internet, making it ideal for active users who need fast access to their crypto. Here are five key ways you can use it:

-

Store and Manage Your Crypto Assets

Hot wallets let you hold a wide range of cryptocurrencies, from Bitcoin to smaller altcoins.

Organize by token: You can view balances, track performance, and monitor different chains in one interface.

Real-time access: Because hot wallets are online, balances and transactions update immediately.

Easy transfers between wallets: You can move assets between wallets or exchanges with minimal delay.

Hot wallets are essential for daily traders or users involved in DeFi apps, as they provide constant access. However, because they're online, it's vital to use strong passwords and two-factor authentication to minimize security risks.

-

Send and Receive Crypto Instantly

One of the main uses of a hot wallet is sending and receiving funds in real time.

QR code scanning: Speeds up in-person transfers without typing long addresses.

Address book features: Some wallets save contacts to simplify future transactions.

Low confirmation delays: Hot wallets help users track transaction status quickly.

This feature is particularly helpful for freelancers or businesses accepting crypto payments.

Also, using services like MetaMask or Trust Wallet, you can receive assets from friends through exchanges or even airdrops with minimal setup.

-

Connect to DeFi Platforms and DApps

Hot wallets can directly link to decentralized applications (DApps) such as Uniswap or Aave.

One-click Web3 access: Wallets like MetaMask or Coinbase Wallet allow browser extension integration.

Sign smart contracts: You can approve transactions like staking, swaps, or liquidity pooling securely.

Manage NFT and token permissions: View and revoke approvals if needed.

This function is crucial if you're exploring DeFi or participating in yield farming.

Because most platforms operate on-chain, having a connected wallet is the gateway to using these protocols effectively.

-

Swap Tokens Within the Wallet

Many hot wallets now include built-in token swapping, removing the need for external exchanges.

Choose best rates: Some wallets aggregate decentralized exchange (DEX) prices.

Reduce gas usage: Swaps are optimized for the network’s current fee environment.

Stay in control: You don’t give up custody, unlike when using centralized exchanges.

This is useful when you want to move quickly on market trends without leaving your wallet. Also, you can maintain greater control over your private keys and avoid third-party exchange risks.

-

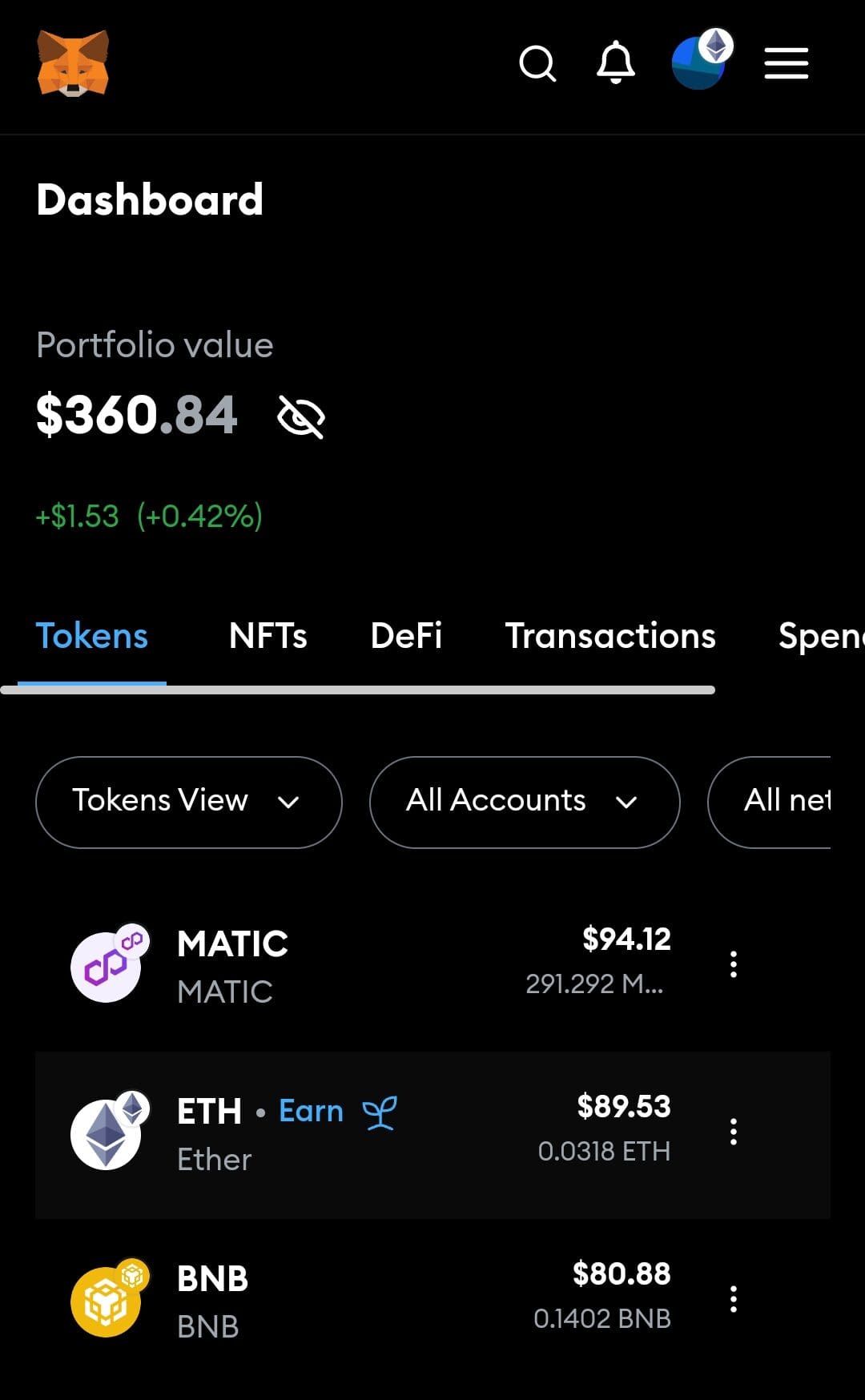

Monitor Market Prices and Portfolio Value

Hot wallets often include dashboards showing current values, trends, and news.

Real-time portfolio tracking: See how your assets perform across multiple chains.

Price alerts: Set notifications for key tokens or market events.

Integrated news feeds: Some wallets include crypto news updates and on-chain signals.

This helps users make faster, informed decisions without opening extra tools or apps. As a result, hot wallets serve as an all-in-one hub for both trading and market intelligence.

How to Use a Hardware Wallet

A hardware wallet stores your private keys offline, offering one of the most secure ways to protect your crypto. Here are three key uses:

-

Store Crypto Safely Offline

Hardware wallets provide cold storage, keeping your private keys isolated from internet threats.

No online exposure: Since it operates offline, it’s immune to common online attacks like phishing or malware.

Tamper-proof security chip: Devices like Ledger and Trezor use secure elements to lock access.

PIN and recovery phrase required: These add extra layers of protection if your device is lost or stolen.

This is especially important for long-term holders and high-value portfolios. To store coins, you simply connect the device, transfer from your hot wallet or exchange, and confirm.

After that, you disconnect and store the device in a safe location.

-

Confirm Transactions Securely

You can use your hardware wallet to approve outgoing transactions, ensuring they are manually authorized.

Physical confirmation required: Transactions must be approved via the device’s buttons or screen.

Prevents unauthorized withdrawals: Even if your PC is hacked, funds can’t move without hardware confirmation.

Full transaction visibility: You see exactly what you're signing, helping avoid fake addresses or amounts.

This is critical for avoiding phishing scams and confirming high-stakes transactions.

Always double-check addresses, especially when sending large amounts, and only connect to trusted software like Ledger Live or Trezor Suite.

-

Access Wallets Through Trusted Interfaces

While the hardware wallet holds your keys, you interact with your crypto via desktop or browser apps.

Ledger Live, Trezor Suite: These apps let you manage tokens, track balances, and install coin apps.

Browser extension support: Devices integrate with MetaMask and other Web3 wallets for dApp access.

Multi-coin support: Hardware wallets handle hundreds of assets across multiple chains.

Because your keys never leave the device, it offers both flexibility and strong security. You can transact, swap, or stake without compromising your private key.

-

How to Connect Your Wallet to dApps, DeFi, and NFT Platforms

Connecting your wallet to decentralized apps unlocks a broader world of crypto use cases. This includes earning yields, trading NFTs, and providing liquidity.

Using MetaMask or WalletConnect: Most hardware wallets connect to dApps by syncing with MetaMask or WalletConnect. You authorize access by unlocking your device and confirming the connection manually.

Approving smart contracts securely: Before interacting with DeFi protocols or marketplaces like OpenSea, you approve the smart contract via the wallet. This helps prevent unauthorized actions.

Staying in control of your assets: You maintain full custody while accessing DeFi lending platforms, staking pools, or NFT collections, ensuring your keys never leave the device.

Common Wallet Use Mistakes – and How to Avoid Them

Wallets are powerful, but misuse can lead to loss of funds. Here are frequent mistakes to avoid:

Not backing up your seed phrase: Without this backup, you’ll lose access if your wallet is damaged or lost. Store it offline in multiple safe places.

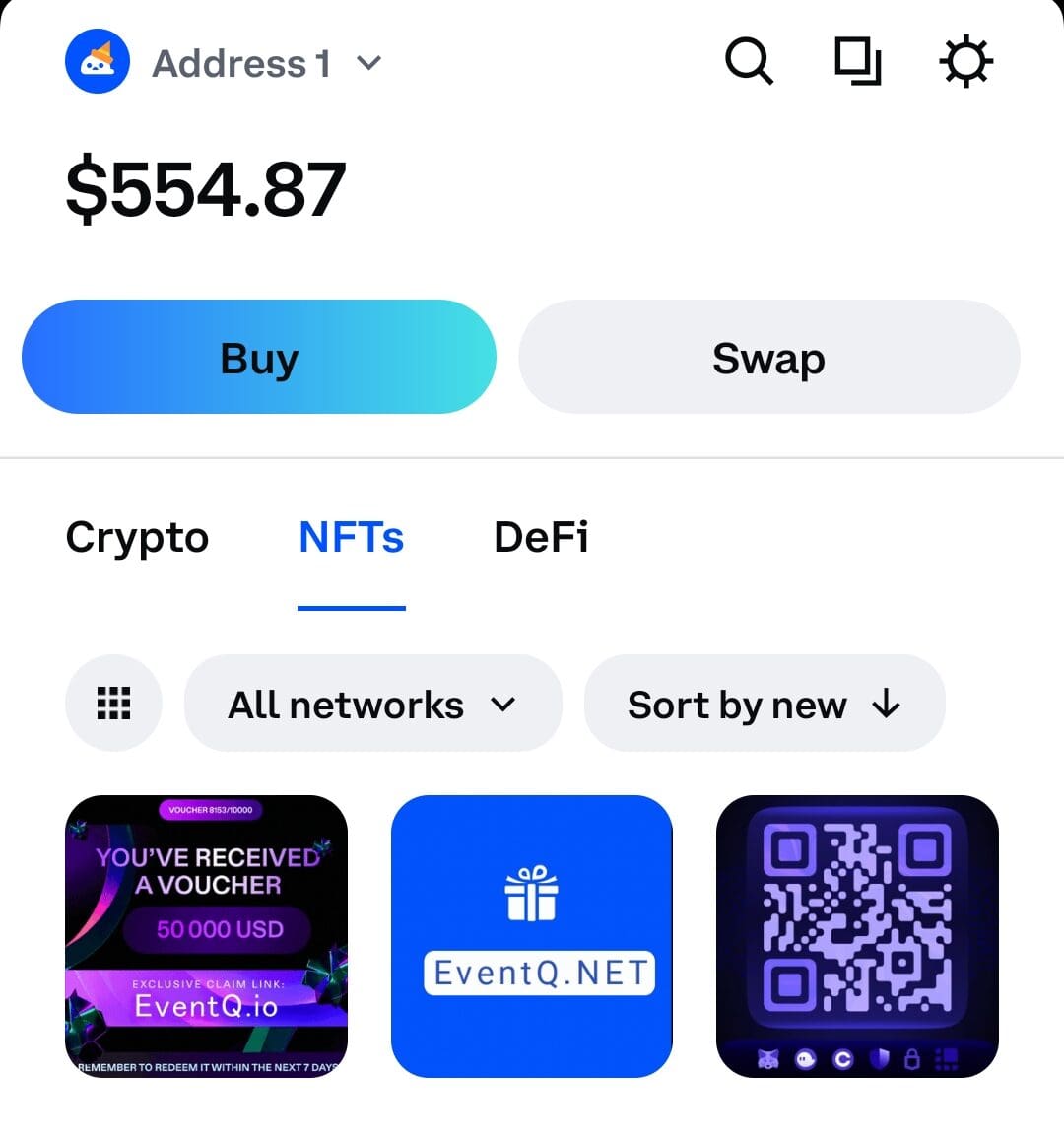

Using fake apps or websites: Scammers often mimic official platforms. Always verify URLs and download from official sources.

Leaving your wallet connected: Disconnect hardware wallets after use. Staying connected increases exposure to potential exploits.

Approving unlimited token allowances: This gives dApps continuous access to your funds. Set custom limits and regularly revoke unused permissions.

Ignoring firmware updates: Updates patch vulnerabilities. Keep your wallet software current to stay protected from new threats.

Avoiding these common errors can help you maintain full control over your assets and reduce the risk of theft or accidental loss.

FAQ

Yes, many wallets like Trust Wallet or Ledger support multiple cryptocurrencies. Just ensure the wallet supports the blockchain you're interacting with, like Ethereum or Solana.

If you’ve backed up your recovery phrase properly, you can restore your wallet on another device. Without it, there’s no way to recover access or funds.

Hot wallets require internet to function. Hardware wallets don’t need internet for storage but do need a connection when you send or sign transactions.

They can be secure if used properly with PINs, biometric locks, and device encryption. Still, they’re more vulnerable than cold storage for long-term holding.

Yes, if you restore the wallet using your seed phrase. However, it’s safer to limit the number of devices to reduce potential attack surfaces.

It depends on the dApp. Only connect to trusted platforms and check permissions before approving any transactions or contracts through your wallet.

Download wallets only from verified sources like app stores or official websites. Check community reviews and confirm the URL before using browser extensions.

Some wallets offer integrated swaps via DEX aggregators. These let you trade tokens directly without needing to use centralized exchanges.

Exporting allows you to copy the wallet to another device using the private key or seed. Importing is using that backup to access an existing wallet.

Yes, most self-custody wallets don’t require KYC. You can download and use them anonymously, unlike centralized exchanges which require identity verification.