What Is a Mutual Fund Screener and How Does It Work?

A mutual fund screener helps investors filter and compare mutual funds based on key metrics such as expense ratio, historical performance, fund category, and risk profile.

Because the mutual fund universe is vast—with thousands of options across asset classes, sectors, and strategies—a screener simplifies the process of identifying funds that match your investment goals and risk tolerance.

Plan | Subscription | Best For |

|---|---|---|

TradingView Premium | $59.95

$432 ($23.98 / month) if paid annually | Technical Analysts |

Benzinga Pro | $37

$367 ($30.58 / month) if paid annually | News-Driven Traders |

MarketBeat All Access | $39.99

$399 ($33.25 / month) if paid annually | Portfolio Trackers |

GuruFocus Premium | $499 ($41.58/ month)

No monthly plan, price for US citizens, price change by region | Guru Investors Portfolios |

StockTwits Edge | $22.95

$229.50 ($19.10 / month) if paid annually

| Social Sentiment Traders |

Finviz Elite | $39.50

$299.5 ($24.96 / month) if paid annually | Chart Pattern & Backtesting |

The top mutual fund screeners let you sort and filter funds by specific data points. For example:

Screen by Fund Category and Return: You can filter U.S. equity growth funds with 5-year returns above 10% to focus on top-performing funds.

Set Expense Ratio Limits: To minimize costs, use a filter for funds with an expense ratio under 0.50%.

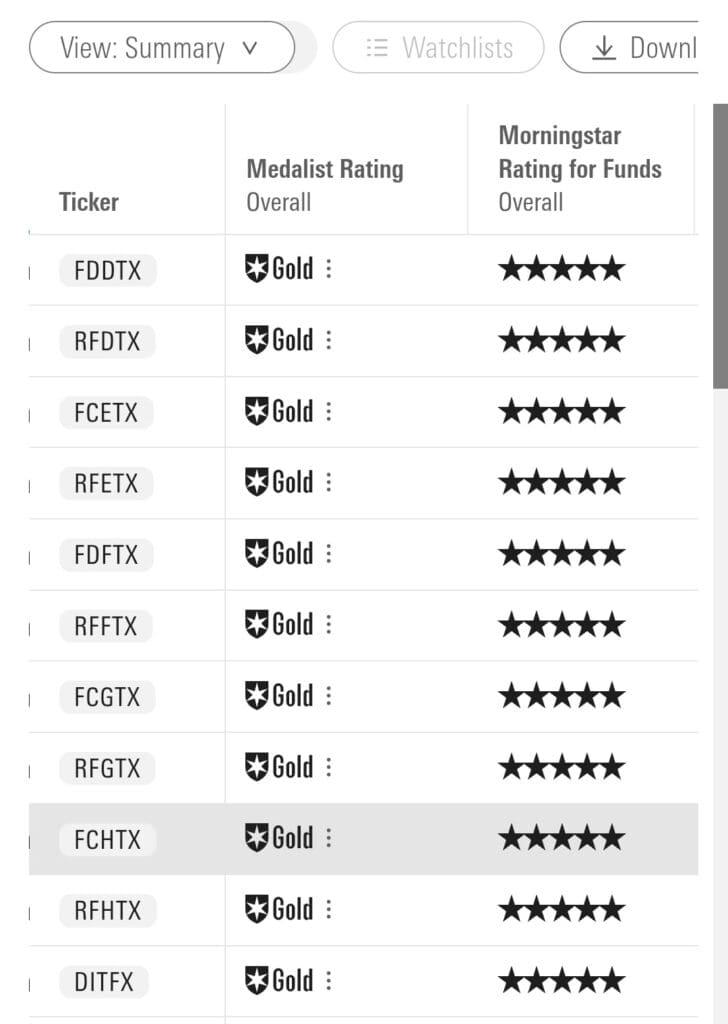

Sort by Morningstar Rating: Choose funds with 4 or 5 stars based on risk-adjusted returns relative to peers.

Filter by Manager Tenure: Screen for funds with stable management teams by selecting tenure over 5 years.

Platforms like Morningstar and Zacks offer free and premium mutual fund screeners with in-depth filtering capabilities.

Best Strategies to Screen for High-Quality Funds

Mutual fund screeners let investors move beyond surface-level stats to evaluate funds by management quality, strategy, consistency, and cost.

Here are some mutual fund strategies we like:

-

Find Low-Cost Index Funds for Long-Term Growth

Index funds with low fees are often ideal for passive investors seeking long-term returns. A screener helps compare similar funds and avoid hidden costs.

Expense Ratio Filter: Choose funds with expense ratios under 0.10% if possible.

Fund Type Filter: Select “Index” or “Passively Managed.”

Performance Filter: Compare 10-year annualized returns to ensure consistency.

For instance, screening U.S. large-cap index funds with under 0.05% fees can surface options like Fidelity ZERO or Vanguard’s Total Stock Market Fund.

-

Identify Top-Rated Funds by Risk-Adjusted Returns

Not all high-return funds are efficient. A mutual fund screener helps you find funds with strong risk-adjusted returns that balance growth with volatility.

Sharpe Ratio Filter: Use a threshold above 1.0 to find well-balanced funds.

Morningstar Rating: Focus on 4 or 5-star funds for consistency.

Volatility Filter: Set a low standard deviation relative to category.

This is especially useful when comparing similar funds—like two large-cap growth funds—where one may outperform with lower downside risk.

-

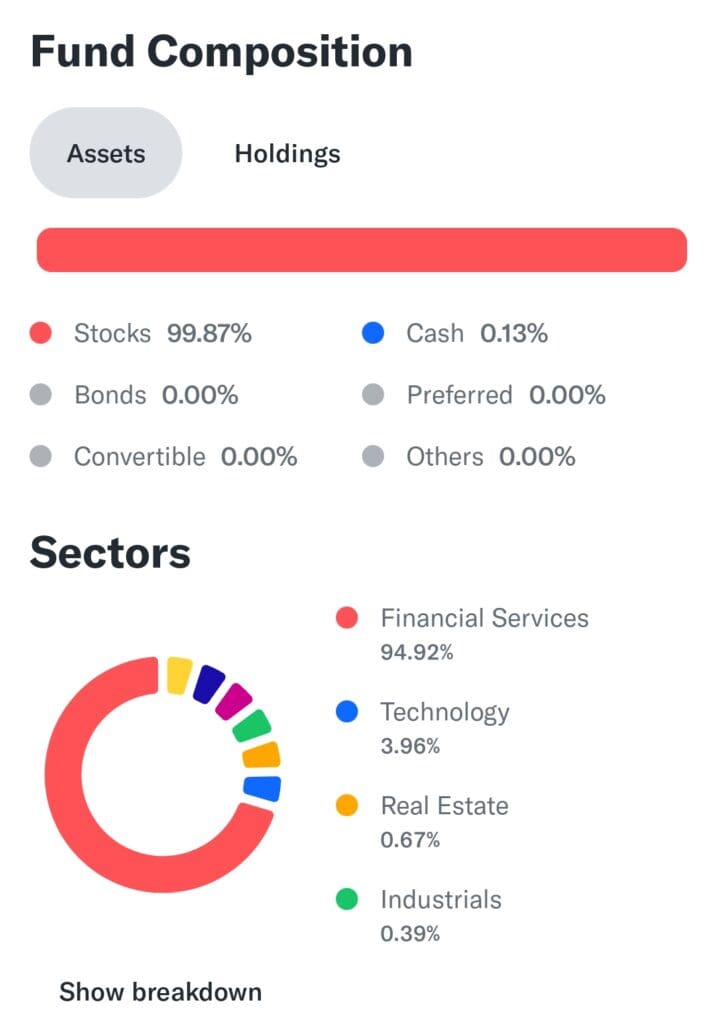

Screen for Sector-Focused Mutual Funds

If you're bullish on specific industries like technology or healthcare, screeners can help find sector-specific mutual funds with solid track records.

Sector Focus: Choose funds with >80% allocation to your desired sector.

Fund Size: Filter for assets under management (AUM) above $100 million.

Performance: Look for consistent outperformance over multiple periods.

For example, if you're bullish on biotech, you might screen for funds in Morningstar’s “Health” category with 3-year returns above 15%.

You can also explore the fund sectors specifically:

-

Target Tax-Efficient Mutual Funds for Taxable Accounts

For non-retirement accounts, tax efficiency matters. Some screeners allow you to factor in turnover rates and distribution history.

Turnover Ratio Filter: Aim for turnover under 30% to reduce taxable events.

Distribution Yield: Compare income distribution history.

Tax Cost Ratio: Some screeners include this to estimate tax drag.

This strategy is especially important for high-income investors trying to reduce capital gains exposure while maintaining diversified equity exposure.

-

Find Consistent Dividend-Paying Mutual Funds

Dividend-focused funds are ideal for income-seeking investors. A screener can help locate funds with steady distributions and strong underlying holdings.

Yield Filter: Look for funds with a trailing 12-month yield above 2.5%.

Dividend History: Screen for funds with consistent quarterly payouts over at least 3 years.

Equity Focus: Choose funds invested in dividend aristocrats or blue-chip stocks.

For example, a screener can help isolate equity income funds that generate steady payouts with lower volatility, making them suitable for retirees or conservative portfolios.

In most platforms, you can also find dividend charts and analysis:

-

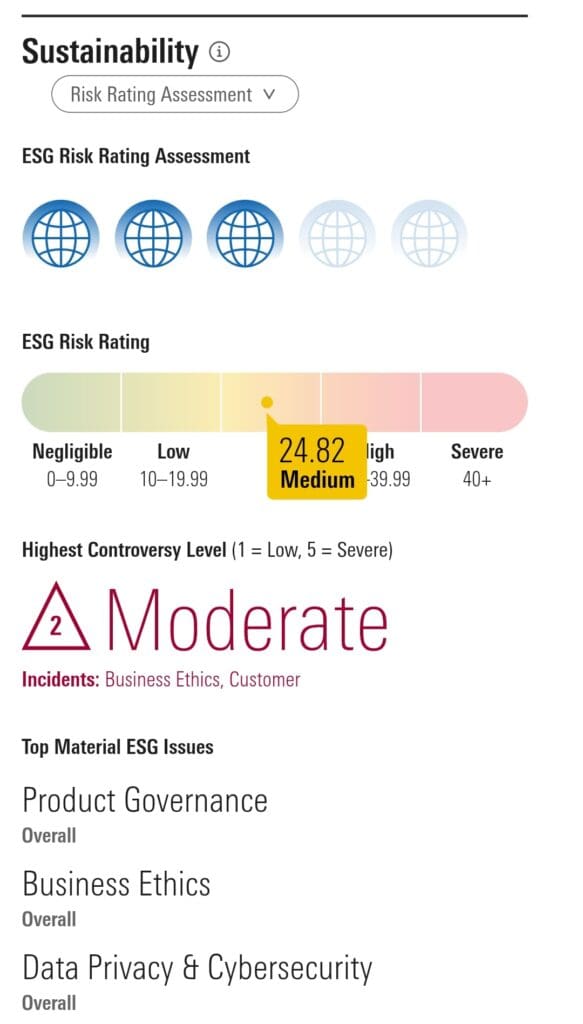

Screen for ESG or Socially Responsible Mutual Funds

Investors who prioritize sustainability can use screeners to find funds aligned with environmental, social, and governance (ESG) criteria.

ESG Fund Filter: Many screeners offer a dedicated “Sustainable” or “ESG” category.

Exclusion Filters: Remove funds with exposure to fossil fuels, tobacco, or weapons.

Third-Party Ratings: Use platforms like Morningstar to compare ESG scores and carbon risk ratings.

This approach allows investors to build ethical portfolios without sacrificing performance, especially with growing ESG fund availability.

-

Spot Emerging Market Mutual Funds for Diversification

Emerging market funds offer higher growth potential but come with added volatility. A screener helps balance risk by filtering by region, return, and volatility.

Region Filter: Select “Emerging Markets” or narrow to Asia, Latin America, etc.

Currency Exposure: Use filters to find funds hedged against foreign exchange risk.

Volatility & Return: Compare standard deviation with 5-year returns for risk-adjusted selection.

For example, filtering for diversified emerging market equity funds with a Sharpe ratio above 0.8 can help identify well-managed options for portfolio diversification.

-

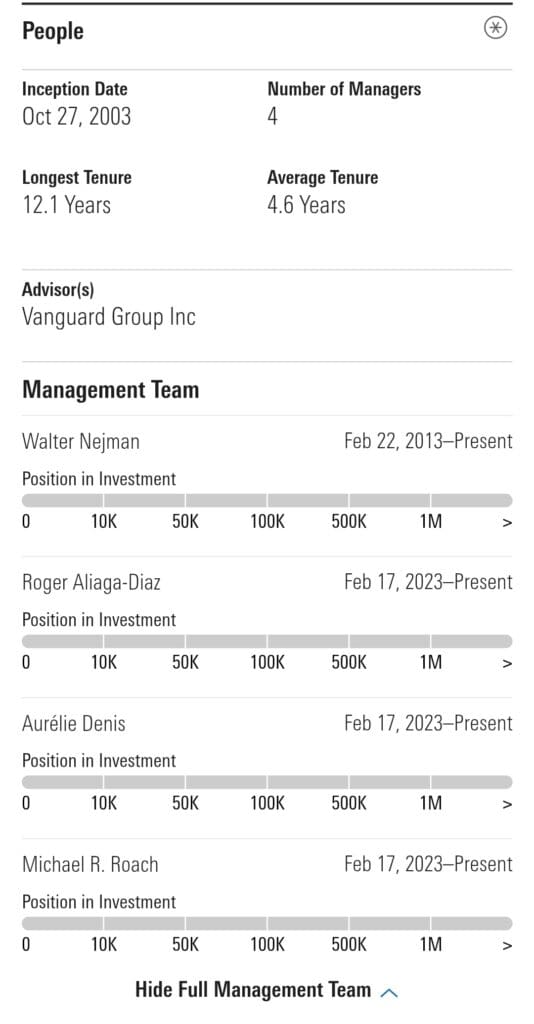

Search for Mutual Funds with Stable Management Teams

A fund’s performance often correlates with the consistency and experience of its managers. Many screeners allow filtering based on manager tenure and experience.

Manager Tenure Filter: Look for lead managers with 5+ years at the fund.

Fund Family Filter: Choose reputable families like T. Rowe Price or Vanguard.

Performance Consistency: Evaluate funds that outperform their category median over multiple timeframes.

This strategy is useful when selecting actively managed funds, where a seasoned manager may add more value than index-style strategies.

Then you can explore specific funds management , here's an example from Morningstar:

-

Filter for Tax-Free Municipal Bond Funds

For investors in high tax brackets, tax-free income from municipal bond funds can offer strong after-tax returns.

Bond Type Filter: Select “Municipal” or “Tax-Exempt” bond categories.

State-Specific Funds: Screen for funds that focus on your home state to maximize tax savings.

Credit Quality Filter: Look for funds with high exposure to AAA or AA-rated bonds to reduce risk.

This is especially relevant for U.S. investors in states with high income taxes, seeking reliable income with minimal federal (and possibly state) tax exposure.

How to Choose the Right Mutual Fund Screener

Choosing the right mutual fund screener depends on your investment goals, the level of detail you need, and your preferred platform features.

Check for Custom Filters: Make sure the screener lets you filter by key criteria like expense ratio, risk metrics, and fund category.

Look for Ratings Integration: A good screener includes data from Morningstar, Lipper, or Zacks to assess fund quality.

Access to Historical Returns: Choose platforms that provide 3-, 5-, and 10-year performance data for long-term comparison.

Compare Free vs. Paid Tools: Paid screeners often offer more advanced features like tax cost ratios and portfolio overlap analysis.

Platform Usability: Make sure the interface is intuitive, especially if you’re running multiple filter combinations or exporting data.

Common Mistakes To Avoid When Using Mutual Fund Screener

A mutual fund screener is powerful, but misusing filters or ignoring key details can lead to poor fund selection or higher costs.

Focusing Only on Performance: High past returns don’t guarantee future results. Also check volatility, manager tenure, and fund strategy.

Ignoring Expense Ratios: Over time, even a 1% fee difference can significantly reduce your overall returns.

Not Adjusting for Risk: Always consider Sharpe ratio or standard deviation to balance growth with volatility.

Overfiltering: Too many filters can eliminate strong funds that slightly miss one metric but excel in others.

Skipping the Fund Prospectus: The screener is just the first step—always review the fund’s strategy, holdings, and risks before investing.

Using a screener smartly means balancing performance with cost, consistency, and suitability for your portfolio goals.

FAQ

A mutual fund screener focuses on actively or passively managed funds that may have higher expense ratios and daily NAV pricing. ETF screeners target exchange-traded funds, which trade like stocks and often have lower fees and greater liquidity.

Yes, most screeners allow filtering by fund provider or fund family. This helps you directly compare performance, fees, and ratings across different companies.

Some screeners include lifecycle or target-date funds under “allocation” categories. You can filter by target retirement year, glide path, or historical returns to find a good fit.

Only advanced or paid screeners may include tax-specific metrics like turnover ratio, tax-cost ratio, or distribution history—helpful for taxable accounts.

Yes, you can apply filters for “no-load” or “load waived” funds to avoid commissions or front-end sales charges when investing.

Many screeners display or allow filtering by minimum investment amount, which is useful when you have a limited budget or want to avoid high entry thresholds.

Most platforms update fund data daily or weekly, but performance and rankings are often based on end-of-month or quarterly data. Always check update frequency.

Yes, mutual fund screeners typically show net performance, meaning returns after management fees and expenses have been deducted.

Advanced screeners often let you export results to Excel or save custom filters for later use. Free tools may have limited functionality.