Table Of Content

Cash App Invest offers a simple, commission-free way to trade stocks, ETFs, and Bitcoin.

With easy-to-use features like fractional shares, recurring investments, and seamless banking integration, it’s perfect for beginners.

Top 10 Cash App Invest Features - And How To Use Them

Cash App Invest offers a user-friendly platform for investing in stocks, ETFs, and Bitcoin with no commission fees.

Below are the key features that set it apart for investors:

1. Beginner-Friendly Trading Experience

Cash App Invest is designed with simplicity in mind, making it ideal for those new to investing.

No Commission Fees: Unlike traditional brokers, Cash App Invest charges no commissions for stock and ETF trades. This makes it an affordable option for beginner investors.

Fractional Share Investing: Investors can buy fractional shares of over 1,800 stocks and ETFs, allowing you to invest as little as $1 in well-known companies.

Easy-to-Use Interface: The app’s clean interface makes it simple to search for stocks, review investment performance, and execute trades in just a few taps.

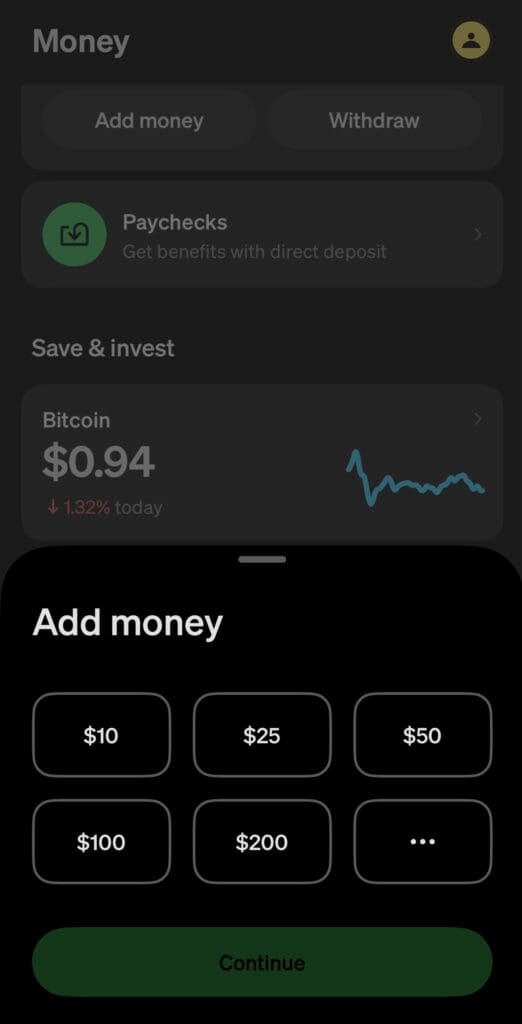

2. Bitcoin Trading & Transfers

While Cash App Invest mainly focuses on traditional stocks and ETFs, it also offers Bitcoin trading, making it a great choice for cryptocurrency investors.

Bitcoin Investment: Cash App allows users to buy, sell, and transfer Bitcoin directly from the app with as little as $1.

Bitcoin Transfers: You can send Bitcoin to an external wallet, providing more control over your assets than some other platforms.

Recurring Bitcoin Purchases: Cash App allows you to set up recurring Bitcoin purchases, making it easy to build your position over time.

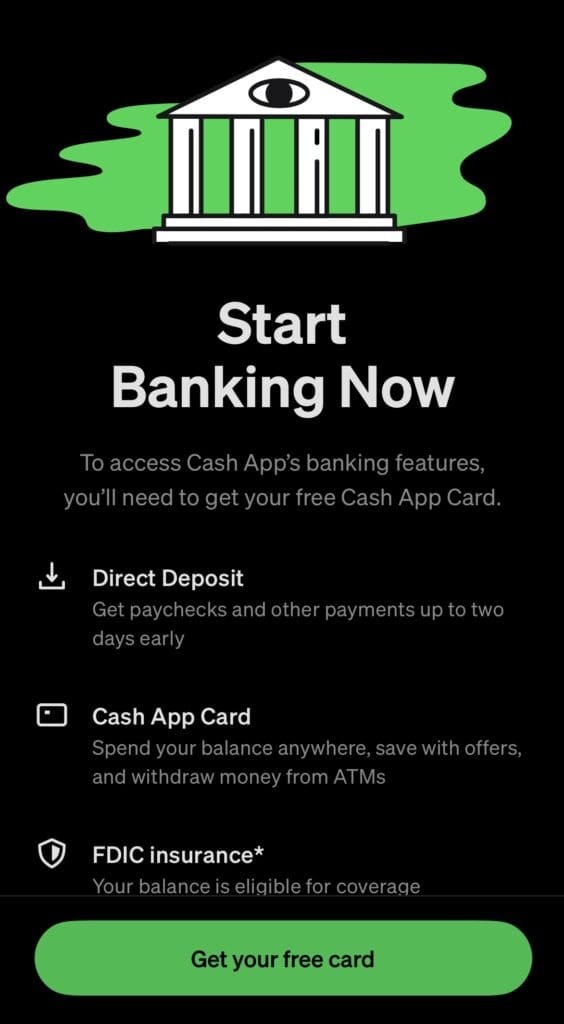

3. Integrated with Cash App Banking

Cash App Invest stands out by seamlessly integrating with Cash App’s banking features, giving you a comprehensive financial management tool in one app.

Instant Fund Transfers: You can transfer funds quickly between your Cash App balance and your investment account, ensuring fast deposits and withdrawals.

Debit Card Access: Cash App offers a free debit card that you can use for everyday purchases, and even spend the money you’ve earned from investments.

Automatic Reinvesting: When you sell stocks or Bitcoin, the proceeds are automatically transferred to your Cash App balance, where you can reinvest or spend it.

4. Cash Back Rewards with Stock & Bitcoin Boosts

Cash App Invest's Boosts program lets you earn stock and Bitcoin rewards, providing a unique way to passively invest while making purchases.

Cash Boosts: The Cash App offers users cashback rewards when they use their debit card at participating retailers. Some of those rewards are invested in stocks or Bitcoin instead of cash.

Stock & Bitcoin Boosts: For example, you may earn 5% cashback in Bitcoin when you make purchases at certain retailers or get a stock-related Boost that deposits small amounts of selected stocks into your portfolio.

Boost Flexibility: Boosts can be used at various retailers, and you can choose the Boost that suits your investment goals, either stocks or cryptocurrency.

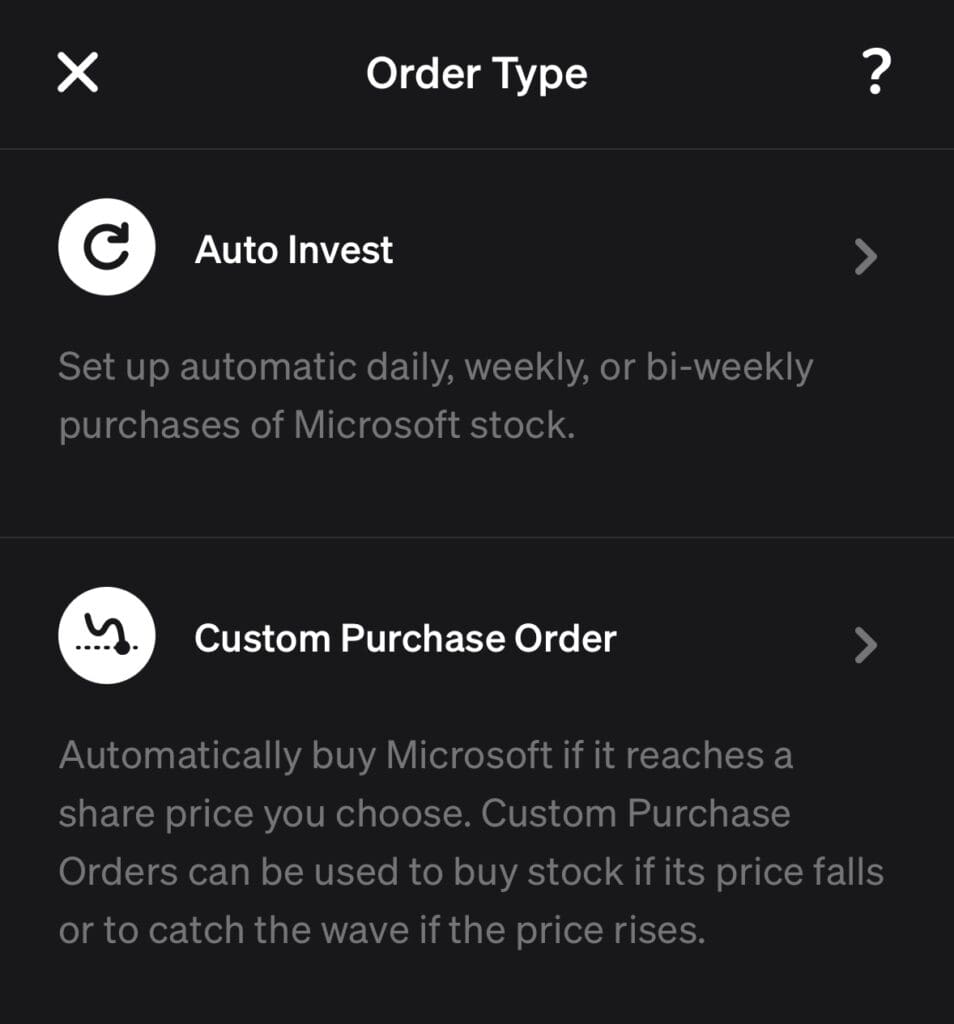

5. Automatic Recurring Investments

Cash App Invest allows users to set up automatic recurring investments, making it easy to build a diversified portfolio over time without having to manually place trades.

Scheduled Investments: You can set your investment frequency to daily, weekly, or monthly, and Cash App will automatically invest your chosen amount into stocks, ETFs, or Bitcoin.

Dollar-Cost Averaging: This feature helps smooth out the impact of market fluctuations, as your money is invested regularly regardless of whether prices are high or low, allowing you to average out the cost of your investments over time.

Building Consistency: This is a great way for investors to stay disciplined in their strategy without worrying about timing the market.

6. Round-Up Investing: Build Your Portfolio Passively

Cash App Invest offers a unique Round-Up Investing feature that allows you to invest small amounts effortlessly, making it easy for beginners to grow their portfolio over time.

Invest Spare Change: When you make purchases using your Cash App debit card, the total is rounded up to the nearest dollar, and the spare change is automatically invested in stocks, ETFs, or Bitcoin.

Automatic Contributions: This feature makes investing seamless and automatic, with no need for manual interventions, perfect for those who prefer hands-off investing.

Compounded Growth: Over time, the small amounts invested through round-ups add up, potentially growing into a more significant portion of your portfolio.

7. Custodial Accounts for Teens

Cash App Invest allows minors aged 13-17 to start investing through custodial accounts, with parental oversight.

Parental Control: Parents or guardians can monitor the account and set spending limits while allowing teens to make their own investment decisions.

Learning Opportunity: Teen investors can buy stocks, ETFs, and Bitcoin starting at just $1, teaching them valuable financial skills.

Round-Up Investing: Teens can use round-up investing, where spare change from purchases is automatically invested in their account, making it easier to build wealth over time.

8. Simplified Tax Reporting

Cash App Invest provides easy-to-understand tax reporting features to help you manage your investments and file taxes.

Tax Documents: At the end of the year, Cash App provides downloadable tax forms such as the 1099-B, making it easier to file your taxes.

Tax-Friendly Investing: While Cash App does not offer retirement accounts like IRAs, it makes the tax-reporting process easier for those who are using the platform for taxable accounts.

Tracking Capital Gains: The platform tracks your capital gains and losses, giving you a clear view of your taxable income from investments.

How to Get Started with Cash App Invest

Getting started with Cash App Invest is easy, even for beginners. Follow these steps to begin trading stocks and Bitcoin in just a few minutes:

Download the App: Start by downloading the Cash App on your mobile device and creating an account.

Link Your Bank Account: Once your account is set up, link a bank account or debit card to fund your investment account.

Verify Your Identity: Complete the identity verification process by submitting your personal details, including your Social Security Number (SSN), to meet regulatory requirements.

Deposit Funds: Add money to your Cash App balance. You can fund your account instantly for a small fee or use a linked bank account for regular deposits.

Start Investing: Once your funds are available, you can begin buying stocks, ETFs, or Bitcoin with as little as $1.

FAQ

No, Cash App Invest only offers stocks, ETFs, and Bitcoin for trading. There are no options for investing in bonds, mutual funds, or other fixed-income securities.

Cash App provides a simple interface where you can view your stocks, ETFs, and Bitcoin investments. You can see historical performance, current market value, and track individual asset changes over time.

Yes, Cash App provides tax documents such as the 1099-B at the end of the year to help you with filing taxes. These documents include information about your gains and losses from trades.

Cash App Invest uses encryption to protect your transactions and personal information. The platform is regulated by financial authorities and offers features like two-factor authentication for additional security.

Yes, Cash App allows users to transfer Bitcoin to external wallets. This gives you more control over your cryptocurrency holdings and allows you to move it to other platforms if needed.

While Cash App Invest offers commission-free trading, there are fees for instant deposits and Bitcoin transactions. Standard deposits and regular stock trades are free.

To start investing in Bitcoin, simply add funds to your Cash App balance, select the Bitcoin option, and choose how much you want to invest. You can buy as little as $1 in Bitcoin.