Crypto.com Exchange is a crypto trading platform designed for both everyday users and advanced traders.

It lets you buy, sell, and swap hundreds of cryptocurrencies, while also offering additional tools like staking, margin trading, and crypto rewards.

Built by the same company behind the popular Crypto.com App, the exchange features a separate interface focused on in-depth trading options, including charts, liquidity, and low fees.

You can use it through your desktop or mobile, and it's fully integrated with the broader Crypto.com ecosystem for easy asset transfers.

Best Features Of Crypto.com Exchange

Crypto.com Exchange packs a mix of trading tools and passive income features. Here’s how to get the most out of it:

-

Spot Trading for Crypto Pairs

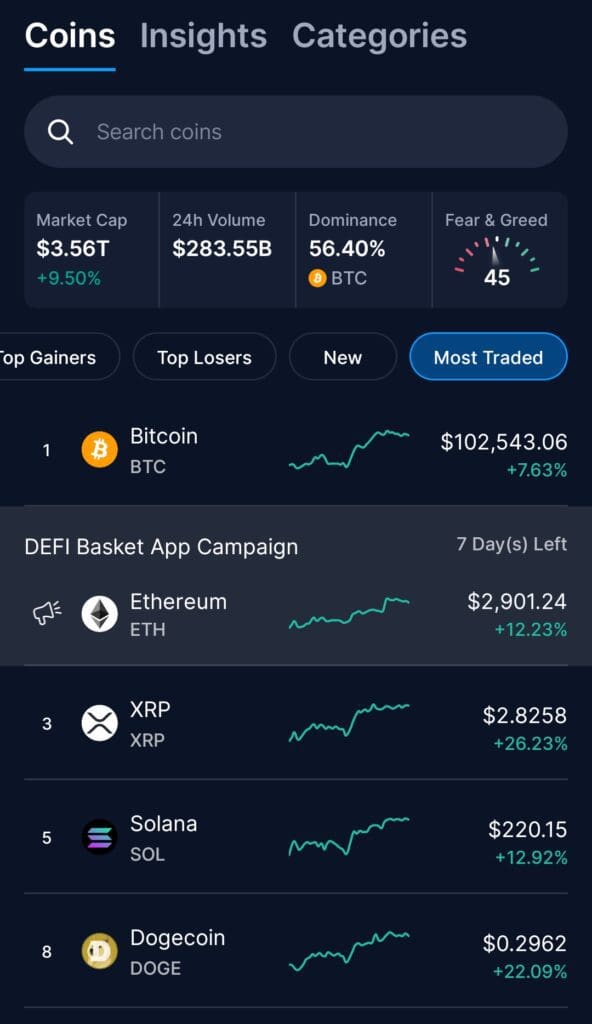

Spot trading on Crypto.com Exchange lets you buy and sell cryptocurrencies in real time with full market transparency. It’s ideal for investors who want control over price execution and access to a wide range of trading pairs.

Live market view: You can analyze real-time order books and trade depth directly on the exchange dashboard.

Trade major and niche coins: Pairs like BTC/USDT, ETH/USDC, and CRO/USDT are actively traded, along with smaller altcoins.

Flexible order types: Use market, limit, and stop-limit orders to control your entry and exit strategy.

This feature suits investors looking to actively manage short-term trades or rebalance portfolios. If you believe ETH will rise past $3,000, you can place a limit order just under that level to catch a dip.

-

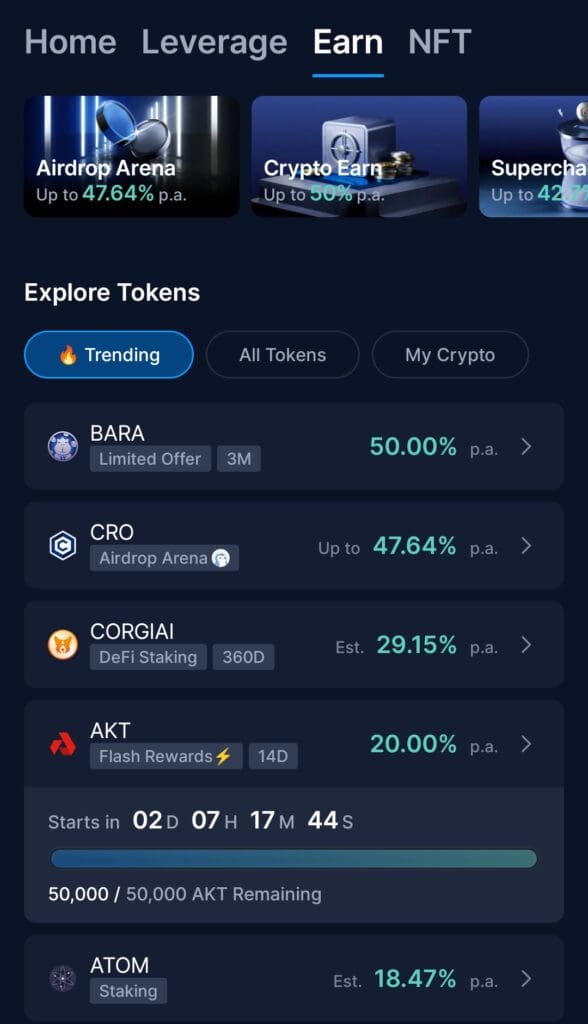

Crypto Earn & Flexible Staking

Crypto.com Earn lets you earn passive income on your crypto by staking popular coins and stablecoins. It’s useful for long-term holders who want their assets to grow while sitting idle.

Earn on idle assets: Stake coins like USDC, BTC, and CRO with flexible or fixed-term options.

Tiered reward system: The more CRO you stake on the platform, the higher your APY earnings.

Automatic rewards: Interest is calculated daily and paid weekly, with reinvestment options available.

Whether you’re holding stablecoins for safety or crypto long-term, this feature helps you generate yield effortlessly. If you don’t plan to sell USDC soon, locking it for 3 months could earn up to 6% annually.

-

Advanced Charting and Trading Tools

For technical traders, Crypto.com’s advanced view includes real-time charts, price analysis tools, and professional-level order options. It’s tailored for users who want to plan entries and exits more strategically.

TradingView integration: Access drawing tools, trendlines, RSI, MACD, and other indicators without leaving the exchange.

Depth & liquidity insight: See live depth charts to understand how much liquidity is behind key price levels.

Risk control tools: Use stop-loss, take-profit, and conditional orders to automate exit points.

This setup works well for users who rely on technical patterns or momentum trades. For instance, if you’re watching a breakout above resistance on SOL/USDT, you can draw confirmation levels and set a stop-loss below.

-

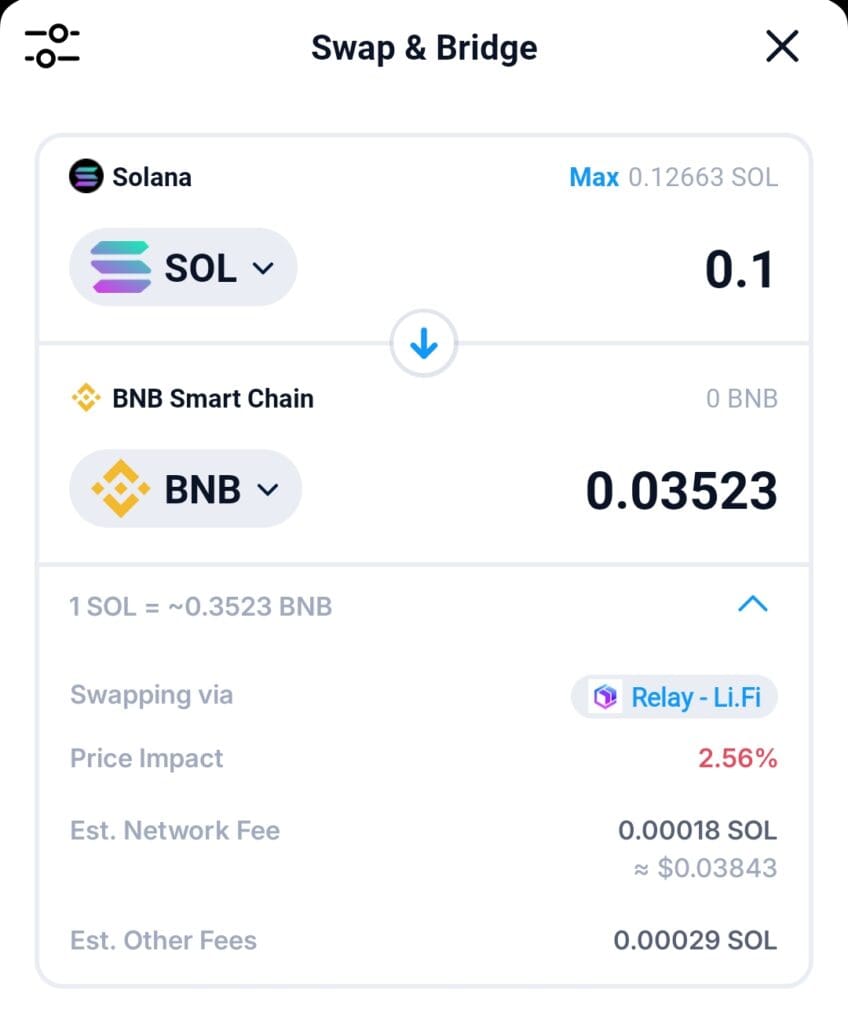

Easy Transfers to App and Onchain Wallet

Crypto.com makes it seamless to move assets between the Exchange, the Crypto.com App, and the Onchain Wallet. This integration is ideal for users managing assets across CeFi and DeFi platforms.

Instant internal transfers: You can move assets between the exchange and app with zero fees and near-instant speed.

DeFi wallet bridge: Use the Onchain Wallet to stake tokens, interact with dApps, or mint NFTs.

Unified ecosystem: The same account gives you access to trading, rewards, Visa card perks, and DeFi options.

If you buy ETH on the Exchange, you can send it to the Onchain DeFi Wallet to stake in a liquidity pool—all within minutes. This smooth connectivity makes the whole experience feel more efficient and less fragmented.

-

Margin Trading with Leverage

Crypto.com Exchange offers margin trading for users who want to amplify gains using borrowed funds. It’s designed for experienced traders looking to increase exposure without adding more capital upfront.

Up to 10x leverage: Eligible users can access margin on major pairs like BTC/USDT and ETH/USDT.

Isolated vs. cross margin: Choose isolated margin to control risk per trade or cross margin for more flexibility across positions.

Real-time risk monitoring: The dashboard helps you track margin ratios and get alerts before liquidation happens.

This is best for traders who understand risk and want to act quickly in volatile markets. For example, if you expect a short-term BTC rally, 3x leverage lets you scale returns without additional capital.

-

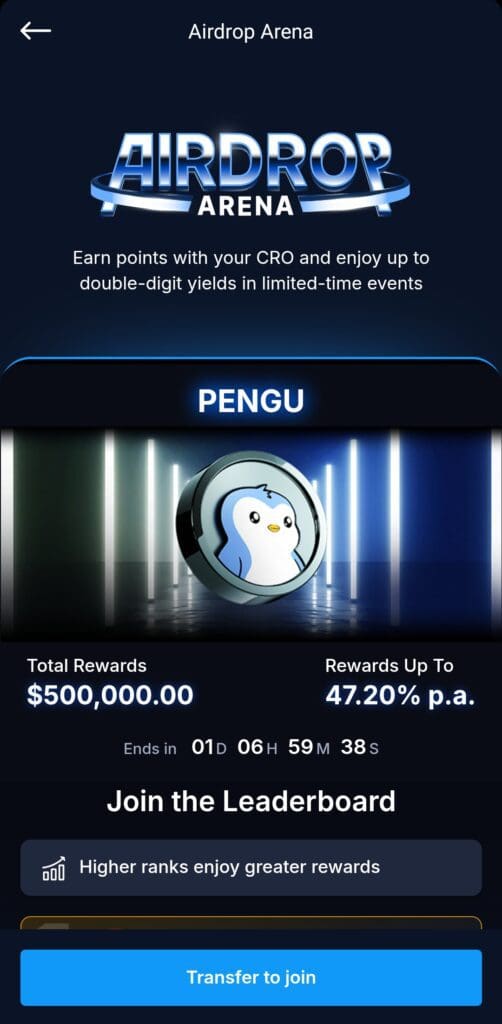

Crypto.com Supercharger: Liquidity Mining Rewards

The Supercharger is a liquidity mining feature that lets you deposit CRO and earn other tokens as rewards. It’s a low-risk way to access trending crypto projects without active trading.

Simple deposit model: Just deposit CRO into the pool during the charging phase — no lock-in period.

Token variety: Past rewards have included DOT, MATIC, and even new project launches.

No staking required: You can withdraw anytime during the event without penalties.

This works well for users who already hold CRO and want passive exposure to new tokens. For instance, depositing CRO during a Supercharger event could earn you AVAX over the next 30 days with no added risk.

-

VIP Program for High-Volume Traders

Crypto.com’s VIP Program rewards users who trade in large volumes with exclusive perks and lower fees. It’s designed for serious investors or institutions managing substantial portfolios.

Lower maker/taker fees: As a VIP, you get some of the best fee tiers available on any exchange.

Dedicated account manager: Receive priority support and market insights tailored to your strategy.

Early access to features: VIPs often get beta access to new tools before public release.

If you're a frequent trader or manage crypto portfolios professionally, VIP status can save thousands in fees. A user trading $1M+ monthly in BTC could cut costs significantly just from fee discounts alone.

-

Crypto.com Lending: Borrow Against Your Holdings

This feature allows you to borrow stablecoins using your crypto as collateral, without needing to sell your assets. It’s useful if you need liquidity but want to keep your crypto position intact.

No credit checks: Loans are secured by crypto, so approval is instant and doesn’t affect your credit score.

Flexible LTV ratios: Borrow up to 50% of your collateral amount in USDT or USDC.

Keep market exposure: You can still benefit if your crypto increases in value while the loan is active.

This is helpful for short-term cash needs. For example, you can borrow $5,000 in USDC against your ETH, pay bills or reinvest, and repay later while still holding your ETH long-term.

-

Crypto.com Trading Arena: Competitions and Rewards

The Trading Arena hosts regular trading competitions with token rewards and cash prizes for top-performing users. It encourages activity while giving something back to the community.

Event-based trading contests: Join ranked events by trading eligible pairs during set timeframes.

Win CRO or altcoins: Rewards often include CRO bonuses or trending tokens like SAND or APT.

Fair rules & tracking: Leaderboards are updated in real-time, and each event comes with clear rules.

If you're already trading actively, joining a contest can be a fun way to earn extra rewards. For example, ranking in the top 10 for a BTC/USDT trading event could land you 500 CRO as a bonus.

Avoiding Costly Mistakes on Crypto.com Exchange

Crypto.com is powerful, but a few common missteps can cost you money or lead to frustration. Here's how to steer clear of them:

Skipping fee research: Trading fees change based on your volume and CRO holdings. Always check the fee tier chart before making large trades.

Ignoring CRO benefits: Many users miss out on lower fees, staking rewards, or access to token sales by not holding or staking CRO.

Overusing leverage: Margin trading with high leverage can backfire quickly in a volatile market—especially if you don't set stop-losses.

Forgetting security settings: Not enabling 2FA or withdrawal whitelisting increases the risk of account compromise. Add protection early.

Assuming app and exchange are the same: The Crypto.com App and Exchange are two separate platforms. Make sure you’re using the right one for the right task.

By avoiding these common mistakes, you can get more value and safety out of Crypto.com. Take a few minutes to set up your account the right way before diving into trades or staking.

FAQ

No, but holding or staking CRO gives you lower trading fees, access to Syndicate sales, and better staking rewards.

Go to the “Deposit” or “Withdraw” tab in your wallet. Transfers between the App and Exchange are fee-free and usually instant.

Yes, most funds are held in cold storage and user accounts can enable two-factor authentication and withdrawal whitelists for extra protection.

Yes, the Crypto.com Exchange has a separate mobile app with full trading features including spot, margin, and charting tools.

It varies by coin, but most pairs have a low minimum starting around $10–$20 USD equivalent in crypto.

Yes, KYC verification is required before you can trade or withdraw. This includes uploading a photo ID and completing a face scan.

Yes, you can stake coins through Crypto Earn, participate in Syndicate events, or earn rebates from the VIP program if eligible.

Internal transfers are instant. Blockchain deposits or withdrawals depend on network traffic but typically take a few minutes to a few hours.