Table Of Content

Interactive Brokers (IBKR) stands out for day traders who want institutional-grade tools with deep market access.

While the platform may not be as beginner-friendly as Webull, its customization and range of trading capabilities more than make up for it.

Interactive Brokers Tools for Day Traders

From algorithmic trading to bracket orders and global market access, IBKR is built for serious traders looking to act on fast-moving opportunities.

Here are the features we found most valuable when using Interactive Brokers for day trading.

-

Extended Trading Hours & Global Market Access

IBKR offers one of the broadest ranges of pre-market and after-hours trading — from 4 AM to 8 PM ET — and access to over 150 international markets. This gives you more chances to react to catalysts like overseas earnings or geopolitical developments.

Trade Outside U.S. Hours: You can place trades on European or Asian stocks while U.S. markets are closed.

React to News Early: IBKR’s platform lets you set alerts and place orders before the opening bell or after major earnings calls.

Watch Cross-Market Activity: With global exposure, you can track how ETFs or ADRs move based on overnight market action.

We’ve used this to trade pre-market gaps in U.S. tech stocks influenced by Asian chipmaker results — getting in before the regular session volatility begins.

-

Advanced Charting & Trader Workstation (TWS)

Interactive Brokers’ Trader Workstation is one of the most advanced platforms available. It supports everything from multi-monitor layouts to algo scripting, ideal for technical and active traders.

Powerful Indicators & Studies: Over 100 technical indicators, drawing tools, and risk/reward calculators are available.

Multi-Asset View: You can chart stocks, options, and futures together with linked timeframes or watchlists.

Custom Layouts: Save personal workspaces with chart grids, trade tickets, and scanners for a highly efficient workflow.

For example, we used a four-chart grid showing volume spikes, VWAP, RSI, and MACD to monitor short-term reversals in semiconductor stocks — switching seamlessly between symbols using hotkeys.

-

Paper Trading and Strategy Testing in TWS

Before risking real capital, IBKR’s paper trading account lets you simulate trades with full access to TWS features. It’s a safe space to test strategies, refine setups, or practice position sizing.

Simulate Real-Time Market Conditions: Execute mock trades with real bid/ask prices and live Level 2 data.

Backtest Ideas: Use TWS’s backtesting tools to validate patterns or test trailing stop performance across tickers.

Practice Risk Management: Simulate bracket orders, stop losses, or ladder entries before applying them live.

For instance, we tested a mean-reversion strategy on energy stocks — tweaking entry points based on RSI divergence before moving it to a live account with confidence.

-

Hotkeys, Rapid Order Entry & Smart Routing

TWS offers programmable hotkeys and customizable order entry templates, ideal for executing trades with speed and precision. This is particularly useful in momentum setups or scalp trading.

Assign Buy/Sell Hotkeys: Program keys for order size, type (e.g., limit, market), and routing preferences.

Create Order Presets: Save bracket setups or trailing stops for instant reuse.

SmartRouting® Engine: IBKR’s SmartRouting seeks the best price across exchanges and auto-adjusts routing for execution speed.

When trading small-cap breakouts, we mapped hotkeys for bracket entries with stop-losses preset. Combined with SmartRouting, this reduced slippage during volatile moves.

-

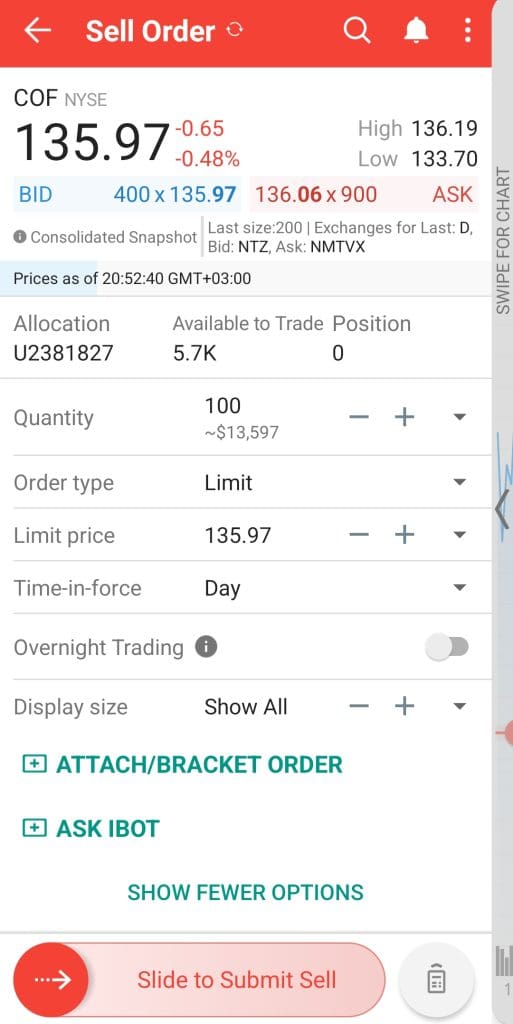

Bracket Orders, Trailing Stops, and Algo Strategies

IBKR supports an array of advanced order types that many brokers lack — making it easier to control risk or automate exits during fast-moving trades.

Bracket Orders: Enter trades with predefined stop-loss and take-profit levels.

Trailing Stops: Automatically adjust stop-losses as prices move in your favor.

Algo Orders: Use built-in algos like VWAP, iceberg, or adaptive to hide size and improve fills.

We often set a trailing stop of 1.5% when trading high-momentum names like Tesla — letting us stay in trades longer without micromanaging exits.

-

Real-Time Options Chain & Strategy Builder

For options-based day traders, IBKR offers a highly detailed, customizable options chain and strategy builder — with real-time Greeks, volatility data, and trade simulations.

Live Chain With Greeks & IV: Monitor delta, theta, and IV skew in real time.

Strategy Builder Tool: Construct verticals, iron condors, or custom spreads directly from the chain.

Options Scanner: Identify high-volume contracts or unusual activity by sector or expiration.

During earnings season, we used the scanner to spot volume spikes in weekly calls — then built debit spreads using the strategy builder to limit exposure.

-

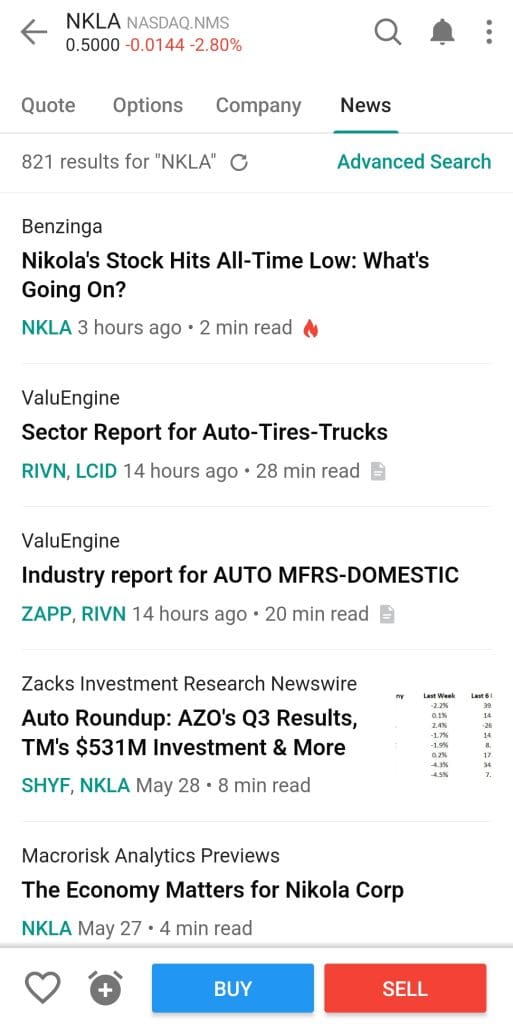

Integrated Market News, Heatmaps & Event Calendar

Day trading is often news-driven. IBKR integrates live headlines, analyst ratings, corporate actions, and earnings calendars directly into the platform.

Filter News by Watchlist: Only see headlines tied to your holdings or sector.

Real-Time Heatmaps: Spot sector momentum visually with customizable filters.

Earnings & Events Calendar: Track pre/post earnings setups, splits, and macroeconomic events.

Ahead of Nvidia’s earnings, we used IBKR app economic calendar to plan risk and watch implied volatility in the options chain.

What’s Still Missing for Some Day Traders

Despite its institutional-grade tools, Interactive Brokers (IBKR) isn’t without shortcomings — especially for traders who value simplicity, community features, or ease of onboarding. While it's ideal for pros and advanced users, there are some gaps worth knowing.

Steep Learning Curve: Trader Workstation (TWS) is highly customizable, but that also means it takes time to master.

Lack of Social or Copy Trading Features: Unlike Webull, eToro, or Public.com, IBKR doesn’t offer community features like trade sharing, forums, or copy trading.

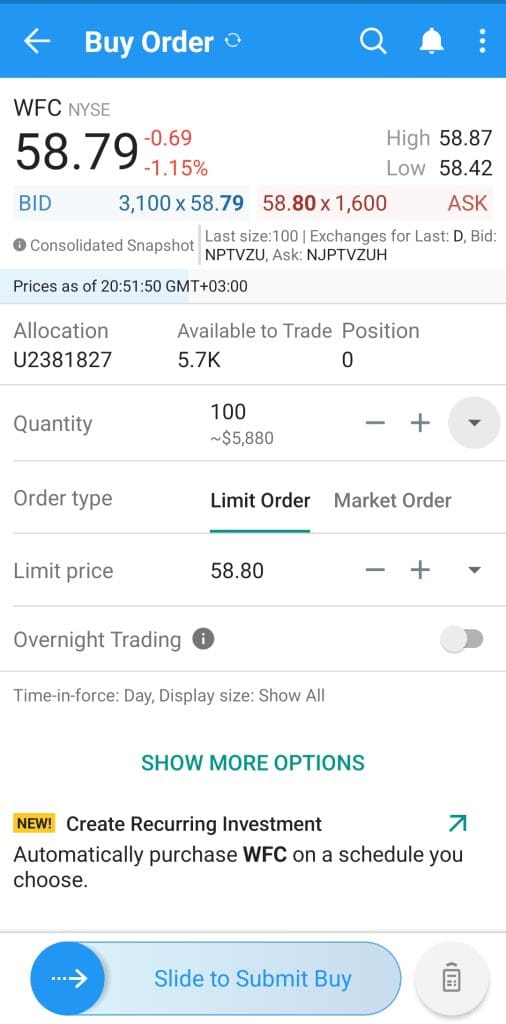

Complex Mobile Interface: While IBKR Mobile mirrors much of the functionality of TWS, it can feel dense and technical for fast mobile execution. Navigating charts, placing conditional orders, or modifying bracket trades on a smaller screen requires familiarity.

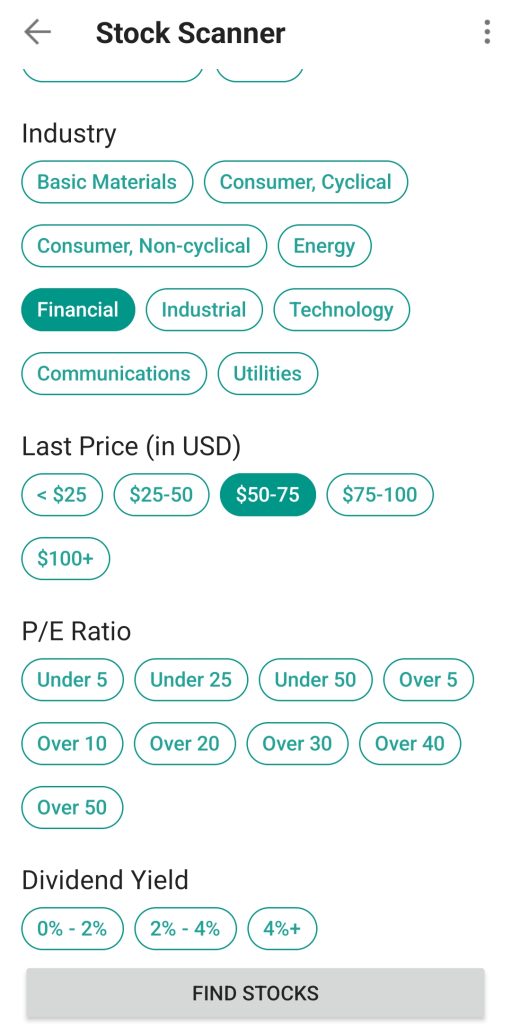

Limited UX for Beginners: Features like stock screeners, fundamental data, or margin usage are powerful — but not as visually intuitive as platforms built for retail investors.

Therefore, if you're still learning day trading or prefer visual simplicity, IBKR might require additional time and resources before you unlock its full potential.

Alternative Platforms for Day Traders

If Interactive Brokers feels overly complex or doesn’t fully match your trading style, there are several strong alternatives that cater to various needs — from high-speed execution to user-friendly mobile interfaces.

Thinkorswim (by Charles Schwab): A top-tier platform for serious technical traders. It offers customizable charting, scripting with thinkScript, paper trading, Level 2 data, and real-time economic indicators — all with zero account minimums.

TradeStation: Known for its automation and lightning-fast execution, TradeStation is ideal for advanced day traders. It supports custom strategies, hotkeys, multi-monitor setups, and even cryptocurrency trading through a separate TradeStation Crypto platform.

Webull: A clean, modern interface designed for newer traders. It combines real-time data, basic technical analysis tools, and extended trading hours — great for those who want to get started quickly with minimal learning curve.

eToro: Best for traders who want a social or copy-trading experience. While not suited for high-frequency strategies, it allows you to follow top-performing traders and mimic their trades, which can help build ideas or momentum-based strategies.

These platforms may offer better tools for scripting, easier navigation, or more community features, depending on your preferences.