Table Of Content

Using sentiment data helps investors go beyond charts and fundamentals by gauging real-time market psychology. Here's how it adds value:

Detects Early Momentum: Positive sentiment spikes—especially on platforms like Stocktwits or Reddit—often precede price breakouts in trending stocks.

Filters Hype From Reality: Sentiment scores can highlight whether enthusiasm is supported by real buying or speculative chatter.

Tracks Retail Investor Behavior: Tools like TipRanks or Barchart show how retail traders position, which can reveal overlooked opportunities.

Complements Technical and Fundamental Analysis: A bullish sentiment score alongside strong earnings or a breakout chart pattern strengthens the case for entry.

Assists in Risk Management: Extreme bullish or bearish sentiment might signal an overbought or oversold stock, helping you time your entry or exit better.

As a result, combining sentiment with other tools can help you spot “hot” stocks early and avoid late-stage chases.

How To Use Stock Sentiment Analysis To Find Hot Stocks?

Stock sentiment analysis is especially helpful for identifying high-interest stocks before major moves. Here's how you can do it:

-

Track Social Media Buzz with Tools Like StockTwits / Reddit

Platforms like StockTwits, Reddit’s r/wallstreetbets, and X (formerly Twitter) offer raw, real-time investor chatter. Sentiment tools scan keywords, ticker mentions, and emojis to rate stocks as bullish or bearish.

For example, a sudden surge in positive mentions for a biotech stock after trial data leaks might signal a buying opportunity.

Using a dashboard like SwaggyStocks helps you track tickers rising in popularity with visual sentiment trends.

Be cautious—volume of mentions doesn’t always mean quality. Confirm with price action or news flow.

This is especially useful for spotting retail-fueled momentum plays and meme stock setups.

-

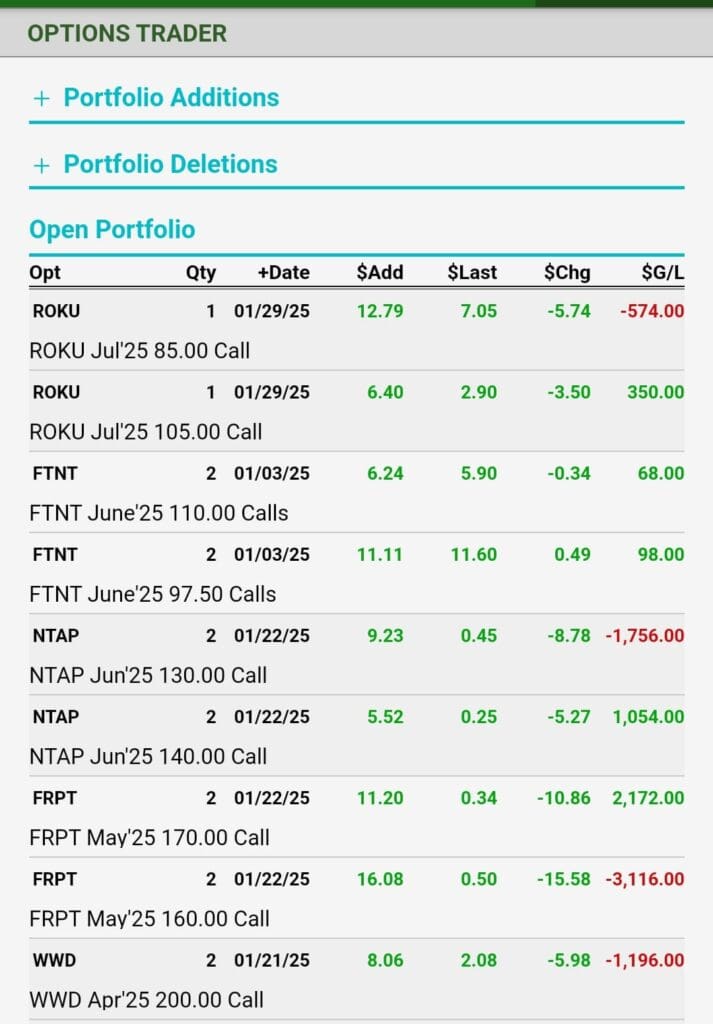

Monitor Options Market Data for Unusual Activity

Options flow reveals where big money is placing directional bets. When unusual call buying occurs, especially out-of-the-money contracts, it may signal expectations for a sharp price move.

Services like Unusual Whales let you track large call sweeps or volume spikes.

For instance, if a mid-cap tech stock sees a surge in weekly calls, it could be ahead of earnings or a takeover rumor.

Combine this with bullish social sentiment for a powerful signal.

Because institutional traders often use options for leverage, their behavior can lead to fast-moving “hot” stock opportunities.

-

Use AI-Powered Sentiment Scores From Analyst Platforms

TipRanks, Seeking Alpha, and Zacks provide sentiment indicators based on analyst opinions, blogger views, and insider activity. These tools combine multiple data points to offer a bullish-bearish scale.

For example, a stock rated as “Very Bullish” on TipRanks may have a combination of analyst upgrades, insider buying, and strong retail chatter.

Seeking Alpha’s Quant Rating includes sentiment in its factor model, providing another angle on stock strength.

Look for upward-trending sentiment alongside positive earnings revisions.

Therefore, these platforms help filter thousands of stocks into a shortlist with rising conviction.

-

Leverage Twitter/X Sentiment Analysis Tools

Twitter is still a powerful source of fast market opinions. Tools like FinSentS and Sentdex use natural language processing (NLP) to score tweets about companies.

For instance, spikes in bullish sentiment for a small-cap AI company could indicate incoming momentum.

Some traders even write scripts to follow specific influencer accounts for signals.

Pair Twitter sentiment with technical breakout levels to time entry.

Because Twitter often reacts to news instantly, tracking sentiment here gives you an edge in speed.

-

Look for Divergence Between Sentiment and Price

Sometimes, price stalls while sentiment rises—a potential early signal. This divergence can highlight undervalued momentum stocks before the crowd notices.

For example, if a solar stock maintains neutral price action while sentiment becomes increasingly positive due to policy changes, that mismatch might precede a breakout.

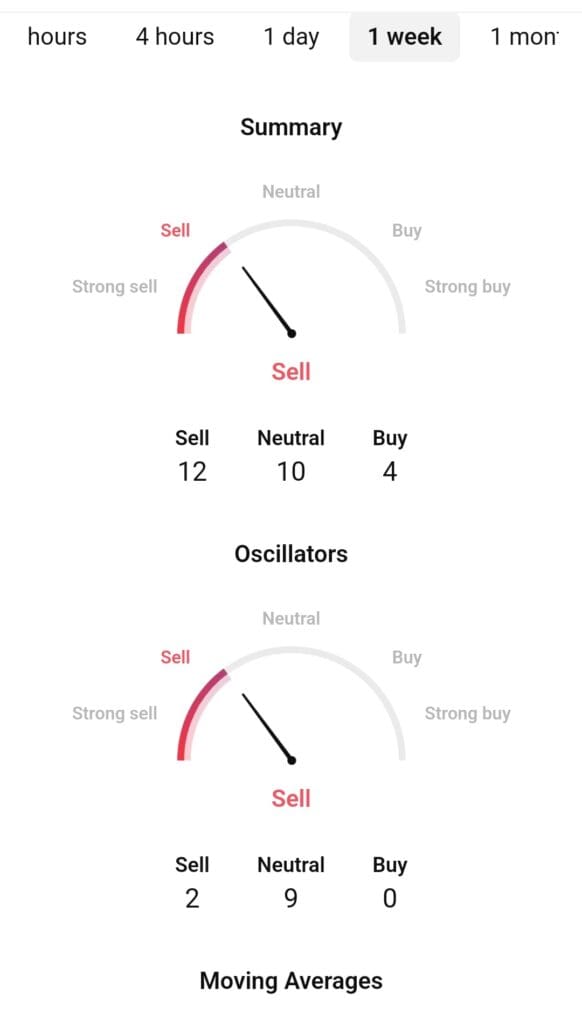

You can visualize this on platforms like TradingView that integrate sentiment overlays from social media or news.

Use this tactic with earnings calendars or macro events to anticipate big moves.

In order to act ahead of technical confirmation, you need to recognize these divergence patterns early.

Don't Forget to Validate Your Idea

Sentiment is powerful, but validating it with supporting tools helps reduce false signals and improves confidence in your trade setup.

Check Volume and Price Trends: Use platforms like TradingView or Finviz to confirm that rising sentiment is matched by volume spikes or technical breakouts. A stock with high bullish sentiment but low volume might lack real buying interest.

Scan Recent News: Platforms like Benzinga or Yahoo Finance help confirm if a stock’s buzz is due to real developments—like an earnings beat or product announcement.

Use Technical Indicators: Adding RSI, MACD, or moving averages can help you gauge if a stock is overbought or in early momentum. This prevents emotional, hype-driven entries.

Compare Peer Sentiment: Tools like TipRanks allow you to see how sentiment compares across similar stocks. If one AI stock is hot while peers aren’t, it may indicate a unique catalyst.

By combining sentiment with volume, technicals, and news context, you create a more complete and objective view of the opportunity.

Tools for Stock Sentiment Analysis

To track investor sentiment effectively, you need specialized tools that aggregate social buzz, options data, analyst views, and price signals.

StockTwits: This service offers real-time investor sentiment by tracking bullish vs. bearish messages per ticker. It is great for meme stocks and retail trends.

TipRanks: Combines analyst ratings, insider trades, blogger sentiment, and hedge fund activity into one comprehensive sentiment score.

Unusual Whales: Focuses on options flow and social sentiment, revealing which stocks are seeing large speculative bets in real-time.

Finviz: A popular screener that includes sentiment-based filters and overlays news, insider trades, and technical setups for validation.

Seeking Alpha: Offers sentiment-driven quant ratings and user comments from active investors. Great for cross-checking opinions.