SoFi Invest provides an easy and user-friendly platform for beginners who want to trade stocks, ETFs, and Bitcoin commission-free.

With integrated banking services and robo-advisor features, it's designed to simplify investing while offering flexibility for those new to the market.

Let's explore some of the best features and options it offers for investors:

1. Beginner-Friendly Trading Experience

SoFi Invest is designed to make investing simple and accessible for newcomers, focusing on ease of use without overwhelming advanced tools.

No Commission Fees: SoFi Invest provides commission-free trading for stocks and ETFs, making it an affordable option for those just starting to invest.

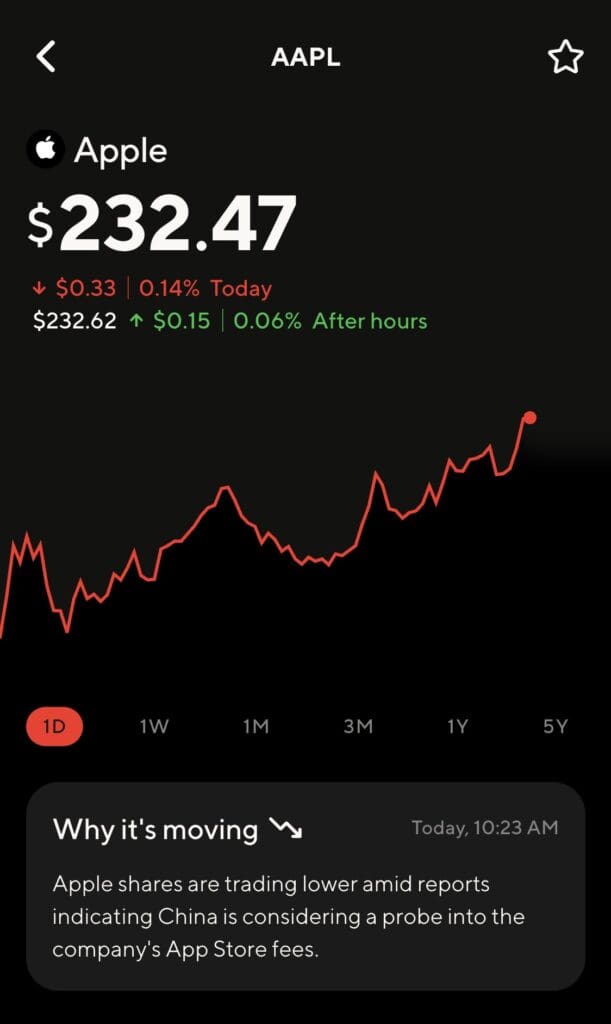

Fractional Shares: Investors can buy fractional shares of over 1,800 stocks and ETFs, meaning you can invest as little as $1 in high-value stocks like Apple or Amazon, making it perfect for those on a budget.

Intuitive Interface: The platform is designed for simplicity. You can easily search for assets, track performance, and place trades without complicated navigation.

- The Smart Investor Tip

Start with small investments in fractional shares of large companies to get a feel for the market without committing large amounts of capital. This way, you can build confidence while learning the ropes.

2. Bitcoin Trading and Transfers

In addition to traditional stocks and ETFs, SoFi Invest offers cryptocurrency trading, providing an all-in-one platform for a variety of investment preferences.

Buy & Sell Bitcoin: With SoFi Invest, you can trade Bitcoin directly from your account with as little as $1, making it accessible even for small investors.

Bitcoin Transfers: You can also send Bitcoin to an external wallet, giving you more control over your crypto holdings compared to some other platforms.

Recurring Bitcoin Purchases: Set up automatic recurring Bitcoin purchases, which allows you to gradually build a Bitcoin position over time, helping manage market volatility.

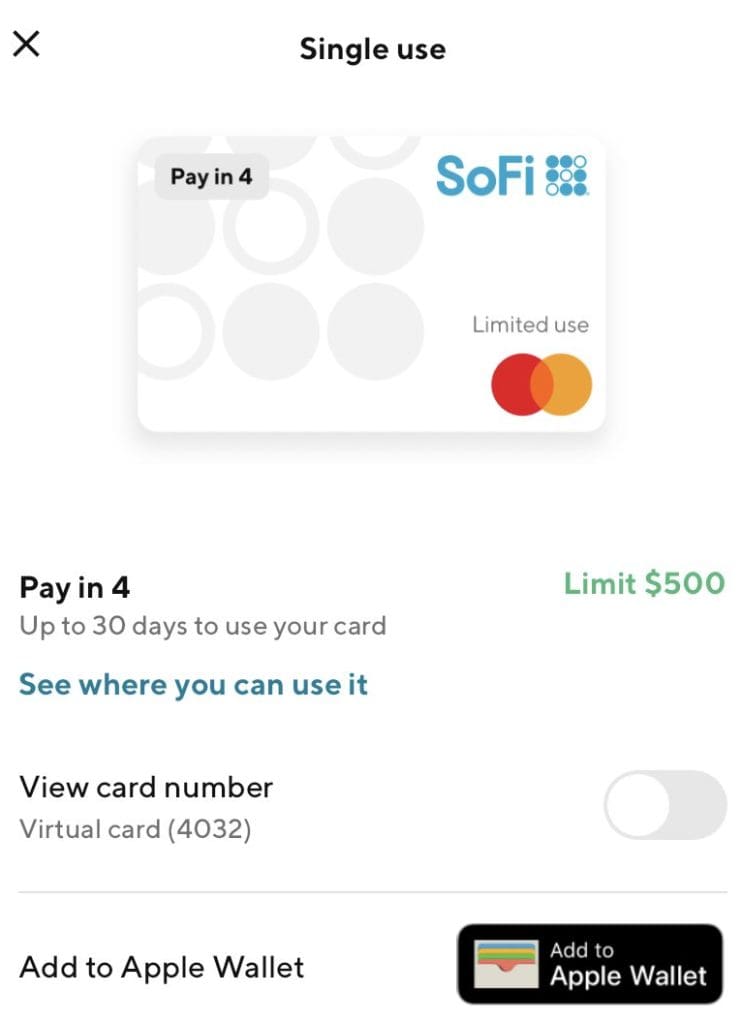

3. Seamless Banking & Investing Integration

SoFi Invest is integrated with SoFi's broader banking services, offering a unified financial experience. This integration allows you to manage both your investments and personal finances in one place.

Instant Fund Transfers: Move funds quickly between your SoFi balance and investment account, making it easy to transfer money for buying and selling assets.

Free Debit Card Access: SoFi provides a free debit card that allows you to spend the money you earn from investments, simplifying your financial life.

Automatic Reinvesting: When you sell assets, the proceeds are automatically deposited into your SoFi balance, where they can either be reinvested or used for other transactions.

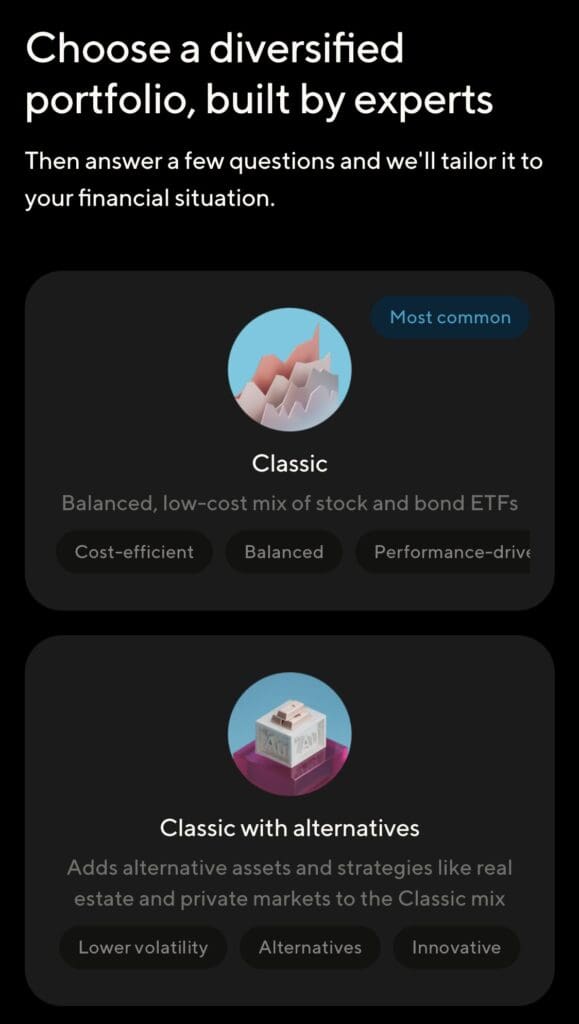

4. Robo Investing: SoFi Automated Investing

SoFi’s Robo Advisor leverages the expertise of SoFi’s investment committee in partnership with BlackRock to design personalized portfolios based on your financial goals and risk tolerance.

Built by Experts: Portfolio recommendations are created by investment experts with over 100 years of combined experience, ensuring your strategy is solid and reliable.

Personalized Investment: Customize your portfolio by setting preferences such as goals, risk tolerance, and time horizon, and let the Robo Advisor build a strategy tailored for you.

- Automated Trading & Rebalancing: Set your preferences, and SoFi’s automation takes care of the rest, ensuring your portfolio is always aligned with your long-term goals.

Three Customizable Portfolio Themes: Select from three distinct portfolio themes, each designed to match your financial goals, values, and risk tolerance.

- The Smart Investor Tip

When setting up your Robo Investing portfolio, take time to review your goals and risk tolerance to ensure that the automated strategy is aligned with your personal financial objectives.

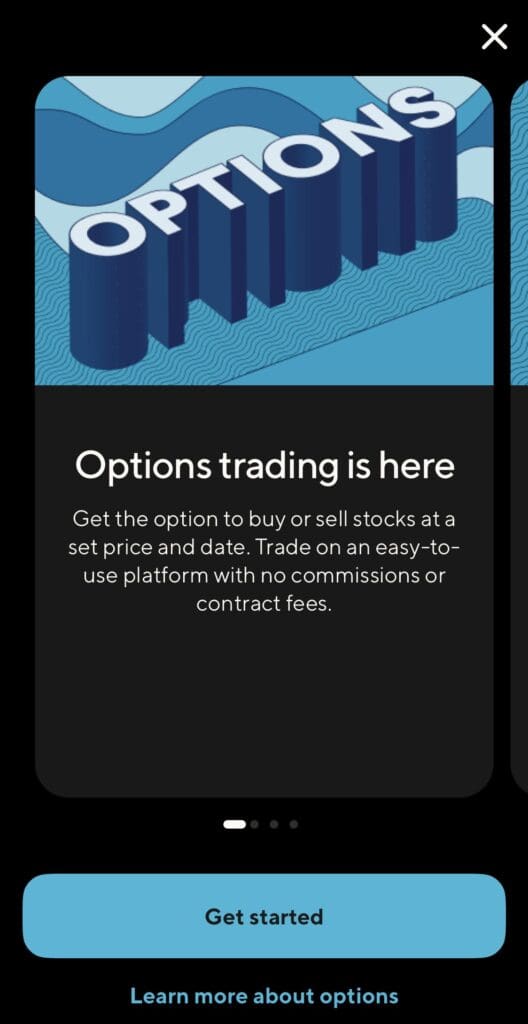

5. Options Trading: Flexibility for Active Traders

SoFi Invest gives you the ability to trade options, providing flexibility and advanced strategies for experienced investors.

Call and Put Options: SoFi allows you to trade call and put options, enabling you to hedge your investments, generate income, or speculate on stock price movements.

No Commission Fees on Options Trades: As with stocks and ETFs, SoFi charges no commission fees for options trades, making it a cost-effective platform for active traders.

Basic Trading Platform: While SoFi’s options platform is suitable for beginners, it lacks advanced features like technical analysis or real-time data, which might limit more sophisticated traders.

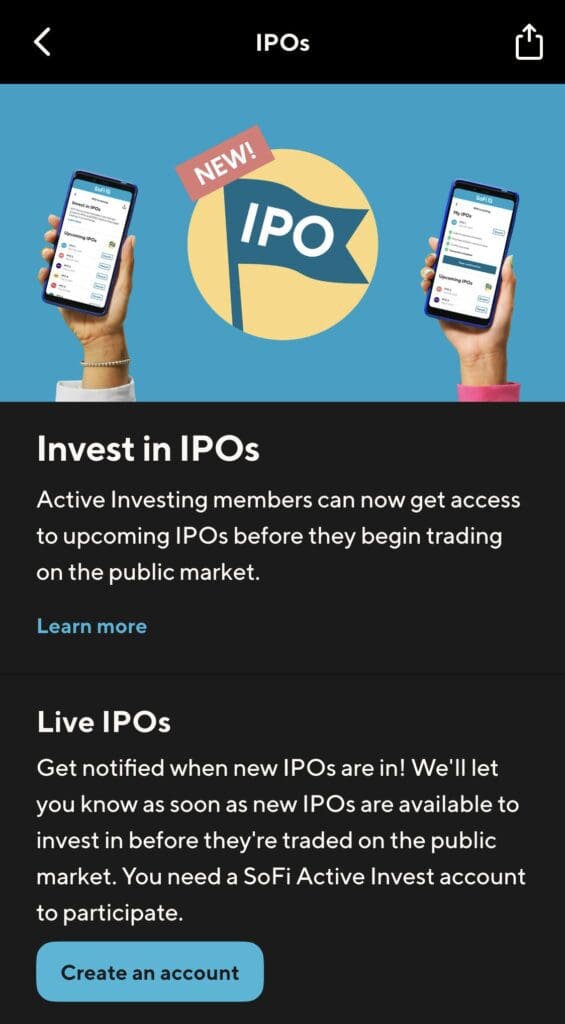

6. IPO Investing: Access New Opportunities Early

SoFi Invest provides access to IPOs, offering you the chance to invest in new companies before they hit the public market.

No Minimum Investment: Unlike many brokers, which require high account balances to participate in IPOs, SoFi Invest allows investors to invest in IPOs with no minimum balance, making it accessible for all investors.

Notifications on Upcoming IPOs: SoFi keeps you updated on upcoming IPOs, so you can apply for shares before they become publicly available, potentially giving you an early advantage.

IPO Risk Consideration: Keep in mind that IPOs are highly volatile, and there’s no guarantee you’ll receive shares or that the investment will perform well after going public.

7. SoFi Plus: Premium Features for Active Investors

SoFi Plus is a membership program that offers additional features and perks for active users looking to get more out of their SoFi Invest experience.

1% Match on Recurring Investments: SoFi Plus members receive a 1% match on their recurring investments, meaning for every $1,000 invested, you receive an additional $10 in rewards points, which can be used for further investments.

Higher Interest Rates on Cash: SoFi Plus members enjoy higher interest rates on uninvested cash in their SoFi account, helping maximize savings while funds are not actively invested.

Exclusive Access to Financial Advisors: SoFi Plus members can schedule additional one-on-one sessions with financial planners, providing personalized guidance on investment strategies, budgeting, and long-term planning.

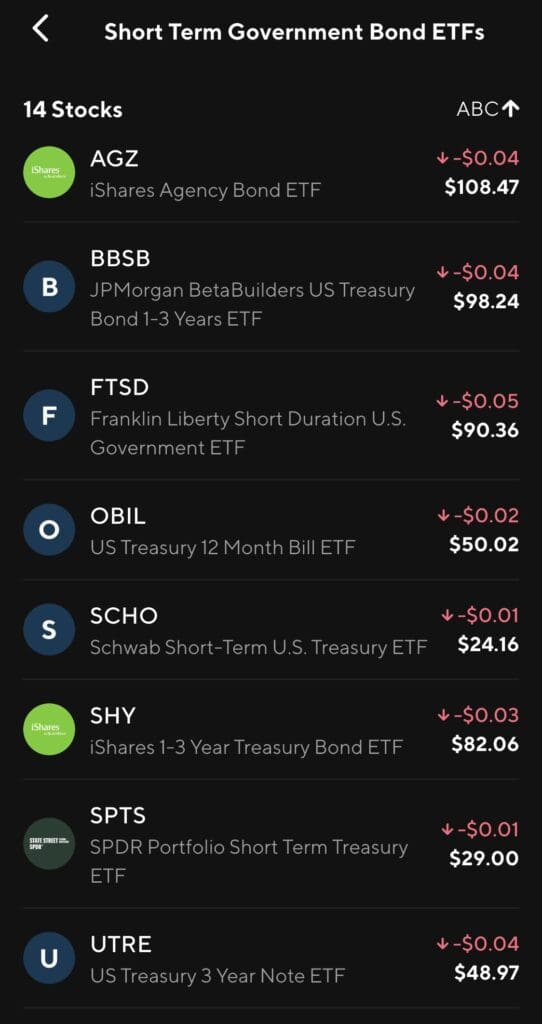

8. ETFs: Low-Cost Diversification with Exchange-Traded Funds

SoFi Invest offers a wide selection of ETFs (Exchange-Traded Funds), which provide cost-effective diversification for your portfolio.

No Fees on ETF Trades: SoFi charges no commission fees for ETF trades, making it an affordable way to invest in diversified baskets of stocks or bonds.

Thematic ETFs: Choose from a wide range of ETFs that focus on different sectors, asset classes, or investment strategies, including socially responsible investing (SRI), tech, and international markets.

Automatic Rebalancing for ETFs: With SoFi’s Auto Pilot service, your ETF portfolio will be automatically rebalanced, ensuring your investments stay aligned with your long-term goals.

- The Smart Investor Tip

Consider using ETFs to diversify your investments across various asset classes and sectors without having to buy individual stocks. It’s an affordable way to balance risk while still participating in the market’s growth.

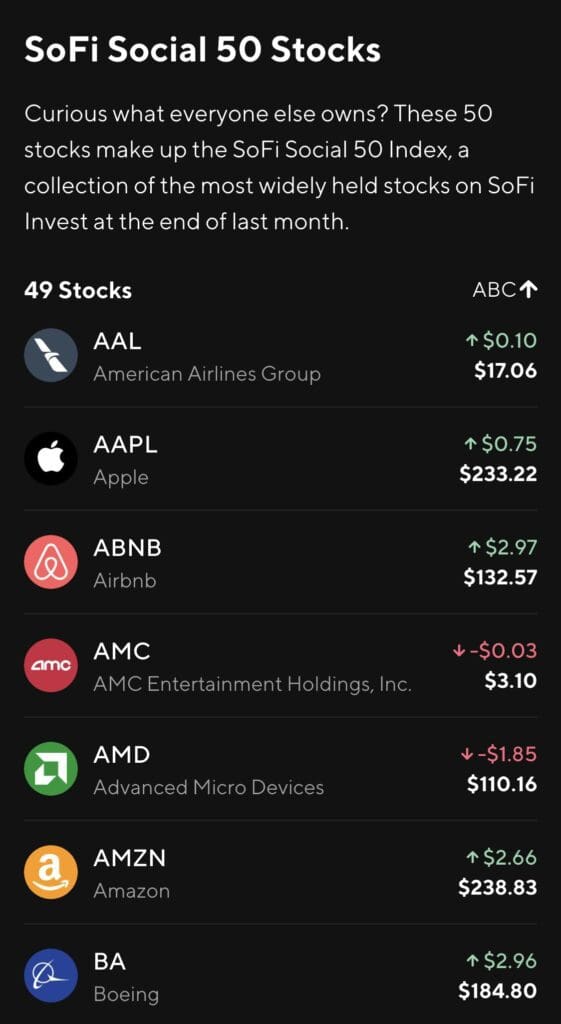

9. Social Investing & Market Sentiment Insights

SoFi Invest offers a social investing feature that gives you an idea of what other investors are trading, providing insights into market sentiment.

Trending Stocks & ETFs: View what stocks and ETFs are popular among SoFi users, giving you an indication of current market trends.

Investor Sentiment: The feature can help you gauge the general mood in the market, which might inspire investment ideas or strategies.

Social Sharing: While it’s not a full-fledged social network, SoFi lets you see some of the investment actions and sentiment of others, useful for beginners who want to learn from their peers.

- The Smart Investor Tip

While social investing insights can guide you, ensure you do your own research before acting on market trends. Use sentiment as a supplementary tool but rely on sound investment principles when making decisions.

How to Get Started with SoFi Invest

SoFi Invest makes it simple to begin your investment journey, offering commission-free trading, fractional shares, and automated portfolios.

Sign Up for an Account: Create an account on the SoFi Invest app or website. It's quick and easy.

Set Investment Goals: Define your goals, risk tolerance, and time horizon to help guide your investment choices.

Choose Your Investment Type: Pick from stocks, ETFs, or cryptocurrency, or let SoFi’s Robo Advisor automate your portfolio for you.

Start with Fractional Shares: Invest as little as $1 in stocks like Apple or Amazon, even if you don't have the funds for a full share.

Link Your Bank Account: Connect your SoFi or external bank account to fund your investments and easily transfer funds for trading.

By following these steps, you’ll be well on your way to managing your investments with ease.

FAQ

SoFi Invest allows you to trade a wide range of assets, including stocks, ETFs, Bitcoin, and alternative investments. The platform provides a commission-free structure for trading these assets, making it easy and affordable to diversify your portfolio.

Yes, SoFi Invest offers fractional share investing, allowing you to invest in high-value stocks like Apple or Amazon with as little as $1. This makes it easy to start investing, even with limited funds.

No, SoFi Invest does not require a minimum deposit to open an account. You can start investing with as little as $1, especially when buying fractional shares.

SoFi’s Robo Advisor creates a personalized portfolio based on your financial goals, risk tolerance, and time horizon. It automatically handles portfolio rebalancing and trading, making it a great option for those who want a hands-off approach to investing.

SoFi Invest does not charge commission fees for trading stocks, ETFs, or Bitcoin. However, there may be other costs related to specific investments or third-party services, so it’s good to review the platform’s fee structure.

Yes, SoFi Invest allows you to trade options on stocks, offering flexibility for active traders. It provides commission-free options trading, but the platform is more basic compared to other advanced options trading platforms.

You can easily transfer funds between your SoFi bank account and SoFi Invest account using the SoFi mobile app or website. The process is fast and seamless, allowing you to manage your investments with ease.