Table Of Content

What Is TipRanks?

TipRanks is a powerful stock research platform that blends data-driven insights with expert-generated content.

It provides access to analyst ratings, hedge fund activity, insider trades, sentiment tracking, and performance metrics from top financial bloggers and Wall Street analysts.

The platform is designed to help retail investors make more informed decisions using expert-backed stock ratings, smart scoring systems, and portfolio tracking tools.

The Free Plan includes stock and ETF screeners, sentiment indicators, market news, and basic portfolio tracking. If you consider a Tipranks subscription, the Premium and Ultimate Plans unlock tools like Smart Score, advanced stock filters, hedge fund insights, insider sentiment, and expert-following capabilities.

Plan | Annual Subscription | Promotion |

|---|---|---|

TipRanks Premium | $359 ($30 / month)

No monthly plan | 30 day money-back guarantee |

TipRanks Ultimate | $599 ($50 / month)

No monthly plan | 30 day money-back guarantee |

How to Use TipRanks Stock Analysis Tools

TipRanks offers a rich set of tools that support both long-term investors and short-term traders.

Below are several effective ways to use TipRanks for smarter investing, using real features and research-backed examples.

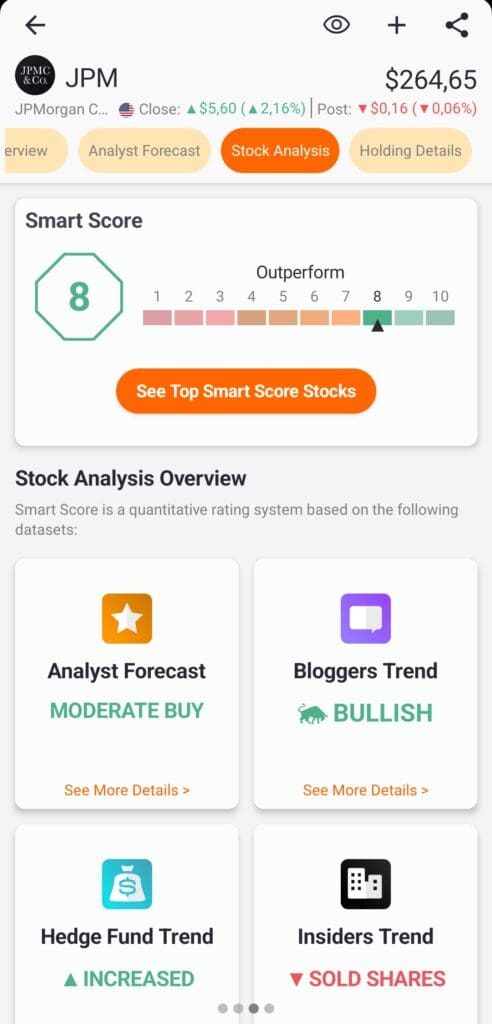

1. Evaluate Stocks Using the Smart Score and Analyst Ratings

The Smart Score is one of TipRanks’ most popular features (Premium only), rating stocks on a scale from 1 to 10 based on analyst ratings, insider trades, hedge fund activity, and technical indicators.

Filter top-rated stocks (score 8–10) to identify companies likely to outperform based on expert and data-driven criteria.

Use analyst ratings to see how top Wall Street analysts view a stock’s price potential and market position.

Track price targets and view historical performance of individual analysts.

In the Tipranks free plan, you can still see analyst consensus like “Strong Buy” or “Hold,” though not the individual analyst insights.

-

Example & The Smart Investor Tip

Suppose you’re researching Microsoft (MSFT). The Smart Score rates it 9, backed by several “Buy” ratings from top-performing analysts. A recent upgrade includes a raised price target and strong revenue forecasts.

Our tip: Use this tool to screen for quality stocks with strong expert support, especially in uncertain markets where analyst consensus may offer more reliability.

2. Analyze Technical Trends with Custom Chart Tools

While TipRanks is not built primarily for technical trading, it still offers customizable charts with key indicators for momentum-based strategies.

Apply popular indicators like Moving Averages, RSI, MACD, Volume, and Stochastic to identify trends and entry/exit points.

Customize chart types (e.g., candlestick, bar, line) and timeframes (daily, weekly, monthly) for multi-angle analysis.

Combine chart signals with sentiment tools for stronger confirmati

-

Example & The Smart Investor Tip

You’re analyzing Nvidia (NVDA). The RSI is approaching 70 and the MACD crosses above its signal line—suggesting bullish momentum.

Our tip: Pair technical analysis with investor sentiment and recent insider purchases for a well-rounded view of stock potential.

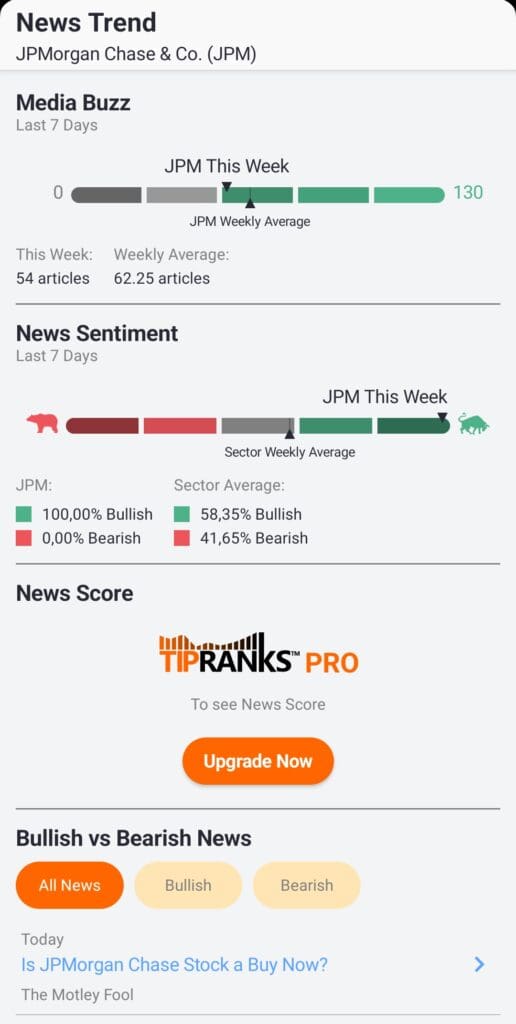

3. Use Sentiment Indicators to Confirm Market Momentum

TipRanks stands out with its suite of sentiment tools, which reflect how various groups view specific stocks.

Check Investor Sentiment to see how portfolios across the platform are positioned.

Use Blogger Consensus and News Sentiment to evaluate media buzz and public perception.

Review insider activity to assess whether executives are buying or selling shares—often a powerful bullish or bearish signal.

-

Example & The Smart Investor Tip

Let’s say Apple (AAPL) shows high investor sentiment, frequent mentions in news with a positive tone, and recent insider buys by a board member.

Our Tip: This alignment of public, media, and insider sentiment adds weight to a bullish thesis. Use it to gain confidence before entering a position.

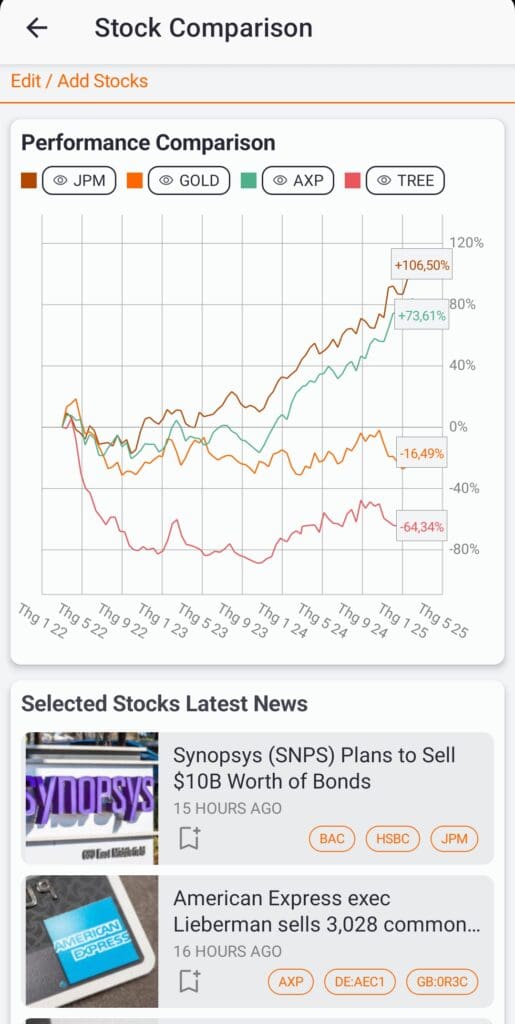

4. Compare Stocks Side-by-Side for Sector or Strategy Analysis

TipRanks’ Stock & ETF Comparison tool lets users evaluate up to 10 stocks at once—ideal for narrowing down investment choices.

Compare financial metrics, analyst ratings, price targets, and technical trends side-by-side.

Filter within the same sector (e.g., tech or healthcare) to identify outperformers or undervalued peers.

Use dividend comparison tools if income generation is your goal.

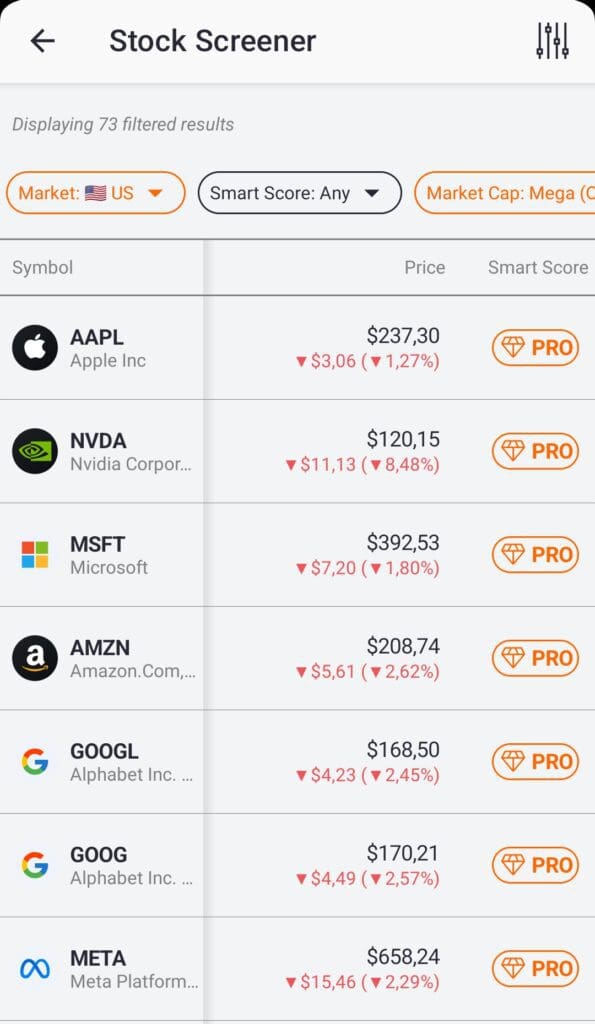

5. Screen Stocks Using TipRanks’ Data-Driven Stock Screener

TipRanks’ Stock Screener is a versatile tool that helps users filter stocks using fundamental metrics, sentiment signals, and expert-driven insights.

While the Free Plan includes basic filters like sector, P/E ratio, and dividend yield, Premium users unlock deeper filters like Smart Score, top analyst ratings, hedge fund activity, and insider buying.

Use standard filters such as market cap, dividend yield, and P/E ratio to find value or income stocks.

Premium users can add Smart Score, Top Analyst Consensus, and Hedge Fund Sentiment for enhanced targeting.

Apply Blogger and News Sentiment to detect trending or positively viewed stocks in the media.

-

Example & The Smart Investor Tip

You're looking for high-quality dividend stocks in the healthcare sector. In the free plan, you filter by sector, dividend yield over 4%, and P/E ratio under 20.

In Premium, you enhance this by adding Smart Score 8+, recent insider buying, and “Strong Buy” analyst consensus.

Our Tip: Use the screener to build actionable watchlists based on both fundamentals and expert sentiment—great for long-term and income-focused investors.

6. Find Momentum Stocks with the TipRanks Momentum Index

TipRanks’ Momentum Index is designed for traders looking for stocks that are trending upward based on a blend of price action, sentiment, and analyst support.

Explore the Top Momentum Gainers list to find stocks with strong recent price movement.

Use the Momentum Heatmap to identify sectors with the highest bullish momentum.

Combine this with technical indicators and insider sentiment for confirmation.

-

Example & The Smart Investor Tip

You’re looking for breakout trades. The Momentum Index highlights Super Micro Computer (SMCI) as a top gainer, with rising sentiment and analyst upgrades.

Our Tip: Use the momentum list to identify fast movers—great for swing trades when paired with RSI or MACD.

7. Identify High-Yield Picks with the Dividend Center

TipRanks' Dividend Center is a valuable resource for income-focused investors. It offers tools to identify, compare, and estimate dividends across different stocks.

Access the Highest Dividend Stocks list and screen by yield, payout ratio, and sector.

Use the Dividend Calculator to estimate income based on share count and payout schedule.

Compare dividend policies across multiple companies to find sustainable income sources.

8. Discover Top Analyst Stocks for Strong Buy Opportunities

One of the standout features in the TipRanks Premium plan is access to the Top Analyst Stocks list. This feature compiles recommendations from analysts with proven track records, offering highly-rated stocks backed by consistent accuracy.

View stocks with high analyst success rates, strong buy ratings, and above-average returns.

Analyze each analyst’s ranking, track record, and historical accuracy.

Combine this with Smart Score and sentiment tools to strengthen your thesis.

Overall, Tipranks is one of the best apps for stock picks based on expert insights.

-

Example & The Smart Investor Tip

You're researching long-term growth stocks. The Top Analyst list includes Salesforce (CRM) with multiple recent “Buy” ratings and a high average return from the recommending analysts.

Our Tip: Use this feature to focus on stocks with quality backing from analysts who have consistently outperformed the market.

9. Follow Insider Trades with Daily Insights and Hot Stocks List

TipRanks Premium and Ultimate plans offer real-time tracking of corporate insider trades—a valuable signal when evaluating a stock’s potential.

The Daily Insider Trading tool shows recent purchases/sales by CEOs, CFOs, and board members.

The Insiders’ Hot Stocks list highlights companies with repeated insider buying, often seen as a bullish indicator.

Filter by role, transaction size, or sector for more refined analysis.

FAQ

Yes, users can tailor their dashboard and portfolio view by selecting specific sectors, adding individual stocks, or following key events. This helps create a personalized research workflow based on investing goals.

Currently, TipRanks does not offer specific ESG or sustainability filters. Investors seeking socially responsible investing tools may need to combine TipRanks with platforms like Morningstar or MSCI for ESG insights.

While TipRanks doesn't directly flag short opportunities, users can identify overbought stocks with negative sentiment, insider selling, or low Smart Scores—useful signals when researching potential short plays.

Yes, TipRanks ranks analysts based on historical performance, including success rate and average return per rating. This helps users evaluate which experts are consistently reliable before following their stock picks.

The Premium plan supports up to three portfolios, while Ultimate allows six. You can track performance, allocation, and volatility across each one, making it easier to evaluate and compare strategies.

Yes, portfolios track your actual or simulated holdings, while watchlists let you follow stocks without affecting performance metrics. Both support alerts and personalized news feeds based on your selections.

TipRanks provides IPO calendars and upcoming listings but does not include in-depth private company analysis or pre-IPO valuation data. It’s focused mainly on publicly traded equities and ETFs.

Premium users can receive real-time alerts when analyst ratings are updated or when insider/hedge fund activity changes. However, alerts for Smart Score updates are not fully customizable.

Yes, Premium users can access a Penny Stock Screener with filters for market cap, analyst rating, and insider sentiment. However, real-time alerts and advanced charting are still limited in this segment.