Table Of Content

Vanguard’s brokerage account is built for long-term investors who prioritize low-cost, diversified portfolios.

While it may lack the bells and whistles of trading-first platforms, its strength lies in simplicity, transparency, and retirement-focused tools.

Key Features of a Vanguard Brokerage App

A Vanguard app is built for long-term investors who value low fees, simplicity, and reliable tools.

While it’s not built for active traders, it offers essential features like ETFs, retirement planning, and automated investing to support wealth-building strategies.

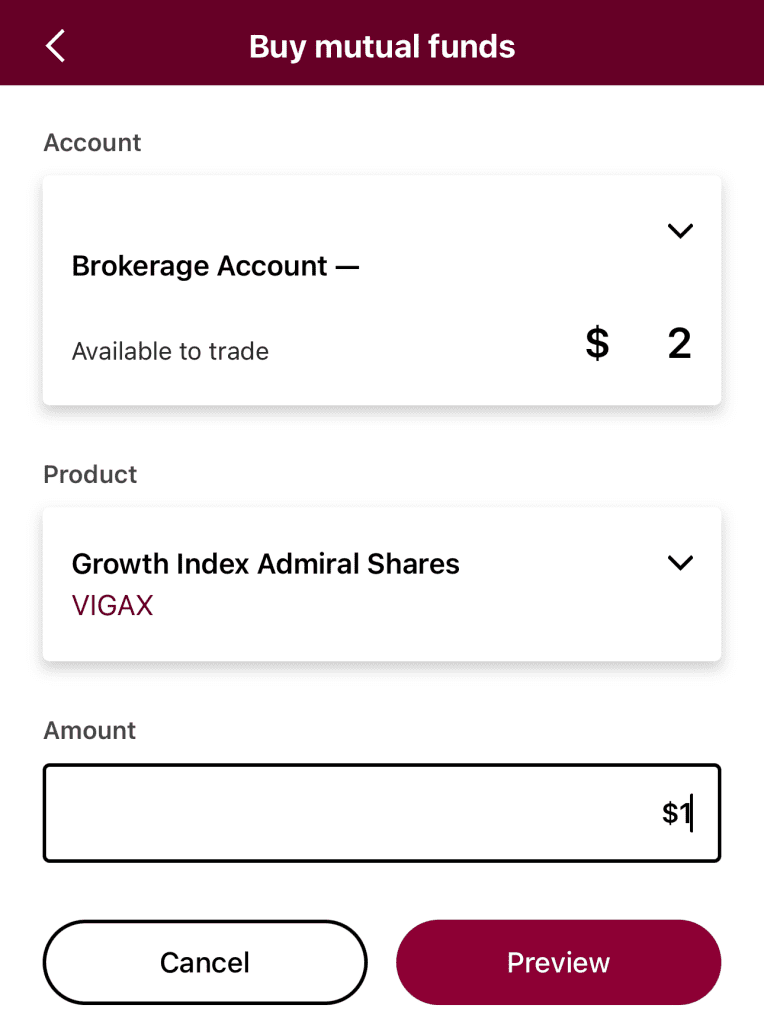

Buy ETFs and Mutual Funds with a Long-Term Focus

Vanguard is known for its low-cost index funds and ETFs, ideal for long-term, passive investing strategies.

Commission-Free Trading: Vanguard clients can buy and sell its proprietary ETFs and mutual funds without paying commissions.

Fractional Mutual Fund Shares: You can purchase Vanguard mutual funds in fractional amounts, but this doesn't extend to individual stocks or third-party ETFs.

Wide Fund Selection: You’ll find access to index funds, ESG funds, retirement target-date funds, and actively managed funds tailored to various investment goals.

For example, you can invest in a Vanguard Total Stock Market Index Fund or choose a socially responsible ETF. While you won’t find active day trading tools, this setup encourages goal-based investing.

Test Portfolio Adjustments with Hypothetical Tools

Vanguard’s Portfolio Tester allows you to simulate how changes to your holdings could affect your overall portfolio—without making real trades.

Play with Allocations: Add new ETFs, stocks, or mutual funds and instantly compare them to your current holdings.

See Risk/Reward Changes: View side-by-side comparisons to understand how the shift impacts diversification, volatility, and potential returns.

No Risk of Mistakes: Because these changes are hypothetical, it’s a low-stakes way to experiment with strategies.

I tested replacing a U.S. large-cap fund with an ESG fund. The tool showed a slight drop in potential yield but improved my ESG score and lowered volatility.

Automate with Vanguard Digital Advisor

For investors seeking automation and low involvement, Vanguard’s Digital Advisor is a practical robo advisor with personalized features.

Personalized Risk Assessment: The onboarding process includes a comprehensive questionnaire to determine your risk tolerance and build a glide path toward your goals.

Glide Path Strategy: The portfolio gradually shifts from higher-risk to lower-risk assets as you near your target date.

Flat Management Fees: Digital Advisor has a simple pricing model with an annual net advisory fee around 0.15%, depending on your account type.

It took about 30 minutes to set up a fully customized plan. I appreciated how clearly the system mapped out my progress, helping me stay on track toward retirement or savings goals.

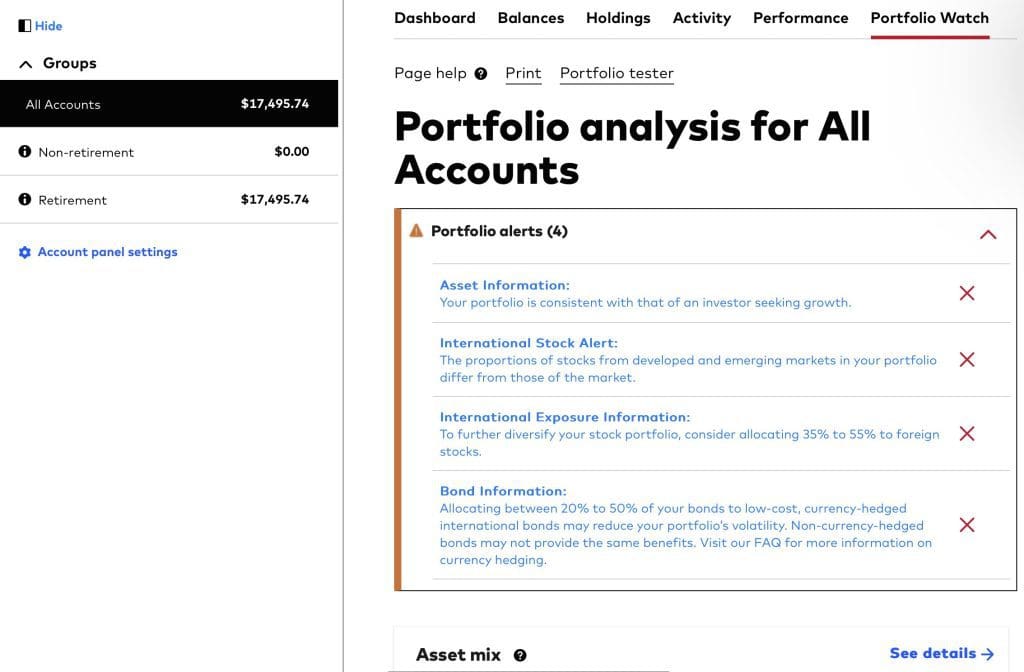

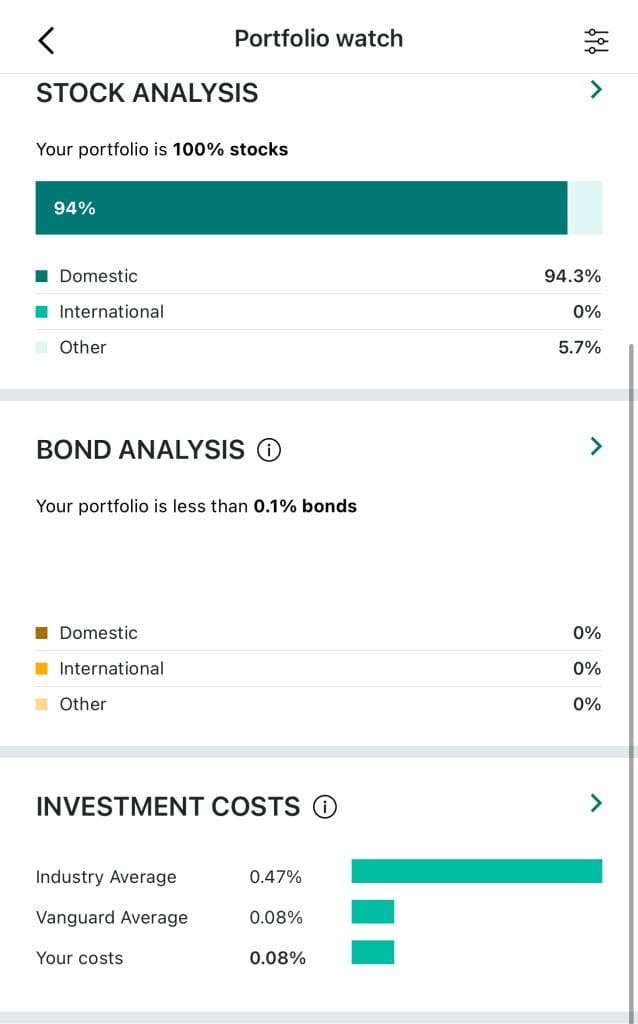

Monitor Your Holdings with Portfolio Watch

Vanguard's Portfolio Watch is one of its most valuable tools for tracking diversification and risk—especially if you invest across asset classes.

Risk Analysis: It compares your current asset allocation with your ideal allocation, highlighting overexposure or underweight positions.

Comprehensive View: You can add external accounts for a full picture of your investment life.

Diversification Insights: The tool flags concentrated holdings and potential blind spots in your portfolio.

I used Portfolio Watch to review my 401(k), brokerage, and Roth IRA holdings together—it showed that I was overweight in tech stocks and helped me rebalance accordingly.

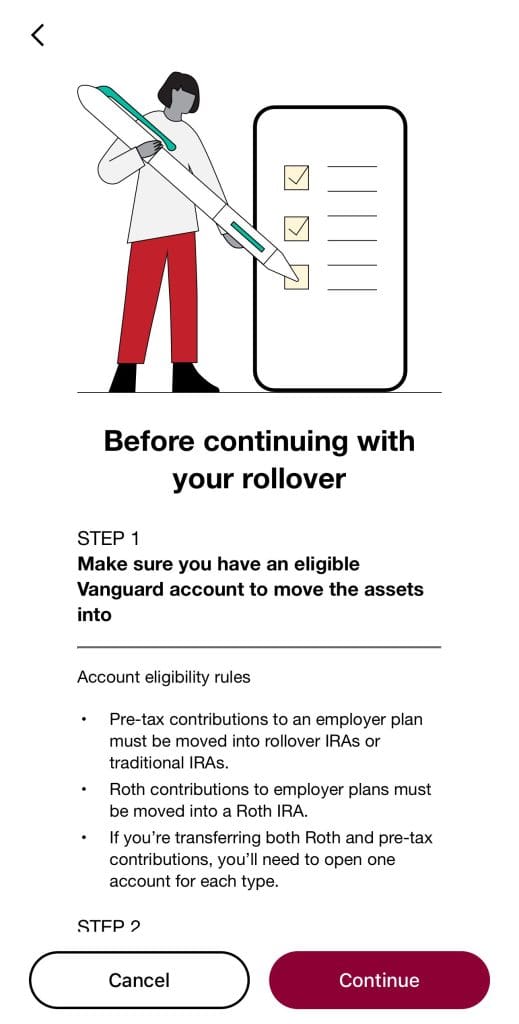

Plan Your Retirement with Specialized Tools

Vanguard emphasizes long-term planning, especially for retirement. Its account tools are built to support structured, milestone-based investing.

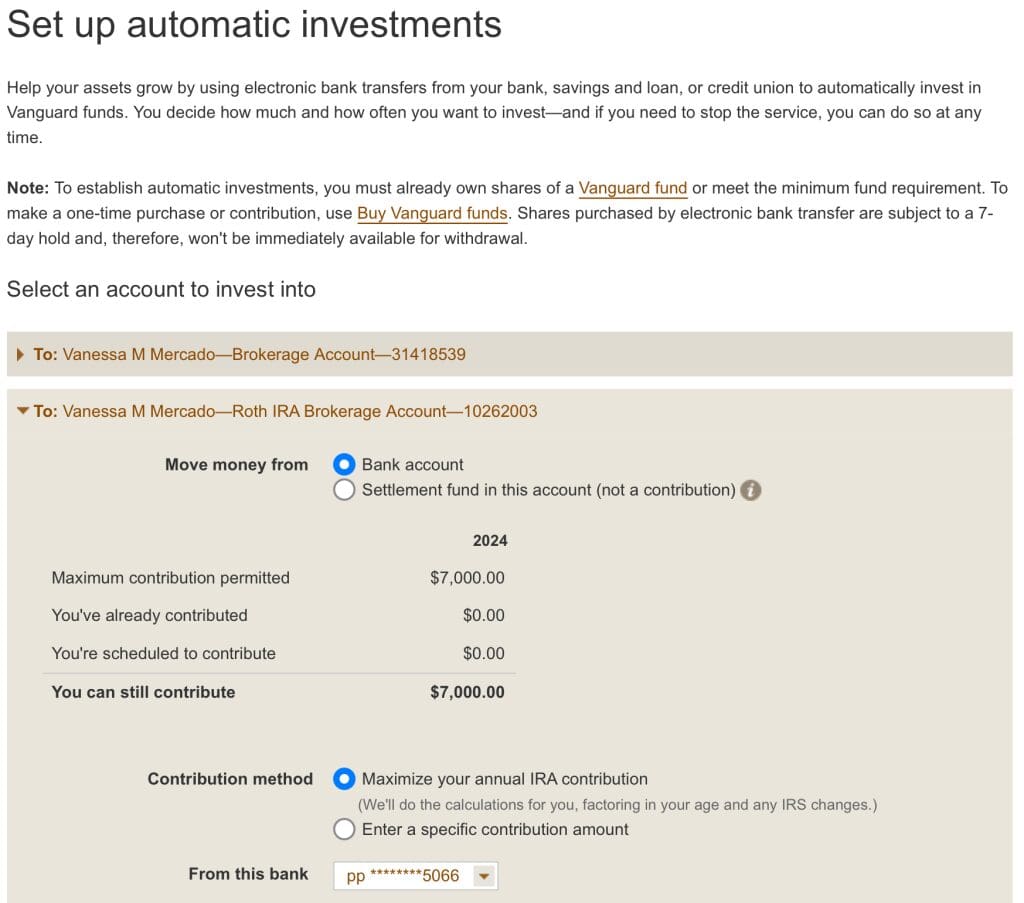

IRA Contribution Snapshots: Track how much you’ve contributed and how much room you have left for the year.

Goal Calculators: Project your future income, Social Security, and expenses to estimate if you're on track.

Rollovers and Transfers: Easily roll over 401(k)s or transfer IRAs from other brokers.

The IRA contribution tracker was particularly useful—when I updated my income, it automatically recalculated my contribution limit and adjusted my goal progress.

Additional Features for Long-Term Investors

Beyond the core investing tools, Vanguard offers a few additional features that support disciplined, long-term portfolio growth and tax efficiency.

These tools can be especially helpful for hands-off investors and those focused on consistent contribution strategies.

Automatic Investment Plans: Set up recurring investments into mutual funds directly from your bank account, helping you stick to a regular investing schedule without manual trades.

Dividend Reinvestment (DRIP): Eligible securities allow automatic reinvestment of dividends into additional shares, supporting compounding and long-term growth.

Tax-Loss Harvesting via Advisor Services: Through Vanguard’s Personal Advisor services, investors with taxable accounts can access strategies like tax-loss harvesting to improve after-tax returns.

While these features may not stand out to active traders, they offer long-term value for investors seeking to grow their portfolios steadily and efficiently over time.

Where Vanguard App Could Be Improved

Vanguard is ideal for passive investing, but it may not suit every investor—especially those looking for advanced tools or daily trading functionality.

Limited Real-Time Tools: You won’t find live charting, Level 2 data, or advanced order types.

Basic Interface: The app and web platform lack real-time screeners or technical overlays found in trading-focused apps.

Still, the simplicity can be a benefit for investors focused on long-term goals. If you're comfortable with the slower pace and supplement your research elsewhere, Vanguard remains one of the most cost-effective platforms.