Withdrawing money from Fidelity is a simple process once your account is set up and funds are available.

Based on our experience, we’ll walk you through the process step by step—and highlight what to watch out for.

1. Check Fund Availability and Settlement Status

Before initiating your withdrawal, ensure that your funds are eligible for transfer. Fidelity follows standard settlement rules, and there are some important factors to keep in mind:

Equity Sales: These take two business days (T+2) to settle before you can access the cash.

ACH Deposits: Similar to Fidelity stock sales, ACH deposits may have a short hold period (up to 3–5 business days) before becoming available for withdrawal.

Margin Accounts: If you have a margin account, funds that are tied to margin balances or collateral cannot be withdrawn until the collateral is released.

To check the funds that are available for withdrawal, navigate to the Transfers section in the Fidelity platform. The available balance will reflect funds that are eligible for withdrawal.

- The Smart Investor Tip

If you just sold stocks or deposited funds, allow the standard settlement period (typically 2 business days) before attempting to withdraw.

2. Choose the Right Withdrawal Method

Fidelity offers several methods for withdrawing funds, including both electronic transfers and paper checks. Here are the most common options:

ACH Withdrawals: This is the fastest method for U.S. users. It typically takes 1–3 business days to process the transfer after it's initiated, and there is no fees.

Wire Transfers: For larger or more urgent withdrawals, wire transfers are available but typically come with additional fees. (Fidelity doesn't charge fees for wire transfers, though you may see fees from the sending or receiving bank.)

Paper Checks: Fidelity also allows withdrawals via mailed paper checks, but this method takes 5-7 business days. Also here, there is no fee.

If you're using an international Fidelity platform, withdrawal options may vary slightly based on location and bank regulations.

3. Verify and Link Your Bank Account

Before you can withdraw money, your bank account must be linked and verified within Fidelity. You can do this through:

Instant Bank Linking (via Plaid): This method lets you link your bank account instantly using your login credentials. It’s the quickest and most seamless option.

Manual Micro-Deposits: Fidelity may also send small test deposits to your account for verification. You’ll need to confirm these amounts in the Fidelity platform.

It’s important to ensure that the bank account details are accurate, as incorrect information can lead to delays or failed transfers.

- The Smart Investor Tip

If you're linking a new bank account, use the Instant Bank Linking option for faster processing. If you use micro-deposits, plan for a delay of 1–2 days for the verification process.

4. Submit the Withdrawal Request

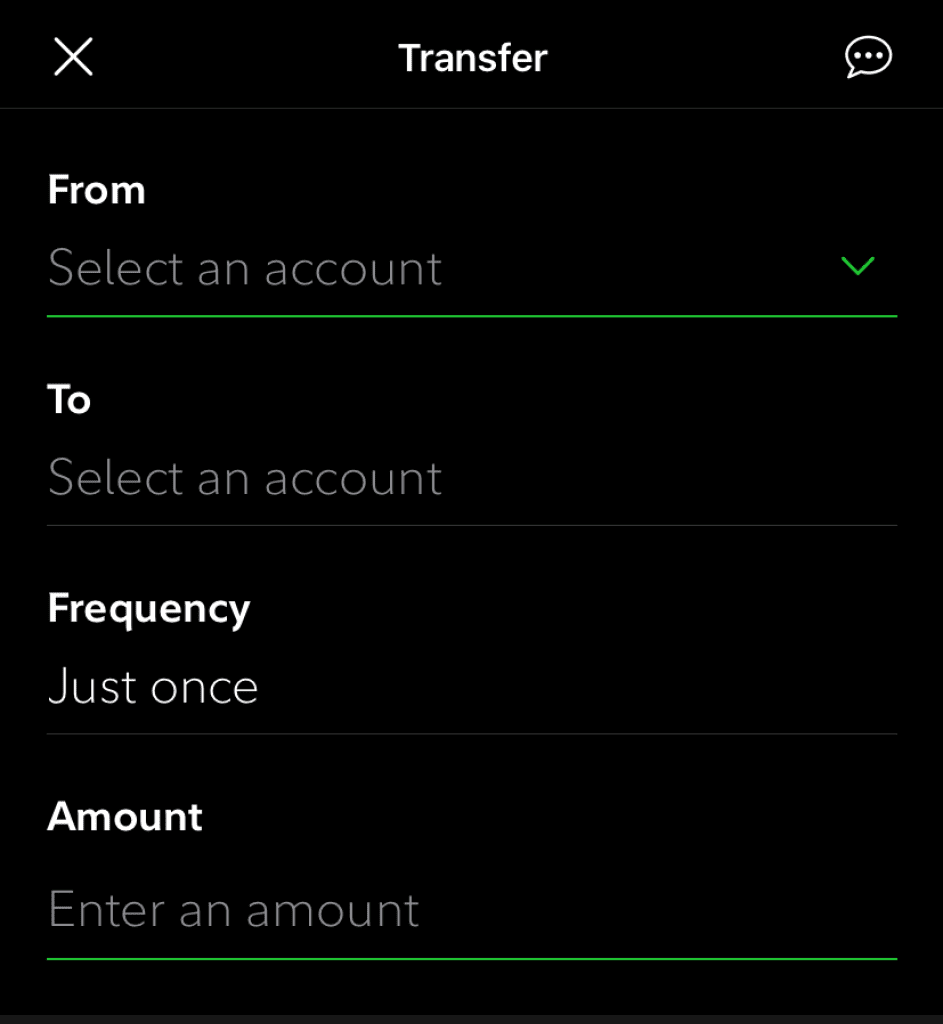

Once your funds are cleared and your bank account is linked, you can initiate the withdrawal process:

In Fidelity’s app or website, go to the Transfers tab and select Withdraw.

Enter the amount you wish to transfer, select your linked bank account, and then submit the request.

You’ll receive an estimated delivery time for the transfer and be notified if any holds or restrictions apply.

Fidelity does not charge fees for standard ACH withdrawals, but your bank may have its own fees or delays.

Can You Cancel a Withdrawal on Fidelity?

Once a withdrawal request is submitted, it cannot typically be canceled once it enters the processing stage. However, you may be able to cancel the request if it is still in a “pending” status.

To cancel, navigate to the Withdrawal History section and check if the option to cancel is available.

If the funds have already been processed or are in transit, Fidelity cannot stop or recall the transaction. You’ll need to coordinate with your bank for any issues that arise.

Why Can’t I Withdraw Money from Fidelity?

There are several reasons Fidelity might block or delay a withdrawal:

Unsettled Funds: If your stocks or ACH deposits haven't yet settled, you may not be able to withdraw.

Incorrect Bank Information: Ensure your bank account is verified and the details are correct.

Margin Account Restrictions: If funds are tied up as margin collateral, they won’t be available for withdrawal.

Temporary Holds: Fidelity may place temporary holds on new accounts or transactions for fraud prevention or security checks.

You can always check your “Available Funds” under the Transfers tab for the most up-to-date information on what’s eligible for withdrawal.