Table Of Content

Interactive Brokers offers one of the most comprehensive mobile trading platforms we've used—designed for active traders but accessible enough for long-term investors.

While it mirrors much of the functionality found in the desktop Trader Workstation (TWS), the app is more streamlined and mobile-friendly.

Key Features of the Interactive Brokers App

Below are standout features we’ve personally used and found most practical on the IBKR app:

-

Trade Global Stocks and ETFs with Transparent Fees

The IBKR app gives you access to stocks and ETFs from over 150 markets—U.S., Europe, Asia, and beyond—with competitive pricing and no hidden spreads.

Fractional Shares: You can invest in fractional shares of U.S. stocks, which is helpful if you want to diversify with a limited budget.

Commission Options: Choose between tiered or fixed pricing based on your trading volume and preferences.

Currency Conversion Tools: If you're trading global assets, the built-in FX tools let you manage currency exposure efficiently.

For example, when I bought shares of a Japanese tech firm, the app automatically handled the currency conversion, letting me monitor it in USD. This flexibility is one of IBKR’s biggest strengths for international investors.

-

Automated Investing with Interactive Advisors

If you're looking for a more passive route, Interactive Advisors offers an easy way to automate your investments—starting with as little as $100.

Prebuilt Portfolios: Choose from dozens of portfolios categorized by risk level, ESG criteria, or performance.

Transparent Fees: Advisory fees range up to 0.75%, and there are no commission charges on trades within these portfolios.

Hands-Off but Flexible: You can review your portfolio at any time and upgrade to a self-directed account when ready.

When I tested it, I filtered for socially responsible portfolios and adjusted my risk level to match my goals. It’s a great entry point if you’re not yet ready for manual trading.

-

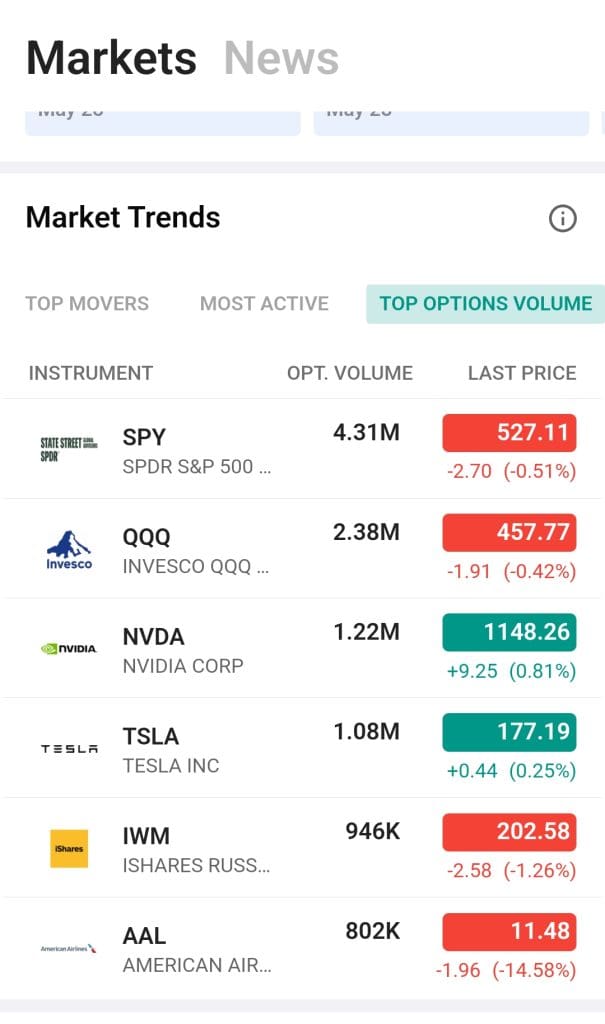

Advanced Charting and Trading Tools on the Go

The IBKR mobile app includes many of the same charting tools available on TWS, making it powerful even for technical traders.

Customizable Charts: Add overlays like Bollinger Bands, RSI, MACD, and draw support/resistance lines with ease.

Order Types: Access advanced orders like trailing stops and bracket orders right from the mobile screen.

Technical Insights: Get automated technical analysis and trend suggestions before placing a trade.

I often adjust moving averages and volume indicators directly in the chart to evaluate entry points. For short-term setups, doing this on mobile is a major advantage.

-

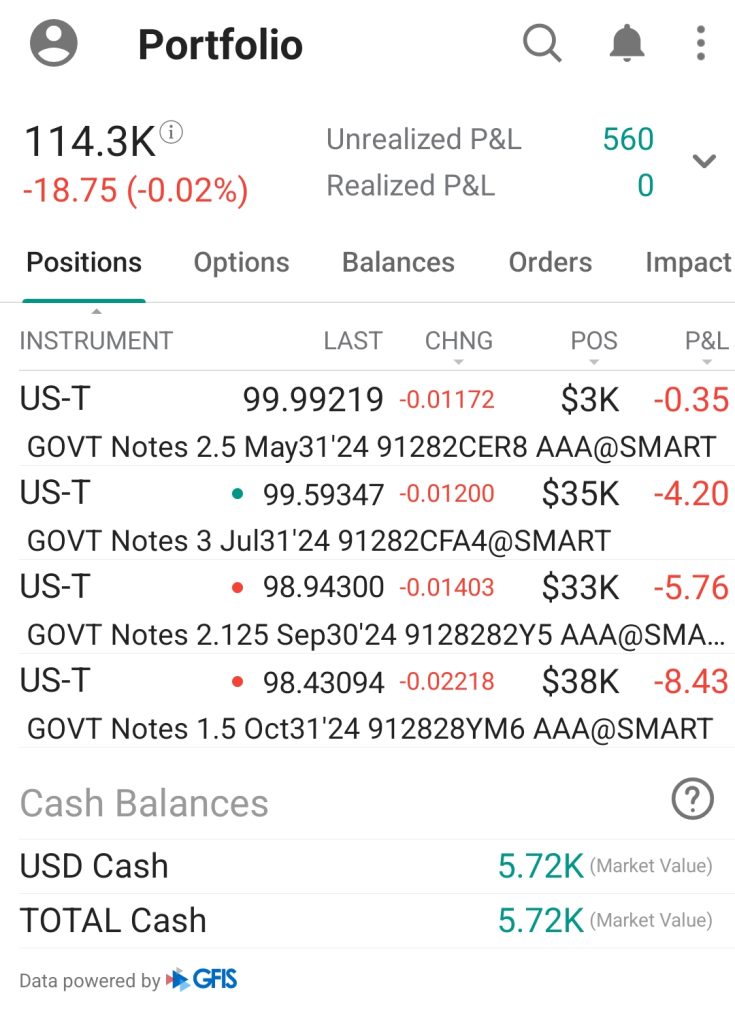

Explore Bonds, Mutual Funds, and Alternative Assets

Unlike most mobile apps, IBKR doesn’t limit you to stocks and ETFs. You can use the app to search and invest in bonds, mutual funds, and even hedge funds (if eligible).

Bond Marketplace: Choose from over one million global fixed-income securities, with no markup.

Mutual Funds Search Tool: Filter by fee type, fund family, and region—over 18,000 are no-transaction-fee funds.

Alternative Investments: Eligible users can explore hedge funds or private equity via the Hedge Fund Marketplace.

For example, I recently used the bond screener to compare U.S. Treasuries and corporate bonds with similar yields but different durations. Having access to this level of detail on mobile is a rare find.

-

Use PortfolioAnalyst for Personalized Insights

IBKR’s built-in PortfolioAnalyst gives you a real-time, customizable view of your overall account performance—including external accounts.

Track Multiple Accounts: Consolidate retirement, brokerage, or even outside bank accounts into one dashboard.

Detailed Metrics: Access up to 35 reporting measures like Sharpe ratio, time-weighted return, and sector exposure.

Retirement Planning Tools: Plan for long-term goals by entering assumptions like future income, expected expenses, and savings rate.

I linked a separate IRA and brokerage account, then set asset allocation goals. The platform highlighted underperforming sectors, helping me rebalance with confidence.

-

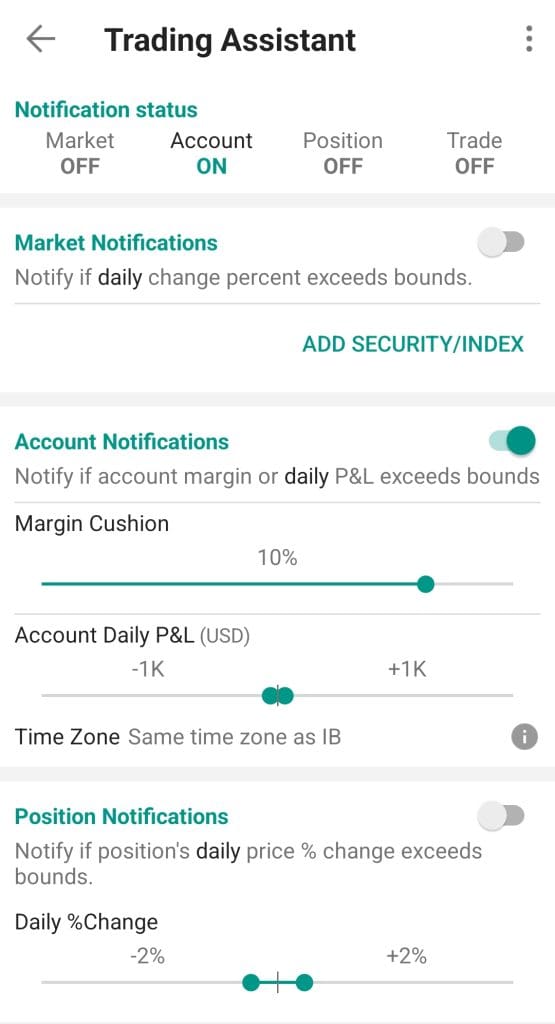

Real-Time Alerts and the IBKR Trading Assistant

The Trading Assistant is a feature I found incredibly useful, especially when I’m away from my screen but still want to stay informed.

Custom Alerts: Get notifications for price levels, order execution, margin status, or P/L swings.

Flexible Delivery: Choose between push alerts, emails, or SMS based on the importance of each alert.

Market Activity Monitor: Get alerts on unusual volume, earnings reports, or specific technical indicators.

For example, I set an alert to notify me when a biotech stock hit my stop-loss threshold, even while I was commuting. The app's responsiveness helped me act quickly.

-

Advanced Stock Screeners for Targeted Searches

Interactive Brokers offers one of the most robust stock screeners available on mobile, making it easier to identify high-potential investments.

Customizable Filters: You can screen for stocks based on criteria such as P/E ratio, dividend yield, market cap, or performance.

Pre-built Screens: IBKR provides pre-configured screens for specific strategies like growth, value, or high dividend yield.

Real-Time Updates: The screener works in real-time, meaning you get the latest market data without delays.

I used the screener to find undervalued stocks within the tech sector, and it helped narrow down my options quickly. Having this tool at my fingertips made research on the go much easier.

-

Fundamental Analysis Research Tools

IBKR also gives you access to a suite of fundamental analysis tools, which are critical for evaluating the financial health of companies.

Company Financials: Access balance sheets, income statements, and cash flow statements directly on the app.

Analyst Reports and Ratings: View ratings and reports from top analysts to assess whether a stock is a good buy.

Earnings Data: Track earnings releases, consensus estimates, and compare historical data.

For example, I reviewed a company’s income statement right before an earnings release, and the insights helped me decide whether to hold my position or exit.

Where the IBKR App Could Improve

While the IBKR app is packed with features, there are some areas where improvements could help newer users or those seeking more simplicity.

Complex Interface: The app inherits many features from TWS, which may overwhelm beginners without guidance.

No Live Chat Support: Support is responsive via tickets and phone, but a real-time chat option would be helpful.

Limited IPO Access: Unlike Webull or SoFi, IBKR doesn’t give everyday investors a chance to participate in IPOs.

That said, the learning curve is manageable with time—and IBKR does offer an extensive help center and video tutorials. For those seeking depth over simplicity, the trade-off is often worth it.