Fidelity | Interactive Brokers | |

Monthly Fee | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% |

Account Types | Brokerage, Retirement, Wealth Management | Brokerage, Retirement |

Savings APY | 3.94% | 0.00% – 3.351% |

Minimum Deposit | $0 – $2M

No minimum for Fidelity Go® and brokerage, $500,000 for Fidelity® Wealth Management, $2 million for Fidelity Private Wealth Management®

| $0 |

Best For | Technical Traders, High Net Worth, Financial Planning | International Investors, Advanced Traders |

Read Review | Read Review |

Fidelity vs Interactive Brokers: Compare Features

Fidelity stands out for its extensive selection of mutual funds, including fee-free options, and a comprehensive retirement product lineup. It also provides innovative tools like Fidelity Go, a robo-advisor.

Where Fidelity surpasses IBKR is in its ease of use, customer support, and accessibility to newer investors.

Interactive Brokers | Fidelity | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | Full Access To Almost Any Asset |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Bonds & CDs, Margin, Mutual Funds, Hedge funds, Forex, Commodities | Stocks, Options, Margin, ETFs, Bonds & CDs, Precious metals, Crypto, Mutual Funds |

Automated Investing | Yes | Yes |

Paper Trading | Yes | No |

IPO Access | No | Yes |

Dedicated Advisor | No | Yes |

In contrast, IBKR excels in catering to advanced traders with its powerful tools and extensive market access.

-

Self Investing And Fundamental Analysis Options

Fidelity and IBKR offer a wide range of investing features and research options, but Fidelity is the winner where due to its extensive research tools.

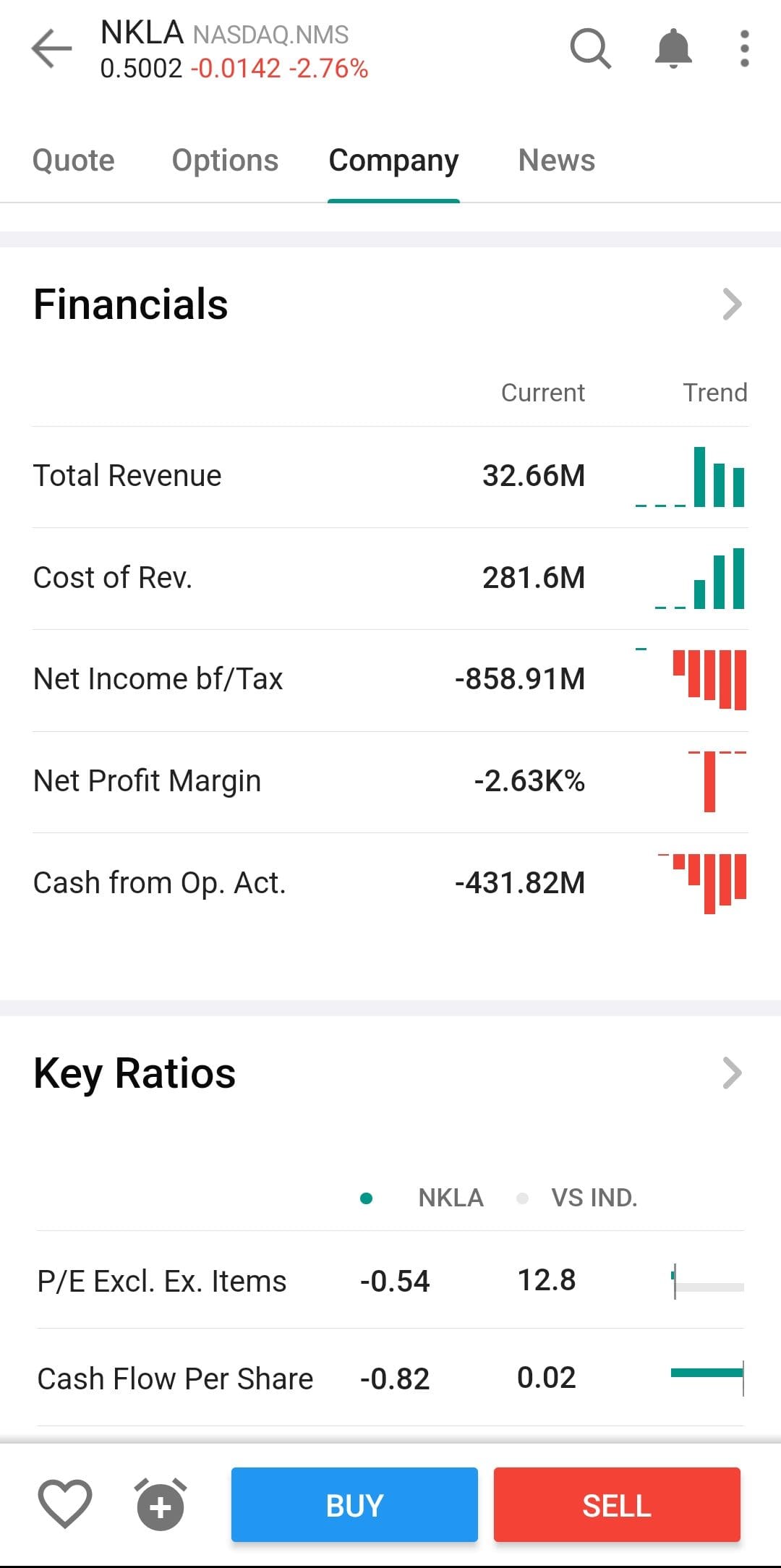

Fidelity excels in providing a broad array of investment options, including stocks, ETFs, mutual funds, options, and bonds, along with sophisticated research tools and analytics.

For fundamental traders, Fidelity provides an extensive suite of research tools that go beyond basic stock information. Users can access in-depth financial statements, analyst ratings, earnings reports, and valuation metrics for individual companies.

On the other hand, IBKR is a powerhouse for both new and experienced investors. Investors can trade stocks, options, futures, forex, bonds, ETFs, and mutual funds, along with access to global markets in over 150 countries.

IBKR also provides a vast selection of global markets and asset classes, offering unmatched access for those interested in international investing.

Furthermore, IBKR’s research tools, including the IBKR Global Analyst and PortfolioAnalyst, allow for deep dives into financial data, which is invaluable for meticulous fundamental analysis.

-

Trading Options And Technical Analysis Tools

Both IBKR and Fidelity offer great tools for traders.

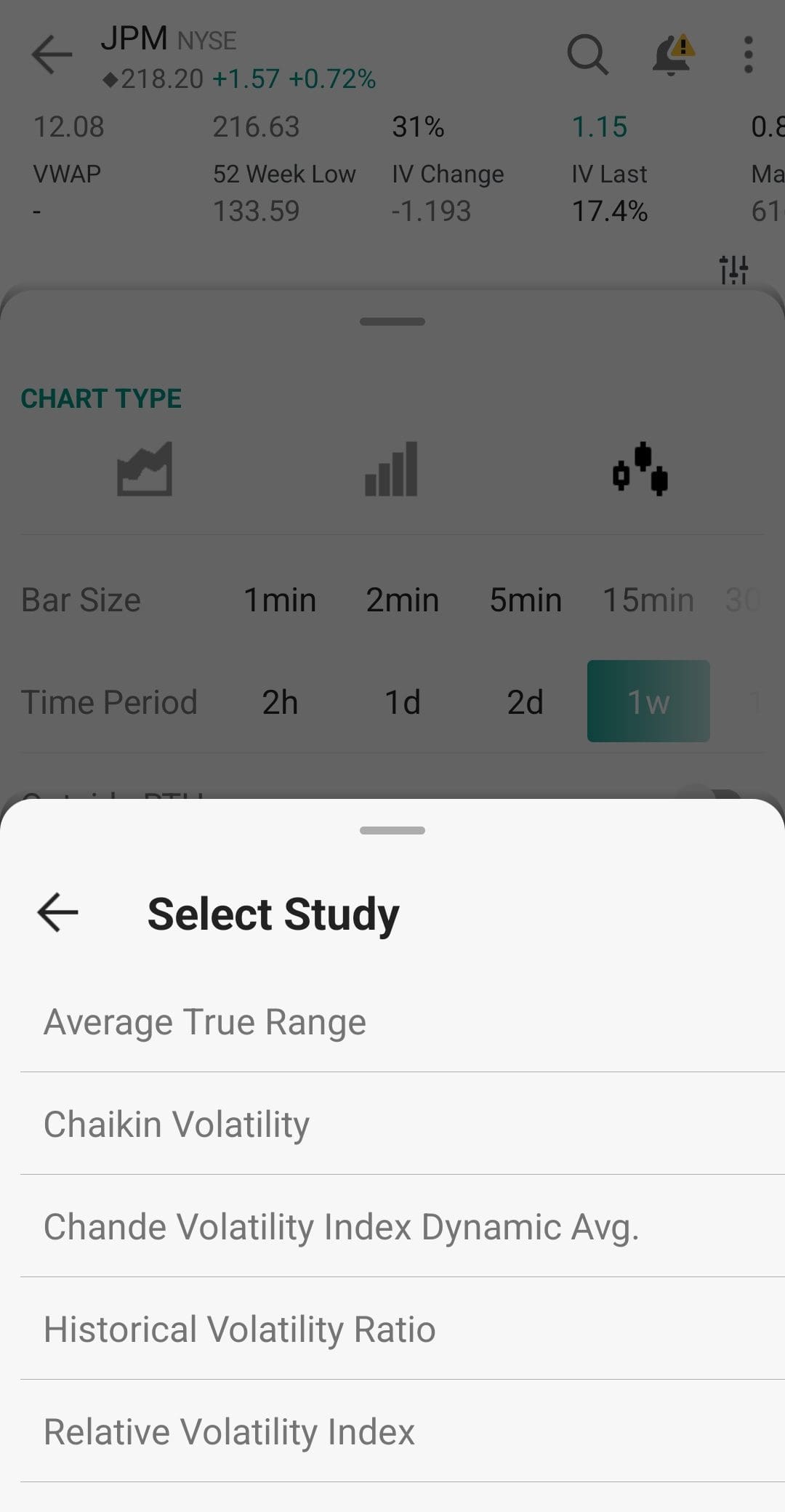

IBKR stands out with its Trader Workstation (TWS), which is designed for the advanced trader with over 100 technical indicators are available, including moving averages, Bollinger Bands, RSI, MACD, and more, enabling traders to conduct in-depth analysis of market trends.

The platform also supports advanced charting features like backtesting, which allows traders to test their strategies against historical data to evaluate their effectiveness.

Additionally, TWS offers real-time data feeds and pattern recognition tools that can automatically detect chart patterns like head and shoulders, triangles, and trendlines, helping traders identify potential trading opportunities.

Fidelity offers comprehensive charting capabilities through its Active Trader Pro software, allowing users to customize charts with a wide range of technical indicators, such as moving averages, Bollinger Bands, MACD, and RSI.

These tools enable traders to analyze price movements, trends, and potential reversals with precision.

Fidelity also provides advanced drawing tools that allow users to add trendlines, Fibonacci retracements, and other visual aids to their charts, helping to identify key support and resistance levels

-

Robo Advisor And Automated Investing

Fidelity Go offers more experience and includes features not available with IBKR, but IBKR's diverse portfolio options are definitely worth considering when choosing a robo-advisor.

IBKR’s automated investing service, Interactive Advisors, caters to investors who desire more customization and control, even within a robo-advisor framework.

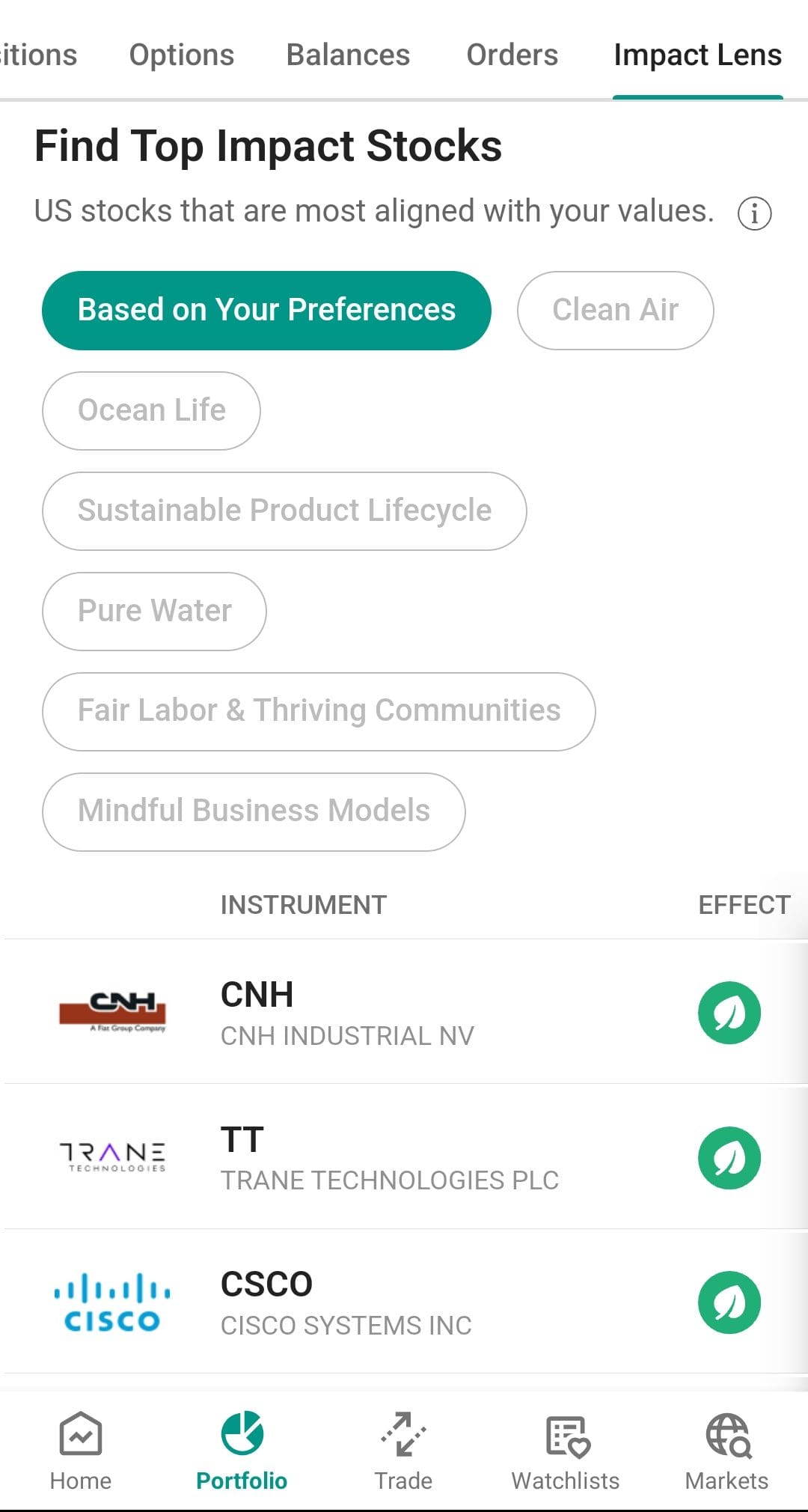

Interactive Advisors offers a variety of portfolios that are color-coded by risk level and investment style, allowing investors to choose from a wide range of strategies, including socially responsible and income-generating portfolios.

The entry point is low, with a minimum investment of just $100, and fees range up to 0.75% depending on the portfolio.

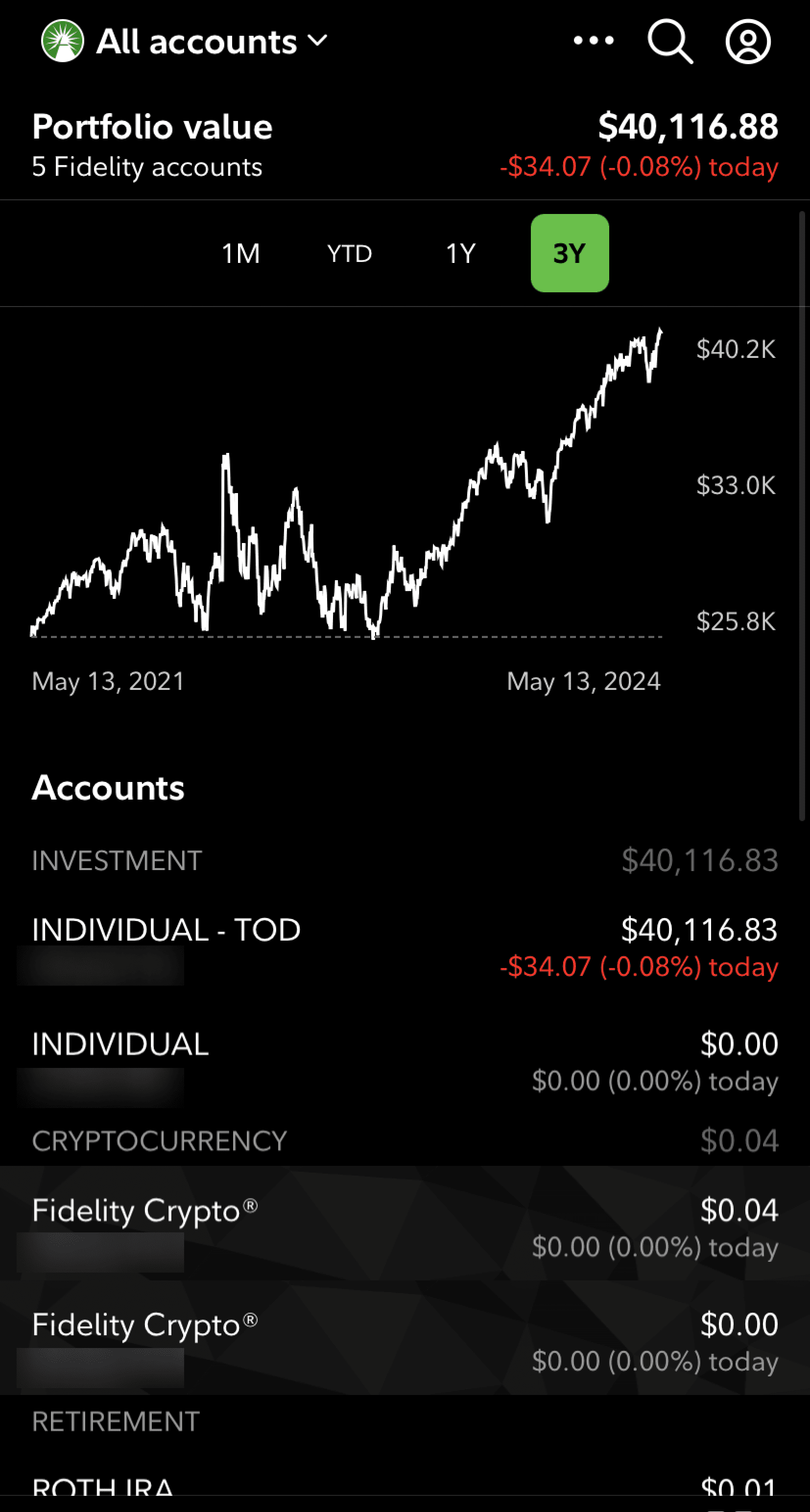

Fidelity’s robo-advisor, Fidelity Go, is designed for investors seeking a hands-off approach with simplicity and low fees. Fidelity Go offers a straightforward, tiered pricing structure with no advisory fees for accounts under $25,000 and a modest 0.35% fee for larger balances.

The platform builds and manages portfolios automatically, rebalancing them as needed to keep investments aligned with the investor’s goals.

-

Retirement Accounts

Fidelity is our top choice if you're focused on retirement investments, particularly planning, as its services are highly geared toward retirement-focused strategies.

Fidelity is widely recognized for its comprehensive suite of retirement products, making it a go-to platform for retirement planning. Fidelity offers a broad range of IRA options, including Traditional, Roth, SEP, and SIMPLE IRAs, with no fees or minimums to open accounts.

Fidelity also excels in providing access to professional advice, allowing investors to consult with dedicated advisors to tailor retirement plans that include strategies for tax efficiency, estate planning, and more.

Interactive Brokers (IBKR) offers a variety of IRA types, including Traditional, Roth, SEP, SIMPLE, and Inherited IRAs. These accounts are available in either cash or margin formats.

The margin IRA allows for more flexible trading, including multi-currency products, though it comes with limitations such as no cash borrowing, no cross-margining, and significantly higher margin requirements for futures trading compared to non-IRA accounts.

-

Fees

When it comes to fees, Interactive Broker is our winner.

Fidelity offers commission-free trading on most stocks and ETFs and low fees on other investment options

However, IBKR offers ultra-low commissions on trades, especially for high-volume traders, and provides access to global markets with competitive pricing on international trades. While IBKR's fees can be more complex, they are more affordable than Fidelity.

Fidelity | Interactive Broker | |

|---|---|---|

Fees | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% |

When it comes to Robo Advisory, Fidelity wins. It's actually free for a small portfolio of up to $25,000 and 0.35% (0% under $25,000) for above $25K.

The Interactive Brokers fee depends on the chosen portfolio and can be anywhere between 0.10% to 0.75%.

-

Cash Management And Savings Rates

When it comes to banking options, both brokers offer cash management with similar features – but Interactive Brokers' interest rate on Univested cash is higher.

Fidelity Cash APY | IB Universal Account | |

|---|---|---|

Savings APY | 3.94% | 0.00% – 3.351% |

IBKR’s Universal Account offers a more investment-focused approach with its cash management features.

The account offers highly competitive interest rates on cash balances, but it requires a minimum of $10,000 to earn the highest rates. Features also include mobile check deposit, direct deposit, and the ability to pay bills directly from the account.

Fidelity’s Cash Management Account stands out for its flexibility and comprehensive features. For those looking for pure savings, Fidelity offers the FDIC Insured Deposit Sweep Program, but the rates are not so competitive.

However, customers can secure higher rates with Fidelity CDs or the Fidelity Government Money Market Fund.

Fidelity’s account comes with no fees or minimums and offers unlimited ATM fee reimbursements, Bill Pay, mobile check deposit, and a debit card with digital wallet compatibility.

-

Wealth Management Options

Fidelity is our winner when it comes to wealth management, as IBKR doesn't offer a personalized wealth management services.

Fidelity offers two main tiers of wealth management services: Wealth Management and Private Wealth Management.

- Wealth Management, designed for clients with a minimum of $500,000 in investable assets, provides a dedicated advisor to develop a customized financial plan covering retirement, estate planning, tax strategies, and investment management.

- Private Wealth Management is for clients with at least $2 million in managed assets or $10 million in total assets with Fidelity.

Bottom Line

Fidelity offers a full package for long term investors, especially for those focused on retirement planning. IBKR may be a better choice for traders looking for advanced trading tools and a broad global market access.

Interactive Brokers vs. Other Trading Platforms

Schwab provides broader tools and analysis options for long-term, value investors, while Interactive Brokers is more suited to active traders

Schwab vs. Interactive Brokers: Which Brokerage is Right for You?

Vanguard provides more options for investors, while Interactive Brokers offers superior technical tools for active traders

Vanguard vs. Interactive Brokers: Which Brokerage is Right for You?

If you're an experienced investor or trader, IBKR may be a better option. If you're a Chase customer or prefer simplicity, consider JP Morgan.

Interactive Brokers vs. J.P. Morgan Self-Directed Investing: Which Broker Wins?

Webull offers user-friendly tools and perfect app design, while IBKR is best suited for more experienced investors and global market access.

Interactive Brokers vs. Webull: Compare Brokerage Account Options

Merrill Edge stands out for its interface and integration with BofA, but IBKR is the ultimate winner for trading and investing. Here's why:

Interactive Brokers vs. Merrill Edge: Compare Brokerage Account Options

IBKR shines with its advanced trading tools and extensive market access. E-trade wins for retirement accounts, wealth management, or banking.

Interactive Brokers vs. E-Trade: Compare Brokerage Account Options

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

Fidelity vs. Competitors: How Does It Stack Up?

Both Schwab and Fidelity offer great options for traders, plans for wealth management, and sophisticated auto-investing platforms.

Fidelity excels in investment options, wealth management, and retirement planning. Webull trading platform is one of the most fascinating we've seen.

Fidelity is our winner due to its investment options, research tools, advanced trading features, and excellent retirement planning services.

J.P. Morgan Self-Directed Investing vs. Fidelity : A Side-by-Side Comparison

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Fidelity in retirement planning and personalized wealth management, while E-Trade stands out with its research tools and competitive savings rates

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners

Fidelity is our choice due to its better retirement options and more extensive trading app. But, the differences are insignificant.