| ||

|---|---|---|

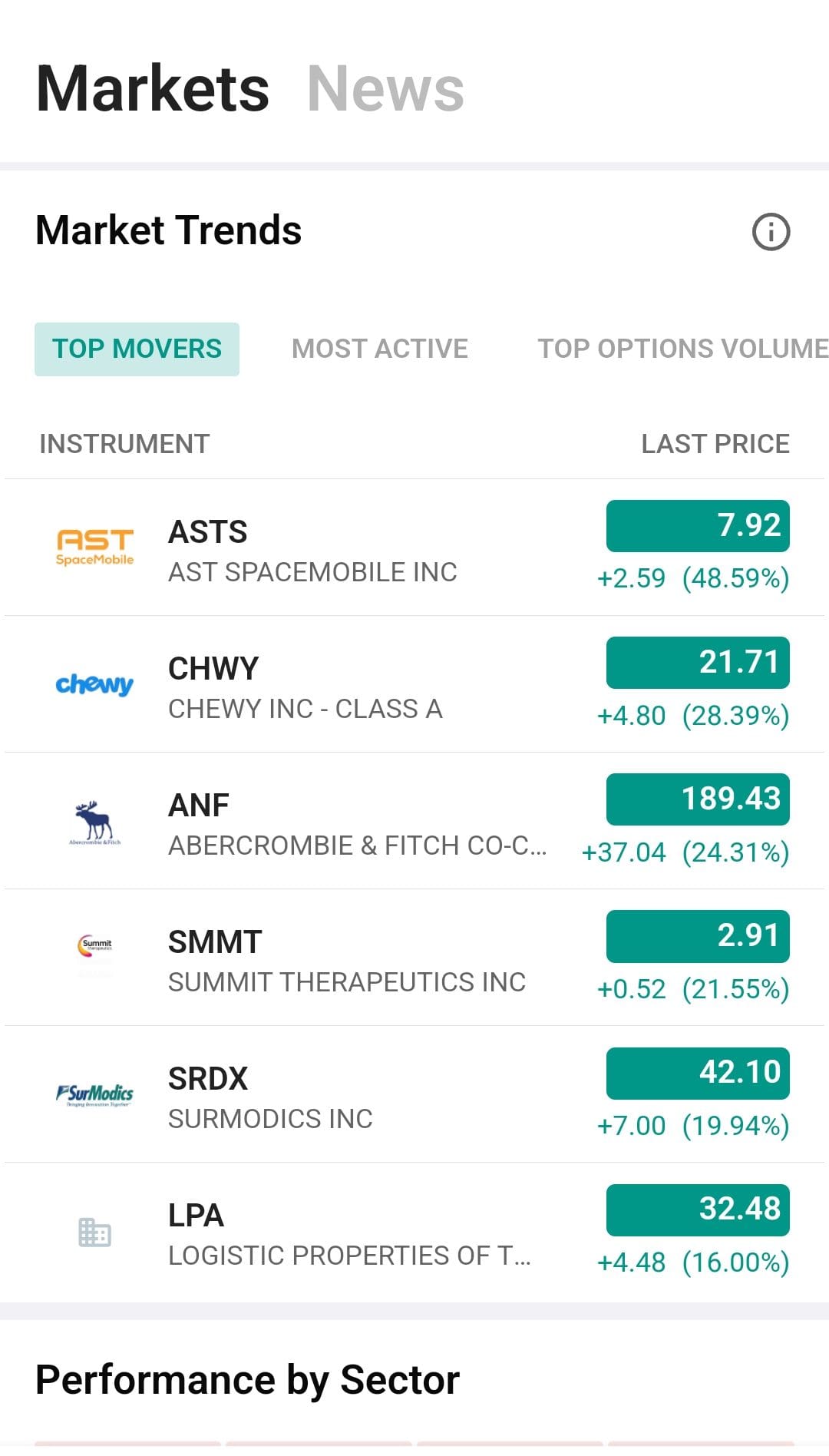

J.P. Morgan Self Directed Investing | Interactive Brokers | |

Monthly Fee | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% |

Account Types | Brokerage, Retirement | Brokerage, Retirement |

Savings APY | 0.01% – 3.99% | 0.00% – 3.190%

|

Minimum Deposit | $0 | $0 |

Best For | Existing Chase Customers, Active Investors Looking To Minimize Fees | International Investors, Advanced Traders |

Read Review | Read Review |

JPM Self-Directed vs IBKR: Compare Features

JP Morgan is ideal for those seeking a simpler, integrated experience, while IBKR is better suited for seasoned investors looking for advanced tools and a wide range of investment options.

Interactive Brokers | JPM Self-Directed Investing | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | 800 stocks and ETFs, 8,000+ mutual funds |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Bonds & CDs, Margin, Mutual Funds, Hedge funds, Forex, Commodities | Stocks, Options, ETFs, Fixed Income, Mutual Funds |

Automated Investing | Yes | No |

Paper Trading | Yes | No |

IPO Access | No | No |

Dedicated Advisor | No | No |

-

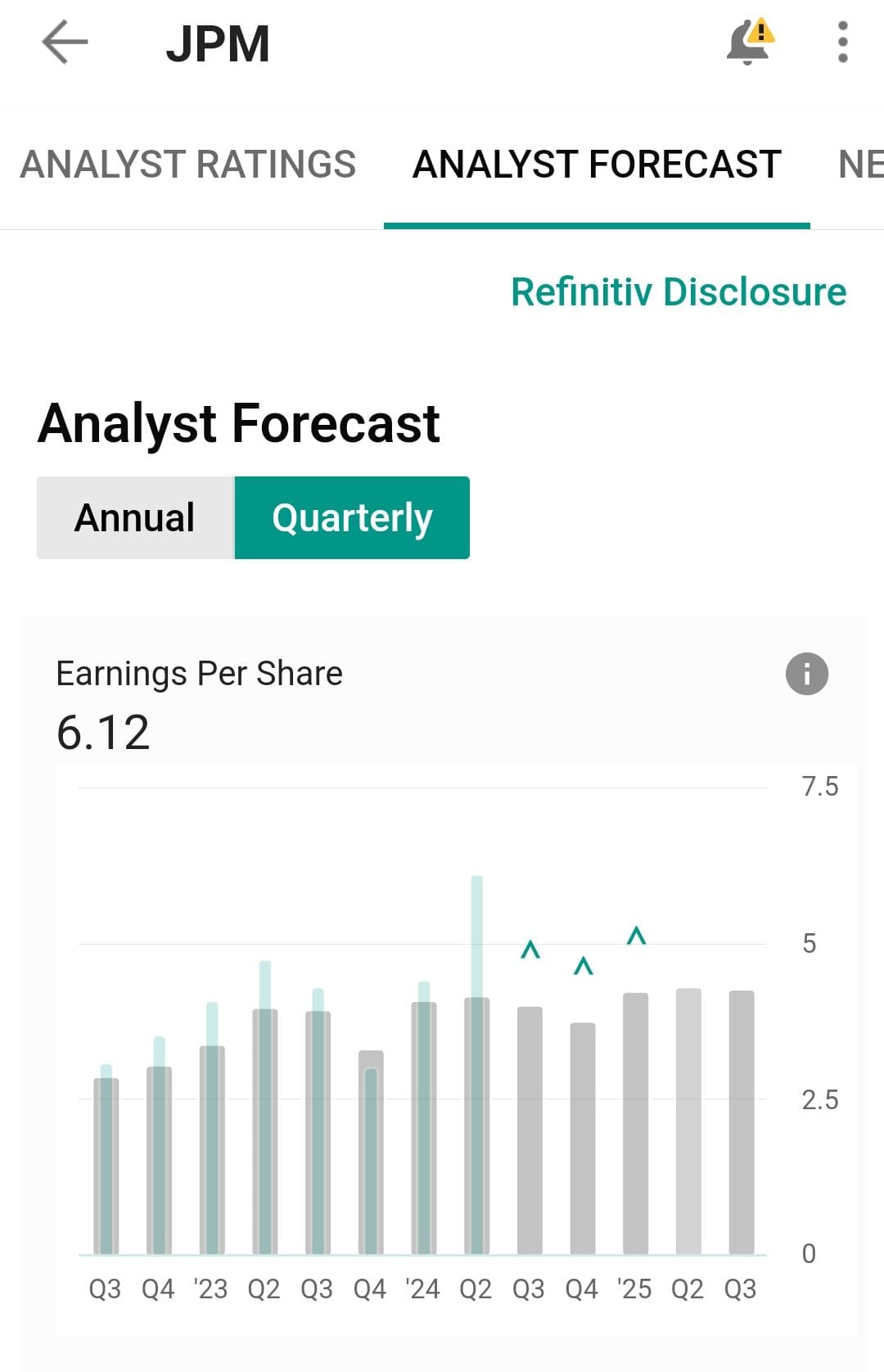

Self Investing And Fundamental Analysis Options

If you're not a beginner and can deal with a bit complex interface, IBKR is our winner here due to its vast investment options and third-party fundamental analysis options.

IBKR offers access to a broader range of global markets, giving traders the ability to execute trades across multiple exchanges worldwide.

For investors who are into detailed fundamental analysis, IBKR’s platform provides comprehensive research tools, including third-party integrations that allow for an even deeper dive into market data and performance metrics.

On the other hand, JP Morgan’s platform is more straightforward and user-friendly, making it ideal for new and intermediate investors.

The platform offers solid tools for fundamental analysis, such as screeners and portfolio tracking, but it lacks the depth and range of third-party research options.

-

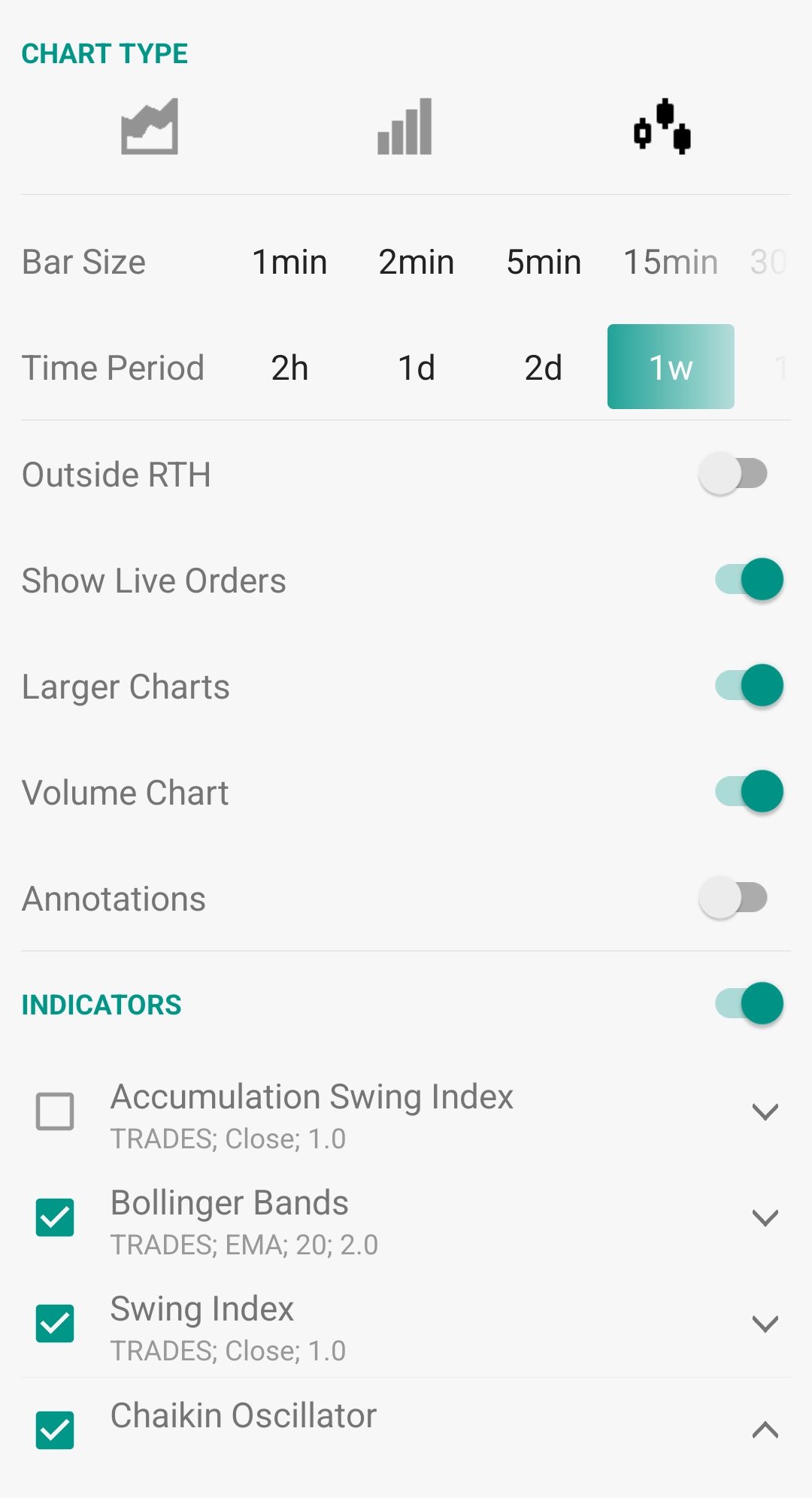

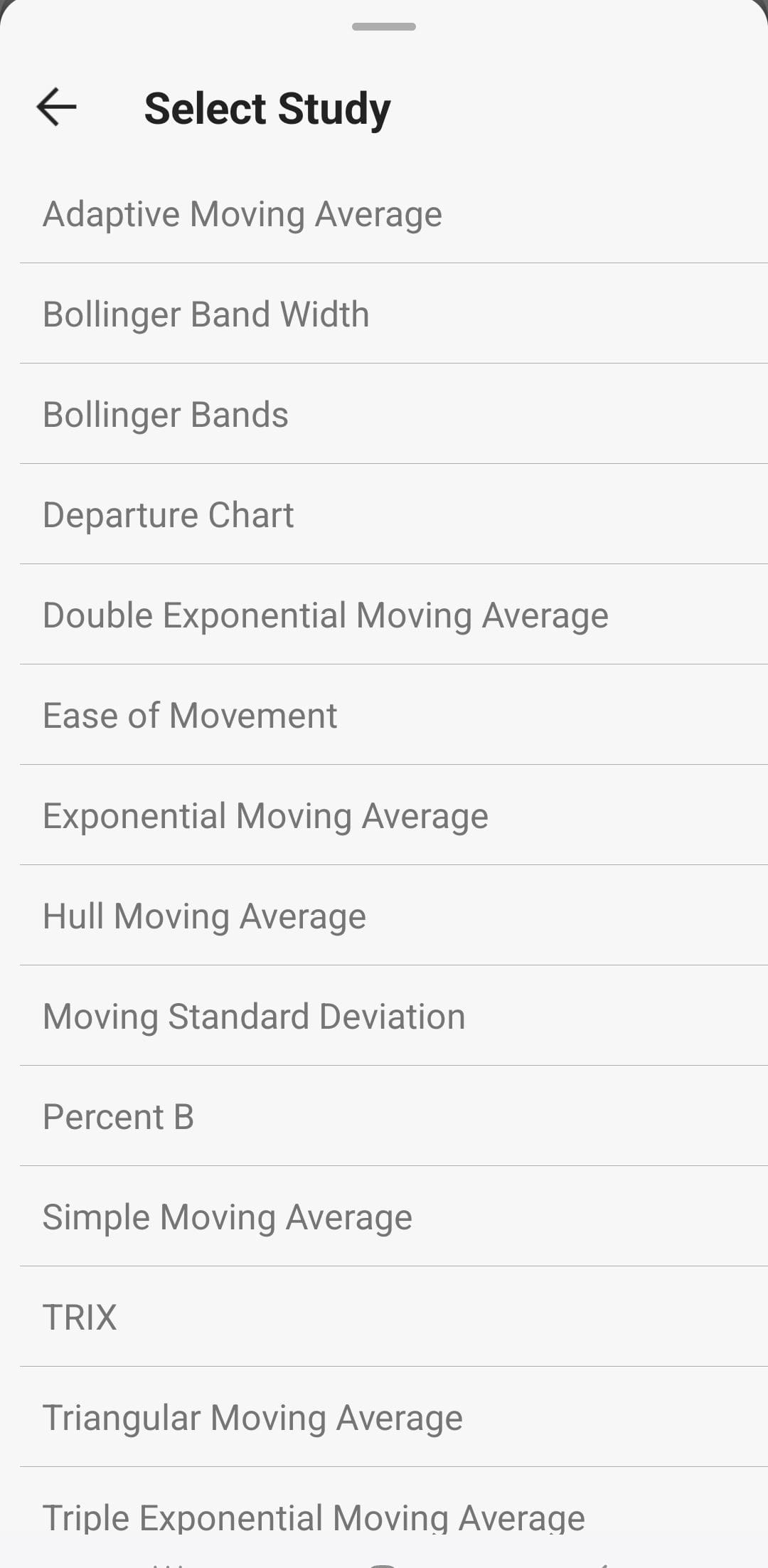

Trading Options And Technical Analysis Tools

Interactive Brokers surpass JPM self-directed when it comes to trading options and tools for traders.

Interactive Brokers, on the other hand, is designed for more experienced traders who demand a higher level of sophistication in their tools, even if it's a bit complex.

The Trader Workstation (TWS) platform is one of the most advanced in the industry, offering a wide range of technical analysis tools that can handle complex trading strategies.

With features like algorithmic trading, bracket orders, and customizable charting tools, IBKR is perfect for traders who need a highly detailed and customizable trading environment.

JP Morgan’s platform offers essential trading options like stocks, ETFs, and mutual funds, with straightforward tools for basic technical analysis.

These tools are user-friendly and integrate well with the platform’s overall design, making it easy for investors to manage their portfolios without feeling overwhelmed.

-

Robo Advisor And Automated Investing

JP Morgan doesn’t currently offer a robo-advisor or any automated investing services through its Self-Directed Investing platform.

This is a clear gap for investors who prefer a more hands-off approach or who want their investments managed with minimal effort.

Interactive Brokers offers Interactive Advisors, a robo-advisor with a low entry point, starting at just $100.

What sets IBKR apart is the wide range of portfolio options, including socially responsible investing and income-generating portfolios.

Interactive Advisors gives you more control and flexibility, with the ability to upgrade to a self-directed portfolio whenever you're ready to take a more active role.

-

Fees

JP Morgan Self-Directed Investing and Interactive Brokers (IBKR) offer competitive fee structures and commission-free trades on stocks, ETFs, and most mutual funds.

Fidelity offers commission-free trading on most stocks and ETFs and low fees on other investment options

JPM Self-Directed Investing | Interactive Broker | |

|---|---|---|

Fees | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% |

When it comes to Robo Advisory, the Interactive Brokers fee depends on the chosen portfolio and can be anywhere between 0.10% to 0.75%.

-

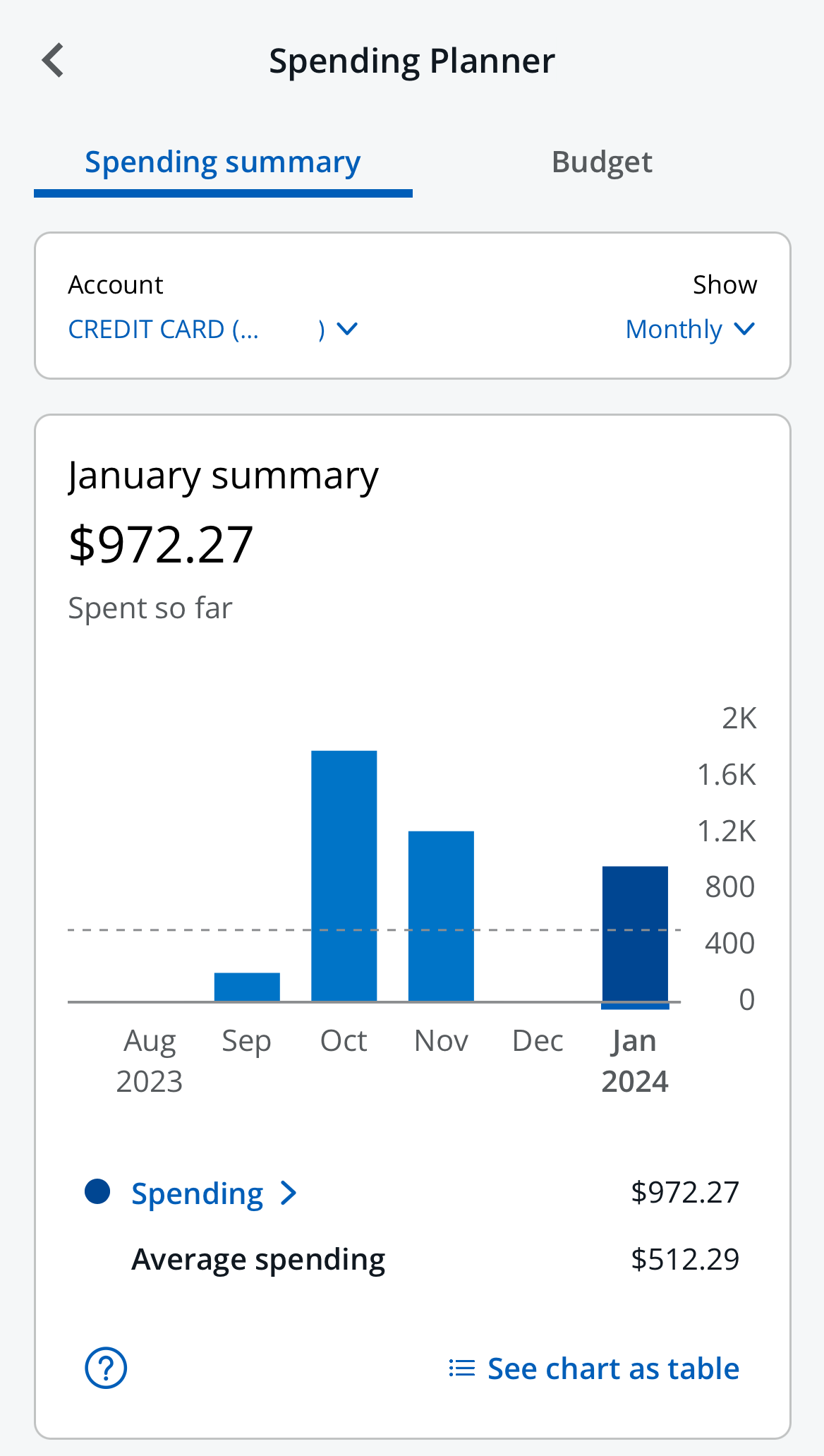

Cash Management And Savings Rates

When it comes to banking options, unless you're a Chase existing customer – IBKR provides better tools for banking and higher rate on uninvested cash.

JPM Self-Directed Cash APY | IB Universal Account | |

|---|---|---|

Savings APY | 0.01% – 3.99% | 0.00% – 3.190%

|

IBKR offers a more robust cash management solution through its IBKR Universal Account. This account allows you to earn competitive interest rates on cash balances, if you have over $10,000 in your account.

Additionally, IBKR's cash management features include mobile check deposits, direct deposits, and a debit card, making it a versatile tool for managing your finances.

JP Morgan Self-Directed Investing doesn't offer any banking services. Instead, it excels in integrating seamlessly with Chase accounts, allowing users to manage banking and investments in one place.

With Chase, you can easily move money between accounts, pay bills, and manage your finances all within the same ecosystem. However, the interest rates on uninvested cash in JP Morgan’s accounts are quite low.

-

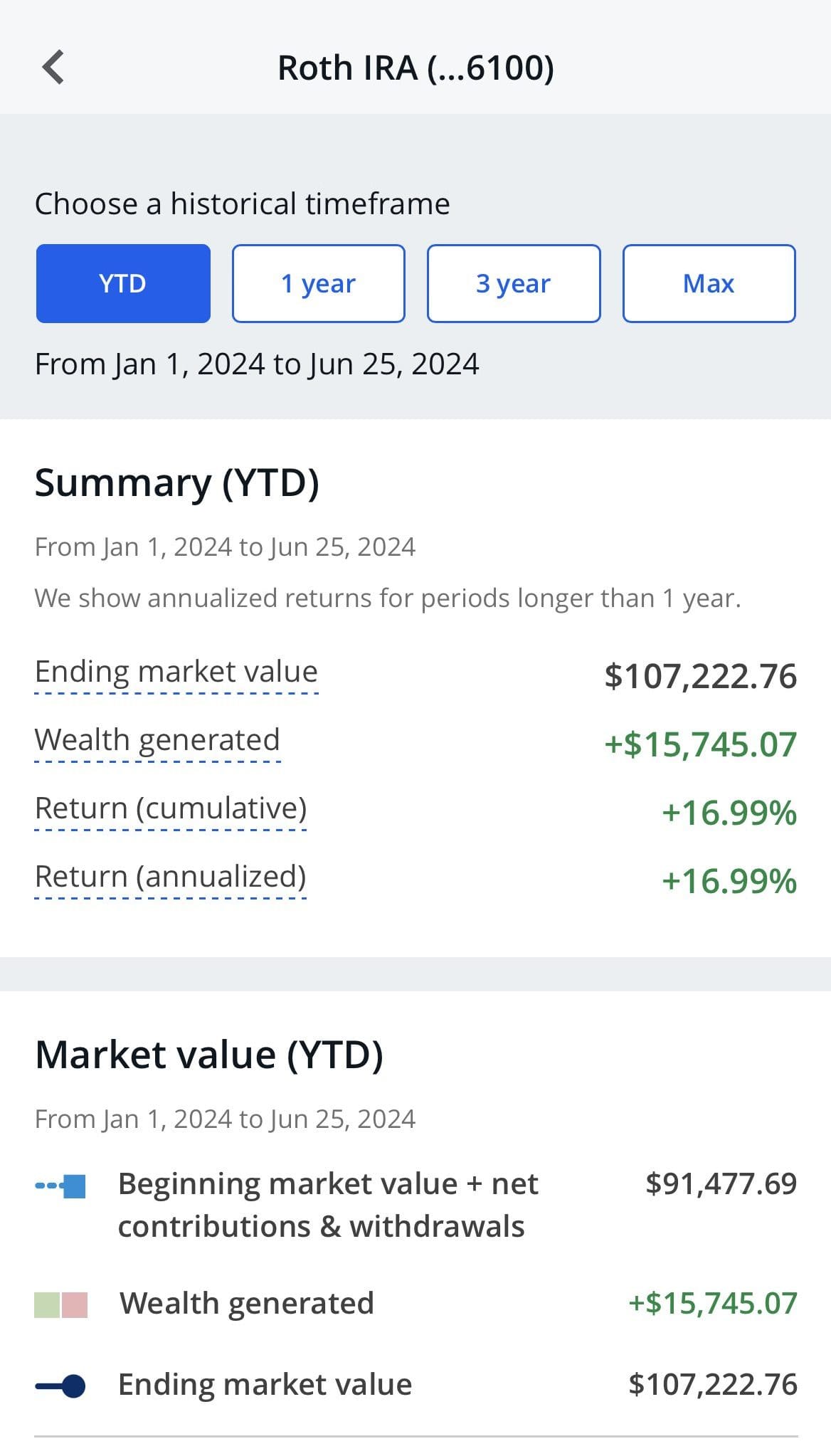

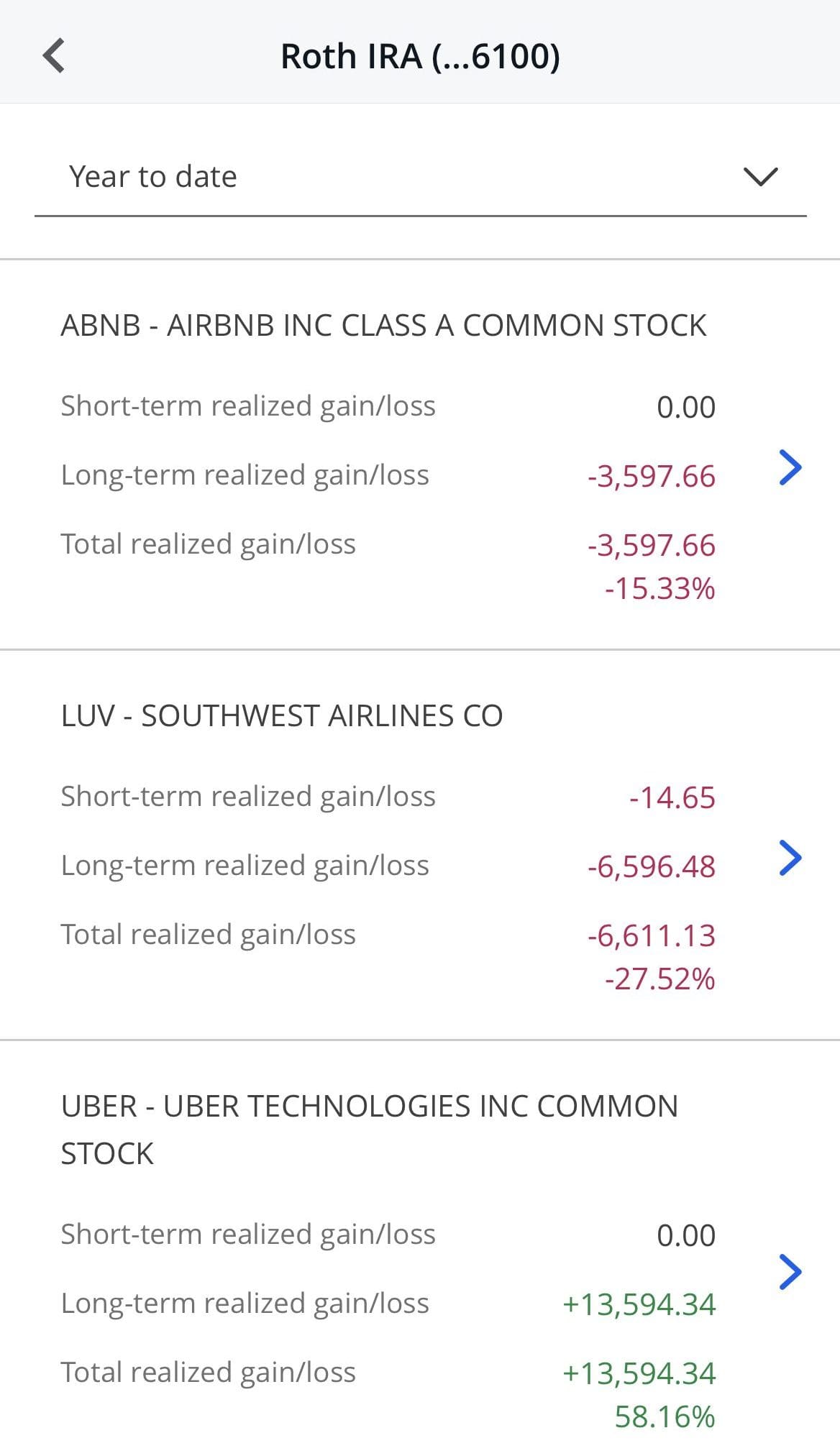

Retirement Accounts

JP Morgan is better for straightforward retirement management, but IBKR offers many more investing options.

JP Morgan’s platform focuses on simplicity and ease of use, offering traditional and Roth IRAs with no annual fees. The platform also provides basic retirement planning tools, which are user-friendly and suitable for those who are just starting to build their retirement nest egg.

On the other hand, Interactive Brokers provides a solid selection of retirement accounts, including traditional and Roth IRAs. These accounts are available in either cash or margin formats.

IBKR is particularly attractive to more advanced investors who want to manage their retirement savings with access to international stocks, options, and other asset classes.

Additionally, IBKR’s low-cost structure, including some of the lowest margin rates in the industry, can be advantageous for those who are more actively managing their retirement portfolios.

-

Wealth Management

JP Morgan is our ultimate winner here as IBKR doesn't offer wealth management.

J.P. Morgan offers two levels of personalized financial advisory services: Personal Advisors and Private Client Advisors, both focused on creating tailored strategies to meet individual financial goals.

- Personal Advisors provide virtual financial planning with ongoing advice, leveraging expert-built portfolios and automated tax-smart technology.

- J.P. Morgan Private Client Advisors offer a more exclusive, one-on-one relationship, focusing on clients with $100,000 or more in investable assets. They provide a custom portfolio, ongoing guidance, and holistic management of investments, retirement, and financial goals.

Bottom Line

Interactive Brokers may be a better option if you're an experienced investor or trader. If you're a Chase customer or prefer simplicity as a beginner or need wealth management services, consider JP Morgan self-directed investing.

Interactive Brokers vs. Other Trading Platforms

Schwab provides broader tools and analysis options for long-term, value investors, while Interactive Brokers is more suited to active traders

Schwab vs. Interactive Brokers: Which Brokerage is Right for You?

Vanguard provides more options for investors, while Interactive Brokers offers superior technical tools for active traders

Vanguard vs. Interactive Brokers: Which Brokerage is Right for You?

Both platforms have great options for investors, but Fidelity excels in comprehensive retirement planning and cash management options

Interactive Brokers vs. Fidelity: Which Brokerage Suits Your Investing Style?

Webull offers user-friendly tools and perfect app design, while IBKR is best suited for more experienced investors and global market access.

Interactive Brokers vs. Webull: Compare Brokerage Account Options

Merrill Edge stands out for its interface and integration with BofA, but IBKR is the ultimate winner for trading and investing. Here's why:

Interactive Brokers vs. Merrill Edge: Compare Brokerage Account Options

IBKR shines with its advanced trading tools and extensive market access. E-trade wins for retirement accounts, wealth management, or banking.

Interactive Brokers vs. E-Trade: Compare Brokerage Account Options

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

How J.P. Morgan Self Directed Compares to Other Online Brokers

Both offer similar tools for the average investor or trader, but Merrill is better at automated investing. Here's our full comparison:

J.P. Morgan Self-Directed Investing vs. Merrill Edge: Compare Brokerage Accounts

Vanguard offers a better approach for serious investors, while JP Morgan's self-directed is better for beginners and advanced traders

Vanguard vs. J.P. Morgan Self-Directed: Which Broker is Best For You?

Schwab surpasses JPM self-directed in most categories, including self-directed investing, robo advisory, and technical analysis.

Schwab vs. J.P. Morgan Self-Directed: Which Brokerage Is Best?

JP Morgan is best for the average investor seeking a simple platform or wealth management, but E-Trade is our overall winner. Here's why.

J.P. Morgan Self-Directed Investing vs. E-Trade: Which Broker Wins?

Fidelity is our winner due to its investment options, research tools, advanced trading features, and excellent retirement planning services.

J.P. Morgan Self-Directed Investing vs. Fidelity : A Side-by-Side Comparison

JP Morgan wins when it comes to fundamental investing tools, but Robinhood is better for technical analysis and trading. Here's why:

J.P. Morgan Self-Directed Investing vs. Robinhood: Compare Brokerage Accounts