Merrill Edge | Interactive Brokers | |

Monthly Fee | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% |

Account Types | Brokerage, Retirement, Wealth Management | Brokerage, Retirement |

Savings APY | 0.01% – 4.11% | 0.00% – 3.351% |

Minimum Deposit | $0 – $50,000

Merrill Edge Self-Directed Trading: $0 Merrill Guided Investing – Robo Advisor: $1,000 for growth-focused strategies OR $50,000 for income-focused strategies Merrill Guided Investing – Online Advisor : $20,000 for growth-focused strategies OR $50,000 for income-focused strategies | $0 |

Best For | Bank of America Customers, Advanced Traders | International Investors, Advanced Traders |

Read Review | Read Review |

Merrill Edge vs Interactive Brokers: Compare Features

Merrill Edge excels in user experience and integration with banking services, making it ideal for domestic investors who value simplicity.

Interactive Brokers | Merrill Edge | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | Full Access To Almost Any Asset |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Bonds & CDs, Margin, Mutual Funds, Hedge funds, Forex, Commodities | Stocks, Options, Margin, ETFs, Bonds & CDs, Mutual Funds, Margin |

Automated Investing | Yes | Yes |

Paper Trading | Yes | No |

IPO Access | No | No |

Dedicated Advisor | No | Yes |

In contrast, IBKR excels in catering to international investors and advanced traders with its powerful tools and extensive market access.

-

Self Investing And Fundamental Analysis Options

While Merrill is a good competitor, IBKR is our winner when it comes to investing and analysis options as it offers a wide range of investing features and research options.

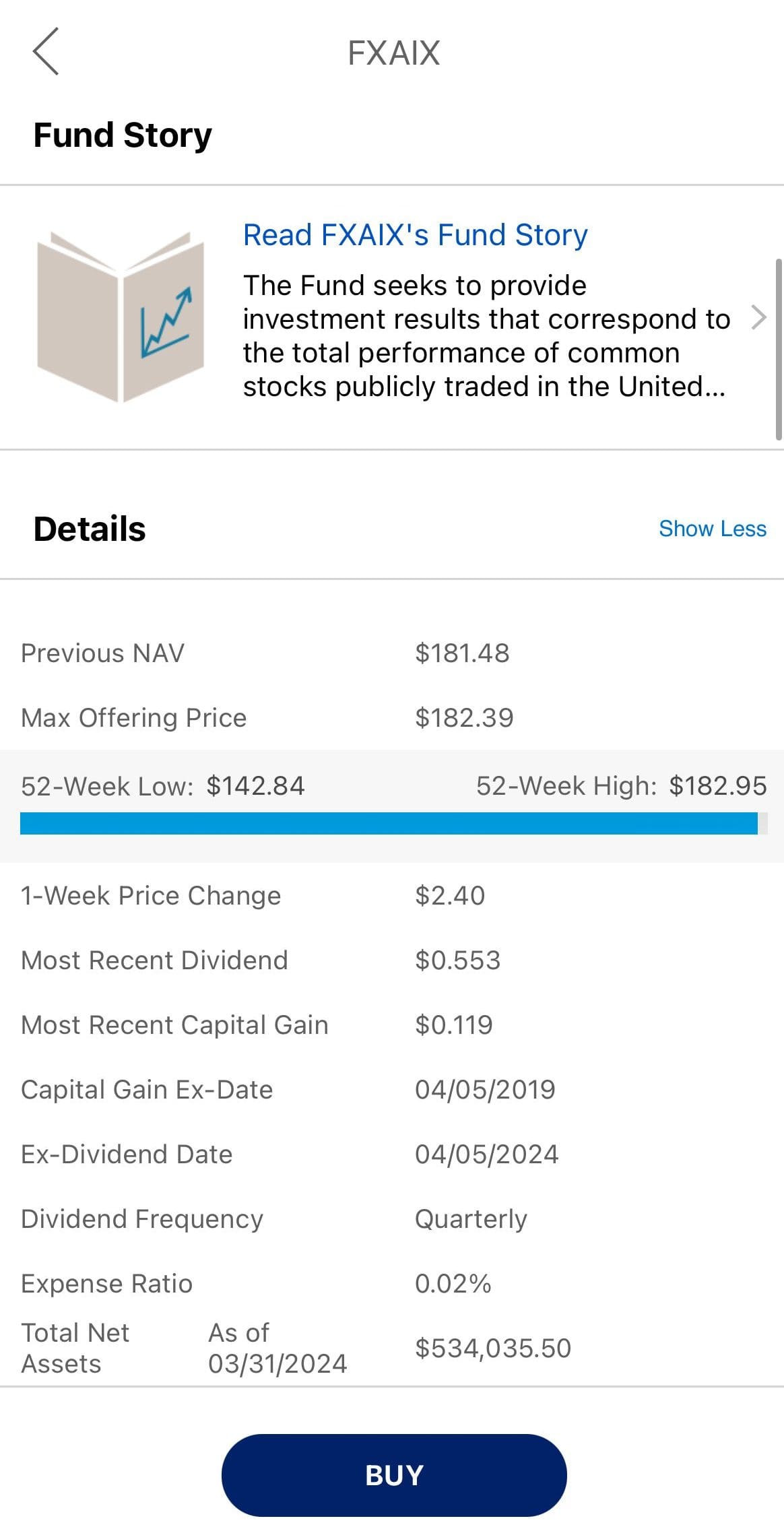

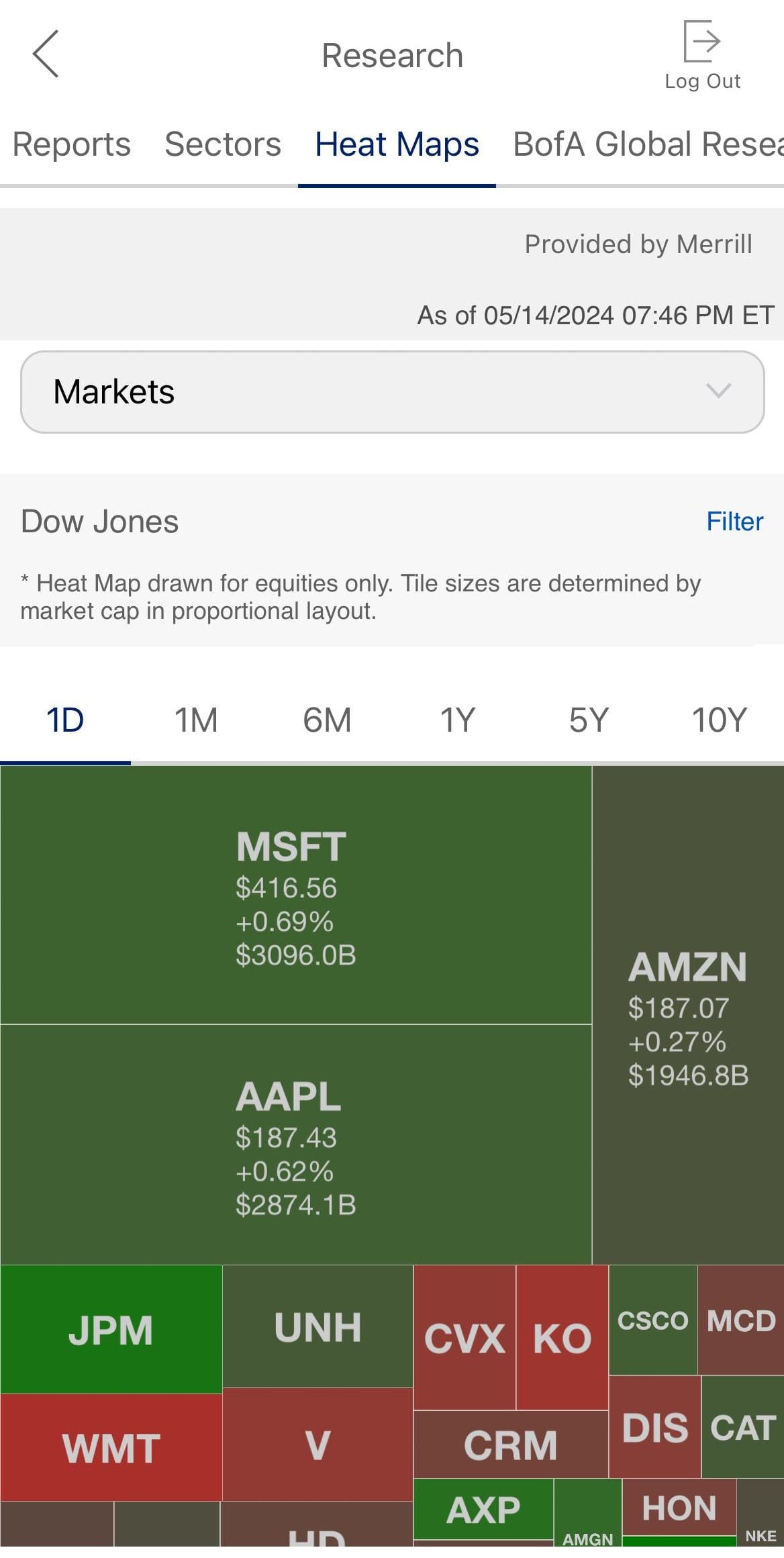

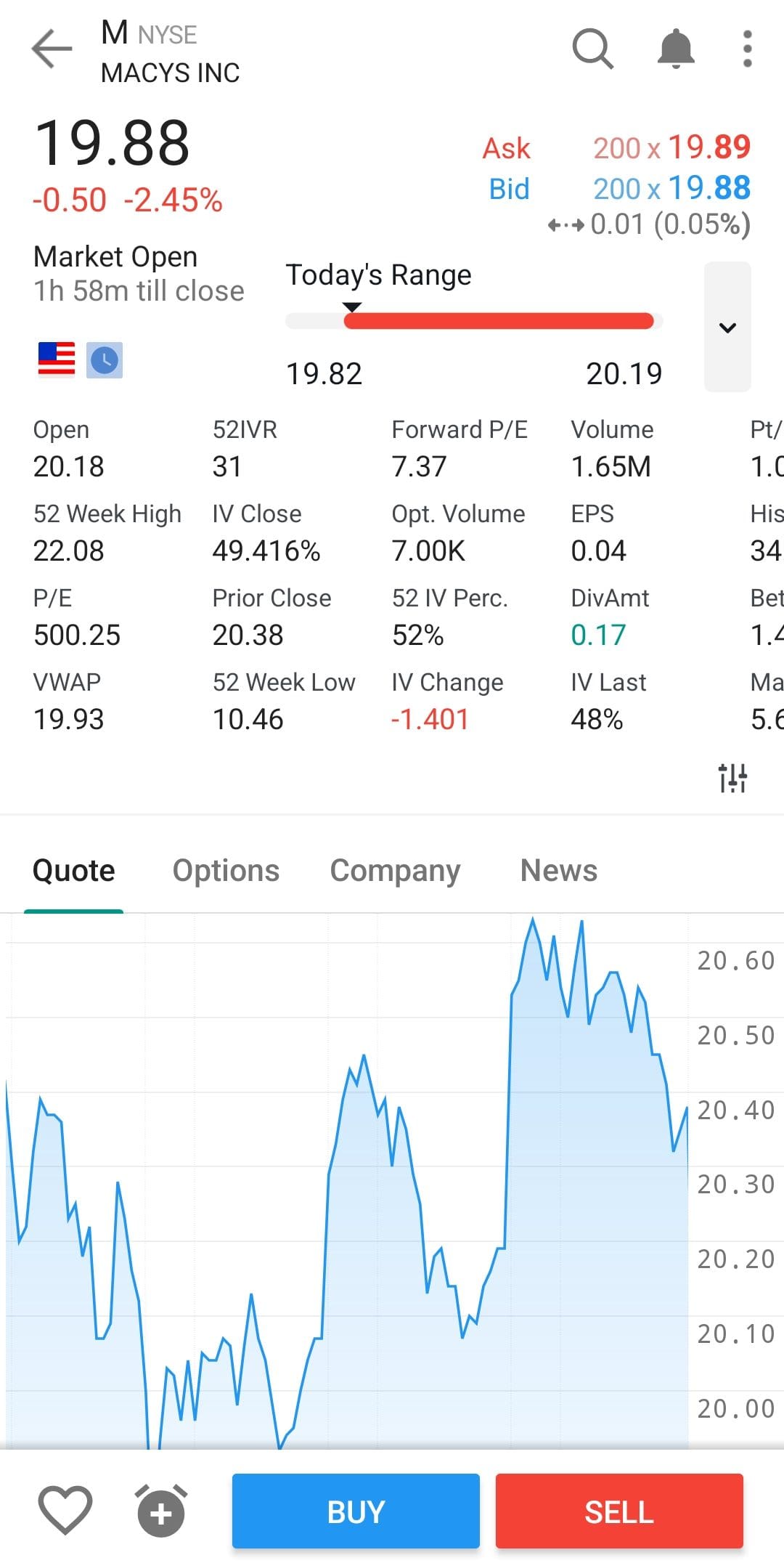

Merrill Edge excels in user-friendly tools for investors and traders. You can get insightful data on almost every tradeable asset:

Its platform is particularly strong in providing comprehensive research and insights, including Morningstar ratings and extensive market analysis.

However, Merrill Edge falls short in the range of available assets, as it does not offer access to international markets, cryptocurrencies, or futures, limiting diversification options.

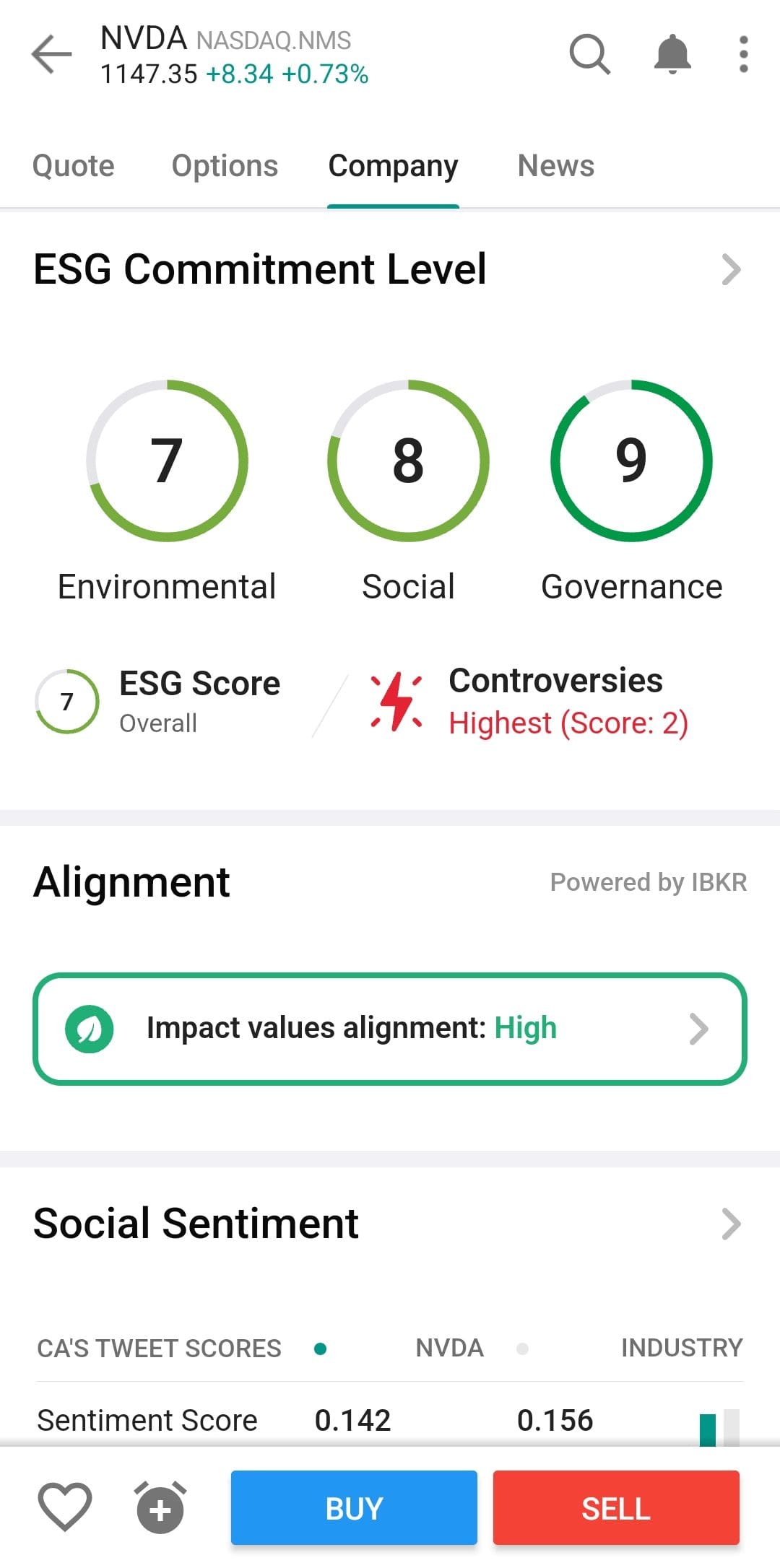

On the other hand, IBKR is a powerhouse for both new and experienced investors. Investors can trade stocks, options, futures, forex, bonds, ETFs, and mutual funds and access global markets in over 150 countries.

IBKR also provides a vast selection of global markets and asset classes, offering unmatched access for those interested in international investing.

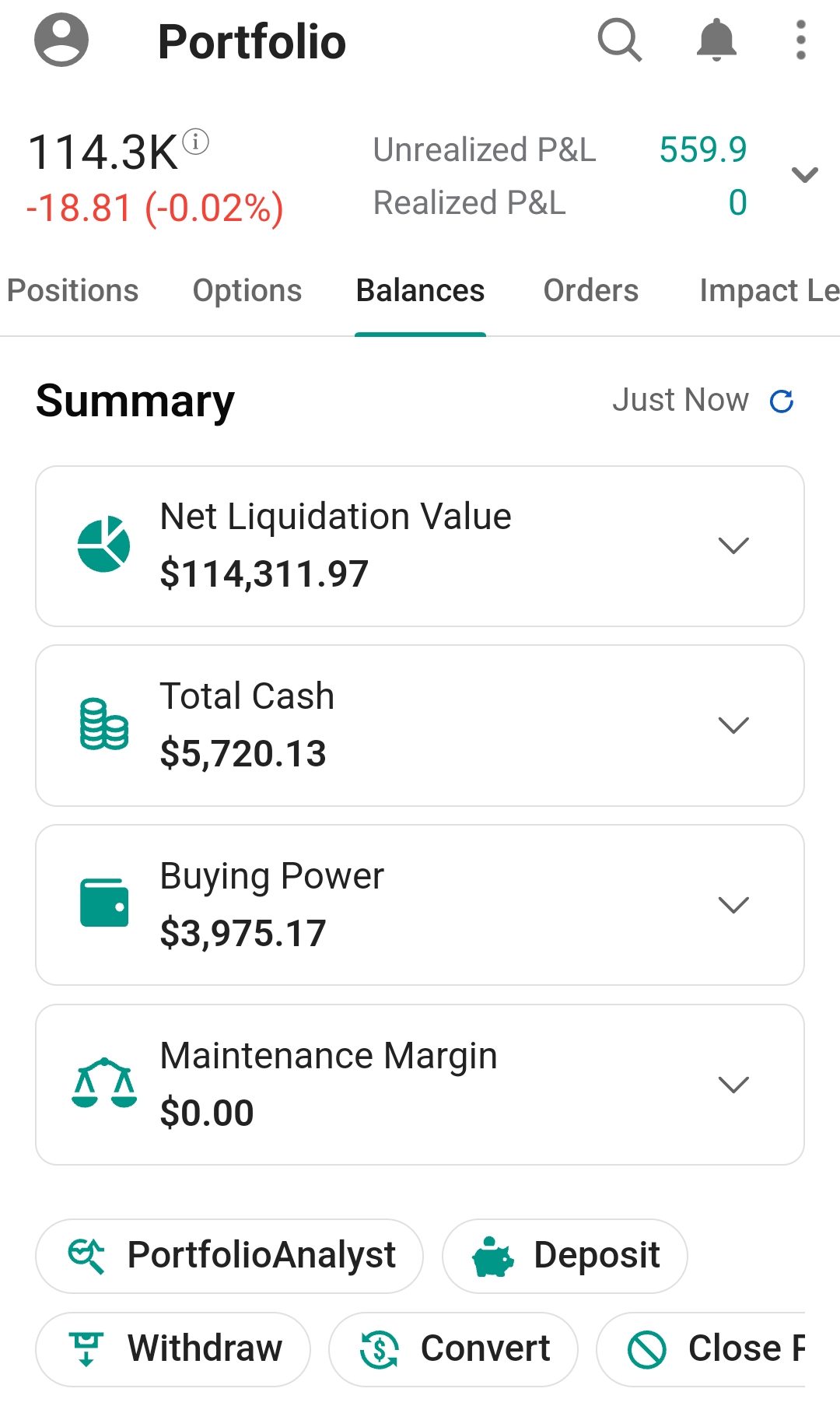

Furthermore, IBKR’s research tools, including the IBKR Global Analyst and PortfolioAnalyst, allow for deep dives into financial data, which is invaluable for meticulous fundamental analysis.

-

Trading Options And Technical Analysis Tools

Interactive Brokers is our winner when it comes to trading options and tools for traders.

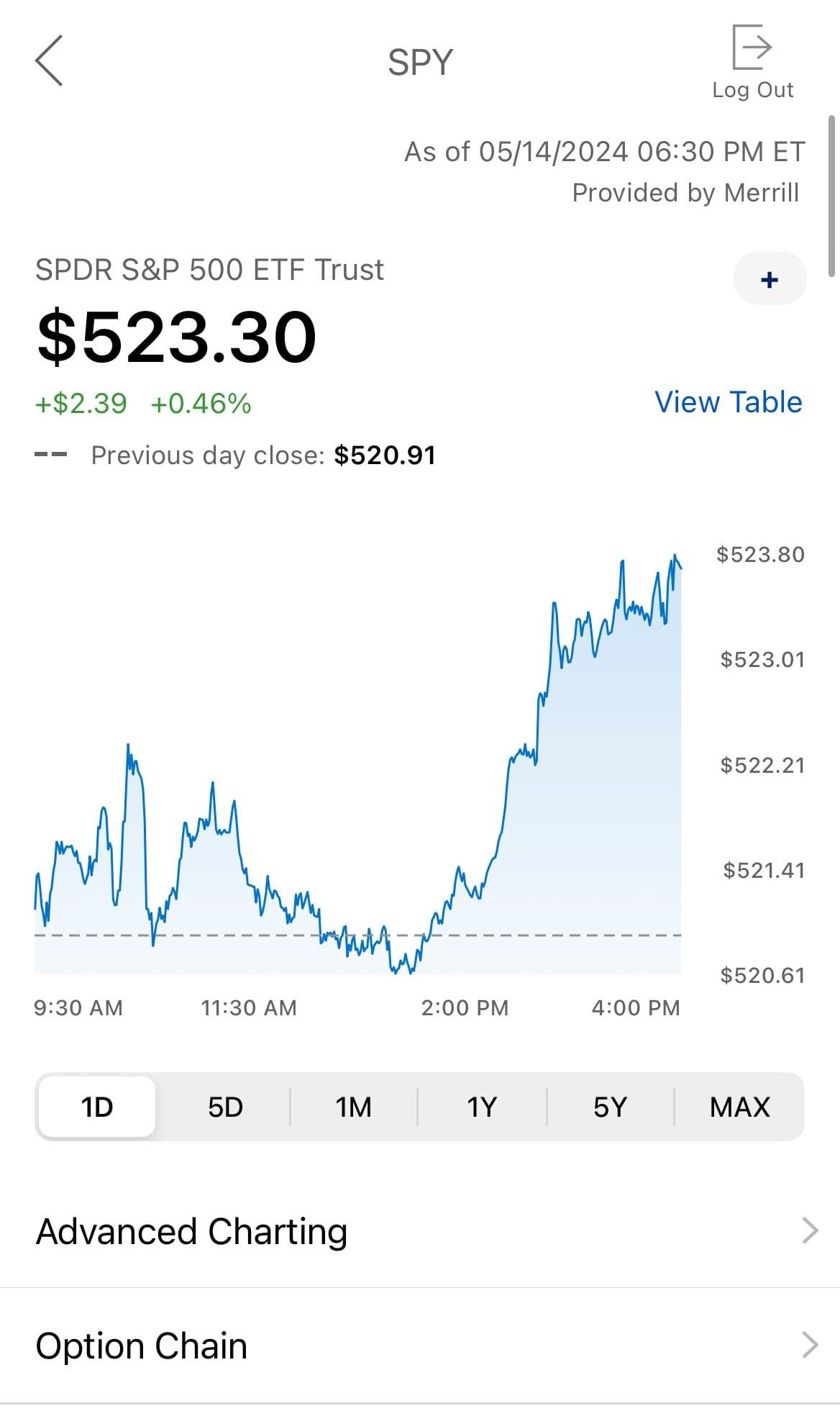

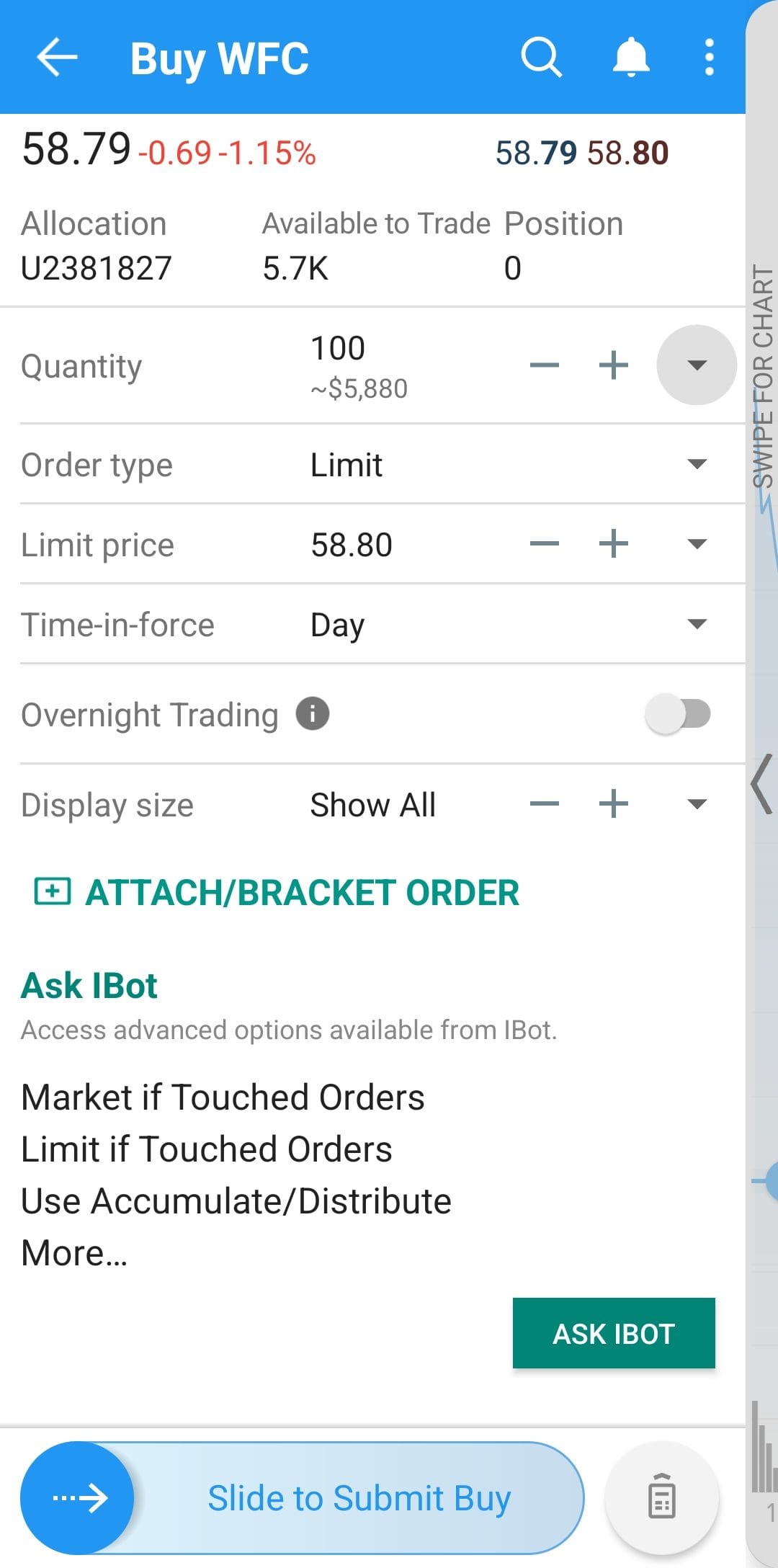

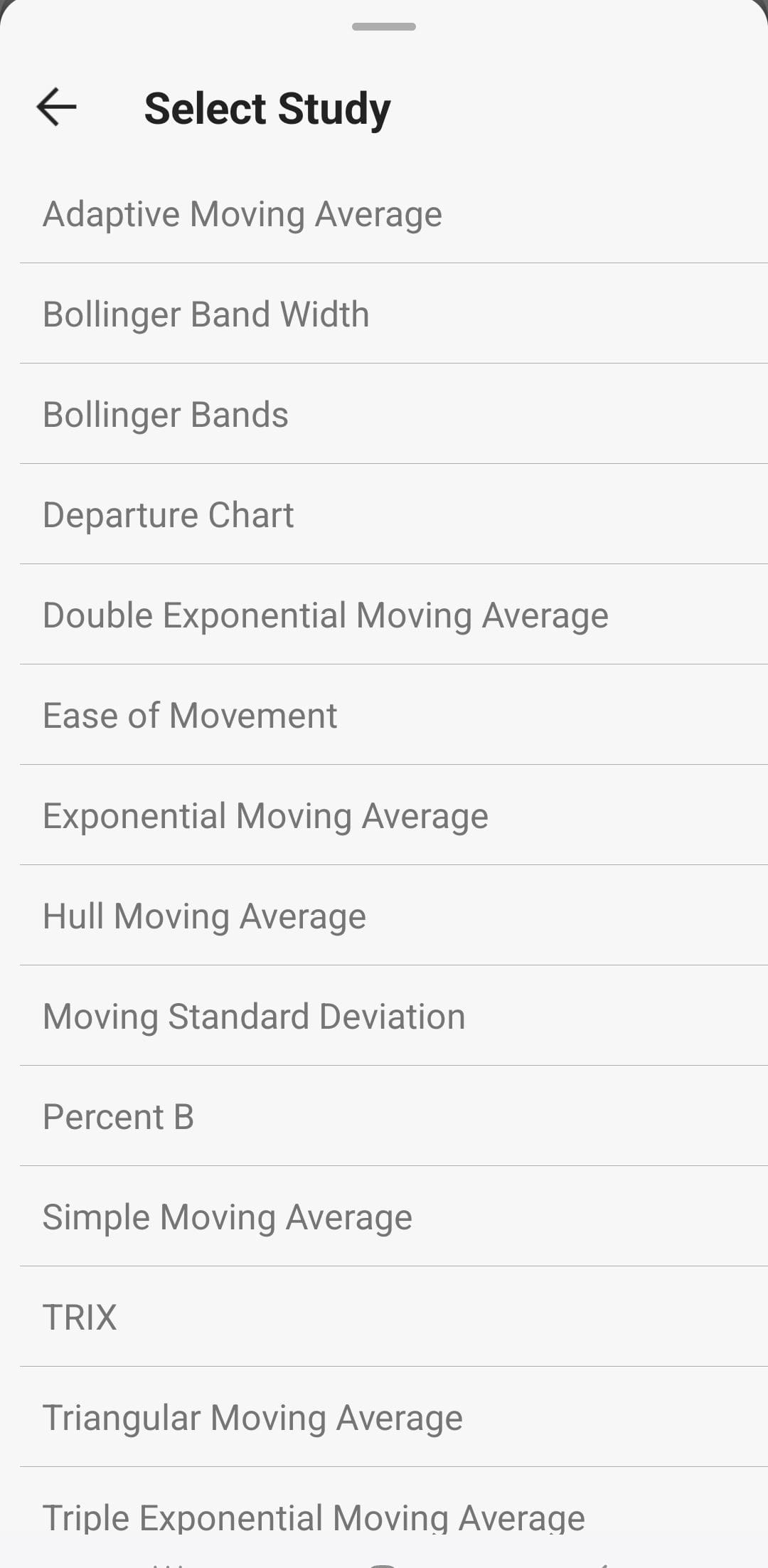

IBKR stands out with its Trader Workstation (TWS), which is designed for the advanced trader. Hundreds of technical indicators, including moving averages, Bollinger Bands, RSI, MACD, and more, are available, enabling traders to conduct in-depth analyses of market trends.

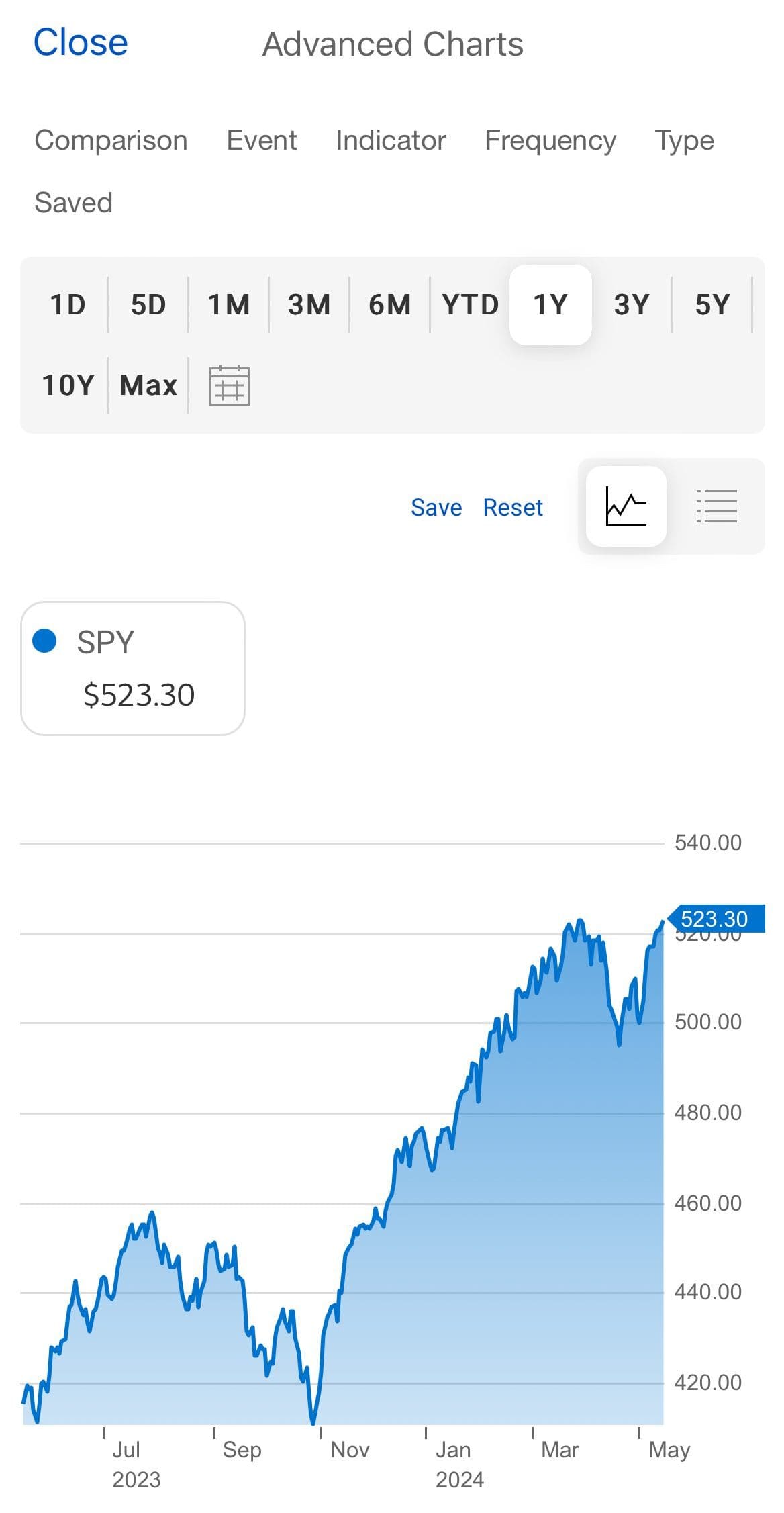

The platform also supports advanced charting features like backtesting, which allows traders to test their strategies against historical data to evaluate their effectiveness.

Additionally, TWS offers real-time data feeds and pattern recognition tools that can automatically detect chart patterns like head and shoulders, triangles, and trendlines, helping traders identify potential trading opportunities.

In contrast, Merrill Edge excels in providing a user-friendly platform with strong technical analysis tools that are accessible even to novice traders.

Its Market Pro platform is particularly well-regarded for advanced charting capabilities, offering over 100 technical indicators and 20+ drawing tools.

Merrill Edge also integrates insights directly into its charts, making it easier for traders to understand market trends and technical events.

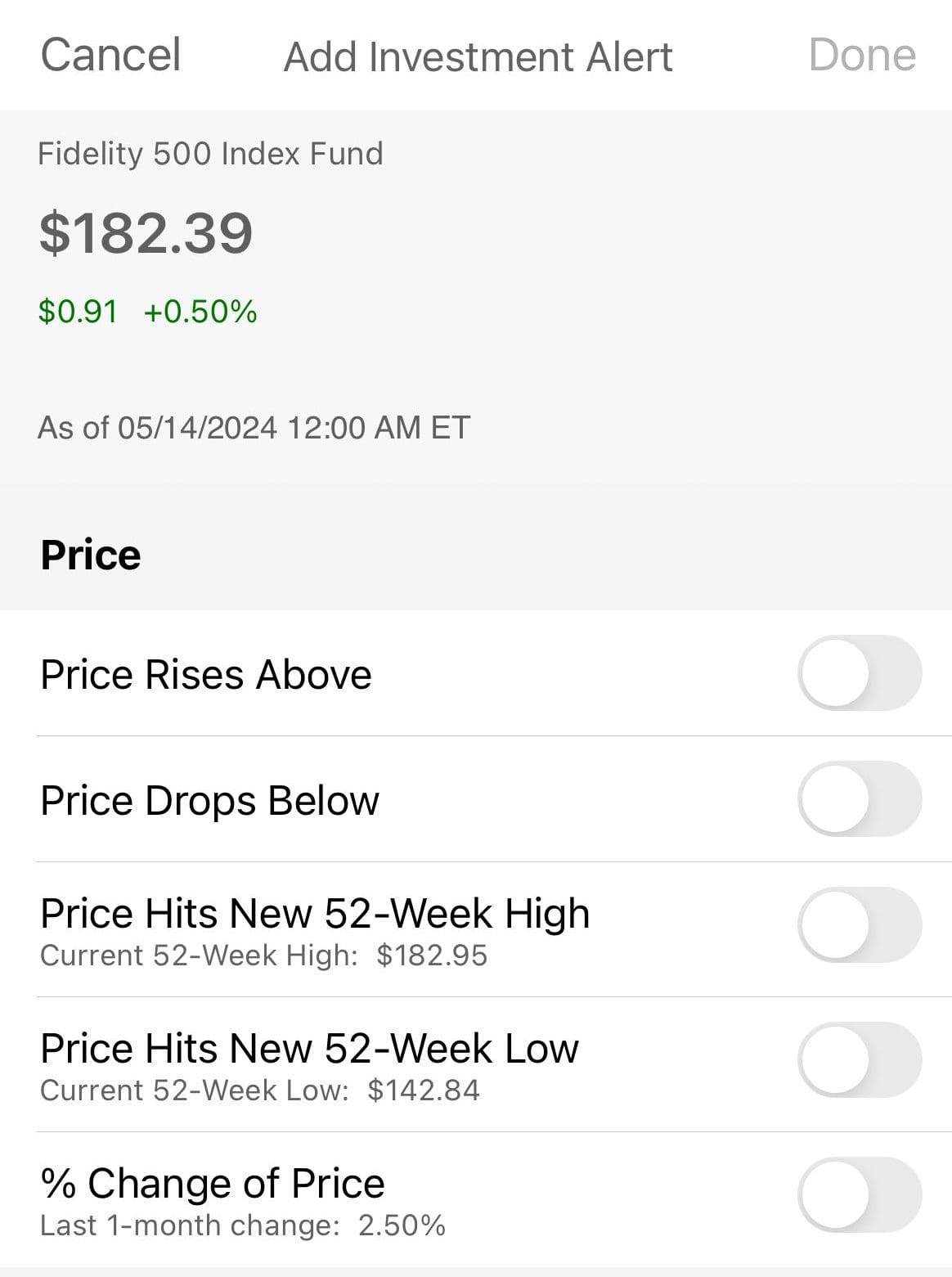

The platform’s simplicity and ease of use make it an attractive choice for those who appreciate a straightforward trading experience. You can set alerts based on many pricing changes and other indicators:

-

Robo Advisor And Automated Investing

There isn’t a definitive winner in this comparison. Merrill robo advisor brings more experience and offers features that IBKR lacks, but IBKR’s wide range of portfolio options makes it a strong contender when selecting a robo-advisor.

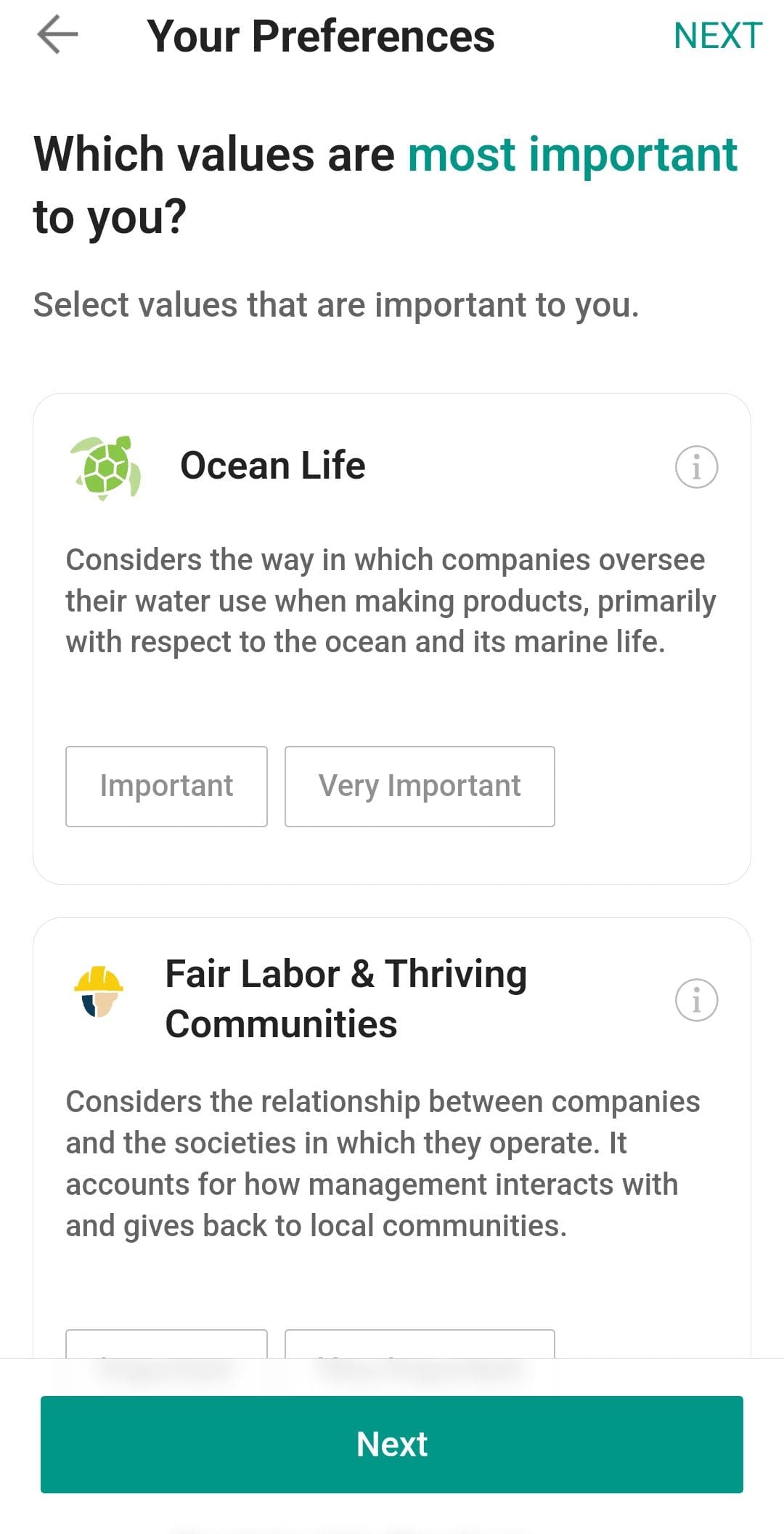

IBKR’s automated investing service, Interactive Advisors, caters to investors who desire more customization and control, even within a robo-advisor framework.

Interactive Advisors offers a variety of portfolios that are color-coded by risk level and investment style, allowing investors to choose from a wide range of strategies, including socially responsible and income-generating portfolios.

Merrill Edge’s robo-advisor, Merrill Guided Investing, is a standout for those who value personalized, hands-off investing with professional oversight.

It offers tailored portfolios managed and rebalanced by Merrill’s team, providing a blend of automated investing with human insight.

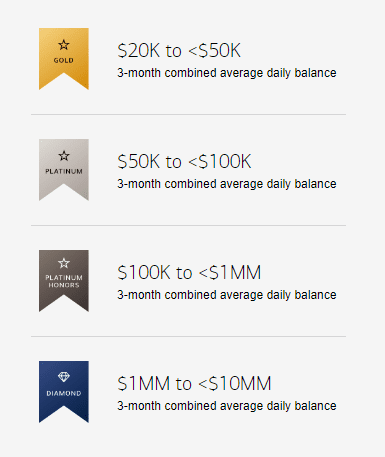

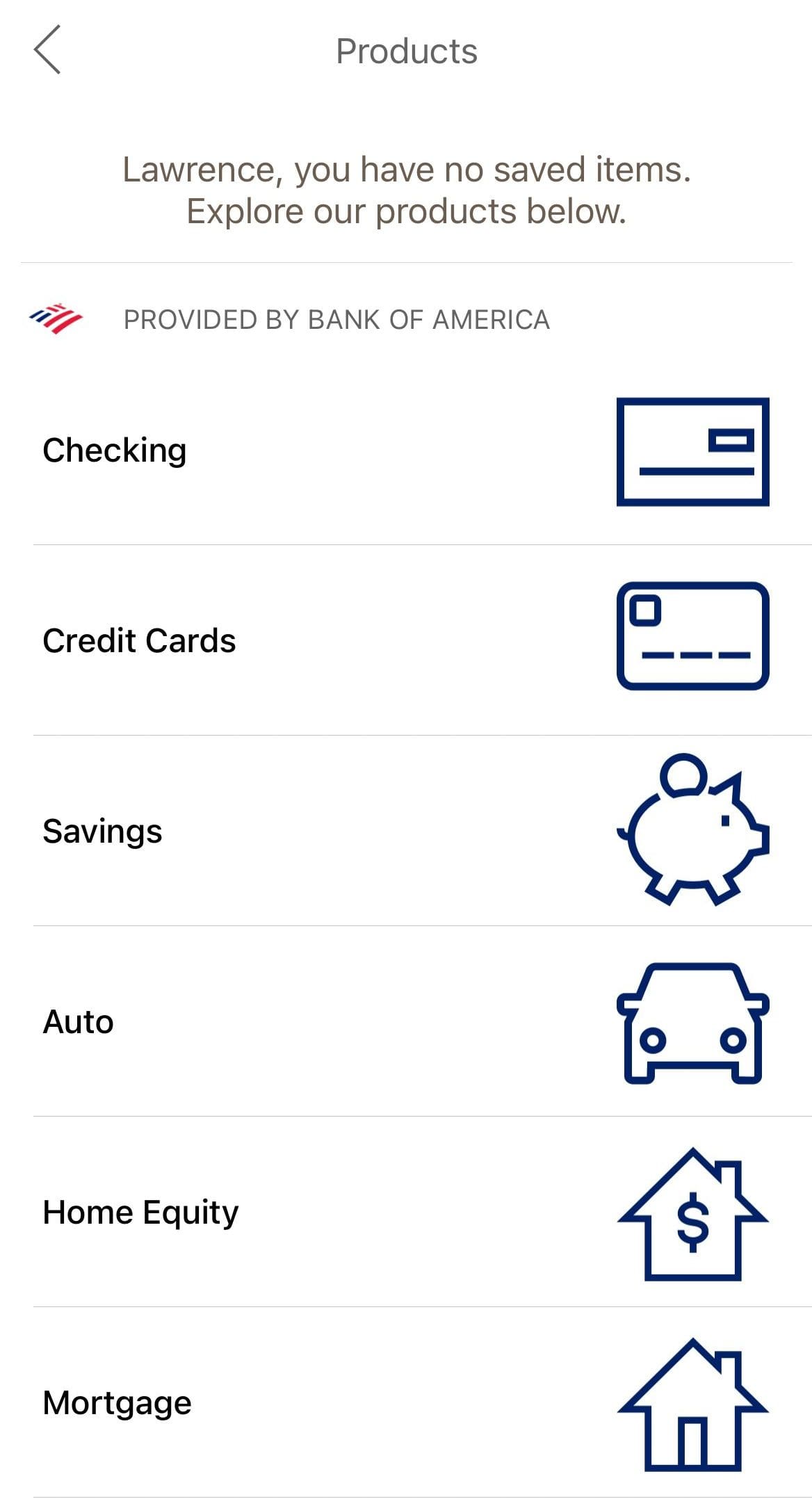

The integration with Bank of America enhances the user experience, particularly for clients who are already part of the BoA ecosystem, allowing seamless movement of funds and access to Preferred Rewards.

-

Retirement Accounts

Interactive Brokers (IBKR) offers a more sophisticated array of investment options within its retirement accounts, making it particularly attractive to experienced investors who want to actively manage their portfolios.

Interactive Brokers (IBKR) offers a variety of Individual Retirement Account (IRA) types, including Traditional, Roth, SEP, SIMPLE, and Inherited IRAs. These accounts are available in either cash or margin formats.

The margin IRA allows for more flexible trading, including multi-currency products, though it comes with limitations such as no cash borrowing, no cross-margining, and significantly higher margin requirements for futures trading compared to non-IRA accounts.

Merrill Edge offers traditional and Roth IRAs, as well as rollover and inherited IRAs. The platform’s intuitive design, along with access to professional advice through Merrill’s advisory services, makes it ideal for those who prefer a guided approach to retirement planning.

-

Fees

When it comes to fees, Interactive Broker is our winner.

Merrill Edge offers commission-free trading on most stocks and ETFs and low fees on other investment options.

However, IBKR offers ultra-low commissions on trades, especially for high-volume traders, and provides access to global markets with competitive pricing on international trades. While IBKR's fees can be more complex, they are more affordable than Merrill Edge.

Merrill Edge | Interactive Broker | |

|---|---|---|

Fees | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% |

When it comes to Robo Advisory, it depends.

The Interactive Brokers fee depends on the chosen portfolio and can be anywhere between 0.10% to 0.75%.

Merrill fees are fixed and increase if you need personal assistance from a dedicated advisor.

-

Cash Management And Savings Rates

IBKR is our winner when it comes to banking options. Only IBKR offers cash management, and its interest rate on Univested cash is higher.

Merrill Cash Account | IB Universal Account | |

|---|---|---|

Savings APY | 0.01% – 4.11% | 0.00% – 3.351% |

IBKR’s Universal Account offers a more investment-focused approach with its cash management features.

The account offers highly competitive interest rates on cash balances, but it requires a minimum of $10,000 to earn the highest rates. Features also include mobile check deposit, direct deposit, and the ability to pay bills directly from the account.

Merrill Edge doesn't offer a stand alone checking account. Instead, existing BofA customers benefit significantly from its integration with Bank of America.

Also, the cash account is disappointed as you are eligible for the high interest only if you maintain at least $100K in your account.

-

Wealth Management Options

Merrill is our winner when it comes to wealth management, as IBKR doesn't offer a personalized wealth management services.

Merrill Wealth Management provides personalized services designed for clients with specific financial goals, offering the opportunity to collaborate closely with a dedicated advisor.

Typically, clients need a minimum of $250,000 in investable assets to access these services. With this threshold, they can explore a diverse range of investment options, including stocks, ETFs, mutual funds, options, and bonds, all expertly managed by Merrill’s experienced team.

Additionally, clients benefit from Bank of America’s premier research and insights, ensuring their investment strategies are informed by expert analysis and up-to-date market trends.

Bottom Line

Merrill Edge stands out for its user-friendly interface, strong integration with Bank of America and wealth management services.

On the other hand, IBKR shines with its extensive global market access, low-cost trading, and advanced tools for sophisticated investors, particularly those interested in self-directed investing and complex trading strategies.

Interactive Brokers vs. Other Trading Platforms

Schwab provides broader tools and analysis options for long-term, value investors, while Interactive Brokers is more suited to active traders

Schwab vs. Interactive Brokers: Which Brokerage is Right for You?

Vanguard provides more options for investors, while Interactive Brokers offers superior technical tools for active traders

Vanguard vs. Interactive Brokers: Which Brokerage is Right for You?

If you're an experienced investor or trader, IBKR may be a better option. If you're a Chase customer or prefer simplicity, consider JP Morgan.

Interactive Brokers vs. J.P. Morgan Self-Directed Investing: Which Broker Wins?

Both platforms have great options for investors, but Fidelity excels in comprehensive retirement planning and cash management options

Interactive Brokers vs. Fidelity: Which Brokerage Suits Your Investing Style?

Webull offers user-friendly tools and perfect app design, while IBKR is best suited for more experienced investors and global market access.

Interactive Brokers vs. Webull: Compare Brokerage Account Options

IBKR shines with its advanced trading tools and extensive market access. E-trade wins for retirement accounts, wealth management, or banking.

Interactive Brokers vs. E-Trade: Compare Brokerage Account Options

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

How Merrill Edge Compares to Other Online Brokers

Vanguard may be a better option for value, long-term investors, while Merrill offers better trading options. Here's a side-by-side comparison

Vanguard vs. Merrill Edge: Which Brokerage is Right for You?

Both offer similar tools for the average investor or trader, but Merrill is better at automated investing. Here's our full comparison:

J.P. Morgan Self-Directed Investing vs. Merrill Edge: Compare Brokerage Accounts

Merrill Edge and E-trade offer great options for long and short-term investors, including robo-advisor, but there are differences.

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Schwab is our winner for investors and traders. However, the differences between brokerages are not significant. Here's our comparison: