Webull | Interactive Brokers | |

Monthly Fee | $0

May be charge specific fees for trading such as stock options, futures, transfers etc

| 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% |

Account Types | Brokerage, Retirement | Brokerage, Retirement |

Savings APY | 5.00% | 0.00% – 3.351% |

Minimum Deposit | $0 | $0 |

Best For | Advanced Traders, Active Investors | International Investors, Advanced Traders |

Read Review | Read Review |

Webull vs Interactive Brokers: Compare Features

While Webull is better suited for those who want simplicity with powerful charting tools, IBKR surpasses in offering a more comprehensive, research-intensive environment, ideal for traders who require advanced features and global market access.

Interactive Brokers | Webull | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | 10,000 US stocks and ETFs. |

Investing Types | Stocks, Options, Futures, ETFs, Crypto, Bonds & CDs, Margin, Mutual Funds, Hedge funds, Forex, Commodities | Stocks, Options, Futures, ETFs, OTC, Margin, Fractional Shares |

Automated Investing | Yes | Yes |

Paper Trading | Yes | Yes |

IPO Access | No | Yes |

Dedicated Advisor | No | No |

-

Self Investing And Fundamental Analysis Options

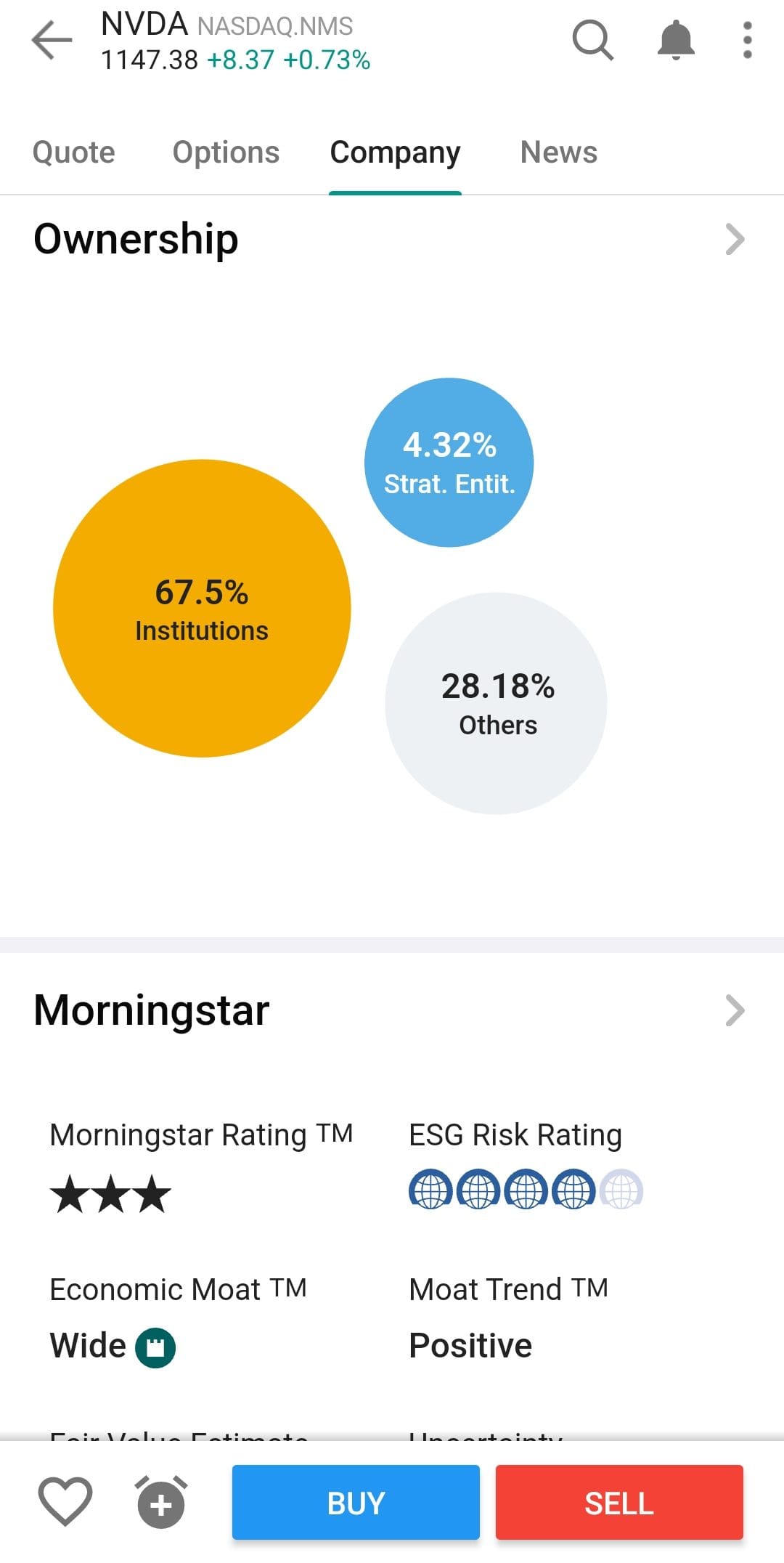

IBKR is our winner here, offering a more comprehensive range of investing features and research options than Webull.

With IBKR, investors can trade stocks, options, futures, forex, bonds, ETFs, and mutual funds, along with access to global markets in over 150 countries.

IBKR also provides a vast selection of global markets and asset classes, offering unmatched access for those interested in international investing.

As you can see in the screenshot, you can also trade currencies and commodities:

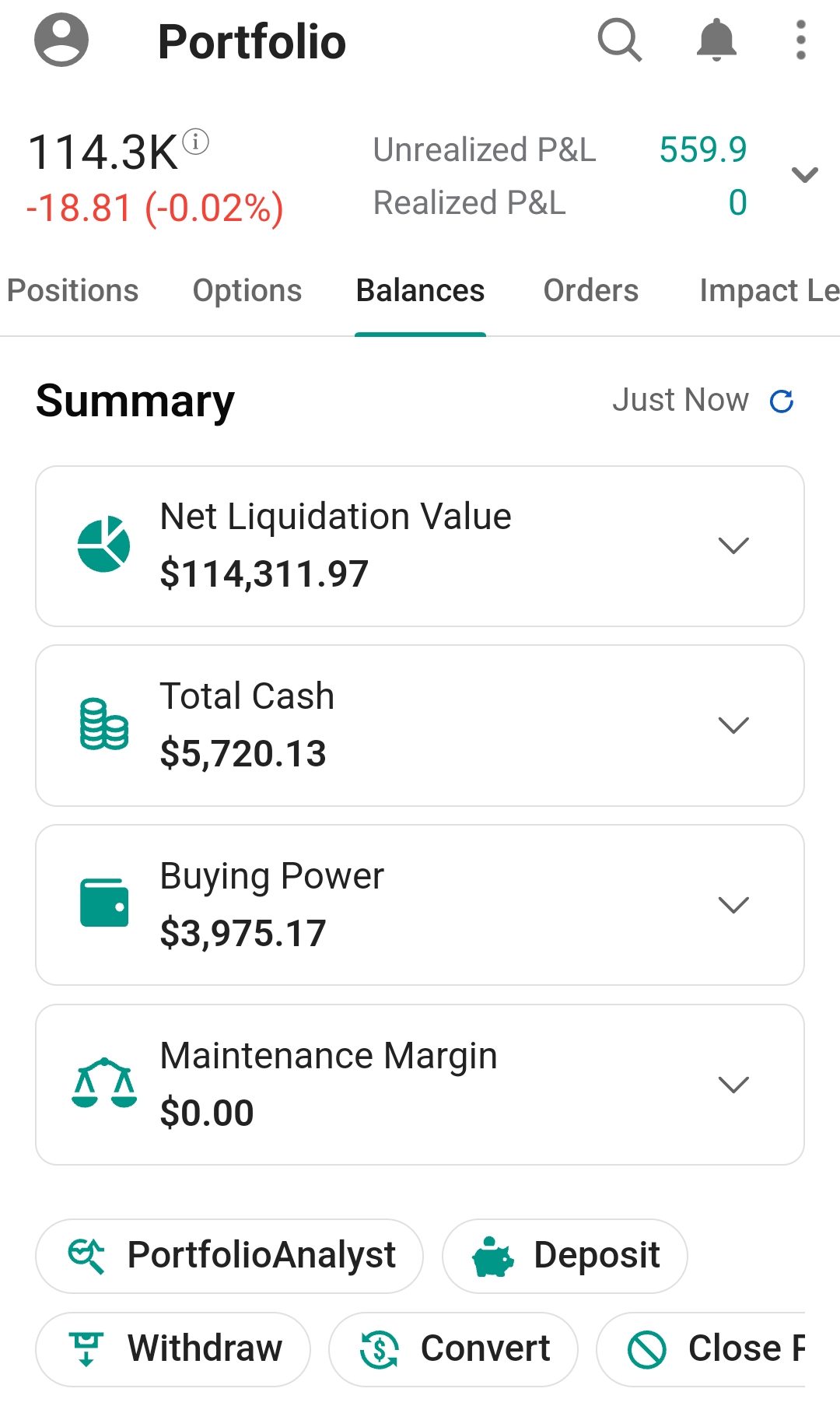

Furthermore, IBKR’s research tools, including the IBKR Global Analyst and PortfolioAnalyst, allow for deep dives into financial data, which is invaluable for meticulous fundamental analysis.

Webull shines in providing an intuitive, user-friendly experience with powerful charting tools. Its platform is ideal for intermediate investors who appreciate straightforward access to features like fractional shares and paper trading.

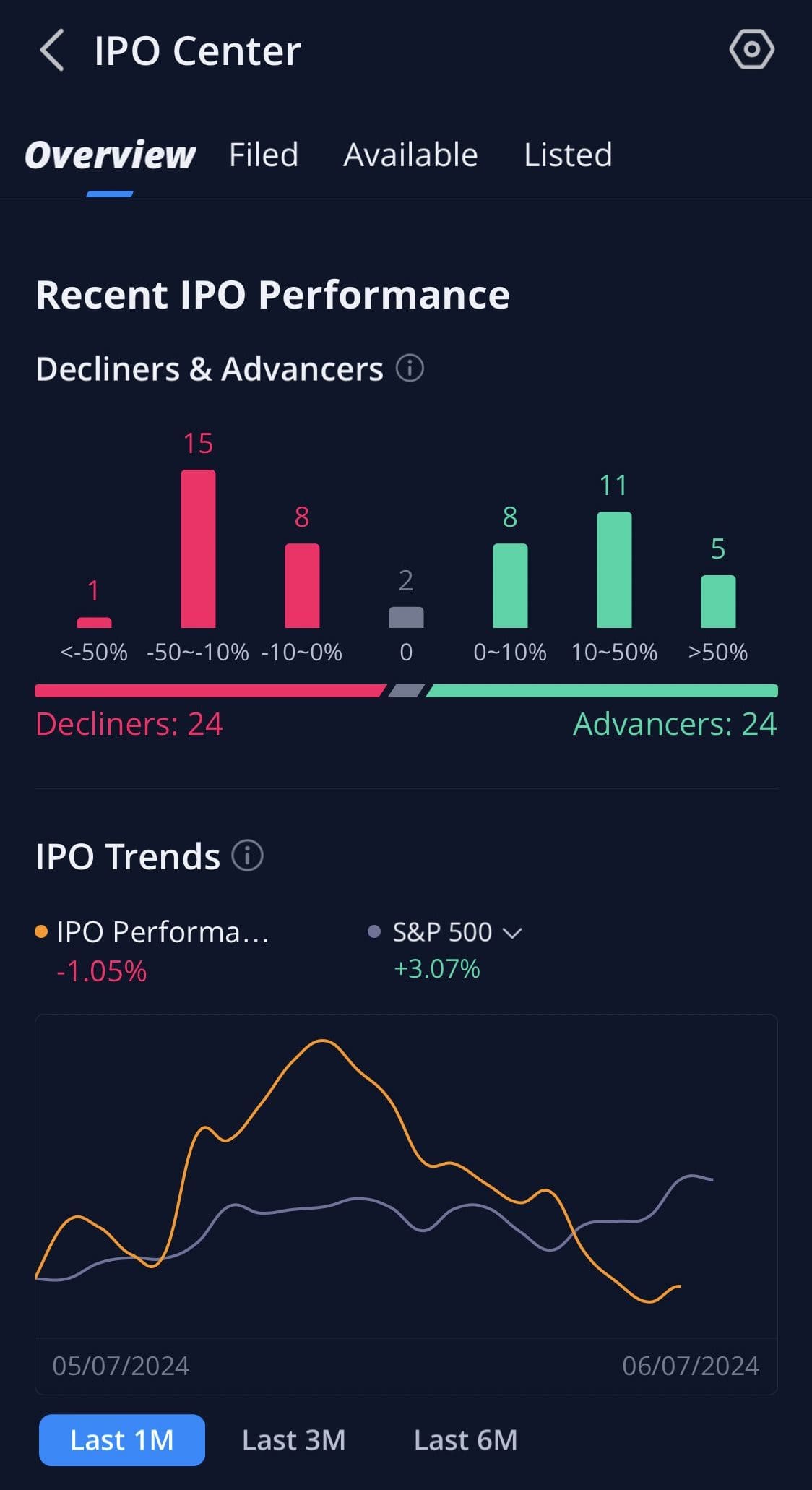

Webull also offers an access to IPOs which is not available with Interactive Brokers:

However, the investing options and fundamental analysis tools are limited compared to IBKR.

-

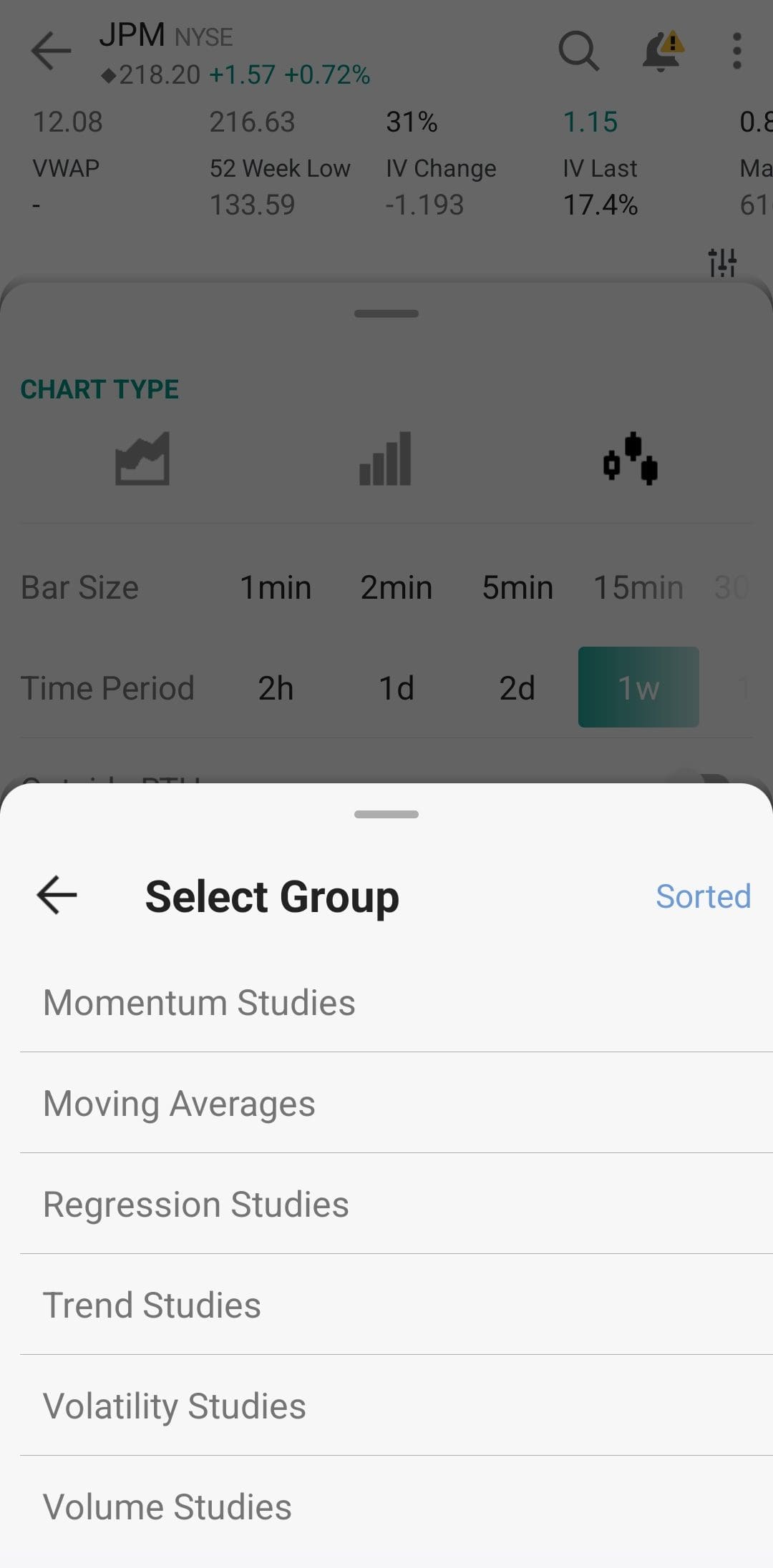

Trading Options And Technical Analysis Tools

Webull is our winner when it comes to trading and analysis due to its excellent interface, various tools, and easy chart analysis for traders.

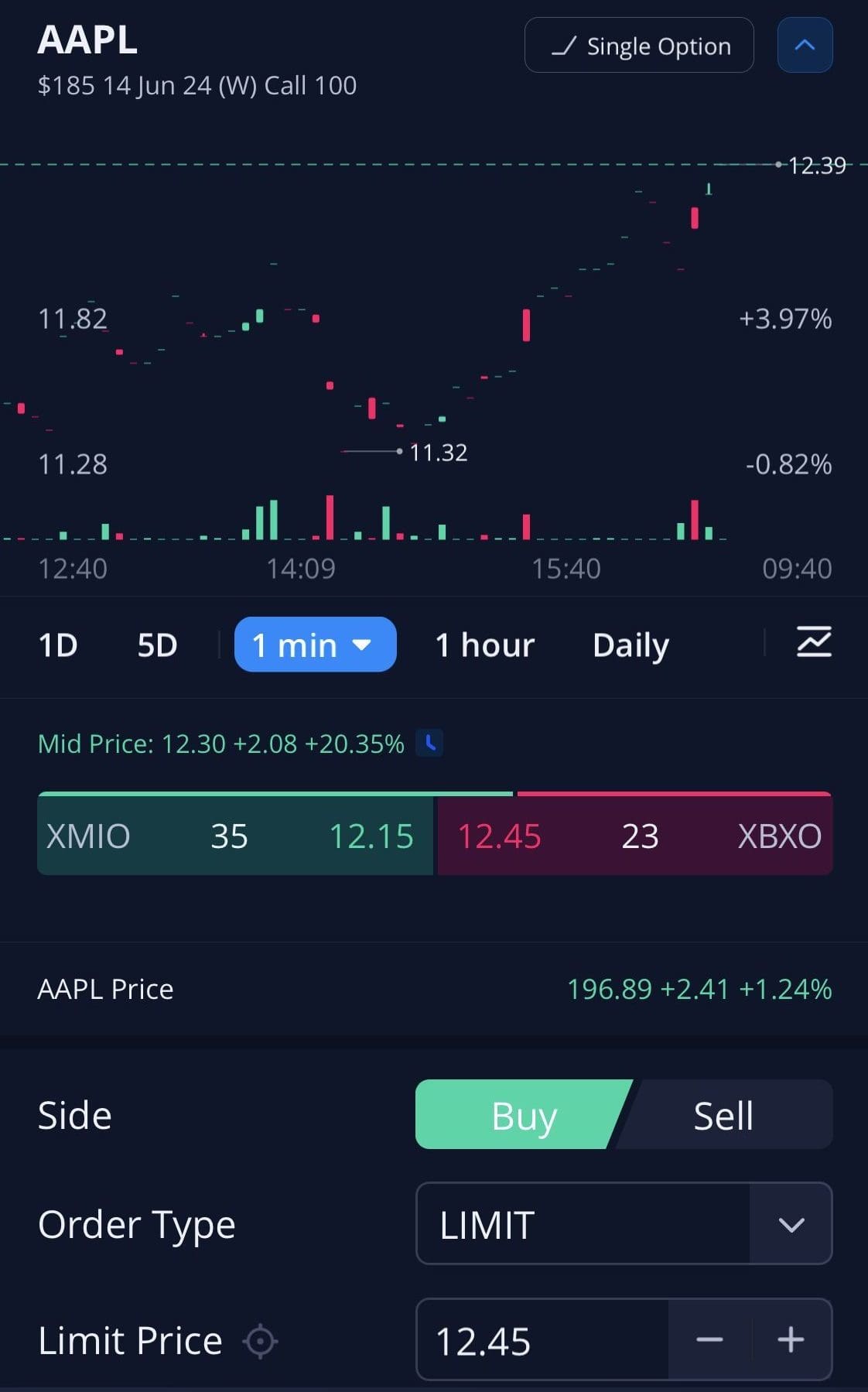

Webull excels in providing an easy-to-use platform that’s perfect for traders who prioritize simplicity without sacrificing functionality.

Its charting tools are among the best for retail traders, offering a range of customizable indicators, drawing tools, and timeframes. This makes Webull particularly strong for traders who focus on technical analysis and want to execute trades directly from their charts.

Webull also provides an intuitive options trading experience, with features that are accessible even for those new to options trading.

In contrast, IBKR stands out with its Trader Workstation (TWS), which is designed for the advanced trader with over 100 technical indicators are available, including moving averages, Bollinger Bands, RSI, MACD, and more, enabling traders to conduct in-depth analysis of market trends.

The platform also supports advanced charting features like backtesting, which allows traders to test their strategies against historical data to evaluate their effectiveness.

Additionally, TWS offers real-time data feeds and pattern recognition tools that can automatically detect chart patterns like head and shoulders, triangles, and trendlines, helping traders identify potential trading opportunities.

-

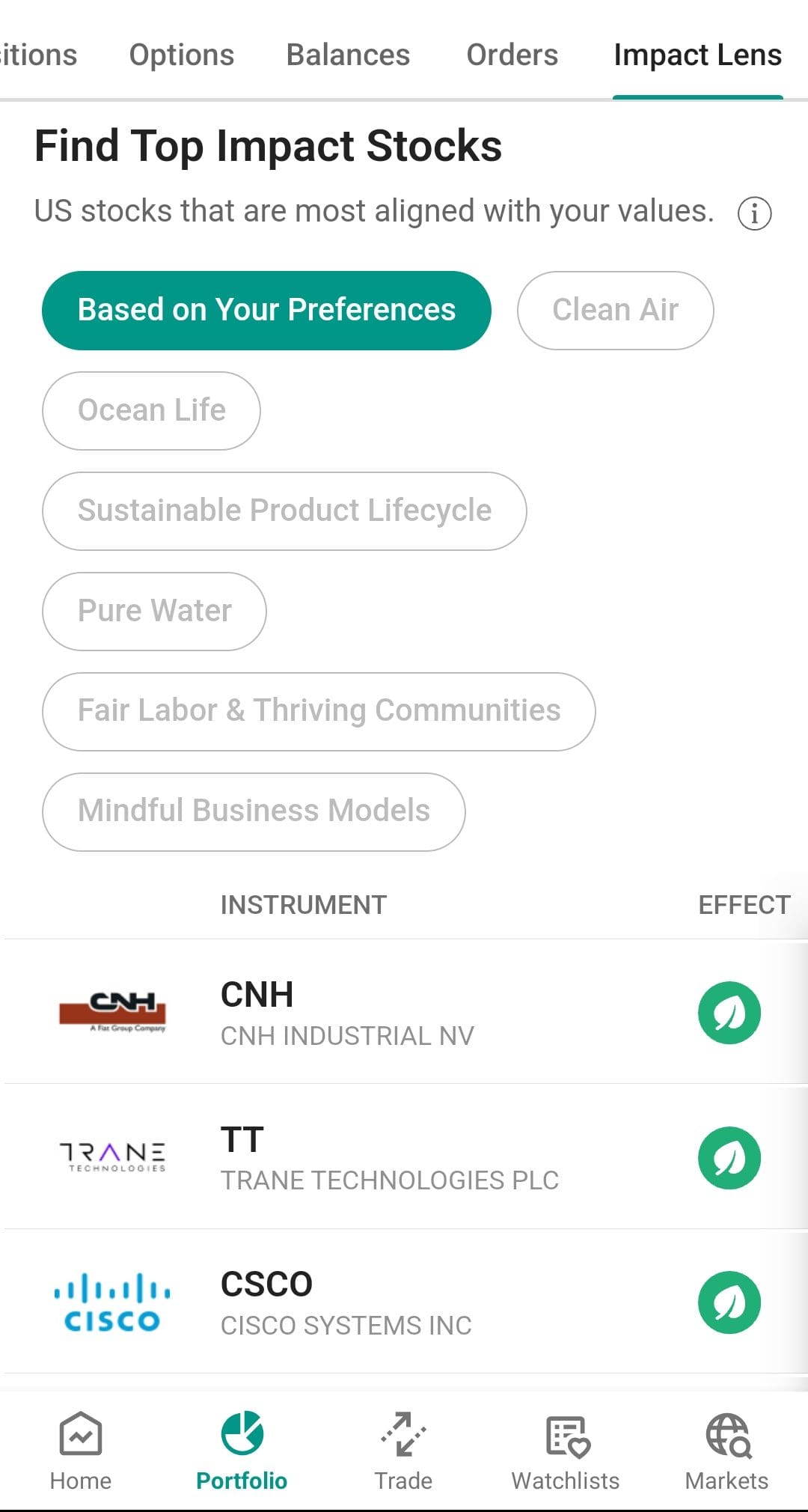

Robo Advisor And Automated Investing

In our opinion, the IBKR robo advisor is better than Webull.

IBKR’s automated investing service, Interactive Advisors, caters to investors who desire more customization and control, even within a robo-advisor framework.

Interactive Advisors offers a variety of portfolios that are color-coded by risk level and investment style, allowing investors to choose from a wide range of strategies, including socially responsible and income-generating portfolios.

The entry point is low, with a minimum investment of just $100, and fees range up to 0.75% depending on the portfolio.

Webull’s automated investing option, Webull Smart Advisor, is relatively new but has quickly gained attention for its simplicity and accessibility.

It’s designed for those who want a low-cost way to invest with minimal effort. In most cases, it will be cheaper than IBKR robo advisor.

The Smart Advisor uses a questionnaire to determine your risk tolerance and then assigns you to one of six ETF-based portfolios, which is much fewer options compared to IBKR robo advisor.

-

Retirement Accounts

Interactive Brokers is our winner when it comes to retirement accounts, especially if you're looking for vast investment options for your retirement.

Webull provides a straightforward approach to retirement accounts, offering traditional, Roth, and rollover IRAs.

Webull's user-friendly interface, coupled with its commission-free trading and no account management fees, makes it a great choice for investors who prefer a low-cost, hassle-free way to build their retirement portfolio.

You can also use Webull financial planning tools to set other goals than retirement:

Interactive Brokers (IBKR) offers a variety of Individual Retirement Account (IRA) types, including Traditional, Roth, SEP, SIMPLE, and Inherited IRAs. These accounts are available in either cash or margin formats.

-

Fees

When it comes to fees, both Webull and Interactive Broker are low-cost.

Webull excels in offering commission-free trading on stocks, ETFs, and options

Interactive Brokers, while also offering low fees, particularly shines for high-volume traders and those trading on a global scale. IBKR offers tiered and fixed pricing models, which can result in lower costs for larger trades or more frequent trading.

Webull | Interactive Broker | |

|---|---|---|

Fees | 0.20% | 0% – 0.75%

$0 online commission on U.S. listed stocks and ETFs, Options: $0.15 – $0.65 per-contract, Futures: $0.25 – $0.85 per-contract. For Interactive Advisors: asset-based management fees of 0.10% to 0.75% |

When it comes to Robo Advisory, Webull usually wins wins. It has a flat fee of 0.20%, while Interactive Brokers fee depends on the chosen portfolio and can be anywhere between 0.10% to 0.75%.

-

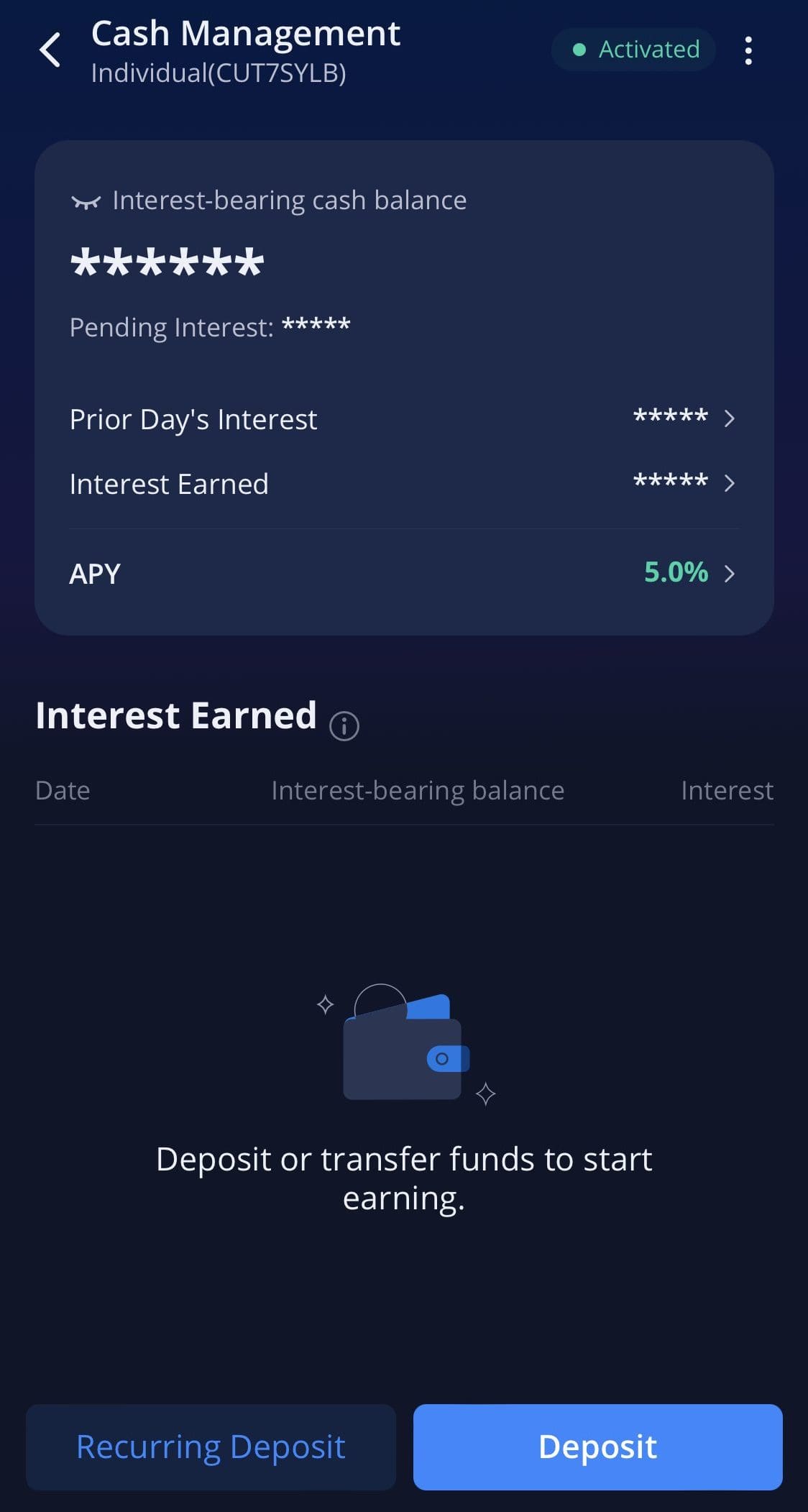

Cash Management And Savings Rates

There is no significant difference here – both IBKR and Webukll offer high rates on uninvested cash and limited cash management options.

Webull | IB Universal Account | |

|---|---|---|

Savings APY | 5.00% | 0.00% – 3.351% |

IBKR account offers highly competitive interest rates on cash balances, but it requires a minimum of $10,000 to earn the highest rates.

Features also include mobile check deposit, direct deposit, and the ability to pay bills directly from the account.

Webull offers a straightforward cash management solution with its High-Yield Cash Management feature. This option allows you to earn a competitive 5.00% APY on uninvested cash within your account, with no fees or minimum balance requirements.

However, while the APY is attractive, Webull’s cash management lacks some of the more comprehensive banking features you with IBKR universal account such as direct deposit from your bank.

Bottom Line

Webull excels in simplicity, offering user-friendly tools without compromising on the quality of charting for active traders.

In contrast, IBKR is best suited for more experienced investors as it provides a vast range of investment options, advanced trading tools, and global market access.

Interactive Brokers vs. Other Trading Platforms

Schwab provides broader tools and analysis options for long-term, value investors, while Interactive Brokers is more suited to active traders

Schwab vs. Interactive Brokers: Which Brokerage is Right for You?

Vanguard provides more options for investors, while Interactive Brokers offers superior technical tools for active traders

Vanguard vs. Interactive Brokers: Which Brokerage is Right for You?

If you're an experienced investor or trader, IBKR may be a better option. If you're a Chase customer or prefer simplicity, consider JP Morgan.

Interactive Brokers vs. J.P. Morgan Self-Directed Investing: Which Broker Wins?

Both platforms have great options for investors, but Fidelity excels in comprehensive retirement planning and cash management options

Interactive Brokers vs. Fidelity: Which Brokerage Suits Your Investing Style?

Merrill Edge stands out for its interface and integration with BofA, but IBKR is the ultimate winner for trading and investing. Here's why:

Interactive Brokers vs. Merrill Edge: Compare Brokerage Account Options

IBKR shines with its advanced trading tools and extensive market access. E-trade wins for retirement accounts, wealth management, or banking.

Interactive Brokers vs. E-Trade: Compare Brokerage Account Options

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

Compare Webull Side By Side

Fidelity excels in investment options, wealth management, and retirement planning. Webull trading platform is one of the most fascinating we've seen.

Webull suits experienced traders with great app design and charting tools, while Stash is ideal for those starting their investment journey

ETRADE is best for a comprehensive array of investment options, while Webull app design and charting is one of the most appealing we've seen

Webull is better suited for experienced traders needing advanced tools, whereas Robinhood caters to beginners and those who prefer simplicity