Founded in 1997, Lear Capital is a well-established precious metals dealer with a particular focus on retirement accounts.

While they’re widely known for gold and silver, they also offer a curated selection of IRA-eligible platinum coins and bars, with dedicated specialists to guide you through the process.

Here's what customers think about them – as you can see, the ratings speak for themselves:

[elementor-template id=”203486″]

5 Steps to Buy Gold from Lear Capital

Let’s walk through the process of buying gold from Lear Capital:

1. Clarify Your Gold Investment Goals

Before making a purchase, understand how gold fits into your investment strategy.

Lear Capital focuses on long-term wealth preservation through physical metals, with particular emphasis on IRA-approved bullion.

Here’s what to consider:

Portfolio Use – Are you buying for direct ownership or through a Gold IRA?

Product Type – Lear Capital specializes in bullion-grade gold coins and bars.

Liquidity – Coins like the American Gold Eagle and Canadian Maple Leaf are widely traded and easy to resell.

IRA Compliance – All eligible products are clearly marked on the site.

2. Set Up Your Account or Gold IRA

Lear Capital makes it easy to get started—whether you’re looking to buy precious metals outright or invest through a retirement account.

-

Direct Purchase (No IRA Required)

If you simply want to buy gold coins or bars for personal storage, you can do so without opening a Gold IRA.

A Lear Capital specialist will walk you through available products, pricing, and payment options.

-

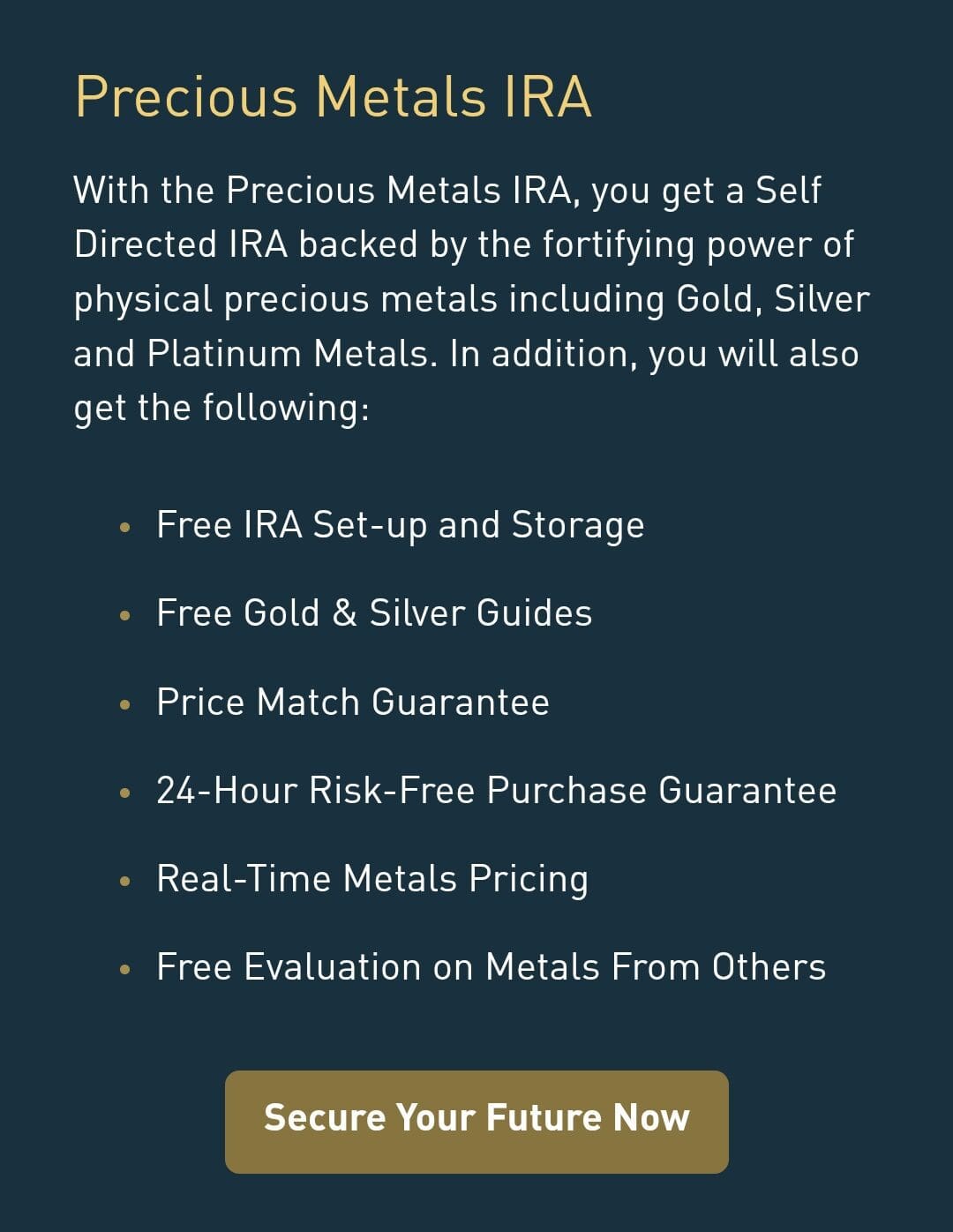

Gold IRA

If your goal is to hold gold in a tax-advantaged retirement account, Lear will guide you through the Gold IRA setup.

They work with trusted custodians like Equity Trust Company to help roll over funds from your 401(k) or traditional IRA, and select IRS-approved gold products.

Choose Gold Coins or Bars from Lear’s Inventory

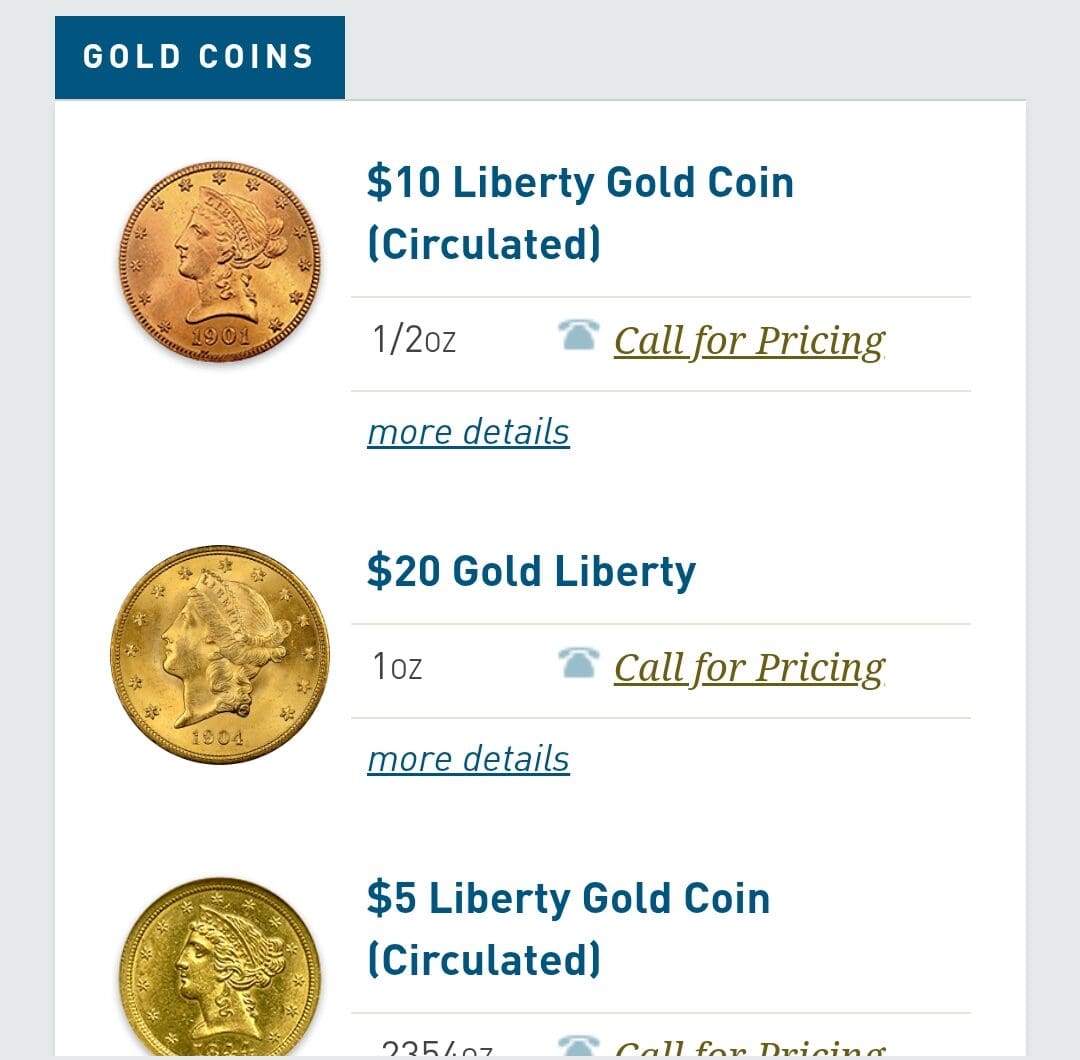

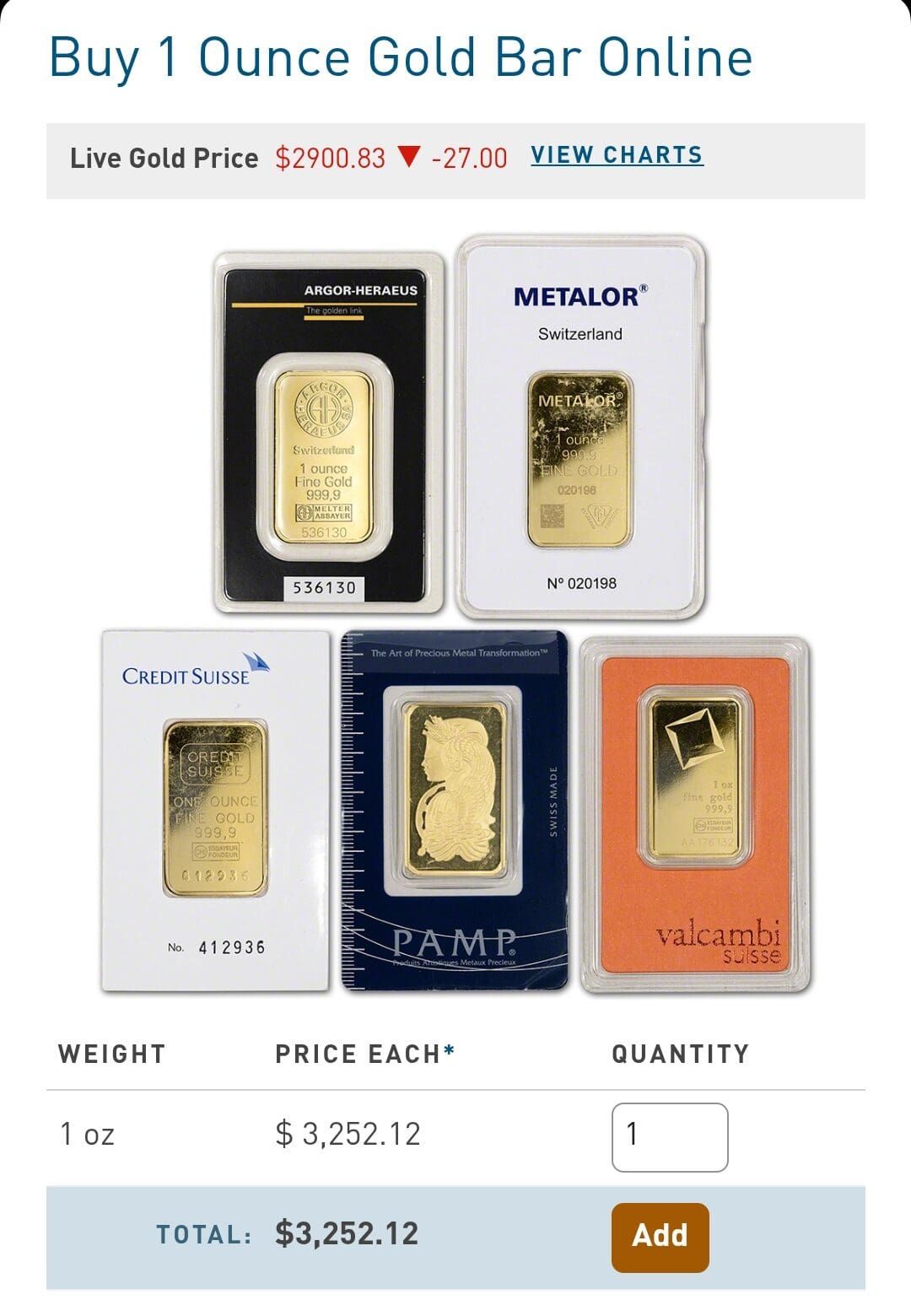

Lear Capital offers a curated selection of high-purity gold products, with most being eligible for IRAs. Unlike open marketplaces, Lear’s platform is designed more like a guided service than a self-serve store.

Once you speak with a rep or request a quote, you’ll get real-time pricing and product availability.

Product Name | IRA-Eligible | Type |

|---|---|---|

American Gold Eagle (1 oz) | Yes | Coin |

American Gold Buffalo (1 oz) | Yes | Coin |

Canadian Gold Maple Leaf (1 oz) | Yes | Coin |

Gold Bars (1 oz, 10 oz) | Yes | Bar |

Austrian Gold Philharmonic | Yes | Coin |

Lear Preferred Gold Portfolio Set | Yes | Mixed Coins |

- The Smart Investor Tip

Lear Capital’s “Preferred Portfolio” includes a mix of well-known IRA-approved coins. It’s a good entry point for hands-off investors who want diversification with fewer decisions.

4. Lock in Pricing and Confirm Your Order

Gold pricing is highly dynamic. With Lear Capital, your price is typically locked at the time of your trade confirmation—whether buying directly or funding a Gold IRA.

Available payment methods:

Wire Transfer – Preferred for larger direct purchases

IRA Rollovers – No penalties or taxes when properly executed

ACH or Check – Accepted but may delay the order lock

Once confirmed, you’ll receive a transaction summary and storage/delivery options

5. Choose Delivery or Secure Storage

You can opt for home delivery or IRS-approved vault storage if investing through an IRA.

Home Delivery: All shipments are insured and discreetly packaged.

Gold IRA Storage: Assets are stored in segregated vaults (Delaware Depository or Brinks).

What to expect:

Delivery tracking and signature confirmation

IRA assets are fully insured and stored separately

Customer service team updates you throughout the process

Does Lear Capital Offer a Gold Buyback Program?

Yes. Lear Capital offers a guaranteed buyback policy—you can sell back your gold at any time without pressure. The rep-guided process includes:

Calling for a real-time buyback quote

Shipping your gold fully insured

Receiving payment after authentication (typically via wire or check)

There are no forced hold periods or hidden fees for buybacks, which makes Lear a convenient choice for investors prioritizing exit flexibility.

What Else Can You Buy from Lear Besides Gold Coins?

While gold coins are a major focus, Lear Capital also offers a broader selection of physical precious metals for those looking to diversify.

These include both IRA-eligible and collectible options:

Gold Bars – Available in 1 oz and 10 oz sizes; ideal for investors seeking bulk holdings with lower premiums.

Silver Coins – American Silver Eagles, Canadian Maple Leafs, and other widely recognized silver bullion coins.

Silver Bars – Lear offers IRA-eligible silver bars with purity of .999 or higher.

Platinum and Palladium – For advanced investors looking to expand beyond gold and silver.

Collectible Coins – Lear does carry limited numismatics, but they're typically geared toward collectors rather than gold IRA investors.

These additional products allow investors to build a custom portfolio that balances value, growth, and long-term stability.

FAQ

Yes, Lear Capital is registered with relevant industry bodies and has been operating since 1997 with a strong compliance record.

No, all purchases require ID verification and transaction records for regulatory compliance, especially with Gold IRAs.

While there’s no set federal minimum, Lear typically recommends starting with at least a few thousand dollars to optimize fees and setup.

Lear may not always be the cheapest, but their pricing is competitive for IRA-approved bullion, and they often run limited-time offers.

Yes, storage is required for IRA accounts. Fees vary by custodian and storage type, but typically range annually.

Yes, Lear offers options like Delaware Depository and Brinks, giving investors some flexibility based on geography and preference.

Your metals will retain intrinsic value, but like any investment, the market fluctuates. Lear emphasizes long-term stability over short-term gains.