Table Of Content

NFTs (non-fungible tokens) have emerged as a unique way to invest in digital assets like art, music, virtual land, and collectibles. Unlike cryptocurrencies, each NFT is unique, providing verifiable ownership on the blockchain.

Investors may be drawn to NFTs because of their potential for long-term appreciation, access to exclusive communities, and utility in virtual worlds and gaming ecosystems. However, they also face high volatility and a rapidly evolving regulatory landscape.

As a result, NFT investing requires careful research, risk management, and an understanding of how digital ownership works.

Pros and Cons of Investing in NFTs

NFTs can unlock powerful opportunities, but they also come with unique challenges that investors must understand before committing capital.

Pros | Cons |

|---|---|

Verifiable Digital Ownership | High Market Volatility |

Access to Exclusive Communities | Limited Liquidity |

Potential for High Returns | Lack of Regulation |

Utility in Gaming & Metaverses | Uncertain Long-Term Value |

Support for Digital Creators | Environmental Concerns |

- Verifiable Digital Ownership

NFTs are recorded on the blockchain, which means proof of ownership can’t be forged, even if the content is copied elsewhere.

- Access to Exclusive Communities

Some NFTs function as membership passes to gated online communities, private events, or early product drops—like Bored Ape Yacht Club.

- Potential for High Returns

Early investors in high-profile NFTs like CryptoPunks saw values soar, although such cases are rare and speculative.

- Utility in Gaming and Metaverses

NFTs can represent in-game assets, characters, or land that hold real-world value, as seen in platforms like Decentraland.

- Support for Digital Creators

Buying NFTs allows investors to directly support artists and often gives them a share of future resale royalties.

- High Market Volatility

NFT prices fluctuate significantly, and popular assets can lose most of their value within days or weeks.

- Limited Liquidity

Unlike cryptocurrencies, NFTs can take time to sell, especially if they aren't part of a well-known collection.

- Lack of Regulation

The NFT space lacks consumer protections, which increases the risk of scams or misleading marketing.

- Uncertain Long-Term Value

Many NFTs may not hold value over time, especially if they lack real-world utility or community support.

- Environmental Concerns

Some NFT blockchains rely on energy-intensive proof-of-work models, raising sustainability concerns among critics.

Investing in NFTs: The Smart Investor Tips

NFTs offer new digital ownership models, but smart investing requires research, risk awareness, and platform understanding to avoid costly mistakes.

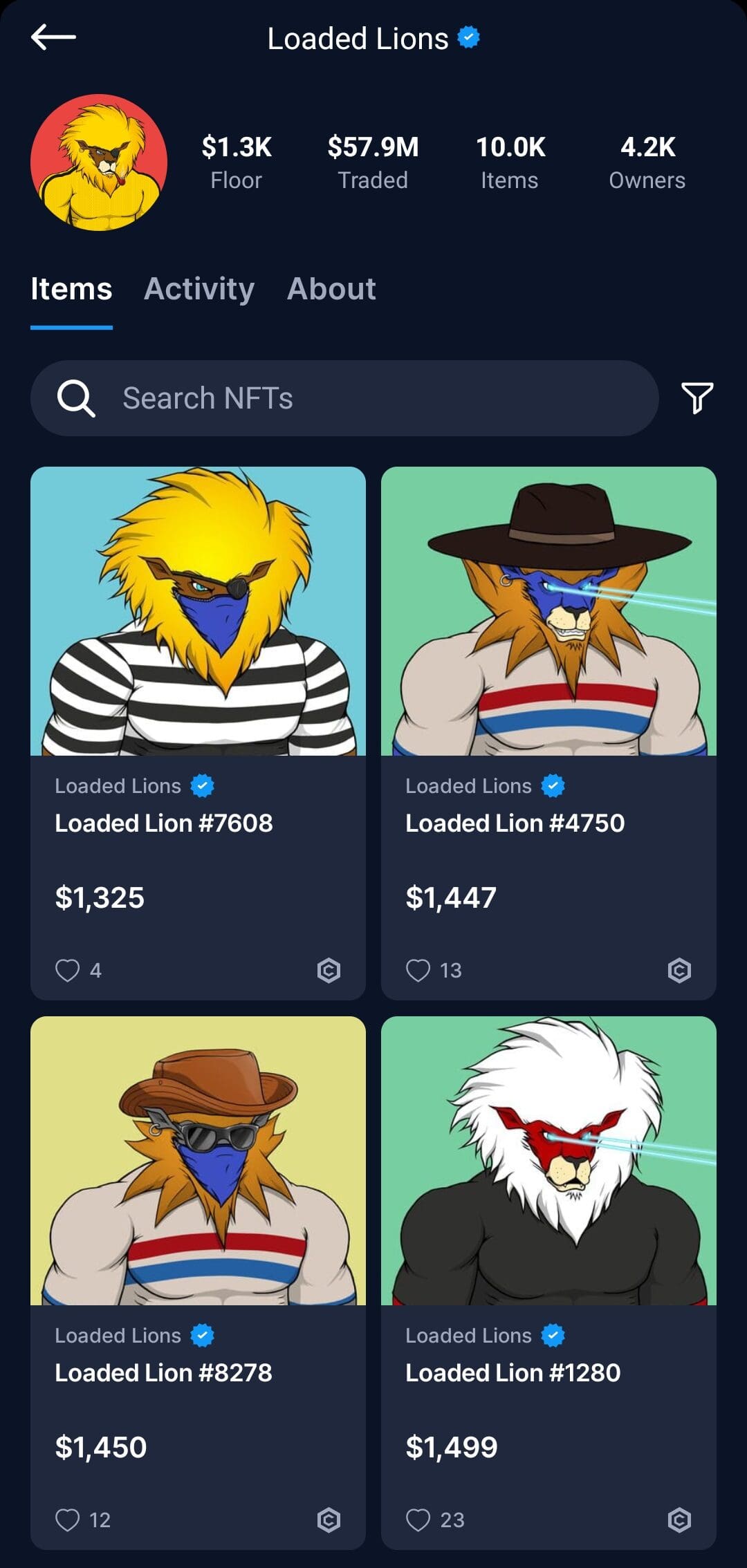

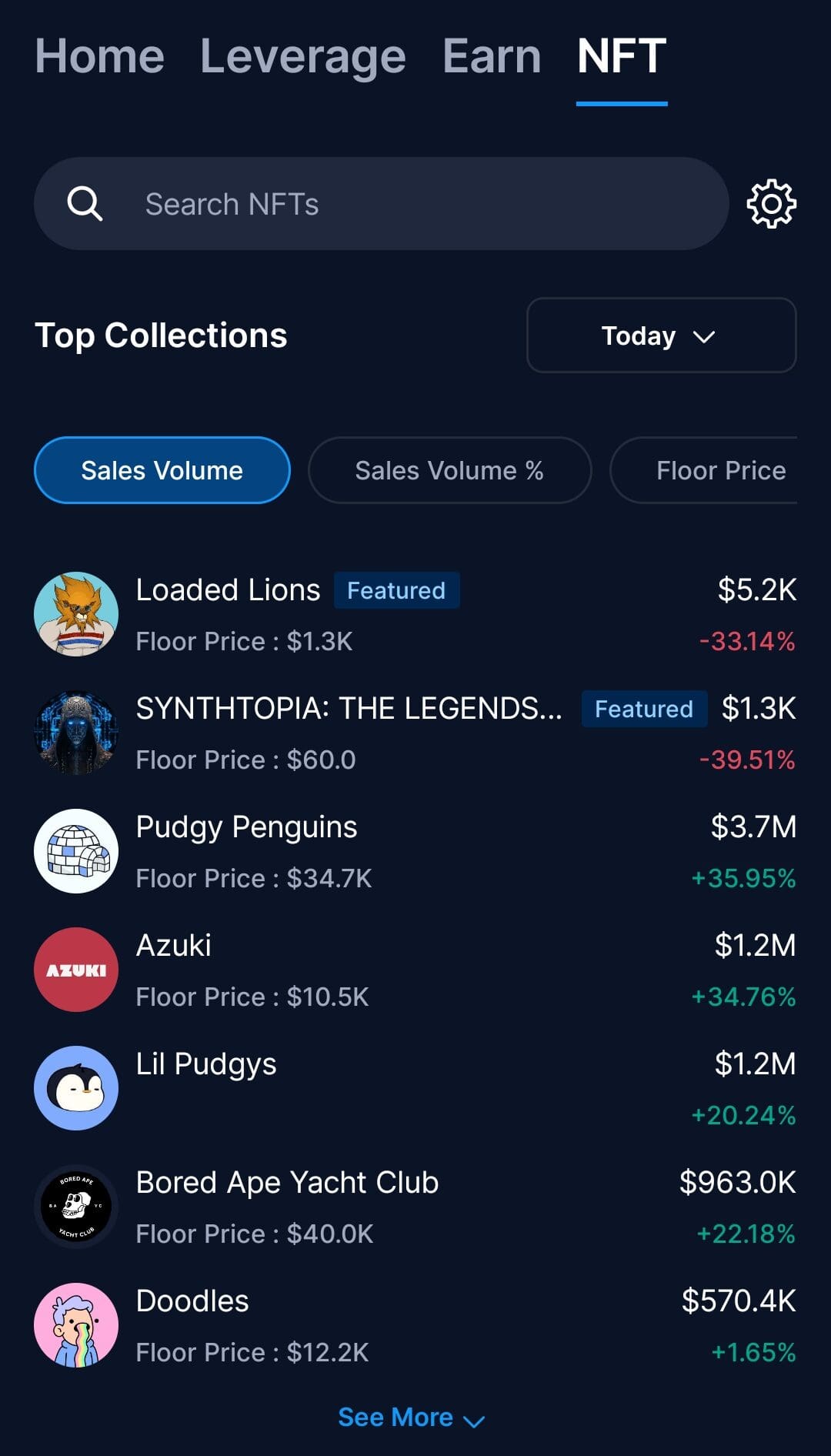

Do Your Due Diligence: Research the project’s creators, roadmap, and community before investing—popular projects like Pudgy Penguins often build value through strong branding.

Diversify Your Digital Portfolio: Avoid putting all your funds into a single NFT or collection. Diversifying across creators and use cases helps reduce risk.

Understand Utility vs. Hype: Ask whether the NFT has actual use—such as in games or as a ticket—or is riding a short-term trend.

Use Reputable Marketplaces: Stick to established NFT marketplaces like OpenSea and Rarible, which offer buyer protections. However, watch for fake listings or phishing.

Track Gas and Transaction Costs: Ethereum-based NFTs have fluctuating gas fees. Before purchasing, factor this into your total investment cost.

When You May Want to Invest in NFTs?

NFTs can be a compelling opportunity when they align with personal interests, tech adoption, and long-term value potential.

You’re Passionate About Digital Art or Culture: If you love art, music, or memes, NFTs offer a way to own a piece of that culture while supporting creators.

You See Long-Term Tech Adoption: Belief in blockchain-based ownership and metaverse expansion can make NFT investing appealing, especially in games like Axie Infinity or The Sandbox.

You Want Access to Exclusive Experiences: Some NFTs unlock events, online communities, or product drops, turning a digital token into a real-world pass.

You’re Comfortable with High-Risk Assets: NFT markets are volatile. If you already understand and accept this risk, they may serve as a small part of a speculative portfolio.

When You May Not Want to Invest in NFTs?

There are situations where NFTs might not fit your goals or risk profile, especially if you prioritize stability or regulatory clarity.

You Need Stable or Income-Generating Assets: NFTs typically don’t produce income and may lose value quickly, making them unsuitable for conservative or income-focused investors.

You’re Unfamiliar with Blockchain or Crypto Wallets: If you don’t understand how wallets or gas fees work, there’s a steep learning curve that could lead to costly mistakes.

You’re Concerned About Scams or Regulation: The NFT space is underregulated, and scams are common—especially on lesser-known platforms or with celebrity hype drops.

You Expect Quick or Guaranteed Returns: NFT investing is speculative. If you're seeking fast profits or guarantees, this may not be the right space for you.

FAQ

Yes, some NFTs offer staking rewards or in-game yield, but most are speculative and don’t provide regular income. Be sure to check the project’s tokenomics before buying.

NFTs are not considered inflation hedges. They are speculative digital assets and may lose value rapidly during economic uncertainty or crypto downturns.

Many investors chase hype without doing proper research, overlook gas fees, or fall for fake collections. Always verify authenticity and project credibility.

Some specialized crypto insurers offer coverage for NFT losses due to theft or hacks, but policies are limited and can be expensive or region-specific.

Unlike stocks or real estate, NFTs don’t generate revenue or cash flow. Their value depends on demand, rarity, and cultural or utility-driven relevance.

Certain DeFi platforms allow NFTs to be used as collateral for loans, but only for highly liquid, well-known collections like Bored Apes or CryptoPunks.

NFTs are usually taxed as property. Selling them at a profit can trigger capital gains tax, and creators may owe income tax on primary sales.

If metadata is not stored on-chain, you may lose access to the actual asset. It’s safer to buy NFTs with fully decentralized storage protocols like IPFS.