Table Of Content

The world of investing can seem intimidating, especially for those starting with limited funds. But what if I told you that you don't need a fortune to get started and grow your wealth over time?

This article will guide you through the steps of starting your investment journey with a small amount of money.

1. Mutual Funds with Low Minimum Investments

Mutual funds with low minimum investments allow individuals to start investing with a small amount of money.

Investors pool their money together in these funds, which are then managed by professional fund managers who allocate the capital across various securities, like stocks and bonds, to diversify risk and aim for a return.

This makes it accessible for beginners or those with limited capital to start building a diversified portfolio without needing a large upfront investment.

-

Where Can I Invest?

Platforms like Charles Schwab, Fidelity, and Vanguard offer mutual funds with low minimum investments, making them accessible for investors with limited capital.

These companies provide a variety of funds, including index funds and target-date funds, allowing investors to start with small amounts and gradually build their portfolios.

-

Thins to Consider

When considering investing in a mutual fund with little money, it's important to take into account the following aspects:

- Understand the Fund's Objective: Know the fund's goals and if they align with your investment strategy.

- Check Expense Ratios: Lower initial investments might come with higher expense ratios.

- Diversification Benefits: These funds offer instant diversification, spreading risk across various assets.

- Performance Tracking: Review past performance, though it's not a guarantee of future results.

- Liquidity Considerations: Understand how to buy and sell shares in the fund.

- Research Fund Manager: Their experience and track record can impact the fund's success.

-

Pros & Cons

Pros | Cons |

|---|---|

Low entry point | Potentially higher expense ratios |

Professional management | Limited control over investment |

Diversification | Management fees |

Suitable for long-term goals |

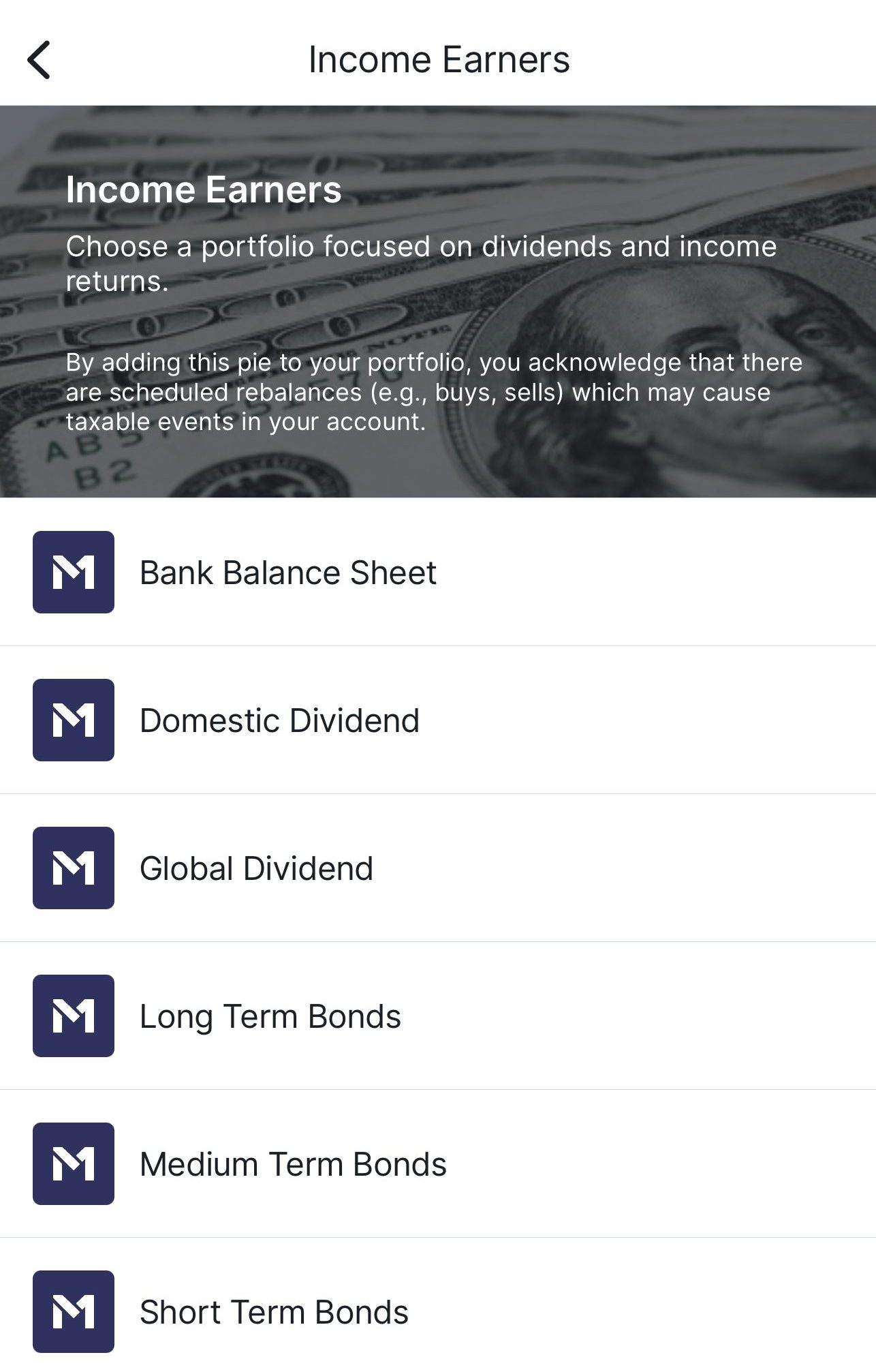

2. Robo-Advisors

Robo-advisors automate the investment process using algorithms to manage portfolios based on the investor's risk tolerance and financial goals.

After an initial questionnaire to determine these factors, the robo-advisor invests in a diversified portfolio, often using ETFs, and continuously rebalances to align with the investor's objectives.

The low minimum investment requirement and relatively low fee structure compared to traditional financial advisors make robo-advisors an attractive option for investors with limited funds.

-

Where Can I Invest?

Robo-advisors are widely available across various platforms, offering automated investment services. Examples include Betterment, Wealthfront, Ellevest, and Schwab Intelligent Portfolios.

-

Things to Consider

When considering investing with robo advisor with little money, it's important to take into account the following aspects:

- Understand the Fees: Know the cost structure, which typically includes a percentage of assets managed.

- Investment Goals: Your goals and risk tolerance guide the robo-advisor's strategy.

- Portfolio Types: Familiarize yourself with how your money will be invested, often in a mix of ETFs.

- Service Level: Be aware of what services are offered, like tax optimization or human advisors at higher tiers.

- Digital Interface: Comfort with managing investments online is crucial.

- Withdrawal: Understand the process and any associated fees or limitations.

-

Pros & Cons

Pros | Cons |

|---|---|

Automated portfolio management | Algorithm-based decisions |

Low fees compared to traditional advisors | Limited customization |

Easy and convenient | Fees |

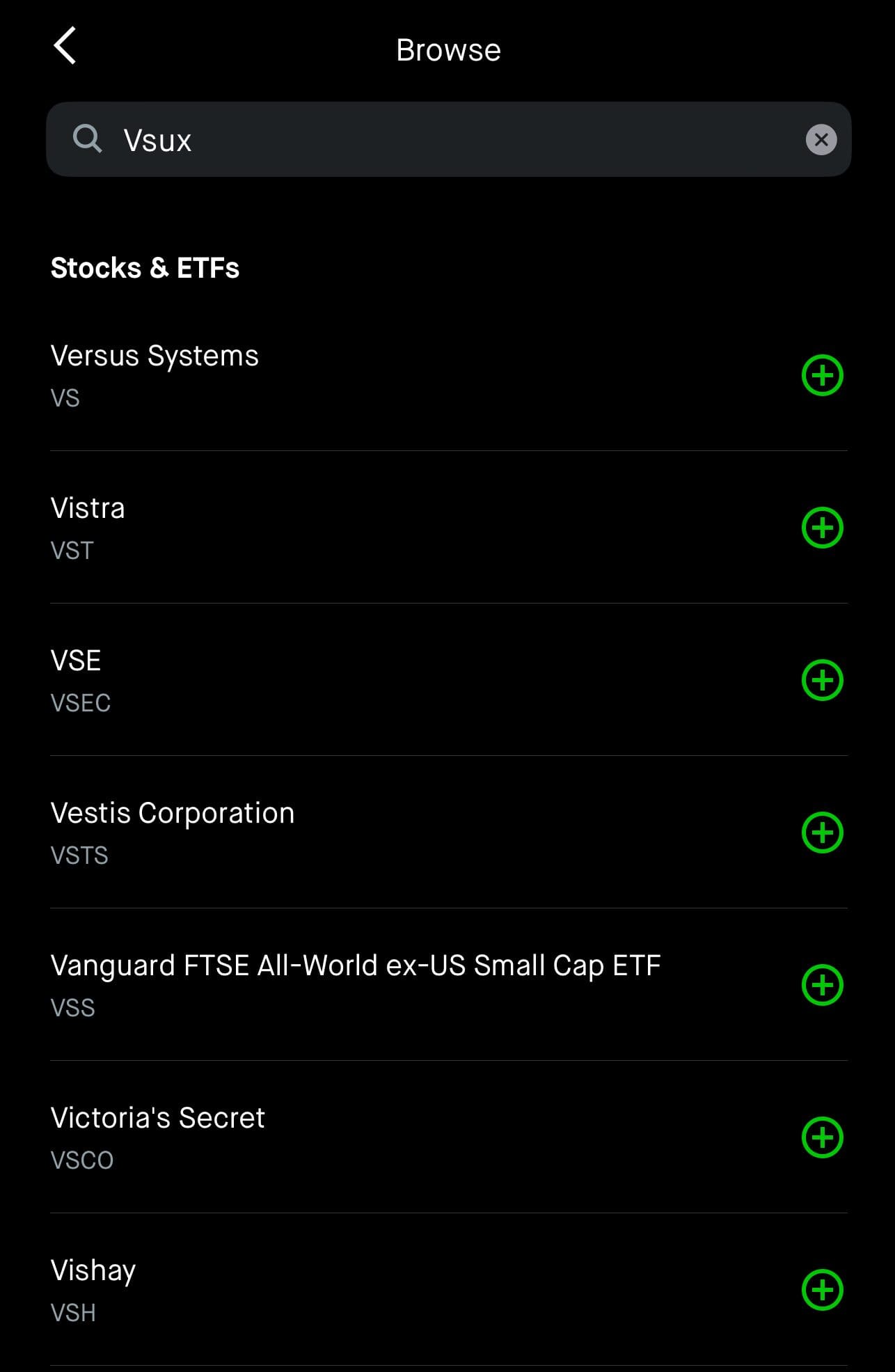

3. Investing In Fractional Shares

Investing in fractional shares allows investors to purchase a portion of a stock, ETF, or other securities, enabling them to own a piece of high-priced assets without buying a whole share.

Investors can diversify their portfolios across more securities, reducing risk and increasing potential for growth.

It's particularly beneficial for beginners with little money as it eliminates the barrier of high share prices, allowing investment in big-name companies and a broader market exposure with minimal initial capital.

This method aligns well with dollar-cost averaging strategies, where small, regular investments can grow over time.

-

Where Can I Invest?

Investing in fractional shares has become increasingly popular, and many platforms now offer this option. Examples include Robinhood, Charles Schwab, Fidelity, and Stash.

These platforms allow you to purchase a portion of a share, making it easier to invest in high-priced stocks with a smaller amount of money.

-

Things to Consider

When considering investing in fractional shares, it's important to take into account the following aspects:

- Understand the Process: Know how to buy and sell fractional shares on your chosen platform.

- Brokerage Selection: Choose a brokerage that offers fractional shares without high fees.

- Diversification: Use this opportunity to diversify your portfolio.

- Investment Strategy: Align fractional share investments with your financial goals.

- Market Research: Understand the stocks you're investing in, even fractionally.

- Long-term Perspective: Consider your long-term investment goals and how fractional shares fit into that.

- Liquidity and Pricing: Know how the brokerage handles the liquidity and pricing of fractional shares.

-

Pros & Cons

Pros | Cons |

|---|---|

Buy expensive stocks affordably | Limited availability in some assets |

Access to top-tier stocks | Market risks remain |

Suitable for dollar-cost averaging | May complicate portfolio tracking |

4. Automatic Investment Plans

Automatic investment plans allow investors to set up recurring investments into selected stocks, mutual funds, or ETFs at regular intervals, like monthly or quarterly.

This approach, often termed “dollar-cost averaging,” involves investing a fixed amount of money regardless of market conditions, which can mitigate the impact of market volatility.

For investors with limited funds, this strategy is advantageous because it doesn't require a large upfront investment; instead, it allows for building an investment portfolio gradually over time.

It encourages a disciplined investment habit, reduces the emotional decision-making often associated with investing, and can lead to significant portfolio growth through compounding over the long term.

-

Where Can I Invest?

Many online brokers and investment platforms offer automatic investment plans, such as Charles Schwab, Vanguard, Fidelity, and Betterment.

These platforms allow investors to automate their investment strategy, making it easier to commit to a long-term investment plan without the need to actively manage purchases.

-

Things to Consider

When considering automatic investment plans, it's important to take into account the following aspects:

- Selecting Investments: Choose which stocks, funds, or ETFs you want to invest in.

- Investment Frequency: Decide how often you want to invest (e.g., weekly, monthly).

- Amount to Invest: Determine the fixed amount you can comfortably invest regularly.

- Brokerage Accounts: Ensure your brokerage offers automatic investment plans.

- Fees: Be aware of any transaction or management fees associated with your investments.

- Long-term Commitment: Understand that this is a long-term strategy that benefits from consistency.

- Market Fluctuations: Your investment buys more shares when prices are low and fewer when they're high, which can average out investment costs.

-

Pros & Cons

Pros | Cons |

|---|---|

Encourages regular saving | Limited control over timing |

Reduces emotional investing | May incur transaction fees |

Enables portfolio growth | Requires long-term commitment |

5. Investment Apps

Investment apps offer a user-friendly platform for individuals to buy and sell securities, manage portfolios, and access financial information with minimal fees.

These apps often allow for investing in fractional shares, enabling users to invest in high-priced stocks with small amounts of money. This democratizes investing, making it accessible to those with limited capital.

The apps provide educational resources, making them ideal for beginners. Their low-cost structure, ease of use, and flexibility in investment choices make them an excellent entry point for investors with little money.

-

Where Can I Invest?

Investment apps like Robinhood, Acorns, and Stash are designed for investors with little money. Robinhood offers commission-free trades, Acorns rounds up your purchases to invest spare change, and Stash allows investing in fractional shares.

These apps are user-friendly, making investing accessible and straightforward for beginners.

-

Things to Consider

When considering investing through investment apps, it's important to take into account the following aspects:

- Research the App: Choose an app that aligns with your investment goals and needs.

- Understand the Fees: Be aware of any associated fees, including transaction or service fees.

- Investment Options: Know what investments are available on the app.

- Security: Ensure the app has robust security measures to protect your financial information.

- Ease of Use: The app should have an intuitive interface.

- Educational Resources: Look for apps that provide learning tools for investors.

- Customer Support: Ensure there is reliable customer support.

-

Pros & Cons

Pros | Cons |

|---|---|

Low or no minimum investment | Can encourage frequent trading |

Easy to start and manage | Fees can add up |

Access to a variety of assets | May lack in-depth research tools |

FAQs

Dollar-cost averaging involves regularly investing a fixed amount of money, which can reduce the impact of market volatility and is an effective strategy for investors with limited funds.

While the financial risk is lower when investing small amounts, the principles remain the same: investments can go up or down, so it's important to choose wisely and be prepared for market fluctuations.

Focus on diversified, low-cost index funds or ETFs, and consider using tools or services that offer guidance based on your financial goals and risk tolerance.

Yes, many high-yield savings accounts have low or no minimum deposit requirements, making them accessible for investors with little money.

Yes, thanks to the power of compounding interest and market growth over time, even small investments can grow significantly.

Most investment platforms offer tools and dashboards to track your investment performance, enabling you to monitor growth and make informed decisions.

Common mistakes include not diversifying, investing based on emotions, neglecting to research, and not considering fees that can erode small investment gains.

For very small investments, a robo-advisor or self-education may be more cost-effective, but for those seeking personalized advice, a human advisor could be beneficial, even for small portfolios.

While traditional real estate investing might be out of reach, small investors can consider real estate crowdfunding platforms or REITs (Real Estate Investment Trusts) that allow investment in real estate with smaller amounts of money.