|

| |

|---|---|---|

JM Bullion | Silver Gold Bull

| |

Min. Investment | $0 | $0 |

Established | 2011 | 2009 |

Storage Fees | 0.5% – 1%

Varies by account, usually 0.5% – 1% . Estimated annual fee. | $225 – $275

$225 for Pooled Storage, $275 for Segregated Storage . Estimated annual fee. |

Coin & Bar Selection | Strong, includes new arrivals | Very wide, includes jewelry & collectibles

|

Payment Methods | Cards, PayPal, Wire, eCheck, Crypto | Cards, PayPal, Wire, eCheck, Crypto |

Pricing Transparency | Real-time spot price updates | Real-time spot price updates |

Best For | IRAs, tools & investing insights | Direct buyers, price match seekers

|

Our Rating |

(4.3/5) |

(4.5/5) |

Read Review | Read Review |

Trust & Reputation: JM Bullion vs Silver Gold Bull

Our winner: Silver Gold Bull – Thanks to stronger Trustpilot scores and overall reputation for customer satisfaction.

While JM Bullion maintains solid reviews (Trustpilot 4.3 with 1,493 reviews), Silver Gold Bull holds a higher Trustpilot rating of 4.8 based on over 4,400 reviews.

[elementor-template id=”203457″]

JM Bullion has more reviews on Consumer Affairs and maintains an A+ with the BBB, but Silver Gold Bull's strong track record, especially on Trustpilot, gives it a reputation edge.

[elementor-template id=”203485″]

Silver Gold Bull also offers broader support options, including live chat, which adds to the customer satisfaction experience.

Direct Gold & Silver Buying: Who’s Better?

Our winner: Silver Gold Bull is our preferred choice for direct purchases, due to its competitive pricing, price match guarantee, and broader product variety including collectibles and jewelry.

When it comes to buying physical gold and silver, both JM Bullion and Silver Gold Bull are strong players with several shared strengths:

Where They’re Both Strong:

Product Range: Both offer gold, silver, platinum, palladium, and copper products in coins, bars, and rounds.

Free Shipping: Orders over $199 qualify for free, insured delivery.

Payment Flexibility: Both accept credit cards, wire transfers, PayPal, e-checks, and even cryptocurrencies like Bitcoin.

Buyback Program: Each dealer offers a reliable buyback program based on real-time spot prices.

Where Silver Gold Bull Stands Out:

Price Match Guarantee: Silver Gold Bull will match prices from other authorized dealers, offering peace of mind for bargain hunters.

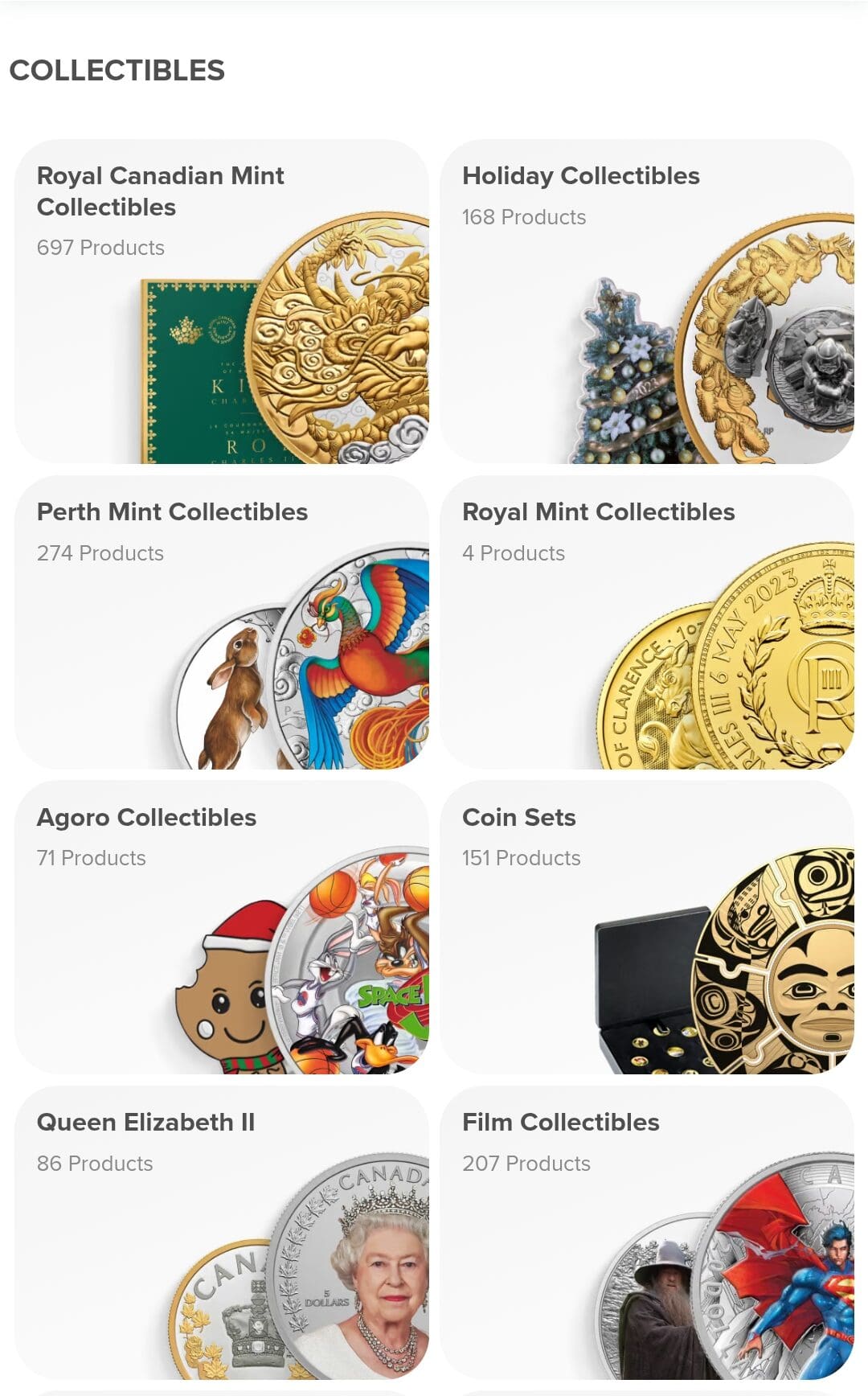

Wider Product Variety: In addition to traditional bullion, they sell numismatic coins, gold jewelry, and collectibles.

Military Discount: A unique perk for veterans and active-duty service members.

Live Chat & Great Website UX: The Silver Gold Bull website is one of the most intuitive platforms.

Where JM Bullion Stands Out:

AutoBuy Tool: Lets you schedule recurring gold or silver purchases automatically.

Investor Tools: Features like the Fear & Greed Index and live charts enhance investor insights.

Website User Experience: Smoother interface, easy navigation, and faster checkout.

Ultimately, Silver Gold Bull’s aggressive pricing approach, price match feature, and extensive selection make it the more attractive option for direct precious metal buyers—especially those purchasing larger quantities or seeking unique items.

Best Gold IRA: Silver Gold Bull or JM Bullion?

Our preferred choice for precious metal IRAs is JM Bullion, mainly due to its storage flexibility, transparent fee structure, and easy-to-follow process.

Both companies support Gold and Silver IRAs through partnerships with trusted third-party custodians, but JM Bullion holds an edge when it comes to investor convenience and international storage options.

Where Both Are Strong:

IRA-Eligible Metals: Offer a broad range of IRS-approved gold, silver, platinum, and palladium.

Third-Party Custodian Partnerships: Work with established custodians to set up and manage IRAs.

Storage Security: Provide secure, insured storage in IRS-approved vaults.

No Minimums: Both allow flexible entry points for IRA investors.

Where JM Bullion Excels:

Transparent Fee Info: Clearly outlines setup, admin, and storage fees on its website.

Global Storage Options: Partners with TDS Vaults in Las Vegas, Zurich, Toronto, and Singapore—offering more flexibility for international-minded investors.

IRA Support Tools: Offers assistance from IRA specialists and live pricing tools to help time purchases.

Self-Service Buyback: Allows investors to liquidate IRA assets quickly through an online tool without needing to call.

Where Silver Gold Bull Falls Short:

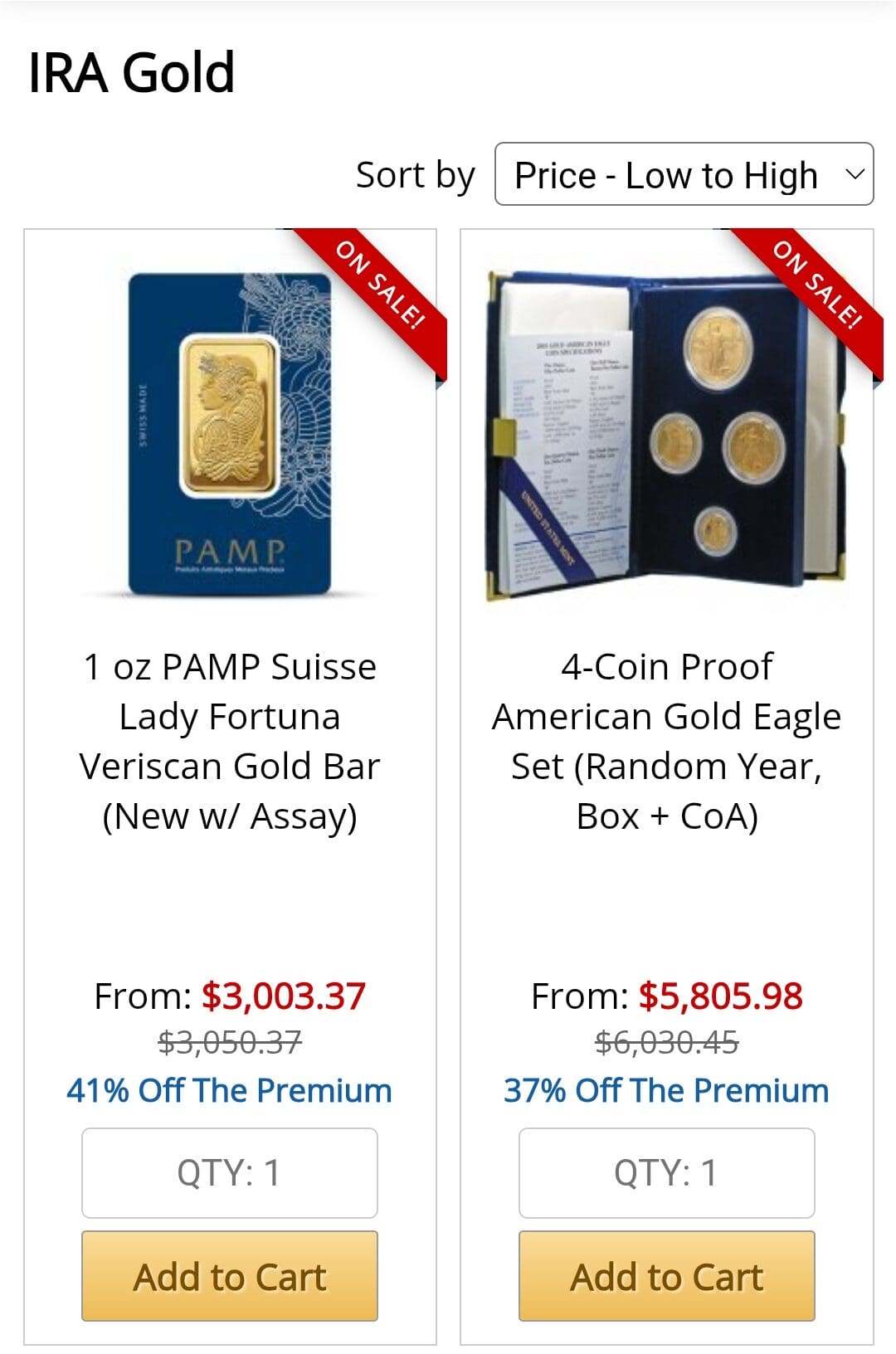

Less Transparency: You’ll need to call or email to get exact fee info.

Fewer Investor Tools: While helpful content is available, the platform doesn’t offer live pricing tools or IRA-focused utilities like JM Bullion does.

JM Bullion’s streamlined process and clearer costs make it our top choice for investors looking to add gold or silver to their retirement accounts.

Final Verdict: Silver Gold Bull vs JM Bullion

Overall, Silver Gold Bull is ideal for investors focused on physical metal purchases, while JM Bullion stands out for retirement investors seeking IRAs.

- Ratings Winner: Silver Gold Bull – Higher Trustpilot score and broader support options.

- Best for Direct Purchase: Silver Gold Bull – Price match, broader selection, and extra buyer perks.

- Best for IRA: JM Bullion – More transparency, better tools, and global storage flexibility.

Both are top-tier platforms—your choice should depend on your investment goals.