J.P. Morgan Self Directed Investing | Fidelity | |

Monthly Fee | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

|

Account Types | Brokerage, Retirement | Brokerage, Retirement, Wealth Management |

Savings APY | 0.01% – 3.99% | 3.94% |

Minimum Deposit | $0 | $0 – $2M

No minimum for Fidelity Go® and brokerage, $500,000 for Fidelity® Wealth Management, $2 million for Fidelity Private Wealth Management®

|

Best For | Existing Chase Customers, Active Investors Looking To Minimize Fees | Technical Traders, High Net Worth, Financial Planning |

Read Review | Read Review |

JPM Self-Directed vs Fidelity: Compare Features

Fidelity’s platform is better suited for those who prioritize detailed analysis, robo advisor and a wider range of investment choices, whereas JPM is more appealing to those who value simplicity and integration with banking services.

Fidelity | JPM Self-Directed Investing | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | 800 stocks and ETFs, 8,000+ mutual funds |

Investing Types | Stocks, Options, Margin, ETFs, Bonds & CDs, Precious metals, Crypto, Mutual Funds | Stocks, Options, ETFs, Fixed Income, Mutual Funds |

Automated Investing | Yes | No |

Paper Trading | No | No |

IPO Access | Yes | No |

Dedicated Advisor | Yes | No |

-

Self Investing And Fundamental Analysis Options

Fidelity is a clear winner in this category.

Fidelity excels in providing a broad array of investment options, including stocks, ETFs, mutual funds, options, and bonds, along with sophisticated research tools and analytics.

Recently, they added a crypto account:

For fundamental traders, Fidelity provides an extensive suite of research tools that go beyond basic stock information.

Users can access in-depth financial statements, analyst ratings, earnings reports, and valuation metrics for individual companies.

Here's an example of the deep insight in Fidelity: Fidelity Social Sentiment is a tool that leverages social media data to gauge market sentiment on specific stocks:

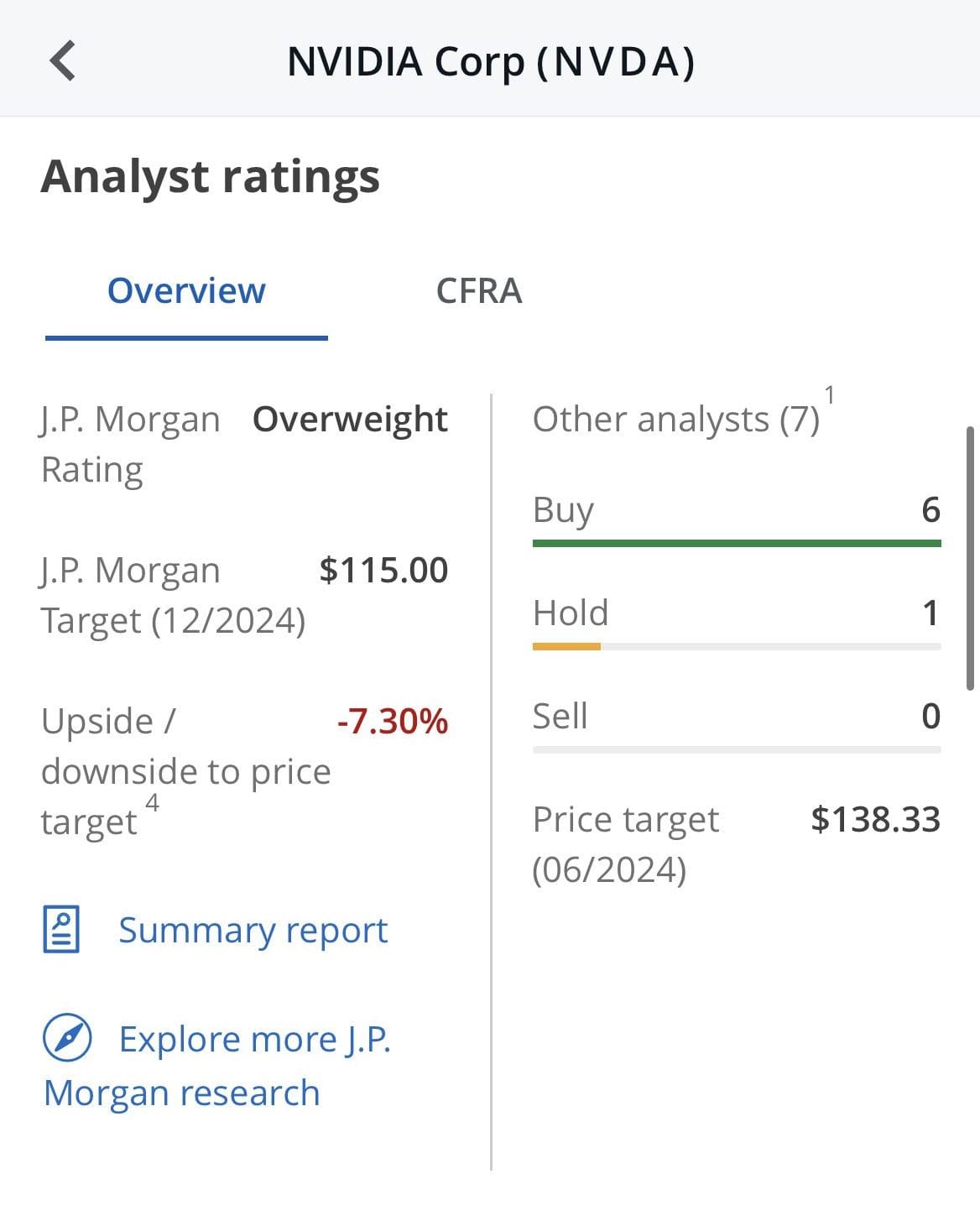

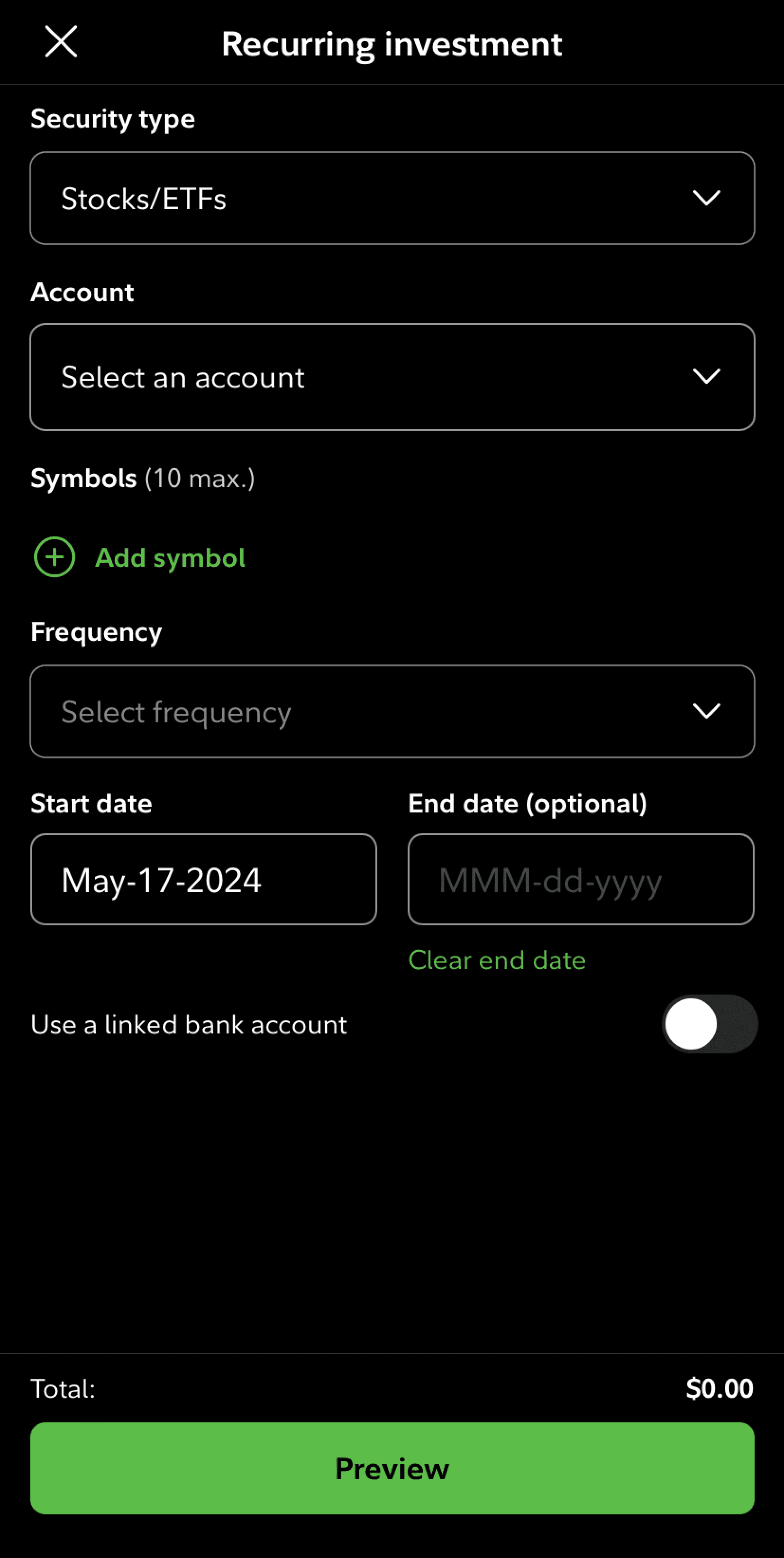

JPM Self-Directed Investing is great for investors who want a simple, easy-to-use platform. For individual stocks, you get access to recent analyst updates, stats, press releases, and the latest news, so you have all the info you need to make smart investment choices.

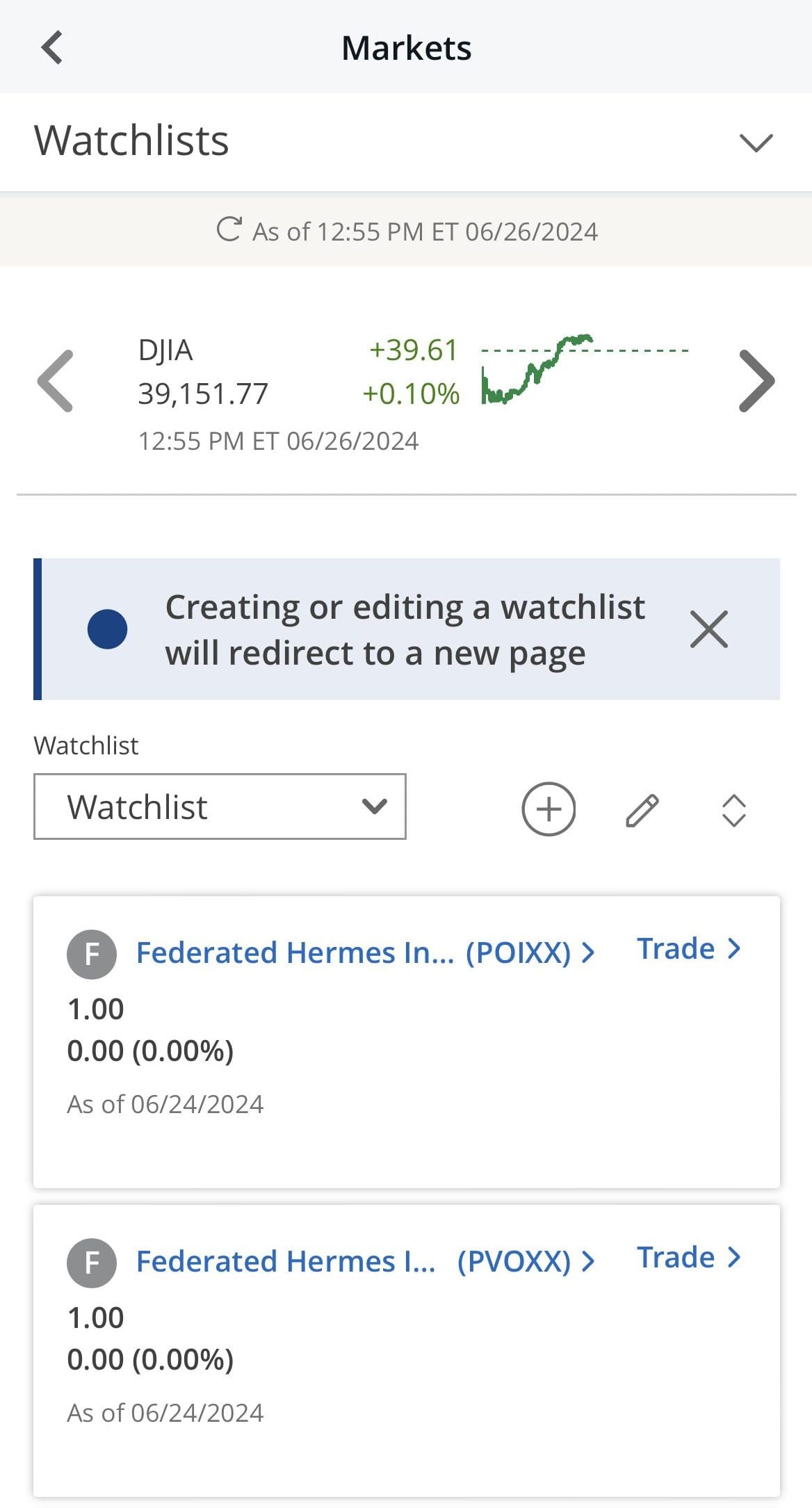

The platform also offers handy features like weekly economic reports, watchlists, and asset allocation charts to help you stay on top of your investments.

The stock screener is a standout tool, letting you filter stocks by sector, industry, market cap, TTM, dividend yield, and more.

If you're interested in socially responsible investing (SRI) or focusing on environmental, social, and governance (ESG) factors, JPM offers solid options to meet those needs.

-

Trading Options And Technical Analysis Tools

JP Morgan Self-Directed Investing provides solid technical analysis tools for the average trader, but if you're looking for more advanced features, Fidelity might be a better option.

Fidelity offers comprehensive charting capabilities through its Active Trader Pro software, allowing users to customize charts with a wide range of technical indicators, such as moving averages, Bollinger Bands, MACD, and RSI.

These tools enable traders to analyze price movements, trends, and potential reversals with precision.

Fidelity also provides advanced drawing tools that allow users to add trendlines, Fibonacci retracements, and other visual aids to their charts, helping to identify key support and resistance levels

In contrast, JP Morgan Self-Directed Investing is a good choice if you're looking to try out options trading without getting overwhelmed by complex features.

It provides the basic tools you need, like charting and stock screeners. When it comes to technical analysis, you can create specific charts based on indicators like volume, momentum, and trends.

The platform lets you use upper and lower indicators, such as moving averages, linear regression, and high/low ratios, giving you deeper insights to make more informed decisions.

-

Robo Advisor And Automated Investing

Fidelity is a clear winner here, as JPM Self-Directed Investing does not offer a dedicated robo-advisor or automated investing service.

Fidelity excels in providing robust automated investing options through its Fidelity Go and Fidelity Managed FidFolios℠ services.

Fidelity Go is a user-friendly robo-advisor that automatically creates and manages a diversified portfolio based on your goals and risk tolerance.

The platform builds and manages portfolios automatically, rebalancing them as needed to keep investments aligned with the investor’s goals.

Fidelity Managed FidFolios℠ takes automated investing a step further by offering personalized portfolio management with the option to include thematic investing based on specific interests or values.

-

Retirement Accounts

Fidelity is our top choice if you're focused on retirement investments, particularly planning, as its services are highly geared toward retirement-focused strategies.

Fidelity is widely recognized for its comprehensive suite of retirement products, making it a go-to platform for retirement planning. Fidelity offers a broad range of IRA options, including Traditional, Roth, SEP, and SIMPLE IRAs, with no fees or minimums to open accounts.

The platform is equipped with retirement planning tools that help investors estimate their retirement needs, track contributions, and monitor their progress towards retirement goals.

Fidelity also excels in providing access to professional advice, allowing investors to consult with dedicated advisors to tailor retirement plans that include strategies for tax efficiency, estate planning, and more.

JPM Self-Directed Investing provides a straightforward option for those looking to manage their own retirement savings with no annual account fees and no commissions on trades for traditional and Roth IRAs.

However, JPM’s retirement offerings are somewhat limited, focusing primarily on basic IRAs without the broader variety of retirement products or advanced planning tools.

-

Fees

When it comes to fees, both platforms models are quite similar.

Fidelity offers commission-free trading on most stocks and ETFs and low fees on other investment options

JPM Self-Directed Investing shines with its straightforward, no-commission trading for U.S. stocks, ETFs, and mutual funds.

Fidelity | JPM Self-Directed Investing | |

|---|---|---|

Fees | 0% – 1.04%

Fidelity Go® Robo advisor: $0: under $25,000, 0.35%/yr: $25,000 and above

Fidelity® Wealth Management dedicated advisor: 0.50%–1.50%

Fidelity Private Wealth Management® advisor-led team: 0.20%–1.04%

| $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract |

When it comes to robo advisor, Fidelity is free for a small portfolio of up to $25,000 and 0.35% (0% under $25,000) for above $25K.

For a higher balance, the fee is 0.35% (0% under $25,000), and it can be higher if you use a dedicated advisor.

-

Cash Management And Savings Rates

When it comes to banking options, Fidelity offers more attractive options.

Fidelity Cash APY | JPM Self-Directed Cash APY | |

|---|---|---|

Savings APY | 3.94% | 0.01% – 3.99% |

Fidelity’s Cash Management Account stands out for its flexibility and comprehensive features. For those looking for pure savings, Fidelity offers the FDIC Insured Deposit Sweep Program, but the rates are not so competitive.

However, customers can secure higher rates with Fidelity CDs or the Fidelity Government Money Market Fund.

Fidelity’s account comes with no fees or minimums and offers unlimited ATM fee reimbursements, Bill Pay, mobile check deposit, and a debit card with digital wallet compatibility.

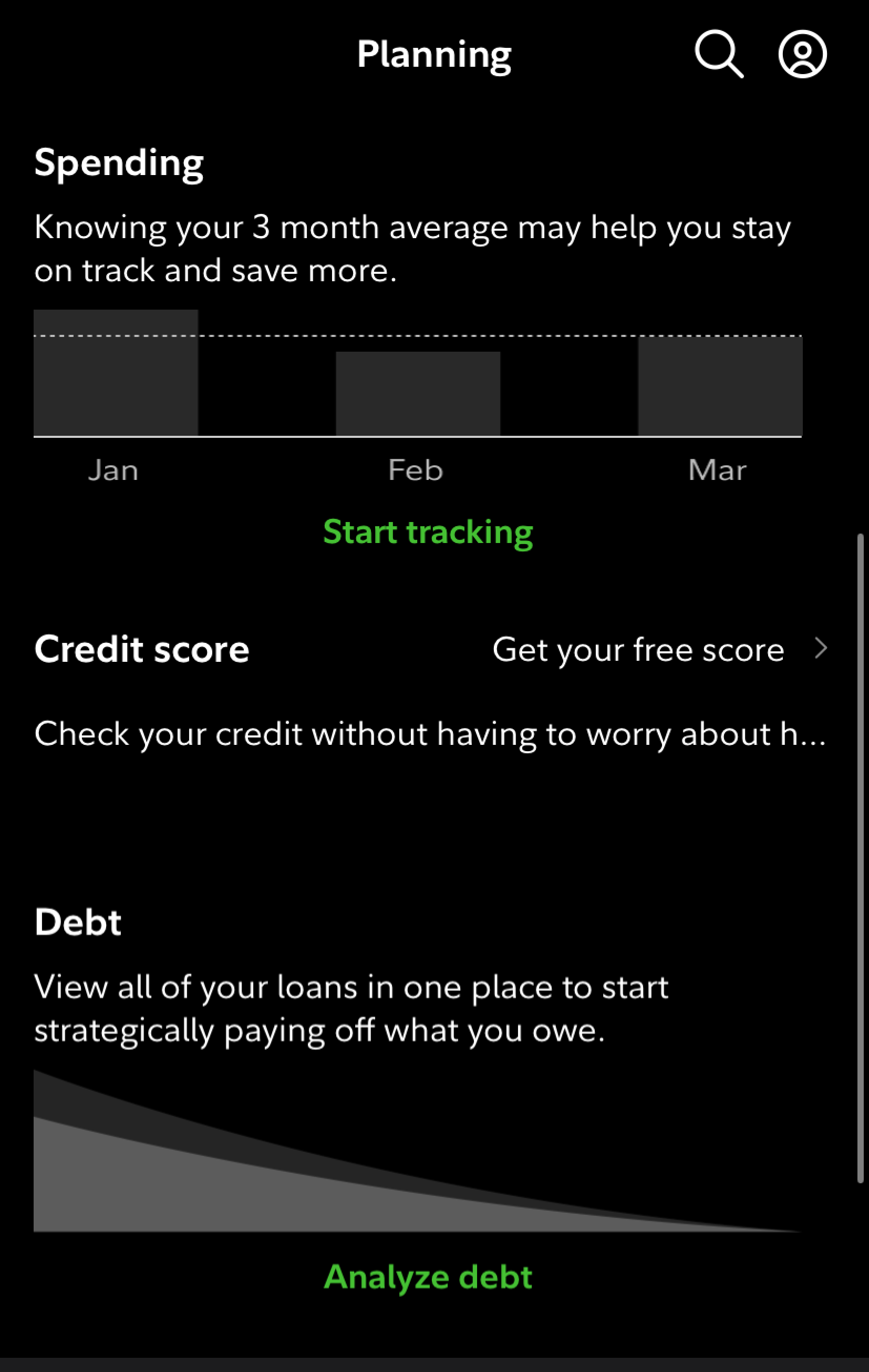

JPM Self-Directed Investing works seamlessly with Chase bank accounts, making it a great option if you're already a Chase customer. This integration makes it easy to transfer money between your investment and banking accounts, streamlining your overall financial management.

However, there's no dedicated cash management option for JPM self-directed customers, and the interest rates on uninvested cash are very low, usually around 0.01%.

-

Wealth Management Options

Both Fidelity and JP Morgan offer excellent options for those who need personal wealth management,

Fidelity offers two main tiers of wealth management services: Wealth Management and Private Wealth Management.

- Wealth Management, designed for clients with a minimum of $500,000 in investable assets, provides a dedicated advisor to develop a customized financial plan covering retirement, estate planning, tax strategies, and investment management.

- Private Wealth Management is for clients with at least $2 million in managed assets or $10 million in total assets with Fidelity.

J.P. Morgan provides two levels of personalized financial advisory services: Personal Advisors and Private Client Advisors, each tailored to meet the specific needs of their clients.

- Personal Advisors offer virtual financial planning, supported by ongoing advice and expert-built portfolios equipped with automated tax-efficient technology.

- For those seeking a more exclusive service, J.P. Morgan Private Client Advisors cater to clients with $100,000 or more in investable assets.

Bottom Line

JPM Self-Directed Investing is ideal for those who value simplicity, especially existing Chase customers, offering basic tools for trading and analysis.

Fidelity, on the other hand, excels with its wide range of investment options, robust research tools, advanced trading features, and excellent retirement planning services.

Fidelity vs. Competitors: How Does It Stack Up?

Both Schwab and Fidelity offer great options for traders, plans for wealth management, and sophisticated auto-investing platforms.

Fidelity excels in investment options, wealth management, and retirement planning. Webull trading platform is one of the most fascinating we've seen.

Both platforms have great options for investors, but Fidelity excels in comprehensive retirement planning and cash management options

Interactive Brokers vs. Fidelity: Which Brokerage Suits Your Investing Style?

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Fidelity in retirement planning and personalized wealth management, while E-Trade stands out with its research tools and competitive savings rates

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners

Fidelity is our choice due to its better retirement options and more extensive trading app. But, the differences are insignificant.

How J.P. Morgan Self Directed Compares to Other Online Brokers

Both offer similar tools for the average investor or trader, but Merrill is better at automated investing. Here's our full comparison:

J.P. Morgan Self-Directed Investing vs. Merrill Edge: Compare Brokerage Accounts

If you're an experienced investor or trader, IBKR may be a better option. If you're a Chase customer or prefer simplicity, consider JP Morgan.

Interactive Brokers vs. J.P. Morgan Self-Directed Investing: Which Broker Wins?

Vanguard offers a better approach for serious investors, while JP Morgan's self-directed is better for beginners and advanced traders

Vanguard vs. J.P. Morgan Self-Directed: Which Broker is Best For You?

Schwab surpasses JPM self-directed in most categories, including self-directed investing, robo advisory, and technical analysis.

Schwab vs. J.P. Morgan Self-Directed: Which Brokerage Is Best?

JP Morgan is best for the average investor seeking a simple platform or wealth management, but E-Trade is our overall winner. Here's why.

J.P. Morgan Self-Directed Investing vs. E-Trade: Which Broker Wins?

JP Morgan wins when it comes to fundamental investing tools, but Robinhood is better for technical analysis and trading. Here's why:

J.P. Morgan Self-Directed Investing vs. Robinhood: Compare Brokerage Accounts