| ||

|---|---|---|

J.P. Morgan Self Directed Investing | Merrill Edge | |

Monthly Fee | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor |

Account Types | Brokerage, Retirement | Brokerage, Retirement, Wealth Management |

Savings APY | 0.01% – 3.99% | 0.01% – 3.77%

|

Minimum Deposit | $0 | $0 – $50,000

Merrill Edge Self-Directed Trading: $0 Merrill Guided Investing – Robo Advisor: $1,000 for growth-focused strategies OR $50,000 for income-focused strategies Merrill Guided Investing – Online Advisor : $20,000 for growth-focused strategies OR $50,000 for income-focused strategies |

Best For | Existing Chase Customers, Active Investors Looking To Minimize Fees | Bank of America Customers, Advanced Traders |

Read Review | Read Review |

JPM Self-Directed vs Merrill Edge: Comparison

JPM Self-Directed Investing excels in accessibility and ease of use, making it ideal for beginners and those seeking seamless banking and investing integration.

Merrill Edge | JPM Self-Directed Investing | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | 800 stocks and ETFs, 8,000+ mutual funds |

Investing Types | Stocks, Options, Margin, ETFs, Bonds & CDs, Mutual Funds, Margin | Stocks, Options, ETFs, Fixed Income, Mutual Funds |

Automated Investing | Yes | No |

Paper Trading | No | No |

IPO Access | No | No |

Dedicated Advisor | Yes | No |

Merrill Edge, on the other hand, is more suitable for experienced investors who require advanced analysis tools, comprehensive research, and a wider array of investment options.

-

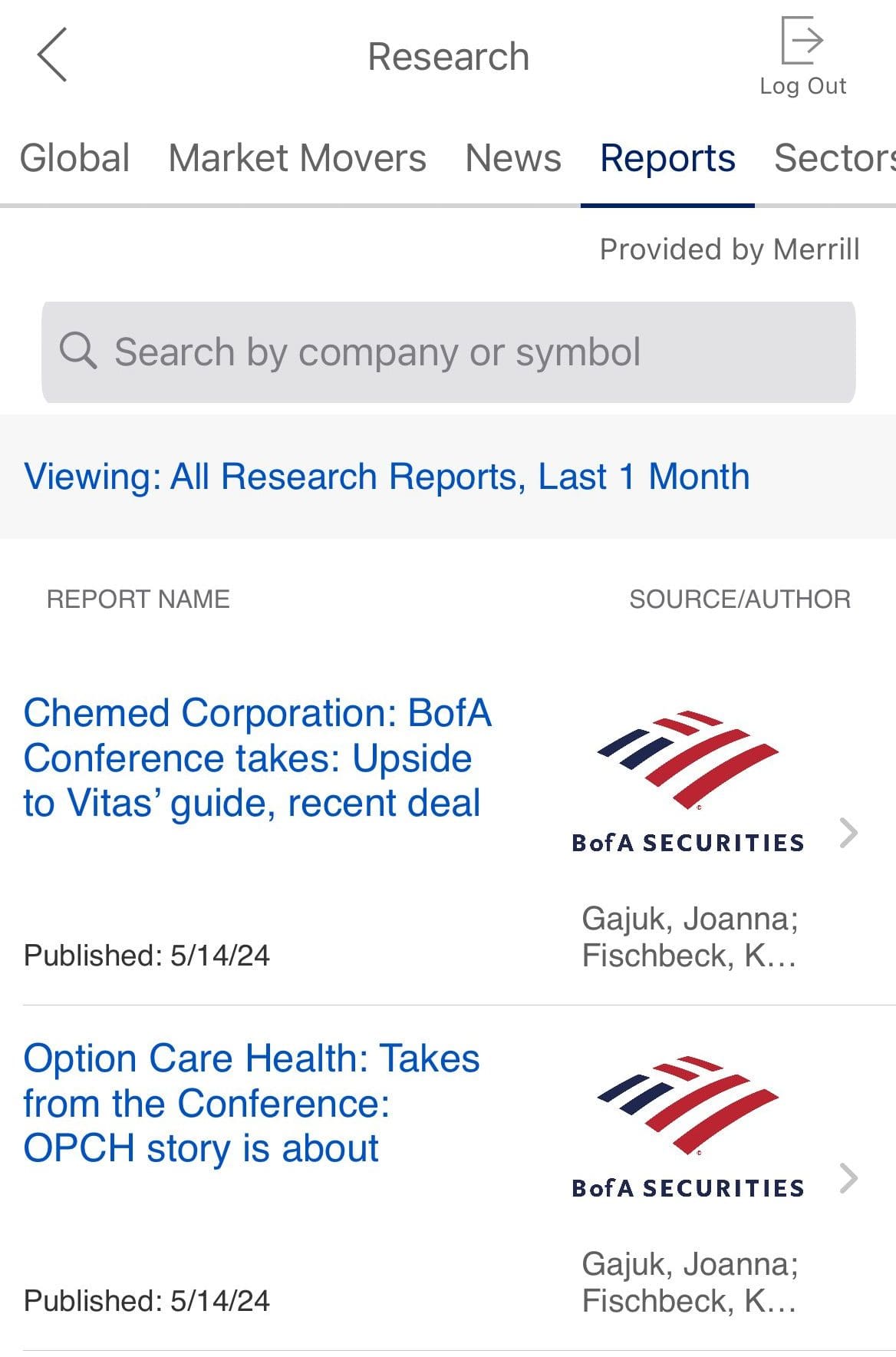

Self Investing And Fundamental Analysis Options

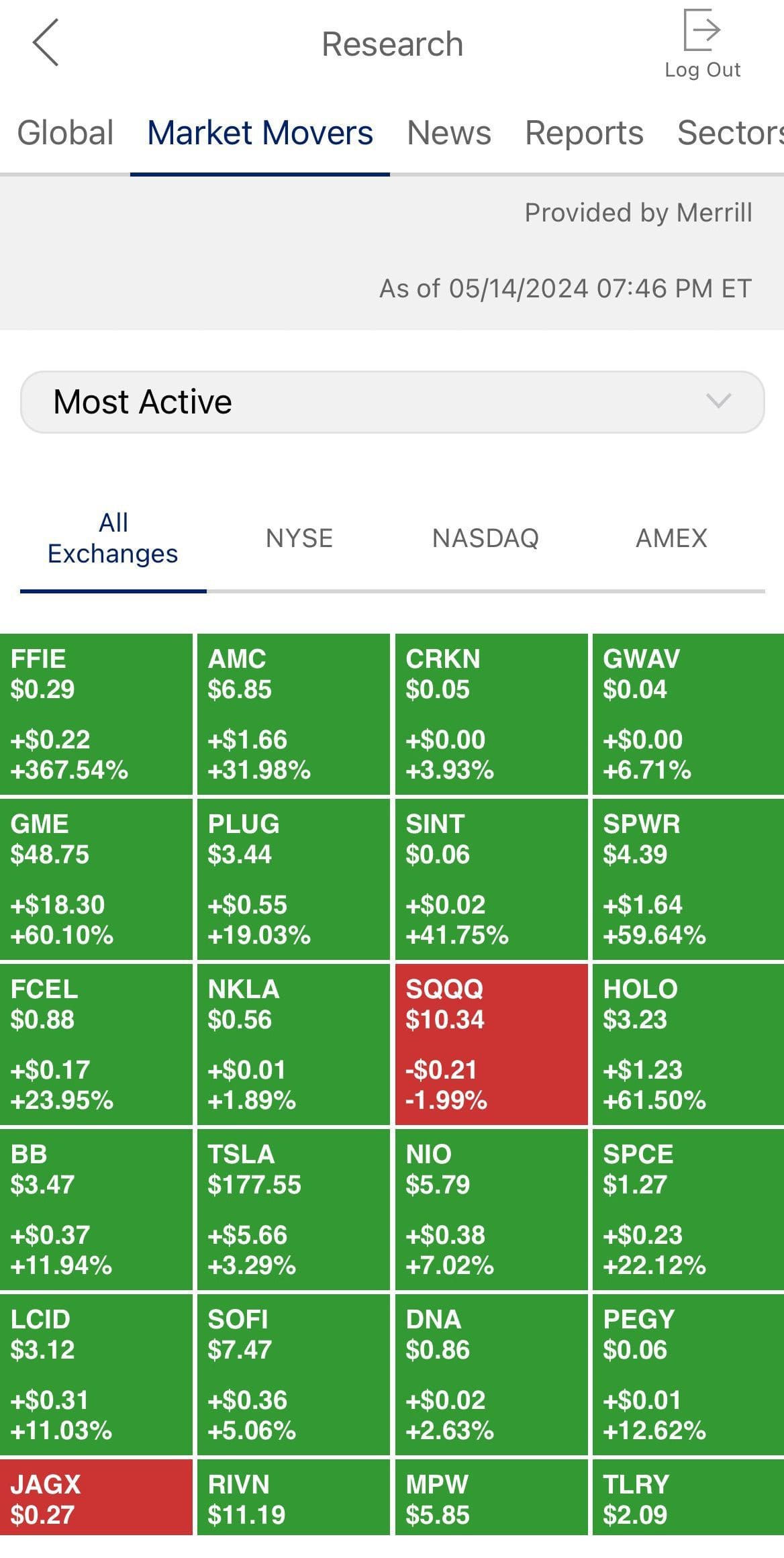

Merrill Edge is our winner in self-investing, but the difference is insignificant.

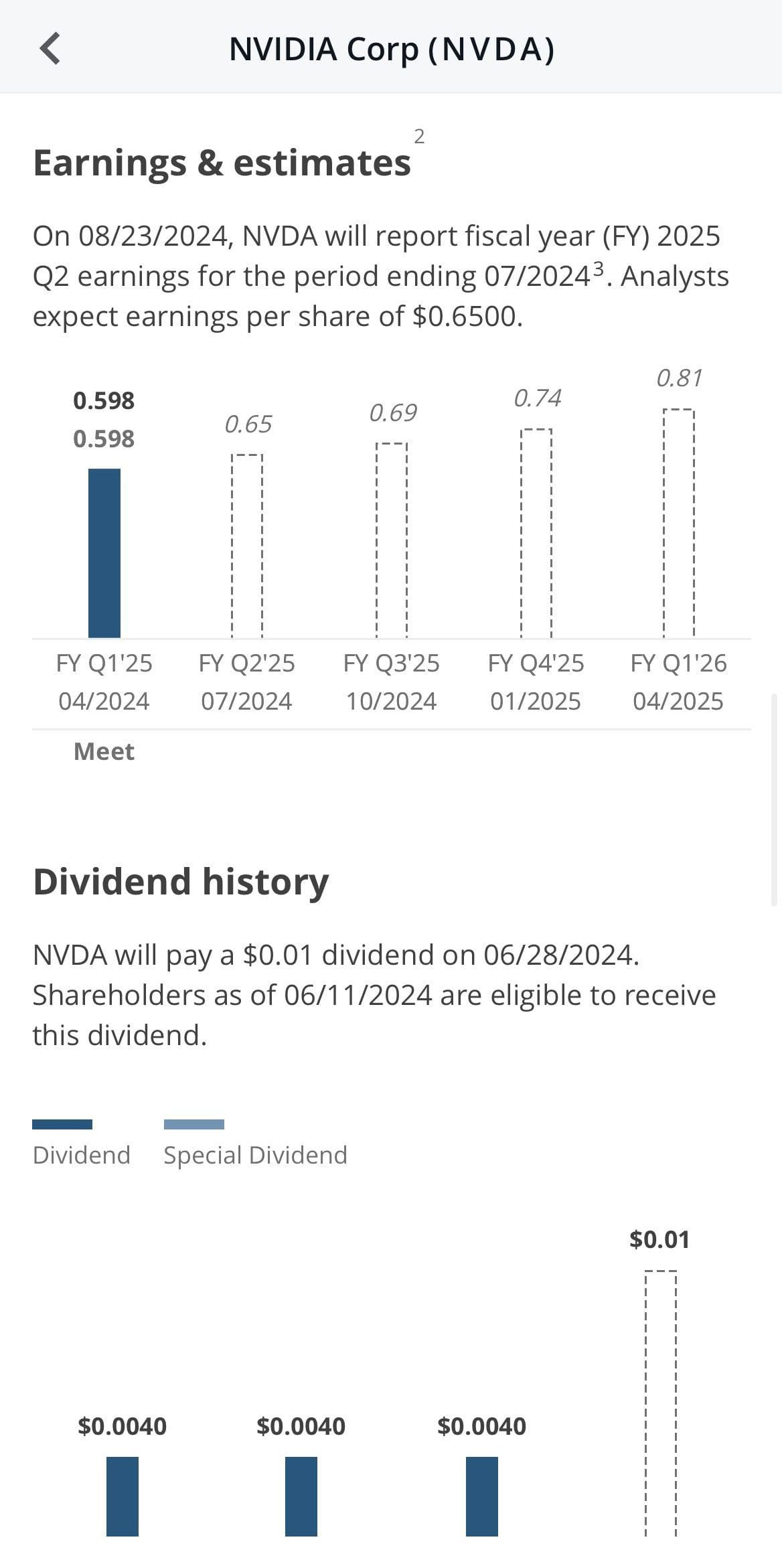

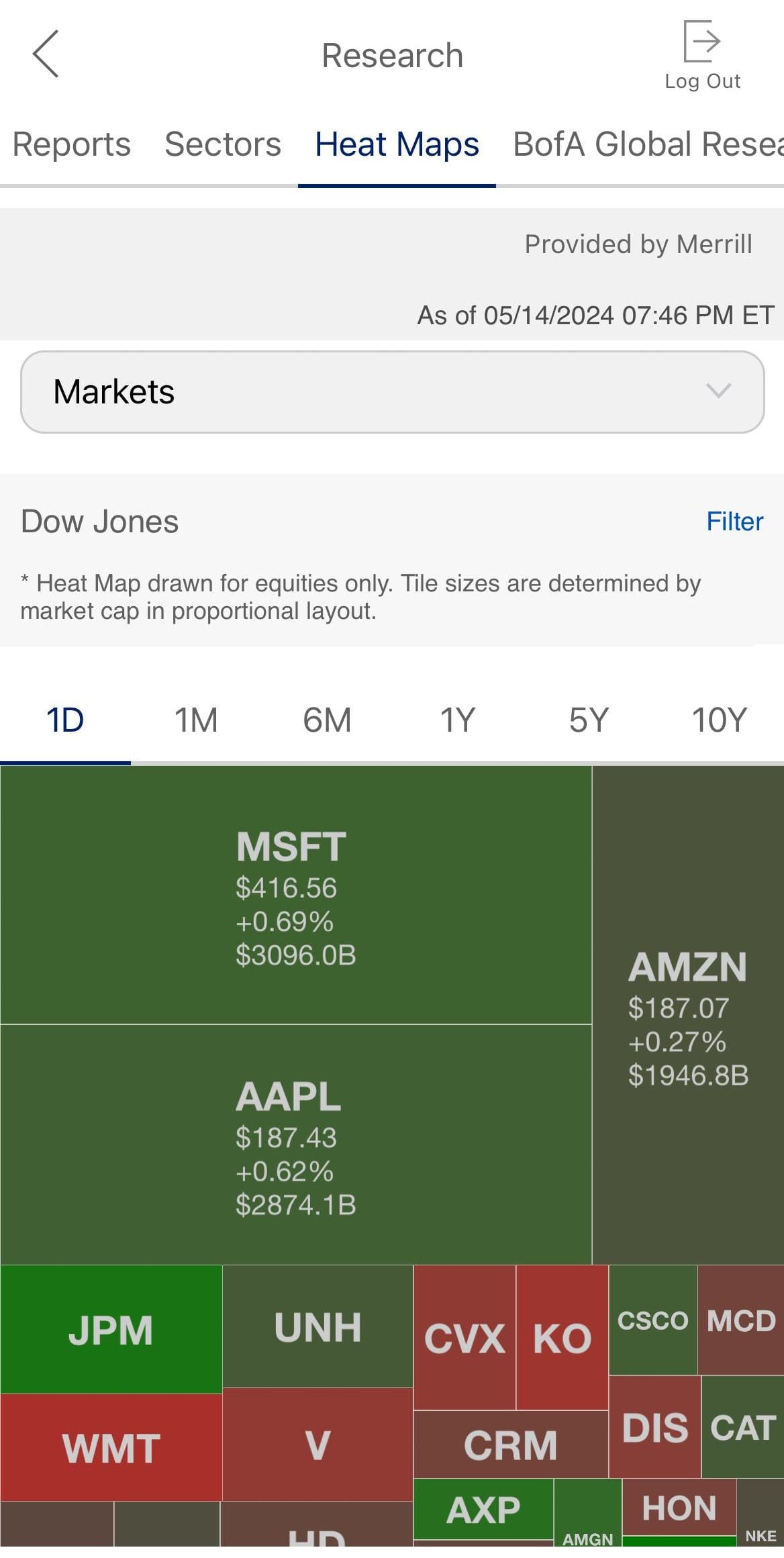

Merrill Edge excels in user-friendly tools and seamless integration with Bank of America, making it ideal for investors who value convenience and accessibility.

Its platform is particularly strong in providing comprehensive research and insights, including Morningstar ratings and extensive market analysis.

The platform includes essential research and screening tools, allowing users to perform basic fundamental analysis and portfolio monitoring, but it lacks more advanced tools and third-party research, limiting its appeal to more experienced investors.

On the other hand, JPM self directed customers have access to recent analyst updates, statistics, press releases, and the latest news, providing comprehensive information to support informed investment decisions.

Investors can take advantage of features like weekly economic reports, watchlists, and asset allocation charts.

JPM also stands out with its integration of fractional shares, which lowers the entry barrier for those with limited funds.

The stock screener is particularly useful, allowing users to filter stocks by sector, industry, market cap, TTM, or annual dividend yield.

-

Trading Options And Technical Analysis Tools

Both JPM Self-Directed Investing and Merrill Edge are quite similar tools when it comes to technical analysis. Both don't have the richest tools in terms of features and options, but it's good enough for the average trader.

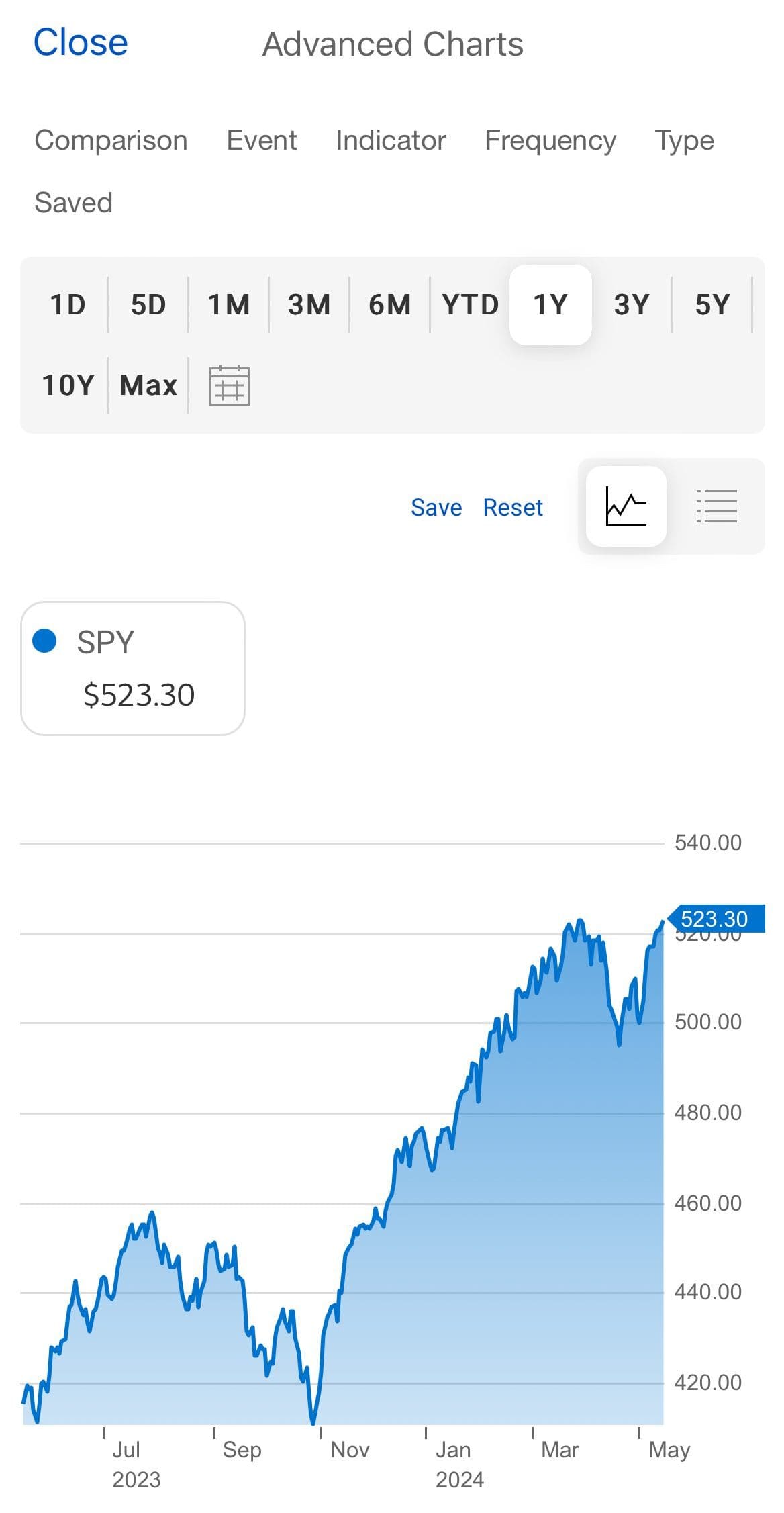

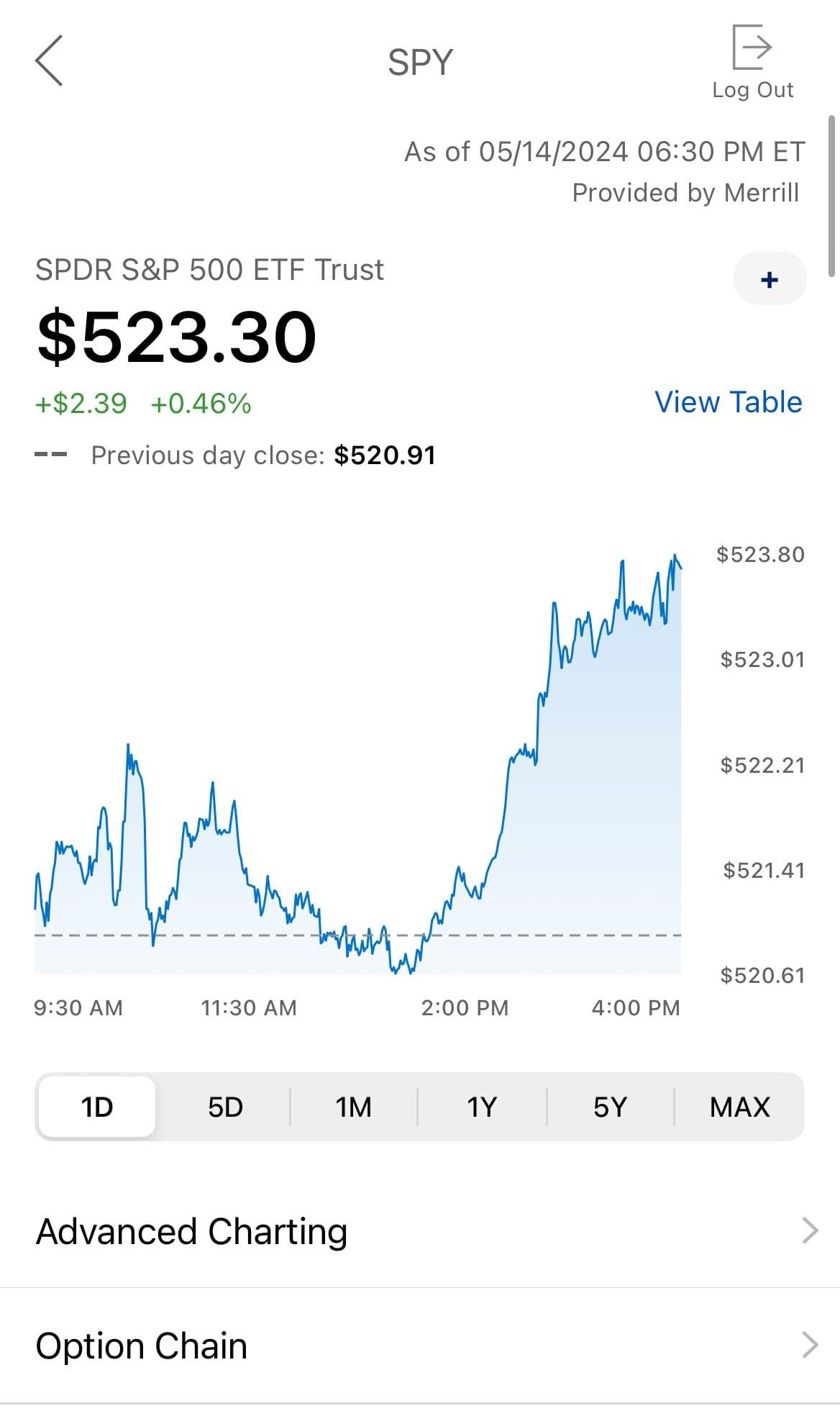

Merrill Edge excels in providing a user-friendly platform with strong technical analysis tools that are accessible even to novice traders. Its Market Pro platform is particularly well-regarded for advanced charting capabilities, offering over 100 technical indicators and 20+ drawing tools.

Merrill Edge also integrates insights directly into its charts, making it easier for traders to understand market trends and technical events.

The platform’s simplicity and ease of use make it an attractive choice for those who appreciate a straightforward trading experience.

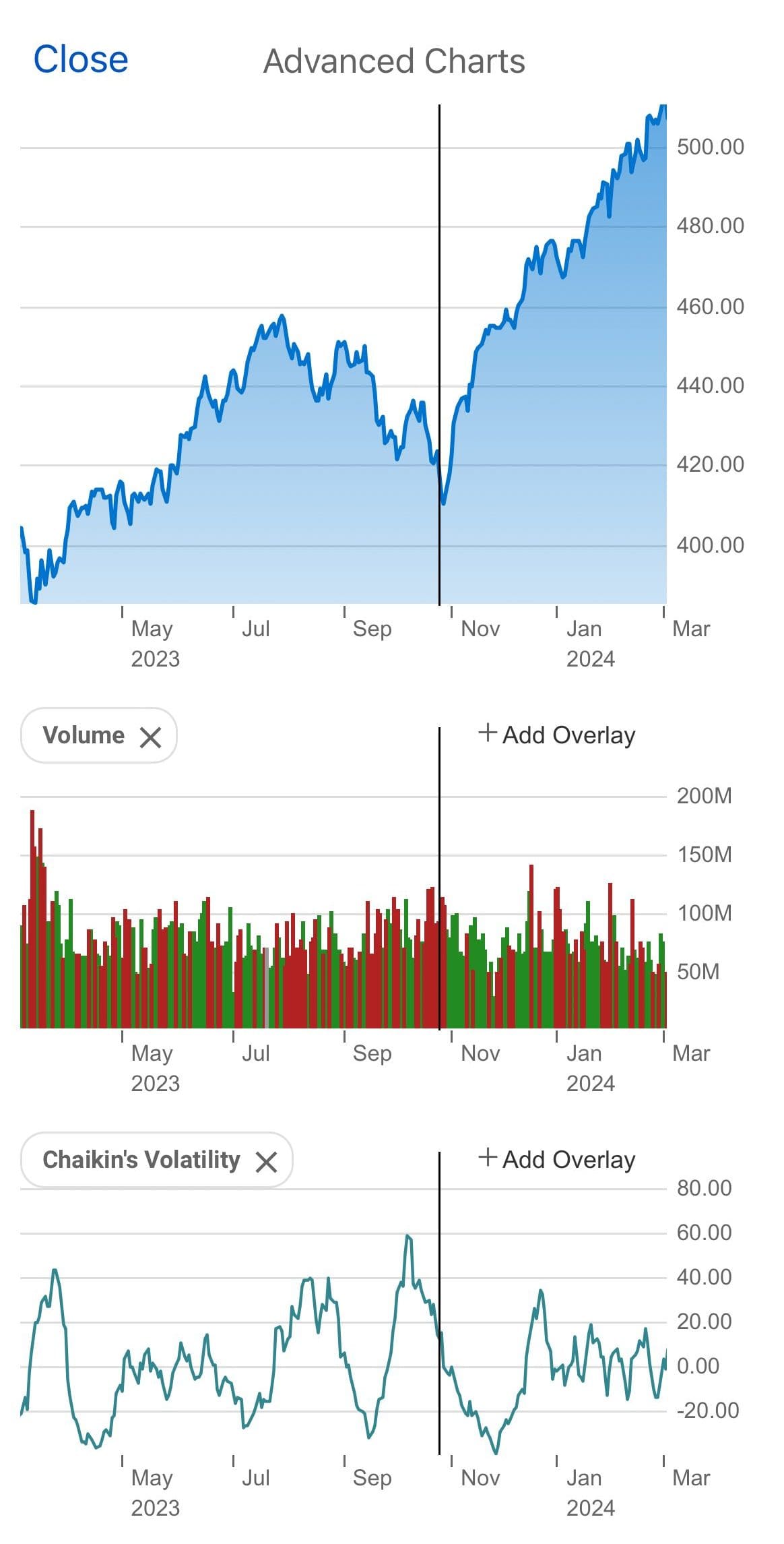

For trading, JPM offers essential tools like charting and stock screeners. When it comes to technical analysis, customers can generate specific graphs based on various indicators such as volume, momentum, and trends.

Additionally, traders can customize their technical views by adding features like Bollinger Bands, oscillators, volatility measures, and RSI to enhance their trading decisions.

The platform also allows the use of upper and lower indicators, such as moving averages, linear regression, and high/low ratios, to gain deeper insights and make more informed technical analysis decisions.

-

Robo Advisor And Automated Investing

Merrill Edge is a clear winner here, as JPM Self-Directed Investing falls short in this area because it doesn't offer a dedicated robo-advisor or automated investing option.

Merrill Edge’s robo-advisor, Merrill Guided Investing, is a standout for those who value personalized, hands-off investing with professional oversight.

It offers tailored portfolios managed and rebalanced by Merrill’s team, providing a blend of automated investing with human insight.

-

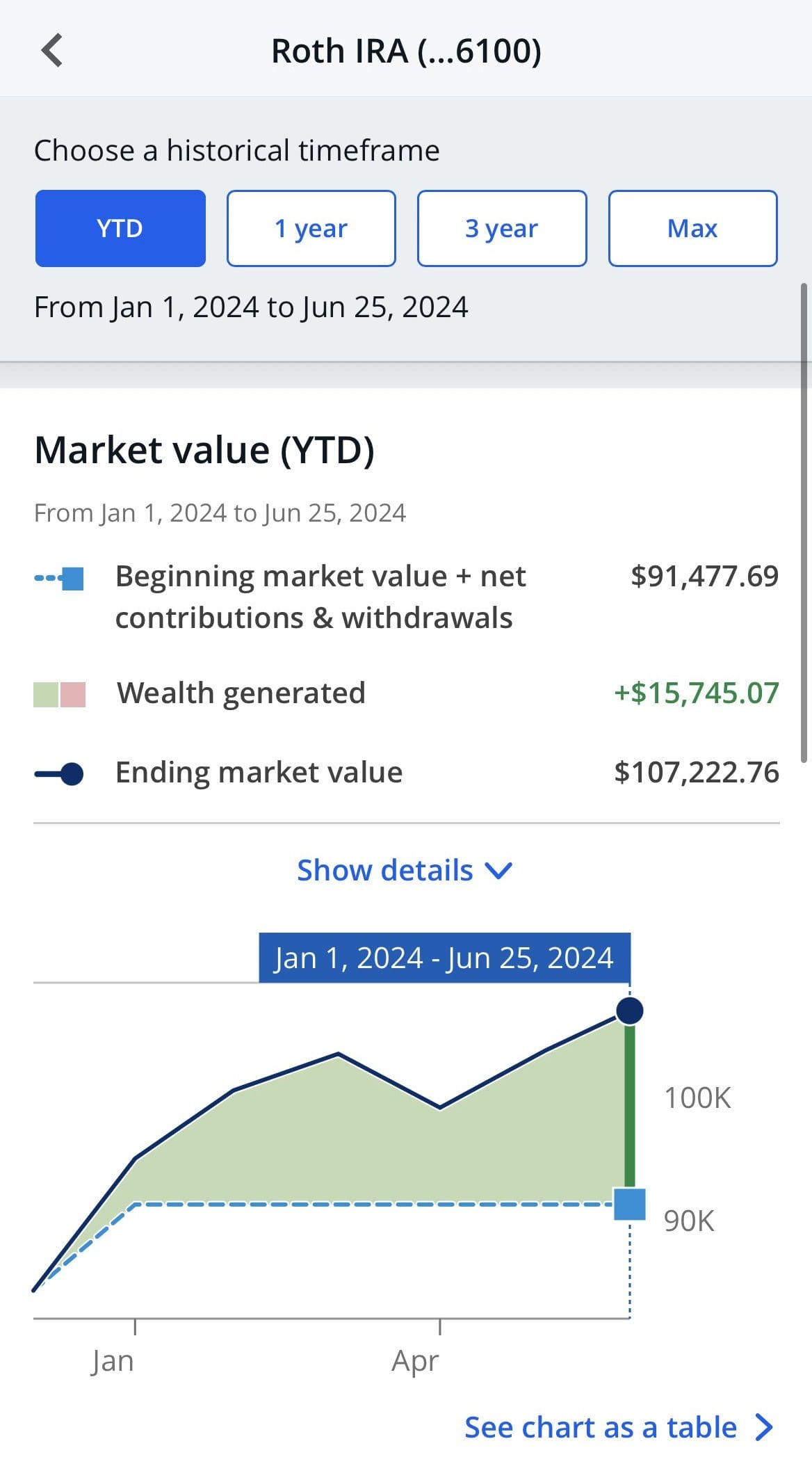

Retirement Accounts

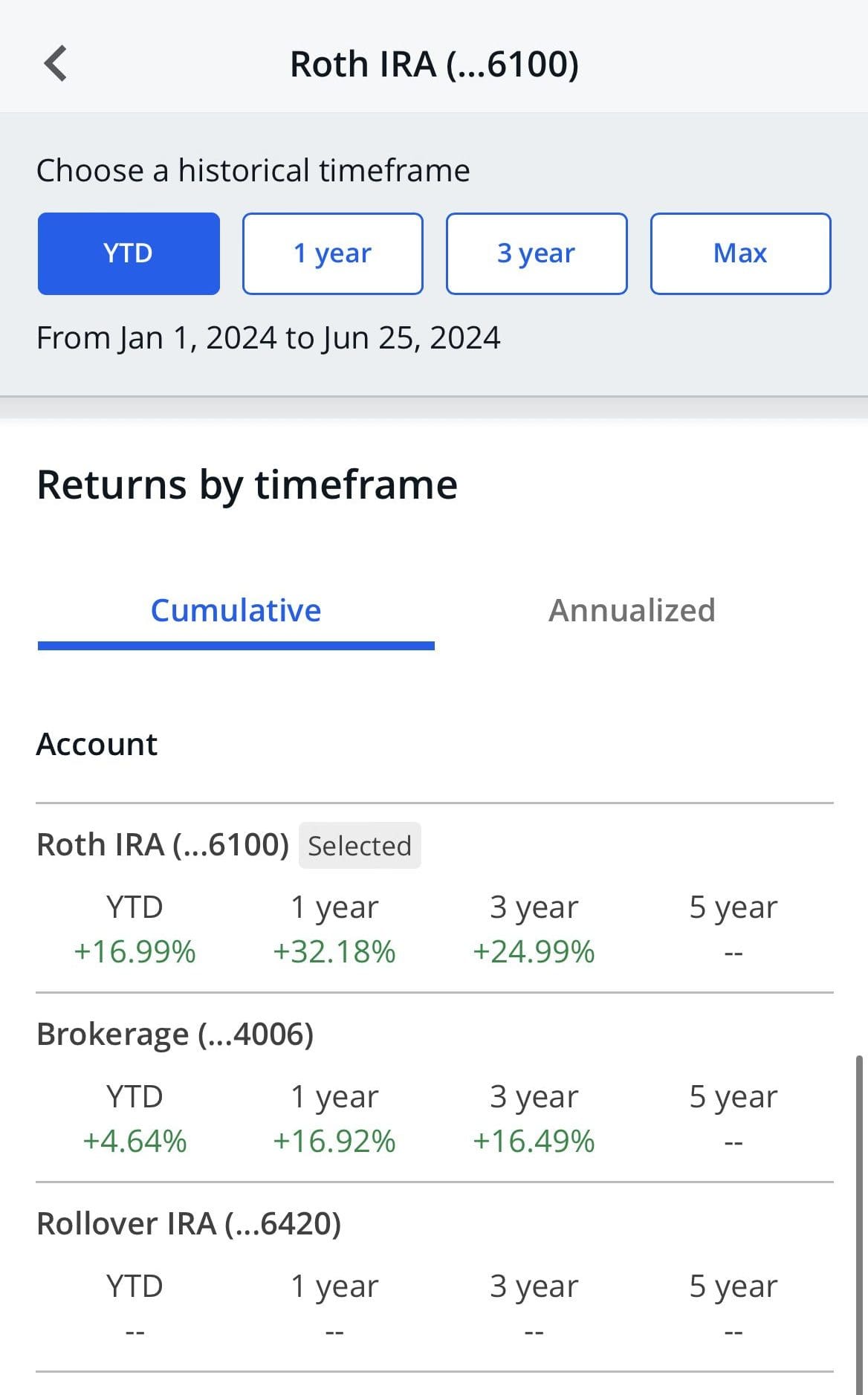

Merrill Edge offers a more sophisticated array of investment options within its retirement accounts.

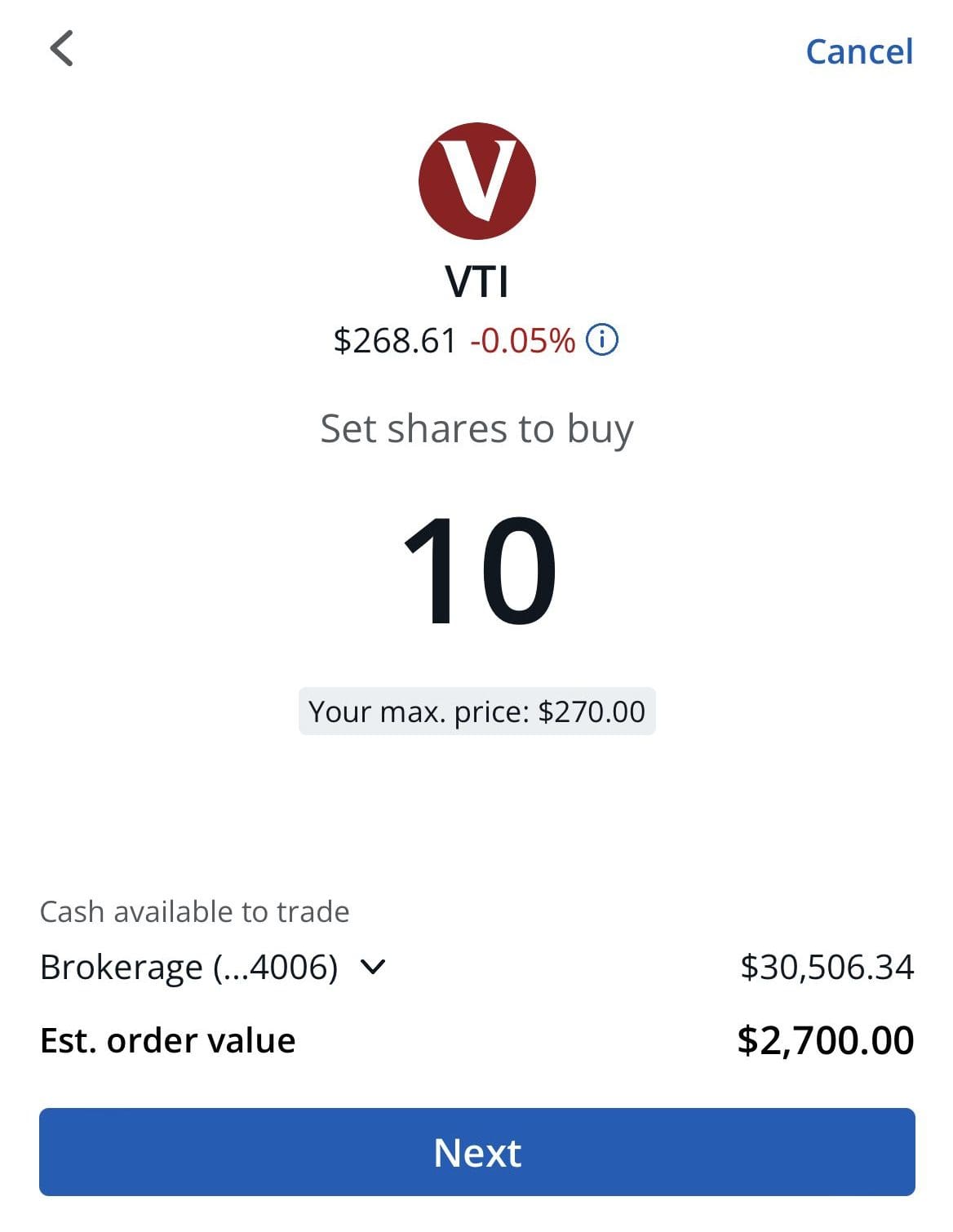

JPM Self-Directed Investing provides traditional and Roth IRAs with no annual account fees and commission-free trading on stocks, ETFs, and mutual funds. JPM also integrates well with existing Chase accounts, making it easier for Chase customers to manage their finances in one place.

However, the offerings are somewhat limited, with fewer retirement product options and no access to rollover IRAs or more specialized retirement accounts.

Merrill Edge offers traditional and Roth IRAs, as well as rollover and inherited IRAs. The platform’s intuitive design, along with access to professional advice through Merrill’s advisory services, makes it ideal for those who prefer a guided approach to retirement planning.

-

Fees

When it comes to fees, both platforms offer similar conditions.

JPM Self-Directed Investing and Merrill Edge both offer commission-free trading on U.S. stocks, ETFs, and mutual funds. and options trading at $0.65 per contract.

Merrill Edge | JPM Self-Directed Investing | |

|---|---|---|

Fees | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | $0

$0 online commission on U.S. listed stocks and ETFs and $0.65 per-contract |

When it comes to Robo Advisory, Merrill fees are fixed and increase if you need personal assistance from a dedicated advisor.

-

Cash Management And Savings Rates

Both JPM and Merrill are quite disappointed when it comes to banking, unless you're a Bofa or Chase customer.

Merrill Cash Account | JPM Self-Directed Cash APY | |

|---|---|---|

Savings APY | 0.01% – 3.77%

| 0.01% – 3.99% |

JPM Self-Directed Investing integrates seamlessly with Chase bank accounts, which is a big plus if you’re already a Chase customer. This integration allows you to easily move money between your investment and banking accounts, making the overall management of your finances smoother.

However, there is no stand-alone cash management for JPM self-directed customers, and the interest rates on uninvested cash are quite low, typically around 0.01%

Similarly, Merrill Edge doesn't offer a stand-alone checking account. Instead, existing BofA customers benefit significantly from its integration with Bank of America.

Also, the cash account is disappointing as you are eligible for the high interest only if you maintain at least $100K in your account.

-

Wealth Management Options

JPM is our winner when it comes to wealth management.

Merrill Wealth Management provides personalized services designed for clients with specific financial goals, offering the opportunity to collaborate closely with a dedicated advisor. Typically, clients need a minimum of $250,000 in investable assets to access these services.

Additionally, clients benefit from Bank of America’s premier research and insights, ensuring their investment strategies are informed by expert analysis and up-to-date market trends.

J.P. Morgan presents two distinct tiers of personalized financial advisory services: Personal Advisors and Private Client Advisors.

- Personal Advisors offer virtual financial planning supported by continuous advice, utilizing expert-designed portfolios and automated tax-efficient technology.

- In contrast, J.P. Morgan Private Client Advisors provide a more exclusive, personalized relationship, targeting clients with $100,000 or more in investable assets.

Bottom Line

Both JPM Self-Directed Investing and Merrill Edge offer quite similar tools for the average investor or trader, including those who use to it to manage their retirement.

However, Merrill is the only platform that offer robo advisor.

How J.P. Morgan Self Directed Compares to Other Online Brokers

If you're an experienced investor or trader, IBKR may be a better option. If you're a Chase customer or prefer simplicity, consider JP Morgan.

Interactive Brokers vs. J.P. Morgan Self-Directed Investing: Which Broker Wins?

Vanguard offers a better approach for serious investors, while JP Morgan's self-directed is better for beginners and advanced traders

Vanguard vs. J.P. Morgan Self-Directed: Which Broker is Best For You?

Schwab surpasses JPM self-directed in most categories, including self-directed investing, robo advisory, and technical analysis.

Schwab vs. J.P. Morgan Self-Directed: Which Brokerage Is Best?

JP Morgan is best for the average investor seeking a simple platform or wealth management, but E-Trade is our overall winner. Here's why.

J.P. Morgan Self-Directed Investing vs. E-Trade: Which Broker Wins?

Fidelity is our winner due to its investment options, research tools, advanced trading features, and excellent retirement planning services.

J.P. Morgan Self-Directed Investing vs. Fidelity : A Side-by-Side Comparison

JP Morgan wins when it comes to fundamental investing tools, but Robinhood is better for technical analysis and trading. Here's why:

J.P. Morgan Self-Directed Investing vs. Robinhood: Compare Brokerage Accounts

How Merrill Edge Compares to Other Online Brokers

Vanguard may be a better option for value, long-term investors, while Merrill offers better trading options. Here's a side-by-side comparison

Vanguard vs. Merrill Edge: Which Brokerage is Right for You?

Merrill Edge and E-trade offer great options for long and short-term investors, including robo-advisor, but there are differences.

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

Merrill Edge stands out for its interface and integration with BofA, but IBKR is the ultimate winner for trading and investing. Here's why:

Interactive Brokers vs. Merrill Edge: Compare Brokerage Account Options

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Schwab is our winner for investors and traders. However, the differences between brokerages are not significant. Here's our comparison: