Kraken Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

Kraken is one of the world’s largest and most well-known cryptocurrency exchanges. Founded in 2011 and based in the U.S., Kraken offers +300 cryptocurrencies for trading, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL).

It provides various trading options, such as spot trading, margin trading, and futures trading, making it a great choice for both beginners and experienced traders.

One of Kraken’s strengths is its strong security measures, including two-factor authentication (2FA) and cold storage for funds. Kraken offers relatively low fees on Kraken Pro, but the standard platform's Instant Buy fees can be high.

The platform is also facing legal challenges from the SEC, which has accused Kraken of operating as an unregistered securities exchange.

Can I use Kraken without verifying my identity?

No, Kraken requires KYC (Know Your Customer) verification for fiat deposits, withdrawals, and most crypto transactions. The basic verification level (Tier allows limited crypto trading, but higher tiers unlock more features and higher limits.

What fiat currencies does Kraken support?

Kraken supports multiple fiat currencies, including USD, EUR, GBP, JPY, CAD, AUD, and CHF. Users can deposit and withdraw fiat using bank transfers, wire transfers, and ACH (for U.S. users).

How long does it take to withdraw money from Kraken?

Fiat withdrawals typically take 1–5 business days, depending on the payment method and location. Crypto withdrawals are usually processed within minutes but depend on blockchain network congestion.

Does Kraken offer a crypto debit card?

No, Kraken does not currently offer a crypto debit card. Some competitors, like Crypto.com and Binance, provide crypto cards for spending crypto like cash.

Can I transfer crypto from another exchange to Kraken?

Yes, you can send crypto from another exchange or wallet to Kraken by copying your Kraken deposit address for the specific cryptocurrency. Be sure to select the correct blockchain network to avoid losing funds.

Pros | Cons |

|---|---|

Strong Security Measures | High Fees for Instant Buy & Credit/Debit Transactions |

Low Trading Fees on Kraken Pro | Limited Availability in the U.S |

Wide Range of Cryptocurrencies | Complex Interface for Beginners |

Advanced Trading Features | Fiat Withdrawal Fees Can Be High |

Staking Rewards | SEC Legal Challenges |

24/7 Customer Support & Phone Service | Customer Support Complaints |

Supported Cryptocurrencies & Assets

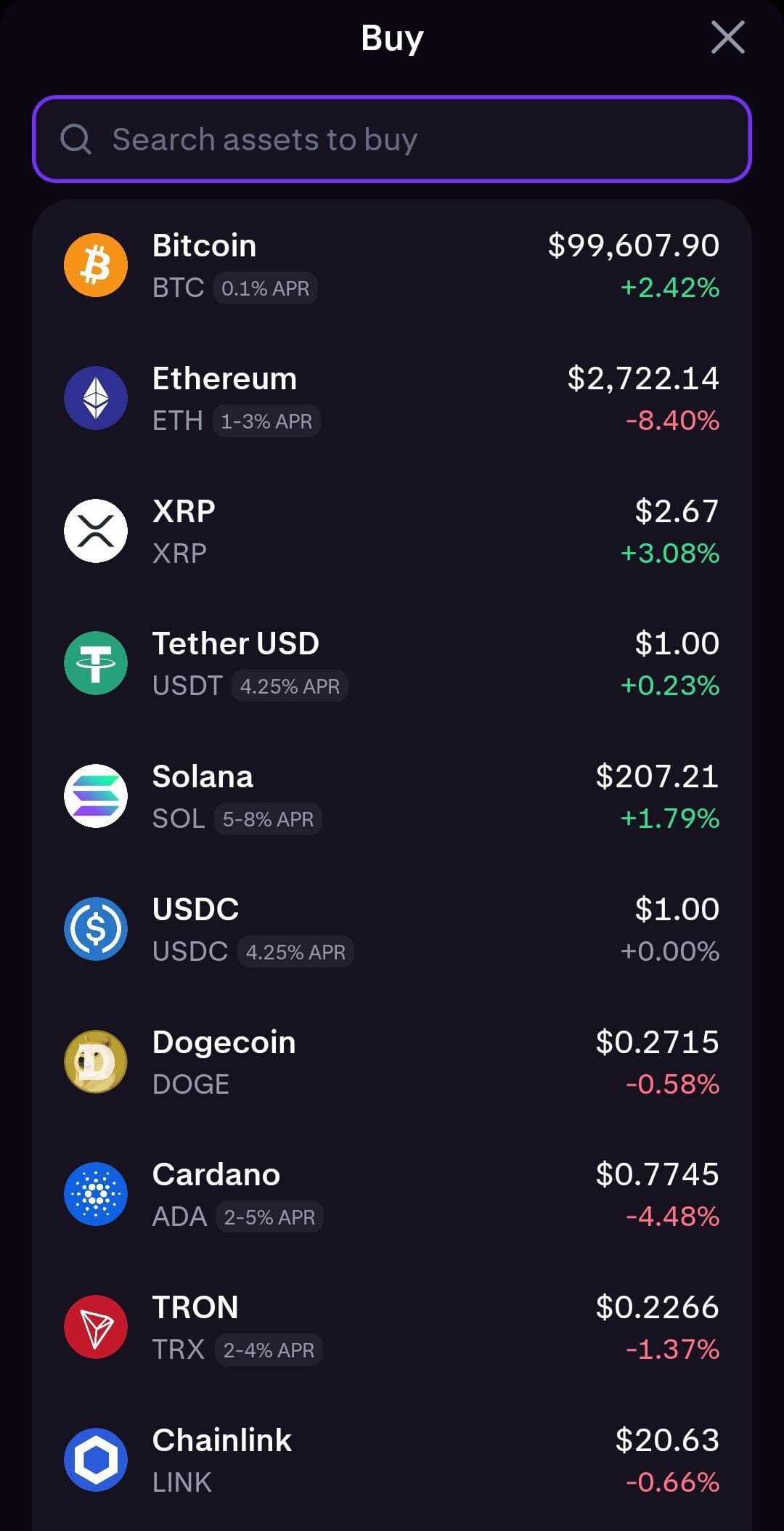

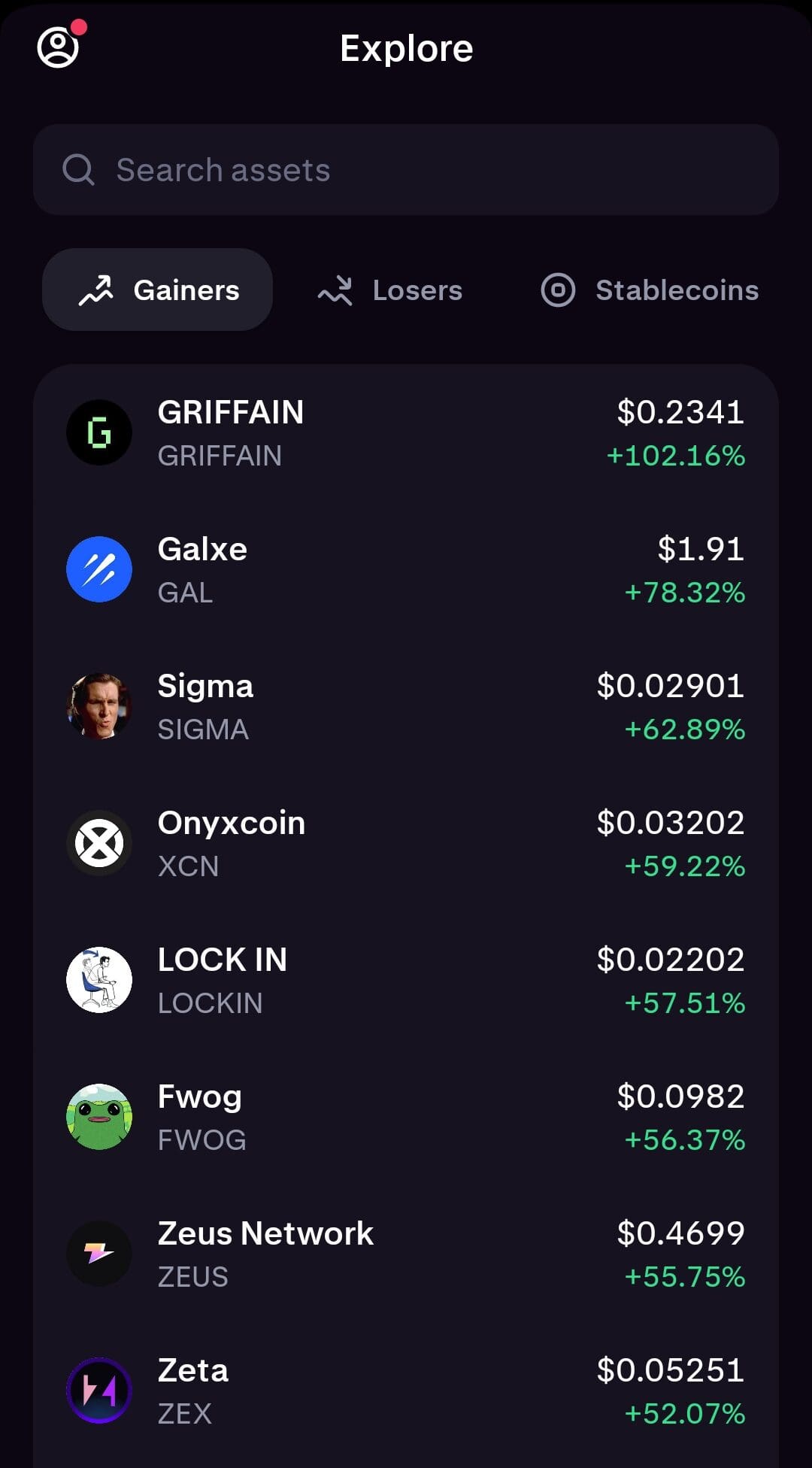

Kraken offers a wide range of cryptocurrencies, with +300 digital assets available for trading.

This includes major cryptocurrencies, altcoins, stablecoins, and some NFT-related tokens. The platform provides users with numerous trading pairs, allowing them to exchange different cryptos easily.

Kraken supports popular stablecoins, such as Tether (USDT), USD Coin (USDC), and Dai (DAI), which help users minimize volatility.

While Kraken does not have a dedicated NFT marketplace, it does offer NFT-related tokens like ApeCoin (APE) and Flow (FLOW), which are associated with NFT projects.

Is Kraken Available In The US?

Yes, Kraken is available in the U.S., but with some restrictions.

While most states allow users to trade and withdraw crypto, New York and Washington residents cannot open accounts or trade on Kraken due to strict state regulations.

Additionally, U.S. users have limited access to certain features.

For example, they cannot stake crypto on Kraken due to a settlement with the SEC, and futures trading is restricted to institutional investors and high-net-worth individuals.

However, spot trading, fiat deposits, and withdrawals are fully available in most states.

U.S. users can trade 300+ cryptocurrencies, deposit USD via ACH, wire transfer, and Plaid, and access Kraken Pro for lower trading fees.

Kraken’s Legal Issues & Trustworthiness

Kraken has faced legal challenges, particularly from the U.S. Securities and Exchange Commission (SEC).

In 2023, Kraken settled with the SEC for $30 million over allegations that it offered unregistered staking services. As a result, Kraken discontinued its staking program for U.S. users but resumed it in 2025.

In late 2023, the SEC filed another major lawsuit, accusing Kraken of operating as an unregistered securities exchange, broker, and clearing agency.

The SEC also alleged that Kraken commingled customer funds with corporate assets, increasing financial risks for users.

Kraken has denied these claims and is actively fighting the lawsuit.

Main Features For Crypto Investors

Here are the key features that I found most appealing in Kraken:

-

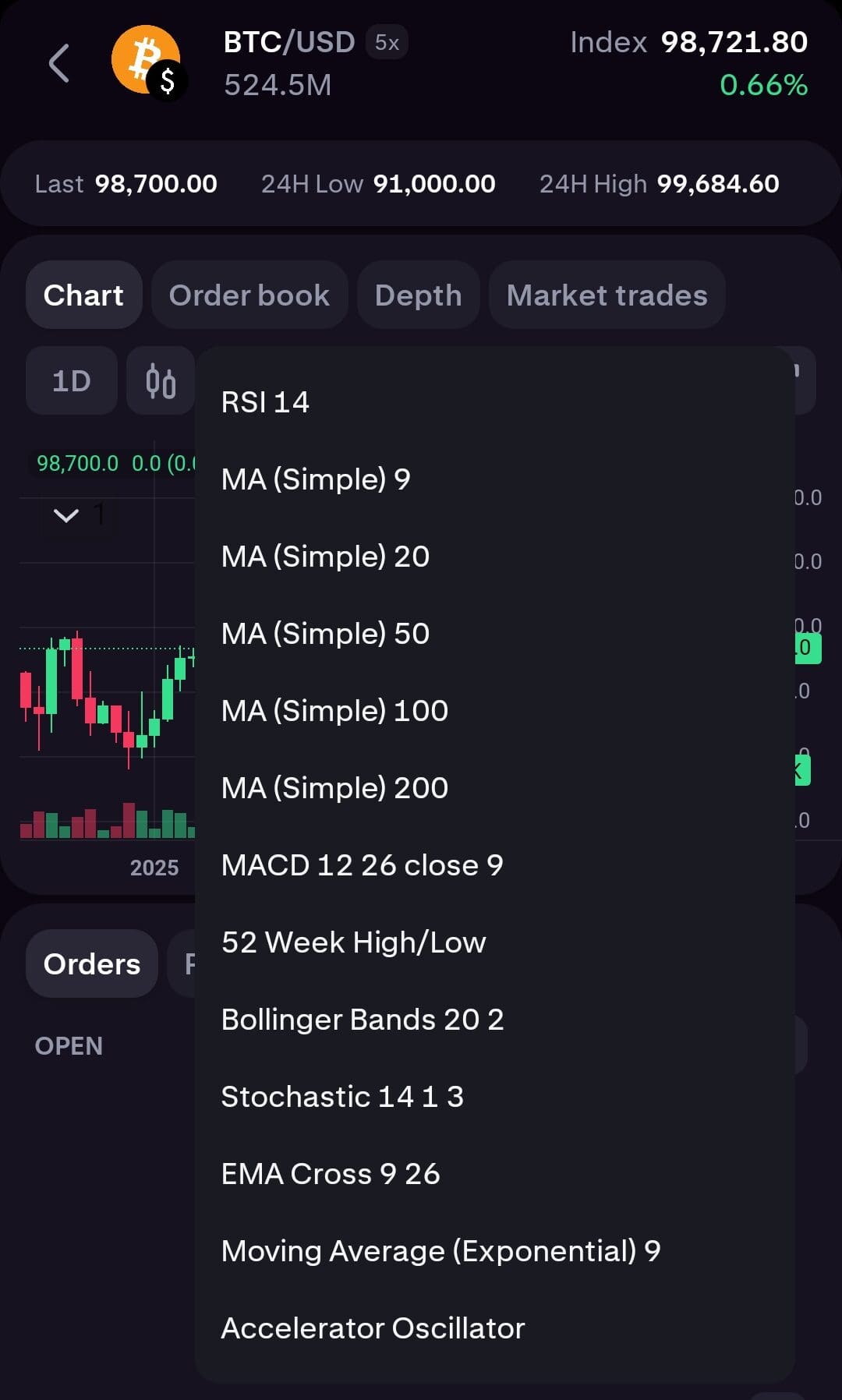

Kraken’s Interface: Good for Beginners, Powerful for Experts

Kraken provides a user-friendly experience for both beginners and advanced traders. The main Kraken platform is designed for simplicity, allowing users to buy and sell crypto with just a few clicks.

Kraken platform offers an Instant Buy feature, but fees are higher compared to trading on Kraken Pro, which has a more advanced interface with charts, order books, and technical tools.

On mobile, Kraken’s app is clean and easy to navigate, offering a simple way to trade on the go. However, some users find the desktop version more powerful, especially for advanced trading options like futures and margin trading.

With its customizable features and extensive trading tools, both beginners and experienced traders will find it a strong choice for crypto trading.

-

How Secure is Kraken? A Look at Its Top Security Features

Kraken is known for its strong security measures, making it one of the safest crypto exchanges.

It uses encryption, cold storage for customer funds, and two-factor authentication (2FA) to enhance account protection. Users can also set up withdrawal whitelisting, which ensures that funds can only be sent to pre-approved addresses.

To comply with regulations, Kraken requires Know Your Customer (KYC) verification for deposits and withdrawals in fiat currency.

It holds various regulatory licenses and follows strict compliance protocols in the regions where it operates.

Kraken does not offer insurance for individual users like some competitors, but it takes internal security measures to prevent hacks.

-

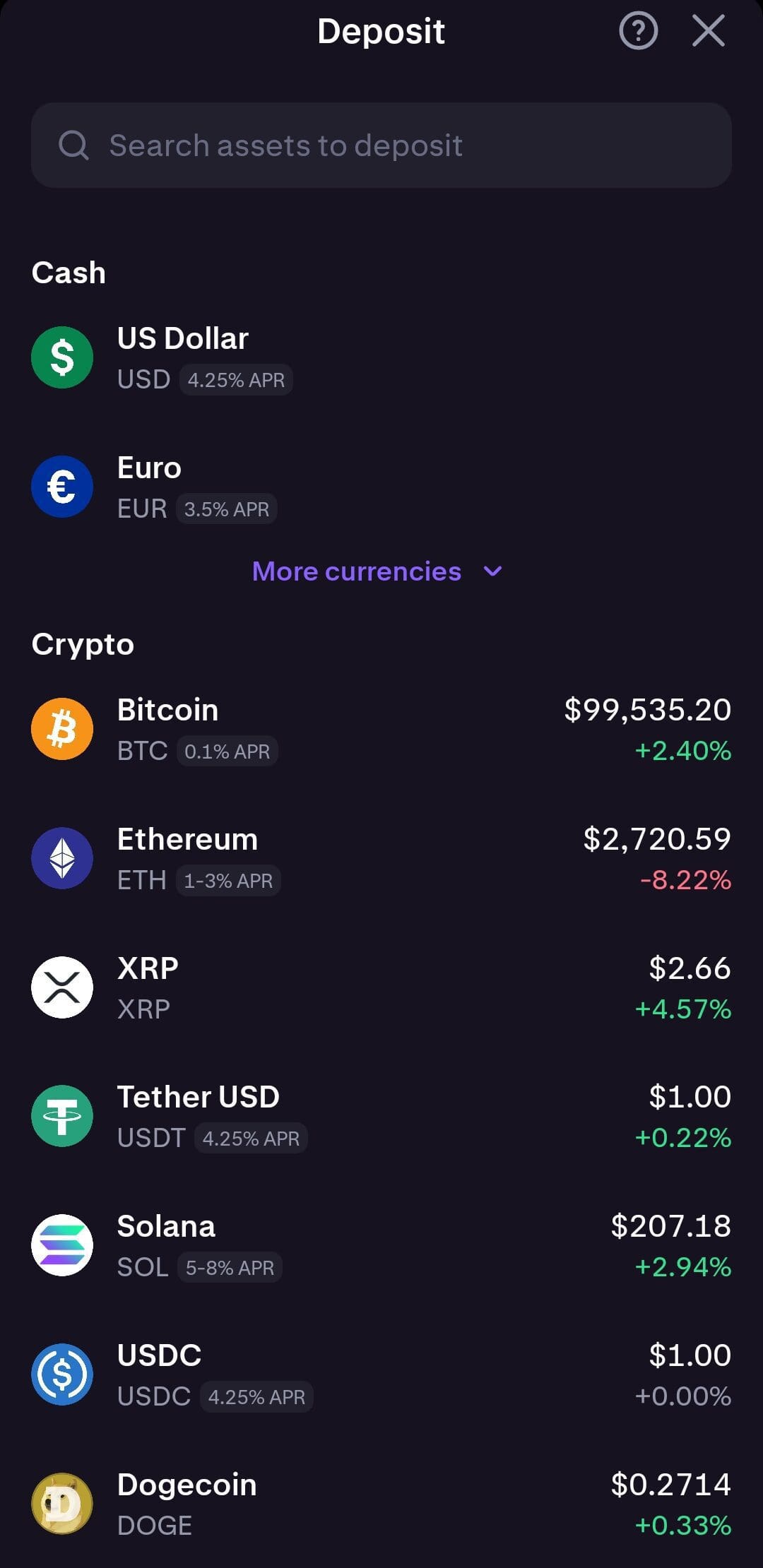

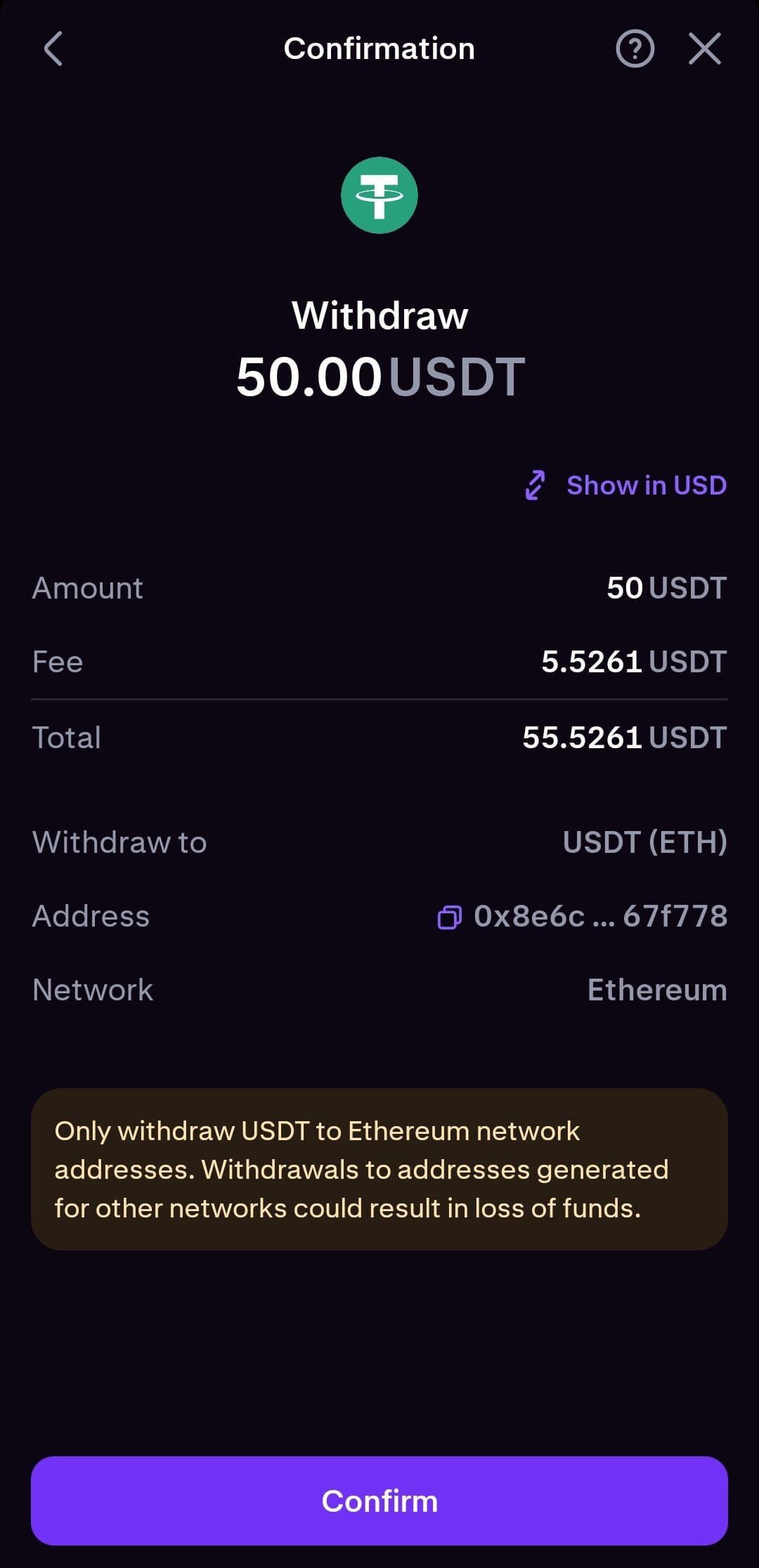

How to Deposit & Withdraw on Kraken

Kraken supports a variety of deposit and withdrawal methods, making it easy to fund your account. Users can deposit both fiat currencies (like USD, EUR, GBP, and JPY) and cryptocurrencies.

For fiat deposits, Kraken supports bank transfers, wire transfers, and ACH (U.S. only). However, credit and debit card deposits are limited.

Withdrawals to U.S. banks via ACH are free, but wire transfers can be expensive (up to $60 for international transactions).

Crypto withdrawals vary by asset and network fees. Bitcoin withdrawals, for example, cost 0.0005 BTC, which is relatively low. Processing times range from a few minutes to several hours, depending on network congestion.

While fiat withdrawals are generally quick, some users have reported delays in bank transfers, so it’s important to check Kraken’s policies based on your location.

-

Basic NFT & Web3 Features

Kraken has limited support for NFTs and Web3 applications compared to platforms like Binance or OpenSea.

While it does not offer a dedicated NFT marketplace, it does support NFT-related tokens like ApeCoin (APE) and Flow (FLOW), which are used in blockchain gaming and NFT ecosystems.

In terms of Web3 integrations, Kraken allows users to trade tokens used in DeFi applications, such as Uniswap (UNI) and Chainlink (LINK).

However, it does not provide direct integrations with decentralized applications (DApps), meaning you can’t connect your Kraken wallet to Web3 platforms like Metamask or OpenSea.

While Kraken is focused more on trading and security, users looking for deeper NFT and Web3 interactions might need to use other platforms that specialize in decentralized finance (DeFi) and blockchain gaming.

-

Kraken Fees Explained: What You’ll Pay & How to Save

Kraken has a tiered fee structure, meaning costs depend on how you trade.

- Kraken Instant Buy – Higher fees, charging 1.5% for crypto and 0.9% for stablecoins.

- Kraken Pro (Spot Trading) – Lower fees (see below)

Spot Trading Fees | Future Trading Fees |

|---|---|

0.40% – 0.25%

0.40% for taker trades and 0.25% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0% – 0.10%. Using GT tokens to pay trading fees offers a 10% discount | 0.02% – 0.05%

0.05% for taker trades and 0.02% for maker trades. The more you trade, the lower the fees – can decrease to as low as 0.005%% – 0.015%. Using GT tokens to pay trading fees offers a 10% discount |

Withdrawal fees vary by asset. Fiat withdrawals via ACH (U.S.) are free, but wire transfers can cost up to $60. Crypto withdrawals have network fees, such as 0.0005 BTC for Bitcoin.

Kraken’s fee structure is competitive, especially on Kraken Pro, but Instant Buy fees are high, making it less cost-effective for small traders.

-

Kraken’s Customer Support: What Users Are Saying

Kraken offers 24/7 customer support, including live chat and phone support, which is rare among crypto exchanges. It also has a help center with FAQs and guides for common issues.

However, many users have reported slow response times and difficulty resolving account issues, especially when it comes to fund withdrawals and verification delays.

On Trustpilot, Kraken has a low rating (1.4/5 stars), with common complaints about frozen accounts and unresponsive support.

Despite these issues, some users have positive experiences, particularly with Kraken Pro and VIP customer support for high-volume traders

-

Kraken Pro vs. Kraken Standard

Kraken Pro is the advanced trading platform for Kraken users, offering lower fees, deeper liquidity, and advanced trading tools.

Unlike the Instant Buy feature, which is more beginner-friendly but has higher fees (1.5% per trade), Kraken Pro operates with a maker-taker fee model, where fees start at 0.40% for takers and 0.25% for makers, decreasing with higher trading volume.

Kraken Standard | Kraken Pro | |

|---|---|---|

Trading Fees | 1.5% per transaction | 0.40% taker, 0.25% maker (lower with high volume)

|

Interface | Simple, beginner-friendly | Advanced charts, real-time order books

|

Order Types | Market orders only | Market, limit, stop-loss, and more |

Leverage & Margin Trading | Not available | Available (up to 5x leverage) |

Best For | Beginners | Advanced & high-volume traders |

Kraken Pro also provides detailed trading charts, order books, and customizable trading tools, making it ideal for experienced traders. It supports limit orders, margin trading, and futures, while the standard Kraken platform is more limited.

-

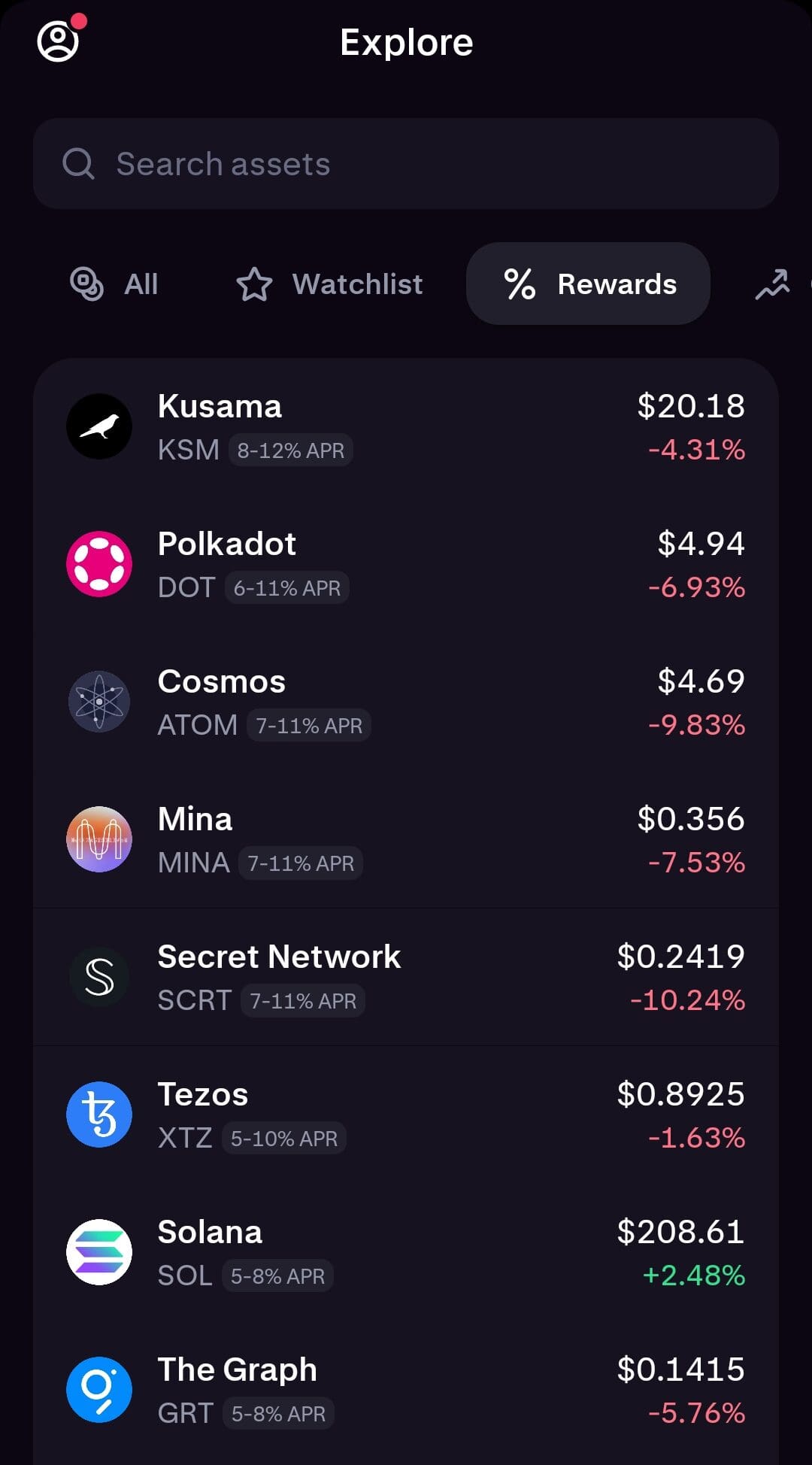

Kraken Staking & Rewards

Kraken allows users to stake their cryptocurrencies and earn rewards, similar to earning interest on a savings account.

Staking involves locking up crypto assets to help secure blockchain networks, and in return, users receive regular payouts.

Kraken supports multiple staking coins, including Ethereum (ETH), Cardano (ADA), Solana (SOL), and Polkadot (DOT). Rewards vary depending on the asset, but some coins offer annual yields of 5% or more.

-

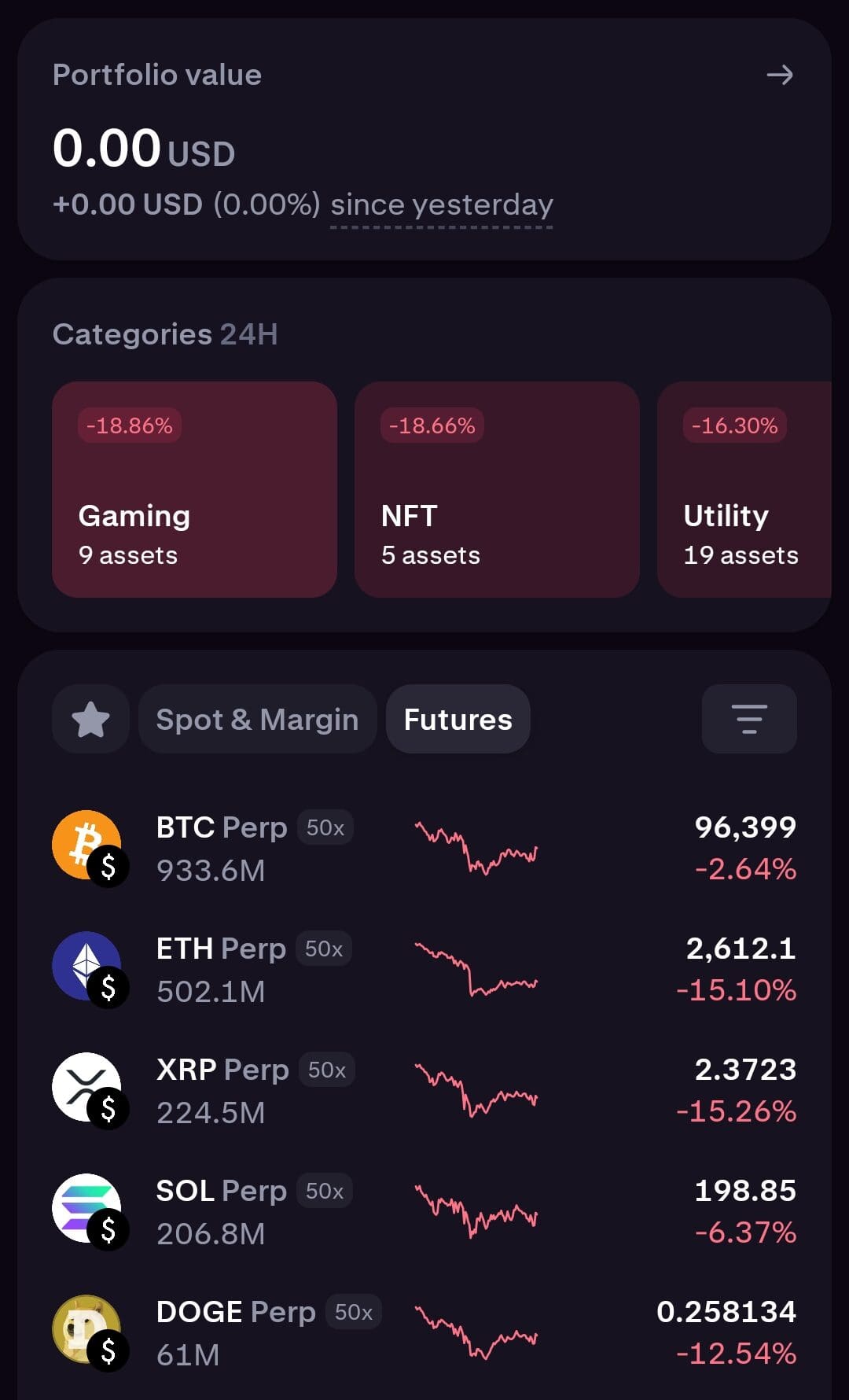

Kraken Futures & Margin Trading (Limited Access to U.S. Users)

For advanced traders, Kraken offers futures trading and margin trading, allowing users to amplify their profits (but also their risks).

- Margin Trading: Traders can borrow funds to increase their position size, with leverage options up to 5x. For example, with $1,000, a trader can control up to $5,000 worth of crypto.

- Futures Trading: Users can speculate on crypto prices without owning the actual asset, trading contracts that expire at a set date. Futures trading offers leverage up to 50x on certain assets.

Both of these trading options can lead to higher profits, but they also increase risk, so they are best suited for experienced traders.

-

Kraken OTC: Private Trading for Large Crypto Transactions

Kraken offers an Over-the-Counter (OTC) trading desk for large-volume trades.

This service is designed for institutional investors, high-net-worth individuals, and businesses looking to buy or sell large amounts of cryptocurrency without affecting market prices.

Unlike standard exchange trading, OTC trades are private and executed off the public order book, ensuring that big transactions don’t cause sudden price swings.

Kraken’s OTC desk provides personalized service, giving clients access to dedicated trading experts who help them get the best possible price for their trades.

When Kraken May Be a Good Choice And Who Should Skip It?

Kraken is a powerful cryptocurrency exchange, but it’s not for everyone. Here are types of users who may find it the best option, and some that may want to skip and look elsewhere:

When Kraken May Be a Good Choice | Who Should Look Elsewhere |

|---|---|

Advanced & High-Volume Traders | Beginners looking for a simple trading experience

|

Security-Conscious Crypto Holders | U.S. users who want futures trading

|

Institutional & Large-Scale Investors | Users wanting an NFT marketplace |

Users Looking for a Regulated & Transparent Exchange | |

Crypto Investors Looking for Staking |

4 Simple Steps to Set Up the Kraken Account

Let's see the main steps when setting up an account with Kraken:

-

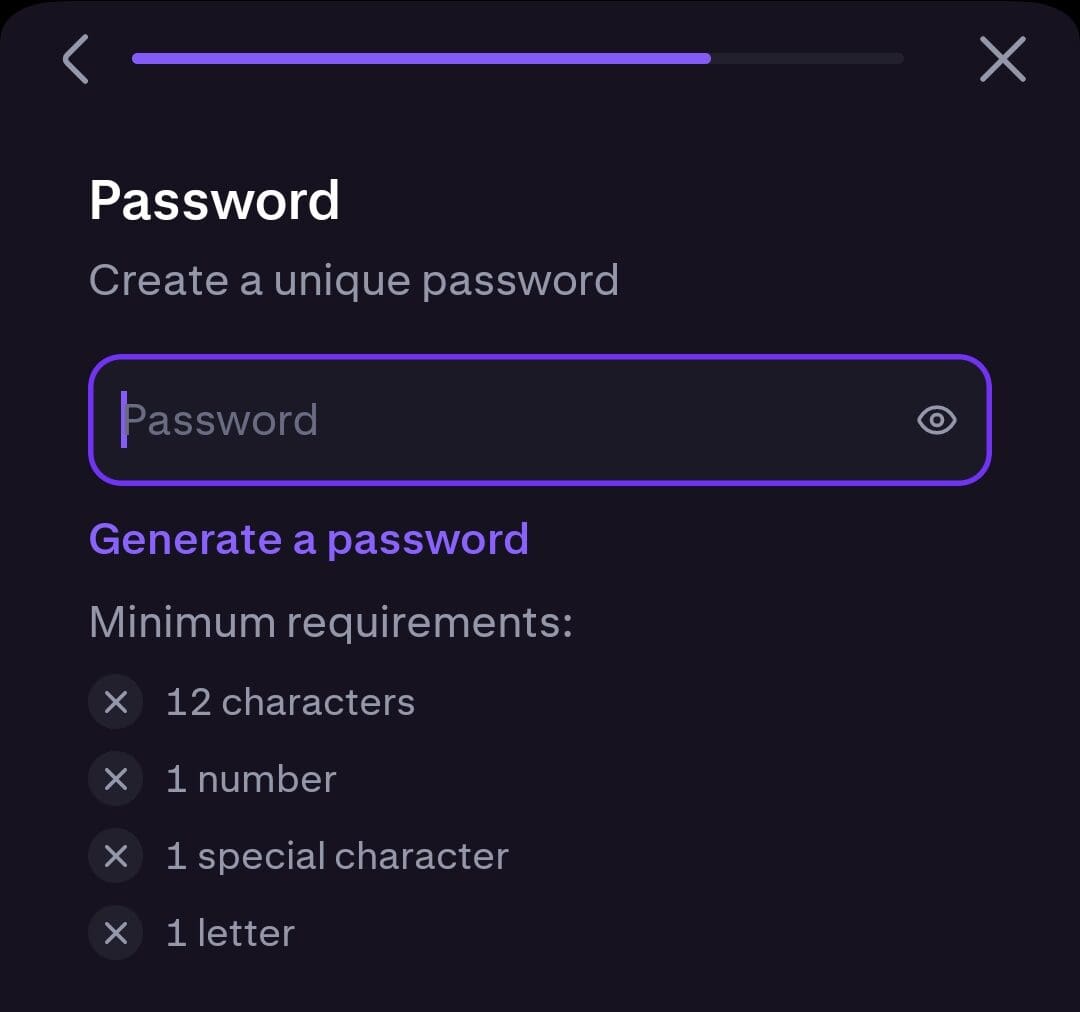

1.Sign Up for a Kraken Account

To create an account, go to Kraken’s official website or download the Kraken app. Click “Sign Up” and enter your email, username, and a strong password.

You will then receive an activation email with a confirmation link. Click the link to verify your email and activate your account.

If you’re signing up for a business or institutional account, additional documents may be required.

Our tips:

🔹 Use a strong, unique password to enhance security. Avoid easy-to-guess passwords like “Kraken123”.

🔹 Choose an email address that you regularly check, as Kraken will send important security updates.

🔹 If you don’t see the verification email, check your spam/junk folder.

-

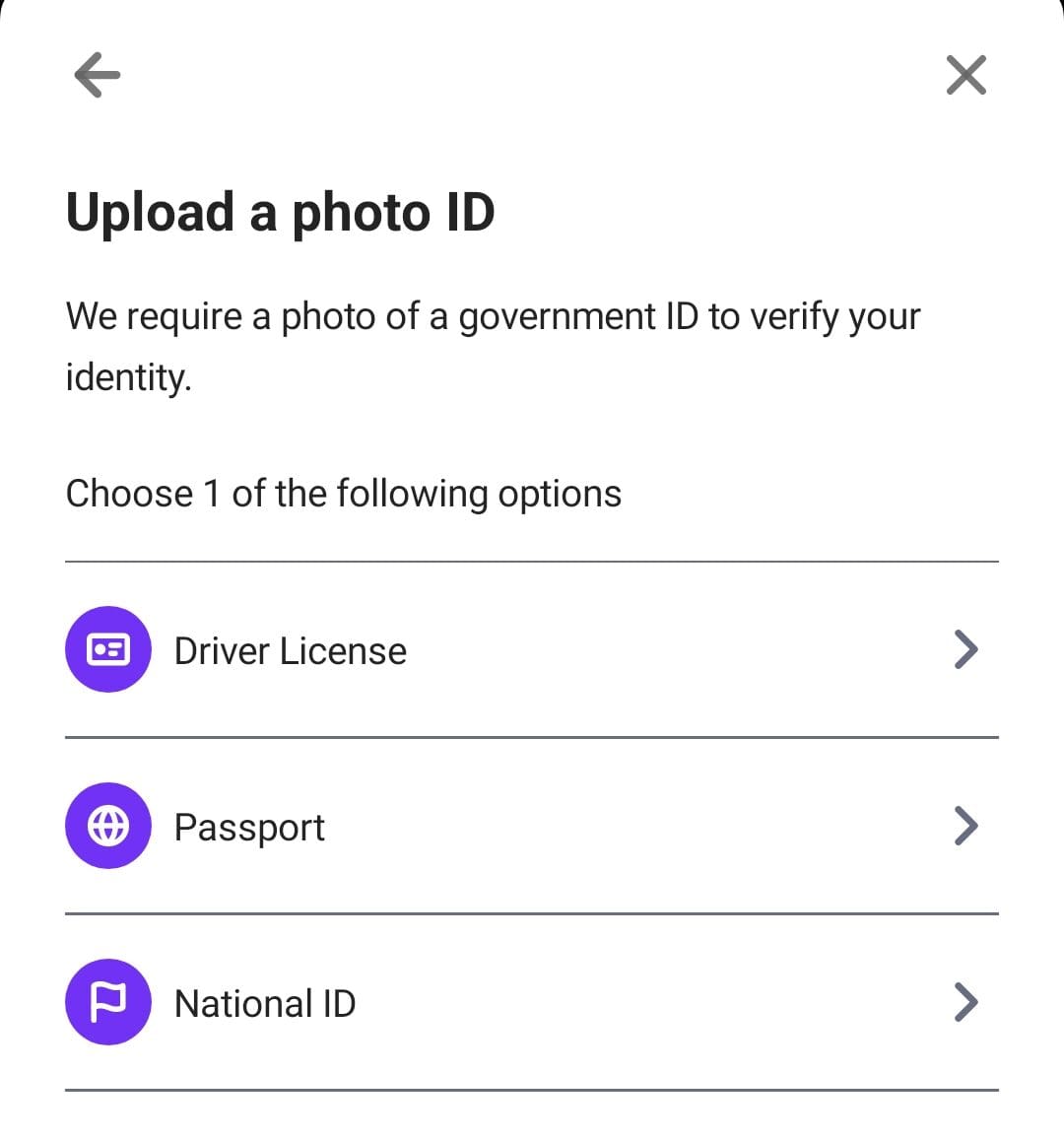

2. Verify Your Identity (KYC Verification)

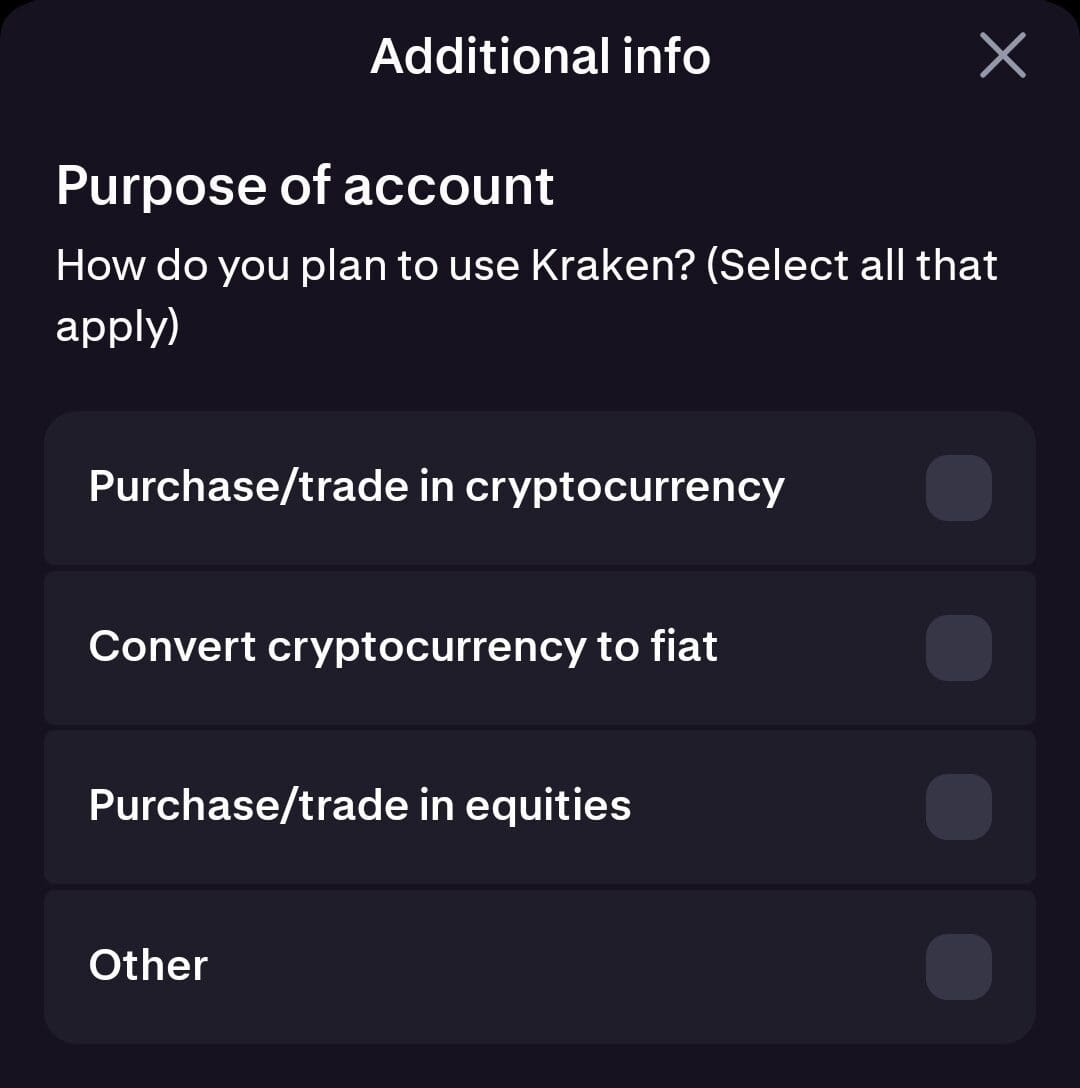

Kraken requires Know Your Customer (KYC) verification to comply with regulations. You will need to provide basic personal details like your name, date of birth, country, and phone number.

For higher account limits, you’ll need to upload a government-issued ID (passport or driver’s license) and proof of address (such as a bank statement or utility bill).

Our tips:

🔹 Ensure your documents are clear and not expired, or Kraken may reject them.

🔹 If verification takes longer than expected, avoid submitting multiple requests—this can slow down processing.

🔹 U.S. customers may need Tier 3 verification to deposit and withdraw fiat currencies.

-

3. Secure Your Account with Two-Factor Authentication (2FA)

Once your account is verified, enable two-factor authentication (2FA) for extra security.

Go to “Security” in your Kraken account settings and activate 2FA using an app like Google Authenticator or YubiKey.

This adds a second layer of protection, requiring a unique code every time you log in or make withdrawals.

Our tips:

🔹 Never use SMS-based 2FA as it is more vulnerable to hacking than app-based 2FA.

🔹 Store your backup recovery codes in a safe place in case you lose access to your authenticator app.

🔹 Activate withdrawal whitelisting, so funds can only be sent to approved wallets.

-

4. Fund Your Account & Start Trading

After securing your account, it’s time to deposit funds. You can deposit fiat currencies (USD, EUR, GBP, etc.) via bank transfer or ACH (U.S. users).

Crypto deposits are also available, and you’ll need to copy your Kraken wallet address to send funds from another exchange or wallet. Once funded, go to the “Trade” tab to buy and sell cryptocurrencies.

Our tips:

🔹 Fiat deposits may take a few hours to a few days, depending on your bank and location.

🔹 Always double-check wallet addresses when depositing or withdrawing crypto to avoid losing funds.

🔹 New traders should start with Simple Trading Mode before exploring margin or futures trading.

🔹 Be aware of trading fees—using Kraken Pro offers lower fees than Instant Buy.

FAQ

Yes, but with some learning required. The Instant Buy feature makes purchasing crypto easy, but Kraken Pro has a more advanced interface that may be confusing at first. Beginners should start with basic trading and explore advanced options over time.

Yes, Kraken offers a mobile app for iOS and Android. It allows users to buy, sell, trade, and manage accounts on the go. There’s also a Kraken Pro app with advanced trading tools for experienced traders.

If you lose access, you can reset your password using email verification. If you enabled 2FA, you’ll need your authentication app or backup codes. If all else fails, Kraken support can help you recover your account after identity verification.

No, Kraken does not have an NFT marketplace. However, it supports NFT-related tokens like ApeCoin (APE) and Flow (FLOW), which are used in blockchain gaming and NFT ecosystems.

If Kraken ever shuts down, users should still have access to withdraw funds, as reputable exchanges typically give advance notice. However, it’s always smart to store long-term holdings in a personal wallet rather than keeping all funds on an exchange.

Review Crypto Exchanges

How We Rated Crypto Exchanges: Review Methodology

At The Smart Investor, we evaluated crypto exchanges based on their overall value, security, and trading experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to traders and investors, including fees, security, liquidity, and available assets. Each exchange was rated based on the following criteria:

- Fees & Costs (15%): We prioritized exchanges with low trading fees, competitive spreads, and transparent pricing. Some platforms had hidden withdrawal fees or costly trading structures.

- User Experience & Interface (15%): A fast, intuitive, and well-designed platform scored highest. Some exchanges felt clunky or slow, impacting trade execution and overall experience.

- Security & Regulation (20%): We favored exchanges with strong encryption, two-factor authentication (2FA), cold storage, and regulatory compliance. Some lacked proper security, making them high-risk.

- Trading Tools & Features (30%): The best exchanges offered advanced charting, real-time market data, order types (limit, stop-loss), and automation tools. Some lacked depth, limiting professional traders.

- Supported Cryptocurrencies (10%): We rated exchanges higher if they supported a broad range of cryptocurrencies, including major coins, altcoins, and stablecoins. Some had limited selections, restricting options.

- Liquidity & Execution Speed (5%): Exchanges with high liquidity, deep order books, and fast execution times scored highest. Lower-rated platforms had frequent slippage or delays.

- Additional Features (5%): We favored exchanges with staking, lending, fiat on-ramps, NFT marketplaces, and DeFi integration. Some lacked these extras, making them less versatile.