Table Of Content

What’s the Difference Between Local and Online Gold Dealers?

Choosing between a local and online gold dealer can significantly affect how you buy, store, and sell precious metals.

Here’s how they differ:

Buying Experience: In-person vs. digital platform

Selection & Pricing: Limited local stock vs. broader online inventory

Security & Privacy: Immediate possession vs. shipped with insurance

Speed & Convenience: Same-day handoff vs. wait time for delivery

Verification & Trust: Face-to-face trust vs. reliance on reviews and credentials

-

Buying Experience: Face-to-Face vs. Digital Transactions

Local dealers offer a personal, face-to-face buying experience. You can walk into a shop, physically inspect a coin or bar, and get answers on the spot.

This appeals to those who value human interaction and want immediate clarity before making a purchase.

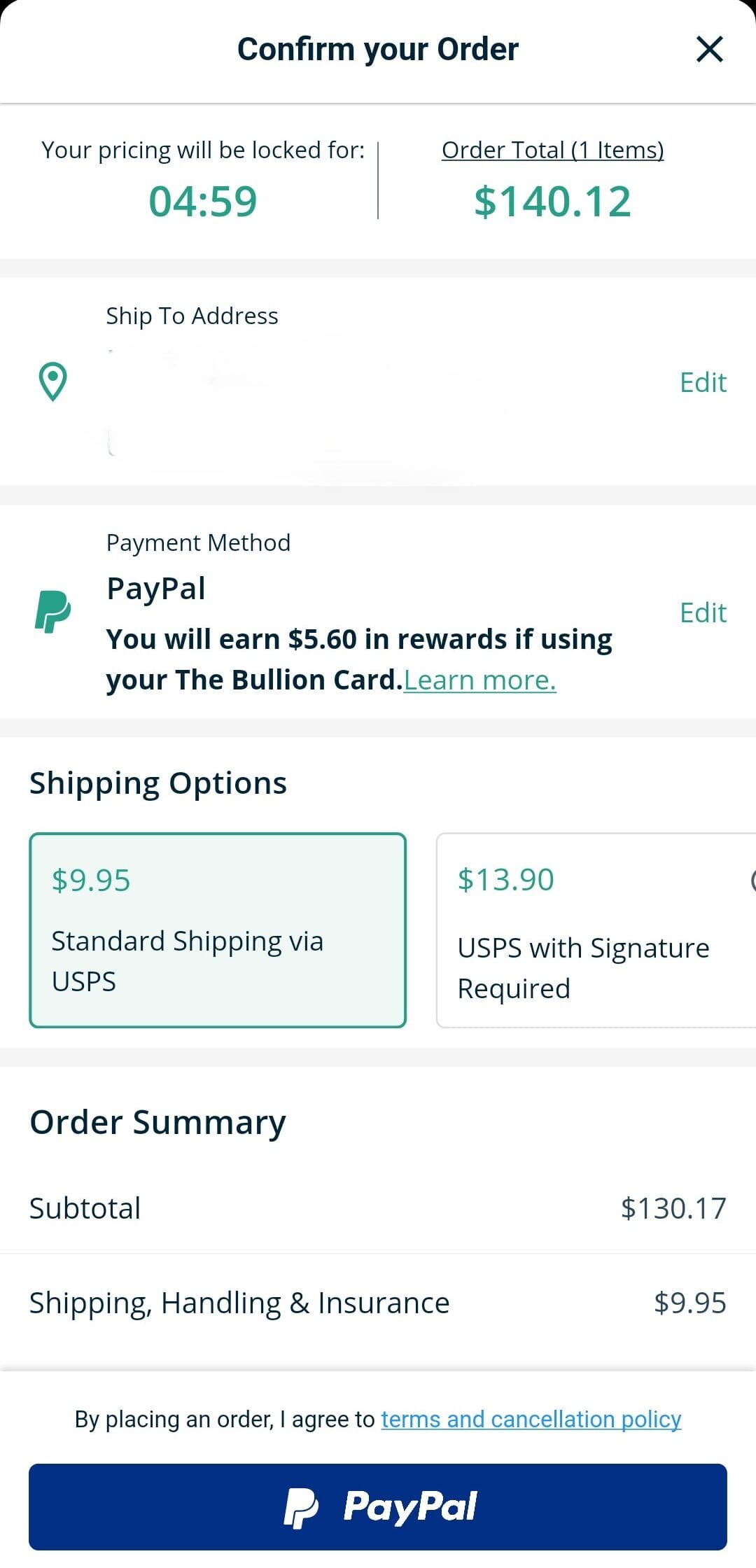

Online dealers like JM Bullion or APMEX, on the other hand, provide an entirely digital process. You browse products, compare prices, and place an order from your laptop or phone.

This is ideal for investors who prefer convenience and a streamlined checkout experience.

-

Selection and Pricing: Broad Online Catalogs vs. Limited Local Stock

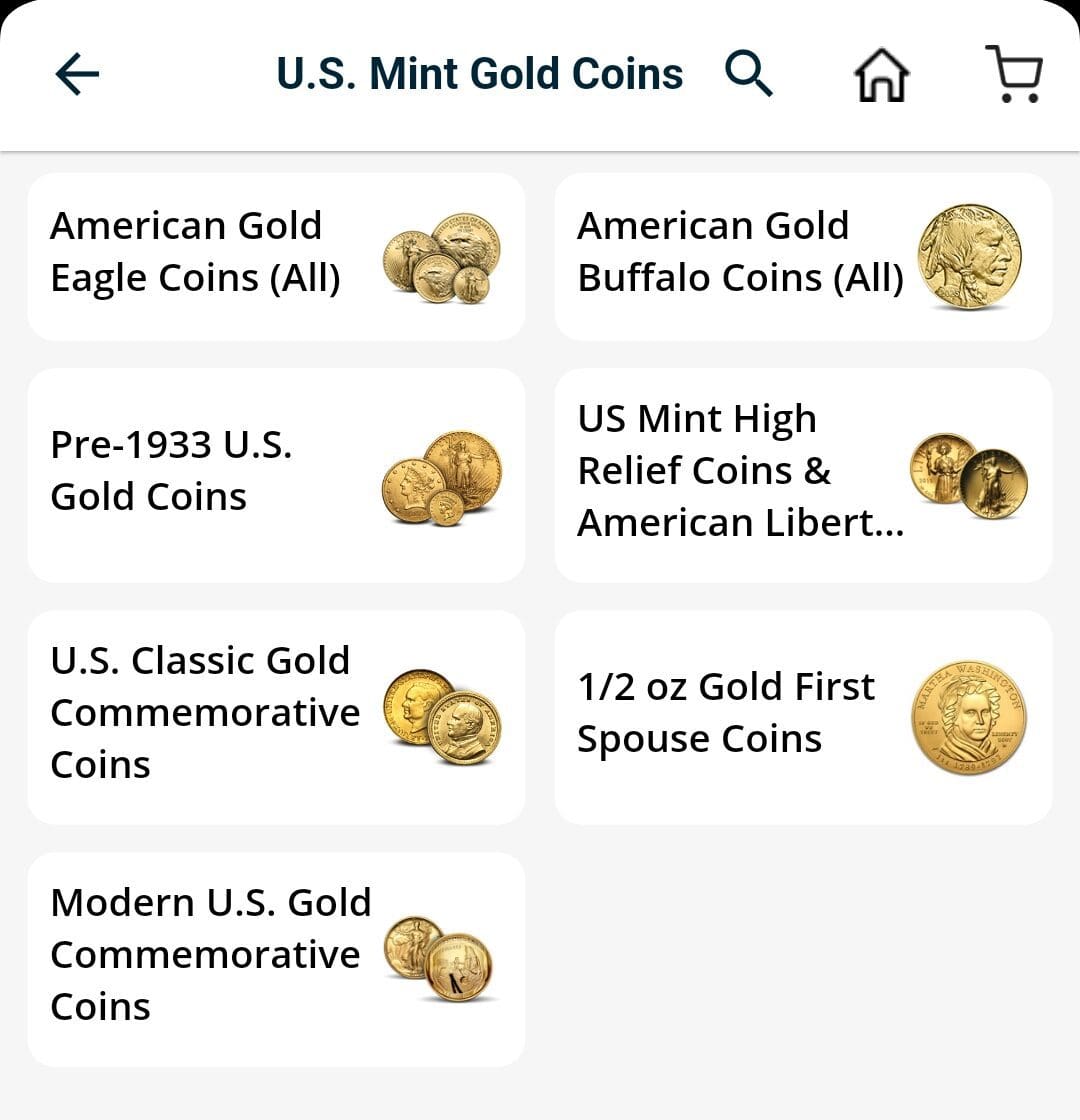

Online dealers typically offer a much wider inventory. For instance, platforms like SD Bullion often stock dozens of gold coin varieties and bars in multiple weights.

This allows buyers to compare fractional coins, sovereign mint issues, and exclusive collector editions—all in one place.

By contrast, local dealers are limited to the inventory they physically hold. You might only find basic 1 oz American Eagles or generic bars.

Also, due to overhead costs and smaller volume, local pricing can be less competitive than online pricing, especially when online dealers run nationwide promotions.

-

Security and Trust: In-Hand Gold vs. Insured Delivery

When you buy locally, you walk out with the gold in hand—no shipping, no tracking, and immediate control.

This appeals to privacy-conscious buyers or those concerned about delivery delays. But you must also trust that the dealer is reputable and the gold is genuine.

Online purchases rely on insured, trackable delivery. Reputable platforms like APMEX ship with full coverage and provide authentication guarantees.

Online dealers also tend to have thousands of customer reviews, BBB ratings, and audit records to help establish credibility. Still, some buyers worry about package theft or delivery errors.

-

Convenience and Timing: Instant Pickups vs. Delayed Fulfillment

If you're in a hurry, local dealers offer same-day purchases. For example, if you want to make a time-sensitive buy based on a gold price dip, walking into a dealer gives you immediate access.

However, online dealers often require 2–5 business days for processing and shipping. This makes them less suitable for spontaneous trades but more convenient for planned investments, especially if you're building a long-term portfolio without urgency.

Pros and Cons of Buying Gold Locally

Buying gold from a local dealer can offer hands-on benefits, but there are also important trade-offs to consider depending on your goals.

Pros | Cons |

|---|---|

Immediate Possession | Limited Selection |

Personal Interaction | Potentially Higher Prices |

No Shipping Risks | Inconsistent Buyback Policies |

Opportunity to Inspect Products | Less Transparent Pricing |

- Immediate Possession

You can walk into a local shop and walk out with your gold the same day, which is ideal during market volatility.

- Personal Interaction

Talking face-to-face with a dealer allows you to ask questions, negotiate prices, and build trust over time—useful for repeat buyers.

- No Shipping Risks

There's no chance of shipping delays, lost packages, or theft since you physically collect the gold on the spot.

- Opportunity to Inspect Products

You can verify the condition of coins or bars before purchasing, which is helpful for buying numismatics or secondhand pieces.

- Limited Selection

Local dealers may only carry basic bullion items like American Eagles or generic bars, so it's harder to find niche or rare items.

- Potentially Higher Prices

Because local shops have smaller volume and overhead costs, their premiums are often higher than large online dealers like APMEX or SD Bullion.

- Inconsistent Buyback Policies

Some dealers may not guarantee buybacks, or they may offer less competitive rates when you want to sell your gold later.

- Less Transparent Pricing

Unlike online dealers with published, real-time pricing, local shops may quote based on spot price estimations, leaving room for subjectivity.

Pros and Cons of Buying Gold Online

Buying gold online offers broad access and competitive pricing, but it also comes with unique considerations related to delivery, trust, and timing.

Pros | Cons |

|---|---|

Wider Product Selection | Shipping Time and Delays |

Competitive Pricing | Risk of Delivery Theft or Loss |

Convenience and 24/7 Access | No Physical Inspection Before Purchase |

Transparent Reviews and Reputation | Scams and Fake Websites |

- Wider Product Selection

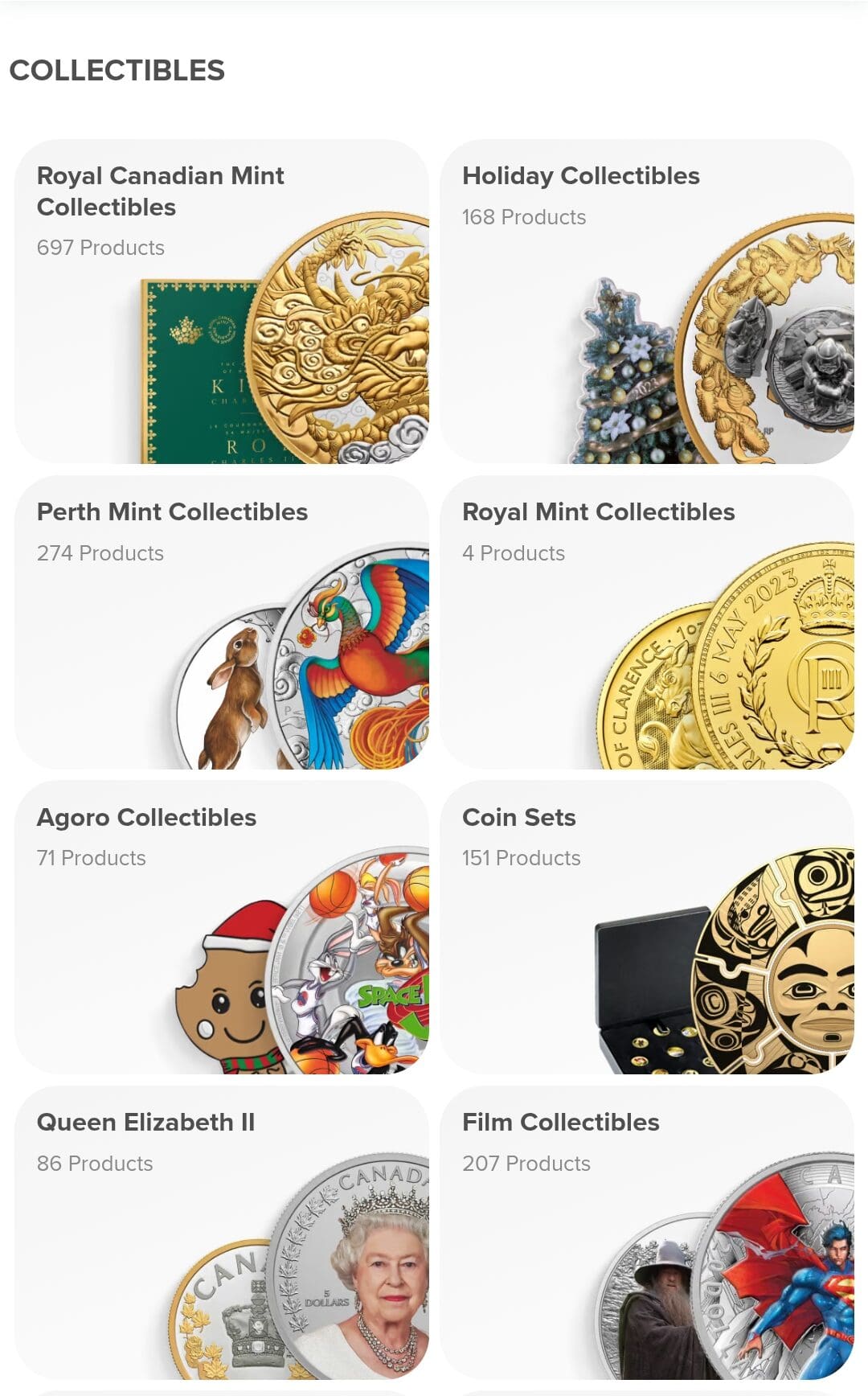

Online dealers like JM Bullion and APMEX offer hundreds of coins, bars, and specialty products not typically available in local shops.

- Competitive Pricing

Because online platforms operate at scale, they often offer lower premiums over spot price and frequent promotional discounts, especially for bulk orders.

- Convenience and 24/7 Access

You can place an order anytime from your phone or computer, whether markets are open or closed, making it easy for busy investors.

- Transparent Reviews and Reputation

Platforms typically show thousands of customer reviews, BBB ratings, and shipping guarantees, helping you evaluate credibility before buying.

- Shipping Time and Delays

Orders may take several days to arrive, and during periods of high demand, shipping could be delayed due to inventory backlogs.

- Risk of Delivery Theft or Loss

Even though shipments are insured, there is still anxiety around packages being lost or stolen in transit—especially for high-value orders.

- No Physical Inspection Before Purchase

You can’t hold or inspect the gold before buying, which may be a concern for those investing in collectible or rare pieces.

- Scams and Fake Websites

There are fraudulent gold websites that mimic legitimate dealers, so you must verify credentials and secure payment methods before purchasing.

When You May Consider a Local Gold Dealer

Working with a local gold dealer makes sense in specific situations where speed, trust, and personal interaction are a priority.

You Need Gold Immediately: If gold prices dip and you want to act fast, buying from a local shop allows you to take immediate possession that day.

You Prefer Face-to-Face Transactions: Some investors feel more confident when they can speak directly to a dealer, ask questions, and see the product before buying.

You’re Buying a Gift or Collectible: For unique or collectible coins, inspecting them in person—especially for condition and presentation—can help you make a more informed choice.

You Want to Avoid Shipping Risks: Local purchases eliminate concerns about lost or delayed packages, which is useful for buyers who prioritize privacy and security.

When You May Consider an Online Gold Dealer

An online gold dealer may be a better choice when you’re looking for variety, convenience, and potentially better prices.

You Want Access to More Products: Online platforms like APMEX or SD Bullion offer a broader range of coins and bars, including international and limited-edition pieces.

You’re Buying in Larger Quantities: Many online dealers offer volume discounts or lower premiums, making them ideal for investors building long-term gold portfolios.

You Prefer Shopping from Home: If you're managing multiple investments or live far from a trusted dealer, buying gold online saves time and effort.

You Rely on Customer Reviews: With hundreds or thousands of reviews available, it's easier to evaluate a dealer’s reputation and service quality before placing an order.

FAQ

Yes, many local gold dealers are open to price negotiations, especially for larger purchases. It's often easier to negotiate in person than online.

Sales tax may apply depending on your state and the online dealer's location. Some states exempt precious metals from sales tax altogether.

Reputable dealers like JM Bullion and APMEX use encrypted platforms, insured shipping, and strong customer service, but you should always verify credentials first.

Local dealers may buy your gold on the spot, which is convenient, but online dealers often offer higher buyback rates and better transparency.

Most local shops carry standard bullion items like American Gold Eagles and generic bars. Specialty coins and rare items are less common.

Yes, many online dealers partner with vaulting services or offer their own storage programs for a fee, especially for large orders.

While most are legitimate, some local shops may overcharge or sell questionable items, so verifying licenses and reviews is essential.

Check BBB ratings and read independent customer reviews on trusted platforms like Trustpilot.