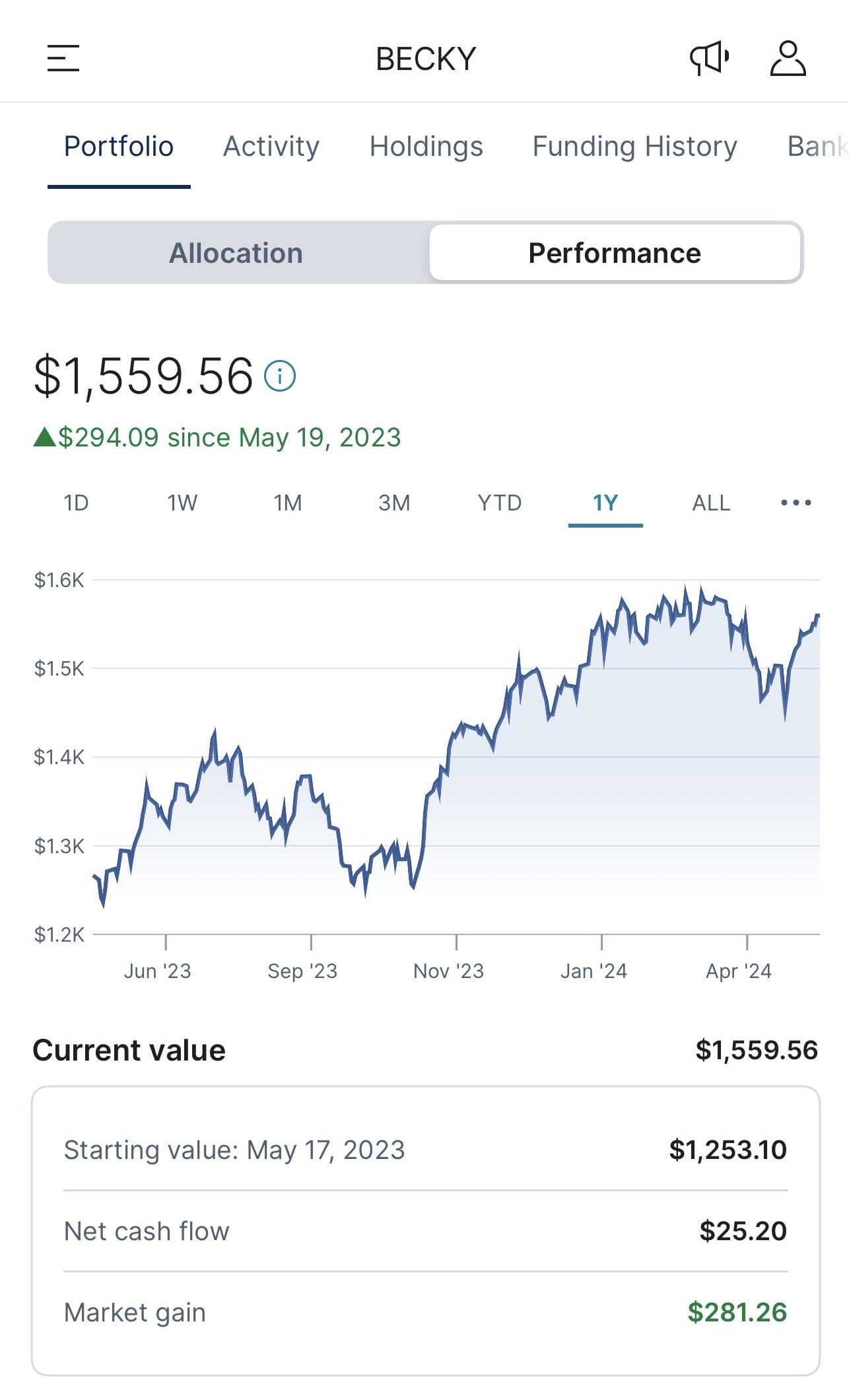

Acorns focuses on simplicity and automation, making it ideal for beginners. Its user-friendly app offers educational resources, retirement accounts, and sustainable investing options, helping users build wealth effortlessly.

In contrast, M1 Finance appeals to more experienced investors seeking greater control over their investments. It combines robo-advisory services with customizable portfolios, allowing users to create and manage their own “pies” of stocks and ETFs.

M1 Finance | Acorns | |

Monthly Fee | $3

Can be waived if you have an active M1 loan or your assets are over $10,000

| $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

|

Account Types | Brokerage, Retirement, Crypto, Trust | Brokerage, Retirement |

Savings APY | Earn 4.00% | 1.00% – 3.00% |

Minimum Deposit | $100 | $0 |

Best For | Beginners And Young Investors, Low Cost Banking, Crypto Investing | Robo Advisor, Young Traders, Crypto Investing |

Read Review | Read Review |

Acorns vs M1 Finance Investing Features

M1 Finance stands out with its flexible investing approach, allowing users to build custom portfolios through Pie Investing, enabling a diversified investment strategy.

On the other hand, Acorns simplifies the investing process through automation, providing access to over 7,000 assets, including options for Bitcoin investments. Its Round Ups feature automatically invests spare change from everyday purchases.

M1 Finance | Acorns | |

|---|---|---|

Investing Options | 6,000+ stocks and ETFs & Crypto | 100+ stocks, +40 ETFs (Up to 7,000 assets with automated investing) |

Account Types | Brokerage, Retirement, Crypto, Trust | Brokerage, Retirement |

Financial Planning | No | No |

Automated Investing | Yes | Yes |

Tax Loss Harvesting | No | No |

-

Self Investing Options

M1 Finance is our winner when it comes to self-investing options, as it offers many more options compared to Acorns.

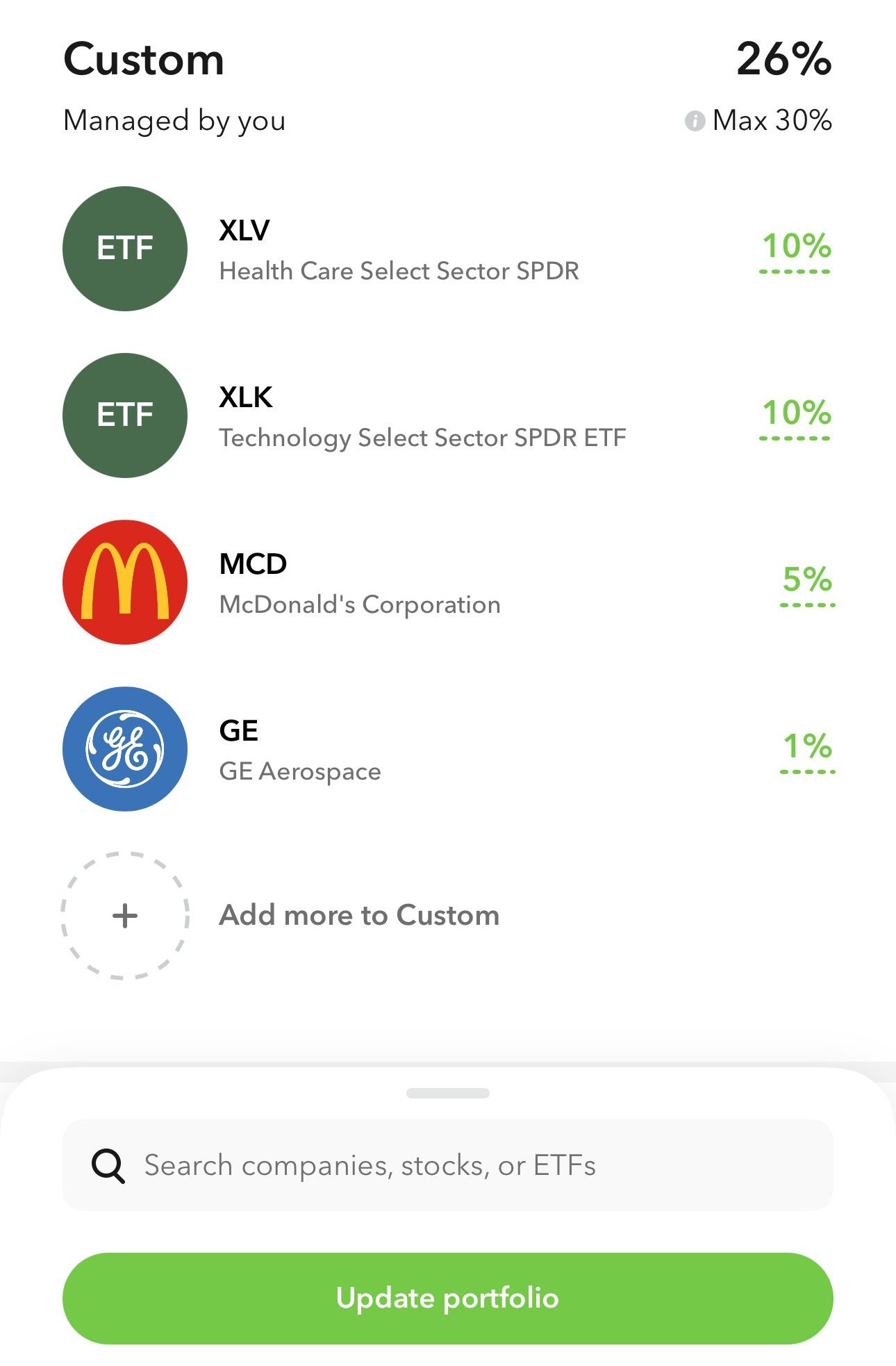

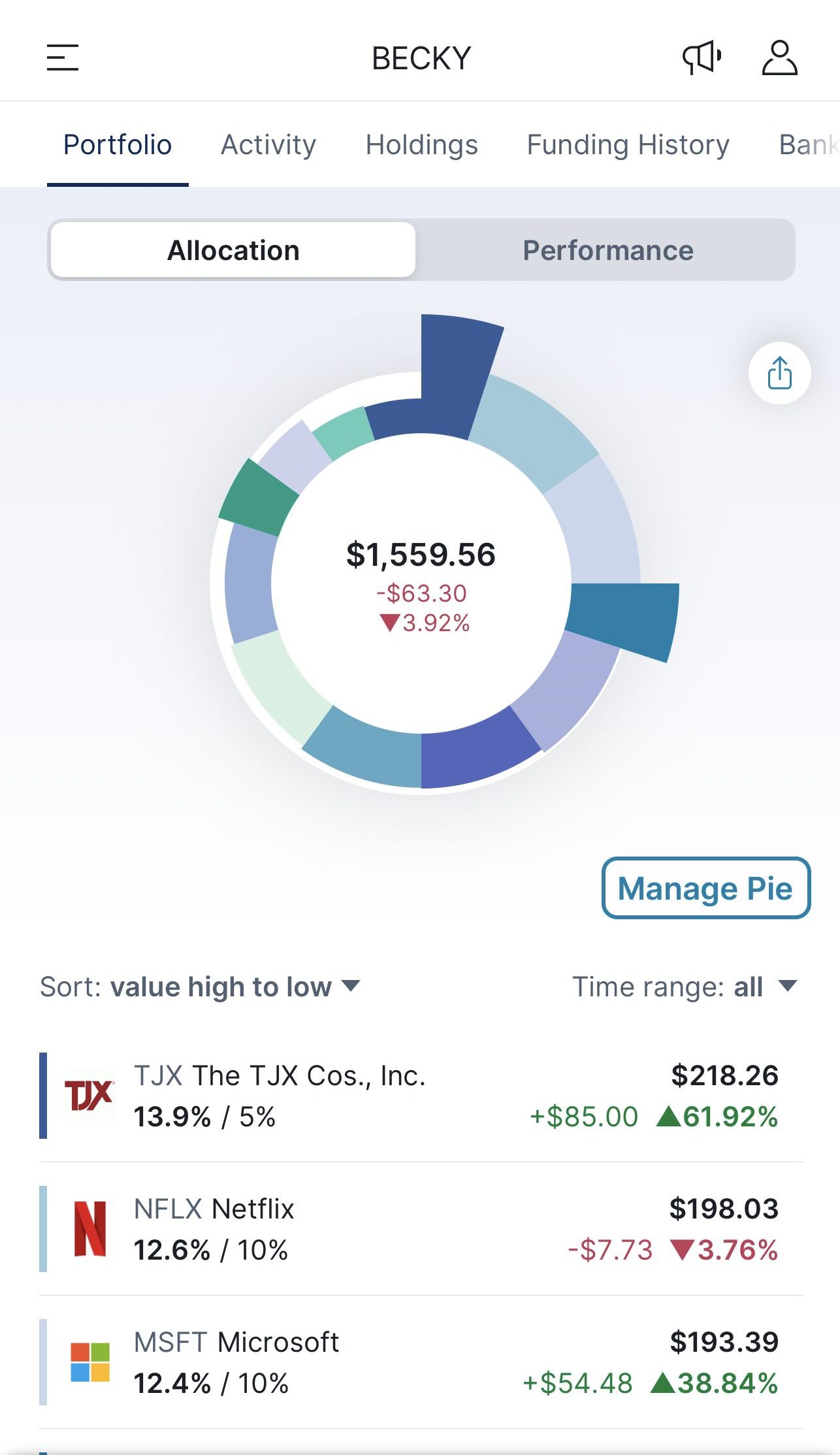

M1 Finance's Pie Investing feature enables users to create portfolios called “pies,” composed of various investment slices. Users can customize their pies to meet specific investment goals and use fractional shares for precise adjustments when necessary.

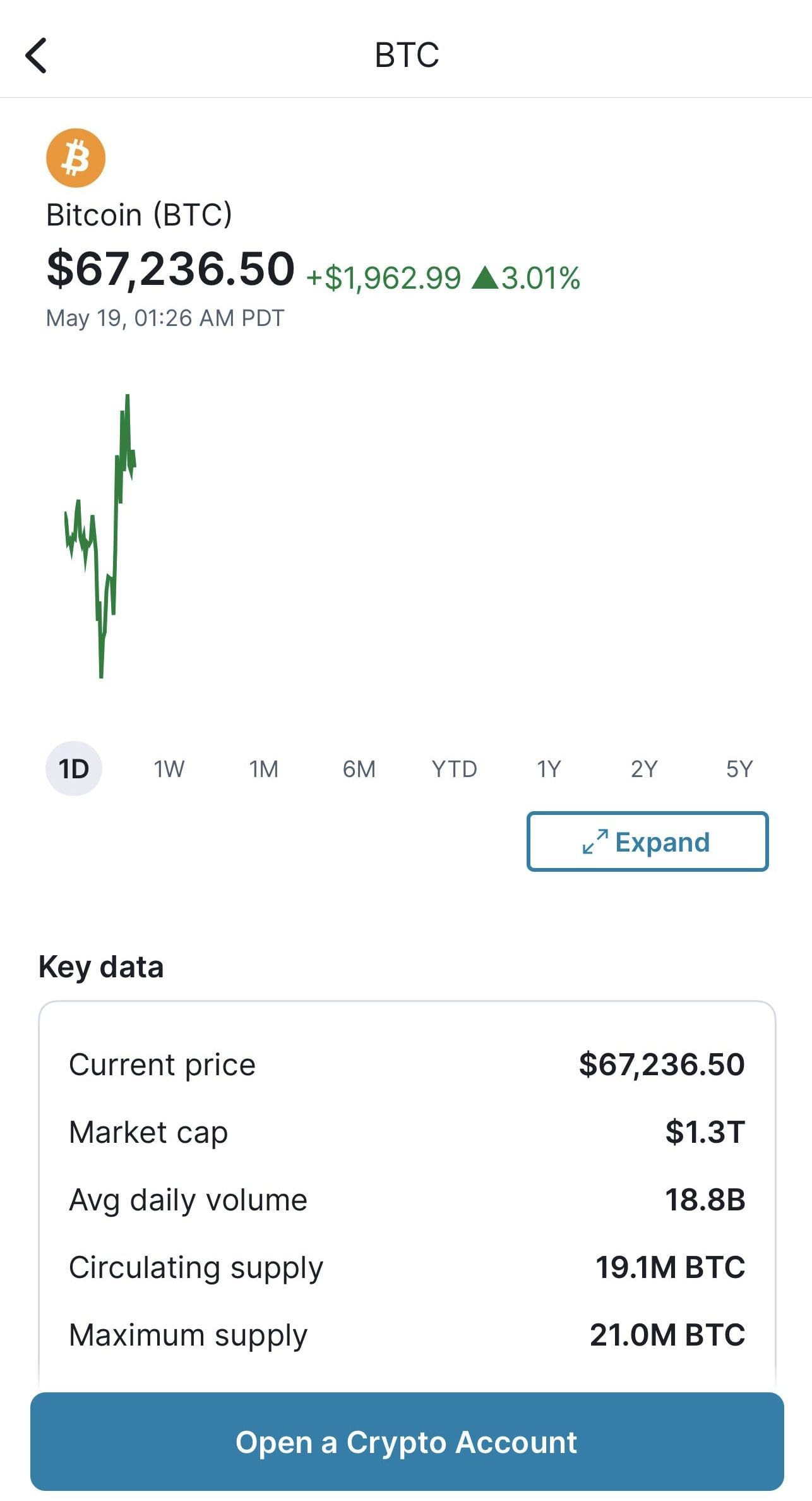

This flexible and customizable approach allows users to select investments from a pool of over 6,000 stocks, ETNs, and ETFs, and also offers exposure to various cryptocurrencies.

As shown in the screenshot below, customers can open a crypto account and start trading top cryptocurrencies:

With Acorns' you can also access fractional shares. This platform provides fractional shares for new purchases and reinvested dividends. Your custom portfolio can make up to 50% of your total Acorns Invest portfolio.

Users can choose from over 100 stocks and more than 40 ETFs, which means less options compared to M1 Finance.

The platform walks you through investment preferences and goals during set up, but you can choose from ETFs that are based on themes.

-

Automated Investing

Acorns is our winner when it comes to automated investing and simplicity.

Acorns ETFs offer exposure to over 7,000 different assets, reducing risk compared to trading individual stocks.

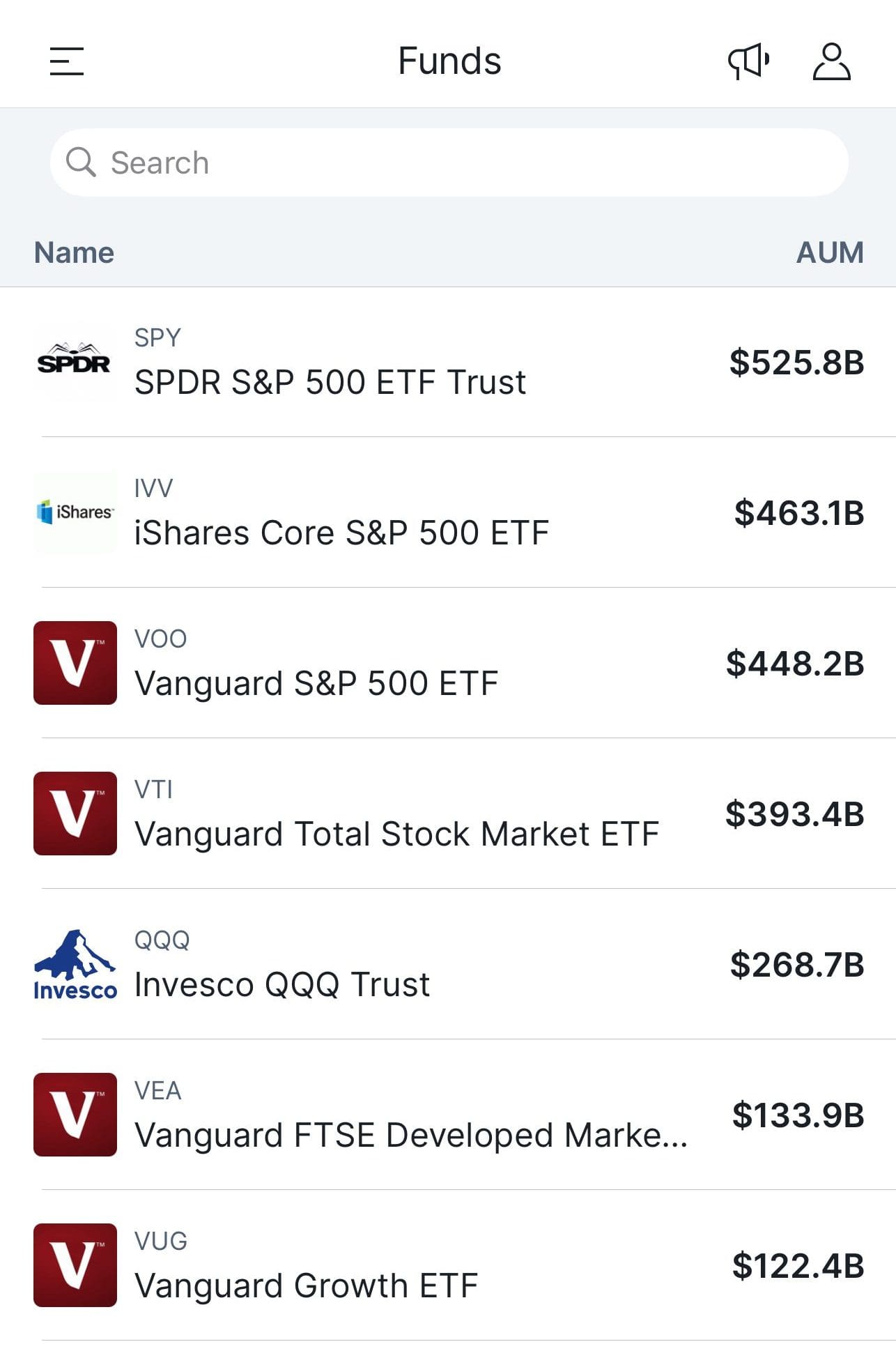

The platform automatically constructs and oversees your portfolio according to your risk tolerance and financial objectives, investing your funds into top-rated Exchange Traded Funds (ETFs), which are professionally designed portfolios.

These portfolios often include shares in top-performing companies like Apple, Amazon, Google, and Berkshire Hathaway, offering exposure to successful businesses.

They also include ETFs managed by professionals at leading firms such as Vanguard and BlackRock, ensuring high-level expertise and robust management.

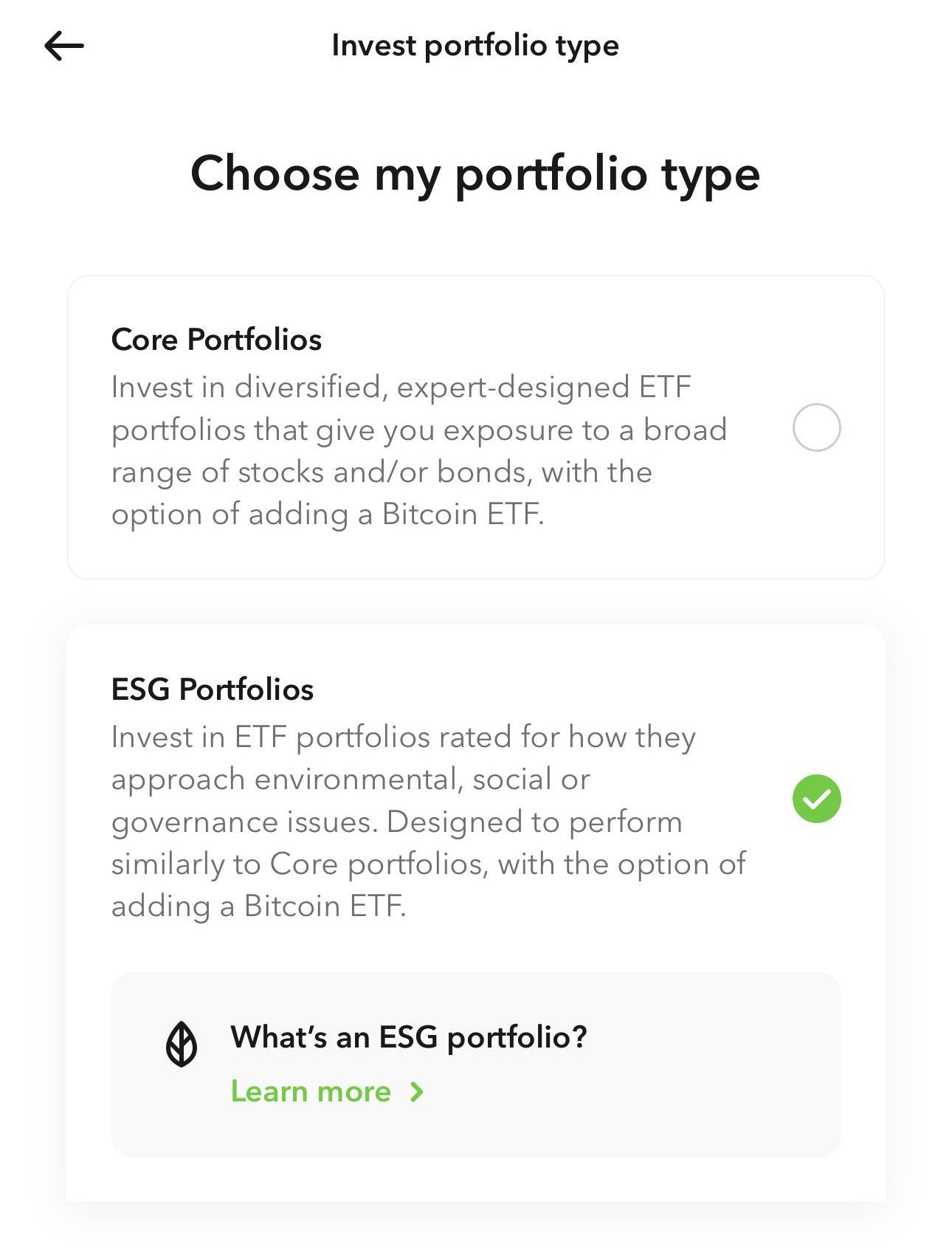

Investors can choose an ESG portfolio:

Alternatively, M1 provides a unique system that allows users to build personalized portfolios or choose from almost 100 pre-designed “expert pies.”

M1 takes care of the ongoing management and rebalancing of these portfolios automatically. The pies are categorized into different types, such as retirement, socially responsible investing, and basic stock and bond options.

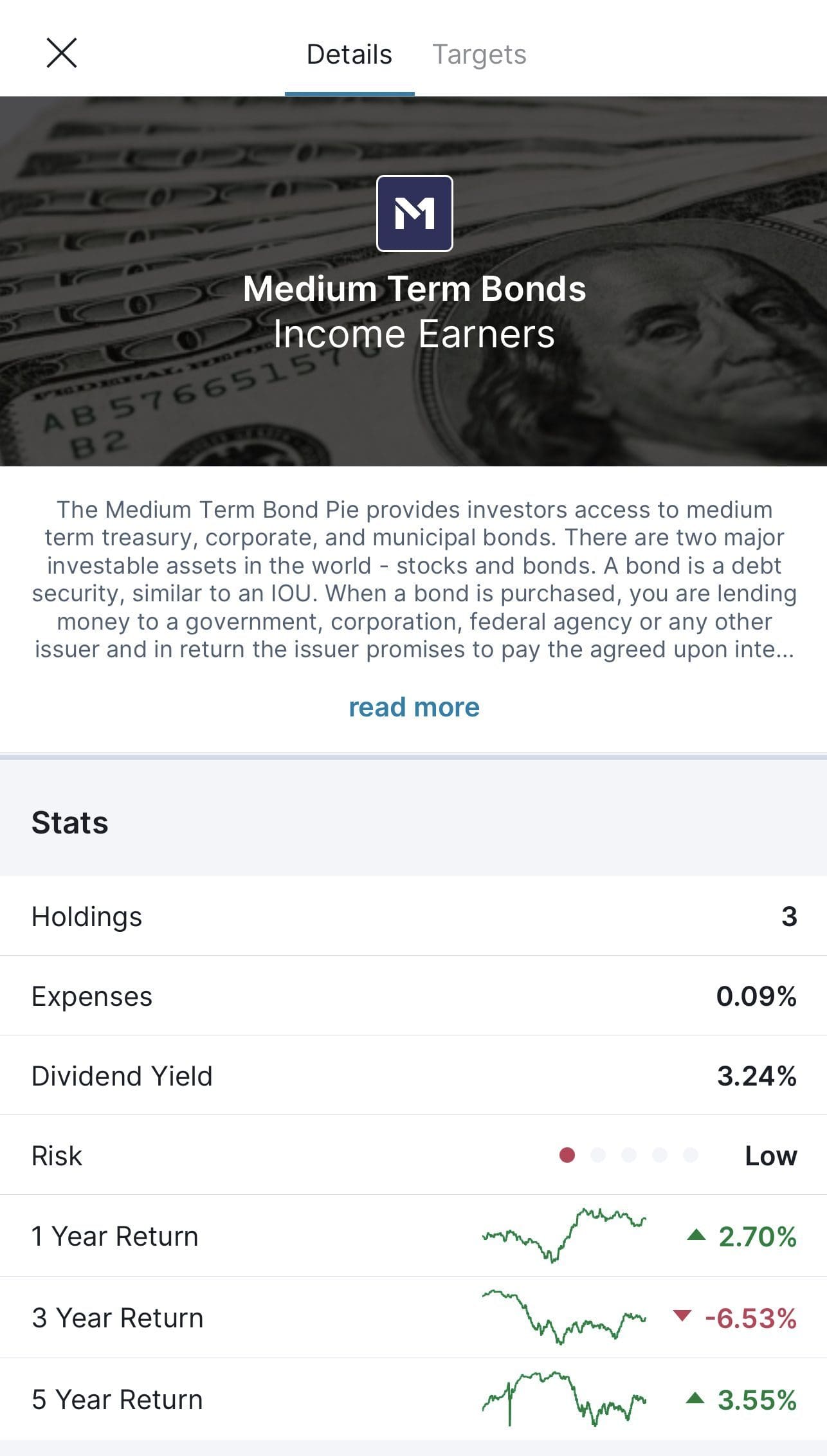

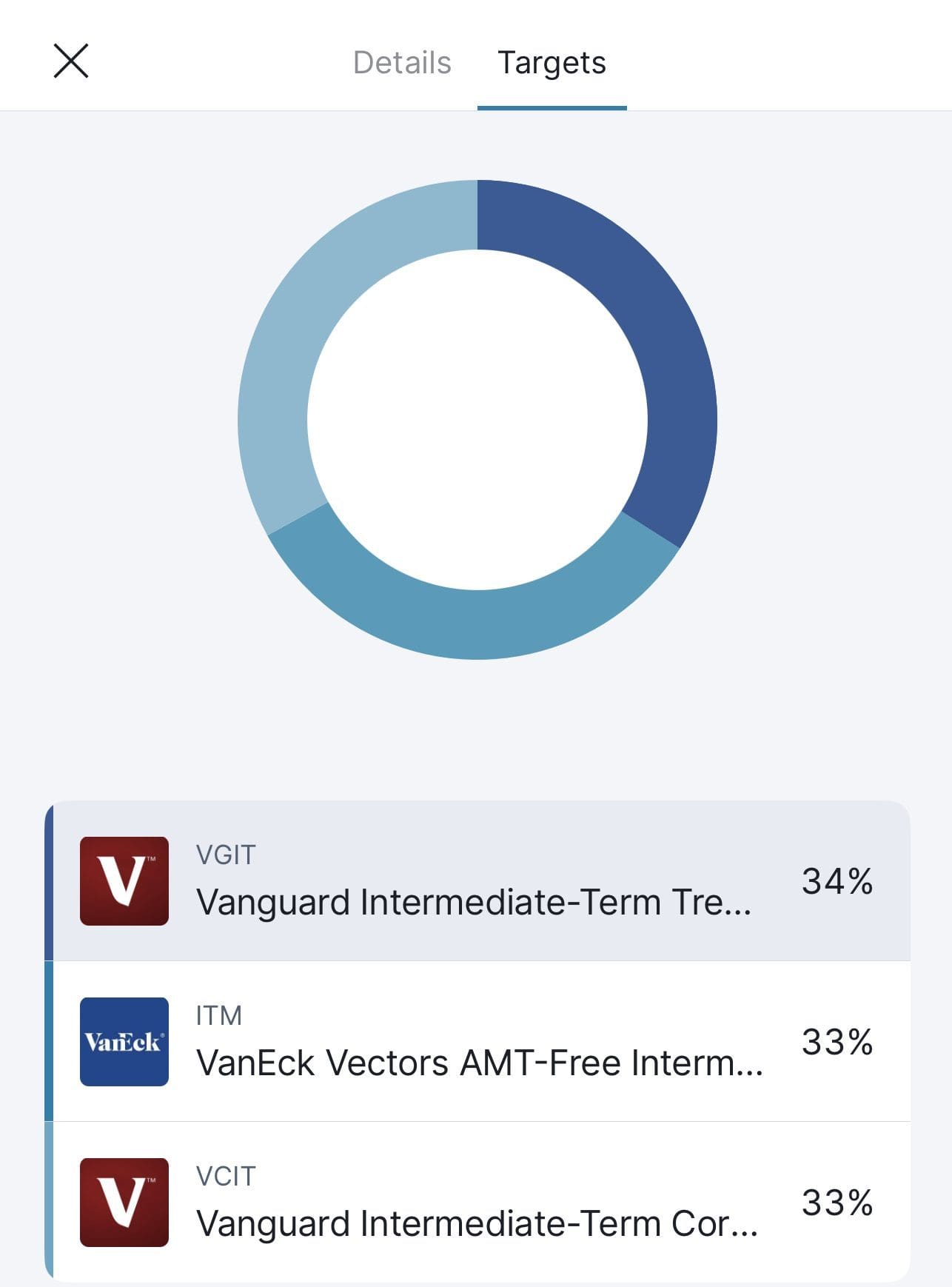

For each fund you can see details and target allocation:

-

Additional Features Worth Mentioning

Acorns Earn stands out by offering rewards for shopping with hundreds of brands, making the platform even more attractive.

With over 300 participating partners, users earn rewards with every eligible purchase, which are then added to their Invest account, boosting their investment portfolio.

Acorns Later helps you automatically invest for retirement with potential tax benefits. It recommends an IRA plan (Roth, Traditional, or SEP) tailored to your goals by answering a few questions.

M1 provides various tools for traders and advanced investors to research stocks, add to watchlists, and track assets:

One of the standout features of M1 is its Dynamic Rebalancing. This automated tool ensures that the cash flow in and out of your account consistently aligns with your investment targets.

Fees

Both platforms don't charge a fee if you trade stocks or ETFs. However, they do charge a monthly fee for the service:

M1 Finance | Acorns | |

|---|---|---|

Monthly Fee | $3

Can be waived if you have an active M1 loan or your assets are over $10,000

| Monthly Fee $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

|

Does Any Of Them Offer Advisory Services?

No, Acorns and M1 Finance focus on automated and self-investing, and they do not offer the option to meet or talk to a financial advisor.

M1 Finance vs Acorns Banking Options

When it comes to banking options, Acorns offers better banking options than M1, but the latter has more lending options for customers than Acorns.

-

Cash Management

Acorns offers a cash management through its Mighty Oak debit card.

Acorns Checking offers a range of features designed to simplify and enhance your banking experience. With Paycheck Split, you can automatically invest a portion of every paycheck, helping you grow your investments effortlessly.

You can access your funds up to two days early with Early Payday and invest regularly through Real-Time Round-Ups®, which rounds up your spare change from purchases.

There are no hidden fees, minimum balance requirements, or overdraft fees. You also have access to over 55,000 fee-free ATMs within the AllPoint network.

Banking services are provided by nbkc bank, ensuring that all accounts are FDIC-insured up to $250,000.

When it comes to cash management, M1 lacks checking account features such as integration with payment apps, ATM withdrawals and transfer money.

-

Savings Rates

When it comes to savings, both platform offers high yield savings rates.

M1 Finance | Acorns | |

|---|---|---|

Savings APY | Earn 4.00% | 1.00% – 3.00% |

The M1 High-Yield Cash Account is a cash reserve linked to your M1 brokerage account, offering Earn 4.00% APY and enjoy FDIC insurance coverage up to $3.75 million, all without hidden fees.

Acorns offers an Emergency Fund account that provides a high Annual Percentage Yield (APY) of 5.00%.

Acorns facilitates automatic recurring contributions, allowing users to set daily, weekly, or monthly deposits into their accounts, promoting consistent saving habits.

-

Credit Cards And Lending Options

M1 offers the M1 Owner’s Rewards Card. The card provides up to 10% cash back on purchases from a curated list of companies that you own shares in through your M1 Finance account and has no annual fee for M1 Plus member.

M1 borrow offers margin loan/line of credit feature that allows you to borrow against your investment portfolio without selling your securities. You can access up to 50% of your portfolio’s value without triggering taxable events.

Acorns offers the Mighty Oak debit card. This card is linked to your Acorns Checking account, so when you use the card, the money comes directly out of your checking balance.

Bottom Line

Overall, M1 and Acorns offer similar features and their target audience is quite similar. However, each of the, has its own beenfits.

Acorns is better in our opinion when it comes to automated investing, while M1 finance is better for those who would like to pick specific stocks and choose their own research.

When it comes to banking, Acorns offers better options for checking accounts, but M1 has more options if you want to borrow.

Compare Acorns Side By Side

Acorns excels in automated investing, ideal for those who prefer a hands-off approach, while Stash is better suited for self investing

While Robinhood caters to traders and advanced investors, Acorns focuses on automated investing and banking. Here's our full comparison.

Wealthfront and Acorns offer advanced automated investing options, appealing investing features, and banking options. Here's our comparison: