There are various financial platform for managing your investments, savings, and overall financial well-being, and Wealthfront and M1 Finance are two popular options.

This article comprehensively compares Wealthfront and M1 Finance, focusing on key aspects such as general platform features, money and cash management, investing options, savings accounts, advisory services, fees, and credit card offerings.

M1 Finance | Wealthfront | |

Main Fees | Monthly Fee $3

Can be waived if you have an active M1 loan or your assets are over $10,000

| Annual 0.25% (Automated investing only) |

Account Types | Brokerage, Retirement, Crypto, Trust | Brokerage, Retirement, College 529s |

Savings APY | Earn 4.00% | 4.25% |

Minimum Deposit | $100 | $500 |

Best For | Beginners And Young Investors, Low Cost Banking, Crypto Investing | Minimal Decision-Making Investing , Financial Planning, Low Cost Banking |

Read Review | Read Review |

Wealthfront vs M1 Finance Investing Features

Wealthfront and M1 Finance offers some advanced features when it comes to automated and self investing, portfolio management, customization, research, and other options for investors. Here are the main features each of them provides, including screenshots taken by our team:

M1 Finance | Wealthfront | |

|---|---|---|

Investing Options | 6,000+ stocks and ETFs & Crypto | 1,500 stocks, ETFs, and REITs |

Account Types | Brokerage, Retirement, Crypto, Trust | Brokerage, Retirement, College 529s |

Financial Planning | No | Yes |

Automated Investing | Yes | Yes |

Tax Loss Harvesting | No | Yes |

-

Self Investing Options

Wealthfront offers a streamlined and intelligent approach to investing in individual stocks, providing tools and features designed to make stock investing easier and more effective. Customers can invest in individual stocks with as little as $1, thanks to the availability of fractional shares.

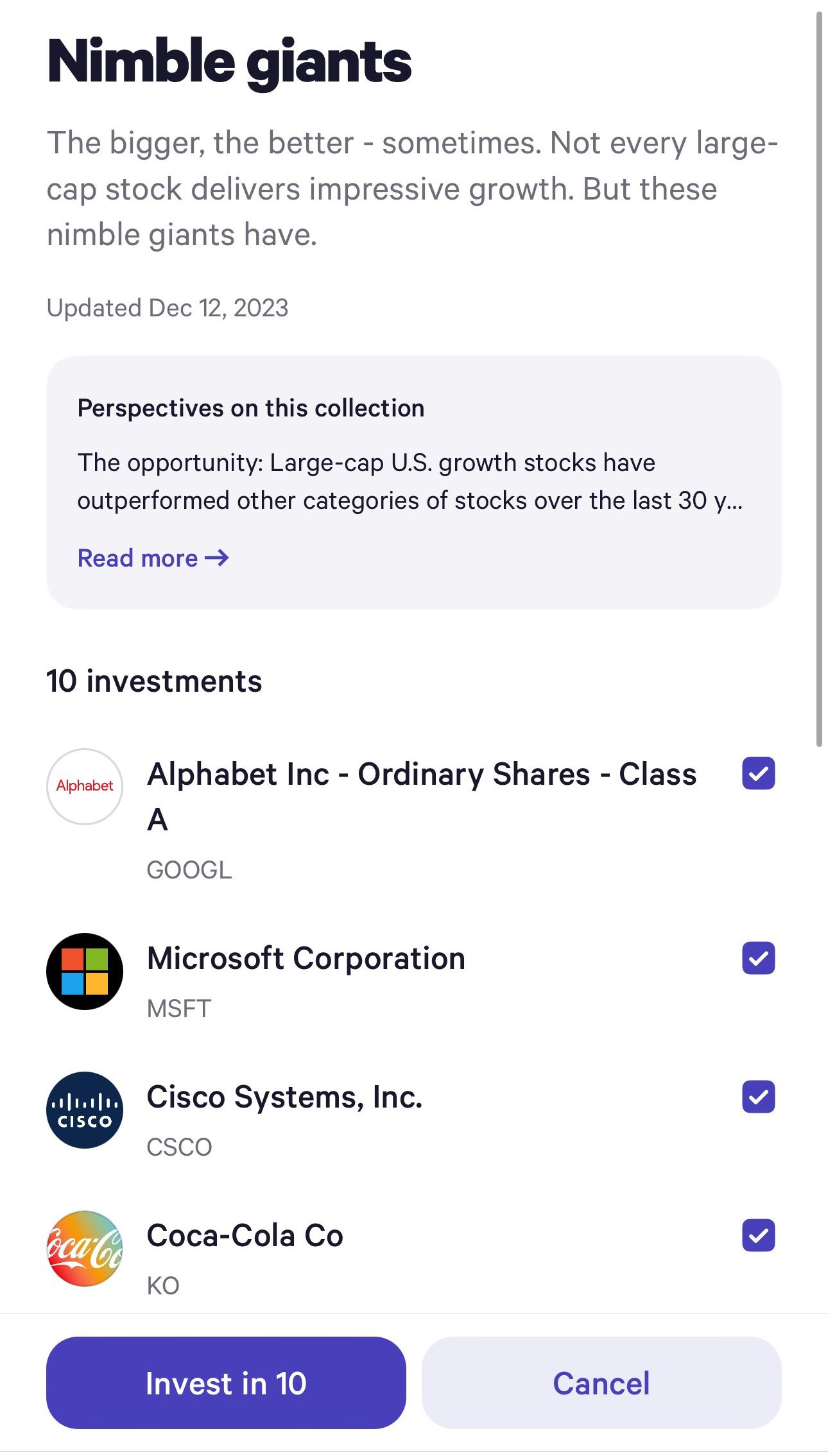

Wealthfront organizes stocks into pre-built collections such as blue chip, tech, semiconductor or cloud computing. These collections help you make smarter investing decisions faster by grouping stocks that share common characteristics or business models.

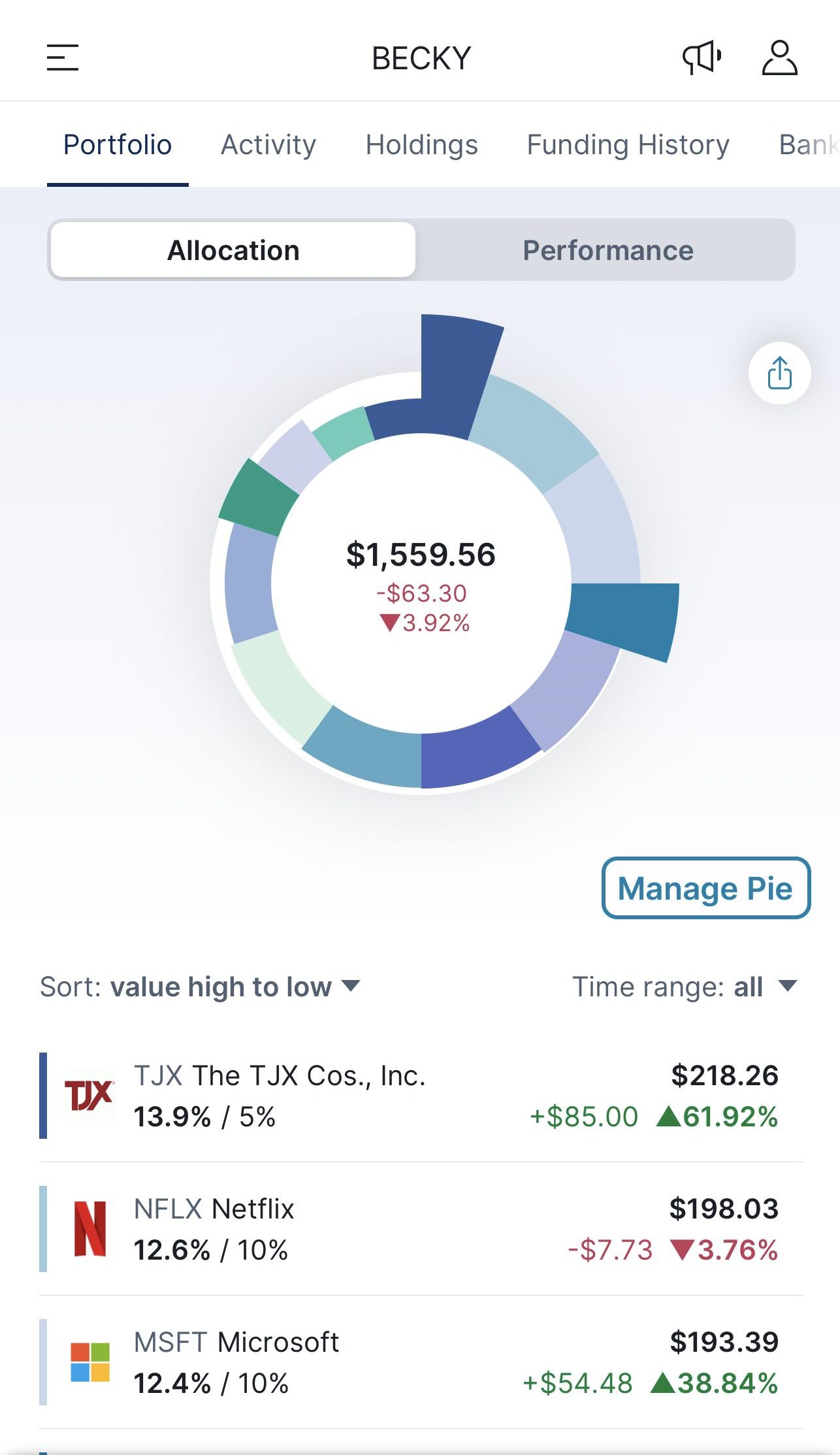

M1 Finance's Pie Investing feature allows users to create portfolios called “pies,” composed of various investment slices. Users can also customize their pies to meet specific investment goals.

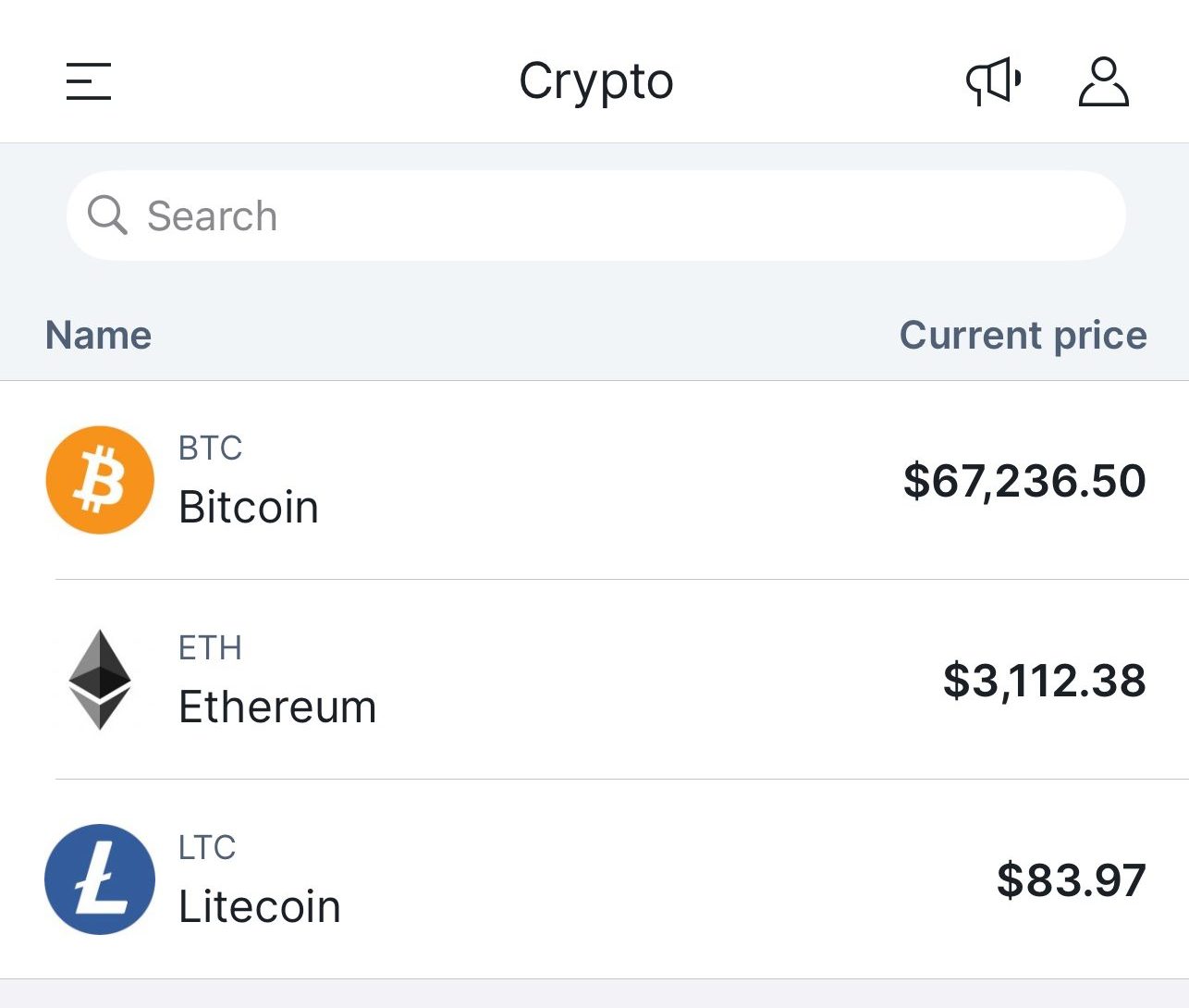

This flexible and highly customizable approach lets users pick investments from a pool of over 6,000 stocks, ETNs, and ETFs. It also offers Crypto exposure with various coins to invest in.

The platform's screener tool makes it easy to search for specific stocks based on criteria such as dividend yield, market capitalization, market sector, or P/E ratio.

-

Account Types

Wealthfront investing account types include personal and joint investment accounts as well as various retirement accounts such as traditional IRA, roth IRA, SEP IRA and Rollover IRA. Also, there are college savings plans, and trust accounts.

On the other hand, M1 Finance both individual and joint brokerage accounts, as well as Individual Retirement Accounts (IRAs) for long-term retirement planning.

Additionally, M1 provides custodial trust accounts for those who want to invest for their children or grandchildren.

-

Automated Investing

Wealthfront creates personalized portfolios based on your risk tolerance, financial goals, and time horizon. During the sign-up process, you answer a series of questions that help determine your risk profile. Wealthfront automatically rebalances your portfolio to maintain the desired asset allocation.

The portfolios are created by industry experts, including renowned economist Dr. Burton Malkiel. These portfolios are designed to be diversified and optimized based on modern portfolio theory.

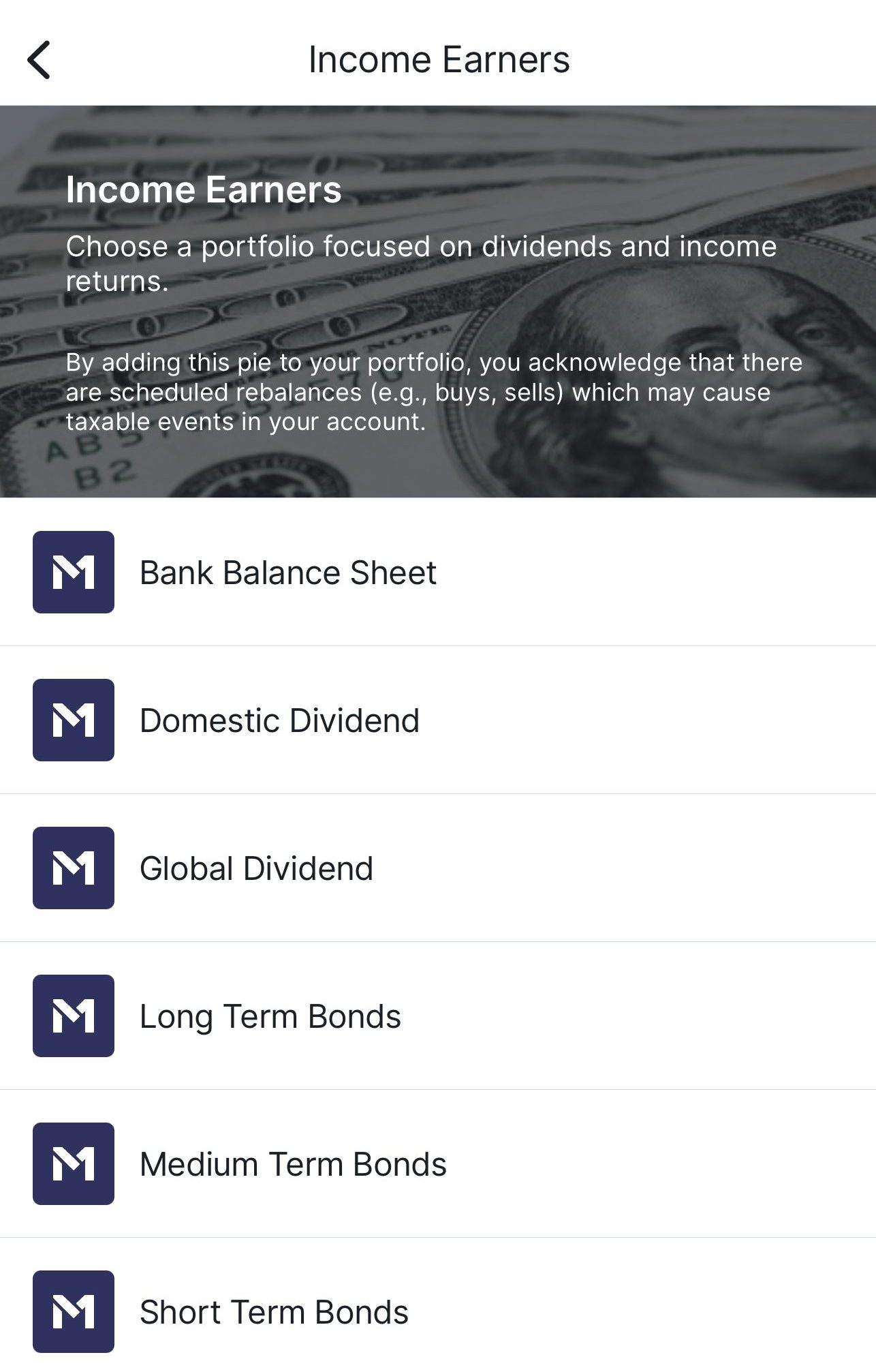

On the other hand, M1 platform provides a unique approach where users can build custom portfolios or choose from pre-made “expert pies,” and M1 handles the ongoing management and rebalancing of these portfolios automatically.

The Dynamic Rebalancing feature in M1 Finance automates the process of maintaining investment targets. When money is transferred or withdraw into the account, it is allocated to slices that are under their target percentages.

-

Additional Features

Wealthfront offers some great additional features for investors. For example, the daily tax-loss harvesting for taxable accounts, which involves selling securities at a loss to offset gains and reduce your overall tax bill.

For accounts with at least $100,000, Wealthfront offers direct indexing, which allows for more granular tax-loss harvesting by investing directly in individual stocks within an index rather than in index funds.

Another nice tool is the automated bond ladder, which invests in US Treasuries with varying maturities, providing a steady income stream while preserving capital.

M1 is more limited when it comes to additional investing features.

Fees

Both platforms don't charge a fee if you trade stocks or ETFs. However:

- There is a monthly fee for M1 finance (that can be waived if your assets exceed $10,000).

- Wealthfront, on the other hand, charges an annual advisory fee of 0.25% when if you use the automated portfolio to manage your investments.

Does Any Of Them Offer Advisory Services?

No. M1 Finance or Wealthfront are focused on automated as well as self-investing, but you won't have the option to meet or talk to a financial advisor.

Wealthfront vs M1 Finance Banking Options

Wealthfront is better for bakning than M1 Finance on our opinion, especially due to its diverse banking features. But, M1 has more options for lending. Let's compare these options side by side:

-

Cash Management

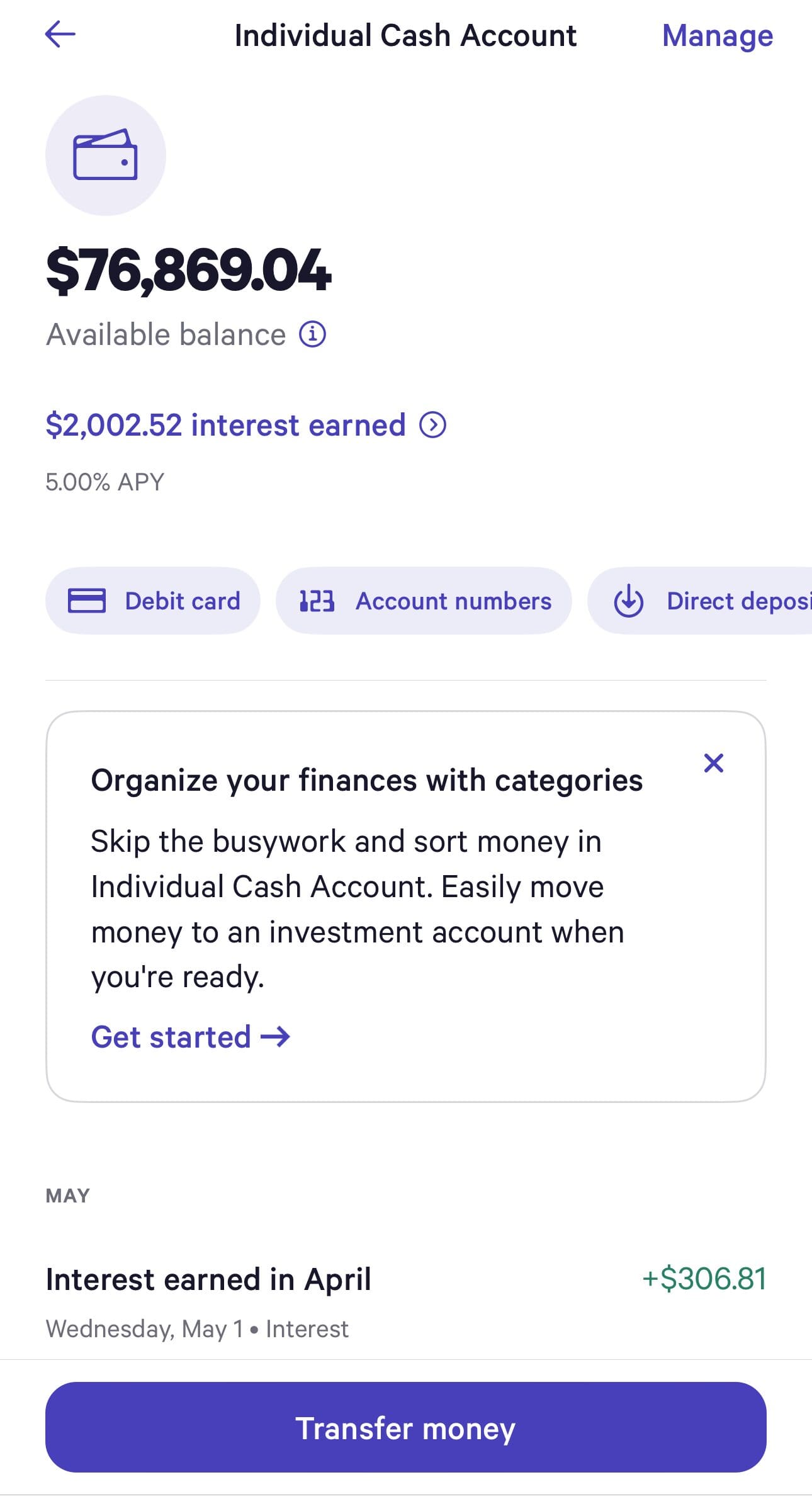

The M1 High-Yield Cash Account serves is more solid. M1 offers Smart Transfers, which automate the movement of funds based on user-defined rules.

For example, users can set rules to maintain a minimum balance in their high-yield savings account, with excess funds automatically transferred to their investment account.

Wealthfront's Cash Management Account combines the best features of a high-yield savings account and a checking account. There are no monthly maintenance fees or ATM charges, and the account can be opened with just $1.

The Wealthfront mobile app allows you to manage your account, track your spending, and transfer funds on the go. Customers can pay bills and make purchases directly through popular payment platforms like PayPal, Apple Pay, Google Pay, Cash App, and Venmo.

-

Savings Rates And Financial Planning

When it comes to savings, both platform offers high yield savings rates – but wealthfront is better when it comes to financial planning and setting specific savings goals.

Wealthfront offers its cash account through partner banks, providing up to $8M in FDIC insurance and a 4.25% APY without any minimum or maximum balance requirements.

The M1 High-Yield Cash Account is a cash reserve linked to your M1 brokerage account, offering Earn 4.00% APY and enjoy FDIC insurance coverage up to $3.75 million, all without hidden fees.

M1 Finance | Wealthfront | |

|---|---|---|

Savings APY | Earn 4.00% | 4.25% |

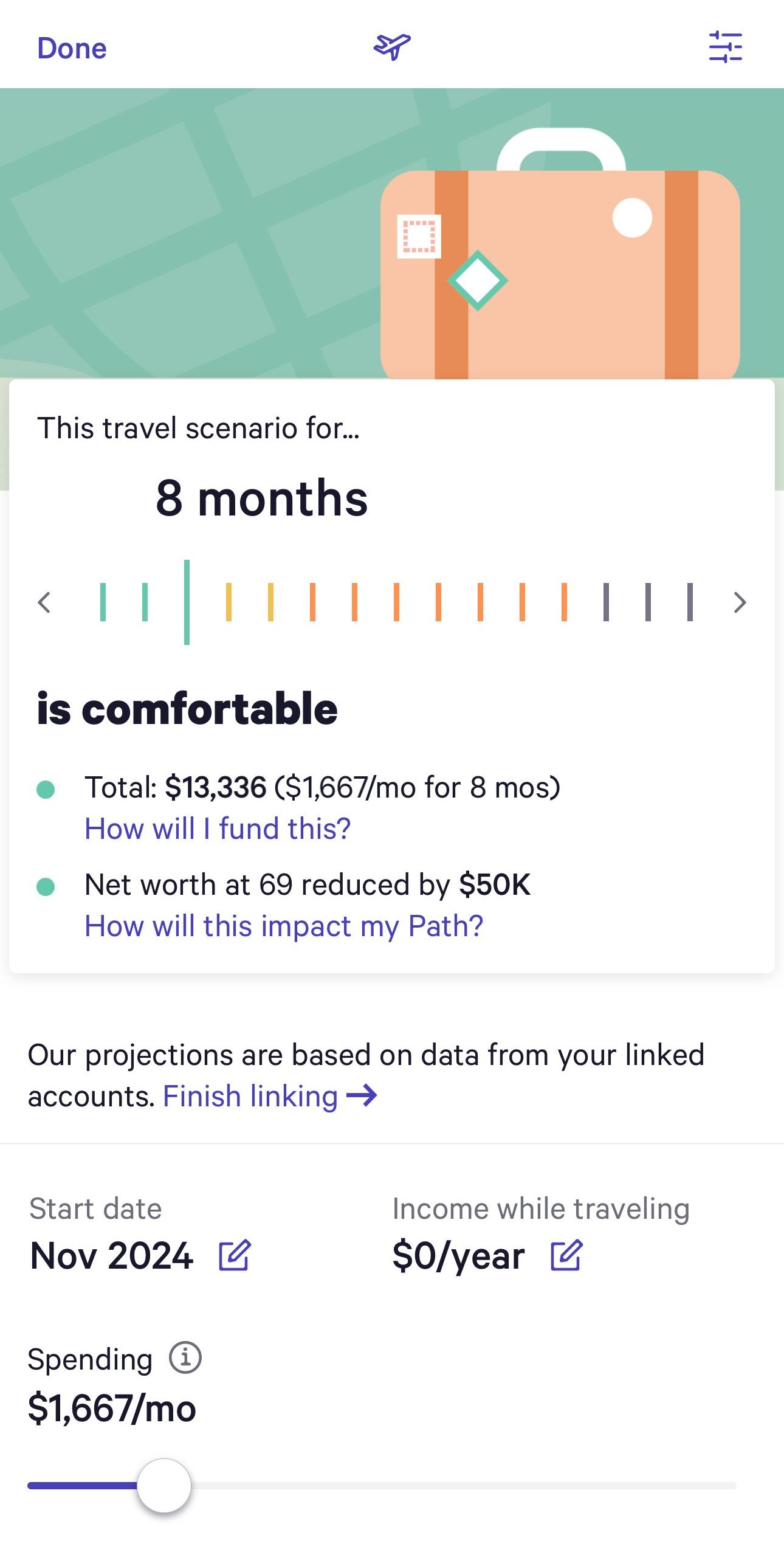

Wealthfront allows users to set multiple financial goals across different time horizons, including short-term, medium-term, and long-term objectives.

The platform continuously monitors your progress towards each goal and provides updates on whether you are on track or need to make adjustments.

Then, users can customize their goals based on their unique financial needs, such as saving for retirement, buying a home, purchasing a car, or planning for a vacation.

-

Credit Cards And Lending Options

M1 offers the M1 Owner’s Rewards Card. The card provides up to 10% cash back on purchases from a curated list of companies that you own shares in through your M1 Finance account and has no annual fee for M1 Plus member.

M1 Finance offers a margin loan/line of credit feature that allows you to borrow against your investment portfolio without selling your securities. You can access up to 50% of your portfolio’s value without triggering taxable events.

With a minimum of $25,000 invested in Wealthfront, you can access a line of credit up to 30% of your portfolio value. The application process is quick, with competitive interest rates and no additional credit checks.

Bottom Line

Overall, Wealthfront offers more features when it comes to investing and banking options that are not available with M1. It also has some great financial planning options.

However, M1 may be a better option for young investors and those who want to take a bit more hands-on approach due to its versatile pull of stocks to choose from, as well as Crypto access.

Wealtfront vs. Competitors: How Does It Stack Up?

Wealthfront is the winner in investing and banking options, while Empower stands out for personal finance tools and tailored advisory services

Wealthfront and Acorns offers advanced automated investing options, appealing investing features and banking options. Here's our comparison: