Robinhood | Merrill Edge | |

Monthly Fee | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor |

Account Types | Brokerage, Retirement, Crypto | Brokerage, Retirement, Wealth Management |

Savings APY | 1.00% – 4.50%

You’ll earn 0.01% Annual Percentage Yield (APY) as a Robinhood Gold member on your uninvested brokerage cash that is swept to the banks in our program. | 0.01% – 4.11% |

Minimum Deposit | $0 | $0 – $50,000

Merrill Edge Self-Directed Trading: $0 Merrill Guided Investing – Robo Advisor: $1,000 for growth-focused strategies OR $50,000 for income-focused strategies Merrill Guided Investing – Online Advisor : $20,000 for growth-focused strategies OR $50,000 for income-focused strategies |

Best For | Active Traders, Tech Savvy Investors | Bank of America Customers, Advanced Traders |

Read Review | Read Review |

Robinhood vs Merrill Edge: Compare Features

Robinhood stands out with its accessibility and simplicity, especially for mobile users.

It pioneered commission-free trading and continues to offer features like fractional shares, crypto trading, and IPO access.

Merrill Edge | Robinhood | |

|---|---|---|

Investing Options | Full Access To Almost Any Asset | Over 5,000 securities, most U.S. stocks and ETFs listed on U.S. exchanges |

Investing Types | Stocks, Options, Margin, ETFs, Bonds & CDs, Mutual Funds, Margin | Stocks, Options, Futures, ETFs, Crypto, Margin, Fractional Shares |

Automated Investing | Yes | No |

Paper Trading | No | No |

IPO Access | No | Yes |

Dedicated Advisor | Yes | No |

Financial Planning | No | No |

Merrill Edge, on the other hand, excels in its integration with Bank of America, offering seamless management of both banking and investment accounts.

It provides a broader range of investment options than Robinhood, including mutual funds and bonds. Merrill Edge advisory services and robo-advisor options are additional advantages.

-

Self Investing And Trading Options

Robinhood is our winner for beginners and light traders, while Merrill is our choice for heavy investors and traders.

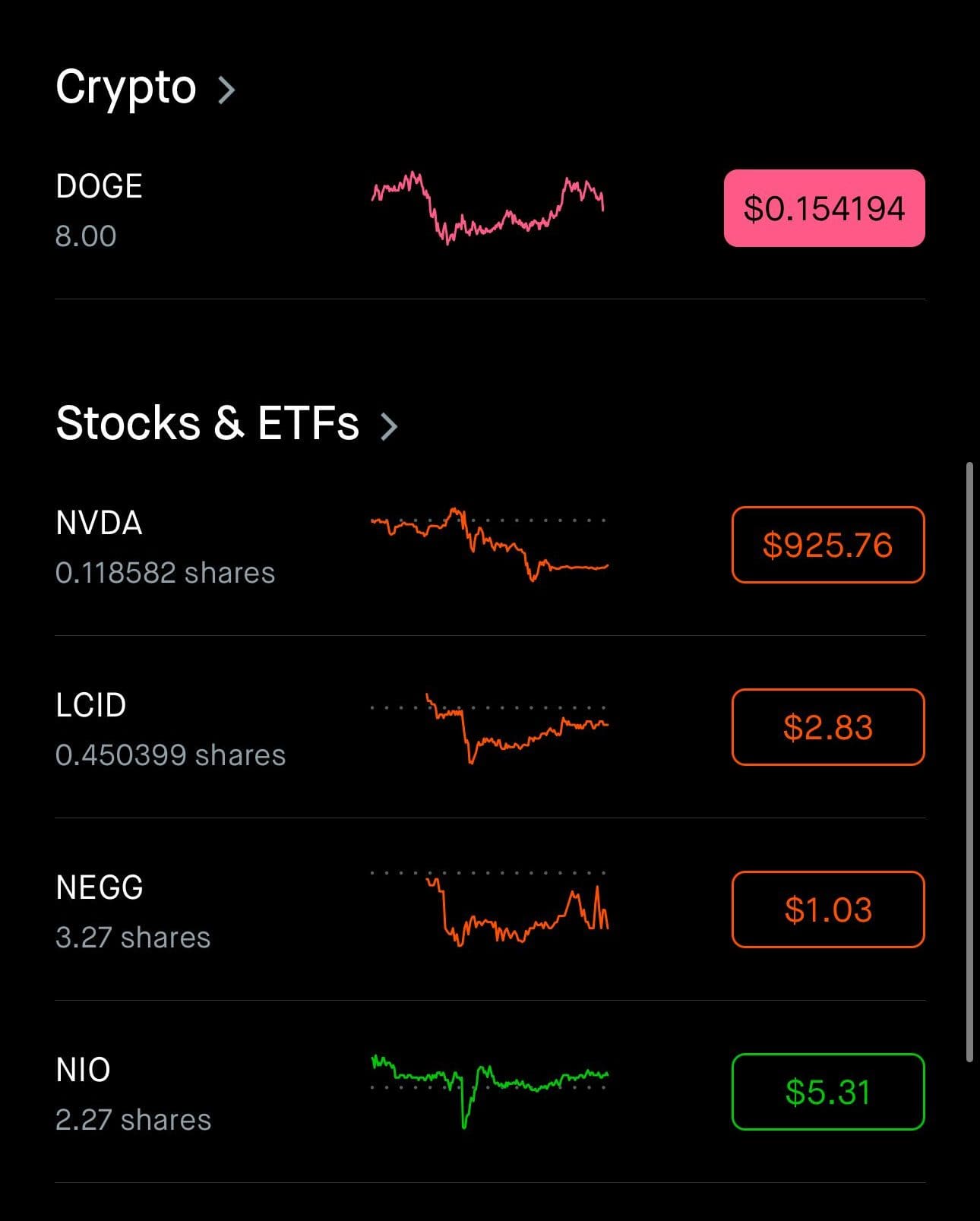

Robinhood's strengths in self-investing and trading lie in its accessibility, cost-effectiveness, and ease of use. The platform's strengths lie in its zero-commission trades, fractional shares, and the ability to trade cryptocurrencies alongside stocks and ETFs

Its user-friendly interface, combined with features like IPO access and a 24-hour market for trading, makes it particularly appealing to younger investors or those new to trading.

However, Robinhood’s simplicity can also be a limitation for more advanced traders. The platform lacks some of the more advanced tools, research options and certain asset classes, like mutual funds and bonds that can be found with Merrill.

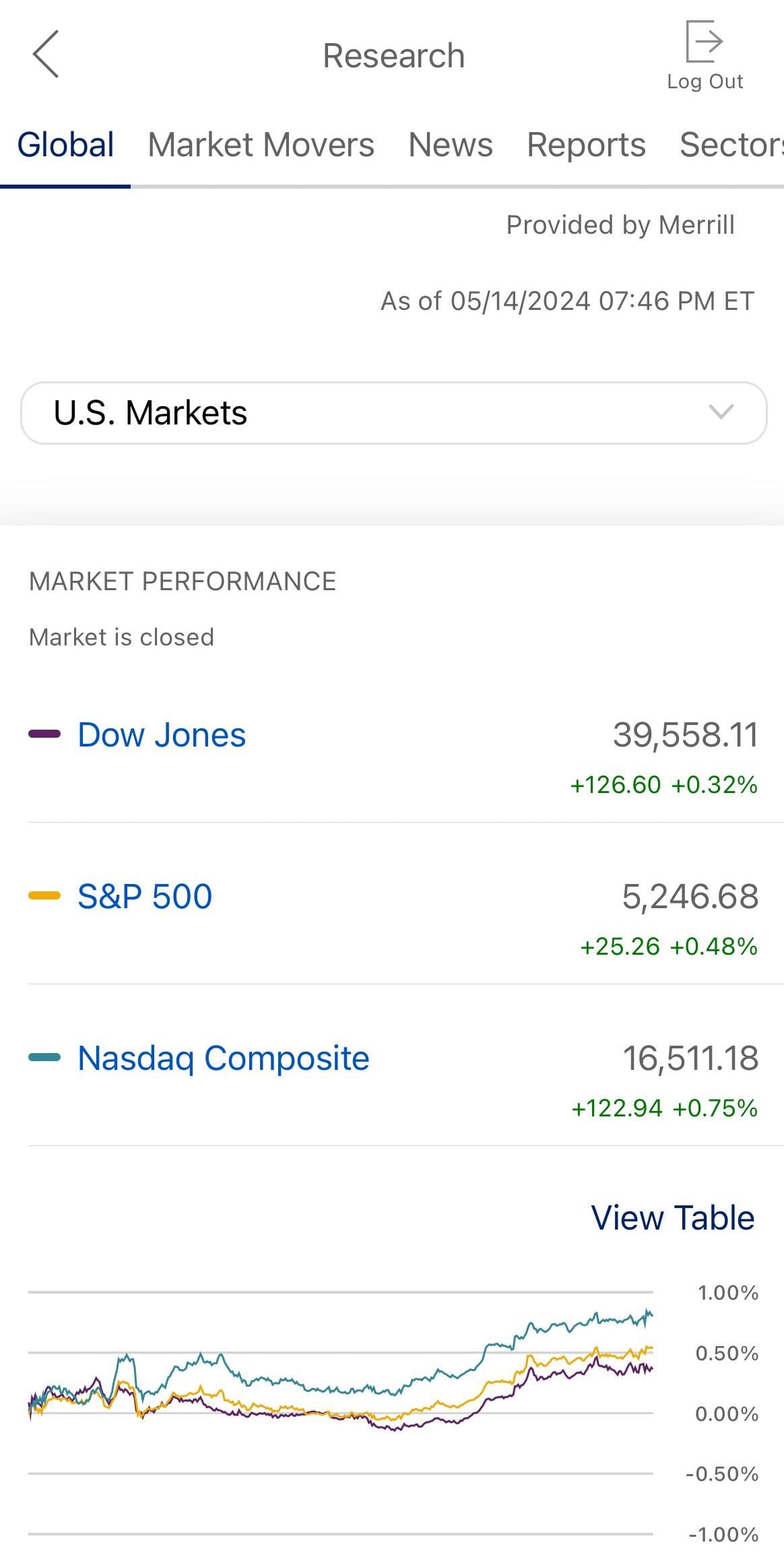

Merrill Edge, conversely, is a more traditional platform that provides a richer set of tools for self-directed investing.

It offers a comprehensive range of investment products and the Merrill Edge MarketPro is powerful solution for those who need an advanced trading tools. Additionally, Merrill Edge’s integration with Bank of America offers seamless financial management.

Despite these strengths, Merrill Edge does not offer fractional shares, which can make it harder for investors with smaller budgets to buy into high-priced stocks, and it does not support cryptocurrency trading.

-

Retirement Accounts And Planning

While Robinhood has some great benefits for savers, Merrill Edge is our winner here, offering many retirement options, including robo-advisory.

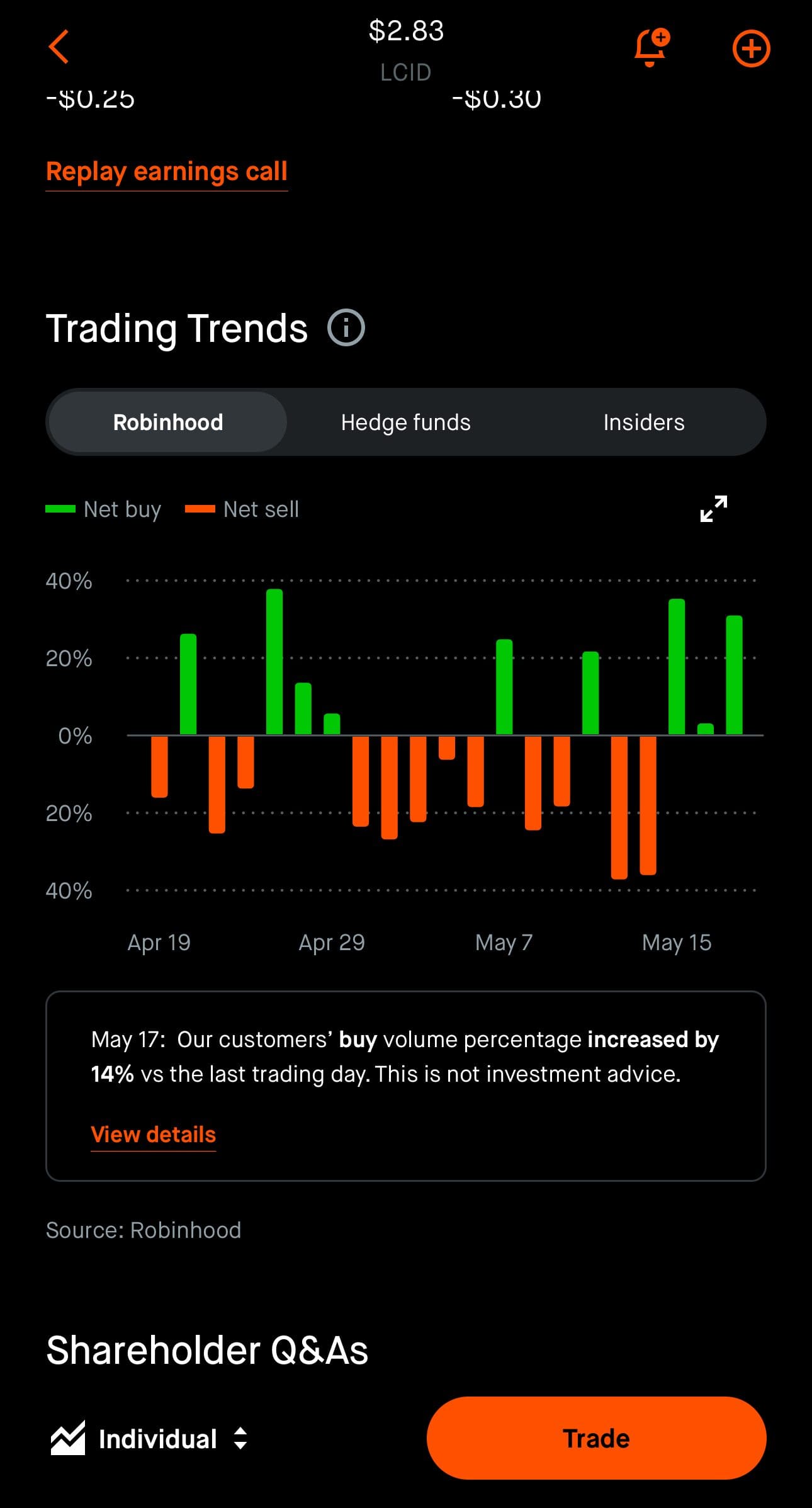

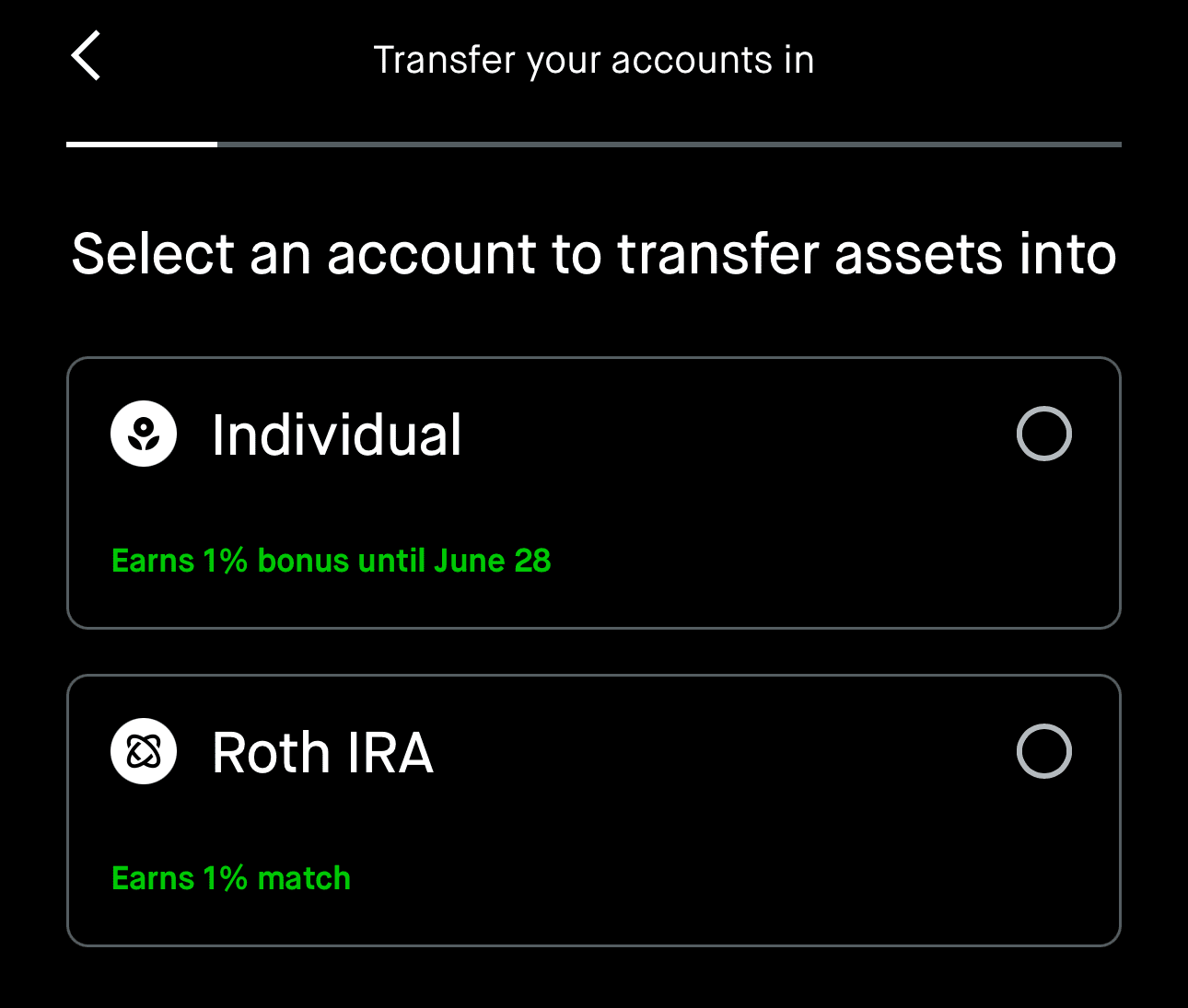

Robinhood excels in providing a straightforward approach to retirement investing with its Roth, Traditional, and Rollover IRAs.

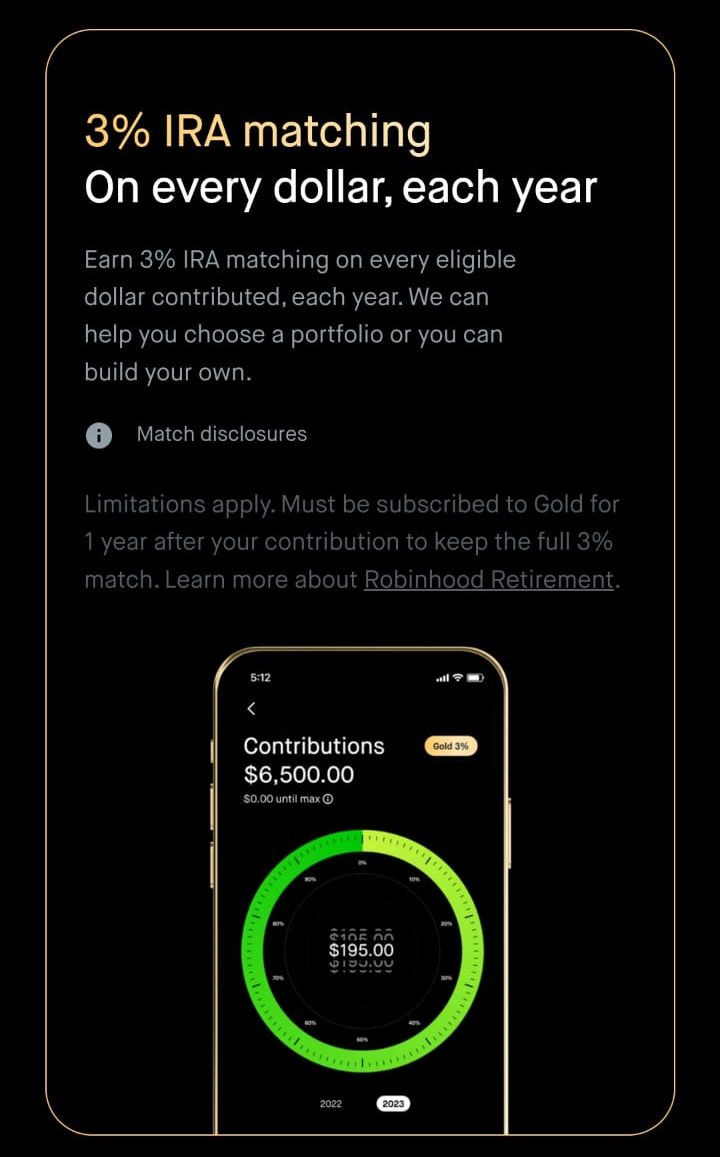

Robinhood offers a 1% match on IRA contributions, which is a unique feature among low-cost brokers. This match can be increased to 3% for Robinhood Gold members, making it an attractive option for those looking to maximize their retirement contributions without incurring high fees.

However, Robinhood’s retirement offerings are relatively basic, as it lacks advisory services and automated investing options.

Merrill Edge, on the other hand, provides a more robust suite of retirement accounts and planning tools. It offers a wide range of IRA options, including Roth, Traditional, Rollover, SEP and SIMPLE IRAs and even Inherited IRAs.

Merrill’s retirement planning excels in its integration with Bank of America and its access to personalized advisory services through Merrill Guided Investing.

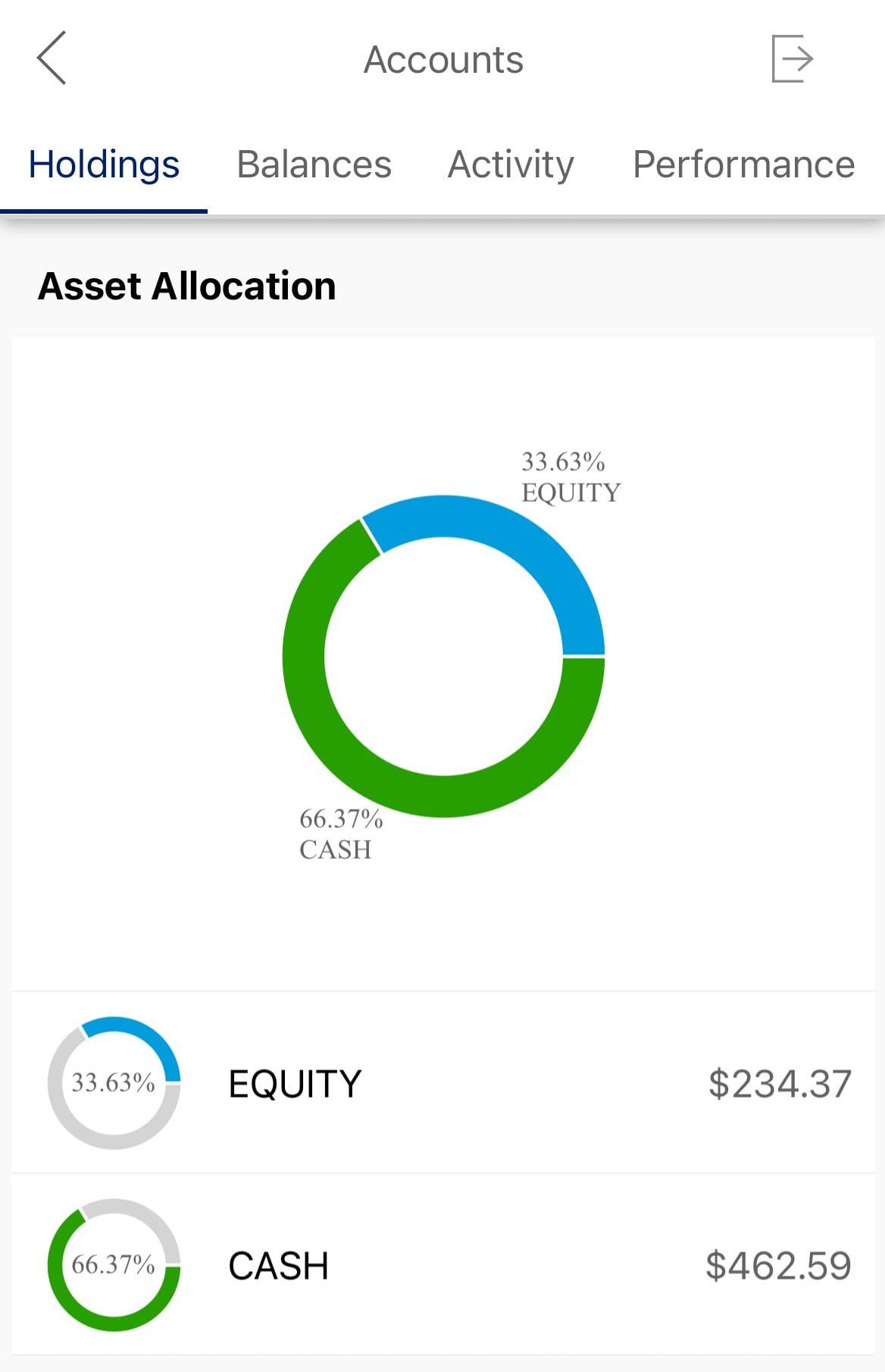

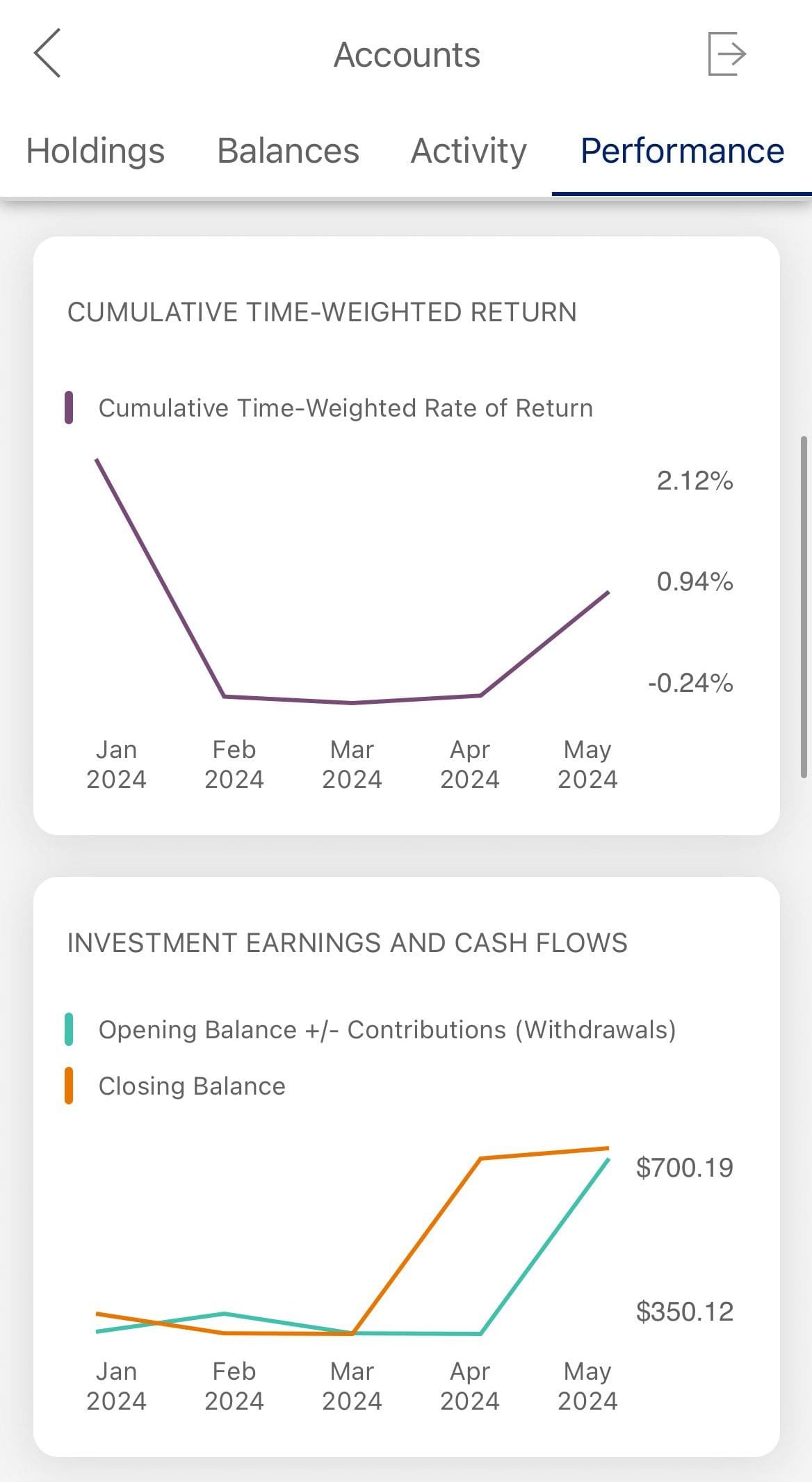

Moreover, Merrill Edge’s advanced tools, such as asset allocation analysis and performance tracking, provide a comprehensive overview of one’s retirement strategy.

-

Fees

Robinhood wins when it comes to fees.

Merrill Edge offers a $0 commission on online stock, ETF, and options trades. However, options trades incur a $0.65 per contract fee.

There is an annual fee based on the assets under management for those who prefer automated investing or personal advisory services.

Merrill Edge | Robinhood | |

|---|---|---|

Fees | 0.45% – 0.85%

0.45% for Merrill Robo Advisor (Guided Investing), 0.85% for Investing With An Advisor | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold |

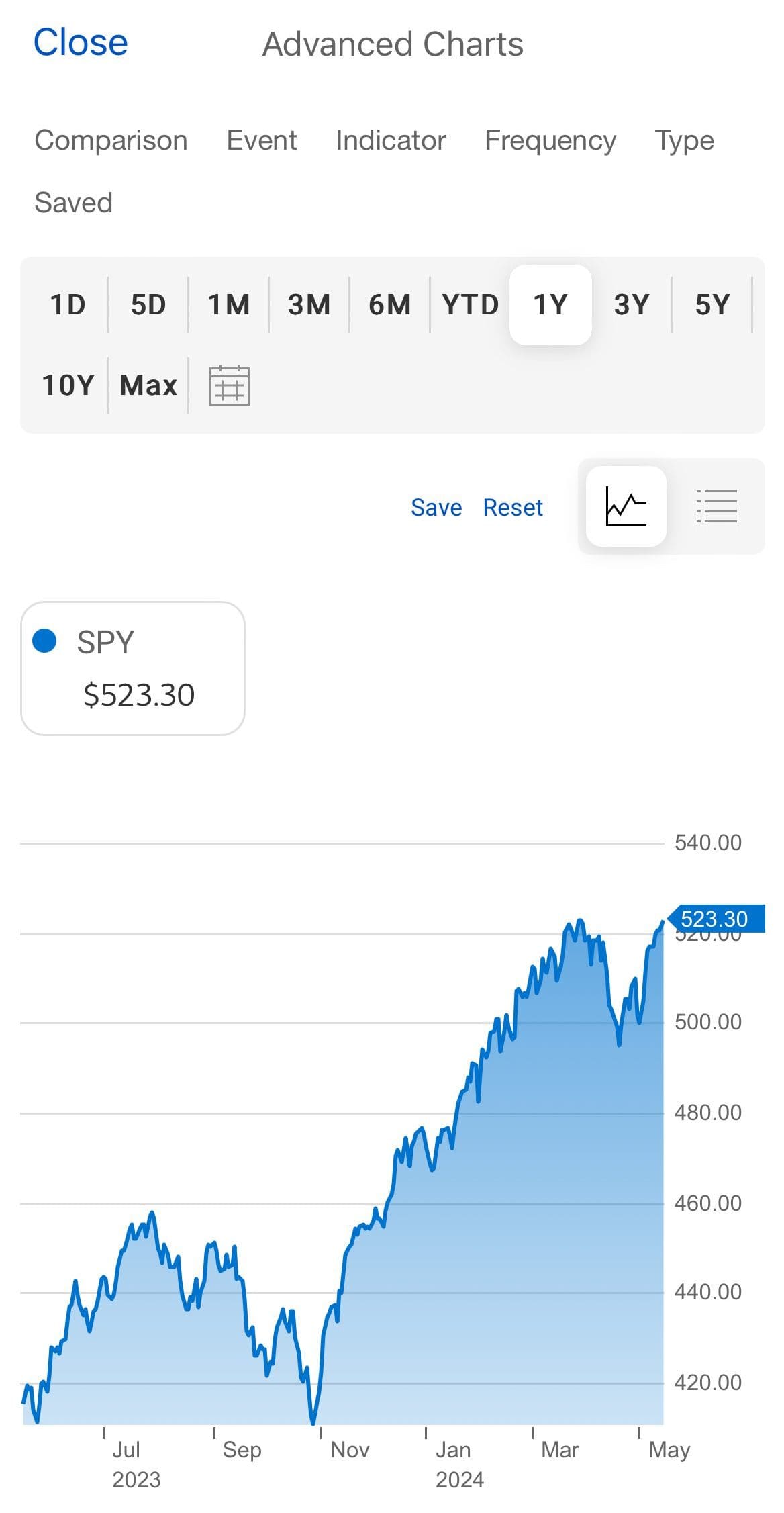

Robinhood stands out for its low-cost structure, offering commission-free trading on stocks, ETFs, and options and there are no account minimums or inactivity fees.

However, there is a monthly service for the Gold service, which provides more options and benefits for customers.

-

Cash Management And Savings Rates

When it comes to banking options, Robinhood is our winner – unless you're an existing Bank Of America customer.

Robinhood lacks checking account features but does offer a high savings rate of 4.00% and a rewards credit card that is exclusive to Gold members.

This is a much more affordable offer compared to the Merrill cash account, which offers high rates only for high balance accounts.

You can earn 5% cash back on travel booked using the Robinhood travel portal and 3% on all other purchases.

Merrill Cash Account | Robinhood | |

|---|---|---|

Savings APY | 0.01% – 4.11% | 1.00% – 4.50%

You’ll earn 0.01% Annual Percentage Yield (APY) as a Robinhood Gold member on your uninvested brokerage cash that is swept to the banks in our program. |

Like Robinhood, Merrill Edge doesn't have its own checking account.

Instead, it links up with Bank of America, letting you move money instantly, use just one login for everything, and access all of Bank of America's branches and ATMs.

Also, customers should have over $100,00 in their account to get high interest on uninvested cash.

Merrill Edge: Which Features Are Unique?

Here are some of the features that investors can find only with Merrill Edge:

-

Automated Investing

Merrill Edge’s robo-advisor, known as Merrill Guided Investing, offers a blend of automated portfolio management and professional guidance.

The service automatically monitors and rebalances your portfolio to align with your goals, adjusting as market conditions change.

For those who want more personalized advice, Merrill offers an upgraded version called Merrill Guided Investing with an Advisor.

This service includes all the benefits of the standard robo-advisor but adds one-on-one guidance from a Merrill financial advisor, allowing for more tailored advice and adjustments as your financial situation evolves.

-

Wealth Management Options

Merrill Wealth Management offers personalized services tailored to clients with specific financial needs, allowing them to work closely with a dedicated advisor.

To access these services, clients usually need at least $250,000 in investable assets. With this, they can choose from a variety of investment options like stocks, ETFs, mutual funds, options, and bonds, all managed by Merrill’s expert team.

Clients also gain access to Bank of America’s top-notch research and insights, ensuring their investment decisions are guided by expert analysis and the latest market trends.

Robinhood: Which Features Are Unique?

Here are some of the features that investors can find only with Robinhood:

-

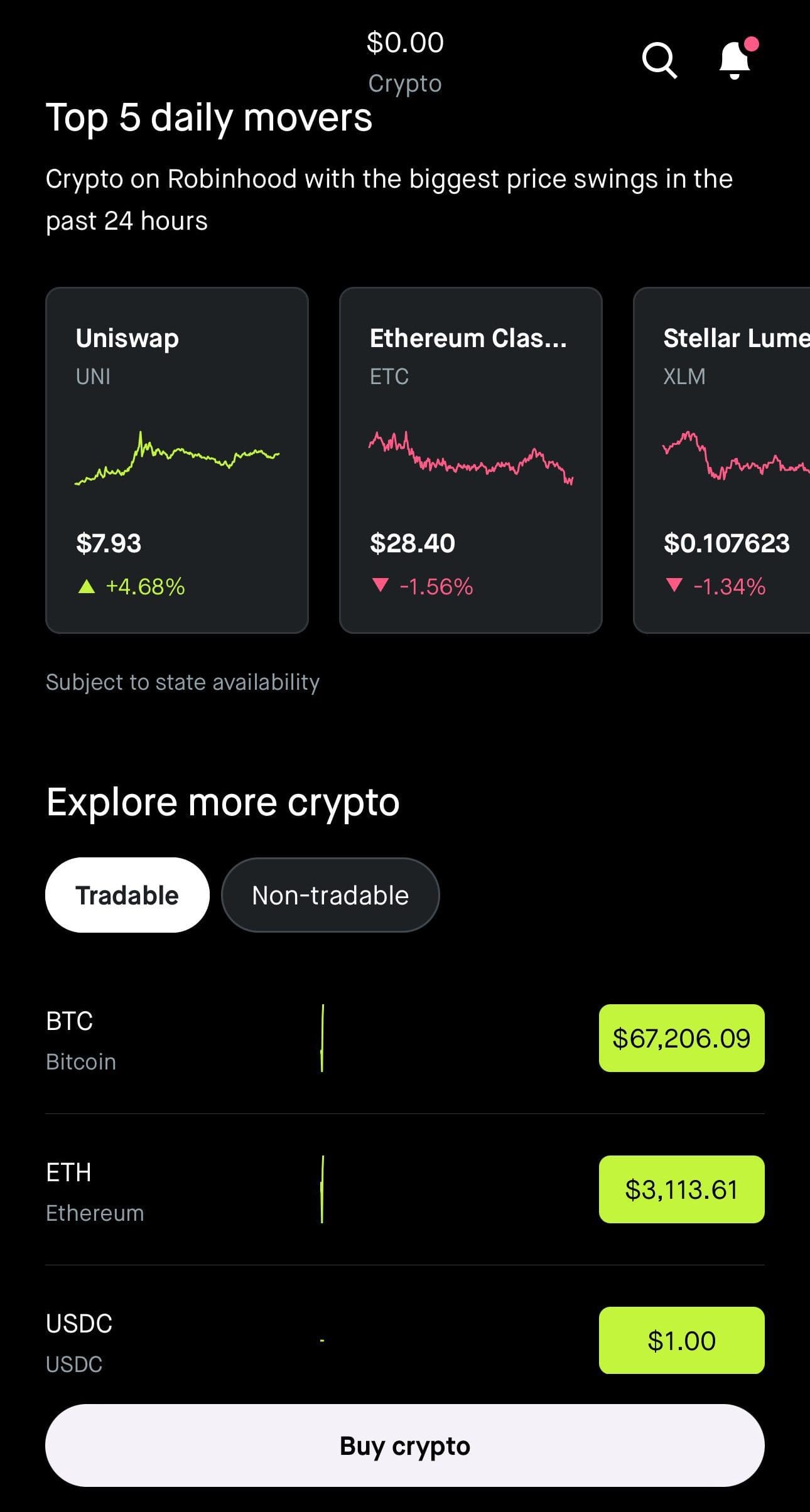

Various Options For Crypto Trading

If you’re interested in cryptocurrencies, Robinhood is a great platform because it allows you to buy, sell, and hold more than 15 popular coins like Bitcoin, Ethereum, and Litecoin.

Customers can start with as little as $1, which makes it accessible for beginners or those who want to dip their toes into the crypto world without a big investment.

-

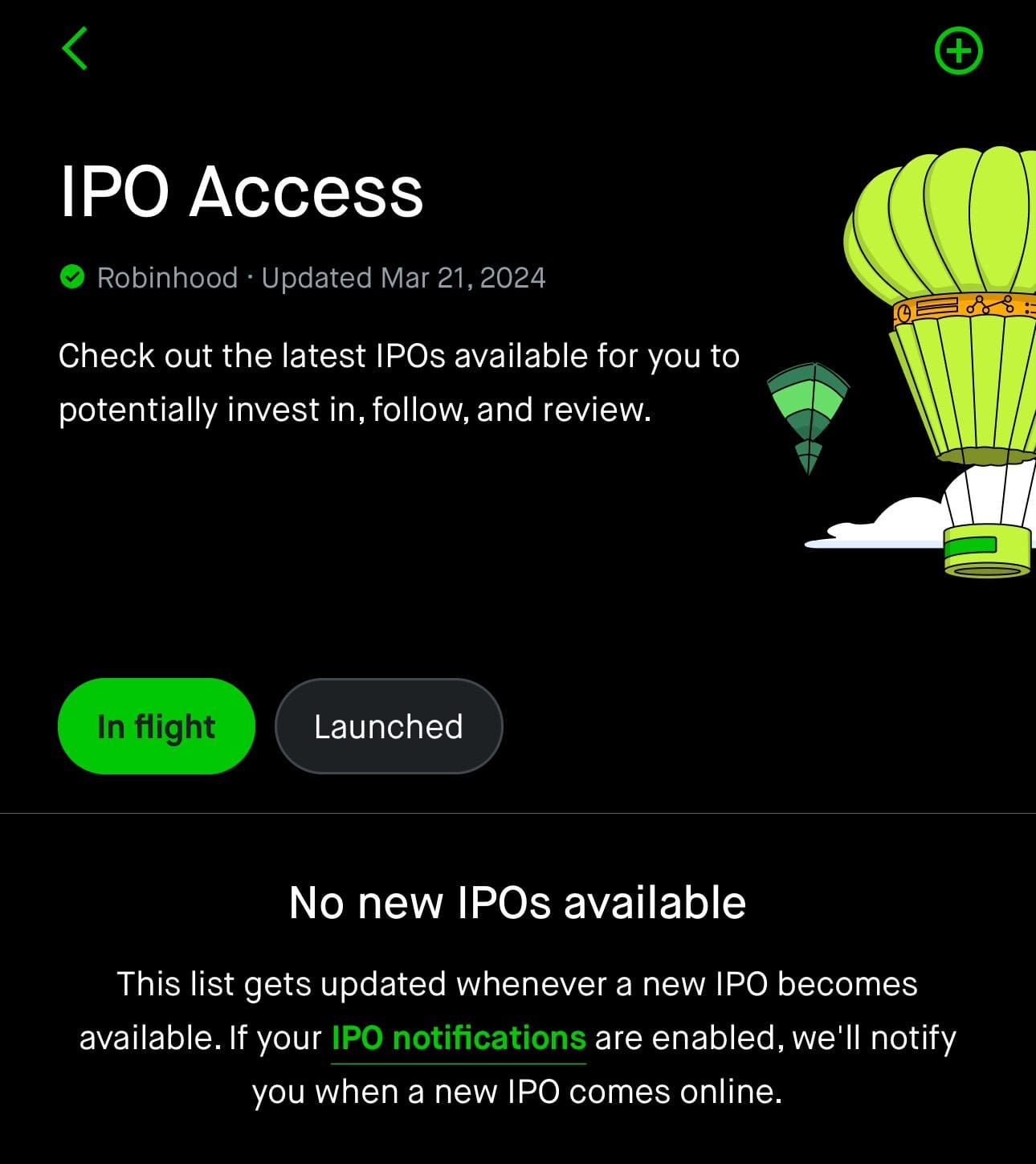

IPO Access

On the IPO side, Robinhood gives you the chance to get in on the ground floor when a company first goes public. IPOs, or Initial Public Offerings, are when a company offers its shares to the public for the first time.

With the IPO Access feature, customers can browse upcoming IPOs, check out the details, and even request to buy shares at the initial listing price.

There’s no account minimum, so whether you’re a new investor or have been trading for a while, you can try your hand at getting shares of a company before it hits the open market.

Bottom Line

Merrill Edge is great for investors who want a well-rounded, research-focused platform for long-term investments, including retirement.

On the other hand, Robinhood is perfect for active traders who value simplicity, low costs, and the convenience of trading anytime, anywhere.

Compare Robinhood Side By Side

Schwab offers more options for investors, including robo advisors and wealth management, while Robinhood is best for beginners and traders.

Schwab vs. Robinhood: Which Brokerage is Right for You?

Vanguard offers more options for investors, including retirement, robo advisors, and wealth management, while Robinhood is best for traders.

JP Morgan wins when it comes to fundamental investing tools, but Robinhood is better for technical analysis and trading. Here's why:

J.P. Morgan Self-Directed Investing vs. Robinhood : Compare Brokerage Accounts

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners.

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

Robinhood is best for low-cost platform for various trading needs, including Crypto. Etrade is better for one stop shop, including banking.

Robinhood is best for traders looking for easy, cost-free trading, while Stash is great for beginner investors who need a financial management tool

While Robinhood caters to traders and advanced investors, Acorns focuses on automated investing and banking. Here's our full comparison.

Webull is better suited for experienced traders needing advanced tools, whereas Robinhood caters to beginners and those who prefer simplicity.

How Merrill Edge Compares to Other Online Brokers

Vanguard may be a better option for value, long-term investors, while Merrill offers better trading options. Here's a side-by-side comparison

Vanguard vs. Merrill Edge: Which Brokerage is Right for You?

Both offer similar tools for the average investor or trader, but Merrill is better at automated investing. Here's our full comparison:

J.P. Morgan Self-Directed Investing vs. Merrill Edge: Compare Brokerage Accounts

Merrill Edge and E-trade offer great options for long and short-term investors, including robo-advisor, but there are differences.

Merrill Edge stands out for its interface and integration with BofA, but IBKR is the ultimate winner for trading and investing. Here's why:

Interactive Brokers vs. Merrill Edge: Compare Brokerage Account Options

Fidelity has more investing options, cheaper robo-advisor, and more banking options. Merrill is better for Bank of America customers.

Schwab is our winner for investors and traders. However, the differences between brokerages are not significant. Here's our comparison: