Warning: Undefined array key "file" in /home/cdzeslcc/domains/thesmartinvestor.com/public_html/wp-includes/media.php on line 1788

MEXC Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

MEXC is a popular global crypto exchange that offers a wide range of features for both beginners and experienced traders.

Launched in 2018, MEXC supports +2,300 cryptocurrencies and 2,800 trading pairs, making it a great choice for those looking to trade altcoins and lesser-known tokens.

It offers spot trading, futures trading with up to 200x leverage, and additional features like copy trading, demo trading, and P2P trading.

MEXC stands out with its low trading fees, which are among the lowest in the industry. While it is accessible in over 170 other countries, MEXC is not available in the United States.

What cryptocurrencies can I trade on MEXC?

MEXC supports over 2,300 cryptocurrencies, including popular ones like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), as well as many lesser-known altcoins and tokens in sectors like AI and DeFi. It also offers over 2,800 trading pairs.

What is the minimum deposit on MEXC?

MEXC does not have a specific minimum deposit amount for cryptocurrency, but each cryptocurrency may have its own network transfer limits. For fiat deposits, minimums vary depending on the payment method.

What payment methods does MEXC support?

MEXC supports a variety of payment methods for deposits, including bank transfers (SEPA), credit/debit cards, and third-party services like MoonPay. However, it’s worth noting that fiat withdrawals are somewhat limited.

Pros | Cons |

|---|---|

Low Fees | No NFT or Web3 Support |

Wide Range of Cryptocurrencies | Limited Fiat Withdrawals |

User-Friendly Interface | Restricted in the US and Other Countries |

Copy Trading Feature | No Margin Trading |

Staking & Earning Options | Mixed Customer Reviews |

Supported Cryptocurrencies & Assets

MEXC supports an impressive variety of cryptocurrencies, offering +2,300 coins and trading pairs.

This makes it an appealing platform for those looking to trade both well-known and newer digital assets.

The exchange includes a range of tokens and stablecoins, such as Bitcoin (BTC), Ethereum (ETH), and Tether (USDT), as well as more niche tokens in sectors like Artificial Intelligence (AI), Decentralized Finance (DeFi), and the Metaverse.

However, MEXC does not support NFTs directly, which means there's no NFT marketplace or trading for digital collectibles.

MEXC Exchange: Supported Countries & Availability

MEXC is available in over 170 countries, include the United Kingdom, Germany, India, South Korea, Brazil, Indonesia, Russia, Mexico, the Philippines, and Turkey.

However, it is not accessible in certain regions, including the United States, Canada, and several others due to regulatory restrictions.

MEXC Legal Issues & Trustworthiness: What You Should Know

There have been no widely reported security breaches or hacks directly involving MEXC to the extent of major exchange breaches like those seen with some other platforms. However, like many crypto exchanges, MEXC has faced some security concerns, including phishing attacks targeting users.

While it has generally maintained a solid reputation, there have been challenges related to regulatory compliance and security.

MEXC is not available in the United States, indicating that it may not meet certain regulatory standards required to operate there.

Also, MEXC does not have a valid regulatory license in any jurisdiction, which could be a red flag for some users looking for fully regulated exchanges.

Main Features For Crypto Investors

Here are the key features that I found most appealing in MEXC:

-

Platform Trading Experience

MEXC is designed with both beginners and advanced traders in mind, offering a user-friendly interface.

For beginners, the platform provides simple navigation and clear menus, making it easy to buy and sell crypto.

The mobile app is streamlined and convenient, letting users trade on the go with the same functionality as the desktop version.

For advanced traders, MEXC offers features like advanced charting, TradingView integration, and multiple order types.

Both the desktop and mobile platforms are well-optimized, ensuring smooth and fast trading without unnecessary complexity.

-

MEXC Security Features

MEXC prioritizes security with features like two-factor authentication (2FA), cold storage for user funds, and withdrawal whitelisting to protect against unauthorized transactions.

It uses AES-256 and SSL encryption to secure data. While KYC (Know Your Customer) is optional, completing it unlocks higher withdrawal limits.

-

Deposits and Withdrawals: How Gate.io Gets Your Crypto In and Out

Gate.io allows crypto deposits without fees, making it easy to fund your account.

For withdrawals, the platform supports a wide variety of cryptocurrencies, though the fees vary by asset. While it supports fiat purchases via third-party services like MoonPay, the exchange does not support direct fiat withdrawals.

Withdrawals typically take a few minutes for crypto assets but may vary depending on network congestion.

-

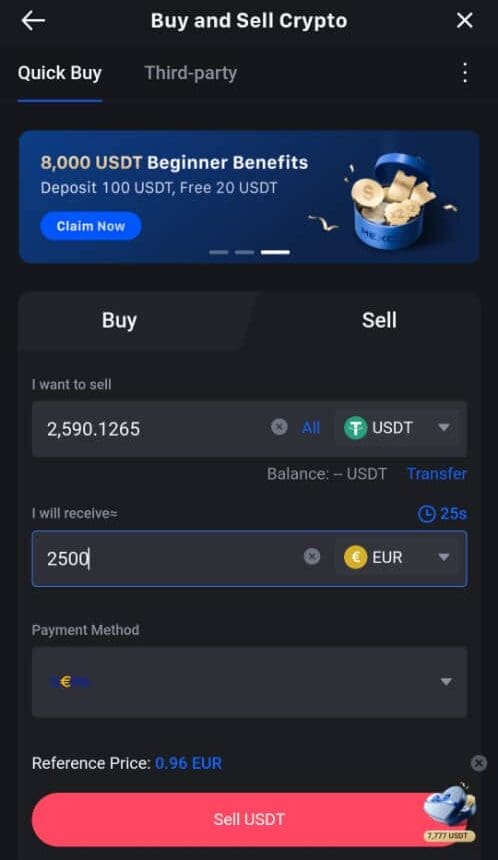

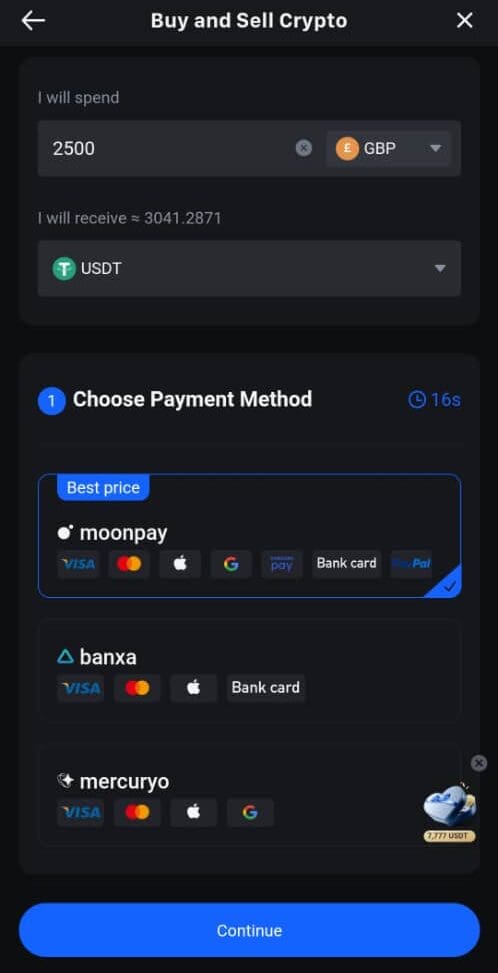

How to Move Your Crypto in and Out of MEXC

MEXC supports several deposit methods, including credit/debit cards, SEPA transfers, and third-party payment services like MoonPay and Mercuryo.

While fiat-to-crypto transactions are available, the platform doesn't support direct fiat-to-fiat withdrawals, meaning users must transfer funds to another exchange for that.

For crypto withdrawals, fees depend on the asset and network. Withdrawal speeds are typically quick, but they can vary based on blockchain traffic.

Users in supported regions can also take advantage of the platform's peer-to-peer (P2P) trading feature for direct crypto sales.

-

Lack Of NFT & Web3 Features

MEXC doesn’t offer direct NFT trading or a marketplace for digital collectibles.

While some platforms like Binance and Bybit have integrated NFT support, MEXC focuses on traditional crypto trading.

The platform also lacks Web3 features like decentralized finance (DeFi) apps integration.

However, MEXC has dabbled in NFT indices, which allowed users to invest in a collection of NFTs, but this feature has since been discontinued.

-

Fees & Costs

There are no hidden charges, and MEXC's fee structure is transparent, allowing users to know what they’re paying:

Spot Trading Fees | Future Trading Fees |

|---|---|

0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | 0% – 0.01%

0.00% for taker trades and 0.01% for maker trades. |

- Withdrawal Fees: Withdrawal fees depend on the cryptocurrency and its respective network; for example, 1 USDT for TRC-20 withdrawals.

- Deposit Fees: MEXC does not charge deposit fees for cryptocurrency, but third-party services may apply fees for fiat deposits.

-

Copy Trading

MEXC offers a copy trading feature, which is ideal for beginners who want to mimic the trades of experienced traders.

After completing the KYC process, users can select a trader to follow based on their performance metrics like ROI and win rate.

Once you choose a trader, MEXC automatically copies their trades in real-time, allowing you to learn while you trade.

You can also monitor the trader’s strategies and decide when to stop copying them.

A commission fee of up to 15% of your profits is paid to the trader you follow, making it a win-win situation for both parties.

-

MEXC’s Futures Demo Mode

MEXC provides a demo trading feature for users who want to practice trading futures contracts without risking real money.

This feature gives you access to a simulated environment where you can trade with virtual funds.

It’s a great way for beginners to familiarize themselves with futures trading strategies and the platform’s tools.

You can experiment with different orders and techniques before moving on to real trades, ensuring you are prepared when you're ready to invest real capital.

-

MEXC’s Staking & Rewards

MEXC offers staking and earning options that allow users to make passive income on their crypto holdings.

With flexible staking, users can earn rewards while keeping the freedom to withdraw at any time.

For higher rewards, fixed staking allows you to lock up your assets for a set period (30, 60, or 120 days) in exchange for better returns.

When MEXC May Be a Good Choice? When Not?

MEXC, like any trading platform, isn't suitable for everyone.

Let’s examine who could benefit from MEXC and who might want to consider other platforms.

When MEXC May Be a Good Choice | Who Should Look Elsewhere |

|---|---|

Beginner Traders | U.S. Residents |

Low-Fee Seekers | NFT and Web3 Enthusiasts |

Altcoin Enthusiasts | Fiat-Centric Traders |

Futures Traders | Advanced Margin Traders |

Global Traders | Regulation-Conscious Users |

FAQ

MEXC implements strong security measures, including two-factor authentication (2FA), cold storage for the majority of funds, and encryption protocols like SSL and AES-256. However, it doesn't have a full regulatory license, which might concern some users.

Yes, you can use MEXC without completing KYC for basic trading, but unverified accounts have limited withdrawal limits (10 BTC daily). Completing KYC increases withdrawal limits and unlocks additional features.

To trade futures, select “Futures” from the MEXC platform, deposit funds, and choose the cryptocurrency you want to trade. You can select from various order types and leverage options (up to 200x) to manage your trades.

Yes, MEXC offers staking services where you can earn rewards by locking up your cryptocurrency. You can choose between flexible and fixed staking options, with competitive annual yields on select assets.

Review Crypto Exchanges

How We Rated Crypto Exchanges: Review Methodology

At The Smart Investor, we evaluated crypto exchanges based on their overall value, security, and trading experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to traders and investors, including fees, security, liquidity, and available assets. Each exchange was rated based on the following criteria:

- Fees & Costs (15%): We prioritized exchanges with low trading fees, competitive spreads, and transparent pricing. Some platforms had hidden withdrawal fees or costly trading structures.

- User Experience & Interface (15%): A fast, intuitive, and well-designed platform scored highest. Some exchanges felt clunky or slow, impacting trade execution and overall experience.

- Security & Regulation (20%): We favored exchanges with strong encryption, two-factor authentication (2FA), cold storage, and regulatory compliance. Some lacked proper security, making them high-risk.

- Trading Tools & Features (30%): The best exchanges offered advanced charting, real-time market data, order types (limit, stop-loss), and automation tools. Some lacked depth, limiting professional traders.

- Supported Cryptocurrencies (10%): We rated exchanges higher if they supported a broad range of cryptocurrencies, including major coins, altcoins, and stablecoins. Some had limited selections, restricting options.

- Liquidity & Execution Speed (5%): Exchanges with high liquidity, deep order books, and fast execution times scored highest. Lower-rated platforms had frequent slippage or delays.

- Additional Features (5%): We favored exchanges with staking, lending, fiat on-ramps, NFT marketplaces, and DeFi integration. Some lacked these extras, making them less versatile.