|

| |

|---|---|---|

MEXC | Bitget | |

Supported Coins | +2,300 | +800 |

Spot Trading Fees | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | 0.10%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0.02%. Using Bitget's native token, BGB, to pay trading fees offers a 20% discount /span> |

Future Trading Fees | 0% – 0.01%

0.00% for taker trades and 0.01% for maker trades. | 0.02% – 0.06%

0.06% for taker trades and 0.02% for maker trades. Using Bitget's native token, BGB, to pay trading fees offers a 20% discount /span> |

Our Rating |

(3.8/5) |

(3.9/5) |

Read Review | Read Review |

MEXC vs. Bitget: Compare The Best Features

Choosing the right crypto exchange means finding a platform that fits your trading style, coin preferences, and technical needs.

In this comparison, we'll dive into how MEXC and Bitget perform side-by-side, from mobile usability to advanced trading features — showing clear examples and verdicts for each.

-

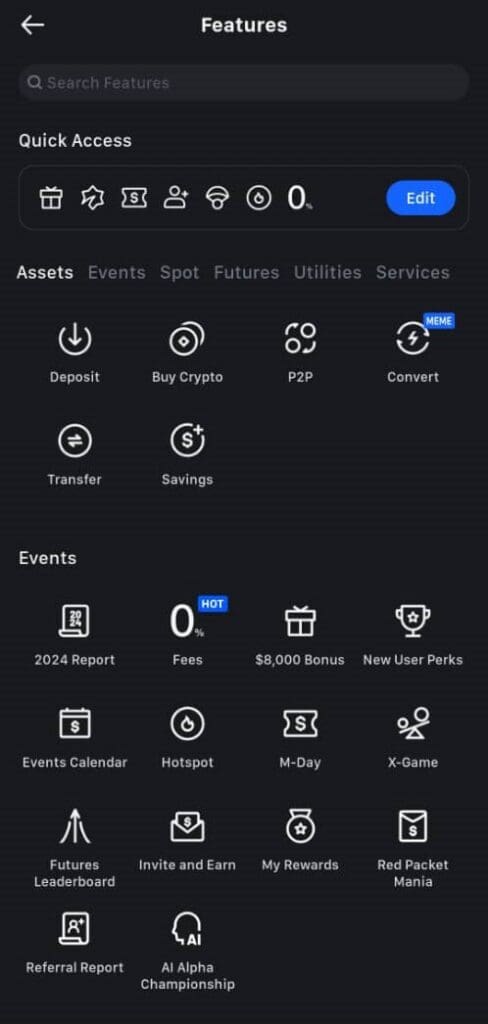

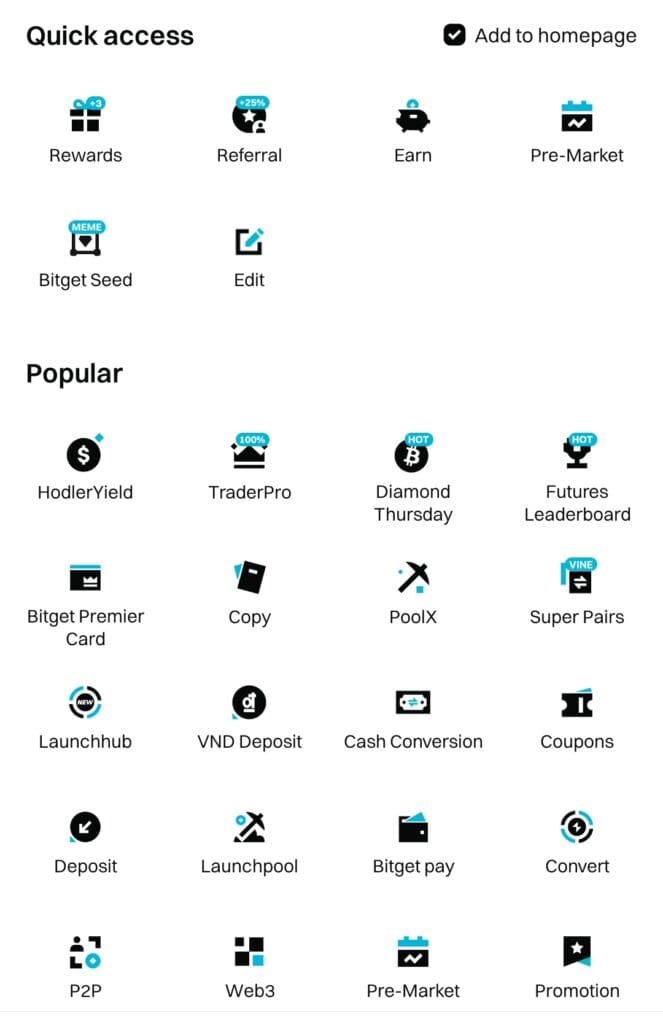

Ease of Use & Mobile App Experience

MEXC offers a streamlined experience for beginners and pros alike, with clean navigation, quick buy/sell options, and a mobile app that mirrors the desktop's full functionality.

Bitget also offers a user-friendly interface, but its mobile app lacks some of the advanced charting tools available on the desktop.

Still, it supports seamless spot, futures, and copy trading directly from the app.

Overall, MEXC offers a smoother mobile trading experience overall, especially for active futures and spot traders who prefer full desktop-like functionality on mobile.

-

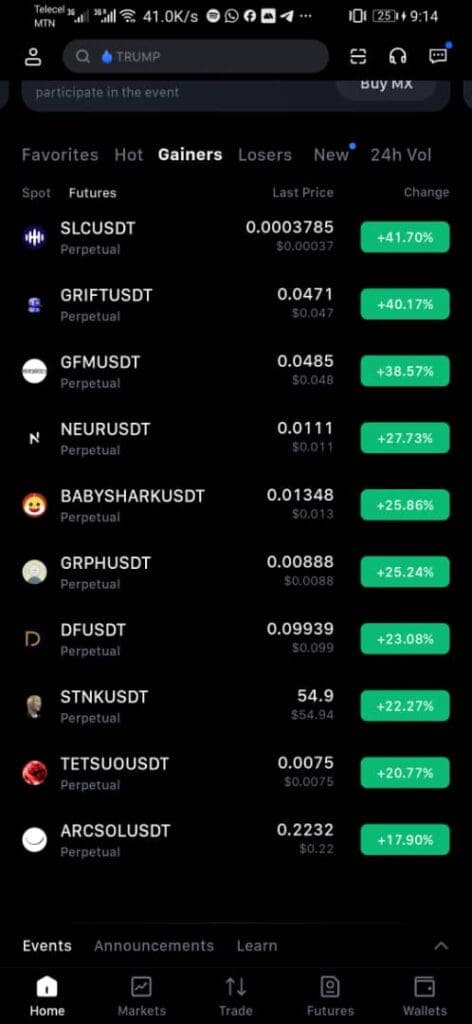

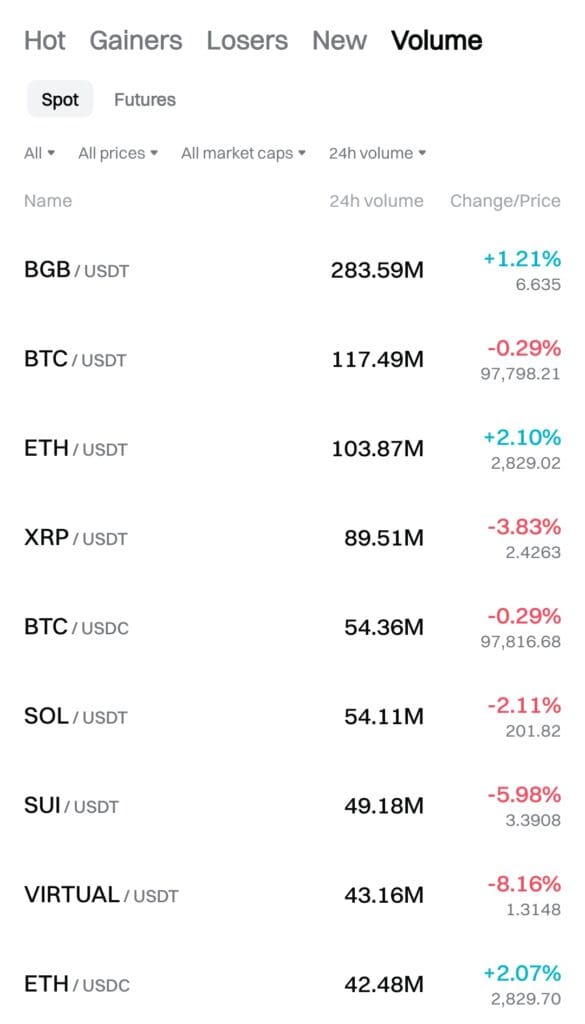

Cryptocurrency Selection

MEXC dominates with over +2,300 coins trading pairs, including niche tokens across AI, DeFi, and Metaverse sectors.

A trader looking to invest early in emerging sectors can easily find rare altcoins here.

Bitget supports +800 assets — fewer than MEXC — but still covers major cryptos like Bitcoin, Ethereum, and top altcoins.

It caters better to traders who focus mainly on established assets and future markets.

-

Trading Crypto Features & Experience

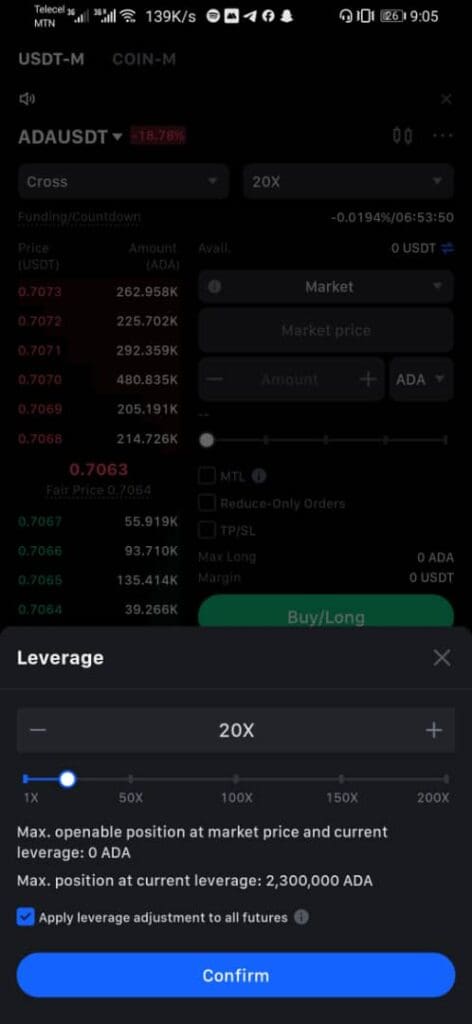

MEXC caters to both beginners and pros with advanced charting (TradingView integration), futures trading up to 200x leverage, copy trading, and a demo mode for simulated futures practice.

For instance, a new trader can safely test leverage strategies using demo funds before risking real money.

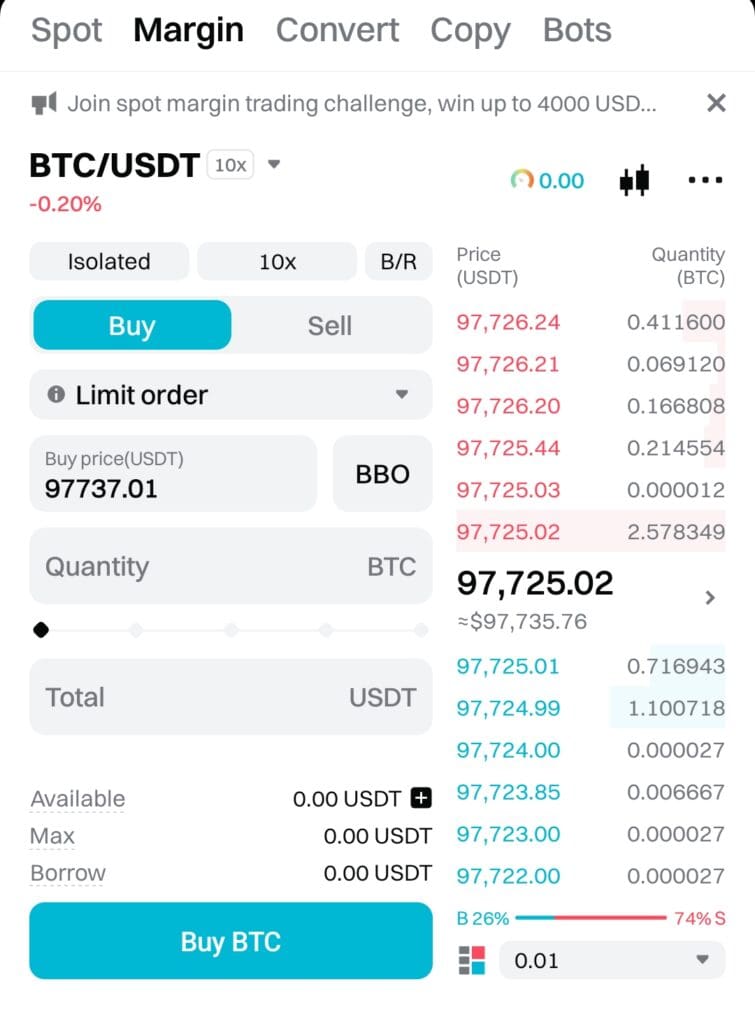

Bitget shines with futures trading up to 125x leverage, margin trading, copy trading, and a Launchpad for early-stage crypto projects.

Investors can join Launchpad token sales to access new projects at ground-floor prices, offering early investment opportunities.

At the end of the day, MEXC is stronger for futures traders who value ultra-high leverage and demo practice, while Bitget appeals to users interested in new project investments through its Launchpad features.

-

Staking Options and Rewards

MEXC offers a diverse range of staking options, including flexible and fixed-term products.

Notably, they provide promotional events such as +50% APR on USDC staking for new users and +200% APR on MNT staking during special campaigns.

Additionally, MEXC's Launchpool allows users to stake tokens like USDT, MX, or MNT to earn airdrop rewards from new projects.

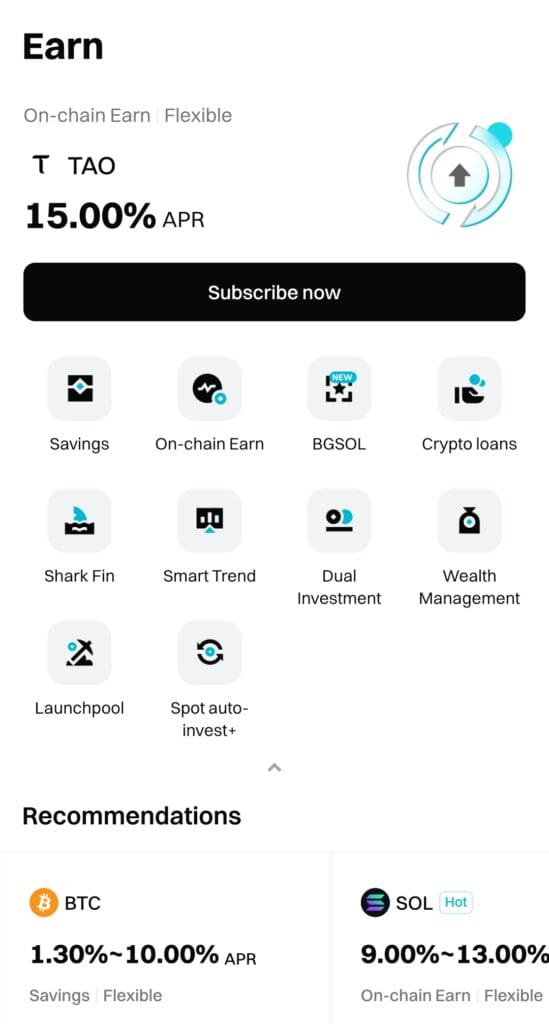

Bitget provides staking opportunities with APRs ranging from 4% to +15%, depending on the asset and staking duration. Their native token, BGB, offers a stable 5% APY when staked through the Bitget Wallet.

Bitget also supports staking for various PoS assets like ETH, LUNC, and SOL, allowing users to earn rewards in the same token they stake.

-

DApps and Web3 Integration

Neither platform leads in DApps or Web3 integration, but Bitget slightly edges out for those wanting to invest in Web3-related tokens even without full DApp support.

-

Wallet Options

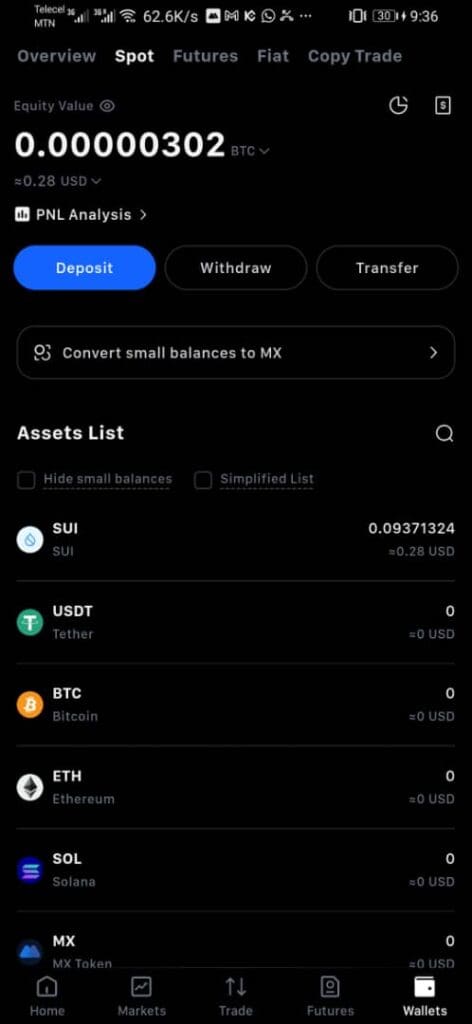

MEXC provides an integrated custodial wallet within its platform, supporting a wide range of cryptocurrencies.

Users can deposit and withdraw funds using various methods, including credit/debit cards and third-party services like MoonPay.

On the other hand, Bitget offers the Bitget Wallet, a non-custodial Web3 wallet supporting over 100 mainnets and 250,000 tokens.

It features advanced tools like real-time token analytics, dynamic trading overlays, and a DApp browser, catering to users interested in DeFi and Web3 applications.

-

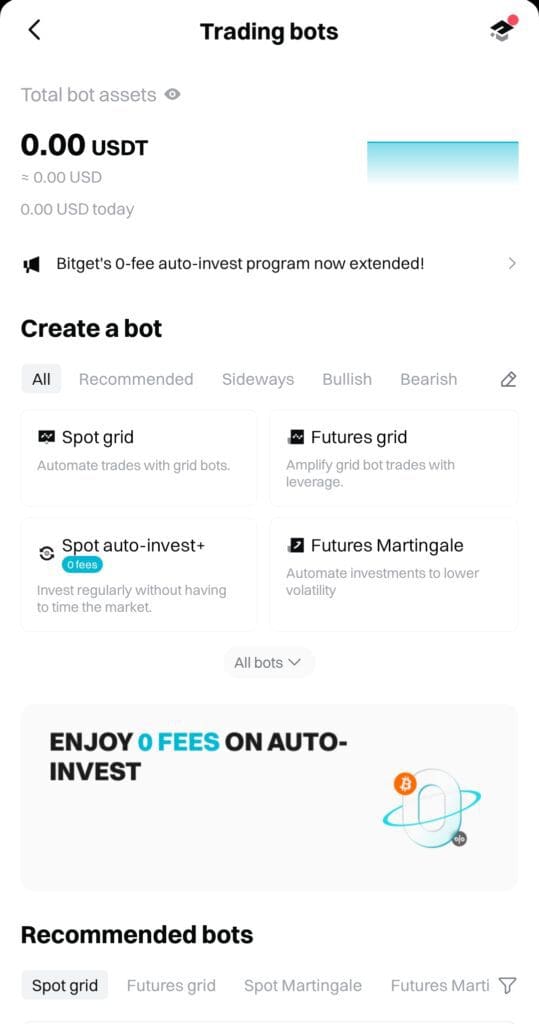

Trading Bots and Automation

Bitget's native AI trading bots offer a more seamless and user-friendly automation experience compared to MEXC's reliance on third-party integrations.

MEXC supports third-party trading bots through platforms like TradersPost and OctoBot, allowing users to automate trading strategies using TradingView indicators.

While MEXC doesn't offer native bots, these integrations enable users to implement custom strategies

Bitget provides built-in AI-powered trading bots, including grid trading, DCA, and CTA-AI strategy bots.

These bots are accessible directly on the platform, offering users automated trading solutions without the need for external integrations.

-

Security Measures And Past Hacks

Bitget utilizes cold storage systems, multi-signature technology, and maintains a $400 million Protection Fund to safeguard user assets.

The platform has not reported any significant security incidents, reflecting its commitment to user safety.

While MEXC itself hasn't experienced major breaches, its affiliate, HTX, suffered a $30 million hack in 2023. In 2025, MEXC partnered with cybersecurity firm Hacken to enhance its security protocols.

Which Investors & Traders May Prefer MEXC Exchange?

MEXC is a great fit for crypto traders who value broad coin selection and low fees without sacrificing advanced features.

Altcoin Enthusiasts: Access to over 2,300 cryptocurrencies, perfect for those looking to trade niche or emerging tokens.

Futures Traders: Up to 200x leverage and a futures demo mode make MEXC ideal for those who want to practice and execute high-risk strategies.

Beginner Investors: Easy-to-use mobile app, intuitive interface, and copy trading options help newcomers get started confidently.

Global Traders: Wide international availability (170+ countries), with flexible deposit methods and P2P trading support.

If you’re seeking maximum crypto variety, flexible trading tools, and a low-cost environment, MEXC delivers a lot.

Which Investors & Traders May Prefer Bitget Exchange?

Bitget suits both beginners and experienced traders who are focused on futures trading, copy trading, and early access to new crypto projects.

Futures and Margin Traders: Strong futures platform with up to 125x leverage and robust margin trading features.

Copy Trading Users: Bitget’s built-in copy trading marketplace is one of the largest, making it easy to follow top-performing traders.

Security-Focused Investors: A $400 million protection fund and strict compliance standards appeal to those prioritizing fund safety.

Launchpad Enthusiasts: Traders wanting early access to promising crypto projects will appreciate Bitget's Launchpad opportunities.

If your strategy revolves around futures, copying pros, and securing early-stage crypto investments, Bitget is a smart choice.

Bottom Line

Both MEXC and Bitget are powerful exchanges but shine in different areas. MEXC is best for altcoin hunters and futures traders who want access to thousands of coins and ultra-low fees.

Meanwhile, Bitget excels in futures trading, security, copy trading, and early project launches.

Choosing the right platform depends on whether you prioritize a massive coin selection and demo trading (MEXC) or deep futures features, a large copy trading network, and strong fund protection (Bitget).