|

| |

|---|---|---|

MEXC | Bybit | |

Supported Coins | +2,300 | +650 |

Spot Trading Fees | 0% – 0.10%

0.00% for taker trades and 0.10% for maker trades. | 0.10%

For both maker and taker orders. The more you trade, the lower the fees – can decrease to as low as 0.02%. Using Bybit's native token, BYD, to pay trading fees offers a 20% discount |

Future Trading Fees | 0% – 0.01%

0.00% for taker trades and 0.01% for maker trades. | 0.025% – 0.075%

0.075% for taker trades and 0.025% for maker trades. Using Bybit's native token, BYD, to pay trading fees offers a 10% discount |

Our Rating |

(3.8/5) |

(2.9/5) |

Read Review | Read Review |

MEXC vs. Bybit: Compare The Best Features

When choosing a crypto exchange, it’s important to look beyond just fees. Features like mobile experience, trading tools, and even Web3 integration can impact your results.

Here’s a side-by-side look at how MEXC and Bybit stack up for different types of crypto investors and traders.

-

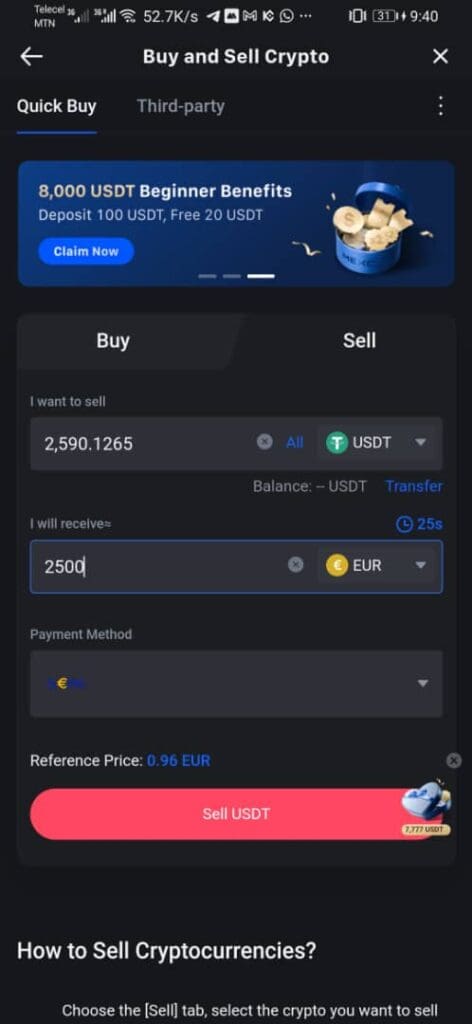

Ease of Use & Mobile App Experience

MEXC offers a highly beginner-friendly layout, where you can easily access spot, futures, and copy trading right from the home screen.

The mobile app mirrors the desktop experience, making it seamless to switch between devices. Quick Buy features allow you to purchase crypto in just a few taps.

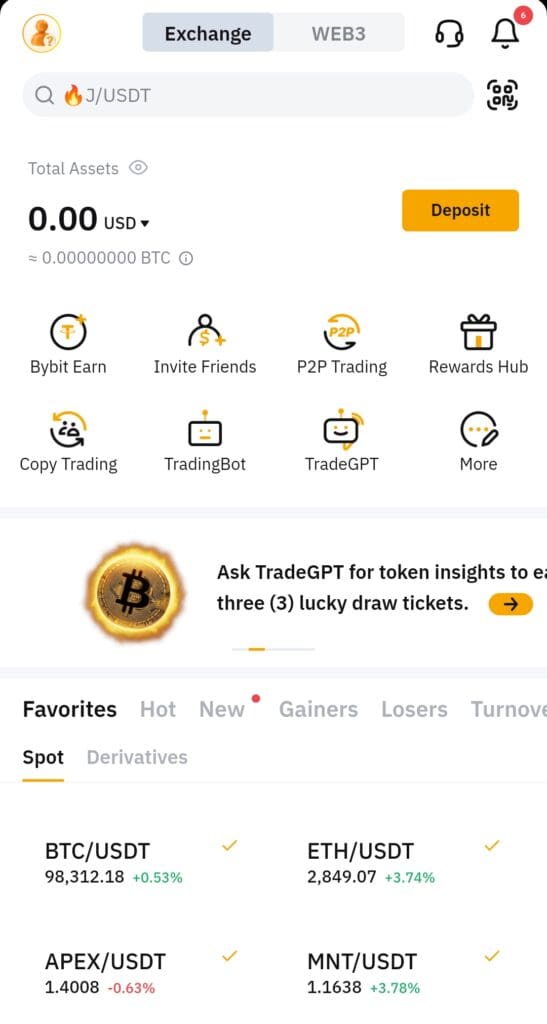

Bybit, while offering a clean mobile app, leans more toward advanced features.

Traders can easily manage spot, futures, and margin positions, but beginners might feel overwhelmed without prior experience.

Overall, MEXC is slightly better for beginners, but Bybit wins for traders wanting powerful tools on mobile.

-

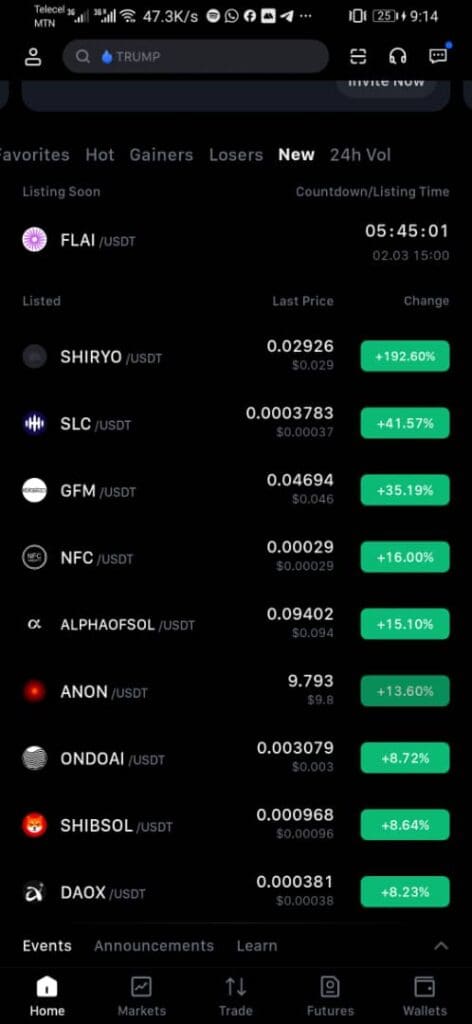

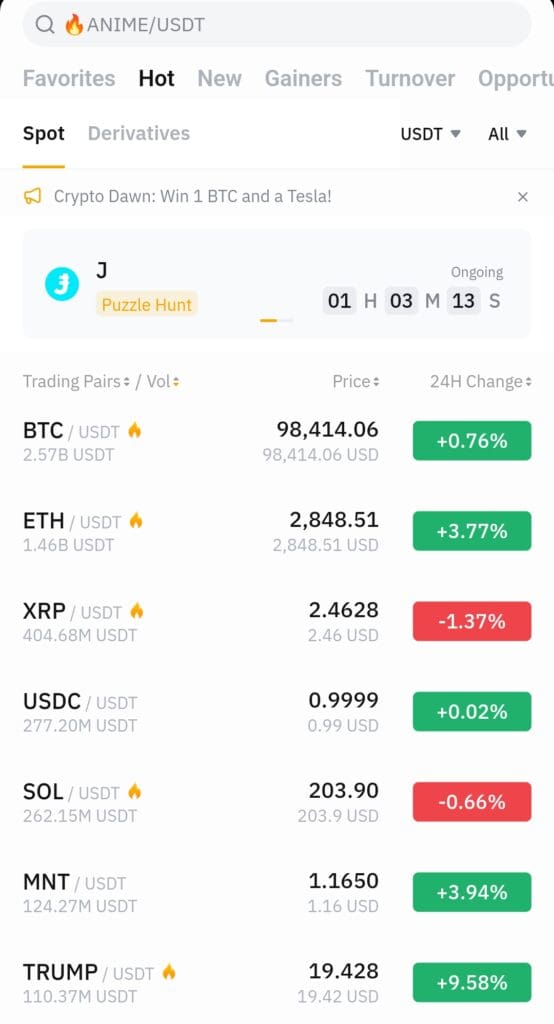

Cryptocurrency Selection

MEXC stands out with +2,300 cryptocurrencies and trading pairs, including trending sectors like AI, DeFi, and Metaverse coins. You can explore new altcoins before they hit major exchanges.

Bybit offers a solid lineup of +650 cryptocurrencies, but with more focus on high-volume, popular assets and NFT collections.

-

Trading Crypto Features & Experience

MEXC caters to both new and intermediate traders with features like spot trading, futures with up to 200x leverage, copy trading, and demo accounts.

For example, a beginner can easily start with demo futures before committing real funds.

Bybit targets advanced users by offering margin trading, spot, futures, options, staking, and automated trading bots like DCA and Spot Grid Bots.

Day traders who need precise tools, such as TradingView integration and risk management features, will feel at home.

Overall, Bybit provides a more sophisticated trading suite, while MEXC offers a flexible environment for beginners and intermediate users.

-

Staking Options and Rewards

MEXC offers flexible and fixed staking options with competitive yields. For example, users can stake USDC for 3 days and earn +50% APR during promotional periods.

The platform also features a Launchpool system where users can stake tokens to earn airdrop rewards from new projects.

Bybit provides staking through its Earn platform, offering both flexible and fixed-term products with guaranteed yields.

Users can stake popular cryptocurrencies like BTC, ETH, and USDT, and participate in Launchpool events for additional rewards.

At the end of the day, MEXC is ideal for users seeking high-yield promotional staking opportunities, while Bybit offers a more stable and diverse staking environment.

-

DApps and Web3 Integration

Bybit goes further by integrating Web3 services, allowing users to connect wallets and explore decentralized finance, blockchain gaming, and NFT marketplaces, all inside the platform.

MEXC does not provide direct Web3 access or a DApp browser. Users wanting to interact with DeFi apps must transfer assets elsewhere, limiting its ecosystem integration.

-

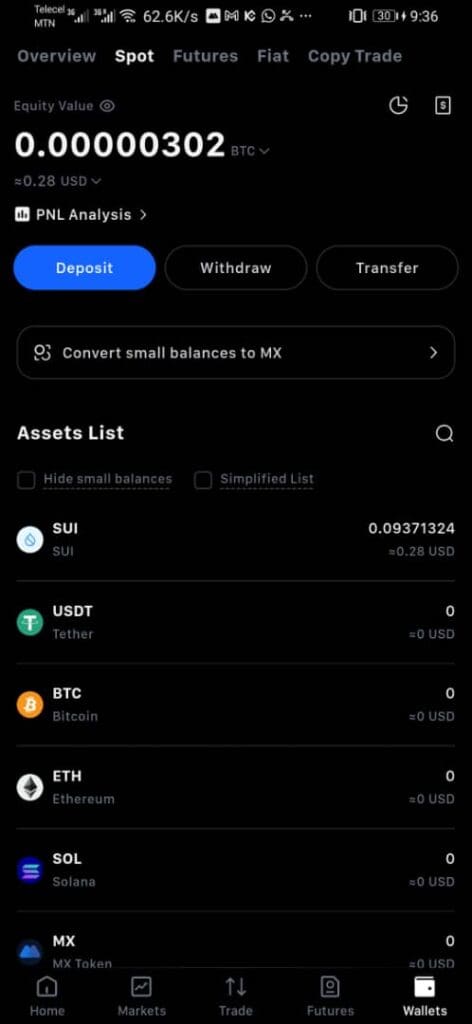

Wallet Options

Bybit provides more flexibility with wallet options, catering to users who prefer managing their own private keys.

It offers both custodial and non-custodial wallet options. Users can choose a cloud wallet managed by Bybit or a seed phrase wallet, giving them full control over their private keys.

MEXC primarily operates with custodial wallets, ensuring user funds are stored securely within the platform. The exchange employs cold storage and multi-signature technologies to protect assets.

-

Trading Bots and Automation

MEXC supports automated trading through third-party platforms like TradersPost and Gunbot, allowing users to deploy custom trading strategies.

Bybit offers built-in trading bots, including Spot Grid and DCA bots, enabling users to automate trades directly on the platform without external tools.

Overall, Bybit provides a more user-friendly experience for automated trading with its integrated bots, while MEXC offers flexibility through third-party integrations.

-

Security Measures And Past Hacks

MEXC currently holds a better security track record, while Bybit is working to rebuild trust after its recent breach

Bybit suffered a significant security breach in February 2025, resulting in the loss of approximately $1.5 billion in digital assets.

The attack exploited vulnerabilities during a routine transfer from a cold wallet. This is a significant reason why our rating is low for Bybit.

While MEXC itself hasn't experienced major breaches, its affiliate, HTX, suffered a $30 million hack in 2023, prompting MEXC to enhance its security measures through partnerships with firms like Hacken.

Which Investors & Traders May Prefer MEXC Exchange?

MEXC is a better fit for a variety of crypto users because of its beginner-friendly design and wide asset selection. Here’s who may prefer MEXC:

Altcoin Hunters: Access to over 2,300 coins makes it a paradise for traders chasing new and niche tokens.

Beginner Investors: The simple mobile app and demo trading features help new traders practice before risking real money.

Copy Trading Enthusiasts: MEXC’s copy trading lets beginners mirror experienced traders with just a few taps.

Global Users Avoiding High Fees: With ultra-low trading costs, frequent global traders can maximize returns without sacrificing profits.

Which Investors & Traders May Prefer Bybit Exchange?

Bybit attracts a different crowd with its more advanced, professional-grade tools and broader ecosystem. It’s ideal for:

Advanced Traders: Those who actively trade futures, margin, or use leverage will benefit from Bybit’s deep toolset.

NFT and Web3 Enthusiasts: Users interested in decentralized finance, NFTs, and gaming can access these ecosystems right through Bybit.

Automated Trading Fans: Bybit’s built-in trading bots help automate strategies like grid trading and DCA without extra setup.

Volume-Based Traders: Thanks to VIP programs, frequent traders can unlock lower fees and better trading conditions over time.

Bottom Line

Both MEXC and Bybit offer strong advantages, but they shine for different audiences. MEXC is perfect for beginners, altcoin enthusiasts, and those seeking low fees with a user-friendly experience.

Bybit, on the other hand, excels with advanced trading options, automated bots, and access to NFTs and Web3 projects.

Your best choice depends on whether you prioritize simplicity and access to altcoins (MEXC) or advanced features and broader Web3 integration (Bybit).