Table Of Content

What Is Morningstar’s Stock Screener?

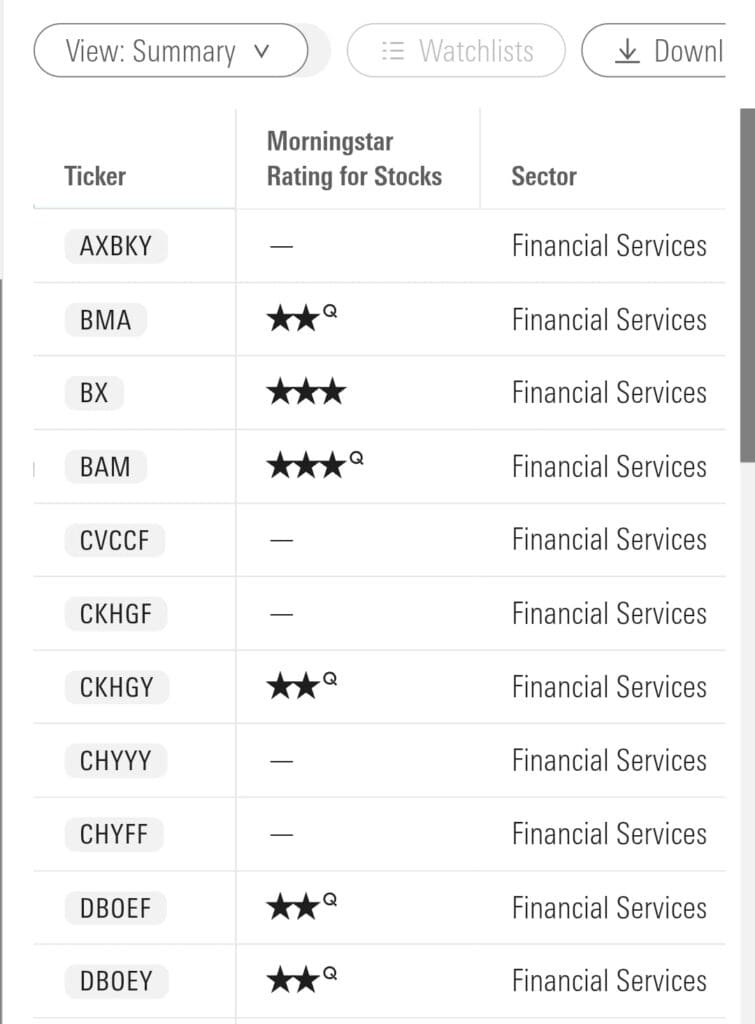

Morningstar’s stock screener is a research tool that helps investors identify publicly traded companies based on specific fundamental and financial criteria.

Rather than chasing fast-moving tickers, this screener is designed for thoughtful, long-term decision-making using analyst insights and company metrics.

With this tool, investors can filter thousands of U.S. and global stocks by valuation, profitability, dividend strength, competitive advantage (moat), and more — making it easier to uncover stocks that align with your strategy and risk profile.

How Morningstar’s Stock Screener Helps Investors

Unlike momentum-based scanners, Morningstar’s screener helps investors build a more strategic, fundamentals-first portfolio by filtering based on long-term value drivers.

- Filter for Quality and Stability: Rather than chasing hype, the screener allows you to focus on companies with consistent earnings, strong returns on equity, and sustainable business models — ideal for long-term wealth building.

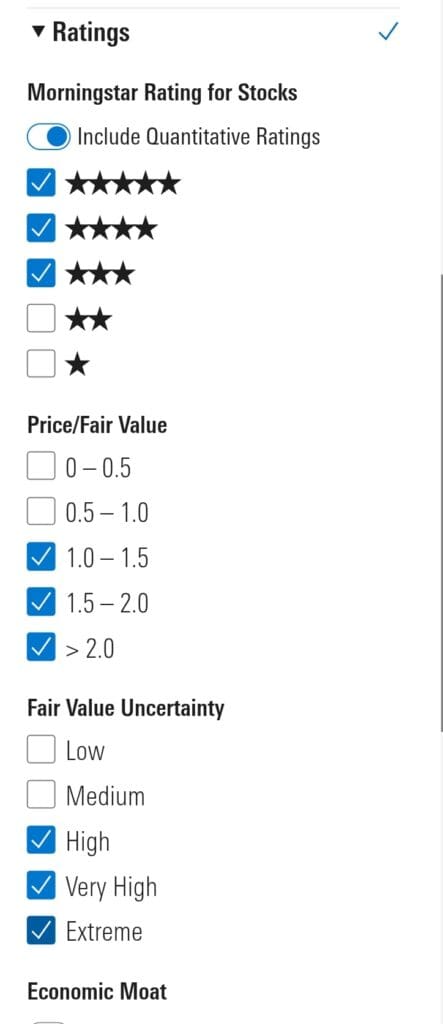

- Spot Undervalued Opportunities: Use filters like Star Rating, Fair Value vs. Market Price, and Price/Earnings Ratio to find stocks trading below their intrinsic value. This helps value investors avoid overpaying for overhyped names.

- Narrow Down Dividend Picks: Looking for income? Filter by dividend yield, payout ratio, and history of dividend growth. You can also combine these with quality metrics to find sustainable income stocks.

- Invest Based on Moat and Margin of Safety: Morningstar’s unique Moat Rating helps identify companies with a lasting competitive edge. Combine this with a 5-star rating and you’ve got a list of undervalued businesses with long-term staying power.

- Make Data-Driven, Repeatable Decisions: Instead of reacting emotionally to headlines, you can use the screener to apply consistent logic across your investments — helping you build discipline and avoid short-term noise.

Mastering Morningstar’s Stock Screener: Key Strategies

Morningstar’s screener is a powerful tool — but it’s most effective when used with a clear investing framework and disciplined criteria. Below are core strategies to get more from your screening process.

-

Start With a Clear Investing Goal

Before building your screen, define what kind of investor you are. Are you focused on long-term growth, dividend income, or undervalued turnaround plays?

Without a clear goal, filters can feel overwhelming. But when tied to a specific outcome, your screening becomes targeted and meaningful.

Examples of goal-based filters:

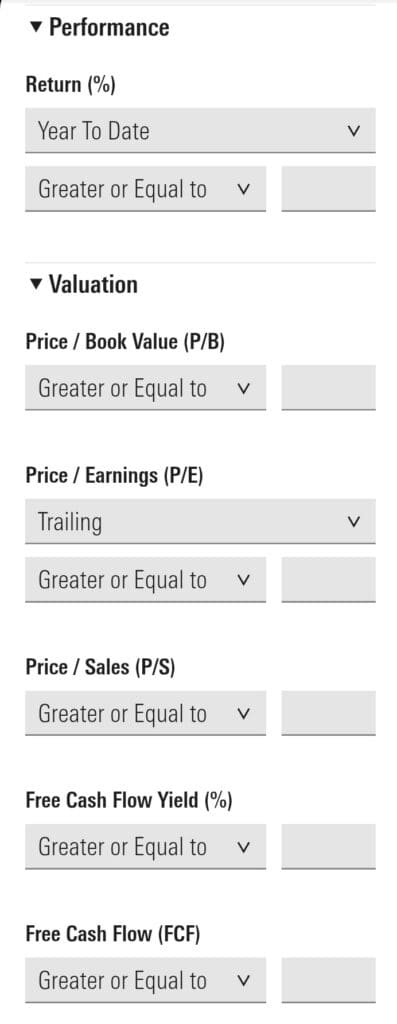

Growth investors might screen for companies with consistent 5-year revenue and EPS growth, plus above-average ROE.

Dividend investors can combine filters like dividend yield > 3%, dividend growth over 5 years, and payout ratio < 60%.

Value investors might look for stocks rated 4- or 5-stars with a fair value estimate at least 15% above market price and a narrow or wide moat rating.

Defining your outcome turns the screener into a precision tool, not just a list generator.

-

Scan Regularly — But Not Daily

Unlike intraday scanners, Morningstar’s tool is best used weekly or monthly to adjust your watchlist or evaluate new market opportunities. This aligns with the long-term focus of most of its metrics.

When to use the screener:

End of month: Check for newly downgraded/upgraded stocks, especially after earnings season or market pullbacks.

Quarterly: Use it to rebalance or refresh your watchlist after key updates in analyst ratings or economic moat assessments.

During volatility: Screen for 4- and 5-star stocks that have pulled back unjustifiably and now present better value.

This slower pace helps maintain discipline and reduce knee-jerk decisions.

-

Focus on Fair Value and Moat for Long-Term Edge

One of Morningstar’s standout features is its analyst-driven valuation model. Two filters worth mastering:

- Fair Value Estimate vs. Current Price: This helps pinpoint undervalued stocks. Filtering for stocks priced at 15%+ discount to fair value can uncover long-term opportunities — especially when paired with stable fundamentals.

- Economic Moat: Choose companies with a wide or narrow moat. This rating reflects how durable a company's competitive advantage is — key for long-term investing.

Combining these two metrics is a powerful strategy: you’re targeting stocks with strong business models and pricing inefficiencies.

-

Use Financial Health & Profitability Metrics

To avoid value traps or unstable companies, screen for financial quality. Morningstar’s filters go beyond basic P/E ratios.

Key filters to consider:

Return on Invested Capital (ROIC) > 10% to find efficient capital users.

Operating margin or net margin above industry averages.

Debt-to-equity ratio < 1 to ensure manageable leverage.

Cash flow trends (positive and growing) over the last 3 years.

These metrics help you identify sustainable businesses — not just cheap ones.

-

Track & Refine Your Screens Over Time

To improve your strategy, track which filters and criteria lead to the best results. Morningstar Premium allows you to save screens, compare past results, and adjust as markets shift.

Tips for refining your process:

Save multiple screens for different strategies (e.g., dividend growth, wide moat value, small-cap innovation).

Compare top hits over time and note which metrics show stronger future performance.

Adjust your filters quarterly based on market environment, sector shifts, and your own portfolio needs.

This ongoing feedback loop helps sharpen your edge as an investor.

Additional Morningstar Screener Features to Leverage

Morningstar’s stock screener includes deeper tools beyond basic valuation and profitability filters. These added features can offer more precision and insight for long-term investors.

Sector & Industry Breakdown: You can fine-tune your screen by narrowing it down to specific industries or sectors, such as semiconductors, REITs, or renewable energy. This is helpful if you're looking to overweight or diversify specific market segments.

Morningstar Quantitative Ratings: For stocks that lack full analyst coverage, Morningstar assigns quantitative ratings based on statistical modeling. This allows you to evaluate more companies with consistent, data-driven scoring.

Global Market Filters: Morningstar covers thousands of international equities. You can use country and region filters to screen for opportunities in emerging markets or undervalued global sectors.

These advanced options make Morningstar a versatile screener for value, income, and global diversification strategies.

Morningstar Stock Screener Alternatives

While Morningstar is a top choice for fundamentals-driven investors, it’s not the only stock screener available.

Other screeners may offer unique advantages depending on your investment style—whether you prefer technical analysis, real-time data, or earnings momentum.

Plan | Subscription | Best For |

|---|---|---|

Morningstar Investor | $34.95

$249 ($20.75 / month) if paid annually | Retirement Planners |

Zacks Premium | $249 ($20.75/month)

No monthly plan | Research-Driven Investors |

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| Stock Picks |

Yahoo Finance Gold | $49.95

$479.40 ($39.95 / month) if paid annually | Casual Investors |

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually | Global Market Investors |

TipRanks Premium | $359 ($30 / month)

No monthly plan | Analysts Followers |

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | Research-Oriented Investors |