OKX Crypto Exchange

U.S. Status

Supported Coins

Our Rating

Spot Trading Fee

-

Overview

- FAQ

OKX is a major cryptocurrency exchange offering a variety of features such as low trading fees, high-interest staking opportunities, and easy access to a large selection of cryptocurrencies.

With +300 supported currencies, including popular ones like Bitcoin, Ethereum, and Solana, it caters to both beginners and experienced traders.

Users can buy crypto using cards, bank transfers, or digital wallets and earn interest on their holdings through staking and savings options.

Despite mixed reviews regarding customer service, many users appreciate the platform’s low fees, diverse features, and solid security, including cold storage for funds.

However, OKX is not available in the United States for residents due to regulatory reasons.

What is OKX’s native token (OKB)?

OKB is OKX’s native utility token, offering users benefits such as lower trading fees, access to exclusive features, and participation in OKX’s token sale platform, Jumpstart. Holding OKB can also provide staking rewards and discounts on transaction costs.

Are my funds safe on OKX?

OKX uses industry-standard security measures such as two-factor authentication (2FA), cold storage for most assets, and encryption to keep funds secure. However, users should always follow best security practices, including enabling 2FA.

Does OKX charge fees for deposits?

No, OKX does not charge fees for cryptocurrency deposits. However, network fees may apply based on the blockchain used, and these fees are determined by the network itself, not OKX.

Pros | Cons |

|---|---|

Wide Range of Cryptocurrencies | Not Available in the U.S. |

Low Fees | Complex Interface for Beginners |

Strong Security | Mixed Customer Support Reviews |

High-Interest Earning Opportunities | Limited Fiat Withdrawal Options |

DeFi & NFT Support |

Supported Cryptocurrencies & Assets

OKX supports +300 cryptocurrencies, offering a wide variety of digital assets for trading, including popular tokens, stablecoins, and even NFTs.

The platform allows users to trade major cryptocurrencies like Bitcoin and Ethereum, as well as various altcoins and newer tokens.

Stablecoins, such as USDT (Tether) and USDC, are also available for trading, offering stability for users amidst the volatility of the crypto market.

In addition to cryptocurrencies, OKX provides access to NFTs through its marketplace, where users can buy and sell digital collectibles

OKX Exchange: Supported Countries & Availability

OKX is available in over 100 countries, including major markets like Singapore, Hong Kong, Japan, United Kingdom, Australia, Germany, and Brazil.

However, the platform is not available in certain regions, including the United States, due to regulatory restrictions.

In addition to the U.S., OKX is not available in other countries with strict cryptocurrency regulations, such as Canada, and in sanctioned countries.

OKX Legal Issues & Trustworthiness: What You Should Know

OKX has generally maintained a solid reputation in the crypto community, but it has faced some legal and regulatory challenges.

Notably, OKX operates in several regions without complete regulatory oversight, which can create concerns about transparency and security for some users.

Regarding security, OKX has not been involved in any major security breaches or hacks that resulted in significant losses for users.

In TrustPilot, the OKX customer service score is 3.6, higher than other exchanges.

Main Features For Crypto Investors

Here are the key features that I found most appealing in OKX:

-

OKX Fees & Costs

Here are the main fees for traders and investors:

Spot Trading Fees | Future Trading Fees |

|---|---|

0.08% – 0.10%

0.10% for taker trades and 0.08% for maker trades. As you trade more or hold more OKB, your fees decrease, potentially reaching as low as 0.02% for high-volume traders | 0.02% – 0.05%

0.05% for taker trades and 0.02% for maker trades. Like spot trading, the more you trade or the more OKB you hold, the lower your fees can become. |

- Withdrawal Fees: OKX does not charge fees for cryptocurrency deposits, but withdrawal fees depend on the asset and blockchain network used.

- Network Fees: These fees are determined by the blockchain's congestion and apply to both crypto deposits and withdrawals.

- Options Trading Fees: Options trading has a maker fee of 0.02% and a taker fee of 0.03%, with lower fees available for high-volume traders.

-

Exploring OKX’s NFT Marketplace and Web3 Features

OKX offers a comprehensive suite of NFT and Web3 features. The platform includes an NFT marketplace where users can buy and sell digital collectibles.

OKX also allows users to explore decentralized finance (DeFi) protocols and blockchain gaming through its Web3 integrations.

By connecting users to DeFi apps, OKX makes it easy to earn, stake, and engage with the broader Web3 ecosystem, all without leaving the platform.

Additionally, the OKX Wallet allows for multi-chain support, making it easy to access various blockchain networks and NFTs.

-

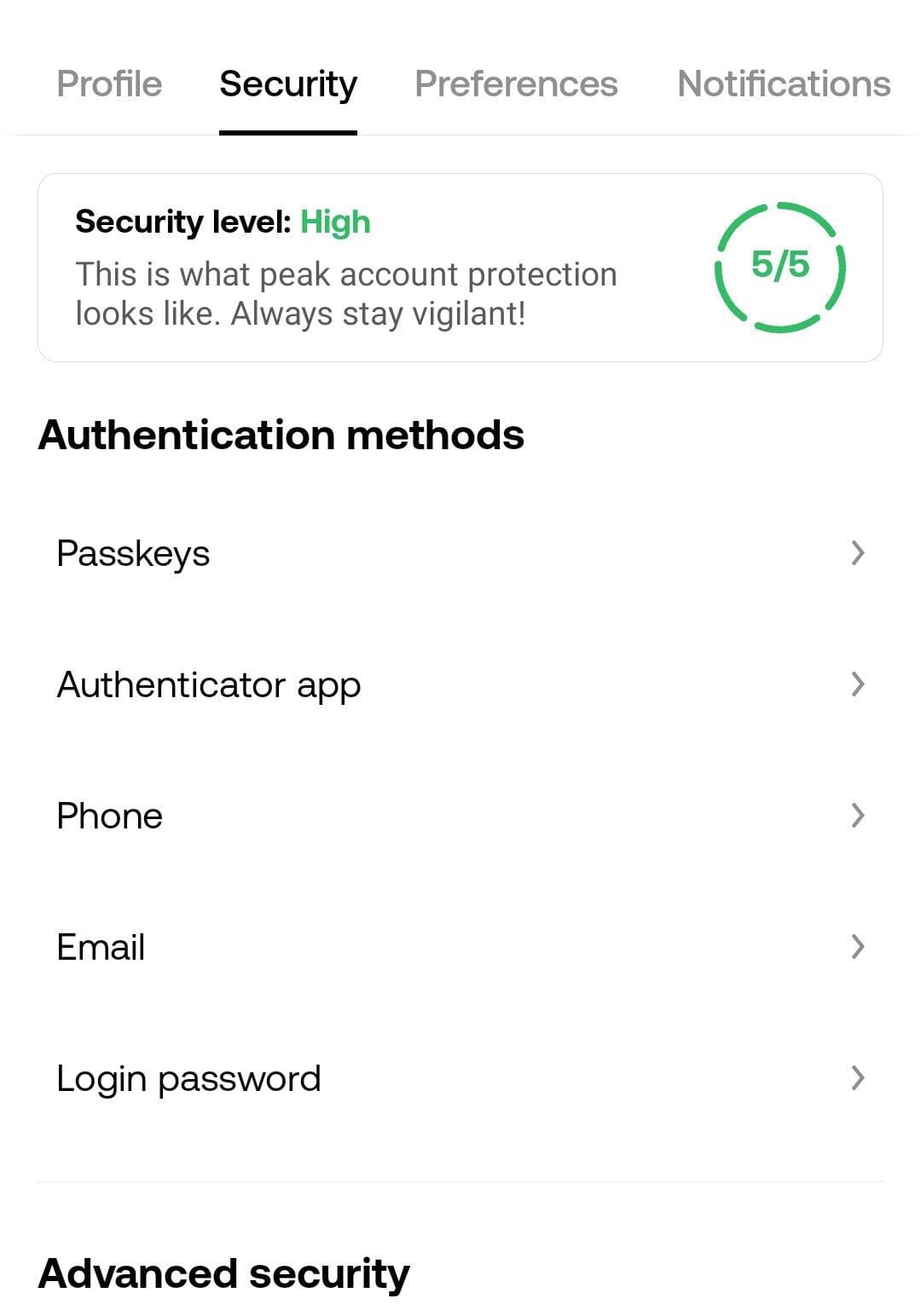

How Secure Is OKX? A Look at Its Security Measures

OKX offering industry-standard encryption, two-factor authentication (2FA), and withdrawal whitelisting to protect user accounts.

The platform requires KYC (Know Your Customer) verification, ensuring regulatory compliance and preventing fraud.

OKX also provides insurance policies and uses cold storage for most assets to safeguard against cyberattacks.

While OKX has secured licenses in regions like Dubai, it’s not fully regulated in all major markets, which may concern some traders.

-

What Deposit and Withdrawal Methods Are Available on OKX?

OKX supports multiple payment options for both deposits and withdrawals.

Users can deposit cryptocurrencies directly or use fiat methods such as debit/credit cards, bank transfers, and third-party services like Apple Pay and Google Pay.

OKX supports fiat withdrawals in certain regions through services like bank transfers, credit/debit cards, and third-party payment platforms such as Apple Pay and Google Pay.

Fiat withdrawals are generally slower than cryptocurrency withdrawals and may take a few business days to process, depending on the method used.

However, OKX has withdrawal limits, which vary depending on user verification levels. Also, fiat withdrawals are restricted in some countries, which may limit certain users.

-

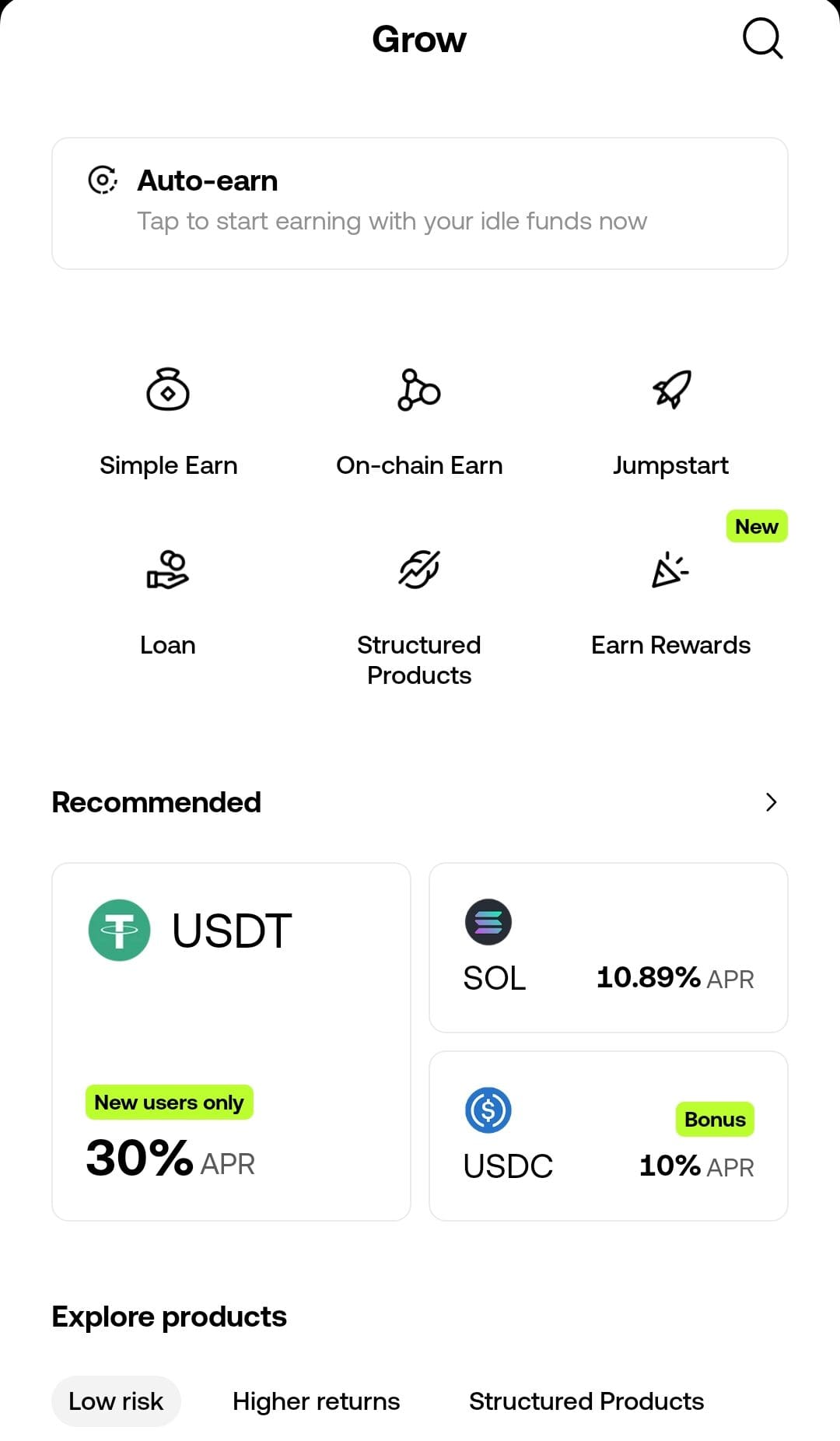

OKX Earn: Staking, Savings, and Structured Products

OKX Earn is a feature that allows users to earn passive income on their crypto holdings. It offers several ways to earn, including staking, savings, and structured products.

For example, users can stake specific cryptocurrencies to earn high annual returns, sometimes over 100%.

OKX also provides structured products that combine derivatives to offer users even higher potential returns, though these come with higher risk.

There are also lower-risk options like savings accounts where users can earn interest on idle assets.

-

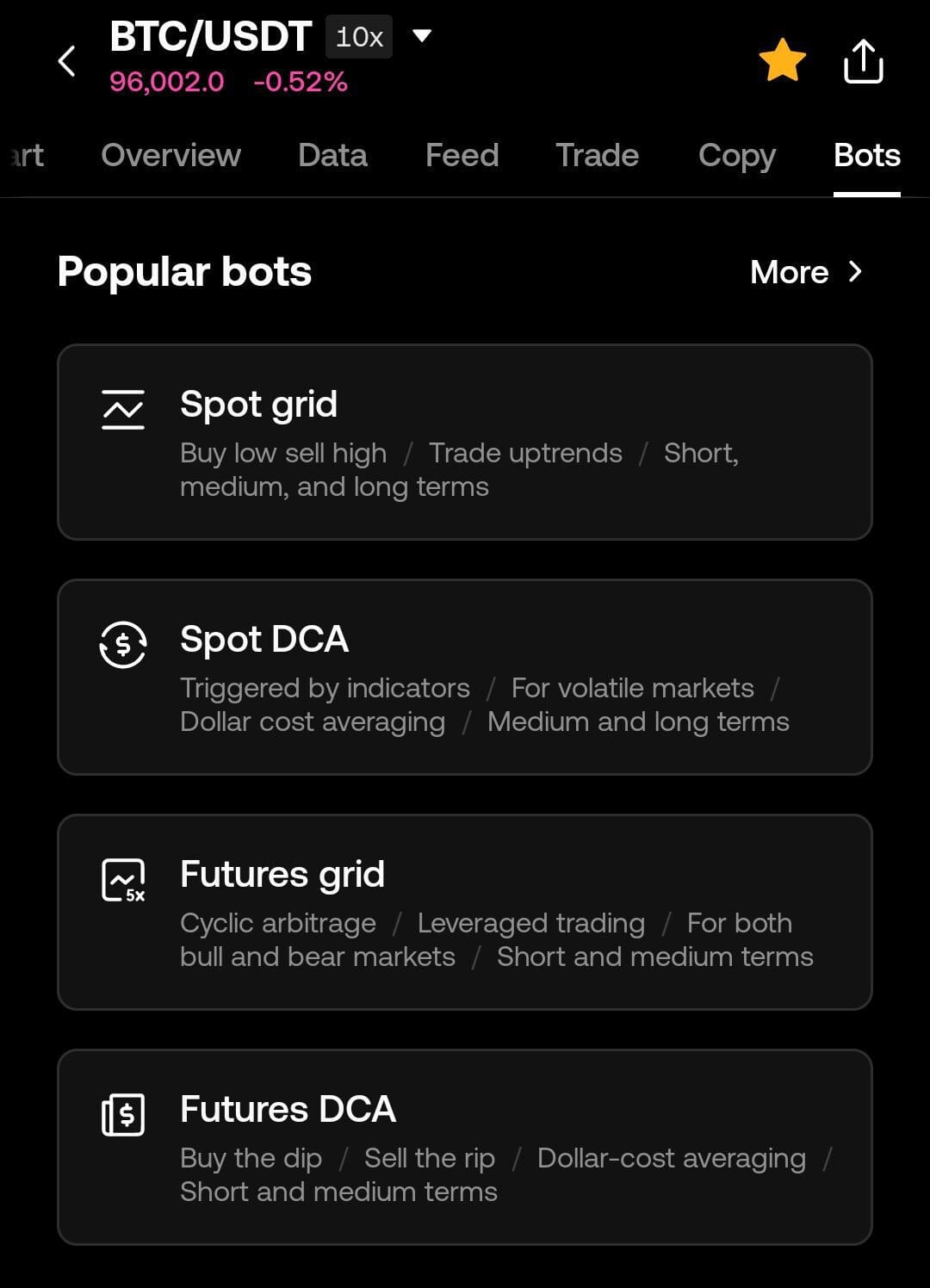

OKX Futures and Perpetual Swaps

OKX offers futures and perpetual swaps, advanced trading products that allow users to bet on the price movement of cryptocurrencies without owning them.

Futures are contracts that obligate the buyer to purchase a crypto asset at a predetermined price and time, while perpetual swaps function similarly but have no expiration date.

Both products allow for leveraged trading, meaning users can control a larger position with less capital.

For example, OKX offers up to 100x leverage on some assets, increasing both potential gains and risks.

-

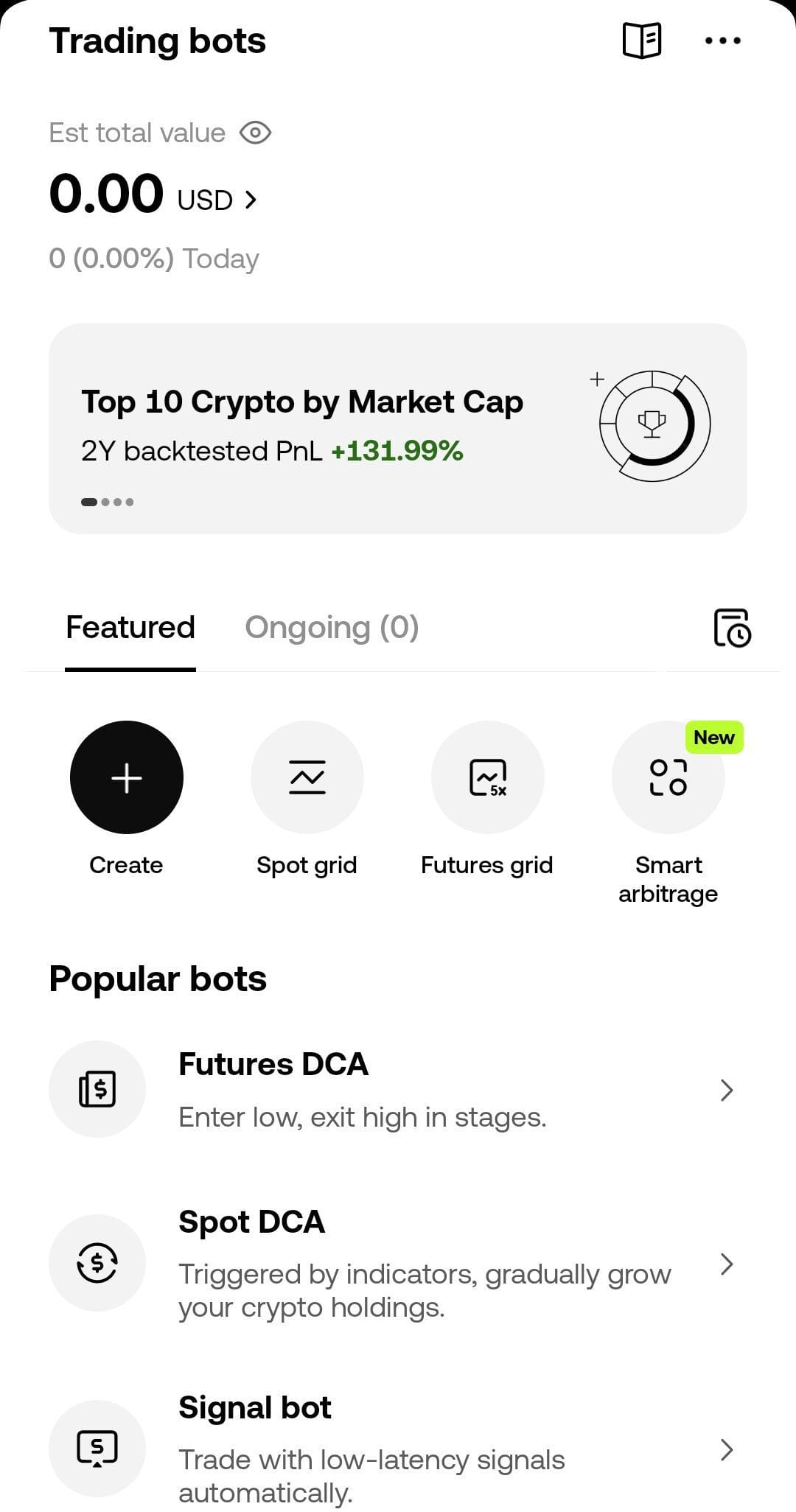

OKX Trading Bots: Automate Your Crypto Trades

OKX offers automated trading bots that can help users trade more efficiently and consistently.

These bots allow you to set rules for buying and selling crypto based on specific market conditions.

For example, you can set a bot to automatically buy Bitcoin if its price drops below a certain threshold.

OKX’s bots also support strategies like grid trading and arbitrage, which are useful for capitalizing on small price differences across markets.

The bots are customizable and easy to set up, making them an excellent option for traders who want to automate their strategies without constant monitoring.

When OKX May Be a Good Choice? When Not?

OKX, like any trading platform, isn't suitable for everyone.

Let’s examine who could benefit from OKX and who might want to consider other platforms.

When OKX May Be a Good Choice | Who Should Look Elsewhere |

|---|---|

Experienced Traders | U.S. Residents |

DeFi Enthusiast | Beginner Traders |

Global Traders | Users Who Prefer Full Regulatory Oversight |

Crypto Holders Looking for Low Fees | Investors Who Need Full Fiat Support |

NFT Collectors and Traders | Users Seeking Instant Withdrawals |

4 Simple Steps to Set Up the Bybit Account

Let's see the main steps when setting up an account with Bybit:

-

1. Registering Your Account

To set up an account on OKX, start by visiting the official OKX website or downloading their mobile app.

You’ll need to provide a valid email address or phone number for registration.

Once you’ve entered your details, you will receive a verification code via email or SMS. Enter this code to confirm your identity and create your account.

Our tips:

🔹 Make sure the email or phone number you use is secure and accessible because you’ll need it for account recovery.

🔹 Avoid using public Wi-Fi when registering to prevent potential security risks.

-

2. Complete KYC Verification

After registering, OKX will prompt you to complete the KYC verification process.

You will need to upload a government-issued ID, a selfie, and sometimes a proof of address.

This step is necessary to unlock higher withdrawal limits and access full trading features.

Our tips:

🔹 Good lighting for your selfie can help ensure the verification process goes smoothly.

🔹 Ensure your ID is clear and legible to avoid delays in verification.

🔹 If there are issues with document verification, double-check the photo quality and the required documents.

-

3. Securing Your Account with 2FA

For enhanced security, enable two-factor authentication (2FA).

This involves linking your account to an authenticator app like Google Authenticator or using SMS for a verification code.

It adds an additional layer of protection, especially when making withdrawals or significant changes to your account settings.

Our tips:

🔹 Google Authenticator is more secure than SMS, so it’s recommended.

🔹 Write down your backup code in case you lose access to your 2FA method.

🔹Never share your 2FA codes with anyone to prevent unauthorized access.

-

4. Making Your First Deposit

Once your account is verified and secured, you can make a deposit. OKX supports deposits via cryptocurrencies or fiat methods like bank transfers and credit cards.

Depending on your region, you can use services like Apple Pay or Google Pay for fiat deposits.

Cryptocurrency deposits are usually faster than fiat, which may take a few business days to process

Our tips:

🔹 Double-check the cryptocurrency address when making deposits to avoid losing funds.

🔹 Always start with small amounts when using leverage or margin.

🔹 Be aware of network fees when transferring cryptocurrencies; they can vary based on the coin and network congestion.

FAQ

Yes, OKX supports fiat-to-crypto transactions using various payment methods, including bank transfers, credit/debit cards, and third-party services like Apple Pay and Google Pay. Availability depends on your location.

OKX provides an order book and transaction history, where you can view your open orders and completed trades. The platform also has customizable charts and technical analysis tools for tracking market movements.

Yes, OKX offers a demo account feature, allowing new users to practice trading with virtual funds. This is a great way to familiarize yourself with the platform and test different strategies before trading with real money.

OKX provides customer support through live chat, email, and a comprehensive help center. For urgent issues, live chat is the fastest way to get in touch with a support agent.

Review Crypto Exchanges

How We Rated Crypto Exchanges: Review Methodology

At The Smart Investor, we evaluated crypto exchanges based on their overall value, security, and trading experience compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to traders and investors, including fees, security, liquidity, and available assets. Each exchange was rated based on the following criteria:

- Fees & Costs (15%): We prioritized exchanges with low trading fees, competitive spreads, and transparent pricing. Some platforms had hidden withdrawal fees or costly trading structures.

- User Experience & Interface (15%): A fast, intuitive, and well-designed platform scored highest. Some exchanges felt clunky or slow, impacting trade execution and overall experience.

- Security & Regulation (20%): We favored exchanges with strong encryption, two-factor authentication (2FA), cold storage, and regulatory compliance. Some lacked proper security, making them high-risk.

- Trading Tools & Features (30%): The best exchanges offered advanced charting, real-time market data, order types (limit, stop-loss), and automation tools. Some lacked depth, limiting professional traders.

- Supported Cryptocurrencies (10%): We rated exchanges higher if they supported a broad range of cryptocurrencies, including major coins, altcoins, and stablecoins. Some had limited selections, restricting options.

- Liquidity & Execution Speed (5%): Exchanges with high liquidity, deep order books, and fast execution times scored highest. Lower-rated platforms had frequent slippage or delays.

- Additional Features (5%): We favored exchanges with staking, lending, fiat on-ramps, NFT marketplaces, and DeFi integration. Some lacked these extras, making them less versatile.