Table Of Content

Opening a robo-advisor account is one of the easiest ways to start investing—even if you’ve never done it before.

In this guide, we’ll walk you through every step of the process so you can get started with confidence and know exactly what to expect.

How to Open a Robo-Advisor Account: Step-by-Step

Opening a robo-advisor account is simple and fast – here’s a step-by-step guide to help you start investing with confidence:

1. Prepare Key Information Before You Sign Up

Before jumping in, gather a few essentials. Most robo-advisors will ask for personal details like your name, Social Security number, and employment information for identity verification and tax reporting.

But just as important is knowing why you’re investing. Are you saving for a house in five years or retirement in 30?

For example, if you plan to open a retirement account (like a Roth IRA), you may also need income information to confirm eligibility.

-

Be Ready For The Following

You’ll typically need:

Social Security number and a valid ID

Employment and income details

Bank account info for linking and transfers

A rough idea of your financial goals and timelines

2. Sign Up and Verify Your Identity

Signing up is usually done online or via the robo-advisor’s app. The process is user-friendly and designed for beginners.

After entering your personal details, most platforms will require identity verification.

This might mean uploading a photo of your driver’s license or answering security questions based on your credit history.

-

Expect to:

Create a login and password

Answer identity verification questions or upload an ID

Provide your Social Security number for tax purposes

Accept terms of service and risk disclosures

3. Complete the Investor Questionnaire

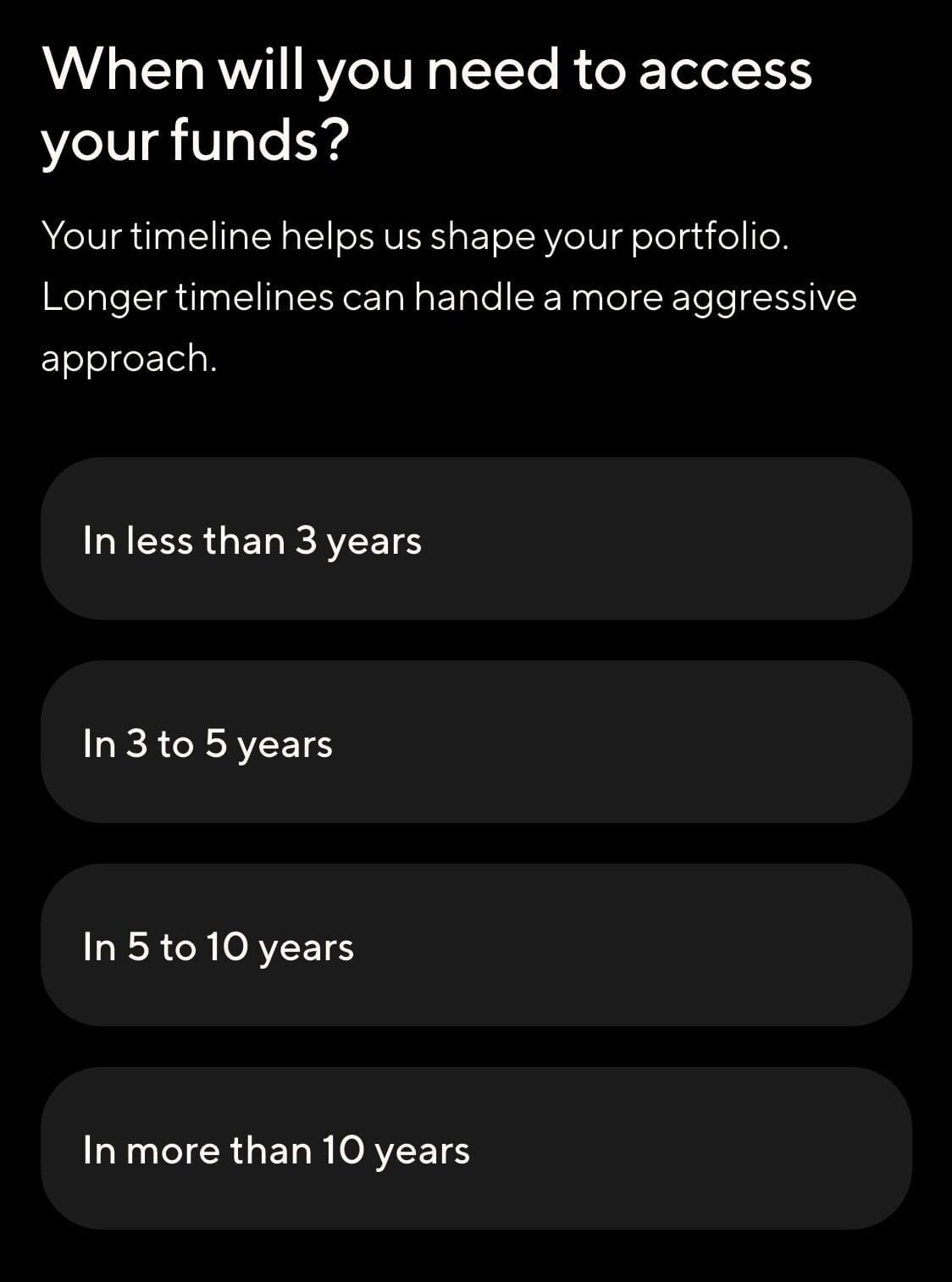

Once verified, you’ll be asked a series of questions to determine your financial profile. These cover your income, investment goals, risk tolerance, and how long you plan to keep your money invested. The robo-advisor uses this data to recommend an asset allocation and build a portfolio that fits your needs.

For example, if you're a 30-year-old investing for retirement, the platform might suggest a portfolio with 80% stocks and 20% bonds. But if you're saving for a short-term goal, like a home down payment in three years, you may be offered a more conservative mix.

This step typically takes 5–10 minutes. Common questions include:

What’s your investment goal?

When do you need the money?

How would you react to a 10% market drop?

Based on your responses, robo-advisors will show a sample portfolio with estimated returns and risk levels.

4. Choose Your Account Type and Fund It

Next, you’ll choose the type of account you want to open. Most robo-advisors offer several options:

Taxable brokerage accounts for general investing

Retirement accounts like Roth IRA or Traditional IRA

529 plans or custodial accounts for education or minors

Let’s say you're opening a Roth IRA with Betterment. Once selected, you’ll be prompted to connect your bank account.

Some platforms require a minimum deposit (e.g., Wealthfront: $500), while others, like SoFi, let you start with as little as $1.

The funding process usually involves logging into your bank or entering your routing and account number. ACH transfers can take 1–3 business days to process. You can also set up recurring deposits to automate your investing.

5. Review Your Portfolio and Begin Investing

Before your money is invested, you’ll see a preview of your portfolio, including how much is allocated to U.S. stocks, international stocks, bonds, and other assets.

Some platforms allow you to tweak your risk level or swap out ETFs, while others are fully automated and don’t offer customization.

After funding, the platform will automatically invest your money according to your preferences. You can track progress via the app or dashboard.

Features like auto-rebalancing and tax-loss harvesting may also kick in, depending on your account size.

How to Manage Your Robo-Advisor Account Over Time

Opening your robo-advisor account is just the start. While these platforms automate a lot of the heavy lifting, it’s still important to check in periodically and make sure your investment plan still aligns with your goals.

You don’t need to micromanage, but a little attention goes a long way when it comes to long-term success.

-

Review your account quarterly or after life changes

For example, if you got a new job or had a child, your investment timeline and risk tolerance might shift.

A quick check-in lets you adjust your strategy accordingly—most platforms allow you to update your goals and preferences.

-

Turn on or adjust auto-deposits

Automating contributions is one of the best ways to grow your portfolio consistently.

Say you set a $200/month deposit with Betterment. If your budget changes, you can easily increase or pause it via the app.

-

Track performance without overreacting

Avoid reacting to daily market dips. Platforms like Wealthfront show your long-term projections—stick to your plan unless something major changes in your life.

-

Enable advanced features like tax-loss harvesting

Some robo-advisors offer this to reduce your tax bill. For example, Wealthfront’s tax-loss harvesting can generate tax savings even during market downturns.

Popular Robo Advisors For Starters

Not all robo-advisors are the same. Some are better for beginners, while others offer more advanced features like tax optimization and crypto investing.

Choosing the right platform depends on your financial goals, account size, and how much customization you want.

Betterment: One of the largest and most beginner-friendly options. Offers features like goal-based planning, automatic rebalancing, and tax-loss harvesting. Ideal for those seeking a fully automated experience.

Wealthfront: Great for investors who want automation plus extras like financial planning tools and tax-efficient investing. For example, Wealthfront’s Path tool lets you simulate real-life goals like early retirement or buying a home.

SoFi Invest: Best for new investors looking for no account minimums and free access to human advisors. It’s perfect if you’re starting with a small amount and want support without high fees.

Fidelity Go: Backed by a trusted name, Fidelity Go is a solid choice for those already using Fidelity. It offers low-cost portfolios managed by Fidelity professionals rather than algorithms alone.

FAQ

Yes, but the time it takes depends on the platform and account type. Taxable accounts allow quicker withdrawals than retirement accounts.

They use encryption and are regulated like traditional brokerages. Most accounts are SIPC-insured up to $500,000 for securities.

Not typically. Most follow passive investing strategies using index ETFs aimed at long-term growth rather than outperforming the market.

Many robo-advisors, like SoFi and Betterment Premium, offer access to financial advisors or customer support for account questions.

Your assets are held with a custodian and are still yours. SIPC insurance also protects against broker-dealer failure.

Yes, some platforms let you opt into socially responsible or ESG portfolios—Betterment and Wealthsimple both offer this.

Primarily through advisory fees (e.g., 0.25% of assets). Some may earn interest on uninvested cash or offer premium services.

Yes, most robo-advisors allow ACAT transfers from other brokerages, though the process can take 5–7 days.

You’ll receive tax forms (like 1099s) for taxable accounts. Gains, dividends, and interest may be taxable depending on your situation.