What Is an Options Screener and How Does It Work?

An options screener is a tool that helps traders scan the market for options contracts that match specific criteria—such as expiration date, strike price, implied volatility, or unusual volume.

Because the options market includes millions of contracts with different expirations and strike combinations, a screener is essential to isolate high-potential setups and reduce noise.

Plan | Subscription | Best For |

|---|---|---|

TradingView Premium | $59.95

$432 ($23.98 / month) if paid annually | Technical Analysts |

Benzinga Pro | $37

$367 ($30.58 / month) if paid annually | News-Driven Traders |

MarketBeat All Access | $39.99

$399 ($33.25 / month) if paid annually | Portfolio Trackers |

GuruFocus Premium | $499 ($41.58/ month)

No monthly plan, price for US citizens, price change by region | Guru Investors Portfolios |

StockTwits Edge | $22.95

$229.50 ($19.10 / month) if paid annually

| Social Sentiment Traders |

Finviz Elite | $39.50

$299.5 ($24.96 / month) if paid annually | Chart Pattern & Backtesting |

The top options screeners let you filter based on trade strategy (e.g., covered calls, vertical spreads), sentiment indicators, or profitability metrics. For example:

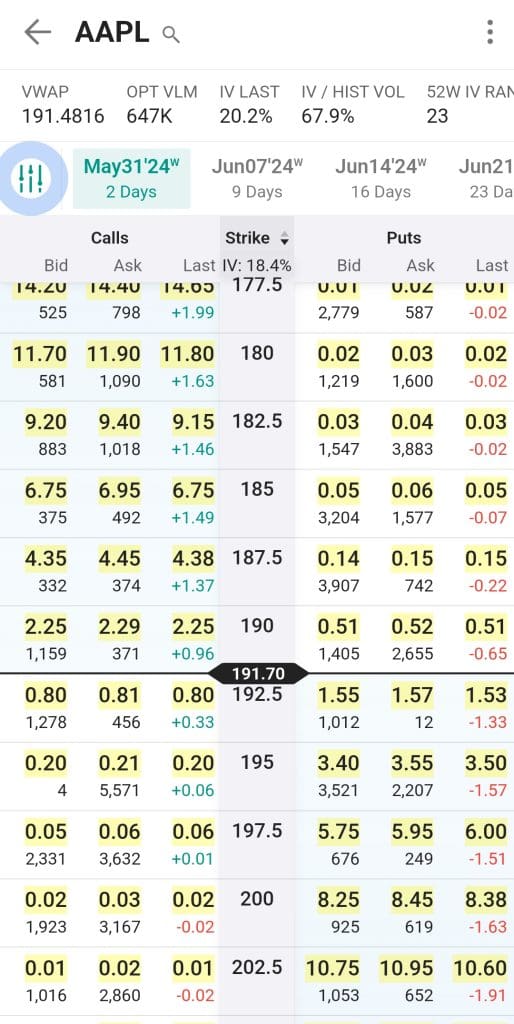

Filter by Implied Volatility and Volume: Scan for high implied volatility and large option volume spikes, which often signal upcoming moves.

Screen by Strategy Type: Select “bull put spreads” or “cash-secured puts” if you're looking for income trades with defined risk.

Find Unusual Options Activity: Spot contracts with volume far exceeding open interest—this can indicate large directional bets by institutions.

Best Strategies to Screen for Profitable Options Trades

Options screeners are most effective when paired with a strategy. Below are actionable screening approaches to help uncover trades with favorable risk-reward setups.

-

Find Unusual Options Activity to Spot Big Bets

When institutional traders make aggressive moves, they often show up as spikes in options volume. Screeners can alert you to this activity in real time.

Volume vs Open Interest: Filter for contracts where volume exceeds open interest by 2x or more.

Implied Volatility Change: Sort by IV increases over 10%—this suggests rising expectations of a price move.

Expiration Within 7–14 Days: Focus on near-term contracts to catch momentum-driven plays.

This strategy is useful for short-term traders trying to ride the wave of institutional positioning. For example, a sudden surge in call volume on AMD before earnings might hint at bullish sentiment building up.

-

Use Covered Call Screener for Income Generation

Covered call strategies are popular among conservative investors seeking consistent returns. A screener helps you compare yield potential across multiple stocks.

Select ‘Covered Call’ Strategy: Most screeners let you filter by income strategies.

Target High Options Yield: Look for stocks with annualized returns above 12% from premiums.

Filter by Delta (20–40): Lower deltas reduce the chance of early assignment.

For example, writing a covered call on Coca-Cola with a 30-day expiry might yield a 1.5% monthly return, offering income with a reasonable buffer.

-

Find High Probability Put Selling Opportunities

Selling cash-secured puts can be a way to either generate premium or acquire shares at a discount. A screener can help you focus on safer entry points.

Screen for High Probability Trades: Filter for delta values between 0.15 and 0.30 to favor low assignment risk.

Set Strike Price Below Support Levels: This offers technical protection in case of a pullback.

Compare Premium vs Margin Required: Use ROI filters to find the most efficient use of capital.

For instance, selling a $90 put on Intel when it’s trading at $94 might net a decent premium while still offering a comfortable entry price.

-

Screen for Vertical Spreads with Favorable Risk/Reward

Credit and debit spreads allow defined-risk trading. Screeners help identify spreads with optimal reward potential and manageable risk.

Choose ‘Bull Put’ or ‘Bear Call’ Strategy: Focus based on market direction.

Target 70%+ Probability of Profit: Many tools calculate POP based on delta and volatility.

Look for Return on Risk >25%: This ensures you’re not risking too much for minimal reward.

This approach works well for traders using spreads in sideways or moderately trending markets. For example, entering a bull put spread on SPY with a wide strike gap can offer high returns without needing a big move.

-

Identify Earnings Plays Using Options Volatility

Options screeners can uncover short-term opportunities around earnings, where implied volatility typically spikes.

Filter for Upcoming Earnings: Choose stocks reporting within 7 days.

Scan for Elevated Implied Volatility: IV Rank above 70 indicates strong earnings-related pricing.

Look at Straddle Premiums: Helps estimate the expected move and compare to historical earnings moves.

For example, if NVDA has an IV Rank of 85 before earnings, traders might analyze straddles or iron condors to profit from expected volatility crush.

-

Look for Options with Mispriced Volatility

Some options trade with implied volatility (IV) that's significantly higher or lower than historical volatility (HV), offering potential edge for volatility-based strategies.

Screen by IV vs HV Spread: Look for contracts where IV is at least 20% higher than HV—suggesting the market is overpricing risk.

Ideal for Options Sellers: Traders can sell premium (via straddles or iron condors) when IV is inflated.

Add Liquidity Filters: Ensure high open interest and tight bid-ask spreads to reduce slippage.

For instance, if IV on Tesla options is 80% while HV is only 40%, that disconnect may allow you to sell options at a rich premium before volatility reverts.

-

Identify High Return, Low-Cost Call Spreads

Call spreads offer directional upside at a defined, reduced cost—great for high-priced growth stocks with strong trends.

Choose Bull Call Spreads: Target rising tech or consumer growth names.

Target Breakeven Close to Current Price: This ensures the move required for profit is realistic.

Look for >2:1 Reward/Risk Ratio: Helps balance probability of profit with meaningful return.

For example, with Amazon trading at $140, buying the $145/$155 call spread for $2 might return $8 if it reaches $155 by expiration.

-

Use Options Screener to Plan Protective Puts (Hedging)

Traders with long stock positions can use a screener to identify affordable put options for downside protection.

Filter for Put Options 5–10% Below Current Price: This offers meaningful protection without excessive cost.

Set Expiry 30–60 Days Out: Enough time to cover short-term uncertainty.

Focus on Low Implied Volatility: Cheaper premiums make hedging more cost-effective.

If you own shares of Microsoft and fear a short-term pullback, a 60-day put with a strike 10% below current price might act as insurance—limiting potential losses without selling your position.

How to Choose the Right Options Screener

Choosing the right options screener depends on your trading goals, experience level, and the features you need to execute your strategy.

Strategy-Based Filters: Look for screeners that support covered calls, spreads, or cash-secured puts based on your preferred options trading style.

Access to Real-Time Data: Delayed data can lead to missed opportunities, especially when trading around earnings or volatility spikes.

Greeks and Volatility Metrics: Ensure the screener includes delta, theta, and implied volatility filters for better risk analysis.

User Interface and Customization: A clean, flexible layout makes it easier to build and save scans tailored to your needs.

Cost and Plan Limits: Some tools are free with basic filters, but advanced features may require a paid plan or subscription.

A reliable screener should enhance your decision-making, not overwhelm you with complexity or irrelevant data.