Table Of Content

What Is the OTC Market?

The over-the-counter (OTC) market is a decentralized marketplace where trading happens directly between two parties, rather than through centralized exchanges like the NYSE or NASDAQ.

It’s commonly used for trading stocks of smaller companies that don’t meet listing requirements or choose not to list on major exchanges.

Because it isn't bound by the same strict regulations as formal exchanges, the OTC market offers more flexibility—but also greater risk.

As a result, while it offers opportunities for growth, the lack of transparency and lower liquidity means investors must do more due diligence before making trades

How OTC Trading Works Compared to NYSE and NASDAQ

Unlike the NYSE and NASDAQ, which are centralized and regulated exchanges, the OTC market operates through broker-dealer networks without a physical location.

This difference impacts liquidity, transparency, and the types of companies traded. Here's a quick comparison:

Feature | OTC Market | NYSE | NASDAQ |

|---|---|---|---|

Regulation Level | Less regulated | Heavily regulated | Heavily regulated |

Listing Requirements | Minimal | Strict | Strict |

Trade Transparency | Limited | High | High |

Typical Companies | Small/startups | Large corporations | Tech-heavy firms |

Trading Method | Dealer-driven | Auction-based | Dealer/automated |

Physical Exchange | No | Yes | No |

For instance, a startup in biotech may choose to trade OTC because it’s not yet profitable and can’t meet NYSE’s financial criteria.

However, a large company like Apple trades on NASDAQ due to its high regulatory compliance and public visibility.

OTC Market: Which Popular Assets Are Traded?

Many investors associate the OTC market with penny stocks, but it also includes a wide range of financial instruments. These markets offer access to assets that are less commonly available through traditional exchanges.

Examples of commonly traded OTC assets:

Penny stocks – Thinly traded companies like small-cap biotech firms or startups.

Foreign ADRs – International firms such as Nestlé (NSRGY) that don't trade on U.S. exchanges directly.

Corporate bonds – Debt instruments from smaller or private companies.

Derivatives – Customized swaps or options traded between institutions.

For example, an investor seeking exposure to a Swiss company like Nestlé might buy its ADR over-the-counter.

Similarly, fixed-income investors might purchase bonds issued by a mid-sized private energy firm not listed on public exchanges.

Investing in OTC Securities: Pros and Cons

Investing in over-the-counter (OTC) securities can open doors to unique opportunities, but it also brings specific risks that investors must weigh carefully:

Pros | Cons |

|---|---|

Early access to growth firms | Limited liquidity |

Low share prices | Poor financial transparency |

Global stock exposure | Highly volatile |

High potential upside | Risk of fraud or manipulation |

- Access to Emerging Companies

OTC markets let you invest in startups or small-cap firms early in their growth, often before they go public on larger exchanges.

- Potential for High Returns

Because many OTC stocks are undervalued or unknown, their prices can spike quickly with positive news or earnings, as seen with some early-stage cannabis stocks.

- Global Exposure

You can invest in international companies via OTC-listed ADRs.

- Lower Entry Costs

Many OTC stocks trade under $5, making them affordable for retail investors who want to build positions with limited capital.

- Low Liquidity

Many OTC securities have limited trading volume, which can make it hard to sell quickly or at a favorable price.

- Lack of Transparency

OTC companies aren’t subject to the same disclosure requirements as NYSE or NASDAQ firms, so financials may be outdated or incomplete.

- Higher Volatility and Risk

OTC stocks can fluctuate dramatically due to speculation or low float, as seen in sudden spikes of meme stocks traded OTC.

- Greater Potential for Scams

Because of minimal regulation, some OTC stocks are associated with pump-and-dump schemes or shell companies.

How to Research OTC Companies?

Researching OTC companies requires a deeper look into disclosures, financials, and risk signals because they operate outside major stock exchanges.

-

Check OTC Markets Website

Use otcmarkets.com to find company profiles, real-time quotes, financial disclosures, and their market tier (OTCQX, OTCQB, or Pink).

For example, OTCQX firms typically meet stricter standards and offer more transparency.

-

Review Financial Filings

Not all OTC companies file with the SEC, but those that do can be researched via SEC EDGAR.

This is especially important for evaluating revenue, debt, and cash flow trends over time.

-

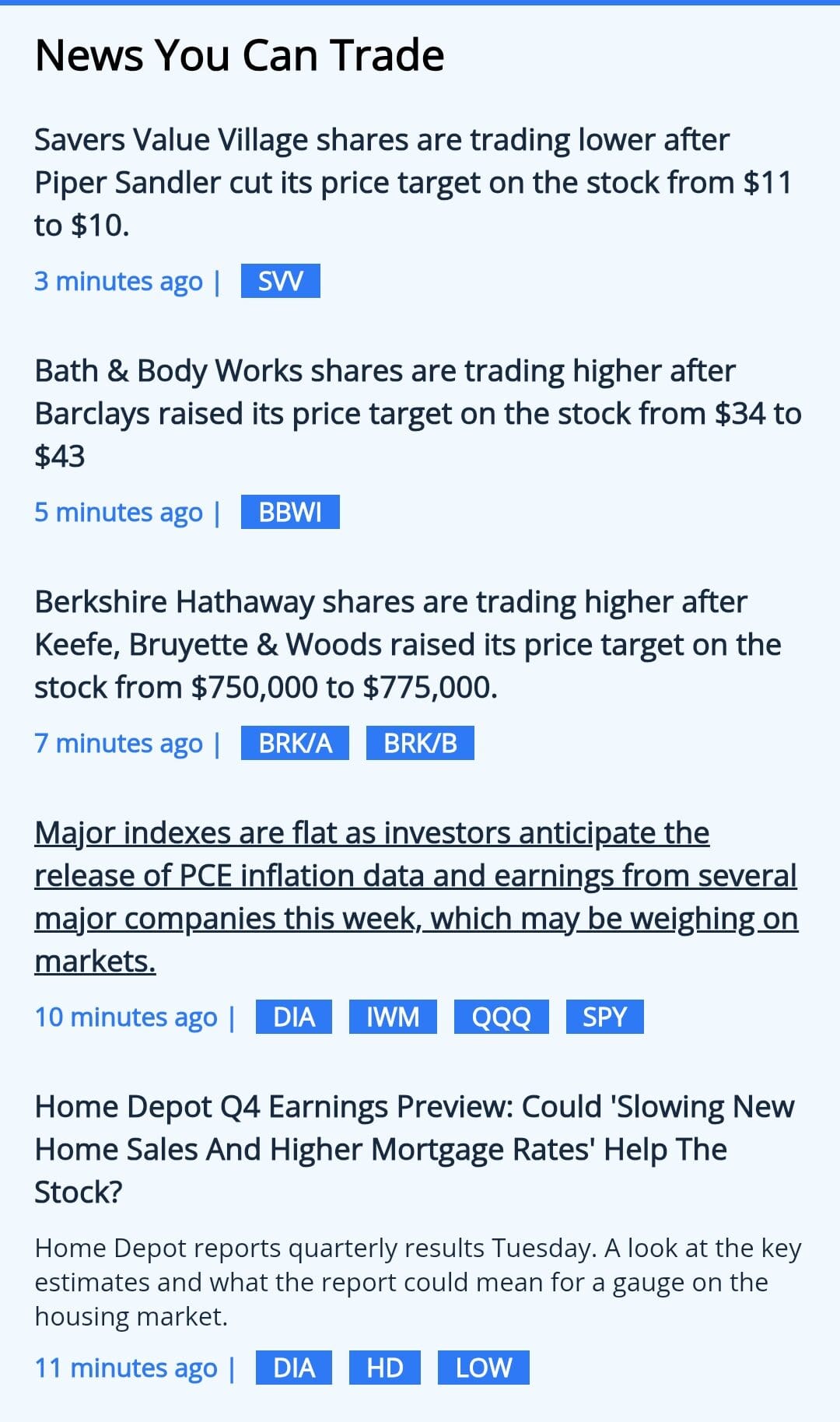

Analyze News and Press Releases

Because analyst coverage is limited, it’s important to monitor official press releases for major updates like mergers or FDA approvals, especially for industries like biotech or energy.

-

Evaluate Management and Business Model

Look into the leadership team’s background and the company's core strategy. For instance, a tech startup may promise innovation but lack a clear revenue path.

-

Use Forums With Caution

Platforms like Stocktwits or Reddit may offer sentiment insights, but they’re also prone to hype and misinformation. Cross-reference with official sources to avoid being misled.

FAQ

Some OTC securities are regulated by the SEC, especially those in the OTCQX and OTCQB tiers. However, many Pink Sheet stocks have minimal oversight, making due diligence essential.

Yes, some large international companies like Nestlé and Roche choose to trade OTC in the U.S. using American Depositary Receipts (ADRs) instead of listing on exchanges.

Many penny stocks trade OTC, but not all OTC stocks are penny stocks. The OTC market also includes larger foreign companies and bonds.

Pink Sheets refer to the lowest tier of the OTC market, where companies are not required to provide regular financial disclosures. This makes them high-risk for investors.

Some brokers allow OTC stocks in IRAs, but restrictions often apply depending on the stock’s tier and risk level. It's best to check with your IRA custodian.

Market makers provide liquidity by quoting buy and sell prices for OTC stocks. However, spreads can be wide, especially in low-volume securities.

Companies may trade OTC because they don't meet listing requirements or want to avoid high costs and regulations associated with major exchanges.

Short selling OTC stocks is typically limited and may not be available through many brokers. It also carries higher risk due to low liquidity and price volatility.

There’s no formal limit, but low trading volume in OTC stocks can make it difficult to execute large trades without impacting the price.

Yes, most OTC securities trade during standard U.S. market hours, though some may have reduced liquidity in pre- or after-hours trading.