What Is a Penny Stock Screener and How Does It Work?

A penny stock screener is a tool that helps investors filter and identify low-priced stocks, typically trading under $5, based on custom criteria.

Because penny stocks are often volatile and thinly traded, a screener is essential to reduce risk and uncover potential opportunities more efficiently.

These screeners allow users to set filters based on fundamentals, technical signals, volume, price movement, or sectors. For example:

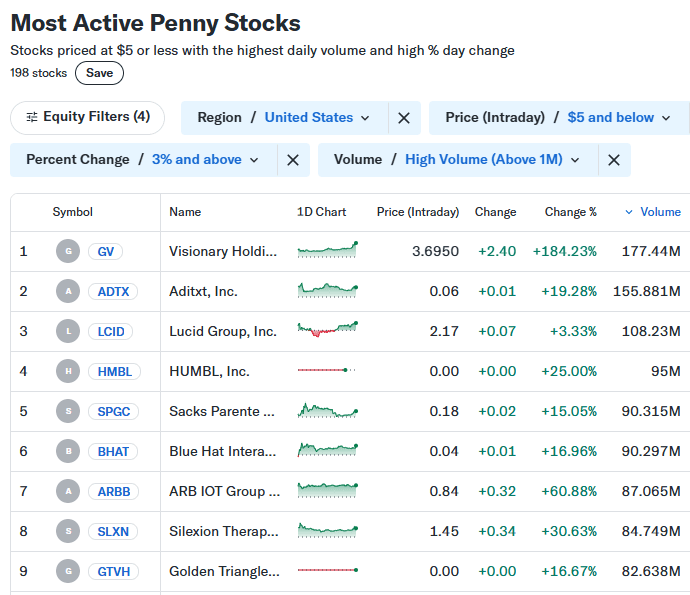

Filter by Price and Volume: To spot liquid opportunities, look for stocks trading below $5 with above-average daily volume.

Use Technical Indicators: Screen for RSI under 30 or bullish MACD crossovers to find possible reversal setups.

Focus on Industry Trends: If you're targeting speculative growth stories, limit results to the biotech or clean energy sectors.

Platforms like Finviz and MarketBeat offer penny stock screening tools that are especially useful for identifying momentum-based trades or undervalued small-cap stocks.

Plan | Subscription | Best For |

|---|---|---|

Morningstar Investor | $34.95

$249 ($20.75 / month) if paid annually | Retirement Planners |

Zacks Premium | $249 ($20.75/month)

No monthly plan | Research-Driven Investors |

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| Stock Picks |

Yahoo Finance Gold | $49.95

$479.40 ($39.95 / month) if paid annually | Casual Investors |

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually | Global Market Investors |

TipRanks Premium | $359 ($30 / month)

No monthly plan | Analysts Followers |

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | Research-Oriented Investors |

Best Strategies to Screen for Winning Penny Stocks

Penny stock screeners help traders spot penny stocks opportunities others often miss by isolating stocks with strong patterns, volume, or catalysts.

Below are our main targeted strategies to uncover high-potential plays using screeners.

-

Find High-Volume Penny Stocks for Day Trading

High-volume penny stocks can offer quick price movements, making them ideal for day trading. A screener helps you filter out illiquid stocks and focus only on those actively moving during the trading session.

Price Filter: Set the stock price between $0.50 and $5 to stay within the penny stock range.

Volume Filter: Look for stocks with a daily average volume over 1 million shares to ensure liquidity.

Percent Change: Filter for stocks up or down more than 5% intraday to capture volatility.

This setup helps day traders avoid dead stocks and focus on momentum. It’s especially useful early in the trading day when volume surges can lead to quick scalping opportunities.

-

Find Penny Stocks with Upcoming Catalyst

Catalysts—like earnings, FDA approvals, or partnerships—often drive penny stock spikes. A screener can help you find stocks with known upcoming events to anticipate moves rather than react late.

Earnings Date Filter: Set for companies reporting within the next 7 days.

Sector Filter: Target biotech, mining, or small-cap tech, which often react sharply to news.

News Activity: Use screeners with news integration (like MarketBeat or Benzinga) to spot press releases and scheduled events.

This approach increases your odds of catching a breakout before the crowd. Be cautious though—catalysts can cut both ways, so risk management is key.

-

Find Breakout Penny Stocks

Breakout stocks can offer explosive upside if you catch them early. A screener helps spot technical setups indicating that a stock is breaking out of resistance or a consolidation phase.

Price Action Filter: Filter for stocks near their 52-week highs or breaking above recent resistance.

Volume Surge: Look for volume spikes over the average of the past 10 days.

Technical Pattern Filter: Use tools that detect triangle breakouts, flags, or consolidation ranges.

By narrowing in on these conditions, you can pinpoint breakout candidates before they hit mainstream attention. These setups are particularly strong when paired with rising volume and bullish sentiment.

-

Find High-Growth Penny Stocks

If you're looking for longer-term potential, focusing on high-growth fundamentals is key. A screener lets you target under-the-radar companies with strong earnings or revenue expansion.

Revenue Growth Filter: Screen for companies with year-over-year revenue growth of at least 20%.

EPS Growth: Look for stocks with positive or accelerating earnings, even if still small.

Forward P/E or PEG Ratio: Target valuations that suggest growth isn't overpriced yet.

This method is ideal for swing traders or long-term investors. While volatility still exists, these are stocks with stronger business momentum that could climb over time if fundamentals hold.

-

Find Oversold Penny Stocks Ready for Reversal

Oversold penny stocks can sometimes bounce hard, especially when technical indicators show signs of a reversal. A screener helps isolate these setups quickly.

RSI Filter: Set RSI below 30 to identify stocks that are technically oversold.

Price Range: Limit the screener to stocks between $0.50 and $3 to focus on deeply discounted names.

MACD Signal: Add MACD crossover or histogram turning positive to confirm early momentum.

This type of screen is especially helpful for swing traders who want to catch rebound trades before they gain widespread traction. Be sure to check volume and news to confirm the move is supported.

-

Find Low Float Penny Stocks with Unusual Volume

Low float stocks—especially with sudden volume spikes—can experience rapid price surges. A screener helps find these rare but explosive opportunities before they trend.

Float Size Filter: Set the float under 25 million shares for scarcity-driven price action.

Volume Spike: Compare current volume to average (2x or more) to detect sudden activity.

Price Volatility: Look for stocks with at least a 5% daily range to spot aggressive movers.

This strategy appeals to aggressive traders looking for high-reward setups. But due to their volatility, position sizing and stop-loss levels are especially important.

-

Find Insider Buying in Penny Stocks

Stocks that reclaim or break above moving averages often signal strength. A screener helps spot these transitions before they become full breakouts.

Moving Averages: Screen for stocks crossing above their 50-day or 200-day moving average.

Volume Confirmation: Require at least 1.5x relative volume to validate the breakout.

Trend Direction: Ensure the moving average itself is starting to slope upward.

This setup is popular for identifying recovery trades or early-stage uptrends. When combined with news or sector strength, it can offer solid risk/reward.

-

Find Earnings Surprise Penny Stocks

Penny stocks that beat earnings expectations often experience strong price reactions. A screener can highlight these post-earnings winners for short-term trading or swing setups.

EPS Surprise Filter: Look for companies with positive earnings surprises in the last quarter.

Price Reaction: Filter for stocks that jumped at least 10% on earnings day.

Sector Focus: Target active sectors like biotech or small-cap tech for more volatility.

This approach lets you focus on fundamentally improving companies with real momentum. If paired with a bullish chart pattern, these stocks can trend for days or even weeks.

How to Choose the Right Penny Stock Screener

With so many tools available, selecting the right penny stock screener depends on your goals, strategy, and budget.

Customization Options: Look for screeners that allow filtering by volume, price, technical indicators, and fundamentals so you can tailor results to your strategy.

Real-Time Data: Choose platforms that offer real-time or near-real-time updates; delayed data can make you miss crucial setups.

News and Catalyst Integration: Tools that incorporate earnings calendars, insider activity, or news feeds help spot breakout potential early.

User Interface and Learning Curve: Make sure the screener is easy to navigate, especially if you're a beginner or using mobile devices.

Cost vs. Features: Free screeners like Finviz or Yahoo Finance are good starters, but paid tools (like Benzinga Pro) offer deeper analysis and alerts.

The right screener helps you focus on quality trades and saves time filtering noise. Pick one that matches both your style and budget.

Avoid Penny Stock Scams and Pump-and-Dump Schemes

The penny stock world is full of opportunities, but it's also a magnet for scams and manipulative trading schemes. Stay alert and cautious.

Watch for Sudden Spikes: Be wary of stocks that rise rapidly on thin volume with no news—it’s often artificial hype.

Check Company Filings: Many scams involve companies with no revenue or SEC compliance. Use EDGAR or OTCMarkets to verify filings.

Avoid Email or Social Media Promotions: If a stock is being aggressively promoted online or via newsletters, it may be part of a pump-and-dump campaign.

Analyze Trading Volume Patterns: Sudden volume increases without fundamentals are red flags that often precede price crashes.

Use Trusted Platforms: Stick with reputable brokers and screeners that don’t support unlisted or gray market securities.

Doing proper due diligence and ignoring hype can save you from major losses. If something seems too good to be true, it probably is.

FAQ

Free screeners typically offer basic filters like price and volume, while paid versions include advanced features such as real-time data, insider activity, and technical pattern recognition.

It depends on your strategy. Day traders may update filters daily to capture intraday momentum, while swing traders might review setups weekly based on market trends.

Yes, by setting filters around unusual volume, insider activity, or upcoming catalysts, a screener can surface stocks before major attention hits.

Absolutely. You can use them to identify overbought conditions for short opportunities or oversold setups for potential longs.

Some platforms allow screening based on fundamentals like earnings growth, revenue, and debt ratios, which helps filter out the weakest companies.

After screening, always perform due diligence—check SEC filings, verify news, review financials, and avoid heavily promoted or suspicious stocks.

Most platforms, especially paid ones, allow you to save custom screeners and watchlists so you can quickly revisit high-potential setups.