Table Of Content

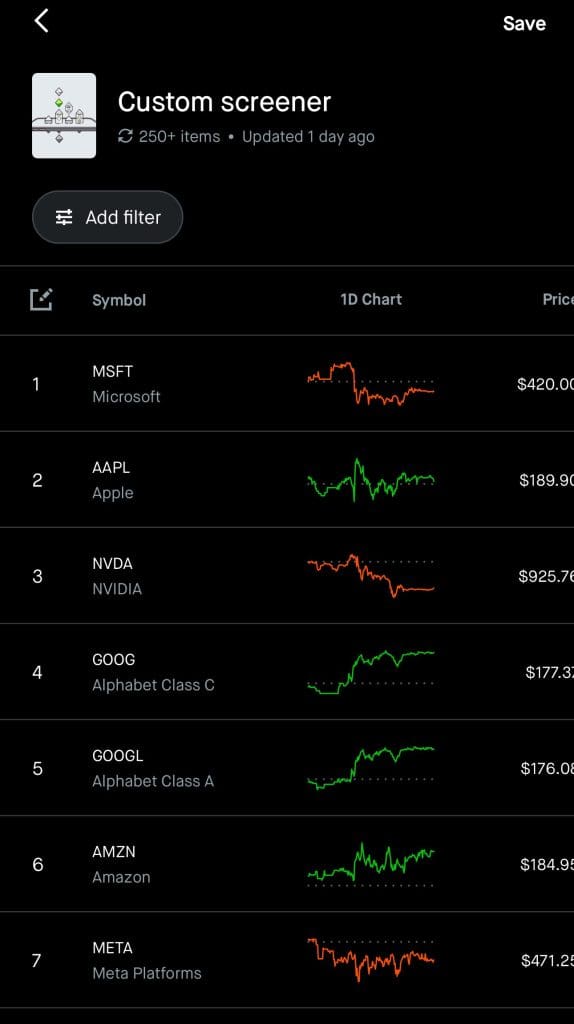

Robinhood App Best Features for Day Trading

Robinhood isn’t a traditional day trading platform, but it offers enough tools for active traders who want to take short-term positions.

With features like real-time charts, 24-hour trading, and price alerts, you can set up practical strategies for day trading. Here are five useful tactics:

-

Trade During Extended Hours with 24-Hour Market

Robinhood’s 24-Hour Market lets you place limit orders any time between 8 PM ET Sunday and 8 PM ET Friday.

This is particularly useful for reacting to earnings announcements or economic reports released outside regular trading hours.

For example, if Netflix reports strong earnings at 6 PM ET, you can place a limit buy at $550 and potentially sell at $570 by pre-market open. This feature helps you catch early moves before regular traders react.

-

Use Technical Indicators to Time Entries

Robinhood’s charting tools allow you to overlay indicators like RSI, MACD, and Moving Averages. A common day trading setup is buying when RSI drops below 30 (oversold) and sells as it climbs above 70.

For instance, if Tesla’s RSI dips to 28 at $180 and rebounds to 70 while the price hits $192, that’s a clear exit point. Use the MACD crossover as a confirmation signal to avoid false starts.

-

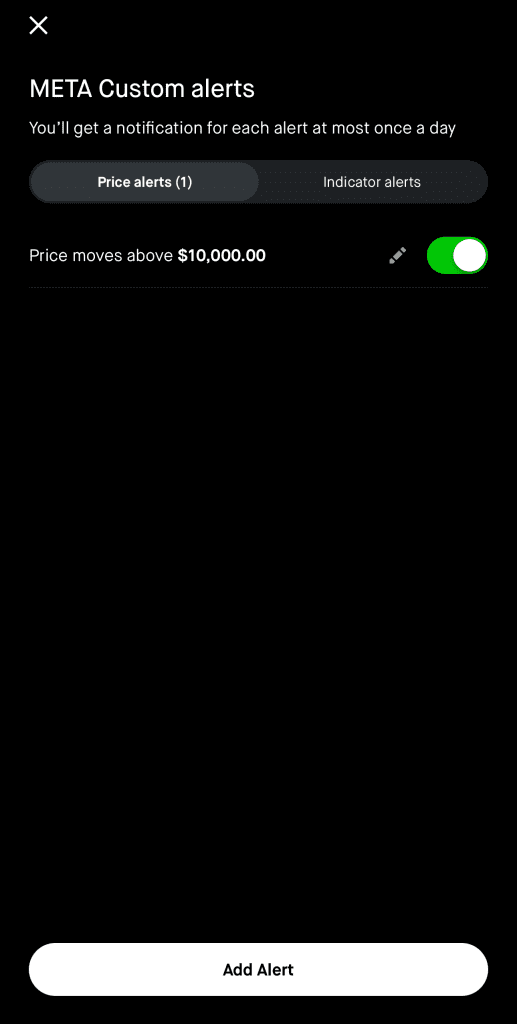

Set Price Alerts to Catch Volatility

Use Robinhood’s custom alerts to monitor rapid price movements.

Set alerts at technical resistance or support levels to avoid constantly staring at charts. For example, if Apple is trading around $165, you could set alerts for $160 (support) and $170 (resistance).

Once triggered, you can decide to enter a position or avoid a fake breakout. This strategy helps prevent emotional trading and lets you stick to your plan.

-

Scalp Trades with Fractional Shares

Scalping is about making multiple small trades for minor price changes.

Robinhood’s fractional shares let you scalp even high-priced stocks like Nvidia. For example, buy $200 worth of NVDA at $880 and sell at $885 — a $5 move on just 0.227 shares gives you ~$1.13 gain.

Small, fast gains can add up if repeated consistently with risk controls. Always set stop-losses or be ready to exit fast.

-

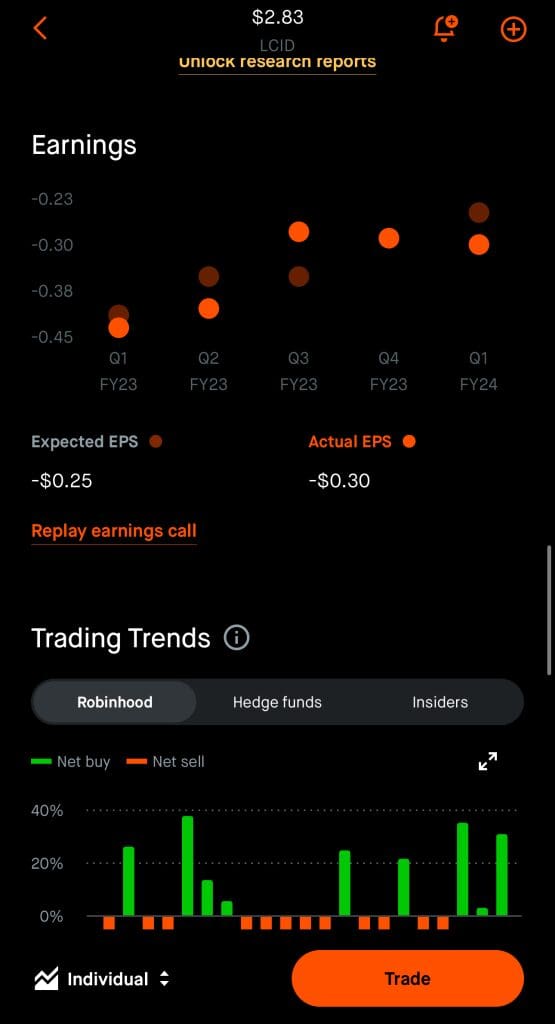

Capitalize on Earnings Momentum

Use the “Upcoming Earnings” section or Robinhood’s news alerts to find stocks with earnings this week. Day traders can benefit from volatility on earnings day.

Let’s say AMD announces results after hours and the stock drops from $100 to $94 — if you believe it’s overdone, you could buy at $94 pre-market and sell into a bounce at $97.

Always review earnings charts in Robinhood’s news section to anticipate reactions.

-

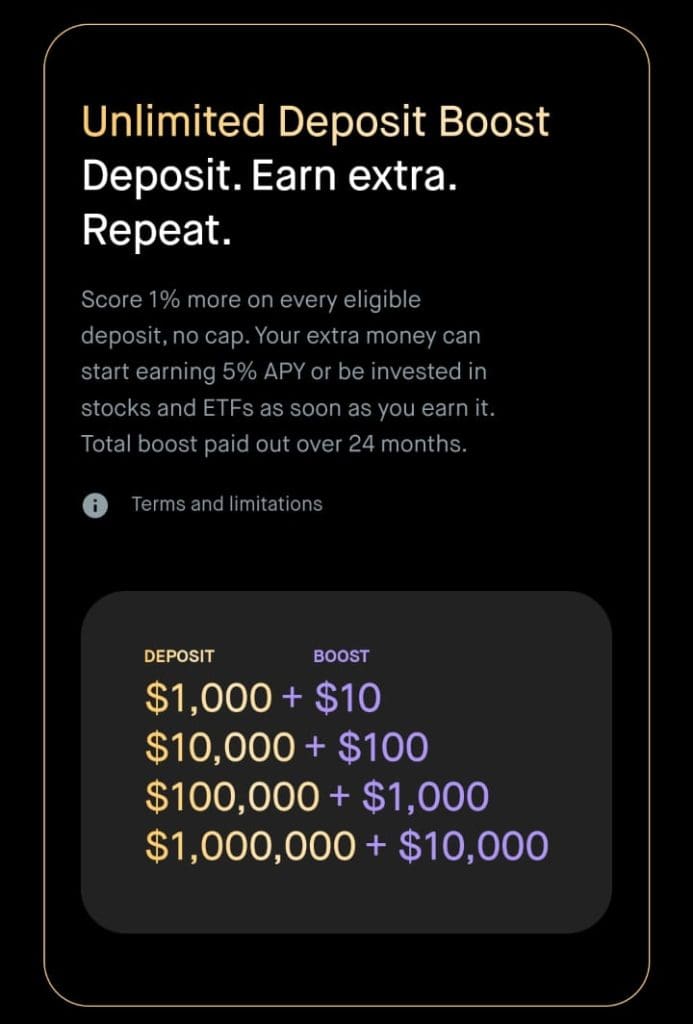

React Quickly Using Instant Deposit Boost (Gold Feature)

Robinhood Gold gives you access to instant deposits up to $50,000 per day.

This is valuable if a trade setup emerges but your cash hasn’t settled. Say you spot a breakout in AMD, but only $500 is settled in your account — with Gold, you can still use the newly deposited $3,000 instantly.

This speed helps you stay competitive with other day traders, especially during earnings seasons or market dips. Just be mindful of the Pattern Day Trader (PDT) rule if your account is under $25,000.

Which Day Trading Features Are Missing on Robinhood?

While Robinhood offers basic tools, it lacks several features that active day traders often rely on for faster, more precise execution:

No Stop-Loss or Take-Profit Orders: Without these, traders must manually close trades, which can lead to missed exits or emotional decisions.

No Trailing Stops or Bracket Orders: These advanced order types help manage risk and lock in gains but aren't available on Robinhood.

Limited Real-Time Data: Level 2 market data is only available to Robinhood Gold users, leaving free users with less visibility.

No Desktop App or Hotkeys: Traders can’t use keyboard shortcuts for instant execution, which slows down fast-paced trading.

No Paper Trading Feature: New traders can’t test strategies in a risk-free environment, increasing the cost of the learning curve.

Alternative Platforms for Day Trading

If you're a serious day trader, you may need a more advanced platform than Robinhood. Here are strong alternatives built for active traders:

Thinkorswim by Charles Schwab: Offers free access to advanced charting, custom indicators, Level 2 data, and a professional desktop terminal.

Interactive Brokers (IBKR): Supports global trading, algorithmic orders, and extremely low margin rates with a customizable desktop suite.

Webull: More trader-friendly than Robinhood, with better charts, paper trading, and more flexible order types like trailing stops.

TradeStation: Known for rapid execution, bracket orders, and deep technical tools that make it ideal for experienced day traders.

Broker | Annual Fees | Best For |

|---|---|---|

Robinhood | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold | Beginner Stock & Crypto Traders |

SoFi Invest | $0 | Automated Investing & Beginners |

eToro | $0 | Copy & Social Trading |

Wealthfront | 0.25% | Hands-Off Investors |

Webull | $0 | Active Day Traders |

Cash App Invest | $0 | Easy Stocks & Bitcoin Purchases |

Ally Invest | $0 | Mobile-Friendly Investing |