Table Of Content

What Is Robinhood’s Stock Screener?

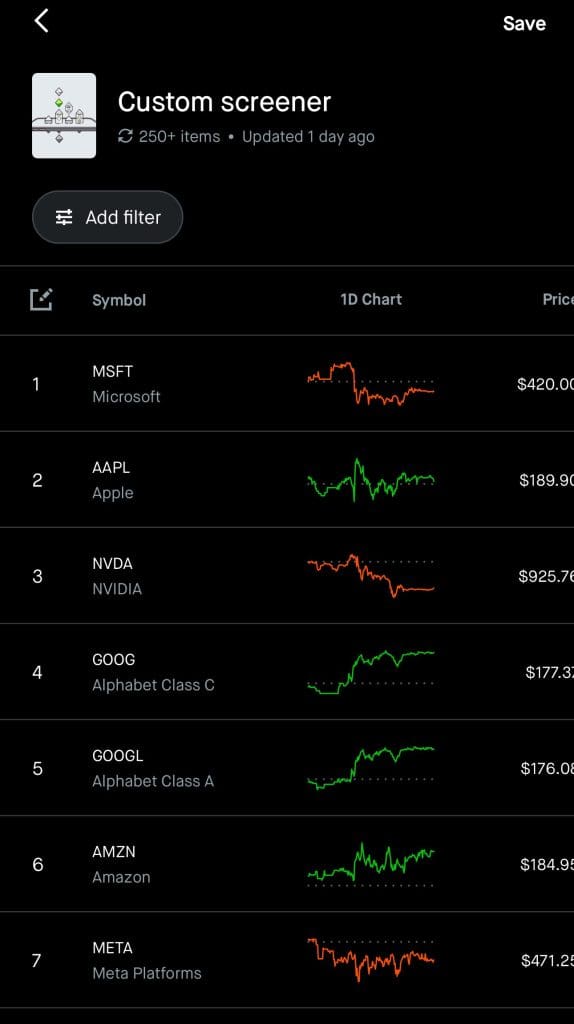

Robinhood’s stock screener is a built-in tool that helps investors filter through stocks directly within the app, based on real-time price movements, market cap, analyst ratings, and other simplified criteria.

It’s not as detailed as advanced screeners like Morningstar or Finviz, but it’s designed for ease of use — especially for newer investors or anyone looking for quick stock ideas on the go.

When we tested it, the screener felt snappy and intuitive. You won’t get in-depth fundamentals like ROIC or moat analysis, but if you’re looking to sort stocks by analyst ratings, price trends, sectors, or volatility, it’s a useful starting point that integrates directly into your Robinhood workflow.

How Robinhood’s Stock Screener Helps Investors

Robinhood’s screener is ideal for users who want a faster, more accessible way to explore investment ideas without opening a separate research tool.

Here’s how it helps in real use:

- Explore by Popular Investment Themes: Robinhood includes preset filters like “Top Movers,” “100 Most Popular,” “Upcoming Earnings,” or “High Dividend Yield.” These are great if you want to quickly discover trending or income-focused stocks without building complex custom filters.

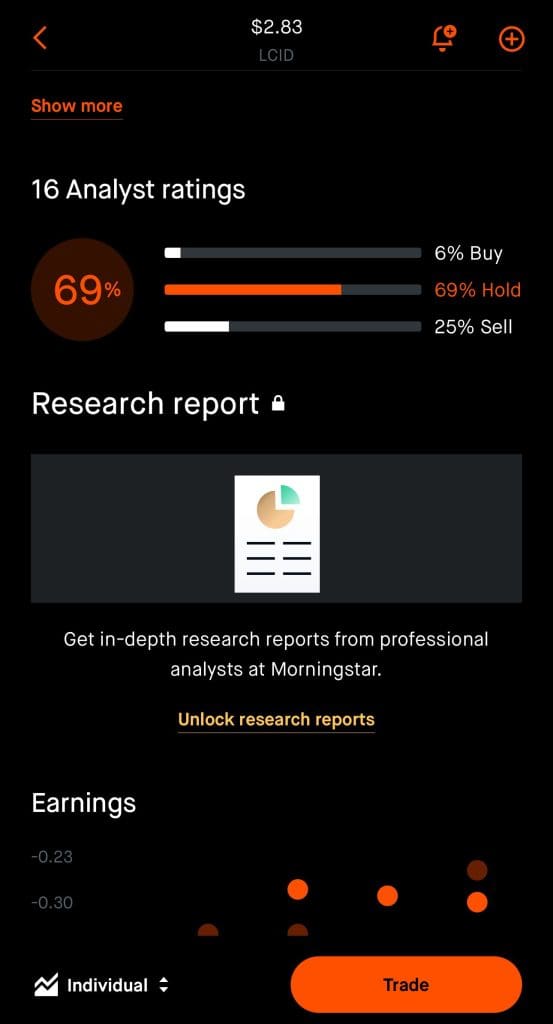

- Sort Stocks by Analyst Ratings: One of the most helpful features we used was the ability to filter by analyst consensus. You can find stocks labeled as “100% Buy” or “Mostly Buy” — a handy shortcut if you're scanning for expert-backed picks.

- Narrow by Sector or Market Cap: You can easily focus your search on specific sectors (like tech or energy) or choose between large-cap and small-cap stocks. For example, we used this to compare dividend-paying utility stocks with growth-oriented tech plays.

- Use Price and Performance Filters: Robinhood allows basic filters like current price, 52-week range, and performance over the past week or month. It’s useful for identifying potential breakout or pullback opportunities.

The platform isn’t built for deep fundamental screening, but for active Robinhood users, it provides just enough to get started with smart filtering and watchlist building.

Mastering Robinhood’s Stock Screener: Key Strategies

Robinhood’s screener shines when paired with specific investing intentions. Based on our testing, here are some strategies that make it more powerful:

-

Start With a Clear Objective

Before opening the screener, decide what you’re trying to achieve — are you looking for momentum plays, income picks, or undervalued growth stocks?

For instance:

If you want dividends, use the “High Dividend Yield” filter and combine it with sectors like utilities or REITs.

If you’re into earnings momentum, check the “Upcoming Earnings” or “Top Movers” sections.

For growth exposure, we filtered tech and healthcare stocks with high analyst buy ratings.

The key is to start with a purpose — that way, the screener becomes a decision-making tool, not just a browsing page.

-

Use It Weekly — Not Just When You’re Trading

We found the screener most useful when used on a weekly basis to refresh watchlists or prep for earnings seasons.

For example, checking “Upcoming Earnings” every Sunday helped us identify potential volatility plays ahead of the week.

We also used “Top Movers” to monitor names gaining or losing momentum — handy for short-term trades or rebalancing ideas.

Unlike a professional trading platform, Robinhood’s screener isn’t about high-frequency updates. It’s best used as a planning tool.

-

Rely on Analyst Ratings for Quick Insights

Since Robinhood doesn’t provide deep fundamental filters, we leaned heavily on the analyst consensus ratings.

Stocks marked “100% Buy” were often large, well-covered names (like Nvidia or Apple) — strong if you're building a core growth portfolio.

“Mostly Buy” lists can reveal mid-cap stocks gaining institutional support.

It’s not perfect, but this feature helped us avoid speculative picks and focus on companies with solid backing from Wall Street analysts.

-

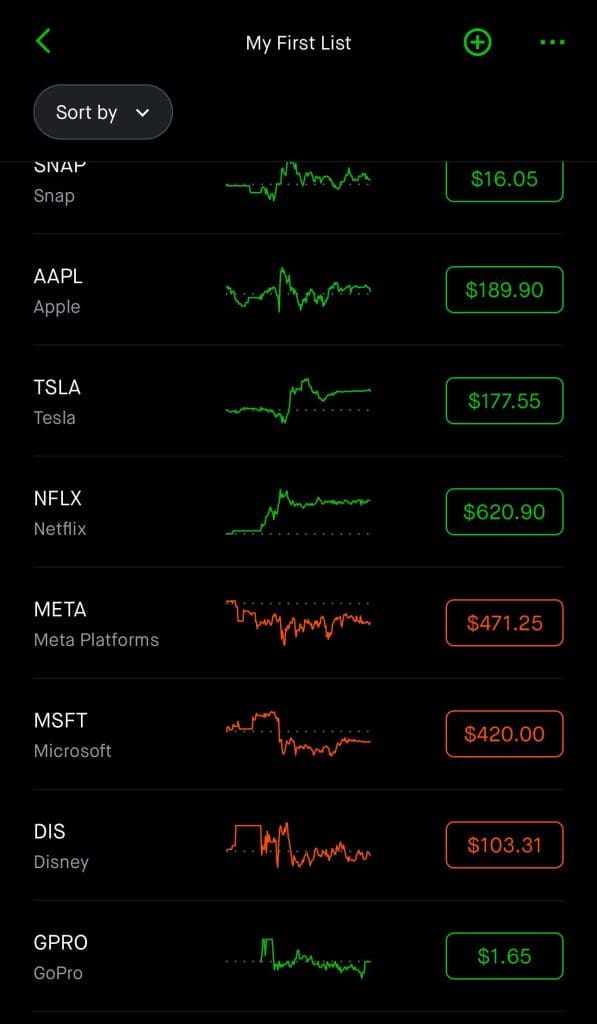

Combine Filters With Watchlists and Alerts

After screening, we saved relevant stocks to custom watchlists and set up price alerts — a workflow that helped us stay on top of new entries or buying opportunities.

Example: After screening for dividend stocks under $50, we added three to a list and were alerted when one dipped below a key support level.

We also used this method for monitoring post-earnings pullbacks.

The integration with watchlists and alerts turns the screener into a more dynamic, ongoing investment tool — rather than a one-time filter.

Additional Robinhood Screener Features to Leverage

Robinhood keeps things simple, but there are a few extra screening angles that are easy to miss and worth trying:

Crypto & ETFs: While not technically part of the “stock screener,” you can browse trending cryptocurrencies or thematic ETFs with similar filtering logic.

Collections: These are pre-built groups of stocks based on themes like “Cloud Computing,” “Women CEOs,” or “IPO Stocks.” These aren't custom filters, but they help uncover ideas in a fun and relevant way.

Top Movers by Timeframe: Filtering by daily, weekly, or monthly gainers/losers helps reveal both short-term momentum and longer trends.

These features give the screener more depth than it first appears — especially if you’re willing to explore beyond the default tabs.

Robinhood Screener Alternatives Worth Exploring

Robinhood’s screener works well for quick filtering within the app, but if you're looking for deeper metrics, there are some solid alternative screeners:

Finviz: Great for fundamentals and technicals. You can screen by P/E, debt ratio, insider ownership, RSI, and more — perfect if you want depth.

Yahoo Finance Premium: Offers detailed filters including valuation multiples, historical earnings, and future growth estimates.

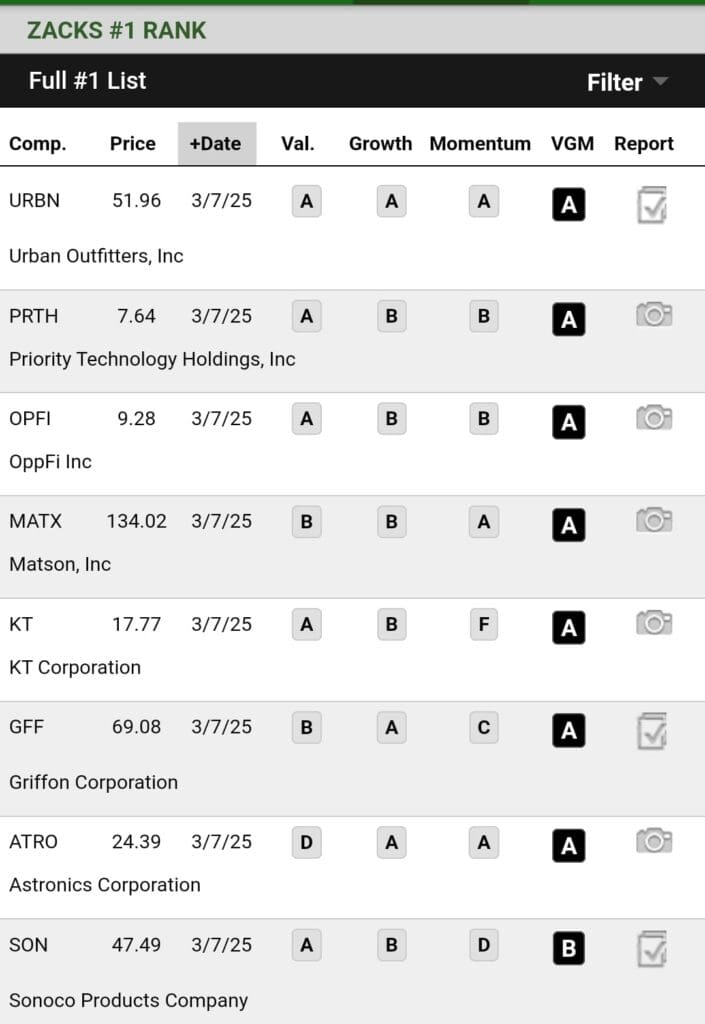

Zacks Premium: Best for combining analyst rank and earnings estimate revisions. Their screener helped us find a few small-cap growth stocks Robinhood didn’t surface.

TradingView: A favorite for chart-heavy investors. You can filter by technical indicators like RSI, MACD crossovers, or support/resistance levels.

Here's a comparison view:

Plan | Subscription | Best For |

|---|---|---|

Morningstar Investor | $34.95

$249 ($20.75 / month) if paid annually | Retirement Planners |

Zacks Premium | $249 ($20.75/month)

No monthly plan | Research-Driven Investors |

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| Stock Picks |

Yahoo Finance Gold | $49.95

$479.40 ($39.95 / month) if paid annually | Casual Investors |

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually | Global Market Investors |

TipRanks Premium | $359 ($30 / month)

No monthly plan | Analysts Followers |

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | Research-Oriented Investors |