Robinhood | Acorns | |

Monthly Fee | $0 – $6.99

$0 for basic account, $6.99 for Robinhood Gold | $3 – $12

$3 for Bronze, $6 for Silver and $12 for Gold

|

Account Types | Brokerage, Retirement, Crypto | Brokerage, Retirement |

Savings APY | 1.00% – 4.50%

You’ll earn 0.01% Annual Percentage Yield (APY) as a Robinhood Gold member on your uninvested brokerage cash that is swept to the banks in our program. | 1.00% – 3.00% |

Minimum Deposit | $0 | $0 |

Best For | Active Traders, Tech Savvy Investors | Robo Advisor, Beginner Traders |

Read Review | Read Review |

Acorns vs Robinhood: Compare Investing Features

Robinhood is well-known for its commission-free trading of stocks, options, ETFs, and cryptocurrencies. The user-friendly app appeals particularly to active, tech-savvy traders or investors.

Robinhood offers real-time market data, customizable watchlists, and a simple interface for buying and selling assets.

Acorns, on the other hand, focuses on automated investing and financial wellness. While users can also invest in fractional shares, Acorns offers many more options for passive investors.

Robinhood | Acorns | |

|---|---|---|

Investing Options | Over 5,000 securities, most U.S. stocks and ETFs listed on U.S. exchanges | 100+ stocks, +40 ETFs (Up to 7,000 assets with automated investing) |

Account Types | Brokerage, Retirement | Brokerage, Retirement |

Financial Planning | No | No |

Automated Investing | No | Yes |

Tax Loss Harvesting | No | No |

-

Self Investing And Trading Options

Robinhood is a clear winner when it comes to active investing and trading options, as it offers much more options than Acorns.

Robinhood's self-investing platform allows users to buy and sell a variety of assets, including stocks, ETFs, options, and cryptocurrencies. Robinhood also offers options trading and access to futures and commodities.

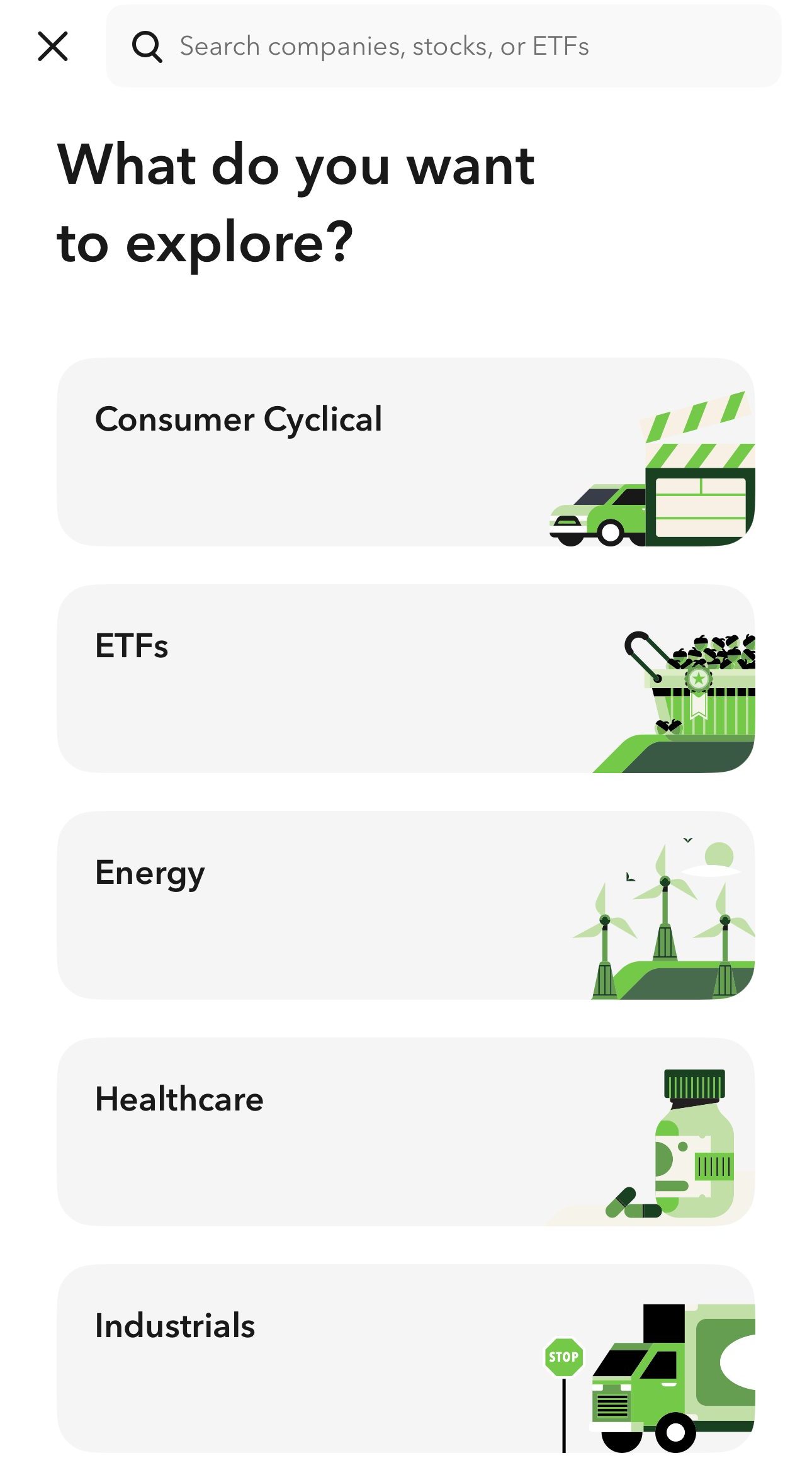

This flexible and customizable approach allows users to select investments from a pool of over 5,000 securities, including most U.S. stocks and ETFs listed on U.S. exchanges. You can browse them easily on the app:

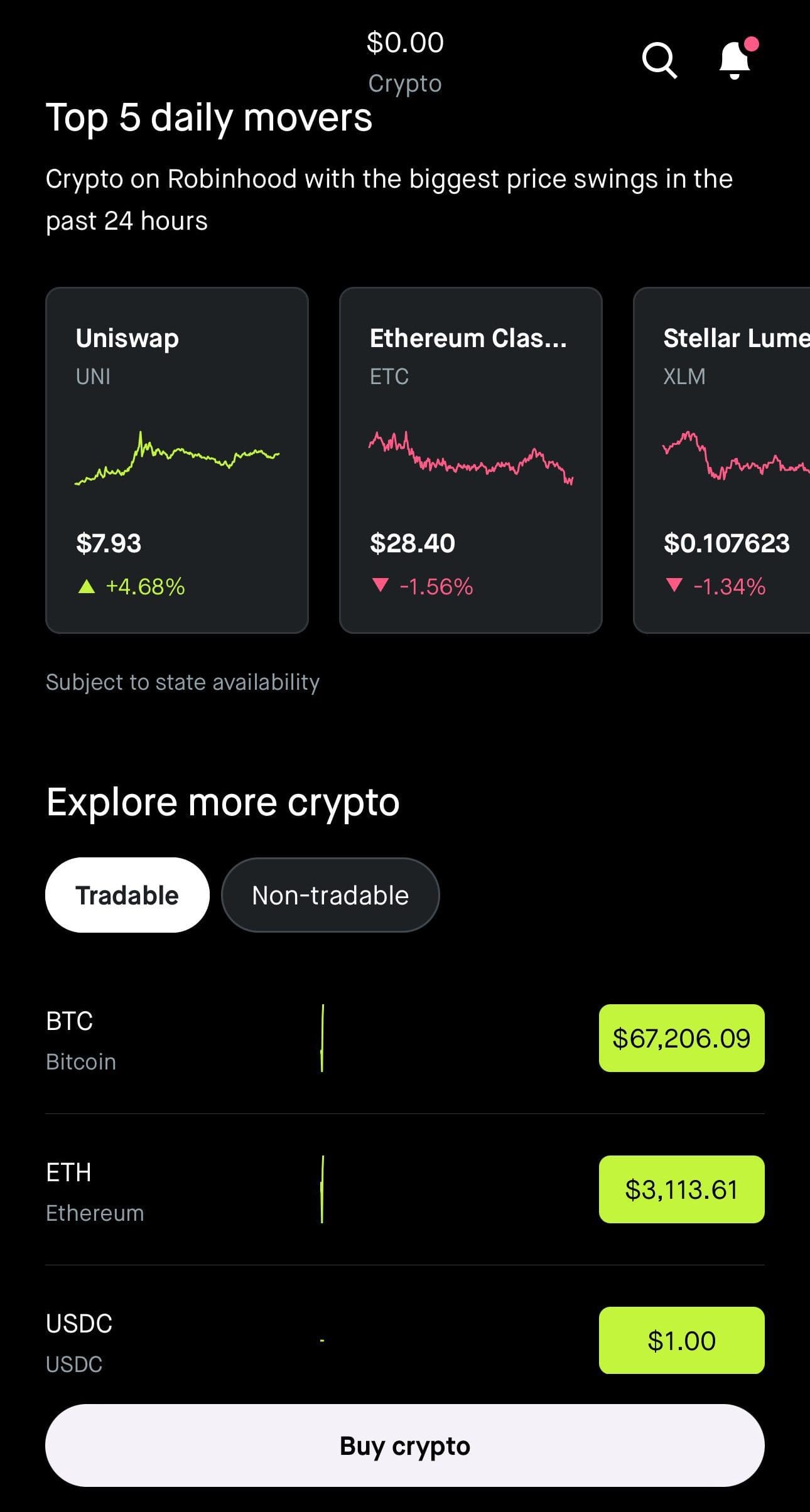

As shown in the screenshot below, customers can also trade cryptocurrencies and get a bunch of trading indicators to support decisions:

With Acorns' you can also access fractional shares, but your custom portfolio can make up to 50% of your total Acorns Invest portfolio.

This platform provides fractional shares for new purchases and reinvested dividends. Users can choose from over 100 stocks and more than 40 ETFs, which means less options compared to Robinhood.

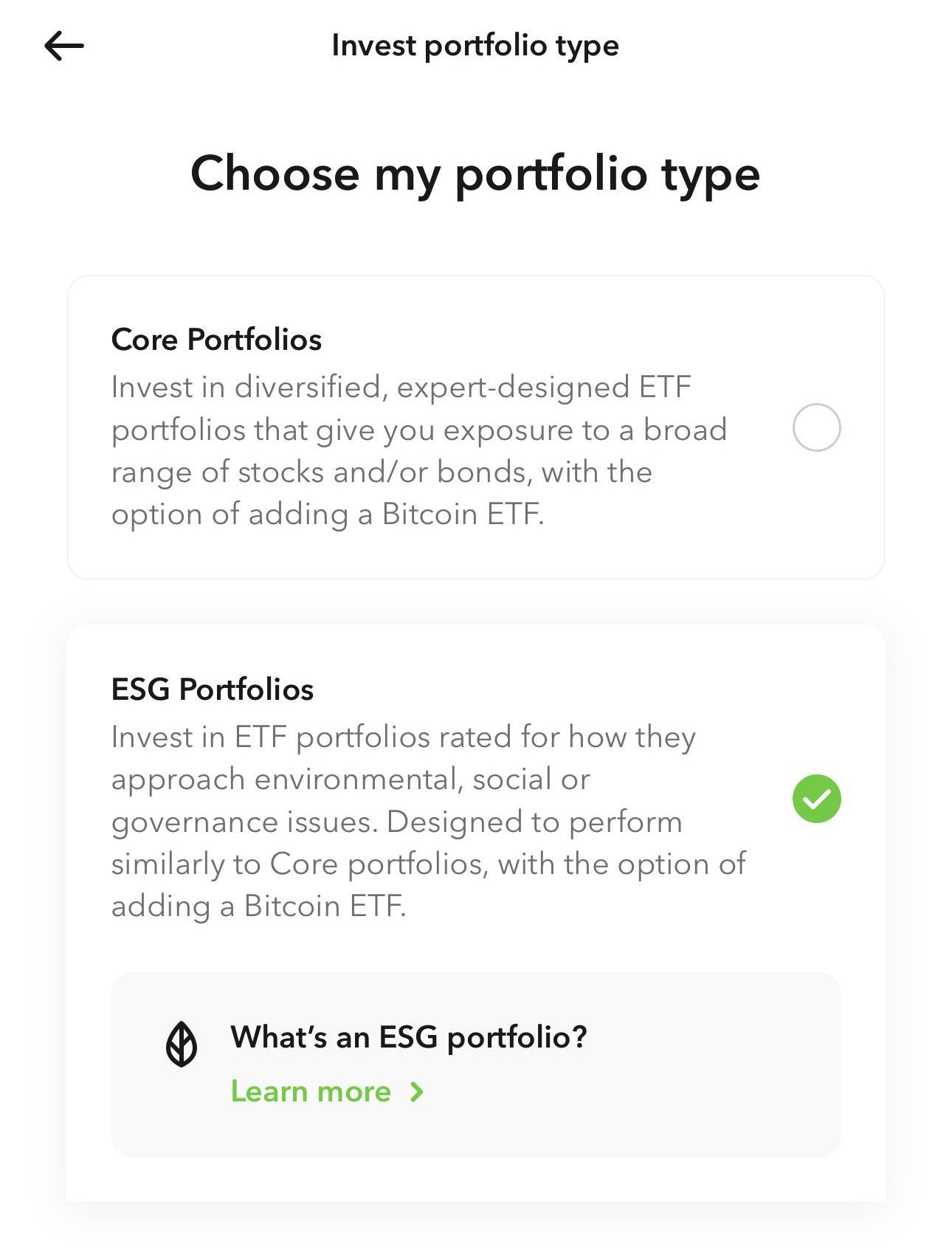

The platform walks you through investment preferences and goals during set up, but you can choose from ETFs or stocks that are based on themes.

-

Managing Retirement Accounts

When it comes to managing your retirement, both Acorns and Robinhood offer great options.

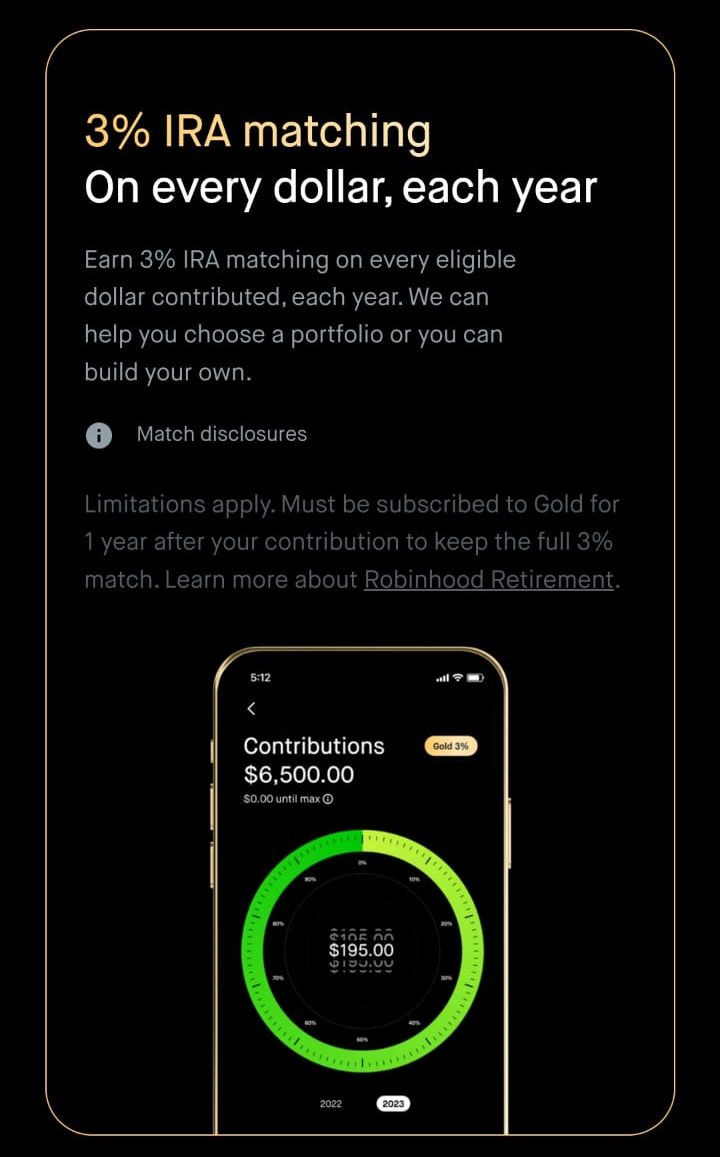

With Robinhood, you have the option to choose from a Traditional, Roth, or Rollover IRA. Opening an account is straightforward, and Robinhood clearly outlines the benefits, eligibility, and any limitations before you commit, as shown in this screenshot.

Moreover, even with the basic free Robinhood tier, you can receive a 1% match on qualified IRA deposits. If you subscribe to Robinhood Gold, you can benefit from a 3% IRA match, allowing you to earn 3% on every eligible dollar contributed to your IRA each year.

Acorns Later is designed to help you automatically invest for retirement while potentially benefiting from tax advantages.

It offers IRA plan recommendations, helping you choose between a Roth, Traditional, or SEP IRA based on your long-term goals by answering a few questions.

With Acorns Premium, you receive a 3% match on new contributions to your Acorns Later account, provided they remain in the account for at least four years.

Acorns: Which Features Are Unique?

Here are some of the features that investors can find only with Acorns:

-

Automated Investing

Acorns is our winner when it comes to automated investing and simplicity.

Acorns ETFs offer exposure to over 7,000 different assets, reducing risk compared to trading individual stocks.

The platform automatically constructs and oversees your portfolio according to your risk tolerance and financial objectives, investing your funds into top-rated Exchange Traded Funds (ETFs), which are professionally designed portfolios.

-

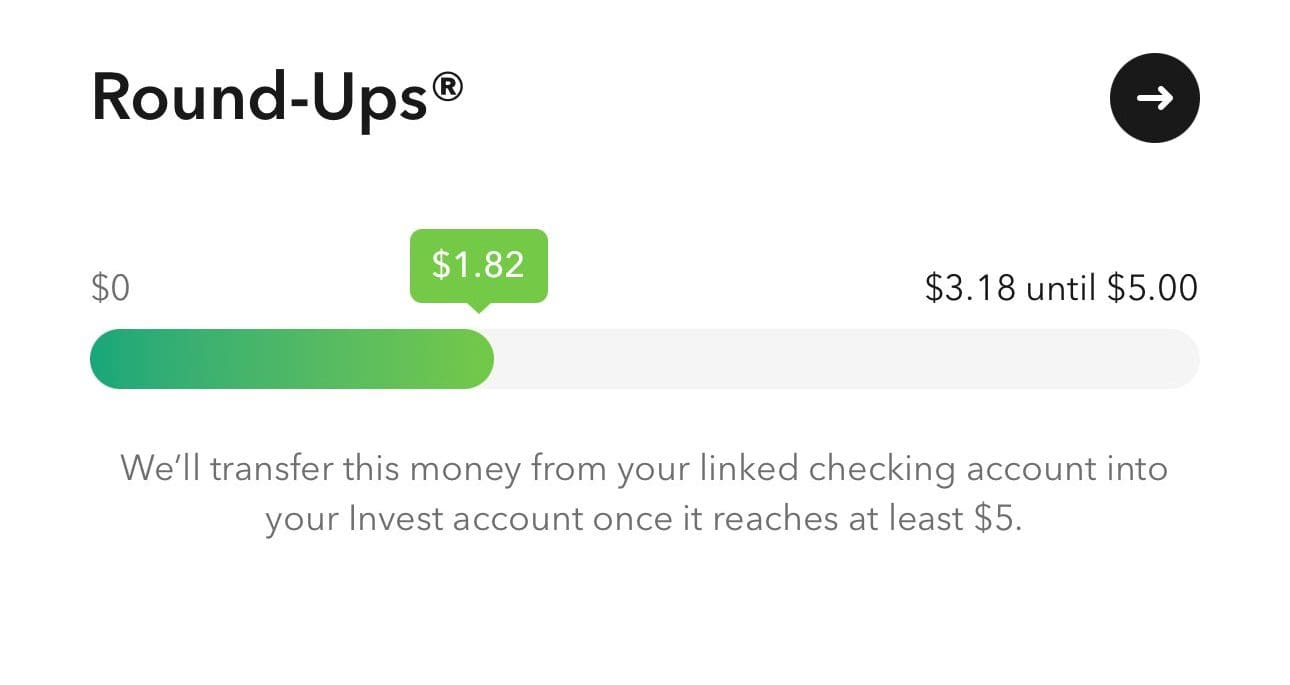

Round Ups

One notable feature of Acorns is the “round-ups.” After opting in, this feature automatically rounds up purchases to the nearest dollar, transferring the extra amount from a linked bank account to the investment account.

For example, if a hamburger costs $7.25, Acorns rounds up the transaction to $8, transferring the additional $0.75 into the investment account. This feature allows users to effortlessly increase their investment funds using spare change from everyday transactions.

-

Acorns Cash Management

Unlike Robinhood, Acorns offer a cash management with various banking options.

Customers can receive a Visa debit card that they can use at over 55,000 locations in the US and other areas of the world with no ATM fees. The account also has no overdraft fees.

Where the potential for this feature really comes into its own is with the Emergency Fund account. This is available to Plus and Premium members. With this you earn 3% APY on checking account balance and 5% on my emergency fund.

Banking services are provided by Mighty Oak Debit Cards issued by nbkc bank, Member FDIC.

Robinhood: Which Features Are Unique?

Here are some of the features that investors can find only with Robinhood:

-

Robinhood Gold

Robinhood Gold is a premium plan that provides a couple of additional benefits.

The subscription includes access to an exclusive Robinhood Gold Card, free instant deposits up to $50,000 per day, and insights from Morningstar and Nasdaq Level 2 data.

One significant feature of Robinhood Gold is the deposit boost, where customers earn an additional 1% on all eligible deposits with no cap.

This extra money can be invested or placed into the cash account to earn interest. Gold members also receive their first $1,000 of margin without incurring any interest fees.

-

Advanced Charting

Robinhood offers advanced charting and research tools designed to empower investors with detailed insights and analytics.

The advanced charting features provide users with customizable charts that include a variety of technical indicators, such as moving averages, Bollinger Bands, and Relative Strength Index (RSI).

Additionally, Robinhood provides in-depth research tools that include professional analyst ratings, price targets, and earnings reports.

Users can access Morningstar research reports, offering detailed analyses of stocks, ETFs, and mutual funds.

-

IPO Access

Robinhood provides investors with access to Initial Public Offerings (IPOs), allowing them to purchase shares of companies going public at the IPO price before they start trading on the public market.

This feature democratizes access to IPOs, which were traditionally available only to institutional investors and high-net-worth individuals.

Users can review available IPOs directly in the app, submit a request to participate, and allocate funds to purchase shares if their request is approved.

This process provides an opportunity to invest in companies at an early stage of their public trading life.

Bottom Line

Overall, Acorns and Robinhood targeted a different type of customers, which is clearly seen in their features.

Robinhood is much more relevant for traders and advanced investors as it offers great charting and research options, IPO access, options and futures trading, and other options that can be great for those who are active traders who want to save on fees.

Acorns, on the other hand, is better for automated investing and banking. Its cash management account offers options not available through Robinhood, and its automated investing options are more powerful.

Compare Acorns Side By Side

Acorns excels in automated investing, ideal for those who prefer a hands-off approach, while Stash is better suited for self investing

Acorns excelling in automated investing and checking accounts, while M1 Finance is better for self investing and borrowing options.

Wealthfront and Acorns offer advanced automated investing options, appealing investing features, and banking options. Here's our comparison:

Compare Robinhood Side By Side

Schwab offers more options for investors, including robo advisors and wealth management, while Robinhood is best for beginners and traders.

Schwab vs. Robinhood: Which Brokerage is Right for You?

Vanguard offers more options for investors, including retirement, robo advisors, and wealth management, while Robinhood is best for traders.

Merrill Edge is best for long-term investments, including retirement, while Robinhood is perfect for active traders who value simplicity.

Merrill Edge vs. Robinhood: Compare Brokerage Account Options

JP Morgan wins when it comes to fundamental investing tools, but Robinhood is better for technical analysis and trading. Here's why:

J.P. Morgan Self-Directed Investing vs. Robinhood : Compare Brokerage Accounts

Fidelity is our winner for diversified long-term investing, while Robinhood shines in cost-effective options for active traders and beginners.

Robinhood is an excellent choice for beginner and casual investors, but IBKR is better suited for experienced investors and advanced traders.

Interactive Brokers vs. Robinhood: Compare Brokerage Account Options

Robinhood is best for low-cost platform for various trading needs, including Crypto. Etrade is better for one stop shop, including banking.

Robinhood is best for traders looking for easy, cost-free trading, while Stash is great for beginner investors who need a financial management tool

Webull is better suited for experienced traders needing advanced tools, whereas Robinhood caters to beginners and those who prefer simplicity.