Table Of Content

When you invest through a robo-advisor, you’re not just handing over your money and hoping for the best. These platforms use smart strategies to help you grow your wealth—and cut your tax bill along the way.

One of the key tools they use is something called tax-loss harvesting. It sounds technical, but it’s actually a clever way to lower the taxes you owe by selling losing investments at the right time.

In this guide, we’ll break it down simply so you can see how it works and why it matters.

What Is Tax-Loss Harvesting and How Does It Work?

Tax-loss harvesting is when you sell investments that have lost value in order to offset gains from other investments that made money.

The idea is simple: by realizing a loss, you can lower the amount of tax you owe on your profits.

-

Example

Let’s say you made a $1,000 profit selling one stock but lost $700 on another.

If you sell the losing stock, you can subtract that $700 from your $1,000 gain—so you’d only pay taxes on $300 in profit.

Robo-advisors automate this process, constantly scanning your portfolio and selling losing assets when it makes tax sense.

They often replace the sold investment with a similar one, keeping your portfolio balanced while locking in the tax benefit.

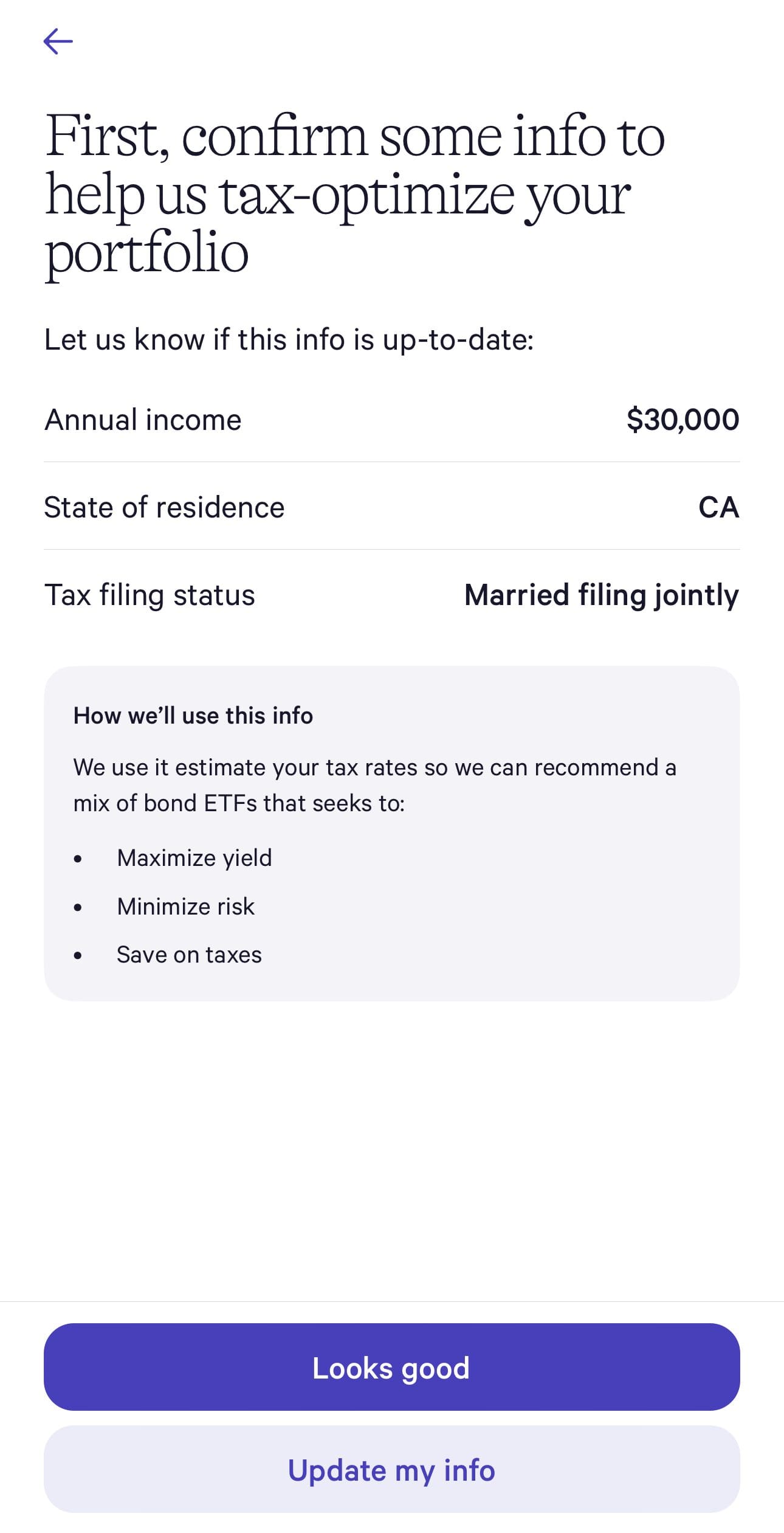

Here's how Walthfront robo-advisor can help with tax loss harvesting:

Why Tax-Loss Harvesting Helps Reduce Capital Gains Taxes

Capital gains taxes are triggered when you sell investments for more than you paid. Tax-loss harvesting gives you a way to lower those taxable gains—sometimes even eliminating them.

Here’s why it helps:

Offsets gains: Losses can be used to cancel out capital gains, reducing your taxable income.

Limits tax on short-term gains: Short-term gains (held less than a year) are taxed at higher rates. Tax-loss harvesting helps reduce or wipe out these gains.

Carries over to future years: If your losses are bigger than your gains, you can use up to $3,000 of losses to reduce regular income—and carry the rest forward.

Automated advantage: Robo-advisors do this year-round, often catching small dips you wouldn’t act on manually.

By using this strategy consistently, you can keep more of your investment returns instead of losing them to taxes.

Robo-Advisors Use Tax-Loss Harvesting to Reduce Taxes

Robo-advisors use algorithms and automation to remove the guesswork from investing, and tax-loss harvesting is one of the most valuable features they offer.

Traditionally, this strategy required close attention and careful timing, but robo-advisors automate it in the background.

Here’s how robo-advisors make tax-loss harvesting work for you:

-

Daily or Frequent Scans for Losses

Instead of waiting until year-end, robo-advisors like Wealthfront and Betterment check your portfolio daily (or regularly) for assets that have dropped in value and are eligible for harvesting.

-

Automatic Selling and Replacing

Once a loss is harvested, the robo-advisor immediately buys a similar investment—often a comparable ETF—so your portfolio stays balanced and doesn’t drift from your long-term strategy.

-

Avoiding the Wash-Sale Rule

The IRS wash-sale rule prevents you from claiming a loss if you buy the same or “substantially identical” security within 30 days.

Robo-advisors are designed to avoid this by selecting replacement investments that are similar, but not identical.

-

Tax Savings Optimized Across Accounts

Some robo-advisors coordinate across multiple accounts—like individual and joint taxable accounts—making sure the overall tax impact is minimized.

-

Year-Round Harvesting vs. Year-End Selling

Unlike human advisors who often wait until December, robo-advisors can take advantage of dips throughout the year, capturing more loss opportunities when they actually happen.

Which Robo-Advisors Offer the Best Tax-Loss Harvesting?

Not all robo-advisors offer tax-loss harvesting, and among those that do, the quality and frequency of the service can vary.

Some platforms provide more advanced strategies, frequent monitoring, and smarter replacement fund choices—all of which lead to better tax efficiency.

Here are some of the top robo-advisors for tax-loss harvesting:

Wealthfront: One of the most advanced platforms, offering daily tax-loss harvesting and even direct indexing for higher account balances, which can unlock additional savings.

Betterment: Offers automated, daily tax-loss harvesting for all taxable accounts, with intelligent fund replacements and tax-coordinated portfolio options for added efficiency.

Schwab Intelligent Portfolios Premium: Includes tax-loss harvesting for accounts over a certain size ($50,000+), with the backing of Schwab’s broad investment tools.

Empower (Personal Capital): Provides tax optimization for high-net-worth clients, including selective harvesting, though it’s more of a hybrid service than a traditional robo-advisor.

For most investors, Wealthfront and Betterment are the go-to choices for the most consistent and effective tax-loss harvesting.

FAQ

Not necessarily. It depends on your realized gains and overall tax situation. If there are no gains to offset, the harvested losses may carry forward instead of generating immediate savings.

Yes, in some cases selling and replacing assets may trigger short-term gains. However, robo-advisors typically aim to minimize short-term taxable events when managing trades.

They use ETFs or similar funds that track the same market sector but aren’t considered “substantially identical,” helping maintain your portfolio allocation while avoiding the wash-sale rule.

You may miss short-term recovery gains in the sold asset, but the replacement investment is usually similar enough to benefit from the rebound as well.

No, robo-advisors maintain your overall asset allocation and risk profile even while harvesting losses. The strategy is designed to lower taxes without altering your investment goals.

In rare cases, trades made during tax-loss harvesting could generate gains or dividends. However, robo-advisors work to ensure the overall tax impact remains beneficial.

Yes, those in higher tax brackets tend to benefit more from reducing taxable capital gains and ordinary income through strategic loss harvesting.

You can review transactions in your account dashboard or on year-end tax forms like the 1099-B. Many robo-advisors also provide tax reports summarizing harvested losses.

Yes, if your capital losses exceed your gains, you can deduct up to $3,000 per year from your ordinary income. Any additional losses can be carried forward to future tax years indefinitely.

No, tax-loss harvesting only applies to taxable accounts. Retirement accounts like IRAs and 401(k)s are tax-deferred, so gains and losses aren’t realized or taxed until withdrawal.

No, most robo-advisors handle tax-loss harvesting automatically. You don’t need to manually approve trades—they execute them as part of their ongoing portfolio management strategy.